Professional Documents

Culture Documents

Financial Payslip Details

Uploaded by

ravi0 ratings0% found this document useful (0 votes)

16 views1 pagevachaanu

Original Title

bochu

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentvachaanu

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views1 pageFinancial Payslip Details

Uploaded by

ravivachaanu

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

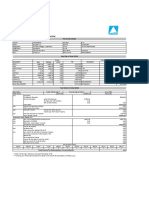

TEAMSPACE FINANCIAL SERVICES PVT.

LTD

C-19/20, Shri Ram Industrial Estate, 13, G D Ambekar Road,

Wadala West, Mumbai - 400031. Maharashtra, India.

info@TeamSpaceIndia.com

Payslip for the month of February 2023

Employee Code T11103 Employee name Aidapu Sathish

Company TeamSpace Financial Services Pvt. Ltd Client Yes Bank Limited

BusinessUnit Yes Bank - CPA Department MIB BIZ

SubDepartment MIB Designation Sales Executive

Region South State Telangana

Location Hyderabad Sub Location Hyderabad

UAN Number 101147411927 PF Account Number MHBAN00478180000024305

Esic Account Number 5217116230

Bank Name Au Small Finance Bank Ltd Bank Account Number 2211249345372359

IFSC Code AUBL0002493 Date of Birth 24 Jan 1989

Date of Joining 01 Feb 2021 Days Worked 28

Arrears Days 1

Earnings Monthly Rate Current Month Arrears Total Deductions Amount

BASIC 15085.00 15085.00 487.00 15572.00 Employee’s Contribution to PF 1,800.00

House Rent Allowance 7430.00 7430.00 240.00 7670.00 Arrears Employee’s Contribution to PF 48.00

Incentive/Statutory Bonus 0.00 2500.00 0.00 2500.00 Employee’s Contribution to LWF 1.00

(Monthly Advance)

Profession Tax 200.00

GMC (Employee) 300.00

GPA (Employee) 15.00

GTL (Employee) 20.00

Gross Earnings 25,742.00 Total Deductions 2,384.00

In words ( ) : Twenty Three Thousand Three Hundred Fifty Eight Only Net Salary : 23,358.00

Income Tax Calculation for the financial Year 2022-2023

Particular Cumulative Projected Current Annual Details Of Exemption U/S 10

BASIC 150363.00 15085.00 15572.00 181020.00 Conveyance Exemption 0

House Rent 74060.00 7430.00 7670.00 89160.00 Leave Travel Exemption 0

Allowance

Washing Exemption 0

Incentive/Statutory 39500.00 0.00 2500.00 42000.00

Bonus (Monthly

Advance)

Investment Details

PF + VPF + Prev Emplr PF + Prev Emplr VPF 21600.00

Salary For The Year 312180.00

Gross Salary 312180.00

Gross Taxable Income 312180.00

LESS : Profession Tax 2300.00

Less : Standard Deduction 50000.00

LESS : Deduction Under section 80C 21600.00

Net Taxable Income (Rounded Off) 238280.00

Income Tax Deduction

87A 0.00

Income Tax Payable 0.00

Surcharge 0.00

Education Cess 0.00

Total Income Tax & Surcharge Payable 0.00

Esop Tax to be Recovered in this Month 0.00

Esop Tax Already Deducted 0.00

Less Tax Deducted at source till current month 0.00

Less Tax Deducted by Previous Employer 0.00

Balance Tax Payable/Refundable 0.00

Average Tax Payable per Month 0.00

This is a System-Generated Statement and does not require a Signature / Stamp.

Under the directives of TeamSpace Code of Conduct, Policies, Appointment Terms, it is expected of the Employee

to maintain absolute Confidentiality about Remuneration and any breach may lead to stringent action(s).

FORM X [Rule 26 (1)]; FORM XI [Rule 26 (2)]

You might also like

- Journal Entries For Merchandising Business Problem 1Document12 pagesJournal Entries For Merchandising Business Problem 1Arn Manuyag88% (24)

- BM2613Document1 pageBM2613Pratik DesaiNo ratings yet

- Payslip 2023 2024 5 200000000029454 IGSLDocument2 pagesPayslip 2023 2024 5 200000000029454 IGSLMohit SagarNo ratings yet

- BM2613Document1 pageBM2613Pratik DesaiNo ratings yet

- Altruist Customer Management India PVT LTD: Personal DetailsDocument1 pageAltruist Customer Management India PVT LTD: Personal DetailsSampathKPNo ratings yet

- INTELENET BUSINESS SERVICES PAYSLIPDocument1 pageINTELENET BUSINESS SERVICES PAYSLIPshail100% (1)

- Payslip 2023 2024 6 200000000029454 IGSLDocument1 pagePayslip 2023 2024 6 200000000029454 IGSLMohit SagarNo ratings yet

- Payslip India June - 2023Document2 pagesPayslip India June - 2023RAJESH DNo ratings yet

- TerraCog Global Positioning SystemsDocument3 pagesTerraCog Global Positioning SystemsSky HearttNo ratings yet

- Teleperformance Global Services Private Limited: Payslip For The Month of November 2021Document1 pageTeleperformance Global Services Private Limited: Payslip For The Month of November 2021gajala jamirNo ratings yet

- Salary SlipDocument1 pageSalary SlipPhagun BehlNo ratings yet

- Salary SlipDocument2 pagesSalary Slipchethankapoor9999No ratings yet

- Payslip 4 2022Document1 pagePayslip 4 2022Sunil B R SunilshettyNo ratings yet

- Payslip India August - 2023 (1) - Unlocked-1Document1 pagePayslip India August - 2023 (1) - Unlocked-1Bhaskar Siva KumarNo ratings yet

- July SlipDocument1 pageJuly SlipNILAMANI SAHOONo ratings yet

- Info Sys Salary SlipDocument2 pagesInfo Sys Salary SlipGurpreetS Myvisa100% (1)

- Payslip 2023 2024 4 200000000029454 IGSLDocument1 pagePayslip 2023 2024 4 200000000029454 IGSLMohit SagarNo ratings yet

- Subramani PayslipDocument2 pagesSubramani PayslipMr. HarshaNo ratings yet

- 'KS21596'NovDocument1 page'KS21596'NovRiya paiNo ratings yet

- Amazon Development Center India Pvt. LTD: Amount in INRDocument1 pageAmazon Development Center India Pvt. LTD: Amount in INRMaaz Uddin Siddiqui0% (1)

- Break Even AnalysisDocument6 pagesBreak Even Analysisemmanuel Johny100% (1)

- Payslip 2023 2024 5 100000000546055 IGSL PDFDocument1 pagePayslip 2023 2024 5 100000000546055 IGSL PDFKapilNo ratings yet

- Payslip 2023 2024 5 100000000546055 IGSL PDFDocument1 pagePayslip 2023 2024 5 100000000546055 IGSL PDFKapilNo ratings yet

- Payslip 2023 2024 10 05607 VASTUGROUPDocument1 pagePayslip 2023 2024 10 05607 VASTUGROUPNavamani VigneshNo ratings yet

- Payslip For The Month of November 2020: Cms It Services Private LimitedDocument2 pagesPayslip For The Month of November 2020: Cms It Services Private LimitedKrishna AryanNo ratings yet

- Altruist Technologies Pvt. LTD.: Personal DetailsDocument1 pageAltruist Technologies Pvt. LTD.: Personal DetailsDeepak kumar M R100% (1)

- AISATS Payslip April 2023Document1 pageAISATS Payslip April 2023Sahil shahNo ratings yet

- Payslip March 2023Document1 pagePayslip March 2023kaushalNo ratings yet

- CRM Services Payslip for September 2021Document1 pageCRM Services Payslip for September 2021Phagun BehlNo ratings yet

- Payslip India May - 2023Document2 pagesPayslip India May - 2023RAJESH DNo ratings yet

- Gaurav Joshi Payslip Nov 2021Document1 pageGaurav Joshi Payslip Nov 2021Gaurav Jay JoshiNo ratings yet

- Payslip For The Month of June 2022: Kotak Mahindra Bank LTDDocument1 pagePayslip For The Month of June 2022: Kotak Mahindra Bank LTDshubham choure100% (1)

- Treasury Enterprise Architecture Framework (TEAF)Document164 pagesTreasury Enterprise Architecture Framework (TEAF)sreeni1750% (2)

- Conneqt Business Solutions Limited: 295190 Shivanand Amarnath MauryaDocument1 pageConneqt Business Solutions Limited: 295190 Shivanand Amarnath MauryaBhushan JadhavNo ratings yet

- YesukoDocument1 pageYesukoraviNo ratings yet

- Intelenet payslip titleDocument1 pageIntelenet payslip titleSandeep SranNo ratings yet

- SAP Procurement CertificationDocument6 pagesSAP Procurement CertificationFerhanMalik0% (1)

- PDF Administrative Aide III (Clerk I)Document2 pagesPDF Administrative Aide III (Clerk I)June DelaPaz Baunillo50% (2)

- CRM Initiatives at 3M PDFDocument10 pagesCRM Initiatives at 3M PDFPradumna KasaudhanNo ratings yet

- Teleperformance Payslip for February 2021Document1 pageTeleperformance Payslip for February 2021x foxNo ratings yet

- TELEPERFORMANCE GLOBAL SERVICES PRIVATE LIMITED Payslip for December 2021Document1 pageTELEPERFORMANCE GLOBAL SERVICES PRIVATE LIMITED Payslip for December 2021gajala jamirNo ratings yet

- Lean ITDocument372 pagesLean ITHoang Nguyen100% (2)

- Durgesh Jamdar HDB Pay Slip Aug 2022Document1 pageDurgesh Jamdar HDB Pay Slip Aug 2022DURGESH JAMDAR0% (1)

- Salary Sep.20 SlipDocument1 pageSalary Sep.20 Slipkedarnath jaiswalNo ratings yet

- Salary Nov.20 SlipDocument1 pageSalary Nov.20 Slipkedarnath jaiswalNo ratings yet

- Adobe Scan 12 Sept 2023Document1 pageAdobe Scan 12 Sept 2023MEENAKSHI RAWATNo ratings yet

- Mahalaxmi Payslip July 2021Document1 pageMahalaxmi Payslip July 2021Pratik DesaiNo ratings yet

- Salary Sep.20 SlipDocument1 pageSalary Sep.20 Slipkedarnath jaiswalNo ratings yet

- Salary SlipDocument2 pagesSalary Slipchethankapoor9999No ratings yet

- Salary SlipDocument2 pagesSalary Slipchethankapoor9999No ratings yet

- 101, Part-III, G.I.D.C.Estate, Sector-28, Gandhinagar-382028 Salary Slip For The Month of November2023Document1 page101, Part-III, G.I.D.C.Estate, Sector-28, Gandhinagar-382028 Salary Slip For The Month of November2023ralesh694No ratings yet

- Nikhil KotakDocument2 pagesNikhil Kotaknikhilkadam607No ratings yet

- SalaryDocument1 pageSalaryBale MishraNo ratings yet

- Salary & Reliving LetterDocument6 pagesSalary & Reliving LetterYash ShettyNo ratings yet

- unknown (4)Document1 pageunknown (4)Firoz ShaikhNo ratings yet

- March Pay SlipDocument1 pageMarch Pay SlipBale MishraNo ratings yet

- April Pay SlipDocument1 pageApril Pay SlipBale MishraNo ratings yet

- Payslip FormatDocument1 pagePayslip FormatAjit AttreeNo ratings yet

- Kotak Securities Payslip for August 2020Document1 pageKotak Securities Payslip for August 2020Aakash PrajapatiNo ratings yet

- Deepika3Document1 pageDeepika3chanduazad8808No ratings yet

- Duca Industries March 2023 pay slip for Dipankar MondalDocument1 pageDuca Industries March 2023 pay slip for Dipankar MondalPritam GoswamiNo ratings yet

- Payslip India April - 2023-1-2Document1 pagePayslip India April - 2023-1-2aamirashfaque20No ratings yet

- Associate Payment Slip - HarmonyDocument1 pageAssociate Payment Slip - Harmonythebhavesh93No ratings yet

- payslip-2020-2021-12-300000000004232-CRMSIPLDocument1 pagepayslip-2020-2021-12-300000000004232-CRMSIPLvikashpratapkushwahaNo ratings yet

- Payslip IndiaApproved On30 Nov 2023 - UnlockedDocument3 pagesPayslip IndiaApproved On30 Nov 2023 - UnlockedrithulblockchainNo ratings yet

- Duca Industries pay slip titleDocument1 pageDuca Industries pay slip titlePritam GoswamiNo ratings yet

- CRM's Impact on Indian Insurance SectorDocument78 pagesCRM's Impact on Indian Insurance SectorHimanshu Sharma100% (1)

- Helping B2B Companies Get More Meetings With Decision MakersDocument6 pagesHelping B2B Companies Get More Meetings With Decision Makersdaniel SegallNo ratings yet

- What Is UnderemploymentDocument3 pagesWhat Is UnderemploymentVanessa Plata Jumao-asNo ratings yet

- (International Series in Operations Research & Management Science 139) Evangelos Grigoroudis, Yannis Siskos (Auth.) - Customer Satisfaction Evaluation - MethodsDocument318 pages(International Series in Operations Research & Management Science 139) Evangelos Grigoroudis, Yannis Siskos (Auth.) - Customer Satisfaction Evaluation - MethodsMarsha Aulia HakimNo ratings yet

- Lecture II-identification of Entrepreneurial OpportunityDocument43 pagesLecture II-identification of Entrepreneurial Opportunitydonkhalif13No ratings yet

- Senior Category Manager-JDDocument2 pagesSenior Category Manager-JDUDITMUKHIJANo ratings yet

- Philippine Spring Water v CA Ruling on Regular Employment StatusDocument3 pagesPhilippine Spring Water v CA Ruling on Regular Employment StatusEdeline CosicolNo ratings yet

- Flipkart-Growth GuideDocument18 pagesFlipkart-Growth GuideKalashNo ratings yet

- Ms Archana. Wali MBA II Semester Exam No. MBA0702009Document78 pagesMs Archana. Wali MBA II Semester Exam No. MBA0702009vijayakooliNo ratings yet

- Share Capital TransactionsDocument65 pagesShare Capital Transactionsm_kobayashiNo ratings yet

- Southest BankDocument91 pagesSouthest BankMahmudul HasanNo ratings yet

- Intermediate Accounting Vol 1 Canadian 3Rd Edition Lo Solutions Manual Full Chapter PDFDocument61 pagesIntermediate Accounting Vol 1 Canadian 3Rd Edition Lo Solutions Manual Full Chapter PDFwilliambrowntdoypjmnrc100% (6)

- MM ZG512 Ec-2r First Sem 2017-2018Document1 pageMM ZG512 Ec-2r First Sem 2017-2018UDAYAN BIPINKUMAR SHAHNo ratings yet

- Competition and Class: A Reply To Foster and McnallyDocument11 pagesCompetition and Class: A Reply To Foster and McnallyMario CplazaNo ratings yet

- Prepared By: Prepared By: - Gebereyohanes Kahsay ID NO:-0804380Document57 pagesPrepared By: Prepared By: - Gebereyohanes Kahsay ID NO:-0804380Mênfës Mgb GèdēchãNo ratings yet

- Present Value, Annuity, and PerpetuityDocument42 pagesPresent Value, Annuity, and PerpetuityEdwin OctorizaNo ratings yet

- PharmEasy Marketing 1Document9 pagesPharmEasy Marketing 1Pankaj MaryeNo ratings yet

- KMC Speciality Hospitals (India) Limited: Bankers AuditorsDocument43 pagesKMC Speciality Hospitals (India) Limited: Bankers Auditorsanoop8891No ratings yet

- Hypothesis-Driven Problem Solving: Tangible ResultsDocument39 pagesHypothesis-Driven Problem Solving: Tangible ResultsRajNo ratings yet

- A Presentation On Role of Information Technology in Finance and BankingDocument22 pagesA Presentation On Role of Information Technology in Finance and BankingSahil GuptaNo ratings yet

- Solution Manual For Strategic Management 3rd EditionDocument9 pagesSolution Manual For Strategic Management 3rd Editionelfledadylanb11la100% (21)

- English Shva - 2020 FSDocument184 pagesEnglish Shva - 2020 FSSimonasNo ratings yet