Professional Documents

Culture Documents

Provisional Schedule v2022

Uploaded by

Ivana Balija0 ratings0% found this document useful (0 votes)

4 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageProvisional Schedule v2022

Uploaded by

Ivana BalijaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

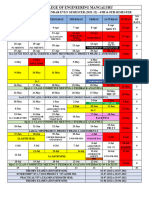

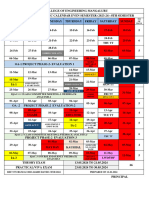

PROVISIONAL SCHEDULE

INTERNATIONAL TAXATION

YEAR 2021/2022 GROUP AR

THEORY (Tuesday) PRACTICES (Wednesday)

12:30-14:30 12:30-14:30

Presentation

1 February 2 February

Unit 1. Basic Concepts

Unit 1

8 February 9 February P-0 Tax Schedules

Basic Concepts

Unit 2

15 February 16 February P-1 UE Database

Taxation in UE

Unit 2

22 February 23 February P-2 Eurostat

Taxation in UE

Unit 3

1 March 2 March P-3 VAT

International Taxation

Unit 4

8 March 9 March P-4 Tax Treaties

Source Jurisdiction

15 March Holiday 16 March Holiday

Unit 5 P-5 Double Taxation (1

22 March 23 March

Double Taxation to 4)

Unit 5 P-5 Double Taxation (5

29 March 30 Marzo

Double Taxation to 8)

Unit 6

5 April 6 April P-6 Transfer Pricing I

Transfer Pricing

Unit 6

12 April 13 April P-6 Transfer Pricing II

Transfer Pricing

19 April Holiday 20 April Holiday

Unit 7

P-7 Subcapitalization

26 April Anti-Avoidance 27 April

and CFCs

Measures

Unit 8

3 May 4 May Review

Tax Treaties

10 May Group Presentations 11 May Group Presentations

17 May Group Presentations 18 May Group Presentations

You might also like

- ACU Schedule 2021-2022 (In House)Document8 pagesACU Schedule 2021-2022 (In House)Vic JamesNo ratings yet

- Weekly Programme 3rd Year 2024 SCDocument1 pageWeekly Programme 3rd Year 2024 SCarronyeagarNo ratings yet

- Tax Lecture Record - b2 SsDocument4 pagesTax Lecture Record - b2 SsMuhammad YousafNo ratings yet

- CPA Gantt Chart5Document13 pagesCPA Gantt Chart5bcap-oceanNo ratings yet

- Group B PlannerDocument4 pagesGroup B Plannerowais95138No ratings yet

- Academic Calendar 2023Document1 pageAcademic Calendar 2023RakshyaNo ratings yet

- Session 6: Advanced Economies II The Euro Area Partha Ray Feb 5 2021Document27 pagesSession 6: Advanced Economies II The Euro Area Partha Ray Feb 5 2021yuval sharmaNo ratings yet

- Itad Bir Ruling No. 043-21Document8 pagesItad Bir Ruling No. 043-21Crizedhen VardeleonNo ratings yet

- TT 7 F Timetable 1Document4 pagesTT 7 F Timetable 1Lakshmi Kameswari EmaniNo ratings yet

- Budget of Work 2020 2021 GR 2Document2 pagesBudget of Work 2020 2021 GR 2Lykx LopezNo ratings yet

- Guzman Cruz Cpas and Co.: Guideline For BIR Tax Deadlines During Enhanced Community Quarantine (ECQ) PeriodDocument2 pagesGuzman Cruz Cpas and Co.: Guideline For BIR Tax Deadlines During Enhanced Community Quarantine (ECQ) PeriodGerald SantosNo ratings yet

- 2 Refuerzo Ampliacion Casa ConoDocument1 page2 Refuerzo Ampliacion Casa ConoJayne WojtasikNo ratings yet

- Academy Course ScheduleDocument2 pagesAcademy Course ScheduleYannick OmbeteNo ratings yet

- Timetable Gantt ChartDocument2 pagesTimetable Gantt ChartRichelle PatricioNo ratings yet

- Spring 2019 Semester Accounting PlannerDocument2 pagesSpring 2019 Semester Accounting PlannerRubab MirzaNo ratings yet

- Econ 138A - Income Taxation Course OverviewDocument1 pageEcon 138A - Income Taxation Course OverviewWallace YeungNo ratings yet

- Training Schedule OverviewDocument3 pagesTraining Schedule OverviewPavan SamudralaNo ratings yet

- Cpa Pep SchedulesDocument6 pagesCpa Pep SchedulesjohnNo ratings yet

- Monthly Report TempDocument17 pagesMonthly Report TempAbu ZyadNo ratings yet

- Budget of Work 2020 2021 GR 3Document2 pagesBudget of Work 2020 2021 GR 3Lykx LopezNo ratings yet

- Edisi 7 Maret 2019 - Laporan Ekonomi MingguanDocument3 pagesEdisi 7 Maret 2019 - Laporan Ekonomi MingguanDavid ArdiyantoNo ratings yet

- Roadmap To FRK 705Document61 pagesRoadmap To FRK 705RaychelNo ratings yet

- Construction Monthly Report: Project Title ABC - Qatar University Doha, State of QatarDocument17 pagesConstruction Monthly Report: Project Title ABC - Qatar University Doha, State of QatarsteluNo ratings yet

- FRK 705 Financial Accounting Year Program 2022Document6 pagesFRK 705 Financial Accounting Year Program 2022RaychelNo ratings yet

- CMA Study PlanDocument10 pagesCMA Study PlanMaha M. Al-MasriNo ratings yet

- Robinson R44 Cadet Poh Full BookDocument216 pagesRobinson R44 Cadet Poh Full BookGourav Das100% (1)

- Cap Timetable 2008-2010 040408Document2 pagesCap Timetable 2008-2010 040408evilslugNo ratings yet

- Curriculum Map Grade 7-8Document2 pagesCurriculum Map Grade 7-8Andre MontañezNo ratings yet

- ACCA Timetable Dec 2010Document1 pageACCA Timetable Dec 2010bogdantomsa6763No ratings yet

- Forum 8 - 14 April 2020Document3 pagesForum 8 - 14 April 2020patrianaaaNo ratings yet

- UntitledDocument6 pagesUntitledMaureen Shelby EvangelistaNo ratings yet

- BIR form deadlines extended for Individuals and Non-Individuals until June 2020Document2 pagesBIR form deadlines extended for Individuals and Non-Individuals until June 2020Felix Eraño Pakinggan UyNo ratings yet

- Timeline Project Cerelac FishDocument5 pagesTimeline Project Cerelac FishSyed Sazzad AliNo ratings yet

- Russian Trade With Finland, Estonia, Latvia and Lithuania: Kätlin KeinastDocument16 pagesRussian Trade With Finland, Estonia, Latvia and Lithuania: Kätlin KeinastreneNo ratings yet

- Step Charts Free Excel XelPlus ErrorBarDocument14 pagesStep Charts Free Excel XelPlus ErrorBarwester_bisNo ratings yet

- Ac-Word - 2021-22-EvenDocument1 pageAc-Word - 2021-22-EvenSaifuddeen KudroliNo ratings yet

- FW Vertical SDocument3 pagesFW Vertical SkarunaNo ratings yet

- Schedule ComparisonDocument7 pagesSchedule ComparisonASIF WAZIRNo ratings yet

- A320 On BoardDocument10 pagesA320 On BoardRoengrat YutisartNo ratings yet

- CERC Coal Escalation IndexDocument11 pagesCERC Coal Escalation IndexGagsNo ratings yet

- Economic Highlights - Industrial Production Slowed Down in April - 10/6/2010Document3 pagesEconomic Highlights - Industrial Production Slowed Down in April - 10/6/2010Rhb InvestNo ratings yet

- Sem 1 Tax ProgramDocument1 pageSem 1 Tax ProgramthamsanqamanciNo ratings yet

- Motor Vehicle Registration Schedule Based On The Plate NumberDocument2 pagesMotor Vehicle Registration Schedule Based On The Plate NumberJessie Marie dela Peña0% (1)

- Ifp Class Schedule For 2010 m2 - m5Document1 pageIfp Class Schedule For 2010 m2 - m5Hero MyNo ratings yet

- Poverty Official LAC 2017-07Document58 pagesPoverty Official LAC 2017-07cuizeroNo ratings yet

- ESCALA DE TIEMPO - en ExcelDocument3 pagesESCALA DE TIEMPO - en ExcelAbimael BeltránNo ratings yet

- Monthwise Syllabus Class 12 ComDocument8 pagesMonthwise Syllabus Class 12 ComKritika ModiNo ratings yet

- Virtual Training Calendar 2024Document2 pagesVirtual Training Calendar 2024loganathanNo ratings yet

- 29 Juni 2023Document4 pages29 Juni 2023cahyono79No ratings yet

- IEC 62305-4 Lightning Protection Standard Voting ResultsDocument51 pagesIEC 62305-4 Lightning Protection Standard Voting Resultsr_omanoNo ratings yet

- Lapor Badora - 19 Mei 2015 ExcelDocument1 pageLapor Badora - 19 Mei 2015 ExcelRestiawan MustafaNo ratings yet

- Coronavirus GermaDocument10 pagesCoronavirus Germagigi stanNo ratings yet

- Curtin Physiotherapy Clinical Program 2020 ScheduleDocument1 pageCurtin Physiotherapy Clinical Program 2020 ScheduleQiyao LeongNo ratings yet

- Dept 2023 24 (Even) 8th SemDocument1 pageDept 2023 24 (Even) 8th SemSaifuddeen KudroliNo ratings yet

- Schedule Ash Pond-R4 - 181218Document2 pagesSchedule Ash Pond-R4 - 181218klukluxlandNo ratings yet

- Fom - Vna e r05 12apr20 NewDocument658 pagesFom - Vna e r05 12apr20 NewHung Nguyen100% (1)

- LTO vehicle registration schedule by plate numberDocument2 pagesLTO vehicle registration schedule by plate numberCiti PinoyNo ratings yet

- Ready Reckoner: Snapshot of India's Oil & Gas DataDocument21 pagesReady Reckoner: Snapshot of India's Oil & Gas DatasmithsvaultNo ratings yet