Professional Documents

Culture Documents

Ethiopia's Cement Market

Uploaded by

Shimondi0 ratings0% found this document useful (0 votes)

515 views2 pagesEthiopia has significant cement production potential as one of Africa's top 10 producers currently utilizing only a small portion of its capacity. The $2.5 billion cement market is dominated by local and international companies and concentrated around Addis Ababa, where over 40% of plants are located. While investments are expanding capacity, Ethiopia still struggles with efficiency and meeting domestic demand due to challenges like conflict, spare parts access, and electricity restrictions limiting production to less than half of installed capacity. Recent deals show both local and international cement producers continuing to invest in new plants and expansions across the country.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentEthiopia has significant cement production potential as one of Africa's top 10 producers currently utilizing only a small portion of its capacity. The $2.5 billion cement market is dominated by local and international companies and concentrated around Addis Ababa, where over 40% of plants are located. While investments are expanding capacity, Ethiopia still struggles with efficiency and meeting domestic demand due to challenges like conflict, spare parts access, and electricity restrictions limiting production to less than half of installed capacity. Recent deals show both local and international cement producers continuing to invest in new plants and expansions across the country.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

515 views2 pagesEthiopia's Cement Market

Uploaded by

ShimondiEthiopia has significant cement production potential as one of Africa's top 10 producers currently utilizing only a small portion of its capacity. The $2.5 billion cement market is dominated by local and international companies and concentrated around Addis Ababa, where over 40% of plants are located. While investments are expanding capacity, Ethiopia still struggles with efficiency and meeting domestic demand due to challenges like conflict, spare parts access, and electricity restrictions limiting production to less than half of installed capacity. Recent deals show both local and international cement producers continuing to invest in new plants and expansions across the country.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Ethiopia's Cement Market

Ethiopia - Construction, Industrial manufacturing

Market Insight: Industry

Last update: Jan 29, 2023

One of Africa's top 10 cement producing countries, Ethiopia's market has significant

growth potential given current low utilisation rates.

Valued at over $2.5 billion in 2022, the East African cement market is one to watch as

the region readies itself to implement a number of infrastructure projects, from large-

scale transport facilities to housing and commercial developments. Three East African

nations feature in the continent’s top 10 cement producers, a grouping which accounts

for close to three-quarters of Africa’s production capacity. Though Kenya is the regional

leader, Ethiopia is not far behind and could become a more significant player should

capacity utilisation rise.

Key Players

With 13 companies operating 23 plants, Ethiopia’s domestic cement market is led by a

mix of international and local players, of which Derba Midroc Cement, Dangote,

Mugher Cement, Messebo Cement, Habesha Cement and National Cement (parent

company East African Holding), are the largest. Production is concentrated in and

around Addis Ababa, which is home to over 40% of plants, with the remainder spread

among five of Ethiopia’s 11 regions.

Market dynamics

Ethiopia’s cement sector has seen increased investment since 2020, after the government

lifted a ban on FDI in the local cement industry. As in other parts of Africa, cement

producers in Ethiopia struggle to meet the significant gap between supply and demand;

as of 2021, the country was 5.5 million tonnes short of domestic demand. In late

December 2022, the government announced it would be setting prices in an attempt to

regulate industry’s supply and demand.

Efficiency is also a challenge for domestic cement manufacturers, which produce less

than half of the installed capacity in a given year. Total production was approximately

7.7 million tonnes per annum (Mt/a) during the 2020/21 fiscal year, despite 19.7 Mt/a

of combined capacity. Conflict in the Tigray region has also affected production,

particularly through the closure of the Messebo Cement Factory. Across Ethiopia,

producers also face challenges such as limited access to machinery spare parts, forex,

and electricity, which further restrict cement production and contribute to Ethiopia's

low cement capacity utilisation rate.

Recent Deals

Despite these challenges, cement producers continue to add capacity to existing plants

and construct new ones. Recent expansion investments include a $282 million upgrade

and 2.5 Mt/a capacity expansion to Midroc Ethiopia Plc Derba cement plant in Oromia,

while Mugher Cement is aiming to increase its market share by boosting production.

Pan-African player Dangote has announced it is finalising feasibility studies to expand

its existing facilities, while a joint venture between East African Holding (National

Cement) and West China Cement are conducting feasibility studies to increase capacity

by 30% at existing Dire Dawa plant, and have also announced the construction of a

10,000-Mt/day plant in Lemi, Amhara Region.

Ethio Cement (ETEM) and the Wacem group have announced the construction of an

integrated plant with 0.77-Mta capacity, while National Cement seeks to establish a $2.5

billion cement plant. Individual investors are also active in this sector, where investor

Getu Gelete Purchased a 40% stake in Habesha Cement in early 2022 and Ethiopian

investor Worku Ayetenew has announced plans to build a $1 billion cement plant with

a production capacity of 12,000 Mt/day.

You might also like

- Business Plan - Cement FactoryDocument22 pagesBusiness Plan - Cement Factorymahlet melese85% (20)

- Corrugated Iron Sheet Production Factory: Investment Project by Moseb Trading PLCDocument28 pagesCorrugated Iron Sheet Production Factory: Investment Project by Moseb Trading PLCmelkamuNo ratings yet

- Commerce MCQ HUB PDFDocument301 pagesCommerce MCQ HUB PDFjyottsna100% (1)

- Aswath Damodaran - Valuation of SynergyDocument60 pagesAswath Damodaran - Valuation of SynergyIvaNo ratings yet

- Sop WarehouseDocument6 pagesSop WarehouseVamsee Deepak100% (1)

- Targeting Israeli Apartheid A Boycott Divestment and Sanctions Handbook.Document383 pagesTargeting Israeli Apartheid A Boycott Divestment and Sanctions Handbook.john_edmonstoneNo ratings yet

- Business Plan For Plastic in Ethiopia DoDocument39 pagesBusiness Plan For Plastic in Ethiopia DoTesfaye Degefa100% (3)

- Cement plant proposalDocument49 pagesCement plant proposalTesfaye Degefa100% (1)

- Project Feasibility Study - Business Plan. - Haqiqa Investment Consultant in EthiopiaDocument1 pageProject Feasibility Study - Business Plan. - Haqiqa Investment Consultant in EthiopiaSuleman100% (1)

- Key Performance Indicators For Sustainable ManufacDocument6 pagesKey Performance Indicators For Sustainable ManufacShimondiNo ratings yet

- EIA For Maize & Wheat Milling Plant DEI PDFDocument110 pagesEIA For Maize & Wheat Milling Plant DEI PDFSasira Fionah100% (2)

- Nail Factory Proposal Targets Growing Demand in EthiopiaDocument25 pagesNail Factory Proposal Targets Growing Demand in Ethiopiamuluken walelgn100% (1)

- Lime Project ProposalDocument39 pagesLime Project ProposalChalachew ZewdieNo ratings yet

- Yufei Electronics PLC: TV Assembling FactoryDocument28 pagesYufei Electronics PLC: TV Assembling FactoryRediet FelekeNo ratings yet

- The Cement Industry in EthiopiaDocument6 pagesThe Cement Industry in EthiopiaShimondi100% (3)

- The Cement Industry in EthiopiaDocument6 pagesThe Cement Industry in EthiopiaShimondi100% (3)

- Marble Profile: Market Study and Production CapacityDocument21 pagesMarble Profile: Market Study and Production CapacityNasra Hussein83% (6)

- Mekdes Carton Project BishoftuDocument33 pagesMekdes Carton Project BishoftuSabrina AbdurahmanNo ratings yet

- Block Industry Business Plan in Nigeria Amp Feasibility Study Business PlanDocument9 pagesBlock Industry Business Plan in Nigeria Amp Feasibility Study Business PlanNwogboji EmmanuelNo ratings yet

- Business Plan For Plastic in Ethiopia Un Modified.Document37 pagesBusiness Plan For Plastic in Ethiopia Un Modified.Yeruksew Fetene100% (1)

- Create your website with WordPress.comDocument1 pageCreate your website with WordPress.comSulemanNo ratings yet

- What is a Futures ContractDocument4 pagesWhat is a Futures Contractareesakhtar100% (1)

- Selling Polyethylene PlasticDocument27 pagesSelling Polyethylene PlasticSileshNo ratings yet

- Cement ProjectDocument66 pagesCement Projectmesfin esheteNo ratings yet

- A.Z.T Food ComplexDocument46 pagesA.Z.T Food ComplexTesfaye Degefa100% (1)

- Ceramics Project ProfileworknehDocument30 pagesCeramics Project Profileworknehsajidaliyi100% (3)

- NISM-Series-VIII Equity Derivatives Solved Exam QuestionsDocument21 pagesNISM-Series-VIII Equity Derivatives Solved Exam QuestionsHitisha agrawalNo ratings yet

- GSTZ Marble Final ReevvisedDocument49 pagesGSTZ Marble Final ReevvisedYonas100% (6)

- Root Cause Analysis ForDocument7 pagesRoot Cause Analysis ForShimondiNo ratings yet

- Feasibility Study On Block Making Industry PDFDocument9 pagesFeasibility Study On Block Making Industry PDFinfopnig50% (2)

- High Standard Office & Household FurnitureDocument26 pagesHigh Standard Office & Household Furniturebig john50% (2)

- Merger and AcquisitionDocument11 pagesMerger and AcquisitionPriyanka AgarwalNo ratings yet

- Executives Summary of ProjectDocument24 pagesExecutives Summary of ProjectgemechuNo ratings yet

- Blocket Factory Business PlanDocument22 pagesBlocket Factory Business Plansena tesema100% (1)

- (Indian Economy - 2) UNIT - 2 POLICIES AND PERFORMANCE IN INDUSTRYDocument16 pages(Indian Economy - 2) UNIT - 2 POLICIES AND PERFORMANCE IN INDUSTRYAndroid Boy100% (1)

- Tire Recycling Business PropsalDocument36 pagesTire Recycling Business PropsalnebiyuNo ratings yet

- The Cement Industry in EthiopiaDocument7 pagesThe Cement Industry in EthiopiaTesfaye Azanie1No ratings yet

- Zeleke Geleta Inves Proposal - G SayoDocument39 pagesZeleke Geleta Inves Proposal - G Sayosileshi AngerasaNo ratings yet

- 04Document63 pages04Haile Kebede100% (2)

- Pre Feasibility SPC FloorDocument6 pagesPre Feasibility SPC Floorashenafii100% (1)

- Nail Making Business PlanDocument11 pagesNail Making Business PlanAbdul-Baaki KadriNo ratings yet

- Profile On The Production of Synthetic Marble EthiopiaDocument29 pagesProfile On The Production of Synthetic Marble EthiopiaNasra HusseinNo ratings yet

- Create your website with WordPress.comDocument1 pageCreate your website with WordPress.comSuleman100% (1)

- Strategic Plan On Al Abbas Cement LTDDocument34 pagesStrategic Plan On Al Abbas Cement LTDRizwan Ahmed91% (11)

- Business Plan For Smart BoutiqueDocument25 pagesBusiness Plan For Smart BoutiqueAnonymous NM7hmMfNo ratings yet

- Vanraj Mini Tractors: 1. Product AnalysisDocument4 pagesVanraj Mini Tractors: 1. Product AnalysispreetjukeboxiNo ratings yet

- Project On The Establishment of Animal FDocument30 pagesProject On The Establishment of Animal FAnggy de Rincon100% (4)

- AdamaDocument38 pagesAdamaMelese FirdisaNo ratings yet

- IFRS Ethiopia Property-Plant-Equipment-Valuation-Guideline-AABE 2Document53 pagesIFRS Ethiopia Property-Plant-Equipment-Valuation-Guideline-AABE 2Tekeba100% (2)

- Kassahun Ewntie Fruit Processing Scoping ProcessingDocument27 pagesKassahun Ewntie Fruit Processing Scoping ProcessingGetachew Mekonnen100% (1)

- Final ESIA On Construction Materials - Tamiru BultoDocument110 pagesFinal ESIA On Construction Materials - Tamiru BultoKayo Shankulie100% (1)

- Eliyas Bussines PlanDocument19 pagesEliyas Bussines PlanMesfin GetachewNo ratings yet

- Ethiopia Paper Bag Market AnalysisDocument4 pagesEthiopia Paper Bag Market Analysiskalkidan gashaw100% (1)

- Geda Corrugated Iron Sheet Manufacturing (Pas - Iron)Document38 pagesGeda Corrugated Iron Sheet Manufacturing (Pas - Iron)Sabrina Abdurahman100% (1)

- History of Cement Factory in EthiopiaDocument4 pagesHistory of Cement Factory in EthiopiaEDEN2203100% (2)

- Tiret ExpansDocument35 pagesTiret Expansmesfin eshete100% (1)

- Feasibility Study For Diesel Engine Assembly Plant Project Proposal Business Plan in Ethiopia. - Haqiqa Investment Consultant in EthiopiaDocument1 pageFeasibility Study For Diesel Engine Assembly Plant Project Proposal Business Plan in Ethiopia. - Haqiqa Investment Consultant in EthiopiaSuleman100% (4)

- Feasibility Study Paint Factory EstablishmentDocument36 pagesFeasibility Study Paint Factory EstablishmentBereket KidaneNo ratings yet

- Feasibility Study For Computer Assembly Plant Project Proposal Business Plan in Ethiopia. - Haqiqa Investment Consultant in EthiopiaDocument1 pageFeasibility Study For Computer Assembly Plant Project Proposal Business Plan in Ethiopia. - Haqiqa Investment Consultant in EthiopiaSuleman75% (4)

- Sandpaper Project ProfileDocument15 pagesSandpaper Project ProfileTekeba Birhane100% (3)

- Business PlanDocument23 pagesBusiness PlanEahbm KaduNo ratings yet

- Medium Density Fiberboard MDF Market Survey Cum Detailed Techno Economic Feasibility Project Report PDFDocument53 pagesMedium Density Fiberboard MDF Market Survey Cum Detailed Techno Economic Feasibility Project Report PDFGagsNo ratings yet

- Background Information: 1.1. The Loan ApplicantDocument14 pagesBackground Information: 1.1. The Loan ApplicantNafyad Tola Abebe0% (1)

- Fuel 1Document14 pagesFuel 1Yosef Adela100% (2)

- ESIA - Afro Links Iron Ore ExplorationDocument66 pagesESIA - Afro Links Iron Ore ExplorationMesfin GetachewNo ratings yet

- Amar PP Bag and Plastic Factory PLCDocument21 pagesAmar PP Bag and Plastic Factory PLCmuluken walelgn100% (1)

- Section OneDocument44 pagesSection OneTesfaye DegefaNo ratings yet

- Project Proposal On The Establishment of Plywood and MDF Medium Density Fiberboard (MDF) Production PlantDocument40 pagesProject Proposal On The Establishment of Plywood and MDF Medium Density Fiberboard (MDF) Production PlantTefera AsefaNo ratings yet

- Developing Blocket PDFDocument15 pagesDeveloping Blocket PDFhaftom teklay91% (11)

- Kafle Report 1Document71 pagesKafle Report 1arjun kafleNo ratings yet

- High Cost Cement Producers On The Verge of Shutdown in EthiopiaDocument3 pagesHigh Cost Cement Producers On The Verge of Shutdown in EthiopiaShimondiNo ratings yet

- The Cement Industry of Pakistan: A Swot Analysis: Najabat Ali, Muhammad Anwer Abbas Jaffar, Syed Murtazain Raza ZaidiDocument10 pagesThe Cement Industry of Pakistan: A Swot Analysis: Najabat Ali, Muhammad Anwer Abbas Jaffar, Syed Murtazain Raza Zaidihassan ziaNo ratings yet

- Impact of Quality On Global CompetitivenDocument30 pagesImpact of Quality On Global CompetitivenShimondiNo ratings yet

- Investigation Into The Development of SMDocument98 pagesInvestigation Into The Development of SMShimondiNo ratings yet

- Coal Beneficiation Paper ZamudaDocument36 pagesCoal Beneficiation Paper Zamudayousufali56No ratings yet

- The Analysis of Industry Value Chain andDocument33 pagesThe Analysis of Industry Value Chain andShimondiNo ratings yet

- Types of Knowledge Management SystemsDocument5 pagesTypes of Knowledge Management SystemsShimondiNo ratings yet

- Causes For Obsolete InventoryDocument2 pagesCauses For Obsolete InventoryShimondiNo ratings yet

- High Cost Cement Producers On The Verge of Shutdown in EthiopiaDocument3 pagesHigh Cost Cement Producers On The Verge of Shutdown in EthiopiaShimondiNo ratings yet

- Purpose of Material Handling Storage ManagementDocument5 pagesPurpose of Material Handling Storage ManagementShimondiNo ratings yet

- Green Purchasing Policy - Purchasing - Babson CollegeDocument4 pagesGreen Purchasing Policy - Purchasing - Babson CollegeShimondiNo ratings yet

- Marketing Research & Promotion ProcedureDocument3 pagesMarketing Research & Promotion ProcedureShimondiNo ratings yet

- Integrated Marketing Communication in CementDocument2 pagesIntegrated Marketing Communication in CementShimondiNo ratings yet

- 09 - Chapter5 Determinents of FDI PDFDocument13 pages09 - Chapter5 Determinents of FDI PDFdeepakadhanaNo ratings yet

- Financial Analysis WikipediaDocument3 pagesFinancial Analysis WikipediaHoussem Eddine BedouiNo ratings yet

- Hyperinflation and Current Cost Accounting ProblemsDocument4 pagesHyperinflation and Current Cost Accounting ProblemsMaan CabolesNo ratings yet

- Government Expenditure On Education in NigeriaDocument3 pagesGovernment Expenditure On Education in NigeriaScottNo ratings yet

- Mahatma Gandhi University Capital Market Chapter 1 QuestionsDocument42 pagesMahatma Gandhi University Capital Market Chapter 1 QuestionscpriyacpNo ratings yet

- Constitution of Business and Classification of MSMEDocument30 pagesConstitution of Business and Classification of MSMERaj ChauhanNo ratings yet

- Ib Export ImportDocument32 pagesIb Export ImportUtkarsh PanditNo ratings yet

- 2 Taxation of International TransactionsDocument7 pages2 Taxation of International TransactionssumanmehtaNo ratings yet

- Midterm Macro 2Document22 pagesMidterm Macro 2chang vicNo ratings yet

- Advanced audit threats and controlsDocument8 pagesAdvanced audit threats and controlsKafonyi JohnNo ratings yet

- Designing Corporate Venturing Capital Successfully Startup Intellect Featured Insight Report FinalDocument24 pagesDesigning Corporate Venturing Capital Successfully Startup Intellect Featured Insight Report Finalali sharifzadehNo ratings yet

- Lecture 10 (Reward Management)Document26 pagesLecture 10 (Reward Management)Shoaib HasanNo ratings yet

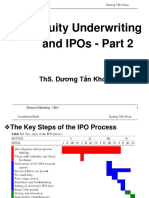

- Chapter 2 - Equity Underwriting and IPO-Part 2Document29 pagesChapter 2 - Equity Underwriting and IPO-Part 2Đỗ Phương DiễmNo ratings yet

- Single MarkettDocument4 pagesSingle Markettapi-305077843No ratings yet

- WACC Calculation for Strategic Asset Leasing IncDocument2 pagesWACC Calculation for Strategic Asset Leasing IncMuzzamil UsmanNo ratings yet

- Questus Global Capital Markets On GXGDocument3 pagesQuestus Global Capital Markets On GXGlcdcomplaintNo ratings yet

- NEFADocument2 pagesNEFAAkash SanganiNo ratings yet

- 1.1 Company Profile: Financial Anlysis of DLF LTDDocument125 pages1.1 Company Profile: Financial Anlysis of DLF LTDAkash VariaNo ratings yet

- Intangibles PDFDocument5 pagesIntangibles PDFJer RamaNo ratings yet

- Strategic Management of HDFC BankDocument30 pagesStrategic Management of HDFC BankHabib KhanNo ratings yet

- Cash FlowDocument24 pagesCash FlowMadhupriya DugarNo ratings yet

- A212 - Topic 2 - Slides (Part I)Document24 pagesA212 - Topic 2 - Slides (Part I)Teo ShengNo ratings yet