Professional Documents

Culture Documents

FAA Unit 3 Theory

FAA Unit 3 Theory

Uploaded by

Arnav 123Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FAA Unit 3 Theory

FAA Unit 3 Theory

Uploaded by

Arnav 123Copyright:

Available Formats

1/26/202

1 FINANCIAL ACCOUNTING AND ANALYSIS

BY

MR. ASHOK KUMAR

2 DEPRECIATION

• DEPRECIATION IS THE PERMANENT AND CONTINUING DECREASE IN THE QUALITY, QUANTITY OR

VALUE OF ASSET.

3 CAUSES OF DEPRECIATION

• WEAR AND TEAR IN ASSETS

• EXHAUSTION- AN ASSET MAY GET EXHAUSTED THROUGH WORKING. EX, COAL, OIL WELLS THEY

WILL GET EXHAUSTED AFTER SOME POINT OF TIME.

• OBSOLENCE- IT MEANS SOME ASSETS ARE REPLACE BY THE NEW MACHNE WHICH IS MORE

EFFICIENT THEN THE OLDER ONE.

• EFFLUX OF TIME- CERTAIN ASSETS GET DECREASED IN THEIR VALUE WITH THE PASSAGE OF TIME

• ACCIDENTS- AN ASSET MAY MEET WITH ACCIDENT AND IT WILL LOST ITS VALUE.

4 OBJECTIVES OF PROVIDING DEPRECIATION

• ASCERTAINMENT OF TRUE PROFIT

• PRESENTATION OF PROFIT- THE ASSET GET DEPRECIATED IN THEIR VALUE OVER THE PERIOD OF

TIME ON ACCOUNT OF VARIOUS FACTORS. IN ORDER TO PRESENT A TRUE STATE OF AFFAIR OF

BUSINESS, THE ASSET SHOULD BE SHOWN IN THE BALANCE SHEET, IN THEIR PROPER VALUE.

• REPLACEMENT OF ASSETS- ASSET USED IN THE BUSINESS NEED REPLACEMENT AFTER THE EXPIRY

OF THEIR SERVICE LIFE. BY PROVIDING DEPRECIATION A PART OF THE PROFITS OF THE BUSINESS

IS KEPT IN THE BUSINESS WHICH CAN BE USED FOR PURCHASE OF NEW ASSETS.

5 DEPRECIATION ON REPLACEMENT COST

• CHARGING DEPRECIATION ON REPLACEMENT COST HELPS THE COMPANY TO PROVIDE ENOUGH

FUNDS TO REPLACE THE OLD ASSETS IN THE COMPANY. IT WILL BE APPROPRIATE TO PROVIDE

DEPRECIATION ON THE REPLACEMENT COST OF THE ASSET RATHER THAN ON HISTORICAL COST.

IF DEPRECIATION IS CHARGED ON THE BASIS OF HISTORICAL COST THEN THERE WILL BE NO

ENOUGH FUND WILL BE AVAILABLE TO REPLACE THE ASSET DUE TO INFLATIONARY EFFECT.

6

• FOLLOWING ARE THE DIFFICULTIES IN CHARGING DEPRECIATION ON THE REPLACEMENT COST.

1. IT IS DIFFICULT TO ESTIMATE THE REPLACEMENT COST OF THE ASSET IN ADVANCE.

2. THE NEW ASSET PURCHASED FOR REPLACING THE OLD ASSET IS ALWAYS OF A BETTER TYPE IN

RESPECT OF ITS QUALITY AS WELL AS EFFICIENCY. OF COURSE ONE HAS TO PAY MORE FOR THE

NEW AND UPGRADED ASSET WHICH WILL INCREASE BUSINESS PROFITABILITY. SO IN CASE

DEPRECIATION IS CHARGED ON REPLACEMENT COST, DEPRECIATION IS CHARGED FOR THE

IMPROVED ASSET EVEN WHEN SUCH ASSET HAS NOT BEEN USED IS VERY DIFFICULT.

3. INCOME TAX AUTHORITY DO NOT GIVE AUTHORITY TO CHARGING DEPRECIATION ON

REPLACEMENT COST.

4. BUSINESSMAN FAVOR CHARGING DEPRECIATION ONLY IN INFLATIONARY PERIOD BUT THEY

WILL NOT DO THE SAME WHEN PRICE ARE FALLING.

5. UNDER THE COMPANIES ACT BUSINESS CAN ONLY CHARGE DEPRECIATION ON ORIGINAL COST

OR THEY CAN CHARGE ON BOOK VALUE.

6.

You might also like

- CSEC Principles of Accounts Revision Course - Basic AccountingDocument9 pagesCSEC Principles of Accounts Revision Course - Basic AccountingVedang Kevlani100% (2)

- Canadian Mutual Funds Investing for Beginners: A Basic Guide for BeginnersFrom EverandCanadian Mutual Funds Investing for Beginners: A Basic Guide for BeginnersNo ratings yet

- Control Case 1 PC DepotDocument8 pagesControl Case 1 PC DepotAbs PangaderNo ratings yet

- Lecture Notes: Auditing Theory AT.0107-Understanding The Entity's Internal Control MAY 2020Document6 pagesLecture Notes: Auditing Theory AT.0107-Understanding The Entity's Internal Control MAY 2020MaeNo ratings yet

- Case 11 Horniman Horticulture 20170504Document16 pagesCase 11 Horniman Horticulture 20170504Chittisa Charoenpanich100% (4)

- Free CFA Mind Maps Level 1 - 2015Document18 pagesFree CFA Mind Maps Level 1 - 2015Jaco Greeff100% (6)

- Saving Capitalism From Short-Termism: How to Build Long-Term Value and Take Back Our Financial FutureFrom EverandSaving Capitalism From Short-Termism: How to Build Long-Term Value and Take Back Our Financial FutureRating: 3.5 out of 5 stars3.5/5 (2)

- Finance For Non Finance - Intro To Financial ManagementDocument45 pagesFinance For Non Finance - Intro To Financial Managementintan deanidaNo ratings yet

- PRC 5 Chap 4 SlidesDocument51 pagesPRC 5 Chap 4 SlidesSyedMaazAliNo ratings yet

- Business Cycles and InflationDocument23 pagesBusiness Cycles and InflationBuen Caloy LlavoreNo ratings yet

- FMPPT 100507015843 Phpapp01Document28 pagesFMPPT 100507015843 Phpapp01Nischay AgarwalNo ratings yet

- IASSS16e Ch13.Ab - AzDocument28 pagesIASSS16e Ch13.Ab - AzLovely DungcaNo ratings yet

- Learning Unit 3busnes MagtDocument19 pagesLearning Unit 3busnes MagtNompumelelo ZuluNo ratings yet

- Presentation On Financial Instrument: Presented by Nishanth H Mba, Rymec BallariDocument19 pagesPresentation On Financial Instrument: Presented by Nishanth H Mba, Rymec BallarivasantharaoNo ratings yet

- 7 Elements of FsDocument29 pages7 Elements of FsAlhaider LagiNo ratings yet

- Payout Policy: B S A 3 - ADocument11 pagesPayout Policy: B S A 3 - AAubrey Joyce SalasNo ratings yet

- Corporate Business LawDocument11 pagesCorporate Business Lawsameer rahimNo ratings yet

- 19UD57 Financial ManagementDocument19 pages19UD57 Financial Management19UD57 Vijay Ananth PNo ratings yet

- Mandatory Converts and Structured ProductsDocument29 pagesMandatory Converts and Structured ProductsAtul YadavNo ratings yet

- Fundamentals of Accounting, Business and Management 2Document85 pagesFundamentals of Accounting, Business and Management 2Louie Jee LabradorNo ratings yet

- Security Analysis and Portfolio ManagementDocument31 pagesSecurity Analysis and Portfolio ManagementAnubhav SonyNo ratings yet

- Labor Relations Module 6-7 Wages Birth of The Wage SystemDocument15 pagesLabor Relations Module 6-7 Wages Birth of The Wage SystemNella ToreNo ratings yet

- AccountsDocument4 pagesAccountsNausheen FatimaNo ratings yet

- International Finance: Concept of Multinational Working Capital ManagementDocument21 pagesInternational Finance: Concept of Multinational Working Capital ManagementGaurav AgrawalNo ratings yet

- Income TaxationDocument19 pagesIncome TaxationNadine LumanogNo ratings yet

- CHP 3 Insurer Ownership, Financial & - Operational StructureDocument24 pagesCHP 3 Insurer Ownership, Financial & - Operational StructureIskandar Zulkarnain Kamalluddin100% (1)

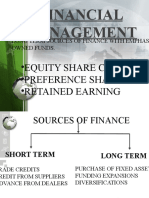

- Financial Management: Sources of FinanceDocument21 pagesFinancial Management: Sources of FinanceananditaNo ratings yet

- Group 5 Wage Structure 1Document22 pagesGroup 5 Wage Structure 1manitomarriz.bipsuNo ratings yet

- Equity SharesDocument11 pagesEquity SharesAbhay H KumarNo ratings yet

- DepreciationDocument6 pagesDepreciationujjawalr9027No ratings yet

- Maruti Suzuki KrrishDocument10 pagesMaruti Suzuki KrrishPushpendra KumarNo ratings yet

- Cost of Capital 4Document5 pagesCost of Capital 4sudarshan1985No ratings yet

- LECTURE 15 N 16 WORKING CAPITAL MANAGEMENTDocument31 pagesLECTURE 15 N 16 WORKING CAPITAL MANAGEMENTVishal AmbadNo ratings yet

- Lecture On Takeover DefenseDocument106 pagesLecture On Takeover DefenseArindom MukherjeeNo ratings yet

- Study Session 02Document15 pagesStudy Session 02firefxyNo ratings yet

- CorporationDocument16 pagesCorporationBrian Daniel BayotNo ratings yet

- Mergers and Acquisitions: AnDocument18 pagesMergers and Acquisitions: AnShruti BarlaNo ratings yet

- Concept of CostDocument10 pagesConcept of Costblackhole4153No ratings yet

- Chapter 2 AbvDocument52 pagesChapter 2 AbvVienne MaceNo ratings yet

- Cash Management Problrms SolvedDocument42 pagesCash Management Problrms SolvedKarthikNo ratings yet

- Unit III. 1 Capital Structure Planning of MSME (Autosaved)Document19 pagesUnit III. 1 Capital Structure Planning of MSME (Autosaved)imnaNo ratings yet

- Working Capital Management - Basic ConceptsDocument15 pagesWorking Capital Management - Basic ConceptsyukiNo ratings yet

- NiSM Exam KeyDocument32 pagesNiSM Exam KeyManish NegiNo ratings yet

- Group 8Document23 pagesGroup 8samuel tettehNo ratings yet

- BAF 462 Investment Analysis and Portfolio Management: Security ValuationDocument54 pagesBAF 462 Investment Analysis and Portfolio Management: Security ValuationLaston MilanziNo ratings yet

- Group 9 Purchasing Department2Document21 pagesGroup 9 Purchasing Department2Lorenz Jedd GuañizoNo ratings yet

- Inventories: Reshyl C. HicaleDocument15 pagesInventories: Reshyl C. HicaleDebbie Grace Latiban LinazaNo ratings yet

- Topic 3 - Working Capital ManagementDocument77 pagesTopic 3 - Working Capital ManagementNiki DimaanoNo ratings yet

- Acc4575 Compare Coverplus CPXDocument2 pagesAcc4575 Compare Coverplus CPXorangecantonNo ratings yet

- Analisis Investasi Tambang - 3Document21 pagesAnalisis Investasi Tambang - 3adrian nurhadiNo ratings yet

- Financing Sources For Indian Companies: by Prof S.Moharana Department of Commerce Utkal UniversityDocument33 pagesFinancing Sources For Indian Companies: by Prof S.Moharana Department of Commerce Utkal UniversityadityajankiNo ratings yet

- MOD8Document27 pagesMOD8Kavitha PichandiNo ratings yet

- Compliance of Buy Back of SharesDocument18 pagesCompliance of Buy Back of Sharesswaraj_chaw1485No ratings yet

- Assignment 3 PPDocument11 pagesAssignment 3 PPNazeeha NazneenNo ratings yet

- Depreciation AccountingDocument9 pagesDepreciation Accountingu1909030No ratings yet

- Fundamentals of Accounting, Business and Management 2Document86 pagesFundamentals of Accounting, Business and Management 2Derek Jason DomanilloNo ratings yet

- Capital Structure, Capitalisation and LeverageDocument53 pagesCapital Structure, Capitalisation and LeverageCollins NyendwaNo ratings yet

- MF Working CapitalDocument81 pagesMF Working CapitalJansen Alonzo BordeyNo ratings yet

- Mod 8Document28 pagesMod 8sri1031No ratings yet

- Working CapitalDocument15 pagesWorking CapitalJoshua CabinasNo ratings yet

- 7 - Adjusting EntriesDocument28 pages7 - Adjusting EntriesBianca RoswellNo ratings yet

- Buy Back of Shares: Miss. Shobha PDocument6 pagesBuy Back of Shares: Miss. Shobha PvcprojectNo ratings yet

- Project Financing Project Financing: Presented By:-Shasmita, SudhansuDocument17 pagesProject Financing Project Financing: Presented By:-Shasmita, SudhansuSabita ChhetryNo ratings yet

- Sport Obermeyer: Group 3Document7 pagesSport Obermeyer: Group 3sheersha kkNo ratings yet

- Working CapitalDocument28 pagesWorking CapitaljannypagalanNo ratings yet

- Paper 10Document111 pagesPaper 10Muralidhar SusvaramNo ratings yet

- Akuntansi - Week 3Document9 pagesAkuntansi - Week 3joddy lintar002No ratings yet

- PK04 NotesDocument24 pagesPK04 NotesBirat Sharma100% (1)

- Date Description PR Debit Credit 2019Document12 pagesDate Description PR Debit Credit 2019Gina Calling DanaoNo ratings yet

- Hilton 11e Chap001Document29 pagesHilton 11e Chap001Hoàng Lan Anh NguyễnNo ratings yet

- CFAB - Accounting - QB - Chapter 10Document14 pagesCFAB - Accounting - QB - Chapter 10Huy NguyenNo ratings yet

- CA Final Audit Q MTP 1 May 2024 Castudynotes ComDocument16 pagesCA Final Audit Q MTP 1 May 2024 Castudynotes Comsonytvhome112233No ratings yet

- 150.curren and Non Current Assets and Liabilities 2Document3 pages150.curren and Non Current Assets and Liabilities 2Melanie SamsonaNo ratings yet

- Adjusting Entry Math LatestDocument4 pagesAdjusting Entry Math LatestOyon Nur newazNo ratings yet

- Bbap2103 - Management Accounting 2016Document16 pagesBbap2103 - Management Accounting 2016yooheechulNo ratings yet

- Norvald Monsen Cameral Accounting As An Alternative To Accrual Accounting WWW Icgfm OrgDocument10 pagesNorvald Monsen Cameral Accounting As An Alternative To Accrual Accounting WWW Icgfm OrgFreeBalanceGRP100% (5)

- Bussniess EthicsDocument23 pagesBussniess EthicsMukesh Manwani100% (1)

- Chapter 1 The Accountancy ProfessionDocument23 pagesChapter 1 The Accountancy Professionsehun ohNo ratings yet

- Auditing I Course OutlineDocument1 pageAuditing I Course OutlineanasfinkileNo ratings yet

- Aud339 Test 2 June 2018 SS 1Document4 pagesAud339 Test 2 June 2018 SS 1NUR LYANA INANI AZMINo ratings yet

- Assistant Accountant Cover LetterDocument8 pagesAssistant Accountant Cover Letterafaocsazx100% (2)

- Du Iba Bba Brochure 2012-2013Document26 pagesDu Iba Bba Brochure 2012-2013William Grant0% (1)

- Equivalent Modules Master ListDocument161 pagesEquivalent Modules Master Listdeelol99No ratings yet

- Test of Controls': School of Business Studies ACCA F8 - Audit & Assurance P2P Session by SK - Test of Controls (TOC) 1/2Document44 pagesTest of Controls': School of Business Studies ACCA F8 - Audit & Assurance P2P Session by SK - Test of Controls (TOC) 1/2Falguni PurohitNo ratings yet

- Zee Entertainment SELL (Recommendation Downgrade) 20240122Document13 pagesZee Entertainment SELL (Recommendation Downgrade) 20240122Rohan KhannaNo ratings yet

- Buscom TableDocument4 pagesBuscom Tablerietzhel22No ratings yet

- History of AccountingDocument4 pagesHistory of AccountingFaith Claire100% (2)

- Salik Prospectous enDocument281 pagesSalik Prospectous enUmar PumpsNo ratings yet

- Director FinanceDocument4 pagesDirector Financeapi-78244370100% (1)

- Comparative Income Statements and Balance Sheets For Merck ($ Millions) FollowDocument6 pagesComparative Income Statements and Balance Sheets For Merck ($ Millions) FollowIman naufalNo ratings yet