Professional Documents

Culture Documents

Adobe Scan 22 Apr 2023

Uploaded by

Sawani GoenkaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adobe Scan 22 Apr 2023

Uploaded by

Sawani GoenkaCopyright:

Available Formats

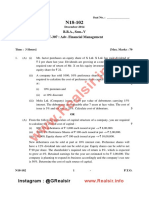

CAL

(3 Marks)

Q-5 (a)

Determine the cost of

value (MV) weights from the capital BestLuck Limited using the book value

of

following information: (BV) and market

Source of Capital

Book Value

Market Value

Equity Shares

1,20,00,000

Retained earnings 2,00,00,000

30,00,000

Preference shares 9,00,000

Debentures 10,40,000

36,00,000

33,75,000

Additional information:

1. Equity: Equity shares are

quoted at Rs.130 per share and new

share will be fully issue priced at Rs.125 per

subscribed; floatation costs will be Rs.5 per share

2. Dividend: During the

previous five years, dividends have steadily

Rs.14.19 per share. Dividend at the end of increased from Rs.10.60 to

the current year is

share expected to be Rs. 15 per

3. Preference shares: 15% preference shares with face value of Rs.100

per share would realize Rs.105

4. Debentures: The company proposes to issue

11-year 15% debentures but the yield on

similar maturity and risk class is 16%;

floatation cost is 2%

. Tax: Corporate tax rate is 35%.

gnore dividend tax

5 Marks)

b) The risk free rate of return is 8%. The

beta of X Limited is 1.4. The risk premium of the

market is 6%. Compute cost of equity using CAPM.

(2 Marks)

You might also like

- Financial Markets Case Study With AnswersDocument2 pagesFinancial Markets Case Study With AnswersShashi Kumar C G83% (12)

- CA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionDocument6 pagesCA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionTanmayNo ratings yet

- Global AssignmentDocument2 pagesGlobal AssignmentVinaySinghNo ratings yet

- Cost of CapitalDocument3 pagesCost of CapitalMr. Pravar Mathur Student, Jaipuria LucknowNo ratings yet

- WACC puOgaACHywDocument3 pagesWACC puOgaACHywAravNo ratings yet

- Cost of CapitalDocument3 pagesCost of CapitalkimjethaNo ratings yet

- Adhish Sir'S Classes 1: Chapter - Cost of CapitalDocument8 pagesAdhish Sir'S Classes 1: Chapter - Cost of CapitaladhishcaNo ratings yet

- Cost of CapitalDocument10 pagesCost of CapitalYasin Misvari T MNo ratings yet

- Cost of DebtDocument2 pagesCost of DebtAdib AkibNo ratings yet

- DEC 2016 AnswersDocument37 pagesDEC 2016 AnswersBKS SannyasiNo ratings yet

- Assignment 3 (Cost of Capital)Document2 pagesAssignment 3 (Cost of Capital)dangerous saifNo ratings yet

- Cost of Capital Nov 2023Document7 pagesCost of Capital Nov 2023tmpvd6gw8fNo ratings yet

- Nov 10Document7 pagesNov 10chandreshNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerDocument17 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerMajidNo ratings yet

- Module 5 - Cost of Capital - QuestionsDocument7 pagesModule 5 - Cost of Capital - QuestionsLAKSHYA AGARWALNo ratings yet

- Cost Ofcapital NumericalsDocument6 pagesCost Ofcapital NumericalsKunal GargNo ratings yet

- Assignment BCH 2023Document1 pageAssignment BCH 2023Archita MalikNo ratings yet

- Test Series: August, 2016 Mock Test Paper - 1 Final Course: Group - I Paper - 2: Strategic Financial ManagementDocument40 pagesTest Series: August, 2016 Mock Test Paper - 1 Final Course: Group - I Paper - 2: Strategic Financial ManagementMuhamed Muhsin PNo ratings yet

- Paper - 2: Strategic Financial Management Questions Risk Analysis in Capital BudgetingDocument25 pagesPaper - 2: Strategic Financial Management Questions Risk Analysis in Capital BudgetingJINENDRA JAINNo ratings yet

- Questions Baesd On WaccDocument1 pageQuestions Baesd On WaccRohit ShrivastavNo ratings yet

- Cost of Capital QuestionDocument9 pagesCost of Capital QuestionMahesh KalyankarNo ratings yet

- CRV - Valuation - ExerciseDocument15 pagesCRV - Valuation - ExerciseVrutika ShahNo ratings yet

- Dividend DecisionDocument6 pagesDividend DecisionYasin Misvari T MNo ratings yet

- Financial Decision MakingDocument4 pagesFinancial Decision MakingHarsh DedhiaNo ratings yet

- c7e8aIndividual+Assignment+1 4 FinalDocument5 pagesc7e8aIndividual+Assignment+1 4 FinalKARAMKJNo ratings yet

- RTP May2022 - Paper 8 FM EcoDocument30 pagesRTP May2022 - Paper 8 FM EcoYash YashwantNo ratings yet

- Equity Valuation QuestionsDocument9 pagesEquity Valuation Questionssairaj bhatkarNo ratings yet

- 7680 PEIIPaper 4 Financial Managementyearmay 2005 Section BDocument15 pages7680 PEIIPaper 4 Financial Managementyearmay 2005 Section BManish MishraNo ratings yet

- SFM Q MTP 1 Final May22Document5 pagesSFM Q MTP 1 Final May22Divya AggarwalNo ratings yet

- 73153bos58999 p8Document27 pages73153bos58999 p8Sagar GuptaNo ratings yet

- Cost of CapitalDocument15 pagesCost of CapitalVasu GuptaNo ratings yet

- SFM QuesDocument5 pagesSFM QuesAstha GoplaniNo ratings yet

- Mock Test Q2 PDFDocument5 pagesMock Test Q2 PDFManasa SureshNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answeradarsh agrawalNo ratings yet

- Chapter Wise Board Question Mutual Fund: Sapan ParikhDocument6 pagesChapter Wise Board Question Mutual Fund: Sapan ParikhAnkitNo ratings yet

- Sep23 Ques-1Document5 pagesSep23 Ques-1absankey770No ratings yet

- CA Intermediate - Financial Management: Swapnil Patni's ClassesDocument3 pagesCA Intermediate - Financial Management: Swapnil Patni's ClassesAniket PatelNo ratings yet

- DBE Sem-2 Question PapersDocument16 pagesDBE Sem-2 Question PapersTanmay AroraNo ratings yet

- 71888bos57845 Inter p8qDocument6 pages71888bos57845 Inter p8qMayank RajputNo ratings yet

- SFM New Sums AddedDocument78 pagesSFM New Sums AddedRohit KhatriNo ratings yet

- Cost of Capital Part 4 - WACCDocument22 pagesCost of Capital Part 4 - WACCGowthami 20 MBANo ratings yet

- FM & Eco Grand Test 1Document8 pagesFM & Eco Grand Test 1moniNo ratings yet

- FM & Eco Grand Test 2Document8 pagesFM & Eco Grand Test 2moniNo ratings yet

- Rajdhani College FM Assignment FinalDocument6 pagesRajdhani College FM Assignment Finalayushkorea52629No ratings yet

- InvestmentTheory&PracticeExamJune, 2022FDocument9 pagesInvestmentTheory&PracticeExamJune, 2022Fbabie naaNo ratings yet

- Cost of Capital QuestionsDocument18 pagesCost of Capital QuestionsRonmaty VixNo ratings yet

- Commando Test On FM (COC, CSP, DP) : Ranker's ClassesDocument3 pagesCommando Test On FM (COC, CSP, DP) : Ranker's ClassesmuskanNo ratings yet

- CC-307 Adv. Financial ManagementDocument8 pagesCC-307 Adv. Financial ManagementFGEFGNo ratings yet

- 7 Corporate Finance - Prof. Gagan SharmaDocument4 pages7 Corporate Finance - Prof. Gagan SharmaVampireNo ratings yet

- Cost of Capital-ProblemsDocument6 pagesCost of Capital-ProblemsUday GowdaNo ratings yet

- ACF NUMERICAL Module 1 29th FebDocument4 pagesACF NUMERICAL Module 1 29th FebRajesh KumarNo ratings yet

- Nov 2018 RTP PDFDocument21 pagesNov 2018 RTP PDFManasa SureshNo ratings yet

- Paper - 2: Strategic Financial Management Questions Merger and AcquisitionsDocument27 pagesPaper - 2: Strategic Financial Management Questions Merger and AcquisitionsObaid RehmanNo ratings yet

- 30779rtpfinalnov2013 2Document26 pages30779rtpfinalnov2013 2Waqar AmjadNo ratings yet

- Irs Kit Part e (Kit Capital Structure) PDFDocument5 pagesIrs Kit Part e (Kit Capital Structure) PDFAmir ArifNo ratings yet

- Test Paper: Chapter-1: Cost of CapitalDocument13 pagesTest Paper: Chapter-1: Cost of Capitalcofinab795No ratings yet

- 1 SFM - QuestionsDocument5 pages1 SFM - QuestionsTarun AbichandaniNo ratings yet

- Cost of CapitalDocument8 pagesCost of CapitalAreeb BaqaiNo ratings yet

- Cost of Capital - PracticalDocument9 pagesCost of Capital - PracticalKhushi RaniNo ratings yet

- Practice QuestionsDocument6 pagesPractice QuestionsMohit BelvanshiNo ratings yet

- Valuation ProblemsDocument5 pagesValuation ProblemsAparna KalaskarNo ratings yet

- Hybrid Securities: Structuring, Pricing and Risk AssessmentFrom EverandHybrid Securities: Structuring, Pricing and Risk AssessmentNo ratings yet

- Marks Obtained (In Omr) : 9Document1 pageMarks Obtained (In Omr) : 9Sawani GoenkaNo ratings yet

- Pivot Table WordDocument9 pagesPivot Table WordSawani GoenkaNo ratings yet

- E Newsletter WICASA March 18Document25 pagesE Newsletter WICASA March 18Sawani GoenkaNo ratings yet

- Pivot TableDocument10 pagesPivot TableSawani GoenkaNo ratings yet

- Data Entry & Operations ( (Pharmaceutical) Internship - Internship - CertificateDocument1 pageData Entry & Operations ( (Pharmaceutical) Internship - Internship - CertificateSawani GoenkaNo ratings yet

- CHP 1 SMDocument6 pagesCHP 1 SMSawani GoenkaNo ratings yet

- SRCRC - CasebookDocument149 pagesSRCRC - CasebookSawani GoenkaNo ratings yet

- CV - 2023 04 26 094804Document1 pageCV - 2023 04 26 094804Sawani GoenkaNo ratings yet

- CA Inter EIS Revision of FlowchartDocument112 pagesCA Inter EIS Revision of FlowchartSawani GoenkaNo ratings yet

- Exam Questions 2022-12-12 22 - 22 - 45Document2 pagesExam Questions 2022-12-12 22 - 22 - 45iujewNo ratings yet

- Valuation and Capital Budgeting For The Levered FirmDocument24 pagesValuation and Capital Budgeting For The Levered FirmBussines LearnNo ratings yet

- All The Kings HorsesDocument74 pagesAll The Kings Horsesastromagick100% (2)

- Bond Portfolio Management StrategiesDocument8 pagesBond Portfolio Management Strategiesmeeshell100% (1)

- Management of Financial Services:: Dodla Dairy Limited IpoDocument4 pagesManagement of Financial Services:: Dodla Dairy Limited IpoAakriti NegiNo ratings yet

- Portfolio RevisionDocument11 pagesPortfolio Revisionveggi expressNo ratings yet

- Pip (Lot) Cost Breakdown SheetDocument2 pagesPip (Lot) Cost Breakdown SheetHicham HasnaouiNo ratings yet

- How Kibor Works 1aDocument11 pagesHow Kibor Works 1asahmad29No ratings yet

- Annual Report and AccountsDocument244 pagesAnnual Report and Accountsantoniotohot100% (1)

- Acct Statement - XX5402 - 13082022Document22 pagesAcct Statement - XX5402 - 13082022Harsh KardamNo ratings yet

- Investment and Security Analysis by Charles P Jones 12th Ed Chapter 1 - Tabish Khan From KohatDocument25 pagesInvestment and Security Analysis by Charles P Jones 12th Ed Chapter 1 - Tabish Khan From KohatTabish KhanNo ratings yet

- CSR Negative Effect On Firm ValueDocument14 pagesCSR Negative Effect On Firm ValueLydia limNo ratings yet

- Summer Internship Report On NJ Flap MBA Finance StudentDocument98 pagesSummer Internship Report On NJ Flap MBA Finance StudentRiddhi TarsariyaNo ratings yet

- Master Mandate Letter - 31052022 - HSL DP-202208261715403588802Document4 pagesMaster Mandate Letter - 31052022 - HSL DP-202208261715403588802Kajal SampatNo ratings yet

- FRM Exam Part II Study PlanDocument7 pagesFRM Exam Part II Study PlanJohn SmithNo ratings yet

- Cost of CapitalDocument35 pagesCost of CapitalgagafikNo ratings yet

- Boom and Crash MethodDocument13 pagesBoom and Crash MethodMr.collageNo ratings yet

- MNJMN RetailDocument8 pagesMNJMN Retail067Rafli Faiz AqmalNo ratings yet

- Zoltan Pozsar - Global Money Notes #1-26 (2015-2019) - Excess Reserves - Federal Reserve PDFDocument521 pagesZoltan Pozsar - Global Money Notes #1-26 (2015-2019) - Excess Reserves - Federal Reserve PDFNameNo ratings yet

- Ch05 - Antitakeover MeasuresDocument57 pagesCh05 - Antitakeover MeasuresAnh Lý100% (1)

- ISSA Catalogue 2018 NewDocument4 pagesISSA Catalogue 2018 Newseamanship99No ratings yet

- CMF 101 - Basic Market Structure (BMS)Document20 pagesCMF 101 - Basic Market Structure (BMS)Sanchit ShresthaNo ratings yet

- Analysis of Mutual FundsDocument88 pagesAnalysis of Mutual FundsMano Bernard100% (2)

- LinkedIn Content Marketing Book FINAl 2.0Document223 pagesLinkedIn Content Marketing Book FINAl 2.0Divyendra KumarNo ratings yet

- LN04 Rejda99500X 12 Principles LN04Document40 pagesLN04 Rejda99500X 12 Principles LN04Wafaa NasserNo ratings yet

- The Power of Concentration: A Theoretical Appeal of Concentrated Portfolios - Subverting The "Law"Document6 pagesThe Power of Concentration: A Theoretical Appeal of Concentrated Portfolios - Subverting The "Law"solid9283No ratings yet

- Forex Dissertation TopicDocument4 pagesForex Dissertation TopicBuyCheapPaperOnlineSingapore100% (1)