Professional Documents

Culture Documents

Bir Gain Tax

Uploaded by

Wella Lafuente Cabanada0 ratings0% found this document useful (0 votes)

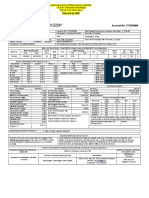

25 views1 page1) This document is an ONETT computation sheet from the Bureau of Internal Revenue calculating capital gains tax and documentary stamp tax owed on the sale of a property from the HRS of Daniel Aguirre Sr. to Daniel Aguirre and Jay Michael Aguirre.

2) The computation determines a tax base of PHP 400,000 for the property based on its zoning and area. This results in PHP 24,000 in capital gains tax owed, plus surcharges and interest over several years totaling PHP 83,456.

3) For documentary stamp tax, PHP 6,000 is owed on the PHP 400,000 tax base, with surcharges and interest over several years totaling PHP 122,

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) This document is an ONETT computation sheet from the Bureau of Internal Revenue calculating capital gains tax and documentary stamp tax owed on the sale of a property from the HRS of Daniel Aguirre Sr. to Daniel Aguirre and Jay Michael Aguirre.

2) The computation determines a tax base of PHP 400,000 for the property based on its zoning and area. This results in PHP 24,000 in capital gains tax owed, plus surcharges and interest over several years totaling PHP 83,456.

3) For documentary stamp tax, PHP 6,000 is owed on the PHP 400,000 tax base, with surcharges and interest over several years totaling PHP 122,

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views1 pageBir Gain Tax

Uploaded by

Wella Lafuente Cabanada1) This document is an ONETT computation sheet from the Bureau of Internal Revenue calculating capital gains tax and documentary stamp tax owed on the sale of a property from the HRS of Daniel Aguirre Sr. to Daniel Aguirre and Jay Michael Aguirre.

2) The computation determines a tax base of PHP 400,000 for the property based on its zoning and area. This results in PHP 24,000 in capital gains tax owed, plus surcharges and interest over several years totaling PHP 83,456.

3) For documentary stamp tax, PHP 6,000 is owed on the PHP 400,000 tax base, with surcharges and interest over several years totaling PHP 122,

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

ONETT COMPUTATION SHEET

CAPITAL GAINS TAX (CGT) and DOCUMENTARY STAMP TAX (DST)

For Onerous Transfer of Real Property Classified as CAPITAL ASSET

Revenue Region No.16 Revenue District Office No. 100, Ozamis City

Sellers(s) Name: HRS. OF DANIEL AGUIRRE SR. rep by NATIVIDAD R. AGUIRRE Adrs: Calamba, Misamis Occidental TIN: 622-649-989

Buyer(s) Name: DANIEL AGUIRRE & JAY MICHAEL AGUIRRE Adrs: Cagayan de Oro City TIN: 934-939-674

Transaction Date: 6-Nov-11 Due Date (CGT): 16-Dec-11 Due Date (DST): 5-Dec-11

OCT/TCT/ Tax Declaration Fair Market Value Selling Tax Base (Higher of

CCT NO. No. (TD)

Location Class Area (m²) ZV/sqm. Zonal Value (ZV) (FMV) per TD ZV/FMV/SP)

Price (SP)

TCT NO. A 36,610 6 400,000 151,390 50,000.00 400,000

P-1208 04-0005-00012 DAPACAN BAJO, CALAMBALAMBA

MISAMIS OCCIDNTAL

New Zonal Value Reflected

TOTAL 400,000 151,390 50,000.00 400,000

COMPUTATION DETAILS Per Audit Per Review

1,) CAPITAL GAINS TAX (CGT)- BIR Form 1706

TAX DUE Tax Base Rate Exempt?

Legal basis: Sec.24(D)(1), 25(A)(3) & 27 (D)(5) 400,000.00 6%

LESS: Tax paid per return, if return was filed

CGT STILL DUE/ (OVERPAYMENT) 24,000

Add: 25% Surcharge 6,000.00

12% Interest per annum

December 17,2011 December 31,2017 2206 31,862.00

Compromise penalty March 31,2023

1-Jan-18 1915 16,594.00

TOTAL AMOUNT STILL DUE ON CGT Failure to file: 5000 5,000.00 59,188.00

83,456.00

2.) DOCUMENTARY STAMP TAX (DST)- BIR Form 2000-OT

TAX DUE

Legal basis: Sections 19 (CTRP) NIRC

₱ 400,000.00 6,000.00

(Tax Base)

LESS: Tax paid per return, if return was filed 6,000.00

DST STILL DUE/ (OVERPAYMENT)

Add: 25% Surcharge 1,500.00

12% Interest per annum December 17,2011 December 31,2017 2206 24,893.19

Compromise penalty 1-Jan-18 March 31,2023 1915 6,077.64 33,470.83

TOTAL AMOUNT STILL DUE ON DST 1,000.00 122,926.83

TOTAL AMOUNT OF 1&2

Remarks

To be accomplished by ONETT Team Payment verified by: To be accomplished upon review

Computed by: Reviewed by:

EDDIE JAY E. TANZO JR. ELSIE VASAYA ADORA L.SIJO

ONETT Officer ONETT Member/Collection Section Chief- Assesment Division

(Signature Over Printed Name) (Signature Over Printed Name)

OR No. Tax Type Payment Date

Approved by: Approved by:

HELEN B. SANTOS EMIR U. ABUTAZIL Regional

Head, ONETT Team Director (Signature

(Signature Over Printed Name) Reference:

Over Printed Name)

The BIR is not precluded from assessing and collecting my deficiency internal revenue tax(es) thay maybe found from the tax payer after examination or review.

Conforme: YLOIZA L. LAFUENTE 0930 022 8561 3/1/2023

TAXPAYER/AUTHORIZED REPRESENTATIVE Contact Number Date

(Signature Over Printed Name)

Instruction: Prepare in duplicate and ascertain that ONETT Computation Sheet is signed by Head ONETT Team before release to taxpayer. Please attached additional sheet, if necessary.

You might also like

- Fifth Avenue Property Dev. Corp.: Onett Computation SheetDocument1 pageFifth Avenue Property Dev. Corp.: Onett Computation SheetLaurenNo ratings yet

- CGT Tomanda AntokDocument1 pageCGT Tomanda AntokNvision PresentNo ratings yet

- Formal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument3 pagesFormal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDominic Dela VegaNo ratings yet

- EWT/DST-Real Property Date of TransactionDocument7 pagesEWT/DST-Real Property Date of TransactionHanabishi RekkaNo ratings yet

- 12 03 20Document25 pages12 03 20Rommel John SandovalNo ratings yet

- 12 02 20Document47 pages12 02 20Rommel John SandovalNo ratings yet

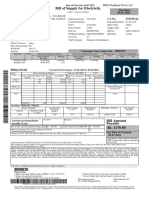

- Utility Bill-BSES PDFDocument2 pagesUtility Bill-BSES PDFKing Tri-ZiNo ratings yet

- Dec'22 Electricity BillDocument1 pageDec'22 Electricity BillAakash SinglaNo ratings yet

- 20200731-0100003503-SMMG-Mall-CULLINAN GROUP INCDocument4 pages20200731-0100003503-SMMG-Mall-CULLINAN GROUP INCEdjon AndalNo ratings yet

- Electricity Bill: Account No: 7791830000Document1 pageElectricity Bill: Account No: 7791830000Jai Mata diNo ratings yet

- Sep 22Document1 pageSep 22krishna tiwari (OHRWA TM)No ratings yet

- PCL As Decision Appealable To CTADocument22 pagesPCL As Decision Appealable To CTAAvelino Garchitorena Alfelor Jr.No ratings yet

- Onett Computation SheetDocument1 pageOnett Computation SheetBreahziel ParillaNo ratings yet

- Electricity Bill Duplicate Bill: Account No: 3094925898Document1 pageElectricity Bill Duplicate Bill: Account No: 3094925898Ravi Pratap SinghNo ratings yet

- Jul 18Document1 pageJul 18piyushjindal980% (1)

- View Bill 1Document1 pageView Bill 1Mitali SrivastavaNo ratings yet

- HTBill PDFDocument1 pageHTBill PDFDta FnbnrNo ratings yet

- Dec17 BillDocument1 pageDec17 Billpiyushjindal98No ratings yet

- Electricity Bill Duplicate Bill: Him SinghDocument1 pageElectricity Bill Duplicate Bill: Him SinghSûmìt KúmãrNo ratings yet

- PL and Balance Sheet Detailed FormatDocument5 pagesPL and Balance Sheet Detailed FormatPradeep G MenonNo ratings yet

- BillDocument1 pageBillSunil KumarNo ratings yet

- SOL MANUAL TAX SHORT QUIZ XXXXXDocument1 pageSOL MANUAL TAX SHORT QUIZ XXXXXJohn Alpon CatudayNo ratings yet

- E BillDocument1 pageE BillManglesh SinghNo ratings yet

- (PDF) Download Card Statement PDFDocument4 pages(PDF) Download Card Statement PDFSamNo ratings yet

- 12 01 20Document39 pages12 01 20Rommel John SandovalNo ratings yet

- Ajay Singh Electric BillDocument1 pageAjay Singh Electric Billyadavgourav377No ratings yet

- Bati Devi Bijli BillDocument1 pageBati Devi Bijli Billravi40440457No ratings yet

- MyPay PDFDocument1 pageMyPay PDFPaul BeznerNo ratings yet

- Taller FinalDocument13 pagesTaller FinalJennifer Ramos PerezNo ratings yet

- Electricity Bill Duplicate Bill: Account No: 2963580000Document1 pageElectricity Bill Duplicate Bill: Account No: 2963580000Manjeet ParasharNo ratings yet

- DHBVNDocument1 pageDHBVNGaurav BediNo ratings yet

- 2550-M October-2022Document2 pages2550-M October-2022Jing ReyesNo ratings yet

- View BillDocument1 pageView BillAnonymous y1DnDY100% (1)

- Electricity Bill House No 113 Sector 38Document2 pagesElectricity Bill House No 113 Sector 38pawan singhalNo ratings yet

- ST Lukes Predominance TestDocument12 pagesST Lukes Predominance TestCARLO JOSE BACTOLNo ratings yet

- SBI Card Statement - 6880 - 01-01-2024Document7 pagesSBI Card Statement - 6880 - 01-01-2024Jagadish LoganathanNo ratings yet

- 1484 HB Flat Hansi AnuDocument1 page1484 HB Flat Hansi Anusaroj bamalNo ratings yet

- SBI Card Statement - 4977 - 18-11-2023Document7 pagesSBI Card Statement - 4977 - 18-11-2023chagusahoo170No ratings yet

- COMPDocument2 pagesCOMPSairishi GhoshNo ratings yet

- Electricity Bill Duplicate Bill: Account No: 6670250000Document1 pageElectricity Bill Duplicate Bill: Account No: 6670250000RohitNo ratings yet

- NON MEDICLAIM AY2024-25 SARBANI BORA-BDPPB0721G-ComputationDocument2 pagesNON MEDICLAIM AY2024-25 SARBANI BORA-BDPPB0721G-ComputationlaskarmohinNo ratings yet

- Electricity Bill Duplicate Bill: Account No: 1973942840Document1 pageElectricity Bill Duplicate Bill: Account No: 1973942840Gaurang GoelNo ratings yet

- Preliminary Assessment NoticeDocument3 pagesPreliminary Assessment NoticeHanabishi RekkaNo ratings yet

- Electricity Bill Duplicate Bill: Account No: 9521630000Document2 pagesElectricity Bill Duplicate Bill: Account No: 9521630000ansh BeriNo ratings yet

- Electricity BillDocument1 pageElectricity BillNaveen KumarNo ratings yet

- Da FMRDocument24 pagesDa FMRnaim indahiNo ratings yet

- Electricity Bill: Account No: 2707420000Document1 pageElectricity Bill: Account No: 2707420000Sûmìt KúmãrNo ratings yet

- View BillDocument1 pageView BillPankaj MunjalNo ratings yet

- South Pacific-MC-PB#2Document12 pagesSouth Pacific-MC-PB#2wendellNo ratings yet

- View BillDocument1 pageView BillPratham BhardwajNo ratings yet

- S.Samanta & Co.: (Chartered Accountants)Document2 pagesS.Samanta & Co.: (Chartered Accountants)Samrat MajumderNo ratings yet

- 732 ElectrcityDocument1 page732 ElectrcityHasan AliNo ratings yet

- View BillDocument1 pageView BillOm PrakashNo ratings yet

- View BillDocument1 pageView BilljinvalmukundNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Week 3 Tax 2 - Assignment - MIPRANUM, RJAYDocument2 pagesWeek 3 Tax 2 - Assignment - MIPRANUM, RJAYAileen Mifranum IINo ratings yet

- Project WorkDocument11 pagesProject WorkGodwin SylvanusNo ratings yet

- P3-Costing and Pricing in TransportationDocument18 pagesP3-Costing and Pricing in Transportationnazwa azzahraNo ratings yet

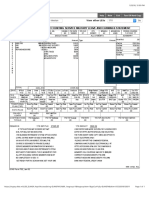

- Useful Life or 60 Mos. (Whichever Is Shorter) : (Attach Additional Sheet, If Necessary)Document6 pagesUseful Life or 60 Mos. (Whichever Is Shorter) : (Attach Additional Sheet, If Necessary)Katherine OlidanNo ratings yet

- BLR 08:30 CCU 11:05: Booking IdDocument2 pagesBLR 08:30 CCU 11:05: Booking IdSourav DasNo ratings yet

- Booking Invoice M06ai24i02958644Document1 pageBooking Invoice M06ai24i02958644neha parabNo ratings yet

- Airtel Bill - JunDocument5 pagesAirtel Bill - JunSaravanan GuruNo ratings yet

- Tax Invoice: IXIFT00004369863: Fare (Incl of All Taxes) 4765.00 Net Other Service Charges & Fees (A) 0.00Document1 pageTax Invoice: IXIFT00004369863: Fare (Incl of All Taxes) 4765.00 Net Other Service Charges & Fees (A) 0.00Manjit raushanNo ratings yet

- NTCC Project Parul JaiswalDocument24 pagesNTCC Project Parul JaiswalRani JaiswalNo ratings yet

- Invoice PDFDocument2 pagesInvoice PDFK SharmaNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Venkat DeepakNo ratings yet

- Vietcombank LC ServiceDocument3 pagesVietcombank LC ServiceK60 Nguyễn Bích VânNo ratings yet

- Customs Declaration: (In KG)Document1 pageCustoms Declaration: (In KG)GXNMNo ratings yet

- The Photovoltaic Tariff For The Peruvian Electric Rural Expansion MREVOLODocument18 pagesThe Photovoltaic Tariff For The Peruvian Electric Rural Expansion MREVOLOcyrinusNo ratings yet

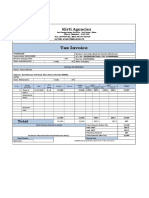

- Tax - Invoice: Burckhardt Compression (India) Pvt. LTDDocument1 pageTax - Invoice: Burckhardt Compression (India) Pvt. LTDYOGESHNo ratings yet

- Kirti Dec BillDocument1 pageKirti Dec BillVishnuNadarNo ratings yet

- estimateACT638 PDFDocument2 pagesestimateACT638 PDFTeam ArihantCabletronicsNo ratings yet

- What Is PESTLE AnalysisDocument3 pagesWhat Is PESTLE AnalysisTawanda Percy MutsandoNo ratings yet

- Foreign Direct Investment AssignmentDocument4 pagesForeign Direct Investment AssignmentRaja Ahsan TariqNo ratings yet

- Muhammad Shafiq S/O Abdul Ghafoor KH 827 NR Hameeda Masjid K/ Kalan LHRDocument1 pageMuhammad Shafiq S/O Abdul Ghafoor KH 827 NR Hameeda Masjid K/ Kalan LHRashfaq4985No ratings yet

- Eco Tutorial Chapter 10Document4 pagesEco Tutorial Chapter 10Rosa MoleaNo ratings yet

- Mepco Online Billl PDFDocument2 pagesMepco Online Billl PDFAamir Hussain SaeediNo ratings yet

- Class 02 MarktingDocument96 pagesClass 02 Marktingmouhid aymanNo ratings yet

- EXC QuoteDocument1 pageEXC QuoteSwapnilNo ratings yet

- PDF ResizeDocument2 pagesPDF Resizeasim maitla03No ratings yet

- Economics I SynopsisDocument4 pagesEconomics I SynopsisKaruna DewdaNo ratings yet

- Charge GSTDocument70 pagesCharge GSTHARSHNo ratings yet

- Subject: Letter in Support of Funding or Visa ApplicationDocument4 pagesSubject: Letter in Support of Funding or Visa ApplicationAkash NarayanNo ratings yet

- Impact of Tax Incentives and Foreign Direct InvestDocument10 pagesImpact of Tax Incentives and Foreign Direct Investtouaf zinebNo ratings yet

- Corresponding Supporting ScheduleDocument2 pagesCorresponding Supporting Schedulealmira garciaNo ratings yet