Professional Documents

Culture Documents

Corporate Finance Question Solved

Uploaded by

Tiasha Kaur0 ratings0% found this document useful (0 votes)

19 views2 pagesProject W should be selected for investment because it has the highest net present value (NPV) of the two projects. NPV is considered the best investment appraisal technique because it discounts future cash flows to determine if a project will be profitable. A positive NPV indicates that a project's earnings will exceed costs, making it a worthwhile investment. As Project W has the highest NPV, it is the best choice for EFG Ltd to pursue.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentProject W should be selected for investment because it has the highest net present value (NPV) of the two projects. NPV is considered the best investment appraisal technique because it discounts future cash flows to determine if a project will be profitable. A positive NPV indicates that a project's earnings will exceed costs, making it a worthwhile investment. As Project W has the highest NPV, it is the best choice for EFG Ltd to pursue.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views2 pagesCorporate Finance Question Solved

Uploaded by

Tiasha KaurProject W should be selected for investment because it has the highest net present value (NPV) of the two projects. NPV is considered the best investment appraisal technique because it discounts future cash flows to determine if a project will be profitable. A positive NPV indicates that a project's earnings will exceed costs, making it a worthwhile investment. As Project W has the highest NPV, it is the best choice for EFG Ltd to pursue.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

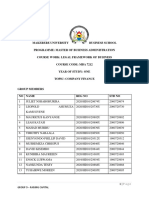

21MBA1271

Megha Bhola

Corporate Finance

Q: EFG Ltd is considering two possible projects but can only raise enough funds to

proceed with one of them. Investment appraisal techniques have been used and the

following results found:

Which of the following is the most logical interpretation of the results?

A. Project W should be selected as it gives the longest payback period

B. Project W should be selected because it will yield the highest NPV

C. Project X should be selected because it will yield the lowest NPV

D. The ARR is the most meaningful investment appraisal technique and hence Project W

should be selected.

Explain.

Ans: B is the correct answer i.e., Project W should be selected

because it will yield the highest NPV. Net Present Value is a

metric that is able to determine whether or not an investment

opportunity is smart financial decision.

Net Present Value is one of many capital budgeting methods

used to evaluate potential physical asset projects in which a

company might want to invest. Usually, these capital investment

projects are large in terms of scope and money, such as

purchasing an expensive set of assembly-line equipment or

constructing a new building.

Net present value uses discounted cash flows in the analysis,

which makes the net present value more precise than of any of

the capital budgeting methods as it considers both the risk and

time variables.

A positive NPV indicates that the projected earnings generated

by a project or investment—in present dollars—exceeds the

21MBA1271

Megha Bhola

anticipated costs, also in present dollars. It is assumed that an

investment with a positive NPV will be profitable.

A net present value analysis involves several variables and

assumptions and evaluates the cash flows forecasted to be

delivered by a project by discounting them back to the present

using information that includes the time span of the project (t) and

the firm's weighted average cost of capital. If the result is positive,

then the firm should invest in the project. If negative, the firm

should not invest in the project.

Net present value is the more commonly used method for

analyzing capital budgets. One of the reasons for its wider

acceptance is that NPV provides a more detailed analysis

compared to IRR calculations because it discounts individual cash

flows from a project separately. NPV is also the ideal option when

planners don't have a discount rate.

Here, in this case, EFG Ltd should select Project W as the NPV

technique is the most reliable investment appraisal technique.

You might also like

- The Basics of Capital BudgetingDocument5 pagesThe Basics of Capital BudgetingChirrelyn Necesario SunioNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Impact of Interest RateDocument7 pagesImpact of Interest RateMary AikhuomobhogbeNo ratings yet

- Balance Sheet and Statement of Cash Flows: True-FalseDocument45 pagesBalance Sheet and Statement of Cash Flows: True-FalseDaniella Mae ElipNo ratings yet

- Case 5: The Investmen Detective: BackgroundDocument5 pagesCase 5: The Investmen Detective: BackgroundMuhamad GilangNo ratings yet

- Group 18 Session 4 Assignment Kraft-Heinz MergerDocument6 pagesGroup 18 Session 4 Assignment Kraft-Heinz MergerAishwarya Yadav BJ20064No ratings yet

- Question and Answer Third Group FMDocument5 pagesQuestion and Answer Third Group FMLive StreamNo ratings yet

- IRR, NPV and PBPDocument13 pagesIRR, NPV and PBPRajesh Shrestha100% (5)

- Capital Budgeting at Birla CementDocument61 pagesCapital Budgeting at Birla Cementrpsinghsikarwar0% (1)

- Concept of AppraisalDocument3 pagesConcept of AppraisalUday SharmaNo ratings yet

- A Study On Dividend Policies of Icic BankDocument98 pagesA Study On Dividend Policies of Icic BankTasmay Enterprises100% (1)

- Cap Budeting FinanaceDocument11 pagesCap Budeting FinanaceShah ZazaiNo ratings yet

- Renewable Part 1 - Introduction, Costs and PFDocument228 pagesRenewable Part 1 - Introduction, Costs and PFApoorvNo ratings yet

- NPV Cha 4 AsigDocument3 pagesNPV Cha 4 AsigWolde LijalemNo ratings yet

- Significance of Capital Budgeting: Discounted Cash Flow MethodDocument8 pagesSignificance of Capital Budgeting: Discounted Cash Flow MethodSarwat AfreenNo ratings yet

- BUS - 539 Capital - Budgeting - Wk.5Document10 pagesBUS - 539 Capital - Budgeting - Wk.5TimNo ratings yet

- Finance, Assignment Investment - Appraisal - Decision - MakingDocument12 pagesFinance, Assignment Investment - Appraisal - Decision - MakingPritam Kumar NayakNo ratings yet

- Capital BudgetingDocument13 pagesCapital BudgetingTanya SanjeevNo ratings yet

- Chapter 9 Capital BudgetinDocument184 pagesChapter 9 Capital BudgetinKatherine Cabading InocandoNo ratings yet

- Chap 11 Problem SolutionsDocument46 pagesChap 11 Problem SolutionsNaufal FigoNo ratings yet

- Capital Budgeting Techniques and Project AnalysisDocument7 pagesCapital Budgeting Techniques and Project AnalysisVic CinoNo ratings yet

- Capital BudgetingDocument11 pagesCapital BudgetingShane PajaberaNo ratings yet

- Exclusive Projects.: Project ClassificationsDocument4 pagesExclusive Projects.: Project Classificationsammar123No ratings yet

- A Literature Review On The Net Present Value (NPV) Valuation MethodDocument5 pagesA Literature Review On The Net Present Value (NPV) Valuation MethodressaevansNo ratings yet

- MBA 511 Final ReportDocument13 pagesMBA 511 Final ReportSifatShoaebNo ratings yet

- BUAD 839 ASSIGNMENT (Group F)Document4 pagesBUAD 839 ASSIGNMENT (Group F)Yemi Jonathan OlusholaNo ratings yet

- Samrat Mondal - Cse A - EconomicsDocument5 pagesSamrat Mondal - Cse A - EconomicsSamrat MondalNo ratings yet

- Capital BudgetingDocument32 pagesCapital BudgetingAKHIL JOSEPHNo ratings yet

- The Basics of Capital Budgeting: Answers To End-Of-Chapter QuestionsDocument46 pagesThe Basics of Capital Budgeting: Answers To End-Of-Chapter QuestionsAndrew ChipwaluNo ratings yet

- CH 13 SolDocument32 pagesCH 13 SolSungho LeeNo ratings yet

- Module 2Document7 pagesModule 2Harsh PatelNo ratings yet

- Project Classification:: Advantages of Net Present Value (NPV)Document5 pagesProject Classification:: Advantages of Net Present Value (NPV)Orko AbirNo ratings yet

- A. The Importance of Capital BudgetingDocument98 pagesA. The Importance of Capital BudgetingShoniqua JohnsonNo ratings yet

- Capital Budgeting On Dinner KariDocument3 pagesCapital Budgeting On Dinner KariVashu KatiyarNo ratings yet

- RABARA - Capital ManagementDocument2 pagesRABARA - Capital Managementjhon rayNo ratings yet

- Financial Management Case Study-2 The Investment DetectiveDocument9 pagesFinancial Management Case Study-2 The Investment DetectiveSushmita DikshitNo ratings yet

- Seminar Manajemen KeuanganDocument8 pagesSeminar Manajemen KeuangannoviyanthyNo ratings yet

- Investment Appraisal TechniquesDocument6 pagesInvestment Appraisal TechniquesERICK MLINGWANo ratings yet

- Capital Budgeting TechniquesDocument26 pagesCapital Budgeting TechniquesMahima GirdharNo ratings yet

- Ch6 Investment EvaluationDocument27 pagesCh6 Investment EvaluationAshenafi Belete AlemayehuNo ratings yet

- TMP - 5567 PK10 191431902Document16 pagesTMP - 5567 PK10 191431902Pijus BiswasNo ratings yet

- Project Selection, Approval and Activation E. AgtarapDocument29 pagesProject Selection, Approval and Activation E. AgtarapEvangeline Chua Agtarap67% (3)

- Financial Management: A Project On Capital BudgetingDocument20 pagesFinancial Management: A Project On Capital BudgetingHimanshi SethNo ratings yet

- Capital Budgeting - IMPORTANT PDFDocument8 pagesCapital Budgeting - IMPORTANT PDFsalehin1969No ratings yet

- CORP FIN Final TheoryDocument5 pagesCORP FIN Final Theoryjesin.estiana09No ratings yet

- Capital Budgeting - 2Document45 pagesCapital Budgeting - 2chloemhae.ogayreNo ratings yet

- Capital Budgeting/Long Term Investment Decisions: Part OneDocument8 pagesCapital Budgeting/Long Term Investment Decisions: Part OneDoreen AwuorNo ratings yet

- Ips Pm-Sub-Notes-1Document41 pagesIps Pm-Sub-Notes-1SamsonNo ratings yet

- Week 4 - NoteDocument1 pageWeek 4 - Notelethuytinh705No ratings yet

- Unit 9 Capital Budgeting BBS Notes EduNEPAL - InfoDocument5 pagesUnit 9 Capital Budgeting BBS Notes EduNEPAL - InfoGrethel Tarun MalenabNo ratings yet

- Capital Budgeting SailDocument84 pagesCapital Budgeting SailJaspreet SinghNo ratings yet

- The Basics of Capital Budgeting Evaluating Cash Flows: Answers To Selected End-Of-Chapter QuestionsDocument16 pagesThe Basics of Capital Budgeting Evaluating Cash Flows: Answers To Selected End-Of-Chapter Questionsadaiya1672887No ratings yet

- PPCM Unit - 1 NotesDocument32 pagesPPCM Unit - 1 NotesAmit KumawatNo ratings yet

- What Is Capital BudgetingDocument24 pagesWhat Is Capital BudgetingZohaib Zohaib Khurshid AhmadNo ratings yet

- Investment AppraisalDocument9 pagesInvestment Appraisal22UG1-0372 WICKRAMAARACHCHI W.A.S.M.No ratings yet

- Ma2 Project Screening Projec Ranking and Capital RationingDocument11 pagesMa2 Project Screening Projec Ranking and Capital RationingMangoStarr Aibelle Vegas100% (1)

- Brewer6ce WYRNTK Ch10Document7 pagesBrewer6ce WYRNTK Ch10Bilal ShahidNo ratings yet

- FM AssignmentDocument5 pagesFM AssignmentMuhammad Haris Muhammad AslamNo ratings yet

- Summary Capital Budgeting (21!10!2021)Document4 pagesSummary Capital Budgeting (21!10!2021)Shafa ENo ratings yet

- Financial Management in Construction 7Document14 pagesFinancial Management in Construction 7kidusNo ratings yet

- Esbm 3Document29 pagesEsbm 3Devendra ChaudharyNo ratings yet

- Capital BudgetingDocument2 pagesCapital Budgetinghaniyaindira3No ratings yet

- Financial Accounting 4th Edition Spiceland Solutions Manual 1Document132 pagesFinancial Accounting 4th Edition Spiceland Solutions Manual 1richard100% (34)

- Stocks and Their ValuationDocument17 pagesStocks and Their ValuationSafaet Rahman SiyamNo ratings yet

- Group 05 Slide - The Lesley Fay CompanyDocument33 pagesGroup 05 Slide - The Lesley Fay CompanyNazmulNo ratings yet

- Classroom Exercises 1 - Statement of Financial Position and Comprehensive IncomeDocument2 pagesClassroom Exercises 1 - Statement of Financial Position and Comprehensive IncomeBianca JovenNo ratings yet

- Chapter 14Document40 pagesChapter 14Phương Anh VũNo ratings yet

- Corporate Finance - Teaching Plan - 2019-21Document18 pagesCorporate Finance - Teaching Plan - 2019-21Dimpy KatharNo ratings yet

- Financial RatiosDocument4 pagesFinancial RatiosRajdeep BanerjeeNo ratings yet

- Unit 3 FM Sem 2Document13 pagesUnit 3 FM Sem 2artisttarunsuthar1No ratings yet

- Quiz 4 Sample QuestionsDocument4 pagesQuiz 4 Sample Questionsbusiness docNo ratings yet

- Topic 6 - ACCA Cash Flow Q SDocument8 pagesTopic 6 - ACCA Cash Flow Q SGeorge Wang100% (1)

- Eurotrader and ForexDoc Free PDFDocument10 pagesEurotrader and ForexDoc Free PDFchaserieNo ratings yet

- Private Equity Holding AGDocument68 pagesPrivate Equity Holding AGArvinLedesmaChiongNo ratings yet

- International Financial Management AssignmentDocument12 pagesInternational Financial Management AssignmentMasara OwenNo ratings yet

- Lesson No 7 Stock Market Terminology (Second Part)Document5 pagesLesson No 7 Stock Market Terminology (Second Part)Yesica AlvaradoNo ratings yet

- FM - Chapter 3 - QuizDocument8 pagesFM - Chapter 3 - QuizHausland Const. Corp.No ratings yet

- Company Finance - Group 9Document20 pagesCompany Finance - Group 9TumwesigyeNo ratings yet

- Chapter 8 - Estimating Incremental Cash FlowsDocument19 pagesChapter 8 - Estimating Incremental Cash FlowsKazi HasanNo ratings yet

- Group 4 - Bank Reconciliation PresentationDocument16 pagesGroup 4 - Bank Reconciliation Presentationelvis page kamunanwireNo ratings yet

- 1 Discuss Briefly About Fair Value Measurement and ImpairmentDocument13 pages1 Discuss Briefly About Fair Value Measurement and ImpairmentBosena TadegeNo ratings yet

- PO BOX 620132 Kalomo 10101, ZAMBIA 2023/01/30 The Ultimate Account K 1008929 136/1Document4 pagesPO BOX 620132 Kalomo 10101, ZAMBIA 2023/01/30 The Ultimate Account K 1008929 136/1Ngosa Davies KundaNo ratings yet

- MCQ MathDocument173 pagesMCQ Mathlavyamehta007No ratings yet

- SBR Specimen Exam Illustrative Answers PDFDocument14 pagesSBR Specimen Exam Illustrative Answers PDFmi_owextoNo ratings yet

- AMAUR Export PlanDocument27 pagesAMAUR Export Planhezron ackNo ratings yet

- PPE QUIZ MAY 2 ProblemsDocument3 pagesPPE QUIZ MAY 2 ProblemsGenivy SalidoNo ratings yet

- Working CapitalDocument2 pagesWorking CapitalPayal bhatiaNo ratings yet