Professional Documents

Culture Documents

Form12bb 8757720

Uploaded by

gajender raoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form12bb 8757720

Uploaded by

gajender raoCopyright:

Available Formats

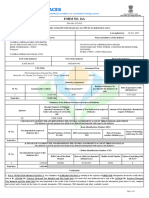

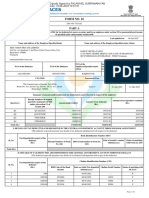

00875772/ADOPK8357P

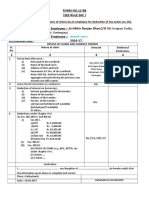

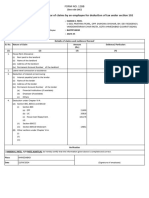

INCOME-TAX RULES, 1962

FORM NO.12BB

(See rule 26C)

Statement showing particulars of claims by an employee for deduction of tax under section

192

1. Name and address of the employee: KUPPA GAJENDER RAO .

C/o 45-224/1,RD.NO.2,NMDC COLONY, EAST ANAND BAGH,MALKAJGIRI,

HYDERABAD, Telangana-500047

2. PAN of the employee : ADOPK8357P

3. Financial year : 2023-2024

Details of claims and evidence thereof

Sl. Amount Evidence /

Nature of Claim

No. (INR) particulars

(1) (2) (3) (4)

1. House Rent Allowance:

2. Leave travel concessions or assistance

3. Deduction of interest on borrowing:

4. Deduction under Chapter VI-A

(A) Section 80C,80CCC and 80CCD

(i) Section 80C

(ii) Section 80CCC

(iii) Section 80CCD

(B) Other sections (e.g. 80E, 80G, 80TTA, etc.) under Chapter

VI-A.

Verification

I, KUPPA GAJENDER RAO ., son/ daughter of ________________________________________ do hereby certify that the information given above

is complete and correct.

Place:

Date: (Signature of the employee)

Designation: Full Name: KUPPA GAJENDER RAO .

You might also like

- Form 12BDocument2 pagesForm 12BNageswar MakalaNo ratings yet

- FormDocument2 pagesFormdileepNo ratings yet

- IT DeclarationDocument1 pageIT DeclarationKranthi kakumanuNo ratings yet

- HDFC Ltd.Document3 pagesHDFC Ltd.Parag KusalkarNo ratings yet

- 2022 2023 Form12bbDocument1 page2022 2023 Form12bbsriramdutta9No ratings yet

- Address: of The of The Employee 2021-2022Document3 pagesAddress: of The of The Employee 2021-2022Dipak PArmarNo ratings yet

- IT Declaration-1555459035665Document1 pageIT Declaration-1555459035665Pooja ParabNo ratings yet

- IT DeclarationDocument1 pageIT Declarationsiva kumaarNo ratings yet

- Mercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageMercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Shubham ShrivastavaNo ratings yet

- ReportPrintDlg PageDocument2 pagesReportPrintDlg Pagealok yadavNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192basha rasulNo ratings yet

- Form12bb 5663202Document2 pagesForm12bb 5663202uttamraochopade52No ratings yet

- HH 1Document1 pageHH 1theartcave03No ratings yet

- Img 0006Document3 pagesImg 0006Puneet GuptaNo ratings yet

- 12bb NR Baria 00402749 2122Document3 pages12bb NR Baria 00402749 2122Dipak PArmarNo ratings yet

- SR Notice ZD080222011894L 20220221045144Document2 pagesSR Notice ZD080222011894L 20220221045144Sonu JainNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportAnkit RajNo ratings yet

- Form 12BB-2021-22 (Final)Document1 pageForm 12BB-2021-22 (Final)Rohan BharadwajNo ratings yet

- Form 12BBDocument1 pageForm 12BBGopala KrishnanNo ratings yet

- New Form 12BBDocument2 pagesNew Form 12BBramanNo ratings yet

- ONGC Road, Patharkandi. Dist. Karimganj.: Form No.12 BB (See Rule 26C)Document1 pageONGC Road, Patharkandi. Dist. Karimganj.: Form No.12 BB (See Rule 26C)Mriganko DharNo ratings yet

- Form-12BB 2019-20Document1 pageForm-12BB 2019-20sabir aliNo ratings yet

- Epsf Form12bb 93445Document1 pageEpsf Form12bb 93445dasari.samratNo ratings yet

- VBRViewer PDFDocument1 pageVBRViewer PDFAshokdheena 619No ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportKabir's World dinoloverNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Guru RajNo ratings yet

- Form 12BBDocument2 pagesForm 12BBsumitgp87No ratings yet

- BP040 Current Process ModelDocument1 pageBP040 Current Process Modelsastrylanka1980No ratings yet

- 12BBDocument3 pages12BBcont2chanduNo ratings yet

- Form16 122726 DBKPS7123E AY-2022-23Document9 pagesForm16 122726 DBKPS7123E AY-2022-23Damodar SurisettyNo ratings yet

- Form 12BBDocument3 pagesForm 12BBAndroid TricksNo ratings yet

- Form12BB-258 (HARDIK K - PATEL)Document1 pageForm12BB-258 (HARDIK K - PATEL)Automobile EngineeringNo ratings yet

- FORM16Document10 pagesFORM16Siva Ramakrishna100% (1)

- FIN AL: Form Gstr-1 (See Rule 59 (1) ) Details of Outward Supplies of Goods or ServicesDocument1 pageFIN AL: Form Gstr-1 (See Rule 59 (1) ) Details of Outward Supplies of Goods or ServicesAtul VermaNo ratings yet

- Section 12BBDocument2 pagesSection 12BBbhaskar ghoshNo ratings yet

- Section 12BB IT ExampleDocument2 pagesSection 12BB IT Examplebhaskar ghoshNo ratings yet

- Dot Notice ZD090622048280J 20220616023346Document5 pagesDot Notice ZD090622048280J 20220616023346suyash pathakNo ratings yet

- Aaacl4159l Q2 2024-25Document3 pagesAaacl4159l Q2 2024-25vbgrandvizagNo ratings yet

- Form12BB FY2122Document3 pagesForm12BB FY2122Anurag pradhanNo ratings yet

- Form12bb 246 (Yagnesh V Anavadiya)Document1 pageForm12bb 246 (Yagnesh V Anavadiya)chanduNo ratings yet

- DRC 03Document2 pagesDRC 03MANISHA SINGHNo ratings yet

- 27a BLRK00717D 26Q Q2 201819Document1 page27a BLRK00717D 26Q Q2 201819GOUTHAM HEGDENo ratings yet

- IT DeclarationDocument1 pageIT Declarationswapna vijayNo ratings yet

- Form 12 BB MsirDocument1 pageForm 12 BB MsirrajeshNo ratings yet

- FORM12BBDocument1 pageFORM12BBBotla RajaNo ratings yet

- Dot Notice ZD070923053452D 20230926013050Document2 pagesDot Notice ZD070923053452D 20230926013050Himanshu GugnaniNo ratings yet

- Form16 GeethapandyK MKS00006 60009369290 600117359 230726 140121Document6 pagesForm16 GeethapandyK MKS00006 60009369290 600117359 230726 140121Mankamuthaka VemaratananaNo ratings yet

- Form No. 16: Part ADocument7 pagesForm No. 16: Part Ahelpdesk svscenterNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- Form 16: TLG India Private LimitedDocument9 pagesForm 16: TLG India Private LimitedcagopalofficebackupNo ratings yet

- 2023-2024 FormNo12BBDocument1 page2023-2024 FormNo12BBvivek070176No ratings yet

- Aaacl4159l Q3 2024-25Document3 pagesAaacl4159l Q3 2024-25vbgrandvizagNo ratings yet

- (See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbDocument1 page(See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbSaad YusufNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportMulpuri Vijaya KumarNo ratings yet

- IT DeclarationDocument1 pageIT DeclarationprasathNo ratings yet

- Neha Enterprise DRC-03 Dated 03-04-2023 (131000)Document2 pagesNeha Enterprise DRC-03 Dated 03-04-2023 (131000)vikenveerNo ratings yet

- Form16-2021-2022 Part ADocument2 pagesForm16-2021-2022 Part Athaarini doraiswamiNo ratings yet

- Form 12BBDocument1 pageForm 12BBdeepak.payalNo ratings yet