Professional Documents

Culture Documents

Annexe 10 ToR Disposition Fund

Uploaded by

vaseenandanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annexe 10 ToR Disposition Fund

Uploaded by

vaseenandanCopyright:

Available Formats

ToR Annex 10

Terms of reference for the Implementation Consultant with regard to the

“Disposition Fund Procedure” of KfW

In the case of this project, the “Authorized party” of the disposition fund management is the

Paropkar Maternal and women’s hospital. The implementation consultant has an assisting

role.

If the Consultant is charged with assisting the Employer in the implementation of a Disposition

Fund in accordance with the Disposition Fund Procedure of KfW, he/she is responsible for the

quality assurance. In this role the Consultant shall assist the Employer in managing a

Disposition Fund including its (local) special account(s) and sub-account(s) according to the

Special Provisions and “General Terms for Disbursements under the Disposition Funds

Procedure” as stated in the Annex “Disbursement Procedure” to the Separate Agreement

between KfW and the Employer (the Separate Agreement).

For this purpose, the Consultant shall

▪ Verify that payments/bank transfers to special accounts, sub-accounts and contractors

are being effected according to supply and services contracts or other relevant contractual

agreements, that the value of such contracts does not exceed the amount specified in the

Special Provisions in the Annex “Disbursement Procedure” and supervise if payments to

local accounts are made based on a one-month forecast (if applicable).

▪ Assist the Employer in archiving or archive himself all documents concerning the special

account(s) and sub-accounts. These documents must be available anytime upon request

of KfW and of international auditors conducting an Assurance Engagement.

▪ Monitor expenditures and verify that expenditures are in line with a budget approved by

KfW. With regard to individual budget lines, deviations and/or changes must be approved

by the responsible project manager at KfW.

▪ Support the Employer in preparing disbursement requests and/or evidence on the use of

funds within the deadlines agreed upon with KfW based on the templates provided in the

Annex “Disbursement Procedures” and covering the respective accounting period

(usually four or six months) as stated in the Separate Agreement. This includes evidence

of use of funds in cases in which no replenishment of funds is requested. In particular, the

Consultant will verify the following documents which are to be submitted together with the

disbursement request:

- Statement of Expenditures (SoE) clearly presenting expenditures of the preceding

accounting period as well as planned expenditures for each budget line for the

following accounting period.

- Bank account statements for each special account and all sub-accounts (covering

the respective accounting period).

- Summary of bank account(s) (consistent to the accounting period as stated in the

SoE) for each special account and all sub-account(s) as well as an overall summary

of all funds still available in the accounts.

By counter-signing or electronically validating (via KfW E-Disbursement Platform if used) the

disbursement request the Consultant implicitly confirms that bank account statements of all

special accounts and sub-accounts have been checked against the amount of expenditures

presented in the SoE for the respective accounting period. The Consultant also confirms that

the information provided is correct and that relevant documents as evidence on expenditures

made via the special account(s) and sub-accounts have been provided by the Employer. In

particular, the Consultant will check and verify final balances of local accounts and petty cash.

ToR Annex 10

In case expenditures have been made in another currency than EUR, the Consultant shall

illustrate and confirm the exchange rate applied (for the respective accounting period) for the

calculation of expenditures as presented in the SoE and summary of bank account(s).

▪ Verify that the amounts listed in the SoE, the Summary of bank account(s), the bank

account statements, and the replenishment request are congruent or else, if there are

deviations, provide an explanation satisfactory to KfW.

▪ Proactively inform KfW in a timely manner about possible delays of evidence of use of

funds including reasons.

▪ Support processes related to annual audits of the disposition fund by an independent

auditor on the basis of Terms of Reference provided by KfW. This includes ensuring that

the audit report is issued within the deadlines stipulated in the General Terms and

proactively informing KfW in a timely manner (including reasons) if the audit report is

delayed.

▪ Inform the Employer and KfW immediately if any issues related to the management of the

disposition fund occur.

▪ Consult the Employer and KfW with regard to closing any of the special and local / sub-

account(s).

In the end the Consultant shall explicitly confirm when signing or electronically validating the

disbursement request that

- The payments from the Disposition Fund have been made based on eligible contracts and

the enclosed Summary of Accounts and Statement of Expenditures have been completed

accurately and that all figures indicated are true and correct.

- Any further information and – to his best knowledge - confirmations contained in the

disbursement request and any supporting documents thereto are true and correct.

You might also like

- Audit Manual 0Document458 pagesAudit Manual 0Faisal JahangirNo ratings yet

- Administration and Financial Management Manual1Document29 pagesAdministration and Financial Management Manual1Aleyn AtuhaireNo ratings yet

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Audit Manual CompleteDocument484 pagesAudit Manual CompleteHassan GullNo ratings yet

- Audit Manual 1Document274 pagesAudit Manual 1Humayoun Ahmad Farooqi100% (2)

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Vouching of Telephone ExpensesDocument11 pagesVouching of Telephone Expensesadeelfeb100% (1)

- COA Cir 94-013, 12-13-94Document4 pagesCOA Cir 94-013, 12-13-94Misc EllaneousNo ratings yet

- Chapter 20 - Answer PDFDocument10 pagesChapter 20 - Answer PDFjhienellNo ratings yet

- Auditing and Accounting Auditing Cash & Bank Balances: ObjectiveDocument3 pagesAuditing and Accounting Auditing Cash & Bank Balances: ObjectiveMohit SainiNo ratings yet

- Budgeting 2006Document50 pagesBudgeting 2006adventure Club ManiaaaNo ratings yet

- Required Docs For Complete Financial TransactionsDocument3 pagesRequired Docs For Complete Financial TransactionsDENNIS TURALBANo ratings yet

- Terms of Reference Audit of Project Financial Statements (Project Name) I. BackgroundDocument5 pagesTerms of Reference Audit of Project Financial Statements (Project Name) I. BackgroundAbdullahi YusufNo ratings yet

- Government AccountingDocument17 pagesGovernment AccountingJaniña Natividad100% (1)

- Audit Manual PakistanDocument460 pagesAudit Manual PakistanKamran Khan100% (9)

- Gov. Acc. Chapter 5Document38 pagesGov. Acc. Chapter 5Thea Marie GuiljonNo ratings yet

- 12.20.BP - Specialaccounts BankingDocument4 pages12.20.BP - Specialaccounts BankingTruth Press MediaNo ratings yet

- Hand Book - Internal AuditDocument37 pagesHand Book - Internal AuditawacskingNo ratings yet

- PaymentsDocument22 pagesPaymentsFifi AdiNo ratings yet

- Financial & Accounting Policies & ProceduresDocument34 pagesFinancial & Accounting Policies & ProceduresAnnabel Strange100% (5)

- Activities of Branches and Other Units of The BankDocument32 pagesActivities of Branches and Other Units of The BankMegbaru MisikirNo ratings yet

- C90 326Document7 pagesC90 326JOHAYNIENo ratings yet

- BADVAC3X MOD 5 Financial StatementsDocument9 pagesBADVAC3X MOD 5 Financial StatementsEouj Oliver DonatoNo ratings yet

- Institue For Global Health Subaward Invoice Guide - 31oct22Document14 pagesInstitue For Global Health Subaward Invoice Guide - 31oct22David McFarlandNo ratings yet

- Accounting For Disbursements and Related TransactionsDocument12 pagesAccounting For Disbursements and Related TransactionsJustine GuilingNo ratings yet

- Coa DBM Joint Circular No 1 S 2021Document11 pagesCoa DBM Joint Circular No 1 S 2021Jessilen Consorte Nidea DexisneNo ratings yet

- System of Financail Control & Budgeting 2006Document47 pagesSystem of Financail Control & Budgeting 2006jamilkiani70% (10)

- Auditing Standards and Practices Council: Philippine Auditing Practice Statement 1000 Inter-Bank Confirmation ProceduresDocument11 pagesAuditing Standards and Practices Council: Philippine Auditing Practice Statement 1000 Inter-Bank Confirmation ProceduresAbigael EsmenaNo ratings yet

- FAQs For ImplementationDocument19 pagesFAQs For ImplementationLasan NicoletaNo ratings yet

- AuditDocument22 pagesAuditYaregal YeshiwasNo ratings yet

- Coa C99-004Document14 pagesCoa C99-004bolNo ratings yet

- NGAS LectureDocument56 pagesNGAS LectureVenianNo ratings yet

- FM LaDocument115 pagesFM LaSamNo ratings yet

- Fund Acct CH 3.2Document60 pagesFund Acct CH 3.2Gabi MamushetNo ratings yet

- Certification On The Obligation RequestDocument4 pagesCertification On The Obligation Requestgnim1520100% (1)

- Basic Features of The New Government Accounting SystemDocument4 pagesBasic Features of The New Government Accounting SystemabbiecdefgNo ratings yet

- ACCO 30053 Auditing and Assurance Concepts and Applications 1 Module - AY2021Document76 pagesACCO 30053 Auditing and Assurance Concepts and Applications 1 Module - AY2021Christel Oruga100% (1)

- COMMISSION ON AUDIT CIRCULAR NO. 90-326 February 22, 1990 TODocument7 pagesCOMMISSION ON AUDIT CIRCULAR NO. 90-326 February 22, 1990 TObolNo ratings yet

- Audit Profit Loss AccountDocument9 pagesAudit Profit Loss Accountasgarali_maniarNo ratings yet

- Coa C97-001Document5 pagesCoa C97-001anon_640773580No ratings yet

- Internal Audit Checklist of Real EstateDocument41 pagesInternal Audit Checklist of Real Estatemaahi781% (43)

- Revolving Fund ProcedureDocument6 pagesRevolving Fund ProcedureJevie Claire GaleosNo ratings yet

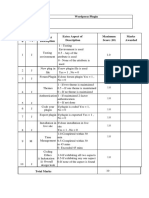

- Cash Advance For Petty Operating ExpensesDocument25 pagesCash Advance For Petty Operating ExpensesGuiller C. Magsumbol100% (2)

- Financial Controls Toolkit 2.0 April 2005 1 / 5 Company ConfidentialDocument5 pagesFinancial Controls Toolkit 2.0 April 2005 1 / 5 Company Confidentialnarasi64No ratings yet

- COA IssuanceDocument10 pagesCOA IssuanceJenny RabanalNo ratings yet

- FSCS08 Rev Sop On Check IssuranceDocument9 pagesFSCS08 Rev Sop On Check IssurancePauline Caceres AbayaNo ratings yet

- Disbursements MommyDocument61 pagesDisbursements MommyLyn CarlosNo ratings yet

- Financial Management Training For Implementing PartnersDocument28 pagesFinancial Management Training For Implementing PartnersBenjamin Kofi QuansahNo ratings yet

- ToR 177Document5 pagesToR 177teletalknasimNo ratings yet

- ACC 312 Semestral OutputDocument11 pagesACC 312 Semestral Outputgelyncastromero25No ratings yet

- Budget Execution, Monitoring and Reporting Sec. 1. Scope. This Chapter Prescribes The Guidelines in Monitoring, Accounting, and Reporting ofDocument4 pagesBudget Execution, Monitoring and Reporting Sec. 1. Scope. This Chapter Prescribes The Guidelines in Monitoring, Accounting, and Reporting ofimsana minatozakiNo ratings yet

- Accounting For Disbursements and Related TransactionsDocument12 pagesAccounting For Disbursements and Related TransactionsVenn Bacus Rabadon100% (9)

- CH 5 Accounting For Disbursements and Related TransactionsDocument3 pagesCH 5 Accounting For Disbursements and Related TransactionsGem Baguinon100% (1)

- Annex 6 201667120 Disbursement Procedure Simpl. ReimbursementDocument12 pagesAnnex 6 201667120 Disbursement Procedure Simpl. ReimbursementĐoàn TâmNo ratings yet

- Audit Manual For CoopsDocument35 pagesAudit Manual For CoopsowieNo ratings yet

- Philippine Auditing Practice Statement 1000 Inter-Bank Confirmation ProceduresDocument6 pagesPhilippine Auditing Practice Statement 1000 Inter-Bank Confirmation ProceduresVincent JohnNo ratings yet

- Accounting Standard 11Document10 pagesAccounting Standard 11api-3828505100% (1)

- Annex 6 Reporting RequirementsDocument23 pagesAnnex 6 Reporting RequirementsvaseenandanNo ratings yet

- Annex 1 Results MatrixDocument11 pagesAnnex 1 Results MatrixvaseenandanNo ratings yet

- Annex 5 Procurement PlanDocument2 pagesAnnex 5 Procurement PlanvaseenandanNo ratings yet

- Bachelor of Interior Design - Bachelor's in Interior Design - Faculty of Design - CEPT1Document1 pageBachelor of Interior Design - Bachelor's in Interior Design - Faculty of Design - CEPT1vaseenandanNo ratings yet

- Annexe 9 Gender Guideleine Health 2015 (German)Document23 pagesAnnexe 9 Gender Guideleine Health 2015 (German)vaseenandanNo ratings yet

- BID CEPT - Seats & EligibilityDocument2 pagesBID CEPT - Seats & EligibilityvaseenandanNo ratings yet

- ITSSB Handbook - Day 21 & Test ProjectDocument14 pagesITSSB Handbook - Day 21 & Test ProjectvaseenandanNo ratings yet

- Best Bachelor Degrees in Interior Design in Asia 2021 Page 1Document8 pagesBest Bachelor Degrees in Interior Design in Asia 2021 Page 1vaseenandanNo ratings yet

- 15 Interior Design Schools Worth Applying To - Architectural DigestDocument14 pages15 Interior Design Schools Worth Applying To - Architectural DigestvaseenandanNo ratings yet

- Top Interior Design Schools in The WorldDocument7 pagesTop Interior Design Schools in The WorldvaseenandanNo ratings yet

- Where To Study Design in SingaporeDocument2 pagesWhere To Study Design in SingaporevaseenandanNo ratings yet

- There Is A Disturbing Tendency of Courts Setting Aside Arbitral Awards ... - SC Upholds Arbitration Award of Rs 2728 Crore Plus Interest in Favour of Delhi Airport Metro Express (P) LTD - SCC BlogDocument5 pagesThere Is A Disturbing Tendency of Courts Setting Aside Arbitral Awards ... - SC Upholds Arbitration Award of Rs 2728 Crore Plus Interest in Favour of Delhi Airport Metro Express (P) LTD - SCC BlogvaseenandanNo ratings yet

- ET712078973IN SpeedPost Track ConsignmentDocument2 pagesET712078973IN SpeedPost Track ConsignmentvaseenandanNo ratings yet

- Web Tech Handbook-Day 21 & Test ProjectDocument8 pagesWeb Tech Handbook-Day 21 & Test ProjectvaseenandanNo ratings yet

- Parents Undertaking FormDocument1 pageParents Undertaking FormvaseenandanNo ratings yet

- ET712080243IN SpeedPost Track ConsignmentDocument2 pagesET712080243IN SpeedPost Track ConsignmentvaseenandanNo ratings yet

- Alankaram Tamil FontDocument1 pageAlankaram Tamil FontvaseenandanNo ratings yet

- Bamini Tamil FontDocument1 pageBamini Tamil FontvaseenandanNo ratings yet

- Icaa Advisory Pamphlet ICAA-AP-002: Subject: Quality System ProgrammeDocument21 pagesIcaa Advisory Pamphlet ICAA-AP-002: Subject: Quality System ProgrammeYousif Jamal MahboubaNo ratings yet

- Quality Assurance (A)Document2 pagesQuality Assurance (A)payal_mehra21No ratings yet

- Mleg-00-Aq-E-00oo84-0 - Electrical WorksDocument155 pagesMleg-00-Aq-E-00oo84-0 - Electrical WorksAimar SmartNo ratings yet

- RMU Technical SpecificationDocument15 pagesRMU Technical SpecificationGAGANNo ratings yet

- Quality Assessment - ManualDocument152 pagesQuality Assessment - ManualprinceejNo ratings yet

- Pharmaceutical Document Manager in NYC Philadelphia PA Resume Christopher ReillyDocument2 pagesPharmaceutical Document Manager in NYC Philadelphia PA Resume Christopher ReillyChristopherReillyNo ratings yet

- QAP1007ADocument4 pagesQAP1007AChristian JosephNo ratings yet

- Curriculum Vitae:: Akhil - Tripathi@yahoo - Co.in (M.) : 09891771791 9311142126Document3 pagesCurriculum Vitae:: Akhil - Tripathi@yahoo - Co.in (M.) : 09891771791 9311142126Anil SharmaNo ratings yet

- Safety Culture in HROsDocument86 pagesSafety Culture in HROsRavishankar1967No ratings yet

- M.E. (Full Time) Construction Engineering and Management: Anna University Chennai-25. Syllabus ForDocument40 pagesM.E. (Full Time) Construction Engineering and Management: Anna University Chennai-25. Syllabus ForSaravana ChandhranNo ratings yet

- 2021 AAQEP AccreditationDocument86 pages2021 AAQEP AccreditationCarlos Galarza - DGradoNo ratings yet

- G16S-0202-07 - Two Layer PaintingDocument7 pagesG16S-0202-07 - Two Layer Paintingpuwarin naja100% (1)

- DRAFT CIOB Code of Quality ManagementDocument98 pagesDRAFT CIOB Code of Quality ManagementKeith Cubero100% (1)

- TM 215461 SRTDocument3 pagesTM 215461 SRTömer cılızNo ratings yet

- Aman Knittings LTD 100% Export Oriented Sweater FactoryDocument7 pagesAman Knittings LTD 100% Export Oriented Sweater FactoryGarmentLearner100% (1)

- Student No. Fsfs 12481Document4 pagesStudent No. Fsfs 12481agentrinaNo ratings yet

- The Problems and Prospects of Science Laboratory Management in Training InstitutDocument8 pagesThe Problems and Prospects of Science Laboratory Management in Training InstitutOkorie SundayNo ratings yet

- UK NEQAS Haematology Participants' ManualDocument72 pagesUK NEQAS Haematology Participants' ManualKingsley AmamchukwuNo ratings yet

- Case Sudy On Quality Management System (Quality Assurance and Quality Control) in Construction Projects - ZipDocument56 pagesCase Sudy On Quality Management System (Quality Assurance and Quality Control) in Construction Projects - ZipArif Azizan100% (2)

- ALFA ENGINEERING ISOLATION JOINTS Brochure PDFDocument11 pagesALFA ENGINEERING ISOLATION JOINTS Brochure PDFSamrandNo ratings yet

- AComparative Studyof Different Software Testing TechniquesDocument9 pagesAComparative Studyof Different Software Testing TechniquesMustejab KhurshidNo ratings yet

- Qa 2 PDFDocument14 pagesQa 2 PDFexcel proNo ratings yet

- TQM PKI'ssDocument76 pagesTQM PKI'ssAbd Ellatif BdlhNo ratings yet

- Lesson 1Document16 pagesLesson 1Angela MagtibayNo ratings yet

- Testing and Quality Assurance 8Document3 pagesTesting and Quality Assurance 8Nivya babuNo ratings yet

- Instruction Manual Installation, Operation, Maintenance Screw Pump Series Type A (Bearings Arranged Externally)Document23 pagesInstruction Manual Installation, Operation, Maintenance Screw Pump Series Type A (Bearings Arranged Externally)Douglas DuarteNo ratings yet

- Quality Control in Poultry Feed Manufacturing: Dr. Mayur M. Vispute, Roll No: M-5631, Division of PSCDocument20 pagesQuality Control in Poultry Feed Manufacturing: Dr. Mayur M. Vispute, Roll No: M-5631, Division of PSCHussam Bany KhalafNo ratings yet

- Lyophilized BMRDocument23 pagesLyophilized BMRMohammed Zubair100% (1)

- 03 BMM Assessment Requirements v1.0Document14 pages03 BMM Assessment Requirements v1.0sary qasimNo ratings yet

- 10 - Quality ControlDocument28 pages10 - Quality ControlBashar BassamNo ratings yet

- Mastering Internal Audit Fundamentals A Step-by-Step ApproachFrom EverandMastering Internal Audit Fundamentals A Step-by-Step ApproachRating: 4 out of 5 stars4/5 (1)

- The Layman's Guide GDPR Compliance for Small Medium BusinessFrom EverandThe Layman's Guide GDPR Compliance for Small Medium BusinessRating: 5 out of 5 stars5/5 (1)

- A Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersFrom EverandA Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersRating: 4.5 out of 5 stars4.5/5 (11)

- Internal Audit Quality: Developing a Quality Assurance and Improvement ProgramFrom EverandInternal Audit Quality: Developing a Quality Assurance and Improvement ProgramNo ratings yet

- Amazon Interview Secrets: A Complete Guide to Help You to Learn the Secrets to Ace the Amazon Interview Questions and Land Your Dream JobFrom EverandAmazon Interview Secrets: A Complete Guide to Help You to Learn the Secrets to Ace the Amazon Interview Questions and Land Your Dream JobRating: 4.5 out of 5 stars4.5/5 (3)

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideFrom Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideRating: 2.5 out of 5 stars2.5/5 (2)

- Business Process Mapping: Improving Customer SatisfactionFrom EverandBusiness Process Mapping: Improving Customer SatisfactionRating: 5 out of 5 stars5/5 (1)

- Financial Shenanigans, Fourth Edition: How to Detect Accounting Gimmicks & Fraud in Financial ReportsFrom EverandFinancial Shenanigans, Fourth Edition: How to Detect Accounting Gimmicks & Fraud in Financial ReportsRating: 4 out of 5 stars4/5 (26)

- Executive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceFrom EverandExecutive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceRating: 4 out of 5 stars4/5 (1)

- Money Laundering Prevention: Deterring, Detecting, and Resolving Financial FraudFrom EverandMoney Laundering Prevention: Deterring, Detecting, and Resolving Financial FraudNo ratings yet

- Building a World-Class Compliance Program: Best Practices and Strategies for SuccessFrom EverandBuilding a World-Class Compliance Program: Best Practices and Strategies for SuccessNo ratings yet

- Electronic Health Records: An Audit and Internal Control GuideFrom EverandElectronic Health Records: An Audit and Internal Control GuideNo ratings yet

- Financial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksFrom EverandFinancial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksRating: 4 out of 5 stars4/5 (1)

- Audit. Review. Compilation. What's the Difference?From EverandAudit. Review. Compilation. What's the Difference?Rating: 5 out of 5 stars5/5 (1)