Professional Documents

Culture Documents

Cola Memo

Uploaded by

Charles Turner0 ratings0% found this document useful (0 votes)

5 views1 pageOriginal Title

cola-memo

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageCola Memo

Uploaded by

Charles TurnerCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

MEMORANDUM

TO: Abby Spieler, Executive Director

FROM: Jenny Bayne, Benefit Auditor

SUBJECT: 2023 Retiree Cost-of-Living Adjustments

DATE: January 17, 2023

In accordance with Sections 104.415.5 & 104.1045.2, the annual COLA increase is determined

each January based on the percentage increase in the average consumer price index from the

previous year. I have made the following computations for the year 2023 based on information

received from the U.S. Department of Labor.

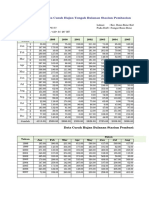

Consumer Price Index for All Urban Consumers (CPI-U)

Month 2021 2022

January 261.582 281.148

February 263.014 283.716

March 264.877 287.504

April 267.054 289.109

May 269.195 292.296

June 271.696 296.311

July 273.003 296.276

August 273.567 296.171

September 274.310 296.808

October 276.589 298.012

November 277.948 297.711

December 278.802 296.797

270.97 292.655

Increase (292.655-270.97)/ 270.97= 8.003% X 80% = 6.402% (max COLA 5.0%)

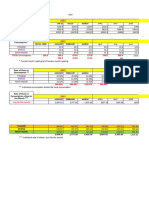

The COLA rate of 5% will be effective for all retirees of the MSEP and MSEP2000 plans. The

COLA rate of 5% will be effective for all retirees of the MSEP2011 plan who are eligible, and not

excluded due to COLA offset in accordance with Section 104.1091.12.

You might also like

- PriceDocument7 pagesPriceVelmurugan ElumalaiNo ratings yet

- Chapter - 4 Data Analysis and Interpretation Moving Average Method 1. Bajaj Elecatricals Table 4.1.1 Bajaj Electricals For The Year 2015Document12 pagesChapter - 4 Data Analysis and Interpretation Moving Average Method 1. Bajaj Elecatricals Table 4.1.1 Bajaj Electricals For The Year 2015Temporary MailNo ratings yet

- BEXIMCO MARICO BRAC BANK STOCK PRICEDocument27 pagesBEXIMCO MARICO BRAC BANK STOCK PRICENameera AlamNo ratings yet

- Data On Sri Lanka Money Policy by CBSLDocument7 pagesData On Sri Lanka Money Policy by CBSLNishantha FernandoNo ratings yet

- T Year Month Demand MA (4) CMA (4) S, I S: Regression StatisticsDocument8 pagesT Year Month Demand MA (4) CMA (4) S, I S: Regression StatisticsAilene QuintoNo ratings yet

- Managerial Economics Midterm Exam AnalysisDocument8 pagesManagerial Economics Midterm Exam AnalysisAilene QuintoNo ratings yet

- Managerial Economics Midterm Exam AnalysisDocument8 pagesManagerial Economics Midterm Exam AnalysisAilene QuintoNo ratings yet

- Ejercicio 12Document28 pagesEjercicio 12Valeria SandovalNo ratings yet

- JA, MUST and DGridDocument6 pagesJA, MUST and DGridAlmu'tasem Al-SaryrehNo ratings yet

- EQProfitLossDetailsDocument2 pagesEQProfitLossDetailsVijaykumar D SNo ratings yet

- Monthly Averages of Air Temperatures (In Celsius) and Amount of Rainfall in Lake Taal From 2000 - 2011Document33 pagesMonthly Averages of Air Temperatures (In Celsius) and Amount of Rainfall in Lake Taal From 2000 - 2011Brian PaguiaNo ratings yet

- Assignment 1Document20 pagesAssignment 1Nour FawazNo ratings yet

- Fajar 18650015 Kelas A Tugas UAS Manajemen Data Metode Moving Average Dan Statical Line MethodDocument6 pagesFajar 18650015 Kelas A Tugas UAS Manajemen Data Metode Moving Average Dan Statical Line MethodFajar AjaNo ratings yet

- Emp 13 Feb 2024Document38 pagesEmp 13 Feb 2024Khuram ShazadNo ratings yet

- QM - Forecasting - AssignmentDocument2 pagesQM - Forecasting - AssignmentVikash Kumar AgrawalNo ratings yet

- Forecasting - Transaction Month of Year 1Document7 pagesForecasting - Transaction Month of Year 1Minza JahangirNo ratings yet

- Blank For Seasonality Forecasting - Naura ZahraniaDocument10 pagesBlank For Seasonality Forecasting - Naura ZahraniaNaura ZahraniaNo ratings yet

- Excel D Đoán PL3Document9 pagesExcel D Đoán PL3kenkoroNo ratings yet

- PVGIS-5 MonthlyRadiation 32.063 - 4.502 Undefined 2005-2020Document3 pagesPVGIS-5 MonthlyRadiation 32.063 - 4.502 Undefined 2005-2020Chaimae BoualiNo ratings yet

- Dataset For Linear Trend and Seasonality Forecasting ExampleDocument54 pagesDataset For Linear Trend and Seasonality Forecasting ExampleManali GawariNo ratings yet

- TOTAL (Revenue and Non-Revenue) Change: Enplaned / Deplaned PassengersDocument8 pagesTOTAL (Revenue and Non-Revenue) Change: Enplaned / Deplaned PassengersNicholas FrancoNo ratings yet

- SahamDocument40 pagesSahamERANo ratings yet

- Treasury Bill Rates Over TimeDocument3 pagesTreasury Bill Rates Over TimeHarry Jay CaviteNo ratings yet

- MANECON SeatworkDocument6 pagesMANECON SeatworkMARY ROSENo ratings yet

- EDCOM Report 2021 Souvenir Program 2Document3 pagesEDCOM Report 2021 Souvenir Program 2Daenarys VeranoNo ratings yet

- Trading Plan Compounding PNLDocument256 pagesTrading Plan Compounding PNLAdhitiya PersadaNo ratings yet

- Stats 2022Document1 pageStats 2022Judith CortezNo ratings yet

- Forecast new product sales with decomposition methodDocument1 pageForecast new product sales with decomposition methodUR ArjunNo ratings yet

- Treasury Bill Rates: For The Period Indicated Rates in PercentDocument1 pageTreasury Bill Rates: For The Period Indicated Rates in PercentLeica JaymeNo ratings yet

- Off-Grid Claculation and SLDDocument6 pagesOff-Grid Claculation and SLDAlmu'tasem Al-SaryrehNo ratings yet

- JA, SOFAR and DGridDocument5 pagesJA, SOFAR and DGridAlmu'tasem Al-SaryrehNo ratings yet

- Treasury Bill Rate 2012 To 2020Document3 pagesTreasury Bill Rate 2012 To 2020Agnes Bianca MendozaNo ratings yet

- Akhir Periode Uang Kartal Uang Giral Jumlah (M1) Uang Kuasi Surat Berharga Selain Saham Jumlah (M2)Document4 pagesAkhir Periode Uang Kartal Uang Giral Jumlah (M1) Uang Kuasi Surat Berharga Selain Saham Jumlah (M2)Gagan HermawanNo ratings yet

- NRECA MakasarDocument167 pagesNRECA MakasarDhian CahayaniNo ratings yet

- Seasonal It yDocument10 pagesSeasonal It yjena_01No ratings yet

- Caraga State University: College of Agriculture and Agri-Industries Ampayon, Butuan CityDocument13 pagesCaraga State University: College of Agriculture and Agri-Industries Ampayon, Butuan CityGaryong VlogNo ratings yet

- Projected Sales Volume (Daily) No of Customers Sales (Peso)Document7 pagesProjected Sales Volume (Daily) No of Customers Sales (Peso)PatOcampoNo ratings yet

- Summary of December 2020 Visitor Arrivals 29Document6 pagesSummary of December 2020 Visitor Arrivals 29Jay KingNo ratings yet

- mts0719 PDFDocument202 pagesmts0719 PDFDevon Gilbert YatesNo ratings yet

- Consumer Price IndexDocument8 pagesConsumer Price IndexDeborah ChiramboNo ratings yet

- Book 1Document2 pagesBook 1Mark CalicaNo ratings yet

- Todate Rainfall 2019 Vs 2020Document10 pagesTodate Rainfall 2019 Vs 2020Kamal AzmanNo ratings yet

- hai-01-2024-housing-affordability-index-2024-03-08Document1 pagehai-01-2024-housing-affordability-index-2024-03-08api-737532809No ratings yet

- CURSLDocument60 pagesCURSLРадомир МутабџијаNo ratings yet

- Electricity Reading: Tiangge Divene Main MeterDocument6 pagesElectricity Reading: Tiangge Divene Main MeterVee MarieNo ratings yet

- Pia EaDocument7 pagesPia EaAlejandro SánchezNo ratings yet

- Energy ConsumedDocument12 pagesEnergy ConsumedMuhammad MurtazaNo ratings yet

- PVGIS-5 MonthlyRadiation 10.603 14.328 Undefined 2005-2020 PDFDocument1 pagePVGIS-5 MonthlyRadiation 10.603 14.328 Undefined 2005-2020 PDFFidelesNo ratings yet

- Sales ReportDocument31 pagesSales Reportvinodh kumarNo ratings yet

- Distribusi Probabilitas A. DP GumbelDocument15 pagesDistribusi Probabilitas A. DP GumbelNoval AznurNo ratings yet

- Monthwise Rainfall MizoramDocument1 pageMonthwise Rainfall MizoramAshwani KumarNo ratings yet

- EQCapitalGainsDetails 2Document2 pagesEQCapitalGainsDetails 2Varad MalpureNo ratings yet

- Consumer Price Index (February 2019 100)Document8 pagesConsumer Price Index (February 2019 100)rzvendiya-1No ratings yet

- BRI Kredit Investasi May 2023Document2 pagesBRI Kredit Investasi May 2023armanNo ratings yet

- Decison Model Case-StudyDocument26 pagesDecison Model Case-StudyUmt BbisNo ratings yet

- Excel ProjectDocument6 pagesExcel Projectapi-353167521No ratings yet

- Arkan's Chicken Citeureup 2021.xlsx - 1Document17 pagesArkan's Chicken Citeureup 2021.xlsx - 1suwarno sanusiNo ratings yet

- FredgraphDocument2 pagesFredgraphnghitran.31211021469No ratings yet

- Calculate Beta (3 Different Methods)Document10 pagesCalculate Beta (3 Different Methods)VISHAL PATILNo ratings yet