Professional Documents

Culture Documents

Weekly Programme 3rd Year 2024 SC

Uploaded by

arronyeagar0 ratings0% found this document useful (0 votes)

3 views1 pageThis document outlines the weekly programme for the IIE Bachelor of Accounting (BAC322) TAXA7319 course for 2024, including:

1) The course is split into two semesters, with the first semester covering topics like VAT, income tax, capital allowances, and CGT, and the second semester covering topics like retirement benefits, trusts, provisional tax, and dividends tax.

2) Each week covers 1-2 learning units on the scheduled tax topics through sessions, with tests and exams scheduled throughout the semesters.

3) The programme includes a mid-year break in July and revision weeks before the final exams in November.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the weekly programme for the IIE Bachelor of Accounting (BAC322) TAXA7319 course for 2024, including:

1) The course is split into two semesters, with the first semester covering topics like VAT, income tax, capital allowances, and CGT, and the second semester covering topics like retirement benefits, trusts, provisional tax, and dividends tax.

2) Each week covers 1-2 learning units on the scheduled tax topics through sessions, with tests and exams scheduled throughout the semesters.

3) The programme includes a mid-year break in July and revision weeks before the final exams in November.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views1 pageWeekly Programme 3rd Year 2024 SC

Uploaded by

arronyeagarThis document outlines the weekly programme for the IIE Bachelor of Accounting (BAC322) TAXA7319 course for 2024, including:

1) The course is split into two semesters, with the first semester covering topics like VAT, income tax, capital allowances, and CGT, and the second semester covering topics like retirement benefits, trusts, provisional tax, and dividends tax.

2) Each week covers 1-2 learning units on the scheduled tax topics through sessions, with tests and exams scheduled throughout the semesters.

3) The programme includes a mid-year break in July and revision weeks before the final exams in November.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

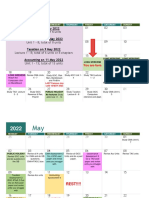

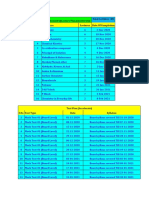

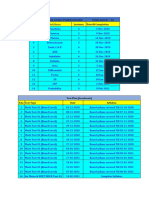

IIE Bachelor of Accounting (BAC322) weekly programme 2024: TAXA7319

Academic Start date Sessions Number of sessions Learning unit Topic

Week

FIRST SEMESTER

1 19-Feb 1 to 4 4 1 Value Added Tax

2 26-Feb 5 to 8 4 1 Value Added Tax

9 to 10 2 1 Value Added Tax

3 4-Mar

11 to 12 2 2&3 Income tax overview, Gross income and special inclusions Self-Study: These two sessions will be used for VAT

4 11-Mar 13 to 16 4 4 Deductions

5 18-Mar 17 to 20 4 4 Deductions

25-Mar Test 1

6 1-Apr 21 to 24 4 5 Capital allowances

7 8-Apr 25 to 28 4 5 Capital allowances

29 to 30 2 5 Capital allowances

8 15-Apr

31 to 31 2 6 CGT

9 22-Apr 33 to 36 4 6 CGT

10 29-Apr 37 to 40 4 6 CGT - individuals

6-May Test Study

13-May Test 2 (integrated)

41 to 42 2 7 Introduction and tax liability framwework

11 20-May

43 to 44 2 8 Exemptions (including non-residents)

45 to 46 2 8 Exemptions (including non-residents)

12 27-May

47 to 48 2 9 Fringe benefits and allowances

13 3-Jun 49 to 52 4 9 Fringe benefits and allowances

14 10-Jun 53 to 56 4 9 Fringe benefits and allowances

15 17-Jun 59 to 60 4 10 Deductions for individuals

24-Jun Test 3

1-Jul

8-Jul Mid-year break

15-Jul

SECOND SEMESTER

16 22-Jul 61 to 64 4 11 Retirement benefits

17 29-Jul 65 to 68 4 14 Donations tax

18 5-Aug 69 to 72 4 12 Trusts

19 12-Aug 73 to 76 4 12 Trusts

20 19-Aug 75 to 78 4 15 Estate Duty

26-Aug Test Study

2-Sep Test 4 (integrated)

21 9-Sep 79 to 82 4 13 Provisional and employees tax

22 16-Sep 83 to 86 4 13 Provisional and employees tax

23 23-Sep 87 to 90 4 16 Dividends tax

30-Sep Replacement Test (integrated on content for year)

7-Oct

14-Oct

Revision and Exam Study (campus to timetable week 6 sessions for revision)

21-Oct

28-Oct

4-Nov

11-Nov Final Exams

18-Nov

You might also like

- Civil Procedure Regalado OCRDocument922 pagesCivil Procedure Regalado OCRNaiza Mae R. Binayao100% (1)

- Affidavit of Witness DefenseDocument2 pagesAffidavit of Witness DefenseBurn-Cindy Abad100% (2)

- Tourism 2024 Work Schedule Grade 12Document18 pagesTourism 2024 Work Schedule Grade 12bongiweshibe55100% (1)

- Concept of Corroborative EvidenceDocument8 pagesConcept of Corroborative Evidencetanmaya_purohitNo ratings yet

- Labor CasesDocument14 pagesLabor Caseshanabi_13No ratings yet

- Maceda Vs OmbudsmanDocument2 pagesMaceda Vs OmbudsmanKanishkaLevIringanNo ratings yet

- People Vs AmigoDocument5 pagesPeople Vs AmigokablasNo ratings yet

- Forcible Entry ComplaintDocument3 pagesForcible Entry ComplaintKaren Mae ServanNo ratings yet

- Lectures on Public Economics: Updated EditionFrom EverandLectures on Public Economics: Updated EditionRating: 5 out of 5 stars5/5 (1)

- Fortich V CoronaDocument1 pageFortich V CoronaHazel Grace AbenesNo ratings yet

- Chong Guan Trading Vs NLRCDocument1 pageChong Guan Trading Vs NLRCMavic MoralesNo ratings yet

- Vishesh JD 04Document2 pagesVishesh JD 04Vpsm SinghNo ratings yet

- Study Timetable 2022Document2 pagesStudy Timetable 2022TamaraNo ratings yet

- Cpa Pep SchedulesDocument6 pagesCpa Pep SchedulesjohnNo ratings yet

- VIJAY JR 01 02 V 1Document2 pagesVIJAY JR 01 02 V 1Piyush KumarNo ratings yet

- Deakin University Professional Experience Timetable MALT 2022Document1 pageDeakin University Professional Experience Timetable MALT 2022Billy James St JohnNo ratings yet

- Course Planner: Subject Wise Syllabus PlanDocument2 pagesCourse Planner: Subject Wise Syllabus PlanRavi KantNo ratings yet

- Course - Planner - Prakhar-II - With Test Grid (2024-25)Document2 pagesCourse - Planner - Prakhar-II - With Test Grid (2024-25)siyavarramchandrakijai1008No ratings yet

- March February April: Integrated Financial Planning Course - Cycles ScheduleDocument1 pageMarch February April: Integrated Financial Planning Course - Cycles Scheduleanshu bohraNo ratings yet

- Vipul JB 01 02 03Document2 pagesVipul JB 01 02 03eGamingMafiaNo ratings yet

- Lecture Planner - Maths - Lakshya JEE New - MathsDocument4 pagesLecture Planner - Maths - Lakshya JEE New - MathsDuma KibutsujiNo ratings yet

- Course Planner: Target: JEE (Main+Advanced) 2022Document2 pagesCourse Planner: Target: JEE (Main+Advanced) 2022ƤʀᴀɴᴀʏNo ratings yet

- Vikaas Ja 01012Document2 pagesVikaas Ja 01012raghavbhatiaNo ratings yet

- Course Planner: Target: JEE (Main+Advanced) 2023Document2 pagesCourse Planner: Target: JEE (Main+Advanced) 2023ZzoNo ratings yet

- Vishesh JD 01Document2 pagesVishesh JD 01Piyush KumarNo ratings yet

- Academic Schedule Jan 2024 Session PGDocument1 pageAcademic Schedule Jan 2024 Session PGnithishchowdary999999999No ratings yet

- UPD-KM-G8-VL-SC-2001 - Project Schedule Rev.0Document4 pagesUPD-KM-G8-VL-SC-2001 - Project Schedule Rev.0Sudar MyshaNo ratings yet

- b11 SKG Rev Urgent Rev 1 PDFDocument1 pageb11 SKG Rev Urgent Rev 1 PDFwanmohdhafiz hafizNo ratings yet

- Course Planner: Subject Wise Syllabus PlanDocument2 pagesCourse Planner: Subject Wise Syllabus PlanRitesh Ranjan100% (1)

- Vijay Resonance 2019Document2 pagesVijay Resonance 2019Anuj SoniNo ratings yet

- Servicii Hoteliere - Turism Si AgrementDocument16 pagesServicii Hoteliere - Turism Si Agrementsss9xNo ratings yet

- Course Planner: Target: JEE (Main+Advanced) 2023Document2 pagesCourse Planner: Target: JEE (Main+Advanced) 2023Vishal GeekNo ratings yet

- Class 12th (Chemistry) Lecture Plan (Accelerate) Total Lectures 86 S.No Lectures Date of CompletionDocument2 pagesClass 12th (Chemistry) Lecture Plan (Accelerate) Total Lectures 86 S.No Lectures Date of CompletionSOURAVNo ratings yet

- Class 12 (Maths.) Lecture Plan (Accelerate) Total Lectures 62 S.No Lectures Date of CompletionDocument2 pagesClass 12 (Maths.) Lecture Plan (Accelerate) Total Lectures 62 S.No Lectures Date of CompletionSOURAVNo ratings yet

- Course Planner: Target: JEE (Main+Advanced) 2023Document2 pagesCourse Planner: Target: JEE (Main+Advanced) 2023Soma YukhiraNo ratings yet

- Course Planner: Subject Wise Syllabus PlanDocument2 pagesCourse Planner: Subject Wise Syllabus PlanAYUSH PREMNo ratings yet

- Micro Schedule 2Document20 pagesMicro Schedule 2Ajad KhanNo ratings yet

- Course Planner: Subject Wise Syllabus PlanDocument2 pagesCourse Planner: Subject Wise Syllabus Plansoni dwivediNo ratings yet

- Group B PlannerDocument4 pagesGroup B Plannerowais95138No ratings yet

- Course Planner: Subject Wise Syllabus PlanDocument2 pagesCourse Planner: Subject Wise Syllabus PlanVishal GeekNo ratings yet

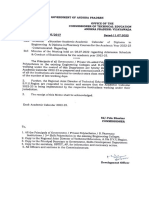

- Government of Andhra Pradesh Office of The Commissioner of Technical Education Andhrapradesh:Vijayawada Dated:11.07.2022Document3 pagesGovernment of Andhra Pradesh Office of The Commissioner of Technical Education Andhrapradesh:Vijayawada Dated:11.07.2022061 David RajuNo ratings yet

- Ajay Er 01Document2 pagesAjay Er 01AslNo ratings yet

- Academic Calendar 2021 2022Document1 pageAcademic Calendar 2021 2022Sandeep MandalNo ratings yet

- Vikas DCS-II Course File NAACDocument220 pagesVikas DCS-II Course File NAACEr. NITIN ARORANo ratings yet

- Vishesh JD 01Document2 pagesVishesh JD 01Himanshu kumarNo ratings yet

- C. CISP Curricular Timelines - TVMC - PY4 - 2024 - 25Document5 pagesC. CISP Curricular Timelines - TVMC - PY4 - 2024 - 25SP MemesNo ratings yet

- Lecture Planner - Physics - JEE MASTER - PhysicsDocument3 pagesLecture Planner - Physics - JEE MASTER - PhysicsAkshit RajputNo ratings yet

- Tampilkan Data Berdasarkan TGLDocument23 pagesTampilkan Data Berdasarkan TGLMuhammad HarrisNo ratings yet

- 1 Million Milestone AchivementDocument12 pages1 Million Milestone Achivementlarsen safetyNo ratings yet

- Section - 8: Bangladesh, Matarbari 2 X 600MW Coal Fired Power Plant ProjectDocument2 pagesSection - 8: Bangladesh, Matarbari 2 X 600MW Coal Fired Power Plant Projectruhul01No ratings yet

- Monthly Training Schedule April - OCDocument5 pagesMonthly Training Schedule April - OCsharmasangeet1992No ratings yet

- Calrratrr Nnuc - Llre: CalificiriiDocument13 pagesCalrratrr Nnuc - Llre: Calificiriiana cecanNo ratings yet

- KRCT - Academic Schedule - Odd Semester S.No Academic Activity Details Iv Year Iii Year Ii YearDocument1 pageKRCT - Academic Schedule - Odd Semester S.No Academic Activity Details Iv Year Iii Year Ii YearVimal MNo ratings yet

- GRADE 12 2024 Programme of Assessment-1Document1 pageGRADE 12 2024 Programme of Assessment-1mthokzin12345No ratings yet

- Course - Planner - Prakhar Integrated-II With Test GridDocument4 pagesCourse - Planner - Prakhar Integrated-II With Test Gridsiyavarramchandrakijai1008No ratings yet

- Tareas DiariasDocument5 pagesTareas DiariasJoseph Diaz VigoNo ratings yet

- Course Planner: Subject Wise Syllabus PlanDocument2 pagesCourse Planner: Subject Wise Syllabus PlanpranathiNo ratings yet

- Calendar of Events - 6th Sem - 2023-24 - Even-SignedDocument3 pagesCalendar of Events - 6th Sem - 2023-24 - Even-Signedbhuvankumar3877No ratings yet

- Construction Management 2: Midterm ExaminationDocument4 pagesConstruction Management 2: Midterm Examinationrovicfranzangelyka reyesNo ratings yet

- MDCI Calc Practical E-Notes-2Document18 pagesMDCI Calc Practical E-Notes-2AnuragNo ratings yet

- Planul de Invatamant Anul III 25.07.2022Document18 pagesPlanul de Invatamant Anul III 25.07.2022Daniela Ginco-FodorNo ratings yet

- 2023 Acc GR 12 Year Planner With Curr CoverageDocument4 pages2023 Acc GR 12 Year Planner With Curr CoverageyandisaNo ratings yet

- Planul de Invatamant Anul III 25.07.2022Document18 pagesPlanul de Invatamant Anul III 25.07.2022Valeria PleșcoNo ratings yet

- Schedule - TSC Shiploader - 240311 PrelimDocument1 pageSchedule - TSC Shiploader - 240311 Prelimm_johairieNo ratings yet

- IB Chemistry Programme DP2 - FA2016Document25 pagesIB Chemistry Programme DP2 - FA2016Lucia PesentiNo ratings yet

- Course Planner: Subject Wise Syllabus PlanDocument2 pagesCourse Planner: Subject Wise Syllabus PlanNilabha DasNo ratings yet

- Vikaas Ja 02Document2 pagesVikaas Ja 02eGamingMafiaNo ratings yet

- Fosma Maritime Institute &researchorganisation: Course Schedule, W.E.F 25 April, 2018Document2 pagesFosma Maritime Institute &researchorganisation: Course Schedule, W.E.F 25 April, 2018Ashis SarkarNo ratings yet

- Efforts and PTO TrackerDocument7 pagesEfforts and PTO TrackervipulNo ratings yet

- Ice Task 2 Delta LTD QuestionDocument5 pagesIce Task 2 Delta LTD QuestionarronyeagarNo ratings yet

- MFAC6211 WorkbookDocument156 pagesMFAC6211 WorkbookarronyeagarNo ratings yet

- LU1 NotesdocxDocument2 pagesLU1 NotesdocxarronyeagarNo ratings yet

- ICE Task #1 - LU1 (Updated Question)Document1 pageICE Task #1 - LU1 (Updated Question)arronyeagarNo ratings yet

- Iie Pgac0801 Contact Full Time Ac 2024 v1Document1 pageIie Pgac0801 Contact Full Time Ac 2024 v1arronyeagarNo ratings yet

- Annexure 2ADocument12 pagesAnnexure 2AarronyeagarNo ratings yet

- Laes5111 MoDocument39 pagesLaes5111 MoarronyeagarNo ratings yet

- Laes5111 MoDocument39 pagesLaes5111 MoarronyeagarNo ratings yet

- Laes5111 Prescribed Material AddendumDocument3 pagesLaes5111 Prescribed Material AddendumarronyeagarNo ratings yet

- LAES 5111 Unit 1 Theme 4 QuestionsDocument2 pagesLAES 5111 Unit 1 Theme 4 QuestionsarronyeagarNo ratings yet

- Iins5211 MoDocument21 pagesIins5211 MoarronyeagarNo ratings yet

- BUET6212T1b THTDocument3 pagesBUET6212T1b THTarronyeagarNo ratings yet

- FIAC5112 WorkbookDocument138 pagesFIAC5112 WorkbookarronyeagarNo ratings yet

- 1 de Leon V EsguerraDocument1 page1 de Leon V EsguerraDaf MarianoNo ratings yet

- Andaya v. RTCDocument2 pagesAndaya v. RTCMargarita Pesons RafolsNo ratings yet

- Sison v. Ancheta - CaseDocument13 pagesSison v. Ancheta - CaseRobeh AtudNo ratings yet

- 1961 - Ram Kr. BA LLBDocument20 pages1961 - Ram Kr. BA LLBRam KumarNo ratings yet

- Heirs of Sps. Liwagon v. Heirs of Sps. LiwagonDocument4 pagesHeirs of Sps. Liwagon v. Heirs of Sps. LiwagonMitch BarandonNo ratings yet

- 10.14 Inundation, Fire, Etc. - People v. MalnganDocument38 pages10.14 Inundation, Fire, Etc. - People v. MalnganweygandtNo ratings yet

- Accused Pentagon Attacker Was Out On Bail After Georgia Home Invasion, Assaults On CopsDocument4 pagesAccused Pentagon Attacker Was Out On Bail After Georgia Home Invasion, Assaults On CopsABC7NewsNo ratings yet

- Pan Pacific Co VDocument2 pagesPan Pacific Co VJunivenReyUmadhayNo ratings yet

- Gudani vs. SengaDocument26 pagesGudani vs. SengaJoana Arilyn CastroNo ratings yet

- Land Titles Cases Final 10.14.15Document60 pagesLand Titles Cases Final 10.14.15francisNo ratings yet

- Recent Filing From UC's Attorneys in Vaccine Mandate CaseDocument20 pagesRecent Filing From UC's Attorneys in Vaccine Mandate CasePete GrieveNo ratings yet

- Shortlisted Candidates - April 2017Document3 pagesShortlisted Candidates - April 2017Inge Papp100% (1)

- Brooks Automation v. Blueshift (Non-Compete 2007)Document4 pagesBrooks Automation v. Blueshift (Non-Compete 2007)gesmerNo ratings yet

- Alcantara v. Dumacon-HassanDocument10 pagesAlcantara v. Dumacon-Hassanf919No ratings yet

- Manifestation Motion GabayDocument3 pagesManifestation Motion GabaySteps RolsNo ratings yet

- Adriano Vs Tanco, Et - Al GR No 16864, July 5, 2010Document6 pagesAdriano Vs Tanco, Et - Al GR No 16864, July 5, 2010Marlito Joshua AmistosoNo ratings yet

- Us v. Eduave - 12155 - CrimDocument2 pagesUs v. Eduave - 12155 - CrimJan Chrys MeerNo ratings yet

- Police Injury Pensions - Review Reconsideration LetterDocument3 pagesPolice Injury Pensions - Review Reconsideration LetterwdtkNo ratings yet

- Zimbabwe - MPs Salaries Benefits and Allowance Act - 1994 - enDocument4 pagesZimbabwe - MPs Salaries Benefits and Allowance Act - 1994 - enfunniNo ratings yet

- 1926 Ramirez - v. - Redfern20210424 12 1eiyzkxDocument3 pages1926 Ramirez - v. - Redfern20210424 12 1eiyzkxErinnea PascualNo ratings yet

- Alwin E. Hopfmann v. Michael Joseph Connolly, 746 F.2d 97, 1st Cir. (1984)Document9 pagesAlwin E. Hopfmann v. Michael Joseph Connolly, 746 F.2d 97, 1st Cir. (1984)Scribd Government DocsNo ratings yet