Professional Documents

Culture Documents

KALRAY

Uploaded by

Muhammad ImranCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

KALRAY

Uploaded by

Muhammad ImranCopyright:

Available Formats

FLASH 7 June 2023

KALRAY

BUY

Electronics

KAL

RAY

EPS 12/23e Unchanged • EPS 12/24e Unchanged

-

BUY

-

Pres

s

rele

ase

+

Con Press releas e +

tact Conta ct

PRICE* TP POTENTIAL

€ 26.00

*closing 06/06/23

€ 36.0 +38.5% Coolidge 2 on schedule

In line with its roadmap, Kalray has announced the tape-out of its new

Coolidge 2 DPU processor. The first samples will be available this

Press release + Contact

summer.

Bloomberg ALKAL FP

Market cap. €m 211

New generation of DPU in 2023

Free Float €m 172

Kalray's new generation of DPU (Data Processing Unit), Coolidge 2, will be launched onto

Volume (3M) €m 0.28/day the market in the second-half of 2023. The group is making a leap in performance

compared with the previous generation of processors (x10), while offering reduced energy

consumption. Its processors are particularly well suited to processing algorithms and data-

Price CAC M&S EPS (GD)

40.0 0.00 intensive storage, features that are currently very much in the spotlight with the success

35.0 -0.50 of ChatGPT, a tool that requires these two types of data processing.

-1.00

30.0

-1.50

The first contract linked to the Coolidge 2 DPU is the jumbo contract, announced at the

25.0

20.0

-2.00 end of 2022. The group is currently in discussions for other contracts of this type.

-2.50

15.0 -3.00

10.0

Jun-21 Dec-21 Jun-22 Dec-22

-3.50

Jun-23 Reminder of the details

In line with its roadmap, Kalray has announced the tape-out of Coolidge 2 (dispatching of

PERFORMANCE 1M 6M 12M the photomask of the circuits to the manufacturing plant), thereby enabling it to have the

Absolute +48.4% +53.5% +12.6% first samples of the processor this summer. This stage represents an investment of €4m,

Rel. / CAC M&S +51.6% +48.7% +19.9% and production of these processors will be performed by the Taiwanese firm TSMC.

AGENDA

Buoyant environment

11/07/23 after the close : H1 sales

Kalray is currently operating in a buoyant environment. In addition to the start to

production of its products and all the news about artificial intelligence and the associated

FINANCIAL ANALYST(S)

need for processors to handle it, the sector is undergoing a strong period of consolidation

Yann de Peyrelongue (acquisition of Fungibles by Microsoft at the beginning of the year).

+33 (0) 1 40 22 41 13

yann.de-peyrelongue@socgen.com Rating and TP confirmed

Document completed on 07/06/2023 - 08:28 We confirm our rating and TP at a time when the group is benefiting from a healthy

Document published on 07/06/2023 - 08:29 momentum, both in its market (strong growth, consolidation) and internally (jumbo

contracts, new hardware and software products). The group has expressed its confidence

in its ability to double sales to €40m this year, thereby enabling it to significantly reduce

its losses. Our forecasts are in line with this guidance.

STOCK RATIOS 12/22 12/23e 12/24e 12/25e FINANCIAL DATA 12/22 12/23e 12/24e 12/25e

P/E ns ns 14.8x 6.8x Sales (€m) 16.4 40.0 80.0 112.0

PEG ns ns ns 0.1x C. EBIT (€m) -19.6 -9.7 9.1 27.2

P/CF 50.9x 18.2x 6.8x 4.4x C. EBIT/Sales -119.6% -24.3% 11.4% 24.3%

EV/Sales 9.9x 5.5x 2.6x 1.7x EBIT (€m) -19.6 -9.7 9.1 27.2

EV/EBITDA ns 30.0x 8.1x 4.2x Net attributable profit (€m) -15.5 -5.2 14.5 31.3

EV/C. EBIT ns ns 23.1x 6.9x Adjusted EPS (€) -1.93 -0.64 1.76 3.80

EV/EBIT ns ns 23.1x 6.9x Chg. ns ns ns 116.1%

EV/Capital employed 5.6x 4.6x 3.9x 3.1x FCF (€m) -16.4 -23.7 7.7 24.5

P/BV 2.9x 5.0x 3.8x 2.4x Net fin. debt (€m) -19.3 4.4 -3.3 -27.8

FCF yield -9.0% -11.1% 3.6% 11.4% Gearing -40.4% 10.4% -5.9% -31.5%

Yield 0.0% 0.0% 0.0% 0.0% ROCE -51.8% -15.5% 12.8% 33.8%

P1 Find our Downloaded

research at www.gilbertdupont.fr I please

on www.gilbertdupont.fr read the DISCLAIMER

by Mubashir Mohammadat the -end of this document

07/06/2023 carefully

09:17:12

Retrouvez notre recherche sur www.gilbertdupont.fr I DISCLAIMER : merci de lire attentivement l’avertissement en fin de document

7 June 2023

KALRAY BUY Yann de Peyrelongue +33 (0) 1 40 22 41 13

PRICE* TP POTENTIAL PROFIT LOSS STATEMENT (€m) 12/20 12/21 12/22 12/23e 12/24e 12/25e

Sales 1.0 1.5 16.4 40.0 80.0 112.0

€ 26.00 € 36.0 +38.5% Chg. -18.3% 40.8% 1028.9% 143.7% 100.0% 40.0%

*closing 06/06/23 Chg. lfl -18.3% 40.8% 203.6% 78.5% 100.0% 40.0%

EBITDA -5.9 -5.8 -2.7 7.3 26.1 44.2

C. EBIT -14.7 -18.6 -19.6 -9.7 9.1 27.2

EBIT -14.7 -18.6 -19.6 -9.7 9.1 27.2

Net interest income -0.1 -0.1 0.2 -0.3 -0.3 -0.3

Tax 3.0 3.6 8.1 4.7 5.6 4.4

Income from associates 0.0 0.0 0.0 0.0 0.0 0.0

Activity Net earnings from discontinued operations 0.0 0.0 0.0 0.0 0.0 0.0

Kalray is a many-core processor conceptor Minority interests 0.0 0.0 0.0 0.0 0.0 0.0

Net attributable profit -11.8 -15.1 -15.5 -5.2 14.5 31.3

addressing datacenter and autonomous Adjusted net attr. profit -11.8 -15.1 -15.5 -5.2 14.5 31.3

vehicle industries

CASH FLOW STATEMENT (€m) 12/20 12/21 12/22 12/23e 12/24e 12/25e

Cash Flow -5.1 -4.8 2.7 11.8 31.5 48.3

- Chg. in WCR 0.5 2.3 4.5 19.5 7.7 5.8

- Capex 10.5 13.6 14.7 16.0 16.0 18.0

= Free Cash Flow -16.2 -20.7 -16.4 -23.7 7.7 24.5

- Net financial investment 0.0 0.0 0.9 0.0 0.0 0.0

- Dividends 0.0 0.0 0.0 0.0 0.0 0.0

Market data + Capital increase/Share buybacks 13.6 11.1 36.7 0.0 0.0 0.0

12M Low/High € 14.08/€ 26.65 + Others 2.3 1.9 1.6 0.0 0.0 0.0

Volume (3M) 15,634 shares/day = Chg. net financial debt -0.2 -7.7 18.8 -23.7 7.7 24.5

Number of shares 8,071,798

BALANCE SHEET (€m) 12/20 12/21 12/22 12/23e 12/24e 12/25e

Market cap. €m 211

Goodwill 0.0 0.0 13.8 13.8 13.8 13.8

Free Float €m 172 Other intangible assets 19.1 19.5 24.4 21.4 18.4 17.4

Market Euronext Growth Tangible assets 4.3 4.8 3.1 5.1 7.1 9.1

Sector Electronics Financial assets 0.6 0.7 0.4 0.4 0.4 0.4

Bloomberg ALKAL FP WCR -1.1 2.2 -12.7 6.7 14.5 20.3

Shareholders' equity (group share) 28.4 25.6 47.7 42.5 57.0 88.2

Isin FR0010722819 Minorities 0.0 0.0 0.0 0.0 0.0 0.0

Index EN Growth Allshare Equity + minorities 28.4 25.6 47.7 42.5 57.0 88.2

Shareholders on 02/12/22 Cash and equivalent 20.2 12.2 32.2 8.5 16.3 40.7

Net financial debt -8.4 -0.6 -19.3 4.4 -3.3 -27.8

Free float 81.4% Capital employed 22.9 27.1 28.9 47.4 54.1 60.9

NXP 6.3%

Pengpai France 4.4% PER SHARE DATA (€) 12/20 12/21 12/22 12/23e 12/24e 12/25e

Safran Corporate Ventures 4.0% Number of shares (000) 5,348 5,830 8,072 8,237 8,237 8,237

CEA Investissement 3.9% Number of diluted shares (000) 5,858 6,436 9,269 9,137 9,137 9,137

Adjusted EPS -2.39 -2.70 -1.93 -0.64 1.76 3.80

Employees on 31/12/22 188 Reported EPS -2.39 -2.70 -1.93 -0.64 1.76 3.80

CF per share -0.95 -0.82 0.34 1.43 3.82 5.86

2022 sales by region Book value per share 5.32 4.40 5.91 5.16 6.91 10.71

Europe 55% Dividend 0.00 0.00 0.00 0.00 0.00 0.00

Others 43% Payout 0% 0% 0% 0% 0% 0%

France 2% RATIOS 12/20 12/21 12/22 12/23e 12/24e 12/25e

2022 sales by activity Gross margin/Sales 70.3% 64.1% 56.0% 55.0% 60.0% 60.0%

EBITDA/Sales -567% -397% -16.7% 18.2% 32.7% 39.5%

C. EBIT/Sales ns ns -120% -24.3% 11.4% 24.3%

EBIT/Sales ns ns -120% -24.3% 11.4% 24.3%

Corp. tax rate 0.0% 0.0% -20.8% 0.0% -2.9% -8.9%

0%

Adjusted NR/Sales ns ns -94.7% -13.1% 18.1% 27.9%

Capex/Sales ns 937% 89.3% 40.0% 20.0% 16.1%

Capex/D&A ns ns ns ns ns ns

38% FCF/Sales ns ns -99.8% -59.2% 9.7% 21.9%

FCF/EBITDA ns ns ns ns 29.7% 55.4%

Goodwill/Equity + minorities 0.0% 0.0% 28.8% 32.4% 24.2% 15.6%

WCR/Sales -108% 150% -77.5% 16.8% 18.1% 18.1%

62% Gearing -29.4% -2.3% -40.4% 10.4% -5.9% -31.5%

Net financial debt/EBITDA 1.4x 0.1x 7.0x 0.6x -0.1x -0.6x

EBITDA/Financial charges ns ns ns 28.2x ns ns

ROCE -54.9% -55.8% -51.8% -15.5% 12.8% 33.8%

ROE -41.6% -59.0% -32.6% -12.3% 25.4% 35.5%

STOCK MARKET DATA 12/20 12/21 12/22 12/23e 12/24e 12/25e

Equipment sales Services Share price performance 40.2% 5.7% -45.3% 49.9% - -

Share price performance vs. CAC M&S 42.0% -9.3% -36.5% 44.7% - -

Share price High (€) 30.00 49.10 35.00 26.65 - -

Sales and C. EBIT Margin Share price Low (€) 13.55 28.50 14.08 15.60 - -

Enterprise value (€m) 96.1 211.5 163.2 218.7 210.9 186.4

Sales (€m) C. EBIT Margin = Market cap. 105.0 212.6 182.5 214.2 214.2 214.2

+ Net financial debt -8.4 -0.6 -19.3 4.4 -3.3 -27.8

20 0% + Minorities 0.0 0.0 0.0 0.0 0.0 0.0

+ Provisions & others 0.1 0.1 0.4 0.5 0.5 0.5

- Financial assets 0.6 0.7 0.4 0.4 0.4 0.4

0 -2000% VALUATION 12/20 12/21 12/22 12/23e 12/24e 12/25e

12/17 12/18 12/19 12/20 12/21 12/22

P/E ns ns ns ns 14.8x 6.8x

PEG ns ns ns ns ns 0.1x

P/CF ns ns 50.9x 18.2x 6.8x 4.4x

EV/Sales ns ns 9.9x 5.5x 2.6x 1.7x

EV/EBITDA ns ns ns 30.0x 8.1x 4.2x

EV/C. EBIT ns ns ns ns 23.1x 6.9x

EV/EBIT ns ns ns ns 23.1x 6.9x

EV/Capital employed 4.2x 7.8x 5.6x 4.6x 3.9x 3.1x

P/BV 5.6x 7.2x 2.9x 5.0x 3.8x 2.4x

FCF yield -15.4% -9.7% -9.0% -11.1% 3.6% 11.4%

Yield 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

Find our research at www.gilbertdupont.fr I please read the DISCLAIMER at the end of this document carefully

P2 Downloaded on www.gilbertdupont.fr by Mubashir Mohammad - 07/06/2023 09:17:12

You might also like

- 21 02 08 DP More Margin More Upside Buy TP 38 From 32Document24 pages21 02 08 DP More Margin More Upside Buy TP 38 From 32tarun606No ratings yet

- Compressortech2 May2018 PDFDocument60 pagesCompressortech2 May2018 PDFCristian SNo ratings yet

- Automotive (DTDocument7 pagesAutomotive (DTS raoNo ratings yet

- Kegs Per Year: We Are Stainless Steel Keg Manufacturers, Worldwide and With The Most InnovatingDocument2 pagesKegs Per Year: We Are Stainless Steel Keg Manufacturers, Worldwide and With The Most InnovatingnickandyNo ratings yet

- D1.3 Digital Twin Enabling Technology CatalogueDocument31 pagesD1.3 Digital Twin Enabling Technology Cataloguev jNo ratings yet

- Catalogue Fisa PDFDocument30 pagesCatalogue Fisa PDFRobobatMaroc2012No ratings yet

- Department of Information Technology &: Artificial Intelligence & Data ScienceDocument4 pagesDepartment of Information Technology &: Artificial Intelligence & Data ScienceVSBCETC EXAM CELLNo ratings yet

- LA-H811P Seite 5Document100 pagesLA-H811P Seite 5vimalsomaNo ratings yet

- Services Pétroliers Schlumberger - Parc PITP - 895 Rue de La Vieille Poste - 34000 Montpellier-FranceDocument7 pagesServices Pétroliers Schlumberger - Parc PITP - 895 Rue de La Vieille Poste - 34000 Montpellier-FranceNavidNo ratings yet

- Organisation and Market Economics: Producer Theory Prof. Thiagu RanganathanDocument14 pagesOrganisation and Market Economics: Producer Theory Prof. Thiagu RanganathanBabiya MoirangthemNo ratings yet

- Men 0100Document20 pagesMen 0100fileseekerNo ratings yet

- Geda Manual EngDocument18 pagesGeda Manual Enganilp12rNo ratings yet

- D60 Line Distance Relay: Instruction ManualDocument484 pagesD60 Line Distance Relay: Instruction ManualyaneiroNo ratings yet

- Manual Book Ge D60Document500 pagesManual Book Ge D60latifu sofwanNo ratings yet

- Att-Telco-002-600-625 - National Osp Design EngineeringDocument174 pagesAtt-Telco-002-600-625 - National Osp Design EngineeringwenNo ratings yet

- D60man x1Document758 pagesD60man x1Basudev PatraNo ratings yet

- IN 3847 00 Rev0 ENDocument7 pagesIN 3847 00 Rev0 ENjmam1992No ratings yet

- D60man x2Document754 pagesD60man x2Hari HidayatNo ratings yet

- ESCATEC TQ - STATUS (Update Oct)Document17 pagesESCATEC TQ - STATUS (Update Oct)Louis ChewNo ratings yet

- Kirloskar Pneumatic Co-Ltd 505283 D 10 Rs.531.2 Rs. 563/348: Stock DataDocument5 pagesKirloskar Pneumatic Co-Ltd 505283 D 10 Rs.531.2 Rs. 563/348: Stock DataForceFieldNo ratings yet

- Computer-To-Plate Technology: Violet or Thermo?: M. MittelhausDocument4 pagesComputer-To-Plate Technology: Violet or Thermo?: M. MittelhausDGrafico Marco Camargo SolizNo ratings yet

- 9001 124 PDFDocument524 pages9001 124 PDFAlex ParaschivuNo ratings yet

- GER-4900 Obsolescence Notification GS December 2020Document12 pagesGER-4900 Obsolescence Notification GS December 2020Senta ClausNo ratings yet

- CT2009 I O Systems SOT 3Document25 pagesCT2009 I O Systems SOT 3Vignesh RajanNo ratings yet

- Compal LA-5151P KAT00 Discrete VGA POITIER Montevina M96-M92 Dell Studio 1745 PDFDocument60 pagesCompal LA-5151P KAT00 Discrete VGA POITIER Montevina M96-M92 Dell Studio 1745 PDFMichael Davenport0% (1)

- D60 Line Distance Relay: Instruction ManualDocument490 pagesD60 Line Distance Relay: Instruction ManualmarcosNo ratings yet

- Electronic Control Module (ECM) - Flash ProgramDocument4 pagesElectronic Control Module (ECM) - Flash ProgramPutra Jawa100% (1)

- TO Miniasic MPW EUROPRACTICE v1 191121 PRELIMINARYDocument3 pagesTO Miniasic MPW EUROPRACTICE v1 191121 PRELIMINARYdalbarNo ratings yet

- Cominucations Guide GE 489Document78 pagesCominucations Guide GE 489Hudson GurgelNo ratings yet

- NISE50 GCIoT PDFDocument2 pagesNISE50 GCIoT PDFjdmarinNo ratings yet

- SALOME 7 2 0 Release Notes PDFDocument32 pagesSALOME 7 2 0 Release Notes PDFdavid0775No ratings yet

- Quick Guide SAP B1 On Cloud Advance 1Document131 pagesQuick Guide SAP B1 On Cloud Advance 1Jhowen ClosaNo ratings yet

- 如何推動高速光纖傳輸系統產業化技術 蔡高峰博士20200213Document14 pages如何推動高速光纖傳輸系統產業化技術 蔡高峰博士20200213David TsuiNo ratings yet

- SL No Description Import Supply, USD Supply Indegeneous Installation IndegeneousDocument6 pagesSL No Description Import Supply, USD Supply Indegeneous Installation IndegeneousraviNo ratings yet

- Digital Adder Circuits: A Review of Power, Delay, Area and Transistor CountDocument6 pagesDigital Adder Circuits: A Review of Power, Delay, Area and Transistor CountDeepak SharmaNo ratings yet

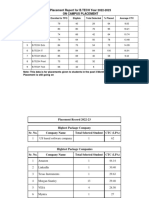

- B.Tech Placement Report 2022 23Document2 pagesB.Tech Placement Report 2022 23himanshu mukaneNo ratings yet

- TMPRO CASABE 1318 Ecopetrol Full Report 2500 PsiDocument79 pagesTMPRO CASABE 1318 Ecopetrol Full Report 2500 PsiDiego CastilloNo ratings yet

- Casper-Uma CR HPB MV MB v1Document81 pagesCasper-Uma CR HPB MV MB v1Ibrahim AlsaidiNo ratings yet

- DSIL Asset-List - AMC2023-24 AMCDocument3 pagesDSIL Asset-List - AMC2023-24 AMCPriyanka YadavNo ratings yet

- DB GP30-DEMO enDocument20 pagesDB GP30-DEMO enKupeKrisztiNo ratings yet

- GD369003 R2 Nitrogen RefillingDocument9 pagesGD369003 R2 Nitrogen RefillingCarlos ParrillaNo ratings yet

- Xh31a 0000 0001 - R1B PDFDocument37 pagesXh31a 0000 0001 - R1B PDFs07081991100% (1)

- Ultrascale Plus Fpga Product Selection GuideDocument11 pagesUltrascale Plus Fpga Product Selection Guideismail topcuNo ratings yet

- VGB PowerTech 2015 12 NAVROTSKY AutorenexemplarDocument7 pagesVGB PowerTech 2015 12 NAVROTSKY AutorenexemplarIrena SavuNo ratings yet

- R20 - Cloud UpdateDocument25 pagesR20 - Cloud Updateshashank singhNo ratings yet

- GUL - DER - ZXSDR B8200 Product DescriptionDocument40 pagesGUL - DER - ZXSDR B8200 Product DescriptionCamilo Bazan Heredia60% (5)

- 37 Patena 2022-01-12 Seminariogesel Jan22Document34 pages37 Patena 2022-01-12 Seminariogesel Jan22Ananda LagoNo ratings yet

- Service Manual (Unique) : History Information For The Following ManualDocument44 pagesService Manual (Unique) : History Information For The Following Manualangel quinteroNo ratings yet

- Grid Solutions: B30 Bus Differential SystemDocument540 pagesGrid Solutions: B30 Bus Differential Systemcanciones cristianas de montes MontesNo ratings yet

- CCTV Handbook 2020Document68 pagesCCTV Handbook 2020cecil swartNo ratings yet

- ASIA Telecom Dec 07Document15 pagesASIA Telecom Dec 07Peter LowNo ratings yet

- RelaysDocument430 pagesRelaysSumith VkNo ratings yet

- Smart Weighting MachineDocument10 pagesSmart Weighting MachineSaroj kumar BiswasNo ratings yet

- R-P-AP-0002 Rev00 Georg Fischer CATA SPEC Description of Structure of PDMS Project PDFDocument4 pagesR-P-AP-0002 Rev00 Georg Fischer CATA SPEC Description of Structure of PDMS Project PDFdesai_tejasNo ratings yet

- Master - Calibration Log (Hugrs)Document5 pagesMaster - Calibration Log (Hugrs)Mohamed AbdelfatahNo ratings yet

- Diatron Communication Protocols r07Document50 pagesDiatron Communication Protocols r07Bogdan PratiaNo ratings yet

- OS IoC As of 18 04 21Document60 pagesOS IoC As of 18 04 21Marco GrecoNo ratings yet

- JPR 54079 DailmerAG EquityResearch Report 1303Document35 pagesJPR 54079 DailmerAG EquityResearch Report 1303André Fonseca100% (1)

- Time For A Pit Stop: Eagers Automotive LTD (APE)Document7 pagesTime For A Pit Stop: Eagers Automotive LTD (APE)Muhammad ImranNo ratings yet

- O/W: Mayne To Reward The Willing: Mayne Pharma Group (MYX)Document8 pagesO/W: Mayne To Reward The Willing: Mayne Pharma Group (MYX)Muhammad ImranNo ratings yet

- So Far, So Good: Reporting SeasonDocument8 pagesSo Far, So Good: Reporting SeasonMuhammad ImranNo ratings yet

- O/W: "You Only Sell The Dresses You Have ": City Chic Collective (CCX)Document5 pagesO/W: "You Only Sell The Dresses You Have ": City Chic Collective (CCX)Muhammad ImranNo ratings yet

- 1H22 Result: Softening Revenue Outlook Likely Requires Timely Cost AdjustmentsDocument8 pages1H22 Result: Softening Revenue Outlook Likely Requires Timely Cost AdjustmentsMuhammad ImranNo ratings yet

- The Benefits of Diversification: Peoplein (Ppe)Document9 pagesThe Benefits of Diversification: Peoplein (Ppe)Muhammad ImranNo ratings yet

- M/W: The French Defence: Ramsay Health Care (RHC)Document8 pagesM/W: The French Defence: Ramsay Health Care (RHC)Muhammad ImranNo ratings yet

- FY22 Solid, Hopefully Modest DC Outlook: Macquarie Telecom Group LTD (MAQ)Document9 pagesFY22 Solid, Hopefully Modest DC Outlook: Macquarie Telecom Group LTD (MAQ)Muhammad ImranNo ratings yet

- O/W: "Foot Traffic Is Up": Universal Store (UNI)Document6 pagesO/W: "Foot Traffic Is Up": Universal Store (UNI)Muhammad ImranNo ratings yet

- Big, Quality Wins Will Build On Solid Base: Etherstack PLC (ESK)Document8 pagesBig, Quality Wins Will Build On Solid Base: Etherstack PLC (ESK)Muhammad ImranNo ratings yet

- First Impressions On FY22 Result: The A2 Milk Company (A2M)Document2 pagesFirst Impressions On FY22 Result: The A2 Milk Company (A2M)Muhammad ImranNo ratings yet

- Robust 1H22 Result: Costa Group (CGC)Document8 pagesRobust 1H22 Result: Costa Group (CGC)Muhammad ImranNo ratings yet

- M/W: Difficult To Read: Lumos Diagnostics (LDX)Document4 pagesM/W: Difficult To Read: Lumos Diagnostics (LDX)Muhammad ImranNo ratings yet

- FY22: A Year of Consolidation: Damstra (DTC)Document7 pagesFY22: A Year of Consolidation: Damstra (DTC)Muhammad ImranNo ratings yet

- FY22: Operating Leverage A Highlight: Nextdc (NXT)Document3 pagesFY22: Operating Leverage A Highlight: Nextdc (NXT)Muhammad ImranNo ratings yet

- July Retail Sales: Real Growth Continues: Consumer DiscretionaryDocument4 pagesJuly Retail Sales: Real Growth Continues: Consumer DiscretionaryMuhammad ImranNo ratings yet

- New O/W: Back To The Future: Countplus (CUP)Document6 pagesNew O/W: Back To The Future: Countplus (CUP)Muhammad ImranNo ratings yet

- O/W: "Strong, Prudent Growth": Wisr LTD (WZR)Document5 pagesO/W: "Strong, Prudent Growth": Wisr LTD (WZR)Muhammad ImranNo ratings yet

- U/W: Investing To Fortify BTM Growth: Polynovo (PNV)Document7 pagesU/W: Investing To Fortify BTM Growth: Polynovo (PNV)Muhammad ImranNo ratings yet

- O/W: More Gains For The Grains: Clinuvel Pharmaceuticals (CUV)Document8 pagesO/W: More Gains For The Grains: Clinuvel Pharmaceuticals (CUV)Muhammad ImranNo ratings yet

- O/W: Seeding More Growth in The Franchise Network: Silk Laser Australia (SLA)Document8 pagesO/W: Seeding More Growth in The Franchise Network: Silk Laser Australia (SLA)Muhammad ImranNo ratings yet

- Abares Upgrades Winter Crop Forecast: Graincorp (GNC)Document2 pagesAbares Upgrades Winter Crop Forecast: Graincorp (GNC)Muhammad ImranNo ratings yet

- Financing and Barley Crop Update: United Malt Group (UMG)Document2 pagesFinancing and Barley Crop Update: United Malt Group (UMG)Muhammad ImranNo ratings yet

- Adolescent Label Submitted: Clinuvel Pharmaceuticals (CUV)Document2 pagesAdolescent Label Submitted: Clinuvel Pharmaceuticals (CUV)Muhammad ImranNo ratings yet

- ASX S&P September Rebalance Predictions: QuantitativeDocument4 pagesASX S&P September Rebalance Predictions: QuantitativeMuhammad ImranNo ratings yet

- Was Jackson Hole A Game Changer For Investment Markets?: 05 September 2022Document5 pagesWas Jackson Hole A Game Changer For Investment Markets?: 05 September 2022Muhammad ImranNo ratings yet

- Time To Switch Channels: 14 September 2022Document5 pagesTime To Switch Channels: 14 September 2022Muhammad ImranNo ratings yet

- Structural Growth Back On The Menu: Focus List September 2022Document12 pagesStructural Growth Back On The Menu: Focus List September 2022Muhammad ImranNo ratings yet

- RECELL Repigmentation Underwhelms: Avita Medical (AVH)Document2 pagesRECELL Repigmentation Underwhelms: Avita Medical (AVH)Muhammad ImranNo ratings yet

- RWSchedule 1378198005086Document4 pagesRWSchedule 1378198005086nsaid_31No ratings yet

- CF BolwithpomDocument4 pagesCF BolwithpomJoseph MarreirosNo ratings yet

- Job Order CostingDocument32 pagesJob Order CostingSetia NurulNo ratings yet

- 2 (F) Amount of Any Other Exemption Under Section 10: Annexure To Form 16 Part BDocument3 pages2 (F) Amount of Any Other Exemption Under Section 10: Annexure To Form 16 Part BAnonymous IIj5AONo ratings yet

- General Concept of Islamic BankingDocument28 pagesGeneral Concept of Islamic BankingEmranNo ratings yet

- Analysis of Business CombinationsDocument58 pagesAnalysis of Business Combinationstehsin123No ratings yet

- Addisalem Assefa PDFDocument54 pagesAddisalem Assefa PDFKefi BelayNo ratings yet

- Wallstreetjournaleurope 20160819 The Wall Street Journal EuropeDocument36 pagesWallstreetjournaleurope 20160819 The Wall Street Journal EuropestefanoNo ratings yet

- Cashflow StatementDocument3 pagesCashflow StatementDEVINA GURRIAHNo ratings yet

- Reconcilliation Part1Document25 pagesReconcilliation Part1019. Disha Das fybafNo ratings yet

- Financial ManagementDocument44 pagesFinancial ManagementNitish SinhaNo ratings yet

- Partnership DeedDocument6 pagesPartnership DeedMD Khalik100% (1)

- VAT Non-Vat VAT Non-Vat: Goods ServicesDocument11 pagesVAT Non-Vat VAT Non-Vat: Goods ServicesAko Si KulitzNo ratings yet

- Case StudyDocument11 pagesCase Studyapi-269859076No ratings yet

- Resources and Needs: GRADES 1 To 12 Daily Lesson Log Monday Tuesday Wednesday Thursday FridayDocument10 pagesResources and Needs: GRADES 1 To 12 Daily Lesson Log Monday Tuesday Wednesday Thursday FridayRey Mark RamosNo ratings yet

- 0807 - Ec 1Document23 pages0807 - Ec 1haryhunter50% (2)

- Clubbing of IncomeDocument18 pagesClubbing of IncometilokiNo ratings yet

- Market Data ApproachDocument29 pagesMarket Data ApproachMarites BalmasNo ratings yet

- 7 Steps To Understanding The Stock Market Ebook v3 PDFDocument40 pages7 Steps To Understanding The Stock Market Ebook v3 PDFRiyasNo ratings yet

- Installment Sales LectureDocument10 pagesInstallment Sales LecturePenny TratiaNo ratings yet

- Wood FSDocument117 pagesWood FSAnton SocoNo ratings yet

- 2007-2013 Taxation Law Philippine Bar Examination Questions and Suggested Answers (JayArhSals&Ladot)Document125 pages2007-2013 Taxation Law Philippine Bar Examination Questions and Suggested Answers (JayArhSals&Ladot)Jay-Arh93% (98)

- NAV Vs SAPDocument7 pagesNAV Vs SAPdanijela_garabiljevicNo ratings yet

- Big Picture: MetalanguageDocument25 pagesBig Picture: MetalanguageANGEL ROSALNo ratings yet

- ANSWERS TO EXERCISES 4 TH Edition Cost B PDFDocument81 pagesANSWERS TO EXERCISES 4 TH Edition Cost B PDFAnnNo ratings yet

- Englisch Truffle 2016Document8 pagesEnglisch Truffle 2016signalhucksterNo ratings yet

- 02 Republic vs. Sunlife Assurance Company of Canada, 473 SCRA 129, G.R. No. 158085 Oct 14, 2005Document23 pages02 Republic vs. Sunlife Assurance Company of Canada, 473 SCRA 129, G.R. No. 158085 Oct 14, 2005Galilee RomasantaNo ratings yet

- 2nd Quarter - 1st ENTREPRENEUR SummativeDocument3 pages2nd Quarter - 1st ENTREPRENEUR SummativeCyrill Gabunilas Fausto100% (1)

- Short Term Decision Making: Vincent Joseph D. Disu, CPPS, MbaDocument22 pagesShort Term Decision Making: Vincent Joseph D. Disu, CPPS, MbaMaria Maganda MalditaNo ratings yet

- Cta 1D CV 08114 D 2014dec10 RefDocument149 pagesCta 1D CV 08114 D 2014dec10 RefCess MelendezNo ratings yet