Professional Documents

Culture Documents

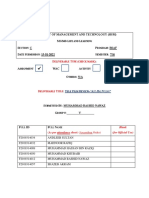

Name and Ids: M. Rashid Nawaz F2019314012

Uploaded by

Rashid Nawaz ChannarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Name and Ids: M. Rashid Nawaz F2019314012

Uploaded by

Rashid Nawaz ChannarCopyright:

Available Formats

Name and IDs: M.

Rashid Nawaz F2019314012

Mehran Ali F2019314006

Shahzaib Akram F2019314057

Sobia Abbas S2019358005

Submitted to: Dr. Muhammad Ather Ashraf

Submitted by: M. Rashid Nawaz

University of Management & Technology

Assignment 1:

1)Entrepreneurial Finance:

The study of value and resource allocation with respect to new ventures is known as entrepreneurial

finance. It addresses important questions that all business owners face, such as how much capital

can and should be raised, when it should be sought, and from whom. It also covers startup valuation

and the structure of fundraising deals and exit decisions.

2)Investment by Stages:

Seed Money

At the seed stage, the business owner often only needs limited funding to conduct feasibility studies,

create prototypes, assess market demand, protect intellectual property, and consider other facets of

business concept.

Startup Phase

Production begins during the start-up phase, sometimes called the launch phase, and sales take

place. The employment of people and the launching of products in the market are its defining

characteristics. Bridge financing, sufficient working capital for the smooth running of the business,

financing of losses incurred during the start-up phase. The start-up phase and the pre-launch phase

can both be financed simultaneously.

First-Stage Financing Phase

The scale-up phase, commonly referred to as early-stage funding, is the final stage of seed funding. It

is characterized by an increase in sales and production. Sales growth is a sign that the company is

successful because it validates the business concept of the company.

Profitability may be within reach when business volume approaches the break-even point. Venture

capitalists might be interested in funding this phase if the business is profitable during the start-up

phase or if it shows clear evidence that it can be profitable during the ramp-up phase.

Second-Stage Financing Phase

This round of funding comes after the first round and provides working money for the first growth of

a business after it has started producing and distributing goods and building up inventory and

accounts receivable. Even though the business has improved, there are still scenarios where it might

not yet be profitable.

Third-Stage or Mezzanine Financing Phase

This is due to the significant expansion of the business, which has increased sales and is profitable.

These funds will be used to pursue plant expansion, marketing, working capital or the development

of improved products.

Fourth-Stage or Bridge Financing Phase

Bridging funding is the time gap between spending and revenue generation. For example,

government grants often include bridge funding. This is because grants are not paid directly for the

purchase of assets (such as equipment), but are returned to the company after the purchase. Thus,

the bridging loan is complete from the moment the expenditure is made (purchase of equipment)

and the company is reimbursed for the subsidy for the purchase of equipment.

Example: Let us consider the example of Uber funding rounds. Uber, as a mobility service provider,

was a unicorn startup. The company decided to go for a Series G round of funding by issuing shares.

With funding from 116 investors, it managed to go through 32 funding rounds and raise a capital of

25.2Billion.

Investment by Industry:

Industry refers to a specific group of companies that operate in a similar business sphere and have

similar business activities. Industries are created by breaking down sectors into more defined

groupings. Therefore, an industry is a subcategory of a sector. For example, the insurance industry

can be broken up into different, specialized divisions like home, auto, life, and corporate insurance.

Investment by Region: In this form of investment venture capitals invest whether which region

provides lower taxes, higher returns and better opportunities. For example, we have divided below:

Region 1: Southeast Asia, South Asia (except Pakistan and Afghanistan) and the Pacific Islands.

Region 2: Afghanistan, Pakistan, Central Asia, East Asia, West Asia, Europe, Africa, North America

and Latin America.

3)What is the major reason that there is some difference in Angel and Venture Capitalist, what are

different people called involved in VCs.

Angel Investors Venture Capitalist

Angel investors are usually wealthy Venture capitalists, on the other

individuals or groups who fund start- hand, are usually large institutions

up businesses. Maybe you are an that invest large sums of money in

entrepreneur yourself and want to established and proven businesses.

support new business ideas and find Venture capitalists focus on later-

high profit potential. Angel investors stage companies with the potential

often have smaller holdings than for growth and high returns. They

venture capitalists, but they generally want to invest in companies that

provide more personal advice and have a clear path to scalability and

guidance than venture capitalists, so profitability, and tend to take a

they can be more involved in the "hands-off" approach to investing,

day-to-day operations of the relying on company management for

company. . decision making. of decision.

The other People involved in Venture capitals are called GPs (General

Partners) and LPs (Limited Partners).

You might also like

- Quiz 1 - 4Document4 pagesQuiz 1 - 4Yong RenNo ratings yet

- Term SheetDocument2 pagesTerm SheetAakash BhardwajNo ratings yet

- Venture CapitalDocument12 pagesVenture Capitalmtasci100% (1)

- Literature ReviewDocument13 pagesLiterature ReviewSukhraj Kaur Chhina100% (5)

- IQP Final Report PDFDocument135 pagesIQP Final Report PDFmalingyee100% (1)

- Hybrid FinancingDocument1 pageHybrid FinancinghitekshaNo ratings yet

- Venture CapitalDocument28 pagesVenture CapitalAdii AdityaNo ratings yet

- Venture Capital Funding - FSDocument14 pagesVenture Capital Funding - FSashaya_j_007No ratings yet

- Financing A New Venture: IndroductionDocument11 pagesFinancing A New Venture: IndroductionAjiLalNo ratings yet

- What Is Venture Capital?Document5 pagesWhat Is Venture Capital?Symon StefenNo ratings yet

- Venture Capital - FINDocument5 pagesVenture Capital - FINclaudiaNo ratings yet

- Financial Sevice ProjectDocument7 pagesFinancial Sevice ProjectAbdul AzeemNo ratings yet

- Lecture9_ (MBA-513)Document25 pagesLecture9_ (MBA-513)Md. Shams SaleheenNo ratings yet

- What Is Venture Capital?Document9 pagesWhat Is Venture Capital?Stephane LabrosseNo ratings yet

- Lesson 8 Raising CapitalDocument20 pagesLesson 8 Raising CapitalJay Wilmer RoqueroNo ratings yet

- UntitledDocument11 pagesUntitlediyaNo ratings yet

- Venture Capital in IndiaDocument44 pagesVenture Capital in IndiaReagan SparkNo ratings yet

- How Venture Capital Firms WorkDocument8 pagesHow Venture Capital Firms Worksanket sunthankarNo ratings yet

- Venture CapitalDocument17 pagesVenture CapitalNor Azlan RamliNo ratings yet

- Our Aim Is Simple - To Help You Find The Funding You Need For Your BusinessDocument11 pagesOur Aim Is Simple - To Help You Find The Funding You Need For Your BusinessShabnam ArshiNo ratings yet

- Key Factors in Attracting Venture CapitalDocument4 pagesKey Factors in Attracting Venture CapitalPadmavathi HanmanthraoNo ratings yet

- Venture Capital: Debt Finance Term LoanDocument4 pagesVenture Capital: Debt Finance Term LoanmansionerNo ratings yet

- VC Funding FinalDocument18 pagesVC Funding FinalShipra SrivastavaNo ratings yet

- Module 4Document11 pagesModule 4Tarun TaterNo ratings yet

- Venture Capital and Entrepreneurial FinanceDocument15 pagesVenture Capital and Entrepreneurial FinanceArun KumarNo ratings yet

- Phase 2Document10 pagesPhase 2Akesh GuptaNo ratings yet

- Course Code:8503 Unit # 06: EntrepreneurshipDocument23 pagesCourse Code:8503 Unit # 06: EntrepreneurshipSalaha AbdullahNo ratings yet

- About Venture Capital (VC)Document16 pagesAbout Venture Capital (VC)Shalini JaiswalNo ratings yet

- PROJECT MANAGEMENTDocument29 pagesPROJECT MANAGEMENTkamalyadav5907No ratings yet

- Module 7 - ED - 14MBA26Document15 pagesModule 7 - ED - 14MBA26Uday GowdaNo ratings yet

- Shri Chinai College of Commerce and Economics Andheri (E) ,: Submitted By: Group 9Document21 pagesShri Chinai College of Commerce and Economics Andheri (E) ,: Submitted By: Group 9Mohit ZaveriNo ratings yet

- Venture Capital FinalDocument18 pagesVenture Capital Finalprgupta92No ratings yet

- A Report On "Stock Offerings and Investor Monitoring": Submitted ToDocument17 pagesA Report On "Stock Offerings and Investor Monitoring": Submitted ToAtiaTahiraNo ratings yet

- Unit 2: Managing Financial Resources and Decisions Submitted By: Muhammad Danyal Aziz Noor To Sir Muhammad Ehtisham Course: HND BusinessDocument45 pagesUnit 2: Managing Financial Resources and Decisions Submitted By: Muhammad Danyal Aziz Noor To Sir Muhammad Ehtisham Course: HND BusinessjojoNo ratings yet

- Venture CapitalDocument6 pagesVenture CapitalpriyankaNo ratings yet

- Venture CpitalDocument32 pagesVenture CpitalshilpavivekNo ratings yet

- Unit 21 Private Equity and Venture CapitalDocument10 pagesUnit 21 Private Equity and Venture CapitalHari RajNo ratings yet

- Investment Banking: Industry AnalysisDocument12 pagesInvestment Banking: Industry Analysiskeshav kumarNo ratings yet

- Definition and Basics of Venture Capital (ASHLEY)Document5 pagesDefinition and Basics of Venture Capital (ASHLEY)Steffanie DarlenyNo ratings yet

- Everything You Need to Know About Venture Capital FinancingDocument28 pagesEverything You Need to Know About Venture Capital FinancingSurbhi10No ratings yet

- Business Environment 1 PDF PDFDocument35 pagesBusiness Environment 1 PDF PDFDave NNo ratings yet

- A Report On Analysis of Venture Capital As A Source of FinanceDocument21 pagesA Report On Analysis of Venture Capital As A Source of Financearun883765No ratings yet

- Chapter 10 COMM 320Document7 pagesChapter 10 COMM 320kosta georgalosNo ratings yet

- Venture Capital and Private Equity Investments: DR Saif SiddiquiDocument22 pagesVenture Capital and Private Equity Investments: DR Saif SiddiquiRahul Kumar JhaNo ratings yet

- Venture CapitalDocument51 pagesVenture Capitaljravish100% (6)

- Ankita Thakur 2nd Sem MBADocument5 pagesAnkita Thakur 2nd Sem MBAkiranNo ratings yet

- Unit-Iii Entrepreneurship: Dr.E.UmareddyDocument19 pagesUnit-Iii Entrepreneurship: Dr.E.UmareddyKarthik SaitejaNo ratings yet

- Venture CapitalDocument27 pagesVenture CapitalVkiran GowdaNo ratings yet

- MFS sem3Document12 pagesMFS sem3skspankaj08No ratings yet

- Fin 9895 Pe Assignment 1Document14 pagesFin 9895 Pe Assignment 1Sheikh shawonNo ratings yet

- Entrepreneurship AssignmentDocument7 pagesEntrepreneurship AssignmentMazhar ArfinNo ratings yet

- Annexure-V Cover Page for Academic Tasks Submitted by KIRAT SINGH BHATIYADocument12 pagesAnnexure-V Cover Page for Academic Tasks Submitted by KIRAT SINGH BHATIYAGaurav AnandNo ratings yet

- VC 1Document29 pagesVC 1khayyumNo ratings yet

- Venture Capital FinanceDocument7 pagesVenture Capital FinanceSachi LunechiyaNo ratings yet

- 3 Is Financial Aspect of The StudyDocument7 pages3 Is Financial Aspect of The StudyKirby DuliguesNo ratings yet

- Capital StructureDocument23 pagesCapital StructureksdNo ratings yet

- Venture CapitalDocument4 pagesVenture CapitalVinayNo ratings yet

- Issue ManagementDocument8 pagesIssue ManagementarvinNo ratings yet

- Marquee JulyDocument3 pagesMarquee JulyMayank AggarwalNo ratings yet

- Venture CapitalDocument24 pagesVenture CapitalBipinNo ratings yet

- Entrepreneurial Finance ResourcesDocument6 pagesEntrepreneurial Finance Resourcesfernando trinidadNo ratings yet

- Capital Catalyst: The Essential Guide to Raising Funds for Your BusinessFrom EverandCapital Catalyst: The Essential Guide to Raising Funds for Your BusinessNo ratings yet

- The Path to Successful Entrepreneurship: Essential Steps for Building a StartupFrom EverandThe Path to Successful Entrepreneurship: Essential Steps for Building a StartupNo ratings yet

- Project 2 SolutionDocument9 pagesProject 2 SolutionRashid Nawaz ChannarNo ratings yet

- Using analytics for investmentDocument180 pagesUsing analytics for investmentRashid Nawaz ChannarNo ratings yet

- General Nigar's Leadership in Overcoming ChallengesDocument7 pagesGeneral Nigar's Leadership in Overcoming ChallengesRashid Nawaz ChannarNo ratings yet

- HSM 1Document4 pagesHSM 1Rashid Nawaz ChannarNo ratings yet

- Rich Dad Poor DadDocument2 pagesRich Dad Poor DadRashid Nawaz ChannarNo ratings yet

- Tugas 2 - AKL 1Document2 pagesTugas 2 - AKL 1Geroro D'PhoenixNo ratings yet

- Basic Accounting Final - QuestionDocument6 pagesBasic Accounting Final - QuestionEdaNo ratings yet

- Principles of Finance: Taguig City University Gen. Santos Ave. Upper Bicutan Taguig City College of Business ManagementDocument4 pagesPrinciples of Finance: Taguig City University Gen. Santos Ave. Upper Bicutan Taguig City College of Business ManagementKimii DoraNo ratings yet

- Definedge Diwali NewsletterDocument10 pagesDefinedge Diwali NewsletterSubbarayudu PasupulaNo ratings yet

- Invitation Card Peshawar Property ExpoDocument2 pagesInvitation Card Peshawar Property ExpokamranNo ratings yet

- Year Stock A's Returns, Ra Stock B's Returns, RB: Realized Rates of ReturnsDocument2 pagesYear Stock A's Returns, Ra Stock B's Returns, RB: Realized Rates of ReturnsArgie Mae Salvador100% (1)

- Management Convergence: (An International Journal of Management)Document13 pagesManagement Convergence: (An International Journal of Management)Dr. Pabitra Kumar MishraNo ratings yet

- Week 1FDocument23 pagesWeek 1FJessicaNo ratings yet

- Comparative Study of Financial Statement Ratios Between Dell and EpsonDocument7 pagesComparative Study of Financial Statement Ratios Between Dell and EpsonMacharia NgunjiriNo ratings yet

- 3 - XV - Market EfficiencyDocument23 pages3 - XV - Market EfficiencyAditya NugrohoNo ratings yet

- For Each of The Following Transactions: Portfolio. CopenhagenDocument18 pagesFor Each of The Following Transactions: Portfolio. CopenhagenHiền NguyễnNo ratings yet

- Tutorial Questions - Solutions: Question OneDocument8 pagesTutorial Questions - Solutions: Question Onephillip quimenNo ratings yet

- Name: Mhel Kathleen M. Tampos Performance Task 6Document5 pagesName: Mhel Kathleen M. Tampos Performance Task 6mhlkthln tmpsNo ratings yet

- Reverse Takeovers - An ExplanationDocument6 pagesReverse Takeovers - An ExplanationMohsin AijazNo ratings yet

- Project 3 - Finlatics IBEPDocument4 pagesProject 3 - Finlatics IBEPRagveer SinghNo ratings yet

- The Value Investing With Options Minifesto: A Brief Overview of The Best Way To Invest. PeriodDocument22 pagesThe Value Investing With Options Minifesto: A Brief Overview of The Best Way To Invest. PeriodAmeerHamsa100% (1)

- Wallstreetjournal 20160329 The Wall Street JournalDocument42 pagesWallstreetjournal 20160329 The Wall Street JournalstefanoNo ratings yet

- UnicornDocument6 pagesUnicornschoolofequity 101No ratings yet

- FTCXSXSXSP - Seminar 8 - AnswersDocument4 pagesFTCXSXSXSP - Seminar 8 - AnswersLewis FergusonNo ratings yet

- 5 Moving Average Signals That Beat Buy and Hold Backtested Stock MarketDocument47 pages5 Moving Average Signals That Beat Buy and Hold Backtested Stock MarketJoelNo ratings yet

- Guest-229194929-Conceptual Framework - The QuizDocument3 pagesGuest-229194929-Conceptual Framework - The QuizZaira PangesfanNo ratings yet

- Bitcoin Investment TrustDocument3 pagesBitcoin Investment Trusthannahpanaligan7No ratings yet

- Types of Investment DecisionDocument7 pagesTypes of Investment Decisiongulmhorster80% (5)

- Disinvestment of Public Sector Enterprises in IndiaDocument2 pagesDisinvestment of Public Sector Enterprises in IndiaBhupendra Singh VermaNo ratings yet

- Chapter 11: The CAPM: Corporate FinanceDocument46 pagesChapter 11: The CAPM: Corporate FinancePháp NguyễnNo ratings yet

- Corporate Finance Question SolvedDocument2 pagesCorporate Finance Question SolvedTiasha KaurNo ratings yet