Professional Documents

Culture Documents

Policy Details

Uploaded by

Myeduniya MEDOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Policy Details

Uploaded by

Myeduniya MEDCopyright:

Available Formats

12-04-2023

Quote No : qbmkff5ofc8de

Benefit Illustration for HDFC Life Click 2 Protect Super

This Illustration has been produced by HDFC Life Insurance Company Limited to help you understand the benefits of your

HDFC Life Click 2 Protect Super

Age is taken as on last birthday Proposal No: NA

Name of the Prospect/Policyholder: Mukesh Bajaj Name of the Product: HDFC Life Click 2 Protect Super

A Non Linked, Non Participating, Individual,

Age: 42 Tag Line: Pure Risk Premium/Savings Life Insurance

Plan

Name of the Life Assured: Mukesh Bajaj Unique Identification No: 101N145V01

Age: 42 GST Rate: 18%*

Gender: Male

Policy Term: 40 Years

Premium Payment Term: 40 Years Tobacco User: No

Amount of Instalment Premium (Without

Rs.3471

GST):

Mode of Premium Payment: Monthly

*0% if qualifies as zero-rated supply under GST law

This benefit illustration is intended to show year-wise premiums payable and benefits under the policy.

This benefit illustration is intended to show year-wise premiums payable and benefits under the policy

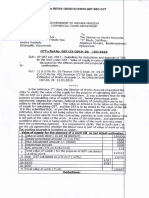

Policy Details

Plan Option Life Basic Sum Assured Rs. 10000000

Sum Assured Factor Option B Sum Assured on Death (at inception of the policy) Rs. 10000000

WOP CI Benefit No WOP on total Permanent Disability No

Return of Premium Benefit No Spouse Cover Option

Level Cover Period(Years) Not Applicable Ammortization Rate Not Applicable

Life Stage Option No

Rider Details

Rider Name Rider UIN Rider PPT Rider PT Rider Sum Assured Rs.

HDFC Life Critical Illness Plus Rider 101B014V02 33 Years 33 Years 1000000

Income Benefit on Accidental Disability Rider 101B013V03 33 Years 33 Years 1000000

HDFC Life Protect Plus rider - Cancer Cover 101B016V01 40 Years 40 Years 1000000

Premium Summary

PP PP PP Total

Base Plan CI Rider IB Rider Rider Rider Rider Instalment

(PAC) (ADC) (CC) Premium

Instalment Premium without GST 3471 706 24 0 0 284 4485

First Year Premium

Instalment Premium with First Year GST 4096 833 28 0 0 335 5292

Instalment Premium without GST 3653 743 24 0 0 284 4704

Second Year Premium

Instalment Premium with GST 2nd Year Onwards 4311 877 28 0 0 335 5551

(Amounts in Rupees.)

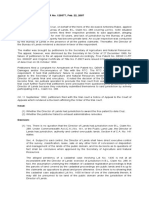

Policy Single/ Guaranteed Non Guaranteed

Year Annualized

Survival Benefit/ Accrued Guaranteed Other Maturity Death Policy Cancelation Min Guaranteed Surrender Special Surrender

Premium

Additions Benefits Benefit Value Value Value

1 39,669 0 0 0 1,00,00,000 0 0 0

2 41,749 0 0 0 1,00,00,000 0 0 0

3 41,749 0 0 0 1,00,00,000 0 0 0

4 41,749 0 0 0 1,00,00,000 0 0 0

5 41,749 0 0 0 1,00,00,000 0 0 0

6 41,749 0 0 0 1,10,00,000 0 0 0

7 41,749 0 0 0 1,10,00,000 0 0 0

8 41,749 0 0 0 1,10,00,000 0 0 0

9 41,749 0 0 0 1,10,00,000 0 0 0

10 41,749 0 0 0 1,10,00,000 0 0 0

11 41,749 0 0 0 1,20,00,000 0 0 0

12 41,749 0 0 0 1,20,00,000 0 0 0

13 41,749 0 0 0 1,20,00,000 0 0 0

14 41,749 0 0 0 1,20,00,000 0 0 0

15 41,749 0 0 0 1,20,00,000 0 0 0

16 41,749 0 0 0 1,30,00,000 0 0 0

17 41,749 0 0 0 1,30,00,000 0 0 0

18 41,749 0 0 0 1,30,00,000 0 0 0

19 41,749 0 0 0 1,30,00,000 0 0 0

20 41,749 0 0 0 1,30,00,000 0 0 0

21 41,749 0 0 0 1,40,00,000 0 0 0

22 41,749 0 0 0 1,40,00,000 0 0 0

23 41,749 0 0 0 1,40,00,000 0 0 0

24 41,749 0 0 0 1,40,00,000 0 0 0

25 41,749 0 0 0 1,40,00,000 0 0 0

26 41,749 0 0 0 1,50,00,000 0 0 0

27 41,749 0 0 0 1,50,00,000 0 0 0

28 41,749 0 0 0 1,50,00,000 0 0 0

29 41,749 0 0 0 1,50,00,000 0 0 0

30 41,749 0 0 0 1,50,00,000 0 0 0

31 41,749 0 0 0 1,60,00,000 0 0 0

32 41,749 0 0 0 1,60,00,000 0 0 0

33 41,749 0 0 0 1,60,00,000 0 0 0

34 41,749 0 0 0 1,60,00,000 0 0 0

35 41,749 0 0 0 1,60,00,000 0 0 0

36 41,749 0 0 0 1,70,00,000 0 0 0

37 41,749 0 0 0 1,70,00,000 0 0 0

38 41,749 0 0 0 1,70,00,000 0 0 0

39 41,749 0 0 0 1,70,00,000 0 0 0

40 41,749 0 0 0 1,70,00,000 0 0 0

Notes:

1.Annualised Premium excludes underwriting extra premium, frequency loading on premiums, the premium paid towards rider, if any, and Goods & Service Tax.

2. The benefits illustrated are as of at end of year.

3. Surrender value (if applicable) will be higher of GSV (Guaranteed Surrender value) and SSV (Special Surrender Value).

I , have explained the premiums/ charges, and benefits under the policy fully to the I Mukesh Bajaj,having received the information with respect to the above, have

prospect / policyholder. understood the above statement before entering into the contract.

Place :

Date : Signature of Agent/ Intermediary/ Official Date: Signature of Prospect / Policyholder

You might also like

- Critical Discourse AnalysisDocument28 pagesCritical Discourse AnalysisNamisha Choudhary100% (2)

- IllustrationDocument2 pagesIllustrationTushar ChaudhariNo ratings yet

- Illustration 3Document2 pagesIllustration 3Satyaki DuttaNo ratings yet

- IllustrationDocument3 pagesIllustrationSai SumanthNo ratings yet

- Illustration Qbyuu7muxf1cvDocument3 pagesIllustration Qbyuu7muxf1cvajayNo ratings yet

- Illustration Qbbphn08e5mlqDocument4 pagesIllustration Qbbphn08e5mlqMaruti KambleNo ratings yet

- HDFC Life Click 2 Protect SuperDocument3 pagesHDFC Life Click 2 Protect SuperABISHKAR SARKARNo ratings yet

- Illustration - 2022-08-31T164229.106Document3 pagesIllustration - 2022-08-31T164229.106Soumen BeraNo ratings yet

- IllustrationDocument3 pagesIllustrationamrutadonNo ratings yet

- Illustr NewDocument2 pagesIllustr NewHar DonNo ratings yet

- Illustration Qapkn8mbwyaa9Document3 pagesIllustration Qapkn8mbwyaa9AnithaNo ratings yet

- IllustrationDocument4 pagesIllustrationVamsi Krishna BNo ratings yet

- Illustration Qbbpi722hqyhtDocument3 pagesIllustration Qbbpi722hqyhtMaruti KambleNo ratings yet

- IllustrationDocument2 pagesIllustrationPULKIT JAINNo ratings yet

- IllustrationDocument2 pagesIllustrationPULKIT JAINNo ratings yet

- Illustration - 2022-08-31T155028.397Document3 pagesIllustration - 2022-08-31T155028.397Soumen BeraNo ratings yet

- Illustration - 2022-08-31T152151.383Document3 pagesIllustration - 2022-08-31T152151.383Soumen BeraNo ratings yet

- Illustration - 2022-08-31T154243.769Document3 pagesIllustration - 2022-08-31T154243.769Soumen BeraNo ratings yet

- IllustrationDocument3 pagesIllustrationamrutadonNo ratings yet

- Illustration - 2022-08-31T155906.546Document3 pagesIllustration - 2022-08-31T155906.546Soumen BeraNo ratings yet

- IllustrationDocument4 pagesIllustrationVamsi Krishna BNo ratings yet

- IllustrationDocument2 pagesIllustrationPULKIT JAINNo ratings yet

- IllustrationDocument3 pagesIllustrationamrutadonNo ratings yet

- Illustration - 2023-09-16T115558.673Document3 pagesIllustration - 2023-09-16T115558.673LogeshParthasarathyNo ratings yet

- Illustration - 2023-11-09T153903.144Document2 pagesIllustration - 2023-11-09T153903.144raamshankar11No ratings yet

- IllustrationDocument3 pagesIllustrationSiddharth GoenkaNo ratings yet

- Illustration - 2022-08-31T122247.414Document3 pagesIllustration - 2022-08-31T122247.414Soumen BeraNo ratings yet

- Illustration - 2022-08-31T122344.433Document3 pagesIllustration - 2022-08-31T122344.433Soumen BeraNo ratings yet

- IllustrationDocument2 pagesIllustrationestrade1112No ratings yet

- IllustrationDocument4 pagesIllustrationVamsi Krishna BNo ratings yet

- IllustrationDocument2 pagesIllustrationPULKIT JAINNo ratings yet

- IllustrationDocument3 pagesIllustrationBujji Bangaram VelagaletiNo ratings yet

- Illustration - 2023-11-09T154448.741Document2 pagesIllustration - 2023-11-09T154448.741raamshankar11No ratings yet

- CZ 56256 BN 564788Document2 pagesCZ 56256 BN 564788aman khatriNo ratings yet

- HDFC Life Guaranteed Income Insurance ( 8 - 16 )Document2 pagesHDFC Life Guaranteed Income Insurance ( 8 - 16 )AbhishekNo ratings yet

- IllustrationDocument2 pagesIllustrationseenasrinivas113No ratings yet

- Illustration - 2023-10-14T171945.641Document2 pagesIllustration - 2023-10-14T171945.641abinashsekharmishra1No ratings yet

- Dummy Please IgnoreDocument4 pagesDummy Please IgnoreShivam SoniNo ratings yet

- IllustrationDocument4 pagesIllustrationvinaagrwalNo ratings yet

- IllustrationDocument2 pagesIllustrationashutoshshinde2210No ratings yet

- IllustrationDocument3 pagesIllustrationRahul KumwatNo ratings yet

- IllustrationDocument2 pagesIllustrationseenasrinivas113No ratings yet

- IllustrationDocument3 pagesIllustrationHar DonNo ratings yet

- Life Time BenifitDocument3 pagesLife Time BenifitRajaNo ratings yet

- Sanchay ParDocument2 pagesSanchay ParAkshay ChaudhryNo ratings yet

- Sanchay Par Immediete IncomeDocument3 pagesSanchay Par Immediete IncomeRavi KumarNo ratings yet

- IllustrationDocument3 pagesIllustrationsonuNo ratings yet

- IllustrationDocument2 pagesIllustrationraamshankar11No ratings yet

- IllustrationDocument2 pagesIllustrationVikas MaheshwariNo ratings yet

- E - SymbiosysFiles - Generated - OutputSIPDF - 09100000264060720Document2 pagesE - SymbiosysFiles - Generated - OutputSIPDF - 09100000264060720Sabarish T ENo ratings yet

- Illustration - 2022-11-04T161802.609Document3 pagesIllustration - 2022-11-04T161802.609BLOODY ASHHERNo ratings yet

- IllustrationDocument2 pagesIllustrationsukh37949No ratings yet

- IllustrationDocument2 pagesIllustrationMayank guptaNo ratings yet

- Pending 1692863217 IllustrationDocument2 pagesPending 1692863217 IllustrationDishani MaityNo ratings yet

- Illustration - 2022-07-30T133834.945Document3 pagesIllustration - 2022-07-30T133834.945Soumen BeraNo ratings yet

- Illustration 990Document2 pagesIllustration 990prachididwania13No ratings yet

- Mrs Richa 8-1-25 10LDocument2 pagesMrs Richa 8-1-25 10LRaju KaliperumalNo ratings yet

- IllustrationDocument2 pagesIllustrationMayank guptaNo ratings yet

- IllustrationDocument2 pagesIllustrationRajnandan shindeNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageSamyNo ratings yet

- Hafele: Elegance Meets FunctionalityDocument48 pagesHafele: Elegance Meets FunctionalityMyeduniya MEDNo ratings yet

- Stockifi Poonawalla Fincorp Detailed Note WWW Stockifi in D67eb7eed6Document13 pagesStockifi Poonawalla Fincorp Detailed Note WWW Stockifi in D67eb7eed6Myeduniya MEDNo ratings yet

- XTREME Price List 2023Document8 pagesXTREME Price List 2023Myeduniya MEDNo ratings yet

- Terms of EngagementDocument6 pagesTerms of EngagementMyeduniya MEDNo ratings yet

- Pre Webinar Presentation-30th Nov PDFDocument11 pagesPre Webinar Presentation-30th Nov PDFMyeduniya MEDNo ratings yet

- Receivables Transfer Agreement - Sample 1Document17 pagesReceivables Transfer Agreement - Sample 1aysin kadirbeyogluNo ratings yet

- DEED OF DONATION OF A PORTION Lionel AstilleroDocument2 pagesDEED OF DONATION OF A PORTION Lionel AstilleroJude RavagoNo ratings yet

- Engineering Economics 1 Feb 2023 Rev0Document14 pagesEngineering Economics 1 Feb 2023 Rev0Lakers FansNo ratings yet

- Guerrero vs. CADocument14 pagesGuerrero vs. CAEdryd RodriguezNo ratings yet

- Comparative Analysis of Treatment of War Captives Under Islamicand International Humanitarian LawsDocument370 pagesComparative Analysis of Treatment of War Captives Under Islamicand International Humanitarian LawsKing Ceasor University Kampala, UgandaNo ratings yet

- 13 Key Answer KSISF 18 KpscvaaniDocument1 page13 Key Answer KSISF 18 KpscvaaniVenkatesh prasadNo ratings yet

- Chapter 8Document6 pagesChapter 8Mark Dave SambranoNo ratings yet

- Family Moot MeemoDocument16 pagesFamily Moot Meemoraj sinhaNo ratings yet

- 3 Brgy. Reso - TripartiteDocument2 pages3 Brgy. Reso - TripartiteBarangay TaguiticNo ratings yet

- Telecommunication Regulation in Bangladesh: An Overview: Anju Man Ara Begum Mohammad Hasan Murad Kazi Arshadul HoqueDocument16 pagesTelecommunication Regulation in Bangladesh: An Overview: Anju Man Ara Begum Mohammad Hasan Murad Kazi Arshadul HoqueTANVIR SADATNo ratings yet

- GST Pass Order PDFDocument4 pagesGST Pass Order PDFvenkat dNo ratings yet

- UDHR70 30on30 Article16 EngDocument3 pagesUDHR70 30on30 Article16 EngMojahid MohamadNo ratings yet

- FPJ Whatsapp Edition-11!08!2021Document18 pagesFPJ Whatsapp Edition-11!08!2021Shardul GopujkarNo ratings yet

- Socio Economic Offences in India PDFDocument8 pagesSocio Economic Offences in India PDFSejwal PrashantNo ratings yet

- T4 AkuntansiDocument3 pagesT4 AkuntansiYusuf HadiNo ratings yet

- Tariff Regime in Pakistan - Sajid Akram NEPRADocument35 pagesTariff Regime in Pakistan - Sajid Akram NEPRASheraz azamNo ratings yet

- CAAT - 004 - FSD AOC Certification & Administration Manual (REV01) - 2800 - 101051Document418 pagesCAAT - 004 - FSD AOC Certification & Administration Manual (REV01) - 2800 - 101051Matteo SirtoriNo ratings yet

- Chambers Corporate Governance 2021 Corporate Governance 2021Document600 pagesChambers Corporate Governance 2021 Corporate Governance 2021Bella TjendriawanNo ratings yet

- US Vs GrantDocument20 pagesUS Vs GrantJohn Wick F. GeminiNo ratings yet

- Excel Function For PracticeDocument17 pagesExcel Function For PracticeMahtab SiddiquiNo ratings yet

- Marx NotesDocument155 pagesMarx NotesChirz CoNo ratings yet

- Bravado International Group Merchandising Services, Inc. v. John Does 1-100 Et Al - Document No. 11Document5 pagesBravado International Group Merchandising Services, Inc. v. John Does 1-100 Et Al - Document No. 11Justia.comNo ratings yet

- Bar Council of India RuleDocument26 pagesBar Council of India RuleShubham Rana100% (1)

- News Release From Tim Danson Re Offender Paul Bernardo and CSC Report (July 20-2023)Document3 pagesNews Release From Tim Danson Re Offender Paul Bernardo and CSC Report (July 20-2023)CityNewsTorontoNo ratings yet

- Didipio Earth-Savers' Multi-Purpose Association, Inc. (DESAMA) Et Al.v Elisea Gozun, Et Al. G.R. No. 157882 March 30, 2006Document65 pagesDidipio Earth-Savers' Multi-Purpose Association, Inc. (DESAMA) Et Al.v Elisea Gozun, Et Al. G.R. No. 157882 March 30, 2006RMC PropertyLawNo ratings yet

- Kingstonian LawsuitDocument11 pagesKingstonian LawsuitDaily FreemanNo ratings yet

- DPC Assignment - IIIDocument46 pagesDPC Assignment - IIIVinod Thomas EfiNo ratings yet

- Credit TransDocument2 pagesCredit TransJessa Mae AdodangNo ratings yet

- Heirs of Tabia v. CA, GR No. 129377, Feb. 22, 2007 FactsDocument2 pagesHeirs of Tabia v. CA, GR No. 129377, Feb. 22, 2007 FactsRussellNo ratings yet