Professional Documents

Culture Documents

Book 1

Book 1

Uploaded by

Deshraj 53220 ratings0% found this document useful (0 votes)

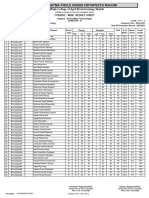

3 views3 pagesThe document contains financial data for three bank branches - B.O. Dhanotu, B.O. Sunder Nagar, and B.O. Chatrokhri - for the fiscal years 2020, 2021, and 2022. It includes data on CASA deposits, CASA/TD ratios, CD ratios, and loans for each branch. The data shows growth rates for various metrics between 2021 and 2022 for comparison across the branches.

Original Description:

Original Title

Book1

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains financial data for three bank branches - B.O. Dhanotu, B.O. Sunder Nagar, and B.O. Chatrokhri - for the fiscal years 2020, 2021, and 2022. It includes data on CASA deposits, CASA/TD ratios, CD ratios, and loans for each branch. The data shows growth rates for various metrics between 2021 and 2022 for comparison across the branches.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views3 pagesBook 1

Book 1

Uploaded by

Deshraj 5322The document contains financial data for three bank branches - B.O. Dhanotu, B.O. Sunder Nagar, and B.O. Chatrokhri - for the fiscal years 2020, 2021, and 2022. It includes data on CASA deposits, CASA/TD ratios, CD ratios, and loans for each branch. The data shows growth rates for various metrics between 2021 and 2022 for comparison across the branches.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

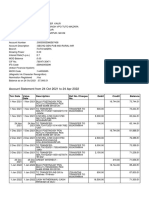

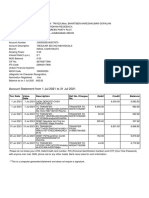

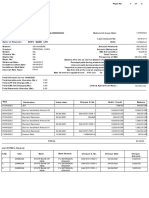

FY F.Y. 2020 F.Y. 2021 F.Y.

2022

Branch In lakhs In lakhs In lakhs Growth %age(21-22)

B.O. Dhanotu 1444 1605 1788.1 0.1141011

CASA DEP

B.O. Sunder Nagar 5259.1 5274.2 5186 -0.0167286

B.O. Chatrokhri 1942.1 2371.5 2274.1 -0.0410663

FY F.Y. 2020 F.Y. 2021 F.Y. 2022

casa/td Branch In lakhs In lakhs In lakhs Growth %age(21-22)

B.O. Dhanotu 0.24 0.26 0.28 0.076923076923077

B.O. Sunder Nagar 0.303 0.297 0.292 -0.01683501683502

B.O. Chatrokhri 0.24 0.28 0.26 -0.07142857142857

FY F.Y. 2020 F.Y. 2021 F.Y. 2022

CD ratio Branch In lakhs In lakhs In lakhs Growth %age(21-22)

B.O. Dhanotu 22.08 22.65 23.78 0.049889625

B.O. Sunder Nagar 45 44.54 44.95 0.009205209

B.O. Chatrokhri 16.32 16.68 20.81 0.247601918

FY F.Y. 2020 F.Y. 2021 F.Y. 2022

Branch In lakhs In lakhs In lakhs Growth %age(21-22)

Loans B.O. Dhanotu 1287.73 1395.52 1500.84 0.075470076

B.O. Sunder Nagar 7792.72 7816.64 7961.16 0.018488762

B.O. Chatrokhri 1284.55 1411.47 1811.48 0.283399576

Serial no. Title Page no.

1 Introduction

1.1 Introduction

1.2 Major functions of Indian Banks

1.3 Different types of banks

1.4. State Cooperative Bank

1.5 Significance of State Cooperative bank

1.6 Features of State Cooperative bank

1.7 Advantages of State Cooperative Bank

1.8 Profile of HPSCB

1.9 Performance of HPSCB

1.1 Objectives of study

1.11 Research Methodology

2 Data Analysis And Interpretation

2.1 Deposits

2.2 Loan/advances

2.3 Credit Deposit (CD) Ratio

2.4 Current account and Saving account (CASA)

2.5 Non-performing Assets (NPA)

3 Findings and Suggestions

4 Conclusions

5 References

You might also like

- Ellen G. White's Pillar of BaalDocument25 pagesEllen G. White's Pillar of Baaljerushah75% (4)

- Workbook Miss AwfulDocument5 pagesWorkbook Miss Awfulputri mayolaNo ratings yet

- Balantang Memorial Cemetery National ShrineDocument6 pagesBalantang Memorial Cemetery National ShrineJoahnna Paula CorpuzNo ratings yet

- ADM 2372, Assignment #2Document8 pagesADM 2372, Assignment #2Daniela Diaz ParedesNo ratings yet

- The Development of Telecommunications Industry in The PhilippinesDocument3 pagesThe Development of Telecommunications Industry in The PhilippinesHubert SemenianoNo ratings yet

- Industrial FinanceDocument9 pagesIndustrial FinancelovleshrubyNo ratings yet

- Net NPA As Percentage of Net Advance Public & Private Sector BanksDocument1 pageNet NPA As Percentage of Net Advance Public & Private Sector BanksPankaj MaryeNo ratings yet

- HDFC Bank LTDDocument1 pageHDFC Bank LTDKhushi JainNo ratings yet

- SEBI Bulletin August 2022 PDocument32 pagesSEBI Bulletin August 2022 Pcontact.corporatewandNo ratings yet

- International Journal of Business and Management Invention (IJBMI)Document37 pagesInternational Journal of Business and Management Invention (IJBMI)inventionjournalsNo ratings yet

- Business Ethics NotesDocument4 pagesBusiness Ethics NotesPawandeep MannNo ratings yet

- ZWD 4 Z Xa BB W43 EYy 8Document1 pageZWD 4 Z Xa BB W43 EYy 8Bhavika VasvaniNo ratings yet

- Project Report - Group 1 - Section CDocument20 pagesProject Report - Group 1 - Section CNaveen K. JindalNo ratings yet

- Pmswa Nidhi DataDocument6 pagesPmswa Nidhi DataManish VermaNo ratings yet

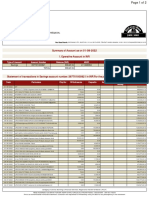

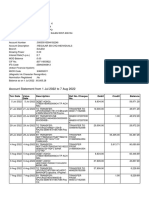

- Summary of Account As On 01-08-2022 I. Operative Account in INRDocument2 pagesSummary of Account As On 01-08-2022 I. Operative Account in INREducation HubNo ratings yet

- Karan 01-01-To-30-06-22Document105 pagesKaran 01-01-To-30-06-22Raja BhattacharjeeNo ratings yet

- Ict 231Document2 pagesIct 231Dnyaneshwar SonawaneNo ratings yet

- Origin and Performance of Regional Rural Bank of IndiaDocument13 pagesOrigin and Performance of Regional Rural Bank of IndiaHetvi TankNo ratings yet

- SBI Dynamic Bond Fund (G) : Portfolio Holdings (Mar 31, 2018)Document3 pagesSBI Dynamic Bond Fund (G) : Portfolio Holdings (Mar 31, 2018)Manmohan TiwariNo ratings yet

- YESBANK 03042024084333 Pre Results Disclosure Q4FY24 Signed-1Document1 pageYESBANK 03042024084333 Pre Results Disclosure Q4FY24 Signed-1Mudasser MullaNo ratings yet

- Account Statement As of 18-01-2022 21:02:27 GMT +0530Document2 pagesAccount Statement As of 18-01-2022 21:02:27 GMT +0530Goutham HNo ratings yet

- Bandhan Bank Net Profit Grows 35.7% (Y-o-Y) in Q3 FY22 To 859.0 Crore From 632.6 Crore in Q3 FY21Document3 pagesBandhan Bank Net Profit Grows 35.7% (Y-o-Y) in Q3 FY22 To 859.0 Crore From 632.6 Crore in Q3 FY21sanath kumarNo ratings yet

- HDFC Bank LTDDocument2 pagesHDFC Bank LTDAkshay PatilNo ratings yet

- BUNTY1Document2 pagesBUNTY1Health EducatumNo ratings yet

- YESBANK 05072023085117 PreresultdisclosureDocument1 pageYESBANK 05072023085117 PreresultdisclosureMukeshNo ratings yet

- MR I in VR PT Global Limit Has Il UploadDocument1 pageMR I in VR PT Global Limit Has Il Uploadbuch1khsanNo ratings yet

- Client Ledger Statement of All Segments S384088Document2 pagesClient Ledger Statement of All Segments S384088Sanjay SoniNo ratings yet

- OpTransactionHistory05 01 2022Document2 pagesOpTransactionHistory05 01 2022Nayyar AlamNo ratings yet

- Comprehensive Study About Banking Sector: State Bank of India Bank of BarodaDocument13 pagesComprehensive Study About Banking Sector: State Bank of India Bank of BarodaKapil KumarNo ratings yet

- Account Statement As of 20-07-2021 17:38:37 GMT +0530Document2 pagesAccount Statement As of 20-07-2021 17:38:37 GMT +0530jayarama rajuNo ratings yet

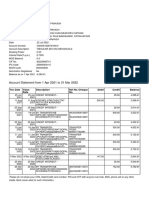

- Account Statement From 1 Nov 2021 To 30 Nov 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument1 pageAccount Statement From 1 Nov 2021 To 30 Nov 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSujit GhoshNo ratings yet

- FM 2 ProjectDocument7 pagesFM 2 ProjectNiket AmanNo ratings yet

- Account Statement As of 18-01-2022 21:02:03 GMT +0530Document2 pagesAccount Statement As of 18-01-2022 21:02:03 GMT +0530Goutham HNo ratings yet

- Financial Data and Ratio - Dec 2021Document1 pageFinancial Data and Ratio - Dec 2021arief rahmanNo ratings yet

- Pushing Financial Inclusion - Issues, Challenges and Way ForwardDocument21 pagesPushing Financial Inclusion - Issues, Challenges and Way ForwardTanay JainNo ratings yet

- Pushing Financial Inclusion - Issues, Challenges and Way ForwardDocument21 pagesPushing Financial Inclusion - Issues, Challenges and Way ForwardRahul MahajanNo ratings yet

- Domestic Debt & LiabDocument10 pagesDomestic Debt & LiabKhizar Khan JiskaniNo ratings yet

- Research-Report - NMS ResourcesDocument5 pagesResearch-Report - NMS Resourcesvanshikaverma1704No ratings yet

- Multiple Month Duplicate Bill: SL Invoice Number Month/Year BTCL Amount Vat Amount TK Total Amount TKDocument1 pageMultiple Month Duplicate Bill: SL Invoice Number Month/Year BTCL Amount Vat Amount TK Total Amount TKMd. YousufNo ratings yet

- A Study On Financial Performance of Nbfc'sDocument22 pagesA Study On Financial Performance of Nbfc'shelna francisNo ratings yet

- Urbanization and Slum Development With Special Reference To Erode District of TamilnaduDocument18 pagesUrbanization and Slum Development With Special Reference To Erode District of TamilnaduIJRASETPublicationsNo ratings yet

- Account Statement As of 18-01-2022 21:00:46 GMT +0530Document2 pagesAccount Statement As of 18-01-2022 21:00:46 GMT +0530Goutham HNo ratings yet

- IJCRT2204055Document5 pagesIJCRT2204055Jay statusNo ratings yet

- Adobe Scan May 06, 2021Document1 pageAdobe Scan May 06, 2021B. B. SINGHNo ratings yet

- Vineet TibrewalDocument21 pagesVineet Tibrewalvineet tibrewalNo ratings yet

- 804 20211026 110045Document1 page804 20211026 110045DEVANG TRIVEDINo ratings yet

- Project MBADocument16 pagesProject MBAbgjhNo ratings yet

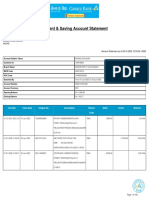

- Lovely Foot Wear Primary Account Holder Name: Your A/C StatusDocument6 pagesLovely Foot Wear Primary Account Holder Name: Your A/C StatusKartikey Singh RajputNo ratings yet

- Gen Next BankingDocument13 pagesGen Next Bankingbadznx4No ratings yet

- Net NPA To Net Advances: HDFC Bank Icici Bank Axis BankDocument2 pagesNet NPA To Net Advances: HDFC Bank Icici Bank Axis Bankmakawana rameshNo ratings yet

- Fahryan Syahreza Lubis FebruariDocument2 pagesFahryan Syahreza Lubis FebruariWaledy DNo ratings yet

- Bank Penetration and SHG-Bank Linkage Programme: A Critique: Pankaj Kumar and Ramesh GolaitDocument20 pagesBank Penetration and SHG-Bank Linkage Programme: A Critique: Pankaj Kumar and Ramesh GolaitAnimesh TiwariNo ratings yet

- ABCDDocument5 pagesABCDAkhil JainNo ratings yet

- Girdhar51 1603693312542 PDFDocument2 pagesGirdhar51 1603693312542 PDFjignesh parmarNo ratings yet

- My Transactions December 2021Document3 pagesMy Transactions December 2021Ian Carlo RoxasNo ratings yet

- 120113-DCCBs in Maharashtra by SunilDocument7 pages120113-DCCBs in Maharashtra by SunilGauresh NaikNo ratings yet

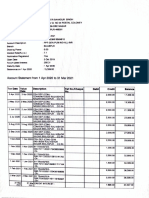

- Account Statement From 1 Feb 2021 To 28 Feb 2021Document2 pagesAccount Statement From 1 Feb 2021 To 28 Feb 2021mohammad shamim33% (3)

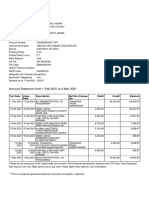

- Account Statement From 1 Feb 2021 To 2 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument1 pageAccount Statement From 1 Feb 2021 To 2 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSuyash HagirNo ratings yet

- Kirancta 1628939921046Document2 pagesKirancta 1628939921046Kiran SNNo ratings yet

- Account Statement From 1 Jul 2022 To 7 Aug 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Jul 2022 To 7 Aug 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceGowthamNo ratings yet

- Annex 262 AU223Document4 pagesAnnex 262 AU223rajautoprincNo ratings yet

- Annual Report 2022 en Final WebsiteDocument76 pagesAnnual Report 2022 en Final WebsiteSin SeutNo ratings yet

- Keputusan Kepala Desa Tentang Penerimaan BSPSDocument5 pagesKeputusan Kepala Desa Tentang Penerimaan BSPSendra JayadiNo ratings yet

- Harnessing Uzbekistan’s Potential of Urbanization: National Urban AssessmentFrom EverandHarnessing Uzbekistan’s Potential of Urbanization: National Urban AssessmentNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Snapshot of Sustainable Development Goals at the Subnational Government Level in IndonesiaFrom EverandSnapshot of Sustainable Development Goals at the Subnational Government Level in IndonesiaNo ratings yet

- 10000004182Document58 pages10000004182Chapter 11 DocketsNo ratings yet

- Delivery of Retail Banking ServicesDocument13 pagesDelivery of Retail Banking ServicesPhilip K BugaNo ratings yet

- Dragnet ClauseDocument2 pagesDragnet ClauseAlarm GuardiansNo ratings yet

- List of Kings of BabylonDocument52 pagesList of Kings of BabylonAhmet Çağrı ApaydınNo ratings yet

- Eco 104: Introduction To Introduction To Macroeconomics: Lecture 10 (Chapter 8) Parisa ShakurDocument24 pagesEco 104: Introduction To Introduction To Macroeconomics: Lecture 10 (Chapter 8) Parisa ShakurTariqul Islam AyanNo ratings yet

- Declaratory SuitsDocument9 pagesDeclaratory SuitsParth RajNo ratings yet

- Eng7-Q4-W5 - Activity On The Types of ConflictDocument2 pagesEng7-Q4-W5 - Activity On The Types of ConflictRia-Flor ValdozNo ratings yet

- Current Booking Current Booking: Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Document2 pagesCurrent Booking Current Booking: Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Abhaya Kumar NayakNo ratings yet

- Consolidated Tax Invoice: Recipient Details Registrant DetailsDocument2 pagesConsolidated Tax Invoice: Recipient Details Registrant DetailsAccounts SkyHawkNo ratings yet

- A Simple Ramadhan Guide For SchoolsDocument14 pagesA Simple Ramadhan Guide For SchoolsFirasNo ratings yet

- Gautama AdaniDocument25 pagesGautama AdaniMark Dennis AsuncionNo ratings yet

- Bertrand Russell Speaks His MindDocument3 pagesBertrand Russell Speaks His MindSilostNo ratings yet

- MEMO - Submission of Monthly Accomplishment Reports Schedule Version 2Document2 pagesMEMO - Submission of Monthly Accomplishment Reports Schedule Version 2Jonathan LarozaNo ratings yet

- Antenatal Registration Tetanus Toxoid Immunization Micronutrient Supplementation Treatment of DiseasesDocument81 pagesAntenatal Registration Tetanus Toxoid Immunization Micronutrient Supplementation Treatment of DiseasesFreeNursingNotesNo ratings yet

- Introduction To CSPPDocument18 pagesIntroduction To CSPPSonny E. CodizarNo ratings yet

- Board ResolutionDocument4 pagesBoard ResolutionPring SumNo ratings yet

- Assess DuterteDocument5 pagesAssess Duterteoy dyNo ratings yet

- Monologues 1Document2 pagesMonologues 1Adrian MateosNo ratings yet

- SHOULDERS by For King & CountryDocument2 pagesSHOULDERS by For King & CountryjustsammeyNo ratings yet

- Appraisal - Integra Realty ResourcesDocument108 pagesAppraisal - Integra Realty ResourcesScott Galvin100% (1)

- Brother (1) Jack Jack. He's Only 1 Years OldDocument1 pageBrother (1) Jack Jack. He's Only 1 Years OldLaura Camelo100% (1)

- Ragesh Subramanian FABL3R230824002Document3 pagesRagesh Subramanian FABL3R230824002Ragesh TrikkurNo ratings yet

- ICICI Bank Platinum Chip Credit Card Membership GuideDocument14 pagesICICI Bank Platinum Chip Credit Card Membership GuideVijay TambareNo ratings yet

- Preporuke Za Dijagnostiku I Lecenje SinkopeDocument42 pagesPreporuke Za Dijagnostiku I Lecenje Sinkopedex99No ratings yet