Professional Documents

Culture Documents

Test 3 Sol

Test 3 Sol

Uploaded by

songs 2019 MalikOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Test 3 Sol

Test 3 Sol

Uploaded by

songs 2019 MalikCopyright:

Available Formats

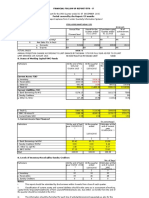

Solution 1

Omega Limited

Notes to Financial statements

For the year ended 31 December 2017

10. Property, plant and equipment 2017 2016

Building Plant Building Plant

Rs. Rs. Rs. Rs.

Cost

Opening 700 475 700 475

Additions - - - -

Revaluation (W-2) (108) - - -

Disposal (87) - - -

Transfer of Acc. Depreciation (42) - - -

Closing 463 475 700 475

Acc. Depreciation & Impairment

Opening 24 115 - 19

Dep. For the year (W-2.1) : (W-1) 22.5 36 24 19

Disposal (4.5)

Impairment (W-1) 77

Transfer to asset account (42) - -

Closing - (151) (24) (115)

Carrying amount as on 31/12/2016 463 324 676 360

Building Plant

10.1 Measurement Basis Revaluation model Cost model

Depreciation Method Straight line Reducing balance

Dep. Rate/Useful life 30 years 10%

10.2 The last revaluation was performed on 31 December 2017 by Najeeb Consultants, an independent

firm of valuers.

10.3 Movement in revaluation surplus:

2017 2016

Opening 116 120

Arose during the year - -

Transferred / adjusted 22.4+3.3+90.3 (116) (4)

WDV as on 31.12.15 - 116

10.4 Had there been no revaluation, the buildings would have appeared as follows

2017 2016

Cost (600-66) 534 600

Less: Accumulated depreciation 600−66 600

( 30 𝑥3):( 30 𝑥2) (53.4) (40)

WDV as on 31.12.15 480.6 560

10.6 Change in Estimate:

During the year 2017, depreciation method of plant was changed from straight line to reducing

balance. The new depreciation rate would be 10%. Due to above change, Depreciation for the year

has increased whereas, Profit for the year has decreased by Rs. 20 million. {𝟑𝟔(𝟑𝟔𝟎 × 𝟏𝟎%) −

𝟑𝟔𝟎

𝟏𝟔 ( 𝟐𝟑 )}

Workings

(W-1) Plant W.D.V

1/1/2015 Cost 475

31/12/2015 Dep. (475/25) (19)

31/12/2016 Dep. (475/25) (19)

31/12/2016 W.D.V 437

Impairment Loss (77)

31/12/2016 Recoverable amount 360

31/12/2017 Dep (360*10%) (36)

WDV 324

(W-2) Revaluation schedule

Rev.

Date Description Building SOCI (P/l)

surplus

1/1/15 Cost 600

31/12/2015 Dep. (600/30) (20)

31/12/2015 W.D.V 580

31/12/2015 Rev. surplus 120 120 -

31/12/2015 Revalued amount 700 120 -

31/12/2016 Dep (700/29) (24) (4) -

31/12/2016 WDV 676 116 -

30/06/2017 Dep. Of 1 building for 6 months (W-3) (1.5) (0.4) -

30/06/2017 WDV of 1 building (W-4) (82.5) (22) -

31/12/2017 Depreciation of remaining buildings (21) (3.3) -

(W-5)

31/12/2017 WDV 571 90.3 -

31/12/2017 Revaluation loss (108) (90.3) (17.7)

31/12/2017 Revalued Amount 463 - (17.7)

(W-2.1) Total Depreciation on buildings for the year 2017

Dep. Of 1 building for 6 months (W-3) 1.5

Depreciation of remaining buildings (W-5) 21

22.5

(W-3) Depreciation of 1 building for 6 months

Cost = 87/29 × 6/12 = 1.5 : Surplus = (23.2)/29 × 6/12 = 0.4

(W-4) WDV of 1 building

Rs. ‘millions’ Rs. ‘

millions’

Building Surplus

Cost

Balance 87 23.2

Acc. Depreciation (87/29 × 1.5) : (23.2/29 × 1.5) (4.5) (1.2)

82.5 22

(W-5) Depreciation of remaining buildings for the year

Rs. ‘millions’ Rs. ‘millions’

Building cost Surplus

Opening 700 120

Disposal (87) (23.2)

Balance 613 96.8

÷ Remaining Life ÷29 ÷29

21 3.3

You might also like

- Lesson Plan Modal Verbs!Document5 pagesLesson Plan Modal Verbs!Adriana Brebenel86% (14)

- Depreciation (110,500 20%) 21,780 Depreciation (3,660 10%) 366Document1 pageDepreciation (110,500 20%) 21,780 Depreciation (3,660 10%) 366Ali MohamedNo ratings yet

- Orchid LimitedDocument3 pagesOrchid LimitedANo ratings yet

- 2017 2016 2015 2014 2013 2012 Gross Carrying AmountDocument3 pages2017 2016 2015 2014 2013 2012 Gross Carrying AmountAli OptimisticNo ratings yet

- Fajarbaru Builder Group BHDDocument5 pagesFajarbaru Builder Group BHDShungchau WongNo ratings yet

- Tutorial Letter 201/1/2017: Distinctive Financial ReportingDocument8 pagesTutorial Letter 201/1/2017: Distinctive Financial ReportingItumeleng KekanaNo ratings yet

- Class Example 1, 3, 6 (Solutions)Document8 pagesClass Example 1, 3, 6 (Solutions)Given RefilweNo ratings yet

- Assessment 1 (Sol.)Document5 pagesAssessment 1 (Sol.)Hadeed HafeezNo ratings yet

- Standalone Financial Results For December 31, 2016 (Result)Document3 pagesStandalone Financial Results For December 31, 2016 (Result)Shyam SunderNo ratings yet

- UBL Annual Report 2018-78Document1 pageUBL Annual Report 2018-78IFRS LabNo ratings yet

- CAF 1 Autumn 2023Document7 pagesCAF 1 Autumn 2023Asim MahmoodNo ratings yet

- Cambridge Assessment International Education: Accounting 9706/31 October/November 2017Document14 pagesCambridge Assessment International Education: Accounting 9706/31 October/November 2017Phiri Arah RachelNo ratings yet

- Chapter 8 Class Exercise-OldDocument30 pagesChapter 8 Class Exercise-OldTiffany ChanceNo ratings yet

- Vitrox q32017Document14 pagesVitrox q32017Dennis AngNo ratings yet

- 3 - IAS 36 SolutionDocument3 pages3 - IAS 36 Solutionsandeshjhanbia021No ratings yet

- Cambridge International Examinations: Accounting 9706/33 May/June 2017Document16 pagesCambridge International Examinations: Accounting 9706/33 May/June 2017Malik AliNo ratings yet

- 2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Possible AnswerDocument9 pages2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Possible AnswerChantelle IsaksNo ratings yet

- MAGML Q3 Accounts For The Period 31.03.2022Document2 pagesMAGML Q3 Accounts For The Period 31.03.2022shoyeb rakibNo ratings yet

- UBL Annual Report 2018-119Document1 pageUBL Annual Report 2018-119IFRS LabNo ratings yet

- WP Inventory - Persediaan PT SugusDocument15 pagesWP Inventory - Persediaan PT SugusZahra AuliaNo ratings yet

- Tutorials On ProvisionsDocument5 pagesTutorials On ProvisionsrollinpeguyNo ratings yet

- Property, Plant and Equipment Assertions ProceduresDocument14 pagesProperty, Plant and Equipment Assertions ProceduresaldriennedelacruzzNo ratings yet

- Financial Statement 2017Document12 pagesFinancial Statement 2017Dina OdehNo ratings yet

- 9706 Accounting: MARK SCHEME For The May/June 2014 SeriesDocument5 pages9706 Accounting: MARK SCHEME For The May/June 2014 SeriesMateeh-ur -rehmanNo ratings yet

- Useful Life/depreciation Rate 20 Years 10% Revaluation Model Cost Model Depreciation Method SLM RBMDocument2 pagesUseful Life/depreciation Rate 20 Years 10% Revaluation Model Cost Model Depreciation Method SLM RBMZohaib AhmedNo ratings yet

- GR 11 Accounting P1 (English 2023 Possible AnswerDocument9 pagesGR 11 Accounting P1 (English 2023 Possible Answert86663375No ratings yet

- AAGB Quarter1 Ended 31.03.2021Document26 pagesAAGB Quarter1 Ended 31.03.2021NUR RAHIMIE FAHMI B.NOOR ADZMAN NUR RAHIMIE FAHMI B.NOOR ADZMANNo ratings yet

- Preparing and Presenting Cost Estimates For Projects and Programs Financed by The Asian Development BankDocument1 pagePreparing and Presenting Cost Estimates For Projects and Programs Financed by The Asian Development BankRyan SombilonNo ratings yet

- Combined Grade 12 Paper One - Balance Sheet and Cashflow - Accounting-1Document42 pagesCombined Grade 12 Paper One - Balance Sheet and Cashflow - Accounting-1Mmamotse KgabiNo ratings yet

- 9706 Accounting: MARK SCHEME For The October/November 2013 SeriesDocument5 pages9706 Accounting: MARK SCHEME For The October/November 2013 SeriestarunyadavfutureNo ratings yet

- Financial Accounting N 6 Test MG 2nd Semester 2017Document8 pagesFinancial Accounting N 6 Test MG 2nd Semester 2017professional accountantsNo ratings yet

- WP Inventory - Persediaan PT Sugus - ZCADocument16 pagesWP Inventory - Persediaan PT Sugus - ZCAZahra AuliaNo ratings yet

- RFL 2nd Quarter 2017 FinalDocument6 pagesRFL 2nd Quarter 2017 Finalanup dasNo ratings yet

- Qis 1,2,3 Sep-22Document41 pagesQis 1,2,3 Sep-22Suraj BardeNo ratings yet

- 2023 Regular and SOLDocument24 pages2023 Regular and SOLtreasurebts19No ratings yet

- 9706 Accounting: MARK SCHEME For The May/June 2015 SeriesDocument6 pages9706 Accounting: MARK SCHEME For The May/June 2015 SeriesMahad UmarNo ratings yet

- Financial Accounting - MGT101 Power Point Slides Lecture 39Document22 pagesFinancial Accounting - MGT101 Power Point Slides Lecture 39Mr. JalilNo ratings yet

- Assignment On: Submitted ToDocument3 pagesAssignment On: Submitted ToTAWHID ARMANNo ratings yet

- 14 - Accounting 4 DepreciationDocument22 pages14 - Accounting 4 DepreciationKAMAL POKHRELNo ratings yet

- Techna-X Berhad: Incorporated in MalaysiaDocument17 pagesTechna-X Berhad: Incorporated in MalaysiaChoon Wei WongNo ratings yet

- Gr11 Accounting P1 (ENG) NOV Possible Answers-2Document9 pagesGr11 Accounting P1 (ENG) NOV Possible Answers-2Shriddhi MaharajNo ratings yet

- Notes To The Financial Statements: December 31, 2017 (Continued)Document2 pagesNotes To The Financial Statements: December 31, 2017 (Continued)Reinardus RakkitasilaNo ratings yet

- SPHR00712A Commercial - Bid - Sheet - Ardi Works - R3Document10 pagesSPHR00712A Commercial - Bid - Sheet - Ardi Works - R3Cahyo Hening Pamardi STNo ratings yet

- Olam International LimitedDocument19 pagesOlam International Limitedashokdb2kNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Chapter 26 - Review QuestionsDocument7 pagesChapter 26 - Review QuestionsAli MohamedNo ratings yet

- Acc GR 12 I & II 2nd E SCHMDocument8 pagesAcc GR 12 I & II 2nd E SCHMSharomyNo ratings yet

- Solution FAR270 NOV 2022Document6 pagesSolution FAR270 NOV 2022Nur Fatin AmirahNo ratings yet

- Financial Follow Up Report (FFR - I) : Steel Hyper Mart India P LTDDocument3 pagesFinancial Follow Up Report (FFR - I) : Steel Hyper Mart India P LTDSURANA1973No ratings yet

- 73264bos59105 Inter P1aDocument12 pages73264bos59105 Inter P1aRaish QURESHINo ratings yet

- Audited FS NVC 2017Document23 pagesAudited FS NVC 2017NVC Foundation100% (1)

- A04 Xgpr15n5xduon8yb.1Document30 pagesA04 Xgpr15n5xduon8yb.1Hiya ByeNo ratings yet

- Answer Key - Assignment PPE Part 2Document8 pagesAnswer Key - Assignment PPE Part 2Silvermist AriaNo ratings yet

- CFS PracticeDocument10 pagesCFS Practicehafeez azizNo ratings yet

- Assignment 3 SolutionDocument2 pagesAssignment 3 SolutionThulani NdlovuNo ratings yet

- 9706 s12 Ms 22 PDFDocument6 pages9706 s12 Ms 22 PDFmarryNo ratings yet

- CAF 5 Spring 2022Document7 pagesCAF 5 Spring 2022Zia Ur RahmanNo ratings yet

- SOCIE Format (CAF Level)Document1 pageSOCIE Format (CAF Level)kashan.ahmed1985No ratings yet

- Reviewer in Auditing Problems by Ocampo/Ocampo (2021 Edition)Document7 pagesReviewer in Auditing Problems by Ocampo/Ocampo (2021 Edition)Rosevilla AbneNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- Lecture 27 PDFDocument1 pageLecture 27 PDFsongs 2019 MalikNo ratings yet

- ICAP Study Text Chap-4 (Solutions)Document3 pagesICAP Study Text Chap-4 (Solutions)songs 2019 MalikNo ratings yet

- ICAP Study Text Chap-4 (Questions)Document3 pagesICAP Study Text Chap-4 (Questions)songs 2019 MalikNo ratings yet

- Chapter 12 MindMapDocument1 pageChapter 12 MindMapsongs 2019 MalikNo ratings yet

- Chapter 10 MindMap PDFDocument2 pagesChapter 10 MindMap PDFsongs 2019 MalikNo ratings yet

- Chapter 09 MindMapDocument1 pageChapter 09 MindMapsongs 2019 MalikNo ratings yet

- Chapter 07 MindMap PDFDocument1 pageChapter 07 MindMap PDFsongs 2019 MalikNo ratings yet

- Chapter 02 MindMapDocument1 pageChapter 02 MindMapsongs 2019 MalikNo ratings yet

- Overview:: Physical (Int) Natural (Cun) Healing (Will) Psychic (PR)Document1 pageOverview:: Physical (Int) Natural (Cun) Healing (Will) Psychic (PR)Brady Shawn TurnerNo ratings yet

- Data 19Document3 pagesData 19Adil AdiloNo ratings yet

- Determination of Cracking Tolerance Index of Asphalt Mixture Using The Indirect Tensile Cracking Test at Intermediate TemperatureDocument6 pagesDetermination of Cracking Tolerance Index of Asphalt Mixture Using The Indirect Tensile Cracking Test at Intermediate TemperatureJulissa Larios100% (3)

- Driven by Passion. Eager To Grow. If That'S You, Join Bearingpoint!Document15 pagesDriven by Passion. Eager To Grow. If That'S You, Join Bearingpoint!Ana Maria PetreNo ratings yet

- 4.sample Lesson Plan #1 - Despartment of English - Junior High-High SchoolDocument2 pages4.sample Lesson Plan #1 - Despartment of English - Junior High-High SchoolÆrikïrÆKǎwǎèNo ratings yet

- TEDxBeaconStreet Speaker GuideDocument20 pagesTEDxBeaconStreet Speaker GuideSartaj Singh AnandNo ratings yet

- Medium High MotorsDocument20 pagesMedium High Motorsshcoway100% (1)

- LP 5Document2 pagesLP 5Sherry Love Boiser AlvaNo ratings yet

- Beautiful Raja AmpatDocument11 pagesBeautiful Raja AmpatSherly Salsa DewiNo ratings yet

- Express Meal Plans-WEEK3 2013Document10 pagesExpress Meal Plans-WEEK3 2013Omar RodriguezNo ratings yet

- Liste de Méthodes de BatterieDocument10 pagesListe de Méthodes de Batteriejulien.cocquebertNo ratings yet

- Domingo vs. Domingo, G.R. No. L-30573 October 29, 1971 DIGESTEDDocument1 pageDomingo vs. Domingo, G.R. No. L-30573 October 29, 1971 DIGESTEDJacquelyn Alegria100% (1)

- English - Reviewer in EnglishDocument9 pagesEnglish - Reviewer in EnglishLouise Juliane LopezNo ratings yet

- Place Value Strips and Base 10 Blocks PrintableDocument30 pagesPlace Value Strips and Base 10 Blocks PrintableIla SidekNo ratings yet

- Ficha Tecnica SX10Document7 pagesFicha Tecnica SX10José CamachoNo ratings yet

- My Little Darling Book 1Document41 pagesMy Little Darling Book 1Sim TiniNo ratings yet

- Star Wars Narrative ParadigmDocument8 pagesStar Wars Narrative Paradigmapi-406089575No ratings yet

- Cabrera vs. ClarinDocument19 pagesCabrera vs. ClarinAngel AmarNo ratings yet

- Proposal PHDDocument1 pageProposal PHDliammiaNo ratings yet

- Advanced AccountingDocument39 pagesAdvanced AccountingHemanth Singh RajpurohitNo ratings yet

- Eureka Forbes Case AnalysisDocument3 pagesEureka Forbes Case AnalysisDiksha TanejaNo ratings yet

- International Committee of The Red CrossDocument39 pagesInternational Committee of The Red Crosspetcusilvia100% (2)

- C QuestionsDocument31 pagesC QuestionsMohan Kumar MNo ratings yet

- Halloween Esl Vocabulary Word Search Puzzle Worksheet For Kids PDFDocument2 pagesHalloween Esl Vocabulary Word Search Puzzle Worksheet For Kids PDFJuanJose100% (2)

- Intertestamental Period PaperDocument6 pagesIntertestamental Period PaperMrNo ratings yet

- Worthing - God, Creation, Contemporary PhysicsDocument213 pagesWorthing - God, Creation, Contemporary PhysicsSaw Min TheinNo ratings yet

- Cpar Module 3BDocument49 pagesCpar Module 3BNiea VenderoNo ratings yet

- Strategic Thinking: Catalyst To Competitive AdvantageDocument26 pagesStrategic Thinking: Catalyst To Competitive AdvantagenoorgikiNo ratings yet

- Verification in Software Testing Is A Process of CheckingDocument3 pagesVerification in Software Testing Is A Process of Checkinggulzar ahmadNo ratings yet