Professional Documents

Culture Documents

SWORD

SWORD

Uploaded by

Muhammad ImranOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SWORD

SWORD

Uploaded by

Muhammad ImranCopyright:

Available Formats

FLASH 7 June 2023

SWORD

ADD

IT Services

SW

OR

EPS 12/23e Unchanged • EPS 12/24e Unchanged

D -

AD

D -

Pres

s

rele

ase

+

Con Press releas e +

f. Conf. call

PRICE* TP

call

POTENTIAL

€ 40.50

*closing 06/06/23

€ 50.0 +23.5% Disposal of the AAA subsidiary prior to

the unveiling of the AI strategy

Press release + Conf. call

In anticipation of the upheavals linked to the rise of AI, the group has

announced its intention to sell its recruitment and staffing business,

Bloomberg SWP FP which represents around 10% of sales, albeit without adjusting its 2023

Market cap. €m 387

Free Float €m 233

EBITDA guidance. A strategic plan around AI will be unveiled in H2 23.

Volume (3M) €m 0.21/day

AAA subsidiary put up for sale

Price CAC M&S EPS (GD)

55.0 2.50

Sword has announced its intention to sell its subsidiary AAA, a specialist recruitment and

50.0 2.00

staffing company based in Aberdeen, Scotland, which mainly works for the oil industry on

45.0

1.50

a fee-for-service basis. Sword acquired AAA in October 2015, at which time the firm

40.0

1.00

presented itself as a specialist in the outsourcing of IT projects. The CEO fears that, in the

35.0

30.0 0.50 future, technical support activities will be replaced by intelligent marketplaces based on

25.0 0.00 AI.

Jun-21 Dec-21 Jun-22 Dec-22 Jun-23

AAA’s profitability profile beneath Sword’s standards

In 2022, the firm generated sales of €26m, accompanied by an EBIT margin of around 4%

PERFORMANCE 1M 6M 12M

and therefore probably around 5% of EBITDA, well below the group's norm (12% to 13%

Absolute -5.2% +3.8% +2.3%

of EBITDA).

Rel. / CAC M&S -3.1% +0.6% +8.9%

A valuation that is likely to be undemanding

AGENDA Given the firm’s small size and low profitability, we believe that the valuation multiples

20/07/23: H1 sales are likely to be undemanding (probably a P/Sales ratio of around 0.2x).

2023 EBITDA guidance nonetheless maintained

FINANCIAL ANALYST(S) Prior to the proposed sale of AAA, the group was forecasting sales growth of 15% in 2023

(i.e. sales of around €305m) accompanied by an EBITDA margin of 12%. Despite this

Emmanuel Parot deconsolidation (reduction in EBITDA of around €1.3m), the group is maintaining its

+33 (0) 1 40 22 41 38

EBITDA target of €36m, which implicitly suggests a +100bps increase in its EBITDA

emmanuel.parot@socgen.com

guidance to 13%.

Document completed on 07/06/2023 - 09:08 AI strategic plan to be unveiled in H2 23

Document published on 07/06/2023 - 09:08

In tandem with the announcement of this disposal, the CEO announced that a strategic

plan aimed at responding to the growing importance of AI will be presented in H2 23. We

understand that a number of initiatives will be taken, bearing in mind that, according to

the management, AI is likely to have a major impact on coding in the years ahead (reduced

need for developers but greater demand for designers). The group has signalled its desire

to strengthen its position in cybersecurity (an activity related to AI), although no target

has been identified at this stage. The group’s aim is to position itself as a cybersecurity

integrator or consultant.

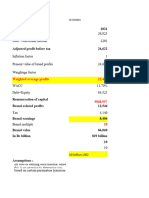

STOCK RATIOS 12/22 12/23e 12/24e 12/25e FINANCIAL DATA 12/22 12/23e 12/24e 12/25e

P/E 32.8x 15.0x 13.3x 11.6x Sales (€m) 272.3 305.6 342.2 383.3

PEG ns 0.1x 1.0x 0.8x C. EBIT (€m) 27.2 29.6 34.1 39.2

P/CF 18.3x 13.2x 11.7x 10.3x C. EBIT/Sales 10.0% 9.7% 10.0% 10.2%

EV/Sales 1.4x 1.2x 1.1x 1.0x EBIT (€m) 117.6 29.6 34.1 39.2

EV/EBITDA 10.9x 9.9x 8.7x 7.6x Net attributable profit (€m) 109.8 23.5 27.2 31.2

EV/C. EBIT 14.0x 12.8x 11.0x 9.4x Adjusted EPS (€) 1.20 2.70 3.05 3.48

EV/EBIT 3.2x 12.8x 11.0x 9.4x Chg. -39.1% 124.8% 13.0% 14.0%

EV/Capital employed 4.0x 3.5x 3.1x 2.8x FCF (€m) 5.4 14.6 18.2 21.1

P/BV 3.7x 3.4x 3.0x 2.6x Net fin. debt (€m) 6.1 5.2 1.2 -5.8

FCF yield 1.4% 3.8% 4.7% 5.5% Gearing 6.0% 4.6% 0.9% -3.9%

Yield 3.0% 3.0% 3.0% 3.0% ROCE 70.6% 16.1% 16.9% 17.6%

P1 Find our Downloaded

research at www.gilbertdupont.fr I please

on www.gilbertdupont.fr read the DISCLAIMER

by Mubashir Mohammadat the -end of this document

07/06/2023 carefully

09:17:14

Retrouvez notre recherche sur www.gilbertdupont.fr I DISCLAIMER : merci de lire attentivement l’avertissement en fin de document

7 June 2023

SWORD ADD Emmanuel Parot +33 (0) 1 40 22 41 38

PRICE* TP POTENTIAL PROFIT LOSS STATEMENT (€m) 12/20 12/21 12/22 12/23e 12/24e 12/25e

Sales 212.5 214.6 272.3 305.6 342.2 383.3

€ 40.50 € 50.0 +23.5% Chg. -0.3% 1.0% 26.9% 12.2% 12.0% 12.0%

*closing 06/06/23 Chg. lfl 9.2% 21.5% 19.0% 13.8% 12.0% 12.0%

EBITDA 29.5 29.3 35.1 38.1 42.8 48.1

C. EBIT 20.1 22.6 27.2 29.6 34.1 39.2

EBIT 68.8 19.1 117.6 29.6 34.1 39.2

Net interest income -11.7 2.4 -5.4 -0.2 -0.2 -0.1

Tax 3.7 3.7 2.4 5.9 6.8 7.8

Income from associates 0.0 0.0 0.0 0.0 0.0 0.0

Activity Net earnings from discontinued operations 0.0 0.0 0.0 0.0 0.0 0.0

Sword is a specialised IT group, involved in Minority interests 0.1 0.2 0.0 0.0 0.0 0.0

Net attributable profit 53.3 17.6 109.8 23.5 27.2 31.2

consulting and the engineering/integration Adjusted net attr. profit 11.6 18.7 11.4 25.7 29.0 33.1

of communicating systems.

CASH FLOW STATEMENT (€m) 12/20 12/21 12/22 12/23e 12/24e 12/25e

Cash Flow 23.8 8.9 20.4 28.9 32.7 37.1

- Chg. in WCR 14.9 -5.1 9.6 6.4 6.6 7.9

- Capex 4.2 10.3 5.4 8.0 8.0 8.0

= Free Cash Flow 4.6 3.7 5.4 14.6 18.2 21.1

- Net financial investment 29.7 8.4 38.6 0.0 0.0 0.0

- Dividends 22.9 45.8 95.4 11.3 11.3 11.3

Market data + Capital increase/Share buybacks 0.0 0.0 0.0 0.0 0.0 0.0

12M Low/High € 35.50/€ 48.90 + Others -16.3 -4.7 11.3 -2.4 -2.8 -2.8

Volume (3M) 4,931 shares/day = Chg. net financial debt 1.1 55.2 3.5 -0.9 -4.0 -7.0

Number of shares 9,544,965

BALANCE SHEET (€m) 12/20 12/21 12/22 12/23e 12/24e 12/25e

Market cap. €m 387 Goodwill 52.1 66.5 71.6 71.6 71.6 71.6

Free Float €m 233 Other intangible assets 16.9 26.9 19.7 19.7 19.7 19.7

Market Euronext B Tangible assets 1.7 3.2 4.7 9.9 15.0 19.8

Sector IT Services Financial assets 11.6 4.5 1.7 1.7 1.7 1.7

WCR 1.5 -3.6 10.5 16.9 23.5 31.4

Bloomberg SWP FP Shareholders' equity (group share) 134.2 92.9 100.8 113.0 128.9 148.8

Isin FR0004180578 Minorities 1.8 1.4 0.7 0.7 0.7 0.8

Index CAC SMALL Equity + minorities 135.9 94.3 101.5 113.8 129.6 149.5

Cash and equivalent 105.8 55.3 57.1 61.0 65.0 72.0

Shareholders on 31/12/22 Net financial debt -52.6 2.6 6.1 5.2 1.2 -5.8

Free Float 60.3% Capital employed 77.6 89.6 95.9 107.5 119.1 131.9

Eximium 20.2%

Financière Sémaphore 17.9% PER SHARE DATA (€) 12/20 12/21 12/22 12/23e 12/24e 12/25e

Employes 1.6% Number of shares (000) 9,545 9,545 9,545 9,545 9,545 9,545

Number of diluted shares (000) 9,545 9,545 9,545 9,545 9,545 9,545

Employees on 31/12/22 2,723 Adjusted EPS 1.23 1.97 1.20 2.70 3.05 3.48

Reported EPS 5.58 1.85 11.50 2.47 2.85 3.27

Sales 2021 by activity CF per share 2.52 0.94 2.16 3.06 3.47 3.93

Services 91% Book value per share 14.40 9.99 10.76 12.05 13.73 15.84

Dividend 7.20 10.00 1.20 1.20 1.20 1.20

Solutions 9% Payout 587% 507% 100% 44% 39% 35%

Sales and EBIT 2021 by division

RATIOS 12/20 12/21 12/22 12/23e 12/24e 12/25e

Sales Gross margin/Sales 95.6% 94.4% 90.3% 90.3% 90.3% 90.3%

EBITDA/Sales 13.9% 13.6% 12.9% 12.5% 12.5% 12.6%

11% C. EBIT/Sales 9.5% 10.5% 10.0% 9.7% 10.0% 10.2%

EBIT/Sales 32.4% 8.9% 43.2% 9.7% 10.0% 10.2%

EBIT Corp. tax rate nd 0.0% 0.0% 0.0% 0.0% 0.0%

Adjusted NR/Sales 5.5% 8.8% 4.2% 8.4% 8.5% 8.6%

17% Capex/Sales 2.0% 4.8% 2.0% 2.6% 2.3% 2.1%

Capex/D&A 0.5x 2.0x 1.0x 1.4x 1.3x 1.3x

FCF/Sales 2.2% 1.7% 2.0% 4.8% 5.3% 5.5%

FCF/EBITDA 15.6% 12.6% 15.3% 38.2% 42.4% 43.9%

83% Goodwill/Equity + minorities 38.3% 70.5% 70.5% 63.0% 55.3% 47.9%

WCR/Sales 0.7% -1.7% 3.9% 5.5% 6.9% 8.2%

Gearing -38.7% 2.7% 6.0% 4.6% 0.9% -3.9%

Net financial debt/EBITDA -1.8x 0.1x 0.2x 0.1x 0.0x -0.1x

89% EBITDA/Financial charges 2.5x ns 6.5x ns ns ns

ROCE 53.3% 12.8% 70.6% 16.1% 16.9% 17.6%

ROE 8.6% 20.1% 11.2% 22.6% 22.4% 22.1%

IT Services Softwares

STOCK MARKET DATA 12/20 12/21 12/22 12/23e 12/24e 12/25e

Share price performance -8.1% 39.2% -9.7% 2.8% - -

Share price performance vs. CAC M&S -6.9% 19.5% 4.8% -0.8% - -

Sales and C. EBIT Margin

Share price High (€) 36.35 45.35 53.50 48.90 - -

Sales (€m) C. EBIT Margin Share price Low (€) 21.00 30.70 35.50 39.00 - -

Enterprise value (€m) 221.6 366.1 381.3 378.7 374.7 367.7

500 20% = Market cap. 291.5 375.1 388.3 386.6 386.6 386.6

+ Net financial debt -52.6 2.6 6.1 5.2 1.2 -5.8

+ Minorities 1.8 1.4 0.7 0.7 0.7 0.8

+ Provisions & others -7.5 -8.4 -12.2 -12.2 -12.2 -12.2

0 0% - Financial assets 11.6 4.5 1.7 1.7 1.7 1.7

12/17 12/18 12/19 12/20 12/21 12/22

VALUATION 12/20 12/21 12/22 12/23e 12/24e 12/25e

P/E 25.6x 22.2x 32.8x 15.0x 13.3x 11.6x

PEG ns 0.4x ns 0.1x 1.0x 0.8x

P/CF 12.5x 46.4x 18.3x 13.2x 11.7x 10.3x

EV/Sales 1.0x 1.7x 1.4x 1.2x 1.1x 1.0x

EV/EBITDA 7.5x 12.5x 10.9x 9.9x 8.7x 7.6x

EV/C. EBIT 11.0x 16.2x 14.0x 12.8x 11.0x 9.4x

EV/EBIT 3.2x 19.1x 3.2x 12.8x 11.0x 9.4x

EV/Capital employed 2.9x 4.1x 4.0x 3.5x 3.1x 2.8x

P/BV 2.2x 4.4x 3.7x 3.4x 3.0x 2.6x

FCF yield 1.6% 1.0% 1.4% 3.8% 4.7% 5.5%

Yield 23.0% 22.9% 3.0% 3.0% 3.0% 3.0%

Find our research at www.gilbertdupont.fr I please read the DISCLAIMER at the end of this document carefully

P2 Downloaded on www.gilbertdupont.fr by Mubashir Mohammad - 07/06/2023 09:17:14

You might also like

- MNPD ResponseDocument5 pagesMNPD ResponseAnonymous GF8PPILW5No ratings yet

- This Study Resource Was: ZumwaldDocument2 pagesThis Study Resource Was: ZumwaldVevo PNo ratings yet

- Hindustan Unilever RBSDocument6 pagesHindustan Unilever RBSJwalit VyasNo ratings yet

- Final Income TaxationDocument44 pagesFinal Income TaxationKimberly Ann Romero100% (2)

- IDBI Capital Sees 5% DOWNSIDE in Birlasoft Long Term Growth IntactDocument13 pagesIDBI Capital Sees 5% DOWNSIDE in Birlasoft Long Term Growth IntactmisfitmedicoNo ratings yet

- BSY Equity Research - Final ReportDocument16 pagesBSY Equity Research - Final Reportjazz.srishNo ratings yet

- Major Gains Were Seen in Our Core Business, The Business Technologies BusinessDocument16 pagesMajor Gains Were Seen in Our Core Business, The Business Technologies BusinessGNo ratings yet

- Alpha and Omega Semiconductor Ltd. (AOSL)Document7 pagesAlpha and Omega Semiconductor Ltd. (AOSL)Shreelalitha KarthikNo ratings yet

- Philippine Market Strategy: Adjusting Estimates On Rollover To 2020Document4 pagesPhilippine Market Strategy: Adjusting Estimates On Rollover To 2020JNo ratings yet

- Orient Electric IC Jun22Document44 pagesOrient Electric IC Jun22nishantNo ratings yet

- Brand Valuation MethodsDocument23 pagesBrand Valuation MethodsvroommNo ratings yet

- Happiest Minds TechnologiesLtd IPO NOTE07092020Document7 pagesHappiest Minds TechnologiesLtd IPO NOTE07092020subham mohantyNo ratings yet

- Gateway Distriparks: Making The Right Moves, Retain BuyDocument3 pagesGateway Distriparks: Making The Right Moves, Retain BuydarshanmadeNo ratings yet

- Centrum Broking Intellect Design Arena Initiating CoverageDocument31 pagesCentrum Broking Intellect Design Arena Initiating CoveragekanadeceNo ratings yet

- Research On CAMS by HDFC Securities - Nov 2020Document22 pagesResearch On CAMS by HDFC Securities - Nov 2020Sanjeet SahooNo ratings yet

- 2020 09 09 PH S Glo PDFDocument7 pages2020 09 09 PH S Glo PDFJNo ratings yet

- Advantech Corp. (2395.TW) - Good Industry 4.0 Concept But Limited Notable Catalysts Initiate at NeutralDocument30 pagesAdvantech Corp. (2395.TW) - Good Industry 4.0 Concept But Limited Notable Catalysts Initiate at NeutralJoachim HagegeNo ratings yet

- Abb - 1qcy20 - Hsie-202005150621199235065Document10 pagesAbb - 1qcy20 - Hsie-202005150621199235065darshanmaldeNo ratings yet

- AAPL ReportDocument4 pagesAAPL Reportyovokew738No ratings yet

- New O/W: Back To The Future: Countplus (CUP)Document6 pagesNew O/W: Back To The Future: Countplus (CUP)Muhammad ImranNo ratings yet

- Ch3 Income Statement - DVDocument44 pagesCh3 Income Statement - DVElf CanNo ratings yet

- Natgate 230515 Cu (Kenanga)Document4 pagesNatgate 230515 Cu (Kenanga)Muhammad SyafiqNo ratings yet

- Rising Footfall To Drive Valuation in Long Run... : Price Band - 221-230Document3 pagesRising Footfall To Drive Valuation in Long Run... : Price Band - 221-230jadeNo ratings yet

- IPO Performance Report - Q4 2021 FINALDocument11 pagesIPO Performance Report - Q4 2021 FINALSassi BaltiNo ratings yet

- MER: 9M20 Core Earnings Exceed Forecast, Raising Estimates On Better OutlookDocument11 pagesMER: 9M20 Core Earnings Exceed Forecast, Raising Estimates On Better OutlookJNo ratings yet

- Semi FinalDocument81 pagesSemi FinalAnkit MehtaNo ratings yet

- ACMELAB Short Equity Note 29012023Document7 pagesACMELAB Short Equity Note 29012023Raihan SobhanNo ratings yet

- Idea India Bulls 20090508Document5 pagesIdea India Bulls 20090508tousa1002No ratings yet

- Purple Style LabsDocument22 pagesPurple Style LabsRishav BothraNo ratings yet

- Hero Motocorp - Update - Feb20 - HDFC Sec-202002211210580924646Document10 pagesHero Motocorp - Update - Feb20 - HDFC Sec-202002211210580924646San DeepNo ratings yet

- Goldman Sachs - Navigating The AI EraDocument13 pagesGoldman Sachs - Navigating The AI Erasantiago.casarino970No ratings yet

- Results Below Expectation Due To Seasonally Weak Quarter Outlook Remains HealthyDocument1 pageResults Below Expectation Due To Seasonally Weak Quarter Outlook Remains HealthyMeharwal TradersNo ratings yet

- KPIT Technologies - Initiating Coverage - Centrum 26022020Document32 pagesKPIT Technologies - Initiating Coverage - Centrum 26022020Adarsh ReddyNo ratings yet

- Silo - Tips - Havells India Limited Hil Sector Consumer Discretionary MidcapDocument15 pagesSilo - Tips - Havells India Limited Hil Sector Consumer Discretionary MidcapRohit bugaliaNo ratings yet

- Avenue Supermarts LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument8 pagesAvenue Supermarts LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Glo: Increasing Digital Services Continues To Unlock Value of GcashDocument6 pagesGlo: Increasing Digital Services Continues To Unlock Value of GcashJajahinaNo ratings yet

- Happiest Minds Technologies Limited: Axis CapitalDocument13 pagesHappiest Minds Technologies Limited: Axis Capitalhthn gfufNo ratings yet

- Rating Update For Apple Inc: Stock Downgraded To Above Average From GoodDocument3 pagesRating Update For Apple Inc: Stock Downgraded To Above Average From Gooda pNo ratings yet

- 9888-HK ICBC International Research 12 Aug '21Document5 pages9888-HK ICBC International Research 12 Aug '21Victor Jávega HervásNo ratings yet

- Just Group Research Report 05.15.21Document4 pagesJust Group Research Report 05.15.21Ralph SuarezNo ratings yet

- Itc (Itc In) : Analyst Meet UpdateDocument18 pagesItc (Itc In) : Analyst Meet UpdateTatsam Vipul100% (1)

- BDO: 1Q19 Earnings Up 67% Y/y Above Estimates: Top Stories For The WeekDocument3 pagesBDO: 1Q19 Earnings Up 67% Y/y Above Estimates: Top Stories For The WeekJajahinaNo ratings yet

- 2023-05-01-APH.N-TD Cowen-Model Update - PT To $70 From $75-101746375Document11 pages2023-05-01-APH.N-TD Cowen-Model Update - PT To $70 From $75-101746375Nikhil PadiaNo ratings yet

- Ewallets Offer Upside Potential: April 30, 2020 Boku LN - Aim Boku.LDocument12 pagesEwallets Offer Upside Potential: April 30, 2020 Boku LN - Aim Boku.LMessina04No ratings yet

- IDirect PGElectroplast ManagementMeetDocument7 pagesIDirect PGElectroplast ManagementMeetbharat.divineNo ratings yet

- Google Earnings ReportDocument8 pagesGoogle Earnings ReportNotice AlertNo ratings yet

- MR Price Group - Annual Results - 2023Document50 pagesMR Price Group - Annual Results - 2023micaela.d.robertsNo ratings yet

- Wipro - Initiating Coverage - 08122020 - 08-12-2020 - 08Document15 pagesWipro - Initiating Coverage - 08122020 - 08-12-2020 - 08Devaansh RakhechaNo ratings yet

- Intraday Trading Rules, Basics Tips & Strategies by Angel BrokingDocument8 pagesIntraday Trading Rules, Basics Tips & Strategies by Angel Brokingmoisha sharmaNo ratings yet

- R R Kabel 20 09 2023 PrabhuDocument40 pagesR R Kabel 20 09 2023 PrabhusamraatjadhavNo ratings yet

- Investment Research: Fundamental Coverage - 3M India LimitedDocument8 pagesInvestment Research: Fundamental Coverage - 3M India Limitedrchawdhry123No ratings yet

- Gadang 3QFY20 Results PDFDocument4 pagesGadang 3QFY20 Results PDFAHMADNo ratings yet

- JP Morgan Task 2 ForagerDocument3 pagesJP Morgan Task 2 ForagerVilhelm CarlssonNo ratings yet

- CMP: Inr913 TP: Inr1030 (+13%) Buy Beats Expectation With Strong Operating PerformanceDocument10 pagesCMP: Inr913 TP: Inr1030 (+13%) Buy Beats Expectation With Strong Operating Performanceyousufch069No ratings yet

- Astra Industrial Group - GIB Capital PDFDocument13 pagesAstra Industrial Group - GIB Capital PDFikhan809No ratings yet

- BajconDocument22 pagesBajcon354Prakriti SharmaNo ratings yet

- Crompton Greaves ConsumerDocument24 pagesCrompton Greaves ConsumerSasidhar ThamilNo ratings yet

- Bernstein - Indian IT Services - Have Margins BottomedDocument30 pagesBernstein - Indian IT Services - Have Margins BottomedRohan ShahNo ratings yet

- SMIFSLimited SwarajEnginesLtd Q3FY24ResultUpdate TractorsontheedgeofpickingupSwarajpositionedwellAccumulate SMIFSInstitutionalResearch Jan 25 2024Document10 pagesSMIFSLimited SwarajEnginesLtd Q3FY24ResultUpdate TractorsontheedgeofpickingupSwarajpositionedwellAccumulate SMIFSInstitutionalResearch Jan 25 2024karankumar432447634784No ratings yet

- IIML ChangemakersDocument10 pagesIIML ChangemakersSAURABH RANGARINo ratings yet

- Task 2 TemplateDocument2 pagesTask 2 TemplateGauravVeeruSinghNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- O/W: "Foot Traffic Is Up": Universal Store (UNI)Document6 pagesO/W: "Foot Traffic Is Up": Universal Store (UNI)Muhammad ImranNo ratings yet

- The Benefits of Diversification: Peoplein (Ppe)Document9 pagesThe Benefits of Diversification: Peoplein (Ppe)Muhammad ImranNo ratings yet

- So Far, So Good: Reporting SeasonDocument8 pagesSo Far, So Good: Reporting SeasonMuhammad ImranNo ratings yet

- Time For A Pit Stop: Eagers Automotive LTD (APE)Document7 pagesTime For A Pit Stop: Eagers Automotive LTD (APE)Muhammad ImranNo ratings yet

- KALRAYDocument2 pagesKALRAYMuhammad ImranNo ratings yet

- O/W: "You Only Sell The Dresses You Have ": City Chic Collective (CCX)Document5 pagesO/W: "You Only Sell The Dresses You Have ": City Chic Collective (CCX)Muhammad ImranNo ratings yet

- Robust 1H22 Result: Costa Group (CGC)Document8 pagesRobust 1H22 Result: Costa Group (CGC)Muhammad ImranNo ratings yet

- FY22 Solid, Hopefully Modest DC Outlook: Macquarie Telecom Group LTD (MAQ)Document9 pagesFY22 Solid, Hopefully Modest DC Outlook: Macquarie Telecom Group LTD (MAQ)Muhammad ImranNo ratings yet

- M/W: The French Defence: Ramsay Health Care (RHC)Document8 pagesM/W: The French Defence: Ramsay Health Care (RHC)Muhammad ImranNo ratings yet

- M/W: Difficult To Read: Lumos Diagnostics (LDX)Document4 pagesM/W: Difficult To Read: Lumos Diagnostics (LDX)Muhammad ImranNo ratings yet

- FY22: Operating Leverage A Highlight: Nextdc (NXT)Document3 pagesFY22: Operating Leverage A Highlight: Nextdc (NXT)Muhammad ImranNo ratings yet

- Big, Quality Wins Will Build On Solid Base: Etherstack PLC (ESK)Document8 pagesBig, Quality Wins Will Build On Solid Base: Etherstack PLC (ESK)Muhammad ImranNo ratings yet

- Financing and Barley Crop Update: United Malt Group (UMG)Document2 pagesFinancing and Barley Crop Update: United Malt Group (UMG)Muhammad ImranNo ratings yet

- FY22: A Year of Consolidation: Damstra (DTC)Document7 pagesFY22: A Year of Consolidation: Damstra (DTC)Muhammad ImranNo ratings yet

- O/W: Seeding More Growth in The Franchise Network: Silk Laser Australia (SLA)Document8 pagesO/W: Seeding More Growth in The Franchise Network: Silk Laser Australia (SLA)Muhammad ImranNo ratings yet

- Time To Switch Channels: 14 September 2022Document5 pagesTime To Switch Channels: 14 September 2022Muhammad ImranNo ratings yet

- O/W: More Gains For The Grains: Clinuvel Pharmaceuticals (CUV)Document8 pagesO/W: More Gains For The Grains: Clinuvel Pharmaceuticals (CUV)Muhammad ImranNo ratings yet

- ASX S&P September Rebalance Predictions: QuantitativeDocument4 pagesASX S&P September Rebalance Predictions: QuantitativeMuhammad ImranNo ratings yet

- U/W: Investing To Fortify BTM Growth: Polynovo (PNV)Document7 pagesU/W: Investing To Fortify BTM Growth: Polynovo (PNV)Muhammad ImranNo ratings yet

- New O/W: Back To The Future: Countplus (CUP)Document6 pagesNew O/W: Back To The Future: Countplus (CUP)Muhammad ImranNo ratings yet

- New Zealand: Australia's Monetary Policy Canary?: 12 September 2022Document6 pagesNew Zealand: Australia's Monetary Policy Canary?: 12 September 2022Muhammad ImranNo ratings yet

- July Retail Sales: Real Growth Continues: Consumer DiscretionaryDocument4 pagesJuly Retail Sales: Real Growth Continues: Consumer DiscretionaryMuhammad ImranNo ratings yet

- Just How Sick Is The Chinese Economy?: 29 August 2022Document6 pagesJust How Sick Is The Chinese Economy?: 29 August 2022Muhammad ImranNo ratings yet

- Was Jackson Hole A Game Changer For Investment Markets?: 05 September 2022Document5 pagesWas Jackson Hole A Game Changer For Investment Markets?: 05 September 2022Muhammad ImranNo ratings yet

- Structural Growth Back On The Menu: Focus List September 2022Document12 pagesStructural Growth Back On The Menu: Focus List September 2022Muhammad ImranNo ratings yet

- O/W: Positive Trading Into PIII Readout: Opthea (OPT)Document4 pagesO/W: Positive Trading Into PIII Readout: Opthea (OPT)Muhammad ImranNo ratings yet

- M/W: Customers Are Returning: Mosaic Brands (MOZ)Document5 pagesM/W: Customers Are Returning: Mosaic Brands (MOZ)Muhammad ImranNo ratings yet

- RECELL Repigmentation Underwhelms: Avita Medical (AVH)Document2 pagesRECELL Repigmentation Underwhelms: Avita Medical (AVH)Muhammad ImranNo ratings yet

- Reporting Season Wrap-Up: 31 August 2022Document6 pagesReporting Season Wrap-Up: 31 August 2022Muhammad ImranNo ratings yet

- M/W: A Long Path of Contrition: Oncosil Medical (OSL)Document4 pagesM/W: A Long Path of Contrition: Oncosil Medical (OSL)Muhammad ImranNo ratings yet

- Parallel and Series ProblemsDocument7 pagesParallel and Series ProblemsJohn Mico GacoNo ratings yet

- CatalogDocument102 pagesCatalogeissa16No ratings yet

- Discrimination at The WorkplaceDocument4 pagesDiscrimination at The WorkplaceThe BNo ratings yet

- OpenText Extended ECM For SAP Solutions 16.2 - Installation and Upgrade Guide English (ERLK160200-00-IGD-En-01)Document184 pagesOpenText Extended ECM For SAP Solutions 16.2 - Installation and Upgrade Guide English (ERLK160200-00-IGD-En-01)Praveen RaoNo ratings yet

- No.123 Landlord and Tenant Responsibility For State and Condition of Property PDFDocument82 pagesNo.123 Landlord and Tenant Responsibility For State and Condition of Property PDFOptiks HamiltonNo ratings yet

- Petrobras Bond Issue (A)Document10 pagesPetrobras Bond Issue (A)Andres Emeric ARNo ratings yet

- Newer Oral Anticoagulants: Dabigatran Etexilate Is An Inactive Pro-DrugDocument5 pagesNewer Oral Anticoagulants: Dabigatran Etexilate Is An Inactive Pro-DrugLouiseNo ratings yet

- Operating Manual: Autobio Labtec Instruments Co.,ltdDocument58 pagesOperating Manual: Autobio Labtec Instruments Co.,ltdpsychejaneNo ratings yet

- Texas Instruments Incorporated: TMS320VC5402 DSKDocument22 pagesTexas Instruments Incorporated: TMS320VC5402 DSK0106062007No ratings yet

- Internship Report at BEML Limited MEDocument25 pagesInternship Report at BEML Limited MEmabu sab0% (1)

- Bagabaldo at AlDocument20 pagesBagabaldo at AlMae Ann SacayNo ratings yet

- Wheel Loaders: Innovative Drivetrain SolutionsDocument4 pagesWheel Loaders: Innovative Drivetrain SolutionsAli Tavakoli NiaNo ratings yet

- Shure Microphone 550L User GuideDocument2 pagesShure Microphone 550L User GuideAlexander J RokowetzNo ratings yet

- Citizenship ReviewerDocument4 pagesCitizenship Reviewerroansalanga100% (2)

- The Best Book To Learn Forex TradingDocument7 pagesThe Best Book To Learn Forex TradingMuhammad Iqbal0% (1)

- ThinkPad L13 Yoga Gen 2 Intel SpecDocument9 pagesThinkPad L13 Yoga Gen 2 Intel SpecKaarel HansberkNo ratings yet

- Corporate Governance in IndiaDocument22 pagesCorporate Governance in Indiaaishwaryasamanta0% (1)

- CS PDFDocument26 pagesCS PDFcwmediaNo ratings yet

- SDFGDocument2 pagesSDFGKirba K.No ratings yet

- dtcp2 261Document8 pagesdtcp2 261Sarthak ShuklaNo ratings yet

- Anna Mae CBLMDocument87 pagesAnna Mae CBLMsumaira abasNo ratings yet

- XML DITA Authoring Training - TechTotalDocument4 pagesXML DITA Authoring Training - TechTotalTechTotalNo ratings yet

- Minor Project Report Unified Wheel OpenerDocument50 pagesMinor Project Report Unified Wheel Openerapi-3757722100% (17)

- Geography Past PapersDocument14 pagesGeography Past PapersAnonymous fwDRDbNo ratings yet

- Radiotelephony Basics: 1. General Operating ProceduresDocument10 pagesRadiotelephony Basics: 1. General Operating ProceduresArunNo ratings yet

- Know Your VetsDocument9 pagesKnow Your VetsjacobNo ratings yet

- VUL Mock Exam 1 (October 2018)Document12 pagesVUL Mock Exam 1 (October 2018)Alona Villamor ChancoNo ratings yet