Professional Documents

Culture Documents

Coal India - Idirect - 100423 - EBR

Uploaded by

Subhash MsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Coal India - Idirect - 100423 - EBR

Uploaded by

Subhash MsCopyright:

Available Formats

Coal India (COALIN)

CMP: | 223 Target: | 260 (17%) Target Period: 12 months BUY

April 10, 2023

Healthy traction in volume augurs well…

About the stock: Coal India (CIL) is one of the largest coal producers in the world.

Company Update

In FY22, CIL produced 623 million tonnes (MT) while offtake was at 662 MT.

• CIL has 345 mines (as on April 1, 2021) of which 151 are underground, 172 Particulars

open cast and 22 mixed mines Particular Amount

Market Capitalization | 136628 crore

• CIL has extensive mining capabilities. It possesses advanced technology in Total Debt (FY22) | 3310 crore

open cast mining Cash and Bank

| 29179 crore

Key Updates: Balance(FY22)

EV | 110759 crore

• Coal India reported production and offtake volume for March 2023 and for 52 week H/L 263 / 165

FY23. For March 2023, CIL reported production volume of 83.5 million

tonnes (MT), up 4% YoY, while offtake volume for March 2023 was at 64.2 Equity capital | 6162.7 crore

MT, up 3.4% YoY

Face value | 10

• CIL has slightly bettered its FY23 production volume target of 700 MT. For Shareholding pattern

FY23, CIL’s production volume was at 703.2 MT, up 12.9% YoY while offtake (in % ) Mar-22 Jun-22 Sep-22 Dec-22

volume for FY23 was at 694.7 MT, up 5% YoY Promoter 66.1 66.1 66.1 66.1

FIIs 6.9 6.5 6.7 7.9

• For FY24, CIL has given a production and offtake target of 780 MT. Of this, DIIs 21.8 22.5 22.5 21.2

610 MT is likely to meet the power sector’s demand. Hence, going forward, Public 5.2 4.8 4.6 4.8

availability of coal for the non-regulated sector (which includes e-auction Total 100.0 100.0 100.0 100.0

ICICI Securities – Retail Equity Research

volumes) is likely to increase notably in FY24 when compared with FY23.

This augurs well for CIL’s e-auction volumes for FY24E Price Chart

What should investors do? CIL’s share price has given a return of ~30% in the

last 12 months (from ~| 172 in April 2022 to ~| 223 levels in April 2023).

• Coal India reported healthy growth in volume for FY23 wherein it slightly

bettered its production volume guidance of 700 MT. Going forward, we

expect healthy traction in volumes to continue. Hence, we upgrade the stock

from HOLD to BUY

Target Price and Valuation: We value CIL at | 260, 4.5x FY24E EV/EBITDA.

Key triggers for future price performance:

Key Risks

• Over FY22-24E, we expect CIL’s consolidated topline to grow at a CAGR of

7.9% while consolidated EBITDA and consolidated PAT are expected to • Higher-than-expected increase

register a CAGR of 13.5% and 16.4%, respectively in operating costs

• Lower-than-expected increase in

• We expect CIL to report consolidated EBITDA margins of 30.9% for FY23E offtake

and 24.9% for FY24E (EBITDA margin of 22.5% for FY22) Research Analyst

Dewang Sanghavi

Alternate Stock Idea: Besides Coal India, we also like NMDC.

dewang.sanghavi@icicisecurities.com

• NMDC is one of the lowest cost iron ore producer in the world.

• BUY with a target price of | 140

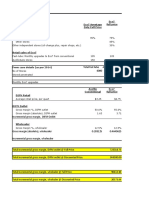

Key Financial Summary

(| Crore) FY19 FY20 FY21 FY22 CAGR in % (FY17-FY22) FY23E FY24E CAGR (FY22-FY24E)

Total Operating Income 99,586 96,080 90,026 1,09,714 5.9% 1,36,051 1,27,670 7.9%

EBITDA 25,006 21,581 18,574 24,691 15.1% 41,651 31,790 13.5%

EBITDA Margin (%) 25.1 22.5 20.6 22.5 30.6 24.9

PAT 17,464 16,700 12,702 17,378 3.8% 30,933 23,543 16.4%

EPS (|) 28.3 27.1 20.6 28.2 50.2 38.2

EV/EBITDA (x) 4.2 5.3 6.6 4.3 2.6 3.5

RoCE (%) 86.3 54.6 42.3 52.0 63.2 40.9

RoE (%) 66.0 51.9 34.8 40.3 50.1 32.3

Source: Company, ICICI Direct Research

Company Update | Coal India ICICI Direct Research

Financial story in charts

Exhibit 1: Trend in production

800 760

703

700 623

602 596

600 We model coal production volume of 760 MT for

million tonne (MT)

500 FY24E

400

300

200

100

0

FY20 FY21 FY22 FY23E FY24E

Source: Company, ICICI Direct Research

Exhibit 2: Trend in offtake

800 750

662 695

700 We model coal offtake volume of 750 MT for FY24E

581 574

.

million tonne (MT)

600

500

400

300

200

100

0

FY20 FY21 FY22 FY23E FY24E

Source: Company, ICICI Direct Research

Exhibit 3: Trend in reported consolidated EBITDA margin (in %)

32.0 30.6

30.0 We expect CIL to report consolidated EBITDA

margin of 30.6% for FY23E and 24.9% for FY24E. We

28.0 expect the company to report EBITDA/tonne of

25.1 | 600/tonne for FY23E and | 424/tonne for FY24E

26.0 24.9

(| 373/tonne for FY22)

(%)

24.0 22.5 22.5

22.0 20.6

20.0

18.0

FY19 FY20 FY20 FY22 FY23E FY24E

Source: Company, ICICI Direct Research

Exhibit 4: Valuation Matrix

Op. Inc. Growth EPS Growth PE EV/EBITDA RoNW RoCE

(| cr) (%) (|) (%) (x) (x) (%) (%)

FY20 96,080 -3.5 27.1 -4.4 8.2 5.3 51.9 54.6

FY21 90,026 -6.3 20.6 -23.9 10.8 6.6 34.8 42.3

FY22 1,09,714 21.9 28.2 36.8 7.9 4.3 40.3 52.0

FY23E 1,36,051 24.0 50.2 78.0 4.4 2.6 50.1 63.2

FY24E 1,27,670 -6.2 38.2 -23.9 5.8 3.5 32.3 40.9

Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 2

Company Update | Coal India ICICI Direct Research

Exhibit 5: Valuation

Particulars Units Mar-24E

EBITDA (FY24E) | crore 31,790

Multiple x 4.5

EV (A) | crore 143054

Gross Debt (FY24E) | crore 3310

Cash and Bank Balance (FY24E) | crore 20,292

Net Cash and Bank Balance (FY24E) (B) in crore 16982

Derived Market Cap (A) + (B) in crore 160036

No. of Equity Shares in crore 616

Target price of Coal India in |/share 260

CMP of Coal India in |/share 223

Upside (%) in % 17%

Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 3

Company Update | Coal India ICICI Direct Research

Financial summary (Consolidated)

Exhibit 6: Profit and loss statement | crore Exhibit 7: Cash flow statement | crore

(Year-end March) FY21 FY22 FY23E FY24E (Year-end March) FY21 FY22 FY23E FY24E

Total Operating Income 90026 109714 136051 127670 Profit after Tax 12702 17378 30933 23543

Growth (%) -6.3 21.9 24.0 -6.2 Add: Depreciation 3709 4429 4421 4642

Total Operating Expenditure 71453 85023 94400 95880 Add: Interest 645 541 555 569

EBITDA 18574 24691 41651 31790 (Inc)/dec in Current Assets -11265 4120 -9476 -3584

Growth (%) -13.9 32.9 68.7 -23.7 Inc/(dec) in CL and Prov. 7595 14171 158 78

Depreciation 3709 4429 4421 4642 CF from operating activities 13387 40639 26590 25248

Interest 645 541 555 569 (Inc)/dec in Investments -3977 -3756 -25 -25

Other Income 3792 3905 4911 5157 (Inc)/dec in Fixed Assets -13115 -15401 -16500 -16500

Share of JV profit / (loss) -3 -9 -249 -274 Others 435 -279 -1000 -1000

PBT 18010 23616 41337 31462 CF from investing activities -16658 -19437 -17525 -17525

Total Tax 5307 6238 10405 7919 Issue/(Buy back) of Equity 0 0 0 0

PAT 12702 17378 30933 23543 Inc/(dec) in loan funds -551 -2566 0 0

Growth (%) -23.9 36.8 78.0 -23.9 Interest Paid -645 -541 -555 -569

EPS (|) 20.6 28.2 50.2 38.2 Dividend paid & dividend tax -9860 -10477 -12325 -12325

Source: Company, ICICI Direct Research Others 3188 4249 50 50

CF from financing activities -7867 -9334 -12830 -12844

Net Cash flow -11139 11869 -3765 -5121

Opening Cash 28449 17310 29179 25413

Closing Cash 17310 29179 25413 20292

Source: Company, ICICI Direct Research

Exhibit 8 : Balance sheet | crore Exhibit 9 :Key ratios | crore

(Year-end March) FY21 FY22 FY23E FY24E (Year-end March) FY21 FY22 FY23E FY24E

Liabilities Per share data (|)

Equity Share Capital 6163 6163 6163 6163 EPS 20.6 28.2 50.2 38.2

Reserve and Surplus 30355 36980 55588 66805 Cash EPS 26.6 35.4 57.4 45.7

Total Shareholders funds 36517 43143 61750 72968 BV 59.3 70.0 100.2 118.4

Total Debt 5875 3310 3310 3310 DPS 16.0 17.0 22.5 22.5

Minority Interest 441 674 724 774 Cash Per Share 28.1 47.3 41.2 32.9

Total Liabilities 42834 47126 65784 77051 Operating Ratios (% )

Assets EBITDA Margin 20.6 22.5 30.6 24.9

Gross Block 95796 104594 119094 133594 PBT / Total Operating income 20.0 21.5 30.4 24.6

Less: Acc Depreciation 53305 57733 62154 66796 PAT Margin 14.1 15.8 22.7 18.4

Net Block 42491 46861 56940 66798 Inventory days 46 30 35 35

CWIP 10404 12714 14714 16714 Debtor days 87 41 42 45

Investments 5950 9706 9731 9756 Creditor days 49 43 35 35

Inventory 8947 7076 9052 9194 Return Ratios (% )

Debtors 19623 11368 15368 15059 Adj RoE 34.8 40.3 50.1 32.3

Loans and Advances 13658 14886 15886 17386 Adj RoCE 42.3 52.0 63.2 40.9

Other Current Assets 41051 45830 48330 50580 Valuation Ratios (x )

Cash 17310 29179 25413 20292 P/E 10.8 7.9 4.4 5.8

Total Current Assets 100590 108338 114049 112511 EV / EBITDA 6.6 4.3 2.6 3.5

Current Liabilities 49301 61190 58848 56426 EV / Net Sales 1.4 1.0 0.8 0.9

Provisions 69645 71927 74427 76927 Market Cap / Sales 1.5 1.2 1.0 1.1

Current Liabilities & Prov 118946 133117 133275 133353 Price to Book Value 3.7 3.2 2.2 1.9

Net Current Assets -18356 -24778 -19226 -20842 Solvency Ratios

Others 2345 2624 3624 4624 Debt/EBITDA 0.3 0.1 0.1 0.1

Application of Funds 42834 47126 65784 77051 Debt / Equity 0.2 0.1 0.1 0.0

Source: Company, ICICI Direct Research Current Ratio 0.8 0.8 0.9 0.8

Quick Ratio 0.8 0.8 0.8 0.8

Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 4

Company Update | Coal India ICICI Direct Research

RATING RATIONALE

ICICI Direct endeavours to provide objective opinions and recommendations. ICICI Direct assigns ratings to its

stocks according to their notional target price vs. current market price and then categorizes them as Buy, Hold,

Reduce and Sell. The performance horizon is two years unless specified and the notional target price is defined

as the analysts' valuation for a stock

Buy: >15%

Hold: -5% to 15%;

Reduce: -15% to -5%;

Sell: <-15%

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com

ICICI Direct Research Desk,

ICICI Securities Limited,

1st Floor, Akruti Trade Centre,

Road No 7, MIDC,

Andheri (East)

Mumbai – 400 093

research@icicidirect.com

ICICI Securities | Retail Research 5

Company Update | Coal India ICICI Direct Research

ANALYST CERTIFICATION

I/We, Dewang Sanghavi MBA (Finance), Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately

reflect our views about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or

view(s) in this report. It is also confirmed that above mentioned Analysts of this report have not received any compensation from the companies mentioned in the report in the preceding

twelve months and do not serve as an officer, director or employee of the companies mentioned in the report.

Terms & conditions and other disclosures:

ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products.

ICICI Securities is Sebi registered stock broker, merchant banker, investment adviser, portfolio manager and Research Analyst. ICICI Securities is registered with Insurance Regulatory Development Authority of India Limited (IRDAI)

as a composite corporate agent and with PFRDA as a Point of Presence. ICICI Securities Limited Research Analyst SEBI Registration Number – INH000000990. ICICI Securities Limited SEBI Registration is INZ000183631 for stock

broker. ICICI Securities is a subsidiary of ICICI Bank which is India’s largest private sector bank and has its various subsidiaries engaged in businesses of housing finance, asset management, life insurance, general insurance, venture

capital fund management, etc. (“associates”), the details in respect of which are available on www.icicibank.com.

ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment banking and other business relationship

with a significant percentage of companies covered by our Investment Research Department. ICICI Securities and its analysts, persons reporting to analysts and their relatives are generally prohibited from maintaining a financial

interest in the securities or derivatives of any companies that the analysts cover.

Recommendation in reports based on technical and derivative analysis centre on studying charts of a stock's price movement, outstanding positions, trading volume etc as opposed to focusing on a company's fundamentals and, as

such, may not match with the recommendation in fundamental reports. Investors may visit icicidirect.com to view the Fundamental and Technical Research Reports.

Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein.

ICICI Securities Limited has two independent equity research groups: Institutional Research and Retail Research. This report has been prepared by the Retail Research. The views and opinions expressed in this document may or may

not match or may be contrary with the views, estimates, rating, and target price of the Institutional Research.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and meant solely for the selected

recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities. While we would

endeavour to update the information herein on a reasonable basis, ICICI Securities is under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI

Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in

circumstances where ICICI Securities might be acting in an advisory capacity to this company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This report and information herein

is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Though disseminated to all the customers

simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting

and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who

must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient.

The recipient should independently evaluate the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities accepts no liabilities

whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks

associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice.

ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve months.

ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of managing or co-

managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction.

ICICI Securities or its associates might have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the companies mentioned in the report in the past

twelve months.

ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its associates or its analysts did not receive any compensation or other

benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI Securities nor Research Analysts and their relatives have any material conflict of

interest at the time of publication of this report.

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

ICICI Securities or its subsidiaries collectively or Research Analysts or their relatives do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of

the research report.

Since associates of ICICI Securities and ICICI Securities as a entity are engaged in various financial service businesses, they might have financial interests or actual/ beneficial ownership of one percent or more or other material

conflict of interest various companies including the subject company/companies mentioned in this report.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report.

We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or

use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in

all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction.

ICICI Securities | Retail Research 6

You might also like

- IDirect CoalIndia Q3FY23Document6 pagesIDirect CoalIndia Q3FY23Sandy SandyNo ratings yet

- Irect TataSteel Q2FY23Document8 pagesIrect TataSteel Q2FY23jeff bezozNo ratings yet

- IDirect JSWSteel Q4FY22Document10 pagesIDirect JSWSteel Q4FY22Porus Saranjit SinghNo ratings yet

- 21163011142022216coal India Limited - 20221116Document5 pages21163011142022216coal India Limited - 20221116Sandy SandyNo ratings yet

- Coal India: Steady Performance...Document8 pagesCoal India: Steady Performance...Tejas ShahNo ratings yet

- Report On Eicher Motors 1Document4 pagesReport On Eicher Motors 1HARSH GARODIANo ratings yet

- (Kotak) Cummins India, July 18, 2022Document11 pages(Kotak) Cummins India, July 18, 2022Abhishek SaxenaNo ratings yet

- ICICI Direct Century Plyboards IndiaDocument10 pagesICICI Direct Century Plyboards IndiaTai TranNo ratings yet

- Investor Presentation FY20Document49 pagesInvestor Presentation FY20Nitin ParasharNo ratings yet

- Sagar Cements Initial (Geojit)Document10 pagesSagar Cements Initial (Geojit)beza manojNo ratings yet

- JM - SailDocument10 pagesJM - SailSanjay PatelNo ratings yet

- Hindalco Industries LTD - Q3FY24 Result Update - 14022024 - 14-02-2024 - 14Document9 pagesHindalco Industries LTD - Q3FY24 Result Update - 14022024 - 14-02-2024 - 14Nikhil GadeNo ratings yet

- In Line Performance... : (Natmin) HoldDocument10 pagesIn Line Performance... : (Natmin) HoldMani SeshadrinathanNo ratings yet

- 4716156162022739schneider Electric Infrastructure Ltd. Q4FY22 - SignedDocument5 pages4716156162022739schneider Electric Infrastructure Ltd. Q4FY22 - SignedbradburywillsNo ratings yet

- Ultratech Cement: Cost Optimisation Drive To Scale Up ProfitabilityDocument10 pagesUltratech Cement: Cost Optimisation Drive To Scale Up ProfitabilityRohan AgrawalNo ratings yet

- Prabhudas Lilladher Sees 7% UPSIDE in Pidilite Industries StrongDocument8 pagesPrabhudas Lilladher Sees 7% UPSIDE in Pidilite Industries StrongDhaval MailNo ratings yet

- Dixon Technologies (India) Limited: Financial HighlightsDocument5 pagesDixon Technologies (India) Limited: Financial HighlightsdarshanmaldeNo ratings yet

- Cummins India (KKC IN) : Analyst Meet UpdateDocument5 pagesCummins India (KKC IN) : Analyst Meet UpdateADNo ratings yet

- Ramco Cement Q2FY24 ResultsDocument8 pagesRamco Cement Q2FY24 ResultseknathNo ratings yet

- Cochin Shipyard: Capital GoodsDocument8 pagesCochin Shipyard: Capital GoodsSonakshi AgarwalNo ratings yet

- ANTONY WASTE HSL Initiating Coverage 190122Document17 pagesANTONY WASTE HSL Initiating Coverage 190122Tejesh GoudNo ratings yet

- SAIL - Q1FY23 - Result Update - 12082022 - 12-08-2022 - 17Document8 pagesSAIL - Q1FY23 - Result Update - 12082022 - 12-08-2022 - 17ayushNo ratings yet

- Diwali Dhanotsav Portfolio 2023Document22 pagesDiwali Dhanotsav Portfolio 2023pramodkgowda3No ratings yet

- Bosch LTD (BOSLIM) : Multiple Variables Drag Margins!Document13 pagesBosch LTD (BOSLIM) : Multiple Variables Drag Margins!SahanaNo ratings yet

- KNR Constructions: Execution Momentum To SustainDocument12 pagesKNR Constructions: Execution Momentum To SustainRishabh RanaNo ratings yet

- Dixon Technologies Q4 Result Update Nirmal BangDocument8 pagesDixon Technologies Q4 Result Update Nirmal BangSwati 45No ratings yet

- IDirect MarutiSuzuki Q2FY19Document12 pagesIDirect MarutiSuzuki Q2FY19Rajani KantNo ratings yet

- Motilal Oswal Sees 18% UPSDIE in Coal India Robust Volume GrowthDocument18 pagesMotilal Oswal Sees 18% UPSDIE in Coal India Robust Volume GrowthDhaval MailNo ratings yet

- Healthy Market Share Gains - VESUVIUS INDIADocument7 pagesHealthy Market Share Gains - VESUVIUS INDIAsarvo_44No ratings yet

- Reliance Jan 2024Document56 pagesReliance Jan 2024jaikumar608jainNo ratings yet

- 25 March 2023Document35 pages25 March 2023Flavio SiqueiraNo ratings yet

- OGDCL Full Year (FY 2021) Results Presentation - 0Document11 pagesOGDCL Full Year (FY 2021) Results Presentation - 0Elishba MustafaNo ratings yet

- 05january2024 India DailyDocument155 pages05january2024 India Dailypradeep kumarNo ratings yet

- Engineers India 09 08 2023 PrabhuDocument7 pagesEngineers India 09 08 2023 PrabhuHKHRHKHRNo ratings yet

- Deepak Nitrite - FinalDocument24 pagesDeepak Nitrite - Finalvajiravel407No ratings yet

- IDirect CenturyPly Q3FY22Document9 pagesIDirect CenturyPly Q3FY22Tai TranNo ratings yet

- Asahi India Glass Uljk 24062022 62b591700001e6ef3fc20002Document7 pagesAsahi India Glass Uljk 24062022 62b591700001e6ef3fc20002darshanmaldeNo ratings yet

- Praj Industries LTD - Q1FY24 Result Update - 28072023 - 28-07-2023 - 11Document8 pagesPraj Industries LTD - Q1FY24 Result Update - 28072023 - 28-07-2023 - 11samraatjadhavNo ratings yet

- EdgeReport IDEA ConcallAnalysis 11-05-2022 294Document2 pagesEdgeReport IDEA ConcallAnalysis 11-05-2022 294prashant_natureNo ratings yet

- Morning - India 20210831 Mosl Mi PG010Document10 pagesMorning - India 20210831 Mosl Mi PG010vikalp123123No ratings yet

- AIA Engineering - Q4FY22 Result Update - 30 May 2022Document7 pagesAIA Engineering - Q4FY22 Result Update - 30 May 2022PavanNo ratings yet

- Q3FY22 Result Update Indo Count Industries LTD: Steady Numbers FY22E Volume Guidance ReducedDocument10 pagesQ3FY22 Result Update Indo Count Industries LTD: Steady Numbers FY22E Volume Guidance ReducedbradburywillsNo ratings yet

- MM Forgings (Q1FY24 Result Update) - 15-Aug-2023Document10 pagesMM Forgings (Q1FY24 Result Update) - 15-Aug-2023instiresmilanNo ratings yet

- Indian Hotel - Q4FY22 Results - DAMDocument8 pagesIndian Hotel - Q4FY22 Results - DAMRajiv BharatiNo ratings yet

- Asian-Paints Broker ReportDocument7 pagesAsian-Paints Broker Reportsj singhNo ratings yet

- Sustainable & Low-Carbon Future: Q3 and 9M FY2022 Earnings PresentationDocument25 pagesSustainable & Low-Carbon Future: Q3 and 9M FY2022 Earnings PresentationbbbsharmaNo ratings yet

- IDirect KalpataruPower Q2FY20Document10 pagesIDirect KalpataruPower Q2FY20QuestAviatorNo ratings yet

- HMCL 20240211 Mosl Ru PG012Document12 pagesHMCL 20240211 Mosl Ru PG012Realm PhangchoNo ratings yet

- Vedanta: CMP: INR320 TP: INR330 (+3%)Document14 pagesVedanta: CMP: INR320 TP: INR330 (+3%)Arun KumarNo ratings yet

- Company Update Indo Count Industries LTD.: Increase in Capacity Would Provide Room To Facilitate Booming Export OrdersDocument8 pagesCompany Update Indo Count Industries LTD.: Increase in Capacity Would Provide Room To Facilitate Booming Export OrdersbradburywillsNo ratings yet

- KEC International 01 01 2023 PrabhuDocument7 pagesKEC International 01 01 2023 Prabhusaran21No ratings yet

- Finance M-5Document30 pagesFinance M-5Vrutika ShahNo ratings yet

- Ajmera Realty and Infra LTD Analyst MeetingDocument7 pagesAjmera Realty and Infra LTD Analyst Meetingarunohri2017No ratings yet

- Geojit On Power MechDocument5 pagesGeojit On Power MechDhittbanda GamingNo ratings yet

- Q2FY22 Result Update Indo Count Industries LTD: Higher Realization Aids FinancialsDocument10 pagesQ2FY22 Result Update Indo Count Industries LTD: Higher Realization Aids FinancialsbradburywillsNo ratings yet

- Sterlite Technologies (STETEC) : Export Demand Drives GrowthDocument10 pagesSterlite Technologies (STETEC) : Export Demand Drives Growthsaran21No ratings yet

- CHAMBLFERT 19052022210352 InvestorPresentation310322Document30 pagesCHAMBLFERT 19052022210352 InvestorPresentation310322bradburywillsNo ratings yet

- Management Accountant Paper 2.2 Dec 2023Document19 pagesManagement Accountant Paper 2.2 Dec 2023MEYVIELYKERNo ratings yet

- ExpectDocument7 pagesExpectPRIYANKA KNo ratings yet

- AT&T Stock Valuation With Dividend Discount ModelDocument1 pageAT&T Stock Valuation With Dividend Discount ModelSubhash MsNo ratings yet

- Subhash Ms Intern ReportDocument29 pagesSubhash Ms Intern ReportSubhash MsNo ratings yet

- Campus ActivewearDocument12 pagesCampus ActivewearSubhash MsNo ratings yet

- Canara Organisation Study Report.Document31 pagesCanara Organisation Study Report.Subhash MsNo ratings yet

- Online AdvertisingDocument56 pagesOnline AdvertisingGaryNo ratings yet

- TEA RulesDocument820 pagesTEA RulesCBS Austin WebteamNo ratings yet

- Supply Chain ProcessesDocument4 pagesSupply Chain Processesgaurav kumarNo ratings yet

- Quiz 1 Modules 1 To 3Document6 pagesQuiz 1 Modules 1 To 3Nicole ConcepcionNo ratings yet

- BrandingDocument6 pagesBrandingSheina FugabanNo ratings yet

- Corporate Behavioural Finance Chap06Document14 pagesCorporate Behavioural Finance Chap06zeeshanshanNo ratings yet

- Wharton PE Certificate ProgramDocument29 pagesWharton PE Certificate ProgramRayanNo ratings yet

- Kuis 4Document12 pagesKuis 4Sakina Nusarifa TantriNo ratings yet

- From Exhibit 6 Eco7 Full PriceDocument2 pagesFrom Exhibit 6 Eco7 Full PriceNerd NerdNo ratings yet

- Delta Spinners 2010Document41 pagesDelta Spinners 2010bari.sarkarNo ratings yet

- Taxation Part 2Document101 pagesTaxation Part 2Akeefah BrockNo ratings yet

- Chapter 5: How To Value Bonds and StocksDocument16 pagesChapter 5: How To Value Bonds and StocksmajorkonigNo ratings yet

- CADBURY - Marketing StretegyDocument25 pagesCADBURY - Marketing StretegyChetan Panara100% (1)

- Final Marketing Strategies For New Market EntriesDocument29 pagesFinal Marketing Strategies For New Market EntriesAmit ShrivastavaNo ratings yet

- Chapter 2 - MCQ - Basic Cost Management ConceptsDocument8 pagesChapter 2 - MCQ - Basic Cost Management Conceptslalith4uNo ratings yet

- IFRS 4 Basis For ConclusionsDocument87 pagesIFRS 4 Basis For ConclusionsMariana Mirela0% (1)

- DescrepaniesDocument21 pagesDescrepaniesHoward boiNo ratings yet

- 9722 Fujita Kanko Inc CompanyFinancialSummary 20180314222612Document5 pages9722 Fujita Kanko Inc CompanyFinancialSummary 20180314222612DamTokyoNo ratings yet

- MKT 501 - CH 567810 (F02)Document12 pagesMKT 501 - CH 567810 (F02)Hasnat nahid HimelNo ratings yet

- INFOTECH 2: Accounting Information SystemDocument5 pagesINFOTECH 2: Accounting Information SystemMaricris AbadNo ratings yet

- Quiz 6 - Answer KeyDocument3 pagesQuiz 6 - Answer KeyAigerim SerikkazinovaNo ratings yet

- Anjo Damiles Lugaw Sales PresentationDocument15 pagesAnjo Damiles Lugaw Sales PresentationLeynard ColladoNo ratings yet

- Chapter 5 Property Plant and EquipmentDocument41 pagesChapter 5 Property Plant and EquipmentHammad Ahmad100% (8)

- Wa0020.Document44 pagesWa0020.ishfana ibrahimNo ratings yet

- Difference Between Marketing and Sales ManagementDocument6 pagesDifference Between Marketing and Sales ManagementAdi PatelNo ratings yet

- Saxo Options BrochureDocument35 pagesSaxo Options Brochuremickael28No ratings yet

- Acc 1013 Trial Quiz 1Document2 pagesAcc 1013 Trial Quiz 1Imran FarhanNo ratings yet

- Quick Guide On IT Audit With Analytics v2023Document146 pagesQuick Guide On IT Audit With Analytics v2023allaccessa01No ratings yet

- Final Project C - Adidas GroupDocument14 pagesFinal Project C - Adidas GroupRabi Gurudatta LamichhaneNo ratings yet

- Assingment SCM SEM4 - 1Document17 pagesAssingment SCM SEM4 - 1KARTHIYAENI VNo ratings yet