Professional Documents

Culture Documents

2022 Property Tax Statement for Kenneth J Schackai

Uploaded by

Rhoda TylerOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2022 Property Tax Statement for Kenneth J Schackai

Uploaded by

Rhoda TylerCopyright:

Available Formats

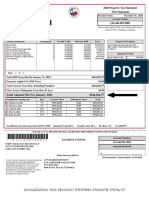

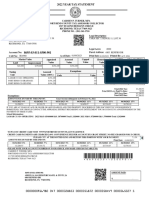

ANN HARRIS BENNETT 2022 Property Tax Statement

TAX ASSESSOR-COLLECTOR

P.O. BOX 3547 Web Statement

HOUSTON, TEXAS 77253-3547

TEL: 713-274-8000 Statement Date: December 12, 2022

Account Number

*0805050000004* 080-505-000-0004

KENNETH J SCHACKAI

21002 STURDIVAN ST,

MEADOWS PLACE,

TEXAS 77477-0000

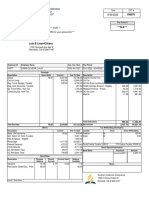

Taxing Jurisdiction Exemptions Taxable Value Rate per $100 Taxes Property Description

Harris County 0 96,105 0.343730 $330.34 2605 WINDSOR LN 77506

Harris County Flood Control Dist 0 96,105 0.030550 $29.36 LT 4 BLK 26 RED BLUFF TERRACE SEC 4

Port of Houston Authority 0 96,105 0.007990 $7.68 .1695 AC

Harris County Hospital District 0 96,105 0.148310 $142.53

Harris County Dept. of Education 0 96,105 0.004900 $4.71

San Jacinto College District 0 96,105 0.155605 $149.54 Appraised Values

City of Pasadena 0 96,105 0.497583 $478.20 Land - Market Value 49,107

Impr - Market Value 46,998

Total Market Value 96,105

Less Capped Mkt Value 0

Appraised Value 96,105

Page: 1 of 1 Exemptions/Deferrals

Total 2022 Taxes Due By January 31, 2023: $1,142.36

Payments Applied To 2022 Taxes $0.00

Total Current Taxes Due (Including Penalties) $1,142.36

Prior Year(s) Delinquent Taxes Due (If Any) $0.00

Total Amount Due For January 2023 $1,142.36

Penalties for Paying Late Rate Current Taxes Delinquent Taxes Total

By Febuary 28, 2023 7% $1,222.33 $0.00 $1,222.33

By March 31, 2023 9% $1,245.17 $0.00 $1,245.17

By April 30, 2023 11% $1,268.02 $0.00 $1,268.02

By May 31, 2023 13% $1,290.87 $0.00 $1,290.87

By June 30, 2023 15% $1,313.71 $0.00 $1,313.71

Tax Bill Increase (Decrease) from 2017 to 2022: Appraised Value 40%, Taxable Value 40%, Tax Rate -15%, Tax Bill 19%.

PLEASE CUT AT THE DOTTED LINE AND RETURN THIS PORTION WITH YOUR PAYMENT.

*0805050000004* PAYMENT COUPON

Account Number

080-505-000-0004

KENNETH J SCHACKAI

21002 STURDIVAN ST, Amount Enclosed

MEADOWS PLACE,

TEXAS 77477-0000

$ .

Make check payable to:

Web Statement - Date Printed: 12-12-2022

IF YOU ARE 65 YEARS OF AGE OR OLDER OR ANN HARRIS BENNETT

ARE DISABLED AND THE PROPERTY TAX ASSESSOR-COLLECTOR

DESCRIBED IN THIS DOCUMENT IS YOUR

RESIDENCE HOMESTEAD, YOU SHOULD

P.O. BOX 4622

CONTACT THE APPRAISAL DISTRICT HOUSTON, TEXAS 77210-4622

REGARDING ANY ENTITLEMENT YOU MAY

HAVE TO A POSTPONEMENT IN THE

PAYMENT OF THESE TAXES.

08050500000044 2022 000114236 000122233 000124517 000126802

You might also like

- Staffmark Paystub Details for Shontera BeamonDocument1 pageStaffmark Paystub Details for Shontera BeamonTera's TarotNo ratings yet

- View paystub details like earnings, taxes, deductionsDocument1 pageView paystub details like earnings, taxes, deductionsjohnathan greyNo ratings yet

- Tax BillDocument1 pageTax BillBrenda SorensonNo ratings yet

- Everett 1Document2 pagesEverett 1João Vitor SouzaNo ratings yet

- 9:30:22Document1 page9:30:22Rosa Medina AlbarránNo ratings yet

- Boa StatementDocument3 pagesBoa Statementmrs merle westonNo ratings yet

- Camille DavidsonDocument2 pagesCamille DavidsonMark WilliamsNo ratings yet

- Tax Bill 2022Document1 pageTax Bill 2022LOUNGE HOMENo ratings yet

- Billing Detail: Late PaymentDocument1 pageBilling Detail: Late Paymenttheodore moses antoine beyNo ratings yet

- Here's Your December 2020 Bank Statement.: Henok Mulat 4051 39th ST 434 San Diego Ca 92105Document3 pagesHere's Your December 2020 Bank Statement.: Henok Mulat 4051 39th ST 434 San Diego Ca 92105Yayehyrad BerhanuNo ratings yet

- 1ROF07100.024 INV-2611994RevDocument1 page1ROF07100.024 INV-2611994RevSiddiq Khan100% (1)

- Xfinity Bill Summary for Dec 2022 Services and Upcoming Price ChangesDocument8 pagesXfinity Bill Summary for Dec 2022 Services and Upcoming Price ChangesMary WinsutNo ratings yet

- Mail Payments To: PO Box 580340 Charlotte, NC 28258-0340 Tel: 800-476-4228Document3 pagesMail Payments To: PO Box 580340 Charlotte, NC 28258-0340 Tel: 800-476-4228Mark WilliamsNo ratings yet

- Lili Account Bank StatementDocument2 pagesLili Account Bank StatementAlex NeziNo ratings yet

- Guide To Low Voltage Busbar Trunking Systems-BeamaDocument20 pagesGuide To Low Voltage Busbar Trunking Systems-BeamaGhayath Omer100% (1)

- PDFDocument2 pagesPDFlita marteNo ratings yet

- Paycheckstub AllDocument3 pagesPaycheckstub AllMyt WovenNo ratings yet

- 4649950001259667ACWAKED : Credit Cards Statement of AccountDocument2 pages4649950001259667ACWAKED : Credit Cards Statement of AccountcaileezNo ratings yet

- Sample SHARKS Worksheet PDFDocument10 pagesSample SHARKS Worksheet PDFAmruta Chhajed100% (2)

- Statement Date:: 4520 71XX XXXX 5156Document3 pagesStatement Date:: 4520 71XX XXXX 5156Dem ThomasNo ratings yet

- Axis Bank LTD Payslip For The Month of April - 2021: Leave DetailsDocument2 pagesAxis Bank LTD Payslip For The Month of April - 2021: Leave Detailssalma saifiNo ratings yet

- "Disaster Readiness and Risk Reduction": Test 2 True or FalseDocument2 pages"Disaster Readiness and Risk Reduction": Test 2 True or FalseMiki AntonNo ratings yet

- Salma Saifi May SlipDocument2 pagesSalma Saifi May Slipsalma saifiNo ratings yet

- Bidder Invoice 1098458 01-06-2023 04-03-05Document2 pagesBidder Invoice 1098458 01-06-2023 04-03-05appp2711No ratings yet

- Safety Budget PlannerDocument12 pagesSafety Budget Plannersidhant nayakNo ratings yet

- Web Payslip 266675 202304Document2 pagesWeb Payslip 266675 202304prabhat.finnproNo ratings yet

- Salary SlipDocument2 pagesSalary Slipprnali.vflNo ratings yet

- 2020 Property Tax Statement for Houston High-RiseDocument1 page2020 Property Tax Statement for Houston High-RiseAisar UddinNo ratings yet

- Aprilrosedavidnarciso : Hseofdavidinvestment&Mgmt Hdgbldgdolorescsf 2000pampangaDocument6 pagesAprilrosedavidnarciso : Hseofdavidinvestment&Mgmt Hdgbldgdolorescsf 2000pampangaApril NNo ratings yet

- Harrison 3Document1 pageHarrison 3derrickwesley912No ratings yet

- Harrison 3Document1 pageHarrison 3derrickwesley912No ratings yet

- Service Invoice: Boyce Excavating, Co. IncDocument1 pageService Invoice: Boyce Excavating, Co. IncjulescjmNo ratings yet

- 20221201-Bank Statement Capital One-2-2Document3 pages20221201-Bank Statement Capital One-2-2EDWARD MCMILLIANNo ratings yet

- Harrison 2Document1 pageHarrison 2derrickwesley912No ratings yet

- Harrison 2Document1 pageHarrison 2derrickwesley912No ratings yet

- Web Payslip 266675 202305Document2 pagesWeb Payslip 266675 202305prabhat.finnproNo ratings yet

- Salary SlipDocument2 pagesSalary Slipprnali.vflNo ratings yet

- Fetch Statementand NoticesDocument3 pagesFetch Statementand NoticessweigartmarianNo ratings yet

- Web Payslip 266675 202306Document2 pagesWeb Payslip 266675 202306prabhat.finnproNo ratings yet

- Income Tax - Computation - 2021Document26 pagesIncome Tax - Computation - 2021umasankarNo ratings yet

- Kathleenannmbalucas : B90L7Adiazst Katarunganvillpoblacion 1776muntinlupacityDocument8 pagesKathleenannmbalucas : B90L7Adiazst Katarunganvillpoblacion 1776muntinlupacityAnjo BalucasNo ratings yet

- Addriena Overstreet Bi-Weekly PaystubDocument1 pageAddriena Overstreet Bi-Weekly PaystubLillian AwtNo ratings yet

- BillSummary - 2021 10 22Document43 pagesBillSummary - 2021 10 22iyas14No ratings yet

- Horace Property Property Tax StatementDocument2 pagesHorace Property Property Tax StatementRob PortNo ratings yet

- Abigailnegradas : 0184purok2 Brgysanisidrosanpablocity 4000lagunaDocument4 pagesAbigailnegradas : 0184purok2 Brgysanisidrosanpablocity 4000lagunaAbby NegradasNo ratings yet

- 1st CheckDocument1 page1st CheckMoeez MaalikNo ratings yet

- Billing StatementDocument1 pageBilling StatementFrengieBotoyNo ratings yet

- Abigailnegradas : 0184purok2 Brgysanisidrosanpablocity 4000lagunaDocument4 pagesAbigailnegradas : 0184purok2 Brgysanisidrosanpablocity 4000lagunaAbby NegradasNo ratings yet

- HolaDocument4 pagesHolakoliveiraNo ratings yet

- Amount Due $8,168.44Document3 pagesAmount Due $8,168.44roblondon77No ratings yet

- Paystub 2Document1 pagePaystub 2Prosper DivignInLifeNo ratings yet

- FB County Tax Statement-2022Document1 pageFB County Tax Statement-2022Sageer AbdullaNo ratings yet

- Fetch Statementand NoticesDocument3 pagesFetch Statementand NoticessweigartmarianNo ratings yet

- Web Payslip 266675 202308Document2 pagesWeb Payslip 266675 202308prabhat.finnproNo ratings yet

- August 2022 Payslip for Sean Derrick BlancoDocument1 pageAugust 2022 Payslip for Sean Derrick BlancoSean Derrick BlancoNo ratings yet

- ParcelReport 070931104172Document1 pageParcelReport 070931104172Ana Gemma Arcival BacarisasNo ratings yet

- PaystubbtittanyDocument1 pagePaystubbtittanyesteysi775No ratings yet

- ZCP4 QS130Document1 pageZCP4 QS130François JonvauxNo ratings yet

- Statement of Account: K-1St Street 131-A Kamuning Quezon City Metro ManilaDocument1 pageStatement of Account: K-1St Street 131-A Kamuning Quezon City Metro ManilaKhristin AllisonNo ratings yet

- Melsergobligacion : 7jupiterstfuentebellasubd Brgytaculing 6100bacolodcityDocument6 pagesMelsergobligacion : 7jupiterstfuentebellasubd Brgytaculing 6100bacolodcityMelser ObligacionNo ratings yet

- ATTBill_4487_Sep2022Document6 pagesATTBill_4487_Sep2022Вероніка АнійчинNo ratings yet

- Miami Dade County Real Estate 30 3128 014 2560 2020 Annual BillDocument1 pageMiami Dade County Real Estate 30 3128 014 2560 2020 Annual BillGeorge GutierrezNo ratings yet

- Jayvion Stub 2Document1 pageJayvion Stub 2raheemtimo1No ratings yet

- Tijani Ademola Usman: Customer StatementDocument71 pagesTijani Ademola Usman: Customer StatementRhoda TylerNo ratings yet

- Rental Application FormDocument2 pagesRental Application FormRhoda TylerNo ratings yet

- McLennan CAD Property Search ResultsDocument2 pagesMcLennan CAD Property Search ResultsRhoda TylerNo ratings yet

- Sarah Sumpter & Troy Kelly Lease AgreementDocument2 pagesSarah Sumpter & Troy Kelly Lease AgreementRhoda TylerNo ratings yet

- Lesson 2.1Document16 pagesLesson 2.1Jeremie Manimbao OrdinarioNo ratings yet

- RNYM02-1120A-12Document2 pagesRNYM02-1120A-12bastian silvaNo ratings yet

- 0809 KarlsenDocument5 pages0809 KarlsenprateekbaldwaNo ratings yet

- Physical Education 8 Quarter 2 - Module 1: Physical Activities Related To Team SportsDocument49 pagesPhysical Education 8 Quarter 2 - Module 1: Physical Activities Related To Team SportsHannah Katreena Joyce JuezanNo ratings yet

- Investigating and EvaluatingDocument12 pagesInvestigating and EvaluatingMuhammad AsifNo ratings yet

- Code: Final Exam in English: Grade 8Document7 pagesCode: Final Exam in English: Grade 8Luka EradzeNo ratings yet

- STDM Course OutlineDocument11 pagesSTDM Course OutlineTp RayNo ratings yet

- 9A01709 Advanced Structural Analysis PDFDocument8 pages9A01709 Advanced Structural Analysis PDFReddy Kiran KDNo ratings yet

- Statistical Theory and Analysis in Bioassay OverviewDocument11 pagesStatistical Theory and Analysis in Bioassay OverviewEgbuna ChukwuebukaNo ratings yet

- Electronic Skin PPT 2Document12 pagesElectronic Skin PPT 2Sunitha AteliNo ratings yet

- IMSP 21 Operational Control EMSDocument3 pagesIMSP 21 Operational Control EMSEvonne LeeNo ratings yet

- Induction Motor StarterDocument5 pagesInduction Motor StarterAnikendu MaitraNo ratings yet

- Question and AnsDocument33 pagesQuestion and AnsHawa MudalaNo ratings yet

- Teltonika Networks CatalogueDocument40 pagesTeltonika Networks CatalogueazizNo ratings yet

- Evaluating Usability of Superstore Self-Checkout KioskDocument48 pagesEvaluating Usability of Superstore Self-Checkout Kioskcipiripi14No ratings yet

- Módulo Dcp-Frcma-I (Frcme-M+sci)Document2 pagesMódulo Dcp-Frcma-I (Frcme-M+sci)alexropaNo ratings yet

- Economic and Eco-Friendly Analysis of Solar Power Refrigeration SystemDocument5 pagesEconomic and Eco-Friendly Analysis of Solar Power Refrigeration SystemSiddh BhattNo ratings yet

- Balco. Vicky. Project Optimation of Product MixDocument67 pagesBalco. Vicky. Project Optimation of Product Mixvicky_rock00007No ratings yet

- Sonic sdw45Document2 pagesSonic sdw45Alonso InostrozaNo ratings yet

- How Computer Viruses Work and How to Prevent InfectionDocument4 pagesHow Computer Viruses Work and How to Prevent InfectionVishal guptaNo ratings yet

- About InvestopediaDocument10 pagesAbout InvestopediaMuhammad SalmanNo ratings yet

- 5 - BOSCH I - O ModuleDocument21 pages5 - BOSCH I - O ModuleFELIPE ANGELES CRUZ ROMONo ratings yet

- SATR-W-2007 Rev 7Document4 pagesSATR-W-2007 Rev 7QA QCNo ratings yet

- LPG Cylinder Market Player - Overview (Bangladesh)Document5 pagesLPG Cylinder Market Player - Overview (Bangladesh)ABID REZA KhanNo ratings yet

- Expert Coaching CatalogDocument37 pagesExpert Coaching CatalogJosh WhiteNo ratings yet

- Antioxidant Activity by DPPH Radical Scavenging Method of Ageratum Conyzoides Linn. LeavesDocument7 pagesAntioxidant Activity by DPPH Radical Scavenging Method of Ageratum Conyzoides Linn. Leavespasid harlisaNo ratings yet