Professional Documents

Culture Documents

InformationSheet 4 GBER 323 PDF

Uploaded by

KaiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

InformationSheet 4 GBER 323 PDF

Uploaded by

KaiCopyright:

Available Formats

IMAGE SOURCE: https://www.lucidchart.

com/blog/risk-management-process

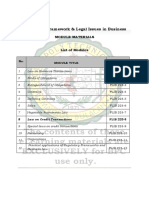

MODULE CONTENT

COURSE TITLE: Governance, Business Ethics, Risk Management,

and Internal Control

MODULE TITLE: CONTROLLING AND MANAGING RISK

MODULE NO: GBER 323-4

NOMINAL DURATION: 6 HRS

SPECIFIC LEARNING OBJECTIVES:

At the end of this module you MUST be able to:

1. Explain and evaluate the role of the accountant in controlling and

mitigating risk

TOPICS:

Targeting and monitoring risk

Methods of controlling and reducing risk

Risk avoidance, retention and modelling

ASSESSMENT METHOD/S:

Online work and activity

REFERENCE/S:

https://www.investopedia.com/

https://survey.charteredaccountantsanz.com/risk_management/small-

firms/monitor.aspx

Bachelor of Science Bulacan Date Developed:

Aug 2020

in Accounting Polytechnic Page 1 of 9

Date Revised:

Information Systems College Sept 2020

Governance, Business Developed by:

Ethics, Risk Management, Document No. Ms. Rachael Louise

and Internal Control Revision No.:02

20-GBER 323

(GBER 323) De Guzman, LPT

https://www.enisa.europa.eu/topics/threat-risk-management/risk-

management/current-risk/risk-management-inventory/rm-

process/monitor-review

https://www.mha-it.com/2016/11/30/defining-risk-

avoidance/#:~:text=Risk%20avoidance%20is%20the%20elimination,to%2

0avoid%20compromising%20events%20entirely.

Bachelor of Science Bulacan Date Developed:

Aug 2020

in Accounting Polytechnic Page 2 of 9

Date Revised:

Information Systems College Sept 2020

Governance, Business Developed by:

Ethics, Risk Management, Document No. Ms. Rachael Louise

and Internal Control Revision No.:02

20-GBER 323

(GBER 323) De Guzman, LPT

Information Sheet GBER 323-4

CONTROLLING AND MANAGING RISK

Learning Objectives:

After reading this INFORMATION SHEET, YOU MUST be able to:

1. Explain and evaluate the role of the accountant in controlling and

mitigating risk

Targeting and Monitoring Risk

“You can’t manage what you don’t measure”

One of the most critical factors affecting the efficiency and effectiveness of the

organization’s risk management process is the establishment of an ongoing

monitor and review process. This process makes sure that the specified

management action plans remain relevant and updated. In today’s continuously

changing business environment, factors affecting the likelihood and

consequences of a risk are very likely to change also. This is even truer for factors

affecting the cost of the risk management options. It is therefore necessary to

repeat the risk management cycle regularly.

To make Risk Management become a part of the organization’s culture and

philosophy, the organization must collect and document experience and

knowledge through a consistent monitoring and review of events, treatment

plans, results and all relevant records. This information, however, will be

pertinent to information risks. Technical details concerning operational issues of

the underlying technology have to be filtered out.

Each stage of the Risk Management process must be recorded appropriately.

Assumptions, methods, data sources, results and reasons for decisions must be

included in the recorded material.

Besides being an extremely valuable information asset for the organization, the

records of such processes are an important aspect of good corporate governance

provided of course that they are in line with:

Bachelor of Science Bulacan Date Developed:

Aug 2020

in Accounting Polytechnic Page 3 of 9

Date Revised:

Information Systems College Sept 2020

Governance, Business Developed by:

Ethics, Risk Management, Document No. Ms. Rachael Louise

and Internal Control Revision No.:02

20-GBER 323

(GBER 323) De Guzman, LPT

• the legal, regulatory, and business needs for records,

• the cost of creating and maintaining such records,

• the benefits of re-using information.

Risk Monitoring

Continuous monitoring by the project risk manager and the project team ensures

that new and changing risks are detected and managed and that risk response

actions are implemented and effective. Risk monitoring continues for the life of

the project.

Risk monitoring and control keeps track of the identified risks, residual risks,

and new risks. It also monitors the execution of planned strategies for the

identified risks and evaluates their effectiveness.

Risk monitoring and control continues for the life of the project. The list of project

risks changes as the project matures, new risks develop, or anticipated risks

disappear. Risk ratings and prioritizations can also change during the project

lifecycle.

Typically, during project execution, risk meetings should be held regularly to

update the status of risks in the risk register and add new risks. This is not

necessary for minor level projects and may only be needed annually for moderate

level projects. Periodic project risk reviews repeat the process of identification,

analysis, and response planning.

Monitoring risk is a continuous activity that results in the awareness of

what is happening across different parts of the organization. Over time,

monitoring risk enables management to:

✓ identify critical trends

✓ respond in an appropriate and efficient manner

✓ spot business opportunities or process improvements that would

otherwise not have been apparent without effective monitoring in place

Bachelor of Science Bulacan Date Developed:

Aug 2020

in Accounting Polytechnic Page 4 of 9

Date Revised:

Information Systems College Sept 2020

Governance, Business Developed by:

Ethics, Risk Management, Document No. Ms. Rachael Louise

and Internal Control Revision No.:02

20-GBER 323

(GBER 323) De Guzman, LPT

Image Source: https://survey.charteredaccountantsanz.com/risk_management/small-firms/monitor.aspx

Monitoring and review should be a planned part of the risk management

process and involve regular checking or surveillance. The results should be

recorded and reported externally and internally, as appropriate. The results

should also be an input to the review and continuous improvement of the firm's

risk management framework.

Responsibilities for monitoring and review should be clearly defined. The firm's

monitoring and review processes should encompass all aspects of the risk

management process for the purposes of:

▪ Ensuring that controls are effective and efficient in both design and

operation

▪ Obtaining further information to improve risk assessment

▪ Analyzing and learning lessons from risk events, including near-misses,

changes, trends, successes, and failures

▪ Detecting changes in the external and internal context, including changes

to risk criteria and to the risks, which may require revision of risk

treatments and priorities

▪ Identifying emerging risks.

Methods of Controlling and Reducing Risk

What Is Risk Control?

Risk control is the set of methods by which firms evaluate potential losses and

take action to reduce or eliminate such threats. It is a technique that utilizes

findings from risk assessments, which involve identifying potential risk factors

in a company's operations, such as technical and non-technical aspects of the

business, financial policies and other issues that may affect the well-being of the

firm.

Risk control also implements proactive changes to reduce risk in these areas.

Risk control thus helps companies limit lost assets and income. Risk control is

a key component of a company's enterprise risk management protocol.

Bachelor of Science Bulacan Date Developed:

Aug 2020

in Accounting Polytechnic Page 5 of 9

Date Revised:

Information Systems College Sept 2020

Governance, Business Developed by:

Ethics, Risk Management, Document No. Ms. Rachael Louise

and Internal Control Revision No.:02

20-GBER 323

(GBER 323) De Guzman, LPT

How Risk Control Works

Modern businesses face a diverse collection of obstacles, competitors, and

potential dangers. Risk control is a plan-based business strategy that aims to

identify, assess, and prepare for any dangers, hazards, and other potentials for

disaster—both physical and figurative—that may interfere with an organization's

operations and objectives. The core concepts of risk control include:

• Avoidance is the best method of loss control. For example, after

discovering that a chemical used in manufacturing a company’s goods is

dangerous for the workers, a factory owner finds a safe substitute chemical

to protect the workers’ health.

• Loss prevention accepts a risk but attempts to minimize the loss rather

than eliminate it. For example, inventory stored in a warehouse is

susceptible to theft. Since there is no way to avoid it, a loss prevention

program is put in place. The program includes patrolling security guards,

video cameras and secured storage facilities. Insurance is another

example of risk prevention that is outsourced to a third party by contract.

• Loss reduction accepts the risk and seeks to limit losses when a threat

occurs. For example, a company storing flammable material in a

warehouse installs state-of-the-art water sprinklers for minimizing

damage in case of fire.

• Separation involves dispersing key assets so that catastrophic events at

one location affect the business only at that location. If all assets were in

the same place, the business would face more serious issues. For example,

a company utilizes a geographically diverse workforce so that production

may continue when issues arise at one warehouse.

• Duplication involves creating a backup plan, often by using technology.

For example, because information system server failure would stop a

company’s operations, a backup server is readily available in case the

primary server fails.

• Diversification allocates business resources for creating multiple lines of

business offering a variety of products or services in different industries.

A significant revenue loss from one line will not result in irreparable harm

to the company’s bottom line. For example, in addition to serving food, a

restaurant has grocery stores carry its line of salad dressings, marinades,

and sauces.

No one risk control technique will be a golden bullet to keep a company free from

potential harm. In practice, these techniques are used in tandem with one

another to varying degree and change as the corporation grows, as the economy

changes, and as the competitive landscape shifts.

Bachelor of Science Bulacan Date Developed:

Aug 2020

in Accounting Polytechnic Page 6 of 9

Date Revised:

Information Systems College Sept 2020

Governance, Business Developed by:

Ethics, Risk Management, Document No. Ms. Rachael Louise

and Internal Control Revision No.:02

20-GBER 323

(GBER 323) De Guzman, LPT

KEY TAKEAWAYS

▪ Risk control is the set of methods by which firms evaluate potential

losses and take action to reduce or eliminate such threats. It is a

technique that utilizes findings from risk assessments.

▪ The goal is to identify and reduce potential risk factors in a company's

operations, such as technical and non-technical aspects of the

business, financial policies and other issues that may affect the well-

being of the firm.

▪ Risk control methods include avoidance, loss prevention, loss

reduction, separation, duplication, and diversification.

Example of Risk Control

As part of Sumitomo Electric’s risk management efforts, the company

developed Business Continuity Plans (BCPs) in fiscal 2008 as a means of

ensuring that core business activities could continue in the event of a disaster.

The BCPs played a role in responding to issues caused by the Great East Japan

earthquake that occurred in March 2011. Because the quake caused massive

damage on an unprecedented scale, far surpassing the damage assumed in the

BCPs, some areas of the plans did not reach their goals.

Based on lessons learned from the company’s response to the earthquake,

executives continue promoting practical drills and training programs, confirming

the effectiveness of the plans and improving them as needed. In addition,

Sumitomo continues setting up a system for coping with risks such as outbreaks

of infectious diseases, including the pandemic influenza virus.

Bachelor of Science Bulacan Date Developed:

Aug 2020

in Accounting Polytechnic Page 7 of 9

Date Revised:

Information Systems College Sept 2020

Governance, Business Developed by:

Ethics, Risk Management, Document No. Ms. Rachael Louise

and Internal Control Revision No.:02

20-GBER 323

(GBER 323) De Guzman, LPT

Image source: https://www.lynda.com/IT-tutorials/Risk-avoidance/2252221/2302012-4.html

RISK AVOIDANCE

Risk avoidance is the elimination of hazards, activities, and exposures that can

negatively affect an organization’s assets.

Whereas risk management aims to control the damages and financial

consequences of threatening events, risk avoidance seeks to avoid compromising

events entirely.

When determining your risk mitigation strategies, don’t confuse the strategies

of risk avoidance or risk acceptance with risk ignorance. Risk ignorance is a

situation where the knowledge about the risk (and any underlying phenomena

and processes) is poor. Just because there are no remediation strategies

currently in place does not mean that a conscious decision has been made to

accept the risk.

We perform assessments regarding risk and risk impact on a daily basis. We

then use those assessments to determine our choice of action. A good example

is wearing a seat belt. We might observe that experienced drivers are more likely

to understand the risks inherent in car travel, and thus choose to wear seat

belts, whereas the less experienced driver (think teenagers) may have to be

reminded constantly of those risks– at least in my house. These are contrasting

examples of risk avoidance (seat belt use) and risk ignorance (no seat belt use).

Neither should be confused with risk acceptance (car travel is dangerous, but I

don’t want to wrinkle my clothes, so I’m not going to wear my seat belt).

Take a moment and think about the type of organization you work with – are

your colleagues seat belt wearers or seat belt rejecters? How do we become a risk

avoidance-based organization, and is that a desirable state?

▪ Understand the risk and impacts. An assessment of how the risk will

impact only one area does not allow for good organizational decisions.

Bachelor of Science Bulacan Date Developed:

Aug 2020

in Accounting Polytechnic Page 8 of 9

Date Revised:

Information Systems College Sept 2020

Governance, Business Developed by:

Ethics, Risk Management, Document No. Ms. Rachael Louise

and Internal Control Revision No.:02

20-GBER 323

(GBER 323) De Guzman, LPT

▪ Ensure the risks and impacts are in business terms, not just technical

or BC terms. If there are no real business impacts, what is the actual risk?

▪ Update the risks and impacts. You should revisit your risk profile on a

regular basis, at least annually.

▪ Identify the risks that have remediation in place. Assess the

effectiveness of that remediation (is it appropriate to the risk impact, will

it work, etc.?).

▪ Identify the risks that have no remediation in place. Document those

risks and the reason why there is no remediation in place. This is where

you must distinguish between choosing to accept a risk or to ignore it.

➢ Conscious management decision based on impact, probability, cost,

etc. (management accepts the risk).

▪ Assess the criticality of the task. Consider why performing the task is

important or why a risk remediation solution is appropriate.

▪ Calculate the financial benefits of the task. Directors must decide when

the cost of the risk is greater than the cost of risk management and

manage their plans accordingly.

▪ Assess the availability of resources. If resources (budget, time, etc.) are

not available to fully remediate the risk, identify a solution that may reduce

risk, even if it does not reduce it to the appropriate level. Something is

better than nothing.

Risk avoidance does not mean remediation is in place to prevent any

potential issue. It does mean that proper evaluation has occurred,

and decisions have been made with the best information possible. A

risk cannot be ignored with the hope that it will not occur. Risk

avoidance is a desirable goal, even if remediation is implemented

incrementally.

Bachelor of Science Bulacan Date Developed:

Aug 2020

in Accounting Polytechnic Page 9 of 9

Date Revised:

Information Systems College Sept 2020

Governance, Business Developed by:

Ethics, Risk Management, Document No. Ms. Rachael Louise

and Internal Control Revision No.:02

20-GBER 323

(GBER 323) De Guzman, LPT

You might also like

- COBIT 2019 - RACI by Role - April 2020Document295 pagesCOBIT 2019 - RACI by Role - April 2020gaston6711100% (1)

- Internal Audit PlanDocument40 pagesInternal Audit Planandysupa100% (8)

- Procedure For Risk and Opportunity ManagementDocument8 pagesProcedure For Risk and Opportunity ManagementYADLADIVYATEJA100% (1)

- Application & Installation Guide G3500 Gas Engines: LEBW5339-07Document35 pagesApplication & Installation Guide G3500 Gas Engines: LEBW5339-07Djebali Mourad100% (1)

- ANT-60A CPN 622-2363-001/002 ANT-60B ADF Antennas CPN 622-3710-001Document4 pagesANT-60A CPN 622-2363-001/002 ANT-60B ADF Antennas CPN 622-3710-001Eka KrisnantaNo ratings yet

- InformationSheet 2 GBER 323Document16 pagesInformationSheet 2 GBER 323KaiNo ratings yet

- InformationSheet 3 GBER 323Document11 pagesInformationSheet 3 GBER 323KaiNo ratings yet

- Risk and Apportunity and Action Plan For Internal and External Issue - 2023Document15 pagesRisk and Apportunity and Action Plan For Internal and External Issue - 2023Super Stone100% (1)

- Internal Audit in The COVID 19 EraDocument7 pagesInternal Audit in The COVID 19 EraMaria PedrazaNo ratings yet

- Chapter 2 Source and Evaluation of Risks Annotated NotesDocument34 pagesChapter 2 Source and Evaluation of Risks Annotated NotesRoshan PednekarNo ratings yet

- Whitepaper The Evolving Role of AuditDocument6 pagesWhitepaper The Evolving Role of AuditEmmelinaErnestineNo ratings yet

- Risk Management IcaiDocument36 pagesRisk Management IcaiNirmal ShresthaNo ratings yet

- Reporting ScriptDocument3 pagesReporting ScriptMitch Tokong MinglanaNo ratings yet

- Report On Audit Planning and Approach of QLD FitsDocument10 pagesReport On Audit Planning and Approach of QLD FitsAdeel AhmedNo ratings yet

- IIA Bulletin Rethinking Preparedness Pandemics and CybersecurityDocument3 pagesIIA Bulletin Rethinking Preparedness Pandemics and CybersecurityBobby IlyasNo ratings yet

- Assessing The Risk Management ProcessDocument32 pagesAssessing The Risk Management ProcessIslam Monged100% (2)

- Source and Evaluation of Risks: Learning OutcomesDocument34 pagesSource and Evaluation of Risks: Learning OutcomesNATURE123No ratings yet

- Governance Risk and Compliance WhitepaperDocument12 pagesGovernance Risk and Compliance WhitepaperSave Bondi-BowlsNo ratings yet

- IM-GOVBUSMAN-FINALS HandoutDocument66 pagesIM-GOVBUSMAN-FINALS HandoutCedrick BartoloNo ratings yet

- COBIT 2019 - RACI by Role - April 2020Document295 pagesCOBIT 2019 - RACI by Role - April 2020efrans christianNo ratings yet

- IT Operational Risks - BaselIIDocument10 pagesIT Operational Risks - BaselIIThilakPATHIRAGENo ratings yet

- Lecture Notes Risk Management ProcessDocument6 pagesLecture Notes Risk Management ProcessTOLENTINO, Joferose AluyenNo ratings yet

- Riskmanagementanddigitisation-Riskmanagementanddigitisation ActuariesDigitalDocument6 pagesRiskmanagementanddigitisation-Riskmanagementanddigitisation ActuariesDigitallinda riveraNo ratings yet

- Control Interno InglesDocument8 pagesControl Interno InglesKathy Cerna RosalesNo ratings yet

- 2015 Mironescu Turcu Si Ceocea - The Operational Risk ManagementDocument13 pages2015 Mironescu Turcu Si Ceocea - The Operational Risk ManagementMircea MerticariuNo ratings yet

- Internal Audit MagazinesDocument3 pagesInternal Audit MagazinesAhmad MuhiddinNo ratings yet

- Identifying, Assessing and Controlling Threats: ImportanceDocument17 pagesIdentifying, Assessing and Controlling Threats: ImportanceJanna BalisacanNo ratings yet

- Beyond Assurance Leveraging Internal Audits Value Add in GRC Strategies - EditedDocument4 pagesBeyond Assurance Leveraging Internal Audits Value Add in GRC Strategies - EditedJon SnymanNo ratings yet

- 8 Financial Reporting and Management Reporting SystemsDocument10 pages8 Financial Reporting and Management Reporting SystemsKaiNo ratings yet

- Riesgo SDocument14 pagesRiesgo Scarolina s lopezNo ratings yet

- Performance Measurement Analysis of XYZ Company Based On Risk With AHP and Omax Concept ApproachDocument11 pagesPerformance Measurement Analysis of XYZ Company Based On Risk With AHP and Omax Concept ApproachInternational Journal of Innovative Science and Research Technology100% (1)

- GCC Top Risks 2022Document32 pagesGCC Top Risks 2022KhanNo ratings yet

- BSAIS-SBA 313 Information Sheet 4Document18 pagesBSAIS-SBA 313 Information Sheet 4jeraldtorressantos0626No ratings yet

- Managing Business Process OutsourcingDocument6 pagesManaging Business Process Outsourcingdhirender testNo ratings yet

- Robert Kennedy College University of Cumbria: CRKC7045 Final Assignment (Apr-May 2021)Document12 pagesRobert Kennedy College University of Cumbria: CRKC7045 Final Assignment (Apr-May 2021)Veshi SrivastavNo ratings yet

- BSAIS-SBA 313 Information Sheet 3Document30 pagesBSAIS-SBA 313 Information Sheet 3jeraldtorressantos0626No ratings yet

- GISM FUNDAMENTALS of RISK MANAGEMENTDocument3 pagesGISM FUNDAMENTALS of RISK MANAGEMENTmoyolisa0No ratings yet

- Cyber Risk Management Assessment 1708187613Document34 pagesCyber Risk Management Assessment 1708187613almaghairehkhaledNo ratings yet

- OnRisk 2020 ReportDocument40 pagesOnRisk 2020 ReportSyed Muhammad HassanNo ratings yet

- Governance Risk Management and Compliance FrameworkDocument4 pagesGovernance Risk Management and Compliance FrameworkAmandaNo ratings yet

- PROJECT REPORT (Risk Management) Santu - Docx 111111111111Document71 pagesPROJECT REPORT (Risk Management) Santu - Docx 111111111111Sami ZamaNo ratings yet

- Ebook Dont Navigate Risk Without Internal AuditorsDocument24 pagesEbook Dont Navigate Risk Without Internal AuditorsAndrew WainainaNo ratings yet

- The Role of Continuous Monitoring and Auditing in GRC by BWise PDFDocument11 pagesThe Role of Continuous Monitoring and Auditing in GRC by BWise PDFgong688665No ratings yet

- Risk-Based Audit Methodology Apply To Organization's IT Risk ManagementDocument26 pagesRisk-Based Audit Methodology Apply To Organization's IT Risk ManagementJorge L. MerchánNo ratings yet

- Unit 3Document15 pagesUnit 3Abhi SharmaNo ratings yet

- Internal Audit: Key Risk Areas 2021: KPMG - NLDocument6 pagesInternal Audit: Key Risk Areas 2021: KPMG - NLAngeNo ratings yet

- Legal Hot SpotsDocument18 pagesLegal Hot SpotsMbelo RNo ratings yet

- CS 5 10 - Session in ArabicDocument93 pagesCS 5 10 - Session in ArabicfatiNo ratings yet

- Internal Control Systems and Quality of Financial Reporting in Insurance Industry in NigeriaDocument10 pagesInternal Control Systems and Quality of Financial Reporting in Insurance Industry in NigeriaFarhan Osman ahmedNo ratings yet

- Eight Red Flags That Indicate You Need A Better Risk Management Approach - Whitepaper - 2020 Sep 07Document6 pagesEight Red Flags That Indicate You Need A Better Risk Management Approach - Whitepaper - 2020 Sep 07Sazones Perú Gerardo SalazarNo ratings yet

- Independent Audit How To Deal With Errors and Frauds in Civil Construction IndustriesDocument6 pagesIndependent Audit How To Deal With Errors and Frauds in Civil Construction IndustriesFabio JuniorNo ratings yet

- Risk Management PolicyDocument7 pagesRisk Management Policyoleksandr.jobNo ratings yet

- Assignment On: "Impact of Cost Accounting On Business Decision Making in Manufacturing Industries of Bangladesh''Document9 pagesAssignment On: "Impact of Cost Accounting On Business Decision Making in Manufacturing Industries of Bangladesh''Enaiya IslamNo ratings yet

- The Internal Control Mechanisms - The Key Factor To Business SuccessDocument5 pagesThe Internal Control Mechanisms - The Key Factor To Business SuccessInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- FAR Lesson 1 65Document38 pagesFAR Lesson 1 65Janine Charmie Manongsong OlivarNo ratings yet

- ACT102 Managerial Accounting IIIDocument5 pagesACT102 Managerial Accounting IIILEARELL DEYPALUBOSNo ratings yet

- "Operational Risk Analysis in Bank'S": Major Research Project OnDocument36 pages"Operational Risk Analysis in Bank'S": Major Research Project OnHemant Singh SisodiyaNo ratings yet

- Module III. Risk ManagementDocument5 pagesModule III. Risk ManagementMelanie SamsonaNo ratings yet

- Chapter 6 Risk ManagementDocument11 pagesChapter 6 Risk Managementricojr.pagalanNo ratings yet

- It GRC (Governance, Risk and Compliance) Access Control SolutionsDocument31 pagesIt GRC (Governance, Risk and Compliance) Access Control SolutionsNormanNo ratings yet

- Segregation of DutiesDocument4 pagesSegregation of DutiesalfonsodzibNo ratings yet

- MIT323 - Infosheet 4Document19 pagesMIT323 - Infosheet 4KaiNo ratings yet

- BSAIS-ISM 323 Information Sheet 2 PDFDocument15 pagesBSAIS-ISM 323 Information Sheet 2 PDFKaiNo ratings yet

- IBT 323 - International Business and TradeDocument7 pagesIBT 323 - International Business and TradeKaiNo ratings yet

- BSAIS-ISM 323 Information Sheet 4 PDFDocument17 pagesBSAIS-ISM 323 Information Sheet 4 PDFKaiNo ratings yet

- MIT323 - Infosheet 7 PDFDocument13 pagesMIT323 - Infosheet 7 PDFKaiNo ratings yet

- InformationSheet 5 GBER 323 PDFDocument17 pagesInformationSheet 5 GBER 323 PDFKaiNo ratings yet

- 8 Financial Reporting and Management Reporting SystemsDocument10 pages8 Financial Reporting and Management Reporting SystemsKaiNo ratings yet

- FLIB 223 8 LawonCreditTransactionsDocument8 pagesFLIB 223 8 LawonCreditTransactionsKaiNo ratings yet

- 7 The Conversion CycleDocument7 pages7 The Conversion CycleKaiNo ratings yet

- Regulatory Framework & Legal Issues in Business: Module MaterialsDocument7 pagesRegulatory Framework & Legal Issues in Business: Module MaterialsKaiNo ratings yet

- Feed Manufacturing-GrindingDocument33 pagesFeed Manufacturing-GrindingDr Anais AsimNo ratings yet

- Image ProcessingDocument12 pagesImage Processingsiddharth.20bcun006No ratings yet

- 2000 High Speed CMOS Data DL129-D c20000324Document408 pages2000 High Speed CMOS Data DL129-D c20000324Dara Nyara Ricardo SocorroNo ratings yet

- Se 4Document15 pagesSe 4Nabin TimsinaNo ratings yet

- Allplan 2006 - SchedulesDocument240 pagesAllplan 2006 - SchedulesbathcolNo ratings yet

- CS Project Tic-Tac-Toe Game UsingDocument10 pagesCS Project Tic-Tac-Toe Game UsingThanyaNo ratings yet

- Pemetaan Potensi Wilayah Pengembangan Sapi Potong Di Kabupaten SitubonDocument11 pagesPemetaan Potensi Wilayah Pengembangan Sapi Potong Di Kabupaten SitubonZuardiNo ratings yet

- Temperature Deviation FormDocument2 pagesTemperature Deviation FormerikaoktavianipurbaNo ratings yet

- Credential Harvestor FacebookDocument23 pagesCredential Harvestor FacebookJ Anthony GreenNo ratings yet

- Ebikemotion Tech APP Framework PDFDocument72 pagesEbikemotion Tech APP Framework PDFJose GarciaNo ratings yet

- Lubricant List - 29-5-14Document13 pagesLubricant List - 29-5-14huyNo ratings yet

- 3 ERP Software RFP Exhibit GDocument575 pages3 ERP Software RFP Exhibit GJacob YeboaNo ratings yet

- Solving Rational InequalityDocument67 pagesSolving Rational Inequalityjeremee balolongNo ratings yet

- Sigma Supplies Luster Ribbon SsDocument2 pagesSigma Supplies Luster Ribbon SsDeng FlynnNo ratings yet

- Manual de FPP TsDocument28 pagesManual de FPP TsAlexander CallaNo ratings yet

- English Theses PDFDocument630 pagesEnglish Theses PDFshakhy azadNo ratings yet

- VRmNet Eyesi Indirect BrochureDocument12 pagesVRmNet Eyesi Indirect BrochureHaag-Streit UK (HS-UK)No ratings yet

- AOS-CX Switch Simulator - NetEdit 2.1 Part 4 Lab GuideDocument7 pagesAOS-CX Switch Simulator - NetEdit 2.1 Part 4 Lab Guidetest testNo ratings yet

- 2 - LLMNRNBT-NS Poisoning With Out CredsDocument1 page2 - LLMNRNBT-NS Poisoning With Out CredsabdelrahemNo ratings yet

- Raychem DS Eu1422 E150 enDocument2 pagesRaychem DS Eu1422 E150 enTrung Trinh BaoNo ratings yet

- COMP1115 Week 11 Microsoft Access Relationships and Queries Part 1 W19Document21 pagesCOMP1115 Week 11 Microsoft Access Relationships and Queries Part 1 W19Raquel Stroher ManoNo ratings yet

- 05.2 Power SeriesDocument30 pages05.2 Power SeriesAli AbdullahNo ratings yet

- 1118mm - Thickness Calculator For MS or DI PipesDocument8 pages1118mm - Thickness Calculator For MS or DI Pipesanirbanpwd76No ratings yet

- NDC96 NDC 96 24-75VDC 1.9-6.0a Stepping Motor Drive Boxed Rta Pavia ManualDocument9 pagesNDC96 NDC 96 24-75VDC 1.9-6.0a Stepping Motor Drive Boxed Rta Pavia Manualrenato vitaliNo ratings yet

- Information ProcessingDocument10 pagesInformation ProcessingSusan BarriotNo ratings yet

- Requirement For T&C Purpose HPUniSZADocument1 pageRequirement For T&C Purpose HPUniSZAAwalJefriNo ratings yet

- 8.1-8.4 ISO 9001 Alex and TDocument6 pages8.1-8.4 ISO 9001 Alex and TKenate MergaNo ratings yet

- Effect of Area Ratio On Flow Separation in Annular Diffuser PDFDocument9 pagesEffect of Area Ratio On Flow Separation in Annular Diffuser PDFArun GuptaNo ratings yet