Professional Documents

Culture Documents

ICAP Study Text Chap-4 (Questions)

Uploaded by

songs 2019 MalikOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ICAP Study Text Chap-4 (Questions)

Uploaded by

songs 2019 MalikCopyright:

Available Formats

CHAPTER 4: ACTIVITY BASED COSTING CAF 3: CMA

6. COMPREHENSIVE EXAMPLES

Example 01:

Giga Incorporations is at the leading edge of paint-spraying technology. It has three customers A,

B and C, who produce G-101, G-102 and G-103 products respectively. These products are finished

by Giga Incorporation after final completion. Product G-101 requires 6 coats of paint, product G-

102 requires 4 coats and product G-103 requires 3 coats of paint. All products are of different

shapes and sizes therefore, different quantities of paint are needed. Paint is delivered in batches

of various sizes, depending upon the finishing required.

Products Litres per unit

G-101 7

AT A GLANCE

G-102 5

G-103 4

Production details for each product are budgeted as follows for the coming month:

Description G-101 G-102 G-103

Units sprayed 500 400 300

Batches of paint required 10 8 6

Machine attendant time in minutes 45 60 50

Cost of paint per unit Rs. 550 500 450

SPOTLIGHT

Machine attendants are paid Rs. 86 per hour.

Estimated overheads in the coming month are given below:

Rupees

Paint stirring and quality control 50,000

Electricity 150,000

Filling of spraying machines 90,000

Cost drivers used for each activity are as follows:

Activity Cost driver

STICKY NOTES

Paint stirring and quality control Batches of paint

Electricity Coats of paint

Filling of spraying machines Litres of paint

Required:

Calculate the unit cost of each product using activity-based costing.

104 THE INSTITUTE OF CHARTERED ACCOUNTANTS OF PAKISTAN

CAF 3: CMA CHAPTER 4: ACTIVITY BASED COSTING

Example 02:

Rizwan Industries has six standard products from stainless steel and brass. The company’s most

popular product is RI-11 and following budgeted data is given for product RI-11.

Activity Cost driver Cost driver Cost pool Rs.

volume/year

Purchasing costs Purchase orders 15,000 750,000

Setting costs Batches produced 28,000 1,120,000

Material handling costs Material requisition 80,000 960,000

Inspection costs Inspections 28,000 700,000

AT A GLANCE

Machining costs Machine hours 500,000 1,500,000

Rizwan manufacturing industries data relating to RI-11 for the month of July, 2021 is given

below.

Description

Purchase orders 25

Output in units 15,000

Production batch size in units 100

Material requisition per batch 6

Inspections per batch 1

SPOTLIGHT

Machine hours per unit 0.1

Required:

Calculate the unit overhead cost of product RI-11 using activity-based costing.

STICKY NOTES

THE INSTITUTE OF CHARTERED ACCOUNTANTS OF PAKISTAN 105

CHAPTER 4: ACTIVITY BASED COSTING CAF 3: CMA

Example 03:

JAM Enterprises, is engaged in the manufacturing of fishing equipment for fishing industry since

a decade. Recently, some of other manufacturers newly entered in to the same business of JAM

Enterprises. As a result, a price competitive situation has occurred in the market, to handle this

situation JAM Enterprises wants to offer best prices for the products as compare to competitors;

JAM Enterprises changed his costing approach to ABC, from traditional full costing approach.

The following budgeted information is related to JAM Enterprises for the forthcoming period:

Activity Product J Product A Product M

AT A GLANCE

Sales and production (units) 30,000 20,000 10,000

Selling price per unit 4,600 9,600 7,400

Prime cost per unit 3,100 8,300 6,400

Machine hours per unit 2.5 5.5 4.5

Labour hours per unit 7.5 3.5 3.5

The overheads that could be re-analyzed in to cost pools for the purpose of Activity based costing,

are as follows:

Cost pool Rs. 000 Cost driver Quantity for the period

Machine services 18,400 Machine hours 230,000

SPOTLIGHT

Assembly services 18,150 Direct labour hours 330,000

Set-up costs 1,200 Set-ups 250

Order processing 7,200 Customer orders 16,000

Purchasing 4,004 Supplier orders 5,600

Following estimates have also been provided for the period:

Cost drivers Product J Product A Product M

Number of set-ups 70 100 80

STICKY NOTES

Number of customer orders 4,800 4,500 6,700

Number of supplier orders 1,800 2,200 1,600

Required:

Calculate the product-wise profit statement, using activity-based costing.

106 THE INSTITUTE OF CHARTERED ACCOUNTANTS OF PAKISTAN

You might also like

- ABC Costing 2Document4 pagesABC Costing 2محمد شہبازNo ratings yet

- Cost Per Unit Rs. Rs. Rs. RS.: M. Azeem/Activity Based CostingDocument4 pagesCost Per Unit Rs. Rs. Rs. RS.: M. Azeem/Activity Based CostingKamran ArifNo ratings yet

- BhaDocument25 pagesBharishu jainNo ratings yet

- Skans Schools of Accountancy: Cost & Management Accounting - Caf-8Document2 pagesSkans Schools of Accountancy: Cost & Management Accounting - Caf-8maryNo ratings yet

- J66998bos54006fold p5Document32 pagesJ66998bos54006fold p5Question BankNo ratings yet

- CAMA Assignment Group 6Document8 pagesCAMA Assignment Group 6Dinkar SuranglikarNo ratings yet

- Short Term Decision Making: Question No. 1Document2 pagesShort Term Decision Making: Question No. 1AbdulAzeemNo ratings yet

- QP MBA FINANCIAL AND MANAGEMENT ACCOUNTING 803FI0C002 Trimester I Cjj8nC4tr8Document5 pagesQP MBA FINANCIAL AND MANAGEMENT ACCOUNTING 803FI0C002 Trimester I Cjj8nC4tr8Rushil JoshiNo ratings yet

- Cost Accounting: The Institute of Chartered Accountants of PakistanDocument4 pagesCost Accounting: The Institute of Chartered Accountants of PakistanShehrozSTNo ratings yet

- Midterm Question Strategic Management Accounting (11th Batch)Document5 pagesMidterm Question Strategic Management Accounting (11th Batch)Samir Raihan ChowdhuryNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Fall 2012 (February 2013) ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Fall 2012 (February 2013) ExaminationsAbdul BasitNo ratings yet

- Cost Accounting: T I C A PDocument4 pagesCost Accounting: T I C A PShehrozSTNo ratings yet

- Advance Management Accounting Test 2 130520200212Document7 pagesAdvance Management Accounting Test 2 130520200212PrinceNo ratings yet

- Problem-42: RequiredDocument7 pagesProblem-42: RequiredRADHIKA V HNo ratings yet

- Marginal Costing Chapter Satelite Centers PDFDocument17 pagesMarginal Costing Chapter Satelite Centers PDFSwasNo ratings yet

- CMA Mock March 2023 Along With Video SolutionsDocument27 pagesCMA Mock March 2023 Along With Video SolutionsMuhammad Ahsan RiazNo ratings yet

- 04 Activity Based Costing PDFDocument11 pages04 Activity Based Costing PDFPappu LalNo ratings yet

- Unit 2 QuestionsDocument5 pagesUnit 2 Questionszf8dkk8fnzNo ratings yet

- Planning, Control and Performance Management: Time Allowed 3 Hours ALL FOUR Questions Are Compulsory and MUST Be AnsweredDocument5 pagesPlanning, Control and Performance Management: Time Allowed 3 Hours ALL FOUR Questions Are Compulsory and MUST Be Answeredapi-19836745No ratings yet

- Car Manufacutring Student Sheet English 2022 VersionDocument24 pagesCar Manufacutring Student Sheet English 2022 VersionSelin PusatNo ratings yet

- Intervention ManDocument47 pagesIntervention ManFrederick GbliNo ratings yet

- Advanced Management Accounting RTPDocument25 pagesAdvanced Management Accounting RTPSamir Raihan ChowdhuryNo ratings yet

- ABC and CashFlow QuestionDocument11 pagesABC and CashFlow QuestionTerryDemetrioCesarNo ratings yet

- SCMPE CLZ Work BookDocument16 pagesSCMPE CLZ Work BookjkrappsNo ratings yet

- CM 19 - 20 - Sem 1Document5 pagesCM 19 - 20 - Sem 1Mukmin ShukriNo ratings yet

- 7401M002 Management AccountingDocument10 pages7401M002 Management AccountingMadhuram SharmaNo ratings yet

- 5) May 2007 Cost ManagementDocument32 pages5) May 2007 Cost Managementshyammy foruNo ratings yet

- Paper - 3: Cost Accounting and Financial Management Part I: Cost Accounting Questions Short Answer Type Questions From Misc ChaptersDocument44 pagesPaper - 3: Cost Accounting and Financial Management Part I: Cost Accounting Questions Short Answer Type Questions From Misc ChaptersVarinder AnandNo ratings yet

- Cost ManagementDocument7 pagesCost ManagementSakshi VermaNo ratings yet

- Part A: Managerial Accounting Assessment - ACC720 - March 2020Document4 pagesPart A: Managerial Accounting Assessment - ACC720 - March 2020Helmy YusoffNo ratings yet

- Marginal & Absorption Costing UpdatedDocument6 pagesMarginal & Absorption Costing UpdatedMUHAMMAD ZAID SIDDIQUI100% (2)

- Pakistan: Marks Q. 1 Excellent Engineering Limited Is A Medium Sized, Well Established Company, Producing HighDocument6 pagesPakistan: Marks Q. 1 Excellent Engineering Limited Is A Medium Sized, Well Established Company, Producing HighAbdul BasitNo ratings yet

- ABC AssignmentDocument3 pagesABC AssignmentSunil ThapaNo ratings yet

- Assignment On ABCDocument5 pagesAssignment On ABCRaghav MehraNo ratings yet

- Chapter 5 ABC System For StudentsDocument14 pagesChapter 5 ABC System For StudentsNour Al Kaddah100% (1)

- Paper - 5: Advanced Management Accounting Questions Current Purchase System Vs Just in Time SystemDocument33 pagesPaper - 5: Advanced Management Accounting Questions Current Purchase System Vs Just in Time SystemVIHARI DNo ratings yet

- (Don Hansen, Guan) Cost Management 1Document4 pages(Don Hansen, Guan) Cost Management 1Muhammad Fareiz KayoshiNo ratings yet

- Full Test 1Document12 pagesFull Test 1mayankchabra7No ratings yet

- CH 5 - Limiting Factor Questions & SolutionDocument26 pagesCH 5 - Limiting Factor Questions & SolutionMuhammad Azam75% (8)

- Decision Making-Limiting FactorDocument4 pagesDecision Making-Limiting FactorMuhammad Azam0% (1)

- Advanced Cost & ManagementDocument3 pagesAdvanced Cost & ManagementsajidNo ratings yet

- Cost Accounting: T I C A PDocument6 pagesCost Accounting: T I C A PShehrozSTNo ratings yet

- Activity Base Costing (ABC Costing)Document12 pagesActivity Base Costing (ABC Costing)SantNo ratings yet

- CAF-3 CMAModelpaperDocument5 pagesCAF-3 CMAModelpaperAsad ZahidNo ratings yet

- Cma Mid TermDocument7 pagesCma Mid TermMehak RasheedNo ratings yet

- Activity Based Costing - ExercisesDocument7 pagesActivity Based Costing - Exercises田淼No ratings yet

- Marginal & Absorption CostingDocument6 pagesMarginal & Absorption CostingEman Mirza100% (4)

- Activity Based Costing Review QuestionsDocument3 pagesActivity Based Costing Review Questionshome labNo ratings yet

- Advanced Cost and Management AccountingDocument5 pagesAdvanced Cost and Management AccountingAivin JosephNo ratings yet

- PT FMDocument12 pagesPT FMNabil NizamNo ratings yet

- Part-A - Strategic Management Accounting: Multiple Choice Questions (MCQS)Document33 pagesPart-A - Strategic Management Accounting: Multiple Choice Questions (MCQS)ARIF HUSSAIN AN ENGLISH LECTURER FOR ALL CLASSESNo ratings yet

- Activity Based Costing Spring 2020 Answers Final - pdf-1Document20 pagesActivity Based Costing Spring 2020 Answers Final - pdf-1b21fa1201No ratings yet

- Pakistan: Extra Reading Time: 15 Minutes Writing Time: 03 Hours Maximum Marks: 100 Roll No.Document6 pagesPakistan: Extra Reading Time: 15 Minutes Writing Time: 03 Hours Maximum Marks: 100 Roll No.Abdul BasitNo ratings yet

- Problems On Pricing DecisionsDocument15 pagesProblems On Pricing DecisionsMae-shane SagayoNo ratings yet

- 31243mtestpaper Ipcc sr2 p3Document8 pages31243mtestpaper Ipcc sr2 p3Sundeep MogantiNo ratings yet

- Problems On Pricing DecisionsDocument15 pagesProblems On Pricing Decisionschintan desaiNo ratings yet

- Caf-03 Cma Artt Mock QP With SolDocument16 pagesCaf-03 Cma Artt Mock QP With Solkulhaq29No ratings yet

- Every Sheet of Answers Should Bear Your Roll NoDocument5 pagesEvery Sheet of Answers Should Bear Your Roll NoKushalNo ratings yet

- Innovation and Inequality: How Does Technical Progress Affect Workers?From EverandInnovation and Inequality: How Does Technical Progress Affect Workers?No ratings yet

- A Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessNo ratings yet

- Test 3 SolDocument2 pagesTest 3 Solsongs 2019 MalikNo ratings yet

- Lecture 27 PDFDocument1 pageLecture 27 PDFsongs 2019 MalikNo ratings yet

- ICAP Study Text Chap-4 (Solutions)Document3 pagesICAP Study Text Chap-4 (Solutions)songs 2019 MalikNo ratings yet

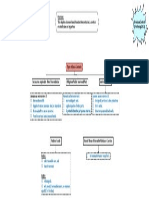

- Chapter 12 MindMapDocument1 pageChapter 12 MindMapsongs 2019 MalikNo ratings yet

- Chapter 10 MindMap PDFDocument2 pagesChapter 10 MindMap PDFsongs 2019 MalikNo ratings yet

- Chapter 09 MindMapDocument1 pageChapter 09 MindMapsongs 2019 MalikNo ratings yet

- Chapter 02 MindMapDocument1 pageChapter 02 MindMapsongs 2019 MalikNo ratings yet

- Chapter 07 MindMap PDFDocument1 pageChapter 07 MindMap PDFsongs 2019 MalikNo ratings yet

- OB MBA Final Summer 22 OB MBA Final Summer 22: Test ContentDocument10 pagesOB MBA Final Summer 22 OB MBA Final Summer 22: Test ContentDUAA ALJEFFRINo ratings yet

- Challenges of ERP Implementation in Myanmar V2Document13 pagesChallenges of ERP Implementation in Myanmar V2Yen H.YNo ratings yet

- Unit-1 Introduction To Management Concepts and Managerial Skills - Google FormsDocument10 pagesUnit-1 Introduction To Management Concepts and Managerial Skills - Google Forms60 Kavita ChimmanNo ratings yet

- Mr. Nayan's Case Is Under MicroscopeDocument23 pagesMr. Nayan's Case Is Under MicroscopeSandip Kumar JanaNo ratings yet

- Human Recourses For Level 3 International Extended Diploma in BusinessDocument33 pagesHuman Recourses For Level 3 International Extended Diploma in BusinessMarlaNo ratings yet

- DIGITAL MARKETING Brochure - GreatmindscommDocument8 pagesDIGITAL MARKETING Brochure - GreatmindscommRayNo ratings yet

- Design School of Strategic ManagementDocument17 pagesDesign School of Strategic ManagementOmari omariNo ratings yet

- 2 Sem Advanced Strategic ManagementDocument20 pages2 Sem Advanced Strategic Managementsruthi kjNo ratings yet

- Chapter 01: An Overview of Project Management Quiz1: (Ii) TemporaryDocument19 pagesChapter 01: An Overview of Project Management Quiz1: (Ii) TemporarySujit DoneraoNo ratings yet

- 110-W2-3-Cost concept-chp02-STDocument85 pages110-W2-3-Cost concept-chp02-STmargaret mariaNo ratings yet

- Session 1 Intergrating Internal and External Business Environment New - 634fdf34d5e60Document49 pagesSession 1 Intergrating Internal and External Business Environment New - 634fdf34d5e60champika de alwisNo ratings yet

- Innovation Strategic ManagementDocument25 pagesInnovation Strategic ManagementNerissa ObliagaNo ratings yet

- EN - ITIL4 - FND - 2019 - SamplePaper1 - QuestionBk - v1.4 Kazeem BalogunDocument13 pagesEN - ITIL4 - FND - 2019 - SamplePaper1 - QuestionBk - v1.4 Kazeem BalogunHappyNo ratings yet

- Influence of Corporate Governance On Strategy Implementation in Kenya Agricultural and Livestock Research OrganizationDocument15 pagesInfluence of Corporate Governance On Strategy Implementation in Kenya Agricultural and Livestock Research Organizationmariam yanalsNo ratings yet

- University of Birmingham - Saxton Bampfylde - Global Executive Search & Leadership Consulting % ChairDocument2 pagesUniversity of Birmingham - Saxton Bampfylde - Global Executive Search & Leadership Consulting % ChairDyl DuckNo ratings yet

- Aurangzeb ResumeDocument1 pageAurangzeb ResumeAyaz GillNo ratings yet

- Lecture One: Introduction To IntrapreneurshipDocument34 pagesLecture One: Introduction To IntrapreneurshipAditya MaitriNo ratings yet

- Lesson 2-A - Principles of Human Resource ManagementDocument6 pagesLesson 2-A - Principles of Human Resource ManagementJohn Joshua LaynesNo ratings yet

- Group 6 - Chapter 6 Marketing MiceDocument42 pagesGroup 6 - Chapter 6 Marketing MiceAshley Gwyneth MortelNo ratings yet

- Garuda1518591 1Document16 pagesGaruda1518591 1Epic SceneNo ratings yet

- Best PF & Esic Consultant in Delhi Gurgoan Noida FaridabadDocument10 pagesBest PF & Esic Consultant in Delhi Gurgoan Noida FaridabadShashi HarishNo ratings yet

- Project Governance Plan TemplateDocument6 pagesProject Governance Plan Templatedrfa program100% (1)

- Talumpati (Pandemya)Document6 pagesTalumpati (Pandemya)Alden JaredNo ratings yet

- PPTXDocument22 pagesPPTXsai raoNo ratings yet

- PLM Integration and Data Migration PDFDocument1 pagePLM Integration and Data Migration PDFsharecareNo ratings yet

- BINUS UniversityDocument3 pagesBINUS UniversityDevonna ViannicaNo ratings yet

- BenefitsDocument4 pagesBenefitsALVA REYTERANNo ratings yet

- Melat ProposalDocument31 pagesMelat ProposalGebru GetachewNo ratings yet

- ISO 45001 Audit ChecklistDocument16 pagesISO 45001 Audit Checklistdinho JesusNo ratings yet

- Post Covid J Management Studies - 2020 - Hitt - Strategic Management Theory in A Post Pandemic and Non Ergodic WorldDocument6 pagesPost Covid J Management Studies - 2020 - Hitt - Strategic Management Theory in A Post Pandemic and Non Ergodic WorldAhmed HassanNo ratings yet