Professional Documents

Culture Documents

Illustration - 2022-08-31T122247.414

Uploaded by

Soumen BeraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Illustration - 2022-08-31T122247.414

Uploaded by

Soumen BeraCopyright:

Available Formats

31-08-2022

Quote No : qbb0t1ryhgw12

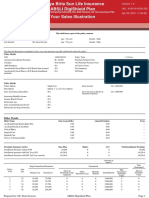

Benefit Illustration for HDFC Life Click 2 Protect Life

This Illustration has been produced by HDFC Life Insurance Company Limited to help you understand the benefits of your

HDFC Life Click 2 Protect Life

DETAILS

Age is taken as on last birthday Proposal No: NA

Name of the Prospect/Policyholder: NITIN Name of Product: HDFC Life Click 2 Protect Life

A Non Linked, Non Participating, Individual,

Age: 38 Tag Line: Pure Risk Premium/Savings Life Insurance

Plan

Name of Life Assured: NITIN Unique Identification No: 101N139V04

Age: 38 GST Rate: 4.5% for first year

Gender: Male 2.25% second year onwards

Policy Term: 27 Years

Premium Paying Term: 10 Years Tobacco User: No

Amount of Instalment Premium(Without

Rs.35799

GST):

Mode of Premium Payment: Annual

This benefit illustration is intended to show year-wise premiums payable and benefits under the policy.

This benefit illustration is intended to show year-wise premiums payable and benefits under the policy

Policy Details

Plan Option Life Protect - Fixed Term Sum Assured Rs. 3500000

WOP CI Benefit No Accidental Death Benefit No

Return of Premium Benefit Yes(lumpsum) Sum Assured on Death (at inception of the policy) Rs. 3500000

Survival Benefit Not Applicable

Premium Summary

PP PP Total

Base Plan CI Rider IB Rider PP Rider (PAC) Rider Rider Instalment

(ADC) (CC) Premium

Instalment Premium without GST 35,799 0 0 0 0 0 35,799

Instalment Premium with First Year GST 37,410 0 0 0 0 0 37,410

Instalment Premium with GST 2nd Year Onwards 36,604 0 0 0 0 0 36,604

(Amount in Rupees)

Policy Single/ Guaranteed

Year Annualized Survival Benefit/ Accrued Guaranteed

Additions Other Maturity Death Inbuilt Benefit on diagnosis of Min Guaranteed Special Surrender

Premium

Benefits Benefit Critical Illness Surrender Value Value

1 35,799 0 0 0 35,00,000 0 0 0

2 35,799 0 0 0 35,00,000 0 21,479 8,942

3 35,799 0 0 0 35,00,000 0 37,589 14,553

4 35,799 0 0 0 35,00,000 0 71,598 21,054

5 35,799 0 0 0 35,00,000 0 89,498 28,554

6 35,799 0 0 0 35,00,000 0 1,07,397 37,178

7 35,799 0 0 0 35,00,000 0 1,25,297 47,061

8 35,799 0 0 0 35,00,000 0 1,48,924 58,356

9 35,799 0 0 0 35,00,000 0 1,73,983 71,230

10 35,799 0 0 0 35,00,000 0 2,00,474 85,872

11 0 0 0 0 35,00,000 0 2,07,634 93,171

12 0 0 0 0 35,00,000 0 2,18,374 1,01,090

13 0 0 0 0 35,00,000 0 2,25,534 1,09,683

14 0 0 0 0 35,00,000 0 2,32,694 1,19,006

15 0 0 0 0 35,00,000 0 2,39,853 1,29,122

16 0 0 0 0 35,00,000 0 2,47,013 1,40,097

17 0 0 0 0 35,00,000 0 2,54,173 1,52,005

18 0 0 0 0 35,00,000 0 2,61,333 1,64,926

19 0 0 0 0 35,00,000 0 2,68,493 1,78,945

20 0 0 0 0 35,00,000 0 2,75,652 1,94,155

21 0 0 0 0 35,00,000 0 2,82,812 2,10,658

22 0 0 0 0 35,00,000 0 2,93,552 2,28,564

23 0 0 0 0 35,00,000 0 3,00,712 2,47,991

24 0 0 0 0 35,00,000 0 3,07,871 2,69,071

25 0 0 0 0 35,00,000 0 3,15,031 2,91,942

26 0 0 0 0 35,00,000 0 3,22,191 3,16,757

27 0 0 0 3,57,990 35,00,000 0 0 0

Notes:

1.Annualized Premium excludes underwriting extra premium, frequency loadings on premiums, the premiums paid towards the riders, if any, and Goods & Service Tax.

2. The benefits illustrated are as of at end of year.

3. Surrender Value payable will be the higher of GSV (Guaranteed Surrender Value) and SSV (Special Surrender Value).

4. On a valid CI Benefit claim, future premiums will be waived off and the Life Cover Sum Assured will be fixed at the then applicable value for the remainder of the policy term

(Applicable only for Life &CI Rebalance plan option).

5. In case Whole of Life option is chosen, the Benefits will be payable for as long as the Life Assured is alive.

I SUMIT BERA, have explained the premiums charges and benefits under the policy I NITIN ,having received the information with respect to the above, have understood

fully to the prospect / policy holder. the above statement before entering into the contract.

Place:

Date: Signature of Agent /Intermediary / Official Date: Signature of Prospect / Policyholder

Note: Kindly note that name of the company has changed from "HDFC Standard Life Insurance Company Limited" to "HDFC Life Insurance Company Limited".

You might also like

- Illustration - 2022-08-31T154243.769Document3 pagesIllustration - 2022-08-31T154243.769Soumen BeraNo ratings yet

- Illustration - 2022-08-31T155906.546Document3 pagesIllustration - 2022-08-31T155906.546Soumen BeraNo ratings yet

- IllustrationDocument4 pagesIllustrationVamsi Krishna BNo ratings yet

- IllustrationDocument4 pagesIllustrationvinaagrwalNo ratings yet

- Illustration - 2022-08-31T122344.433Document3 pagesIllustration - 2022-08-31T122344.433Soumen BeraNo ratings yet

- Illustration - 2022-08-31T155028.397Document3 pagesIllustration - 2022-08-31T155028.397Soumen BeraNo ratings yet

- Illustration - 2022-08-31T152151.383Document3 pagesIllustration - 2022-08-31T152151.383Soumen BeraNo ratings yet

- IllustrationDocument4 pagesIllustrationVamsi Krishna BNo ratings yet

- Dummy Please IgnoreDocument4 pagesDummy Please IgnoreShivam SoniNo ratings yet

- IllustrationDocument4 pagesIllustrationVamsi Krishna BNo ratings yet

- Illustration Qbbphn08e5mlqDocument4 pagesIllustration Qbbphn08e5mlqMaruti KambleNo ratings yet

- Illustration - 2023-11-09T153903.144Document2 pagesIllustration - 2023-11-09T153903.144raamshankar11No ratings yet

- Illustration - 2023-11-09T154448.741Document2 pagesIllustration - 2023-11-09T154448.741raamshankar11No ratings yet

- Illustr NewDocument2 pagesIllustr NewHar DonNo ratings yet

- Illustration - 2022-08-31T164229.106Document3 pagesIllustration - 2022-08-31T164229.106Soumen BeraNo ratings yet

- Illustration - 2023-10-14T171945.641Document2 pagesIllustration - 2023-10-14T171945.641abinashsekharmishra1No ratings yet

- IllustrationDocument3 pagesIllustrationamrutadonNo ratings yet

- Illustration Qbbpi722hqyhtDocument3 pagesIllustration Qbbpi722hqyhtMaruti KambleNo ratings yet

- IllustrationDocument2 pagesIllustrationTushar ChaudhariNo ratings yet

- Illustration 3Document2 pagesIllustration 3Satyaki DuttaNo ratings yet

- HDFC Life Click 2 Protect SuperDocument3 pagesHDFC Life Click 2 Protect SuperABISHKAR SARKARNo ratings yet

- IllustrationDocument3 pagesIllustrationSiddharth GoenkaNo ratings yet

- IllustrationDocument2 pagesIllustrationestrade1112No ratings yet

- IllustrationDocument3 pagesIllustrationamrutadonNo ratings yet

- IllustrationDocument3 pagesIllustrationamrutadonNo ratings yet

- Illustration - 2023-09-16T115558.673Document3 pagesIllustration - 2023-09-16T115558.673LogeshParthasarathyNo ratings yet

- Illustration Qapkn8mbwyaa9Document3 pagesIllustration Qapkn8mbwyaa9AnithaNo ratings yet

- IllustrationDocument3 pagesIllustrationBujji Bangaram VelagaletiNo ratings yet

- Policy DetailsDocument2 pagesPolicy DetailsMyeduniya MEDNo ratings yet

- IllustrationDocument2 pagesIllustrationPULKIT JAINNo ratings yet

- CZ 56256 BN 564788Document2 pagesCZ 56256 BN 564788aman khatriNo ratings yet

- Illustration Qbyuu7muxf1cvDocument3 pagesIllustration Qbyuu7muxf1cvajayNo ratings yet

- IllustrationDocument2 pagesIllustrationPULKIT JAINNo ratings yet

- HDFC Life Guaranteed Income Insurance ( 8 - 16 )Document2 pagesHDFC Life Guaranteed Income Insurance ( 8 - 16 )AbhishekNo ratings yet

- IllustrationDocument2 pagesIllustrationMayank guptaNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageSamyNo ratings yet

- IllustrationDocument2 pagesIllustrationRanjit PanigrahiNo ratings yet

- IllustrationDocument2 pagesIllustrationPULKIT JAINNo ratings yet

- E - SymbiosysFiles - Generated - OutputSIPDF - 09100000264060720Document2 pagesE - SymbiosysFiles - Generated - OutputSIPDF - 09100000264060720Sabarish T ENo ratings yet

- Illustration - 2022-07-30T133834.945Document3 pagesIllustration - 2022-07-30T133834.945Soumen BeraNo ratings yet

- IllustrationDocument2 pagesIllustrationvyasmusicNo ratings yet

- IllustrationDocument2 pagesIllustrationPULKIT JAINNo ratings yet

- Illustration 990Document2 pagesIllustration 990prachididwania13No ratings yet

- IllustrationDocument2 pagesIllustrationvyasmusicNo ratings yet

- Life Insurance: A Non-Linked Non Participating Individual Pure Risk Premium Life Term Insurance PlanDocument3 pagesLife Insurance: A Non-Linked Non Participating Individual Pure Risk Premium Life Term Insurance Plannita davidNo ratings yet

- IllustrationDocument2 pagesIllustrationKiran NNo ratings yet

- Sanchay Par Immediete IncomeDocument3 pagesSanchay Par Immediete IncomeRavi KumarNo ratings yet

- DetailsDocument2 pagesDetailsmailshimmerandshineNo ratings yet

- Illustration - 2022-08-30T164443.287Document2 pagesIllustration - 2022-08-30T164443.287Soumen BeraNo ratings yet

- Sanchay ParDocument2 pagesSanchay ParAkshay ChaudhryNo ratings yet

- IllustrationDocument2 pagesIllustrationsukh37949No ratings yet

- Illustration - 2022-11-04T161802.609Document3 pagesIllustration - 2022-11-04T161802.609BLOODY ASHHERNo ratings yet

- E - SymbiosysFiles - Generated - OutputSIPDF - 09100000264060720Document2 pagesE - SymbiosysFiles - Generated - OutputSIPDF - 09100000264060720Sabarish T ENo ratings yet

- Pending 1692863217 IllustrationDocument2 pagesPending 1692863217 IllustrationDishani MaityNo ratings yet

- IllustrationDocument2 pagesIllustrationNiranjan LenkaNo ratings yet

- Hdfc-Illustration - 2022-09-09T113844.627Document3 pagesHdfc-Illustration - 2022-09-09T113844.627srinivasangsrinivasaNo ratings yet

- Exide Life Assured Gain Plus-Wed Jun 29 10 - 00 - 09 IST 2022Document3 pagesExide Life Assured Gain Plus-Wed Jun 29 10 - 00 - 09 IST 2022lakshmee262No ratings yet

- IllustrationDocument3 pagesIllustrationHar DonNo ratings yet

- Bitcoin Mining 101: The Bitcoin Beginner's Guide to Making Money with BitcoinsFrom EverandBitcoin Mining 101: The Bitcoin Beginner's Guide to Making Money with BitcoinsNo ratings yet

- 70006519865Document4 pages70006519865Soumen BeraNo ratings yet

- PDF 953289030230722Document1 pagePDF 953289030230722Soumen BeraNo ratings yet

- IllustrationDocument2 pagesIllustrationSoumen BeraNo ratings yet

- Illustration - 2022-08-26T182831.858Document2 pagesIllustration - 2022-08-26T182831.858Soumen BeraNo ratings yet

- SMP 15 Year 1 LAKHDocument3 pagesSMP 15 Year 1 LAKHTamil Vanan NNo ratings yet

- IllustrationDocument2 pagesIllustrationSoumen BeraNo ratings yet

- Illustration - 2022-08-26T182737.117Document2 pagesIllustration - 2022-08-26T182737.117Soumen BeraNo ratings yet

- Non DND 1 To 2 PagesDocument20 pagesNon DND 1 To 2 PagesSoumen BeraNo ratings yet

- Delhi NCR Hni Sample WF Ns.Document6 pagesDelhi NCR Hni Sample WF Ns.Soumen BeraNo ratings yet

- Illustration Qapkn8mbwyaa9Document3 pagesIllustration Qapkn8mbwyaa9AnithaNo ratings yet

- Sample 55Document12 pagesSample 55Soumen BeraNo ratings yet

- Illustration - 2022-07-30T141948.715Document3 pagesIllustration - 2022-07-30T141948.715Soumen BeraNo ratings yet

- Illustration Qapkn8mbwyaa9Document3 pagesIllustration Qapkn8mbwyaa9AnithaNo ratings yet

- Illustration - 2022-08-31T155028.397Document3 pagesIllustration - 2022-08-31T155028.397Soumen BeraNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageSamyNo ratings yet

- IllustrationDocument3 pagesIllustrationSoumen BeraNo ratings yet

- Illustration Qapkn8mbwyaa9Document3 pagesIllustration Qapkn8mbwyaa9AnithaNo ratings yet

- Illustration - 2022-08-31T152151.383Document3 pagesIllustration - 2022-08-31T152151.383Soumen BeraNo ratings yet

- Sanchay Par 75Document3 pagesSanchay Par 75Soumen BeraNo ratings yet

- IllustrationDocument3 pagesIllustrationSoumen BeraNo ratings yet

- IllustrationDocument3 pagesIllustrationSoumen BeraNo ratings yet

- Illustration - 2022-08-30T164443.287Document2 pagesIllustration - 2022-08-30T164443.287Soumen BeraNo ratings yet

- Illustration - 2022-07-30T133834.945Document3 pagesIllustration - 2022-07-30T133834.945Soumen BeraNo ratings yet

- IllustrationDocument3 pagesIllustrationSoumen BeraNo ratings yet

- Illustration Qapkn8mbwyaa9Document3 pagesIllustration Qapkn8mbwyaa9AnithaNo ratings yet

- Illustration - 2022-08-31T164229.106Document3 pagesIllustration - 2022-08-31T164229.106Soumen BeraNo ratings yet

- Case StudyDocument84 pagesCase StudykenNo ratings yet

- Sime Darby BerhadDocument16 pagesSime Darby Berhadjue -No ratings yet

- SBI Life - EWealth Insurance 300415 V2Document16 pagesSBI Life - EWealth Insurance 300415 V2Tejas JasaniNo ratings yet

- Magesh.m - A Study On Customer Satisfaction Towards Home Loan With Reference To Home First Finance CompanyDocument67 pagesMagesh.m - A Study On Customer Satisfaction Towards Home Loan With Reference To Home First Finance CompanyDr.P. VENKATESH100% (1)

- Guidelines On VariableDocument22 pagesGuidelines On VariableErnesto Gavas JrNo ratings yet

- Transferring Funds : International Personal BankDocument4 pagesTransferring Funds : International Personal BankGarbo BentleyNo ratings yet

- Department of Education: Republic of The PhilippinesDocument8 pagesDepartment of Education: Republic of The PhilippinesJeweljoy PudaNo ratings yet

- Future Generali India: Insurance Company LimitedDocument2 pagesFuture Generali India: Insurance Company Limitedstar pandiNo ratings yet

- Annual Report FY 17 18Document156 pagesAnnual Report FY 17 18Seada AliyiNo ratings yet

- Accounts Cec 2year Exam PaperDocument3 pagesAccounts Cec 2year Exam PaperMohammad MoinuddinNo ratings yet

- 01 Forensic Accounting, Fraud, Fraudster ProfileDocument27 pages01 Forensic Accounting, Fraud, Fraudster ProfileArif Ahmed100% (1)

- CEMAP-1 QuestionsDocument7 pagesCEMAP-1 QuestionsVeena HingarhNo ratings yet

- Burger KingDocument6 pagesBurger KingAditya SapraNo ratings yet

- Origin and Evolution of Double Entry Bookkeeping A Study of Italian Practice From The Fourteenth Century by Edward Peragallo PDFDocument161 pagesOrigin and Evolution of Double Entry Bookkeeping A Study of Italian Practice From The Fourteenth Century by Edward Peragallo PDFDan PolakovicNo ratings yet

- Financial Markets & Institutions: Maria Jorgeth O. CarbonDocument65 pagesFinancial Markets & Institutions: Maria Jorgeth O. CarbonFelsie Jane Penaso100% (1)

- OutScanner - SFM Solved Compiler - Adish JainDocument545 pagesOutScanner - SFM Solved Compiler - Adish JainRakesh GopuNo ratings yet

- NGT Ubl Bank Statement Fmo May 2023Document5 pagesNGT Ubl Bank Statement Fmo May 2023Arshad SadeequeNo ratings yet

- Part 2 Chapter 1Document4 pagesPart 2 Chapter 1Keay ParadoNo ratings yet

- Financial Performance of Private Sector Banks in India - An EvaluationDocument14 pagesFinancial Performance of Private Sector Banks in India - An Evaluationswapna29No ratings yet

- E Receipt For State Bank Collect Payment: 13731 Suryansh .Tiwari Ug GN Mme Btech Hall3 156 Suryansh@Iitk - Ac.In 55890 0Document1 pageE Receipt For State Bank Collect Payment: 13731 Suryansh .Tiwari Ug GN Mme Btech Hall3 156 Suryansh@Iitk - Ac.In 55890 0Abhishek KulkarniNo ratings yet

- Internship Report On Credit Management oDocument70 pagesInternship Report On Credit Management oAddir Faisal RefatNo ratings yet

- PPT On Raghunandan MoneyDocument17 pagesPPT On Raghunandan MoneyAmarkantNo ratings yet

- Mayes 8e CH05 SolutionsDocument36 pagesMayes 8e CH05 SolutionsRamez AhmedNo ratings yet

- RM Case 01Document3 pagesRM Case 01Milin NagarNo ratings yet

- Name Registration No Sex Sign: Salum Warsh Dicholile T/UDOM/2020/07895 MDocument4 pagesName Registration No Sex Sign: Salum Warsh Dicholile T/UDOM/2020/07895 MSam DizongaNo ratings yet

- Consumer CirDocument7 pagesConsumer CirNitish PandeyNo ratings yet

- Nan Makkalai PeruthalDocument2 pagesNan Makkalai PeruthalSakthivelu NNo ratings yet

- Plastic MoneyDocument48 pagesPlastic Moneyvanishachhabra5008No ratings yet

- FN107-1342 - Footnotes Levin-Coburn Report.Document1,037 pagesFN107-1342 - Footnotes Levin-Coburn Report.Rick ThomaNo ratings yet

- 1819 IB124 Summer Exam PaperDocument6 pages1819 IB124 Summer Exam PaperHarry TaylorNo ratings yet