Professional Documents

Culture Documents

Arcebal Activity#2

Arcebal Activity#2

Uploaded by

Vheia Arcebal0 ratings0% found this document useful (0 votes)

7 views1 pageCarla Arcebal is a resident citizen individual who earned various types of passive income during the tax year. Her total final tax withholding is P30,400, calculated by applying the correct tax rates to her interest income from bank deposits, prizes and winnings, royalties, and dividends. Some sources of income like certain prizes, share from a GPP, and interest income of a non-resident are exempt from tax withholding.

Original Description:

Original Title

Arcebal_Activity#2

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCarla Arcebal is a resident citizen individual who earned various types of passive income during the tax year. Her total final tax withholding is P30,400, calculated by applying the correct tax rates to her interest income from bank deposits, prizes and winnings, royalties, and dividends. Some sources of income like certain prizes, share from a GPP, and interest income of a non-resident are exempt from tax withholding.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageArcebal Activity#2

Arcebal Activity#2

Uploaded by

Vheia ArcebalCarla Arcebal is a resident citizen individual who earned various types of passive income during the tax year. Her total final tax withholding is P30,400, calculated by applying the correct tax rates to her interest income from bank deposits, prizes and winnings, royalties, and dividends. Some sources of income like certain prizes, share from a GPP, and interest income of a non-resident are exempt from tax withholding.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

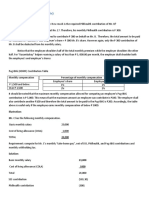

Name: Arcebal, Carla Vheia A.

Section: BSBA 2F

Passive Income of Individuals: Final Withholding Taxes

Instruction: Compute the final tax of the following passive income of resident citizen individual, (unless

stated that it is not the case). Show your computation, if any.

Interest Income from bank deposit 100,000

100 000 x 20% = 20 000

Prizes and Winnings 20000

20 000 x 20% = 4 000

Royalties 15000

15 000 x 20% = 3 OOO

Royalties from musical composition by a non-resident alien 10000

10 000 x 10% = 1 000

Dividends from a domestic corporation 25000

25 000 x 10% = 2 500

Lotto winnings from PCSO 8000

Exempt

Share in the income of a GPP 25000

Exempt

Prizes in sports tournament organized by the National Sports Association 18000

Exempt

Interest income from long term deposit with a bank with BSP certificate pregerminated on its 4 ½ years

18000

18 000 x 5%= 900

Interest income from a bank under the expanded foreign currency deposit system by a non-resident

alien 34000

Exempt

You might also like

- BAM 031 Income Taxation QuizDocument4 pagesBAM 031 Income Taxation Quizbrmo.amatorio.uiNo ratings yet

- Quiz 1 - StrataxDocument3 pagesQuiz 1 - Strataxspongebob SquarepantsNo ratings yet

- 4.1 Assignment - Final Tax On Passive Income (To Be Answered in Lecture)Document6 pages4.1 Assignment - Final Tax On Passive Income (To Be Answered in Lecture)Charles Mateo100% (3)

- Final and Capital Gains TaxDocument7 pagesFinal and Capital Gains TaxElla Marie LopezNo ratings yet

- Proceeds of Property Insurance (BV 4,000,000)Document11 pagesProceeds of Property Insurance (BV 4,000,000)zeref dragneelNo ratings yet

- Final Tax ReviewerDocument35 pagesFinal Tax Revieweryza100% (1)

- Inclusions To Gross Income Illustrative ExamplesDocument5 pagesInclusions To Gross Income Illustrative ExamplesMary Rose CredoNo ratings yet

- Tax On Corporations (Additional Exercises)Document2 pagesTax On Corporations (Additional Exercises)April PacanasNo ratings yet

- Prv-Tax 1Document4 pagesPrv-Tax 1Kathylene GomezNo ratings yet

- 8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Document8 pages8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Roselyn LumbaoNo ratings yet

- Philhealth Contribution (Table) : Illustration: Mr. C Has The Following Monthly CompensationDocument5 pagesPhilhealth Contribution (Table) : Illustration: Mr. C Has The Following Monthly CompensationMaraiah InciongNo ratings yet

- CourseheroDocument3 pagesCourseheronumber oneNo ratings yet

- Income TaxationDocument5 pagesIncome Taxationangellachavezlabalan.cpalawyerNo ratings yet

- Income Tax Quiz AnswerDocument4 pagesIncome Tax Quiz AnswerMarco Alejandro Ibay100% (1)

- Compute The Tax Due Assuming That - A The Foreign Taxes Are Claimed As Tax Credit: 2 500 2.5 10 250,000 45,000 Answer M+ K M× % +Document6 pagesCompute The Tax Due Assuming That - A The Foreign Taxes Are Claimed As Tax Credit: 2 500 2.5 10 250,000 45,000 Answer M+ K M× % +Lenny Ramos Villafuerte100% (1)

- Other Percentage Tax CompuDocument3 pagesOther Percentage Tax CompuRose Diane CabiscuelasNo ratings yet

- Final Income Taxation - Class Discussion (Corrected)Document21 pagesFinal Income Taxation - Class Discussion (Corrected)Christopher SantosNo ratings yet

- Individual Tax Payer - TeachersDocument8 pagesIndividual Tax Payer - TeachersKhervin EvangelistaNo ratings yet

- BAM 031 Income Taxation 2nd Periodical Exam With AKDocument8 pagesBAM 031 Income Taxation 2nd Periodical Exam With AKbrmo.amatorio.uiNo ratings yet

- Taxable Income and Income Tax - Foreign Tax Credit - AdministrDocument52 pagesTaxable Income and Income Tax - Foreign Tax Credit - AdministrCharlotte MalgapoNo ratings yet

- Application - Regular Income Tax On Individuals and CorporationsDocument8 pagesApplication - Regular Income Tax On Individuals and CorporationsElla Marie Lopez0% (1)

- Arcebal QuizonFITDocument4 pagesArcebal QuizonFITVheia ArcebalNo ratings yet

- Tax On Corp. Sample ProblemsDocument2 pagesTax On Corp. Sample ProblemsWenjunNo ratings yet

- Regular Income Tax SeatworkDocument1 pageRegular Income Tax SeatworkJean Diane JoveloNo ratings yet

- Corporate Income TaxDocument8 pagesCorporate Income TaxClaire BarbaNo ratings yet

- Taxation - Corporation - Quizzer - 2018Document4 pagesTaxation - Corporation - Quizzer - 2018Kenneth Bryan Tegerero Tegio100% (4)

- INCOME TAX Part 2Document1 pageINCOME TAX Part 2honeylove uNo ratings yet

- 07 eLMS Review 1 - ARGDocument2 pages07 eLMS Review 1 - ARGRico Marquez100% (1)

- Quiz 3 - CabigonDocument4 pagesQuiz 3 - CabigonRie CabigonNo ratings yet

- 8.2 Assignment - Regular Income Tax For IndividualsDocument8 pages8.2 Assignment - Regular Income Tax For Individualssam imperialNo ratings yet

- INCOME TAX VALUE ADDED TAX ACTIVITY SolutionDocument6 pagesINCOME TAX VALUE ADDED TAX ACTIVITY SolutionMarco Alejandro IbayNo ratings yet

- Ea - TaxDocument8 pagesEa - TaxKc SevillaNo ratings yet

- Prizes - 20% Prizes - 20% Winnings - 20% Winnings - 20%Document4 pagesPrizes - 20% Prizes - 20% Winnings - 20% Winnings - 20%Aly ConcepcionNo ratings yet

- Passive Income + CGTDocument3 pagesPassive Income + CGTRosemarie CruzNo ratings yet

- 6.4. Comprehensive Problems - Final Tax 1Document10 pages6.4. Comprehensive Problems - Final Tax 1Elle VernezNo ratings yet

- Exercise 9-5 No 9-20Document9 pagesExercise 9-5 No 9-20Kent LumanasNo ratings yet

- 2806-Individuals PPT PDFDocument35 pages2806-Individuals PPT PDFMay Grethel Joy PeranteNo ratings yet

- 18515pcc Sugg Paper Nov09 5 PDFDocument16 pages18515pcc Sugg Paper Nov09 5 PDFGaurang AgarwalNo ratings yet

- INCOME TAXATION Drills With AnswersDocument5 pagesINCOME TAXATION Drills With AnswersViky Rose EballeNo ratings yet

- Answer Key Quiz On Graduated Income Tax 1 PDFDocument3 pagesAnswer Key Quiz On Graduated Income Tax 1 PDFMeg CruzNo ratings yet

- Tax 2Document8 pagesTax 2Genel Christian DeypalubosNo ratings yet

- Sri Bharathi Women'S Arts and Science College Kunnathur - ArniDocument3 pagesSri Bharathi Women'S Arts and Science College Kunnathur - ArniElumalaiNo ratings yet

- Seatwork 1 - Final Tax and Compensation Income 2.0Document2 pagesSeatwork 1 - Final Tax and Compensation Income 2.0Magical LunaNo ratings yet

- Solutions For Problem 1Document4 pagesSolutions For Problem 1spongebob SquarepantsNo ratings yet

- Activities No. 2Document5 pagesActivities No. 2Joshua Cabinas60% (5)

- Learning Activity 3 - Inc TaxDocument3 pagesLearning Activity 3 - Inc TaxErica FlorentinoNo ratings yet

- Income Tax Article 24Document18 pagesIncome Tax Article 24JemimaPutriShintaNo ratings yet

- Deductions SummaryDocument8 pagesDeductions SummaryDamdam AlunanNo ratings yet

- Quiz Tax On IndividualsDocument2 pagesQuiz Tax On IndividualsAirah Shane B. DianaNo ratings yet

- Other Perentage TaxDocument33 pagesOther Perentage TaxTrisha Mae BoholNo ratings yet

- Tax On Individuals Quiz - ProblemsDocument3 pagesTax On Individuals Quiz - ProblemsJP Mirafuentes100% (1)

- Optional Standard Deductions ExampleDocument7 pagesOptional Standard Deductions ExampleSandia EspejoNo ratings yet

- SW 1Document11 pagesSW 1Charles Justin C. SaldiNo ratings yet

- Activity Final Tax On Passive IncomeDocument7 pagesActivity Final Tax On Passive IncomeElla Marie Lopez100% (2)

- Revenue With Pool (A)Document6 pagesRevenue With Pool (A)RanaAbdulAzizNo ratings yet

- Take Home Seatwork 11.25.2023Document2 pagesTake Home Seatwork 11.25.2023rhenzadrian.11No ratings yet

- Taxation Class ExerciseDocument6 pagesTaxation Class ExerciseMai PhuongNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Trade Blocs BrochureDocument2 pagesTrade Blocs BrochureVheia ArcebalNo ratings yet

- Arcebal QuizonFITDocument4 pagesArcebal QuizonFITVheia ArcebalNo ratings yet

- Assignment 02Document1 pageAssignment 02Vheia ArcebalNo ratings yet

- Exam Personal Finance AnswersDocument7 pagesExam Personal Finance AnswersVheia ArcebalNo ratings yet