Professional Documents

Culture Documents

Nestle Policy

Uploaded by

Musanif shahOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nestle Policy

Uploaded by

Musanif shahCopyright:

Available Formats

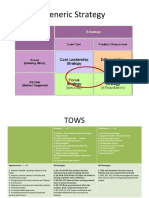

Nestle space matrix:

Financial strength:

1. Return on capital employed increases by 40% 4

2. Price earnings ratio in 2020 was 18.8 as compared to 2018 38.9 5

3. Debt equity ratio changes from 63:37 to 66:34 3

4. Net profit increased by 94% in 2020 as compared to 2018 5

5. Nestlé’s net sale increased by 20% in 2020 as compared to 2018 3

20

Industry strength:

1. In order to maximize profit possibilities, market segment growth has drawn new 5

competitors.

2. an expansion of the consumer food sector by 14% 5

3. Only 6% of businesses overall contribute to the processed milk sector. 4

4. Because of ease of entry in market, Engro Foods and Shezand Foods are 4

effectively using their resources.

18

Competitive advantage:

1. In a number of product categories, Nestle products lead the market. -2

2. high-quality countrywide product distribution networks -1

3. Nestle has a loyal following of customers. -2

4. Nestle's premium brand extension strategy ensures an extended product life cycle. -2

-7

Environmental stability:

1. A slowing economy may result in less demand -2

2. Changing inflationary circumstances in the country -2

3. Price aspects of comparable products -1

-5

1) Average FS= +20/5 = +4

2) Average CA= -7/4 = -1.75

3) Average IS= +18/4 = +4.5

4) Average ES= -5/3 = -1.67

X = CA + IS = ( -1.75) + (+4.5) = +2.75

Y = FS + ES = (+4) + (-1.67) = +2.33

6

Conservative 5

Aggressive

4 Airblue Airline lies on this

3 Quadrant

2

P (2.20, 1.20)

1

-X X

-6 -5 -4 -3 -2 -1 1 2 3 4 5 6

-1

-2

-3

-4

Defensive Competative

-5

-6

-Y

You might also like

- DA4139 Level III CFA Mock Exam 1 AfternoonDocument31 pagesDA4139 Level III CFA Mock Exam 1 AfternoonIndrama Purba100% (1)

- Logic Pivot TradingDocument5 pagesLogic Pivot TradingkosurugNo ratings yet

- Valuation Methods and Shareholder Value CreationFrom EverandValuation Methods and Shareholder Value CreationRating: 4.5 out of 5 stars4.5/5 (3)

- MAC Cheat SheetDocument18 pagesMAC Cheat SheetAmariah ShairNo ratings yet

- Case Study - Biopharma Inc.: Presented ByDocument22 pagesCase Study - Biopharma Inc.: Presented ByGauri Singh100% (2)

- Economics Extended EssayDocument25 pagesEconomics Extended EssayAritra9296No ratings yet

- Strategic Planning Course Taster PDFDocument66 pagesStrategic Planning Course Taster PDFAkchu Kad100% (1)

- Space Matrix SampleDocument3 pagesSpace Matrix SampleAngelicaBernardoNo ratings yet

- SWOT MatrixDocument3 pagesSWOT MatrixMuhammad Raza AdnanNo ratings yet

- Aggressive Conservative FP: Internal AnalysisDocument2 pagesAggressive Conservative FP: Internal AnalysisSamdc23433% (3)

- Final Practice Questions and SolutionsDocument12 pagesFinal Practice Questions and Solutionsshaikhnazneen100No ratings yet

- Introduction To Risk and Return: Principles of Corporate FinanceDocument30 pagesIntroduction To Risk and Return: Principles of Corporate FinancechooisinNo ratings yet

- Shell Swot&SpaceDocument5 pagesShell Swot&SpaceMohamad WafiyNo ratings yet

- Coursera Online Course Corporate Finance Essentials Quiz All AnswersDocument4 pagesCoursera Online Course Corporate Finance Essentials Quiz All AnswersMD GOLAM SARWER100% (5)

- Space MatrixDocument4 pagesSpace MatrixAlvinNo ratings yet

- E) Strategic Position and Action Evaluation (SPACE) Matrix: Financial Position (FP) RateDocument3 pagesE) Strategic Position and Action Evaluation (SPACE) Matrix: Financial Position (FP) RateAleezah Gertrude RegadoNo ratings yet

- Chapter 4 Ethics in The MarketplaceDocument19 pagesChapter 4 Ethics in The MarketplaceLH100% (1)

- Space Matrix NestleDocument2 pagesSpace Matrix NestleHaris AminNo ratings yet

- SPACE Matrix of Microsoft CorpDocument2 pagesSPACE Matrix of Microsoft CorpJaja HollaNo ratings yet

- WS14 Space MatrixDocument4 pagesWS14 Space MatrixTherese PascuaNo ratings yet

- Sample - Snail Market, 2032Document33 pagesSample - Snail Market, 2032munndongatiNo ratings yet

- Space Matrix Gul AhmedDocument4 pagesSpace Matrix Gul AhmedRehan Mansoor100% (2)

- Hira SlidesDocument9 pagesHira SlidesspanglenightNo ratings yet

- PEARSON FORMAT For STRAMA PAPERDocument15 pagesPEARSON FORMAT For STRAMA PAPERmarkanthony08No ratings yet

- The Strategic PositionDocument2 pagesThe Strategic PositionjaidsheikhNo ratings yet

- Space Matrix and IE Matrix of HPDocument3 pagesSpace Matrix and IE Matrix of HPSAMNo ratings yet

- Chinh 8defgDocument6 pagesChinh 8defgThục Chinh TrầnNo ratings yet

- Internal Strength PositionDocument11 pagesInternal Strength PositionkulsoomalamNo ratings yet

- A Strategic Management Case Study: Amirul HanifDocument5 pagesA Strategic Management Case Study: Amirul HanifAmirul Hanif100% (1)

- Feasibility Study of Raisin1Document18 pagesFeasibility Study of Raisin1Abdelmoneim BakheitNo ratings yet

- Ipca Laboratories (IPCLAB) : Weak Formulation Exports Drag NumbersDocument14 pagesIpca Laboratories (IPCLAB) : Weak Formulation Exports Drag NumbersManu GuptaNo ratings yet

- AnalysisDocument29 pagesAnalysisxaxif100% (1)

- Space Matrix Strategic Position and Action Evaluation MatrixDocument4 pagesSpace Matrix Strategic Position and Action Evaluation MatrixJan Mariel JoloanNo ratings yet

- Pearson Format For Strama PaperDocument16 pagesPearson Format For Strama PapershameeydrNo ratings yet

- Space MatrixDocument17 pagesSpace MatrixLifeStacksNo ratings yet

- Institute of Business Management: Final Examinations - FALL 2020Document9 pagesInstitute of Business Management: Final Examinations - FALL 2020Konainr RazaNo ratings yet

- The Umversity of The West IndiesDocument7 pagesThe Umversity of The West IndiesIsmadth2918388No ratings yet

- SPACE Matrix: Internal Analysis: External AnalysisDocument3 pagesSPACE Matrix: Internal Analysis: External AnalysisMuhammad Faiez HazlyNo ratings yet

- Name:-Purva Patel ID NO.: - 20BBA129 Subject: - Business Legend SEM 3 2020-23Document34 pagesName:-Purva Patel ID NO.: - 20BBA129 Subject: - Business Legend SEM 3 2020-23PURVA PATELNo ratings yet

- Strategic Managment (6th Session)Document49 pagesStrategic Managment (6th Session)Omair Hamid EnamNo ratings yet

- Assessment of Wacc of Mcdonald'S Corp. (MCD) : 20127 - Business Valuation Fall Term 2019/2020Document21 pagesAssessment of Wacc of Mcdonald'S Corp. (MCD) : 20127 - Business Valuation Fall Term 2019/2020Mato VikNo ratings yet

- Finance Quiz 8Document71 pagesFinance Quiz 8Peak ChindapolNo ratings yet

- EMH Recap ExercisesDocument3 pagesEMH Recap ExercisesMirela KafalievaNo ratings yet

- Saurashtra University: Faculty of CommerceDocument59 pagesSaurashtra University: Faculty of CommerceUjjval TrivediNo ratings yet

- Template For Content Gap AnalysisDocument48 pagesTemplate For Content Gap AnalysisPratima SinghNo ratings yet

- Security Analysis and Portfolio Management (Fiba732) Mba 3 SemesterDocument3 pagesSecurity Analysis and Portfolio Management (Fiba732) Mba 3 SemesterAnay BiswasNo ratings yet

- Financial Reporting Paper 2.1Document24 pagesFinancial Reporting Paper 2.1abbeangedesireNo ratings yet

- Space Matrix SlidesDocument12 pagesSpace Matrix SlidesHong JunNo ratings yet

- April 2018 Investor PresentationDocument39 pagesApril 2018 Investor PresentationAlex lyuNo ratings yet

- AcknowledgementDocument14 pagesAcknowledgementZunair FiazNo ratings yet

- Sapphire Space MatrixDocument7 pagesSapphire Space Matrixmian577938No ratings yet

- Asset Pricing Models PDFDocument2 pagesAsset Pricing Models PDFsakshi68No ratings yet

- INA W5Formative TSDocument5 pagesINA W5Formative TSNayden GeorgievNo ratings yet

- Industry ReportDocument58 pagesIndustry ReportSwarup TarkaseNo ratings yet

- Agri Input Report-18020242026Document9 pagesAgri Input Report-18020242026jyothsnaNo ratings yet

- CH 4 - Portfolio Management (2024) - HandoutDocument21 pagesCH 4 - Portfolio Management (2024) - HandoutMayibongwe MpofuNo ratings yet

- Wastage Azdpur Mandi 13-5-2015Document92 pagesWastage Azdpur Mandi 13-5-2015zinga007No ratings yet

- 13 Kgopakumar ONGC - IndiaDocument28 pages13 Kgopakumar ONGC - Indiapasha khanNo ratings yet

- An Economic Analysis of Post - Harvest Losses and Marketing of Groundnut (Arachis Hypogaea) in Anantapur District of Andhra PradeshDocument5 pagesAn Economic Analysis of Post - Harvest Losses and Marketing of Groundnut (Arachis Hypogaea) in Anantapur District of Andhra PradeshInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- HandbookDocument48 pagesHandbookSanjay SharmaNo ratings yet

- Chapter 6 Strategy Analysis and Choice For REVLON IncDocument12 pagesChapter 6 Strategy Analysis and Choice For REVLON IncShelly Mae SiguaNo ratings yet

- CRISIL Research Ier Report Kanpur PlasticpackDocument22 pagesCRISIL Research Ier Report Kanpur PlasticpackdidwaniasNo ratings yet

- Report Writing GuidelinesDocument7 pagesReport Writing GuidelinesTaz UddinNo ratings yet

- Business Valuation: Abdul Azeempage 1Document1 pageBusiness Valuation: Abdul Azeempage 1AbdulAzeemNo ratings yet

- SME Internationalization Strategies: Innovation to Conquer New MarketsFrom EverandSME Internationalization Strategies: Innovation to Conquer New MarketsNo ratings yet

- Air Blue Strategic Management Mohib Hussain, Obaid Khan, Musanif Shah, Faisal Razim & Hamza AkhtarDocument14 pagesAir Blue Strategic Management Mohib Hussain, Obaid Khan, Musanif Shah, Faisal Razim & Hamza AkhtarMusanif shahNo ratings yet

- Concept of Riba and Its Modes in Classical - PPTX QDocument12 pagesConcept of Riba and Its Modes in Classical - PPTX QMusanif shahNo ratings yet

- 0 Takaful QuizDocument2 pages0 Takaful QuizMusanif shahNo ratings yet

- 12 - Shariah Governance For Islamic Banks in PakistanDocument35 pages12 - Shariah Governance For Islamic Banks in PakistanMusanif shahNo ratings yet

- Chapter 2Document20 pagesChapter 2PreethaSureshNo ratings yet

- Strategic Module 1Document17 pagesStrategic Module 1Racky King PalacioNo ratings yet

- Ceylon Cold Storage Annual Report 2022-23Document252 pagesCeylon Cold Storage Annual Report 2022-23Joya AhasanNo ratings yet

- Industrial Location Theories - Alka GautamDocument16 pagesIndustrial Location Theories - Alka GautamRasha DeyNo ratings yet

- Udah Bener'Document4 pagesUdah Bener'Shafa AzahraNo ratings yet

- Responsibility AccountingDocument12 pagesResponsibility AccountingYannah HidalgoNo ratings yet

- Revitalizing The BrandDocument28 pagesRevitalizing The Brandanindya_kunduNo ratings yet

- QANT520 Render Ch07 0706 ProblemsDocument10 pagesQANT520 Render Ch07 0706 ProblemsRahil VermaNo ratings yet

- What Are Advantages and Disadvantages of Global Sourcing?Document2 pagesWhat Are Advantages and Disadvantages of Global Sourcing?Gaurav Bagga81% (32)

- UntitledDocument482 pagesUntitlednanu miglaniNo ratings yet

- Perfectly Competitive MarketsDocument36 pagesPerfectly Competitive MarketsSaurabh SharmaNo ratings yet

- I BDocument7 pagesI BMarimuthuNo ratings yet

- The Economics of FootballDocument32 pagesThe Economics of FootballEshrat SharminNo ratings yet

- Robin SheremetaDocument48 pagesRobin SheremetaImran SikandarNo ratings yet

- Gut Effi Ciency The Key Ingredient in Pig and Poultry ProductionDocument193 pagesGut Effi Ciency The Key Ingredient in Pig and Poultry Productionadin dazaNo ratings yet

- Pricing Strategies For Firms With Market PowerDocument33 pagesPricing Strategies For Firms With Market PowerIkrame KiyadiNo ratings yet

- Business Math Q1 W4 M4 LDS Markup Markdown and Mark On ALG RTPDocument8 pagesBusiness Math Q1 W4 M4 LDS Markup Markdown and Mark On ALG RTPABMachineryNo ratings yet

- AE Handout 4 Market Strucuture - Contemporary Problems of EntrepreneurDocument3 pagesAE Handout 4 Market Strucuture - Contemporary Problems of EntrepreneurJake CanlasNo ratings yet

- Econ1268 Price Theory Third Semester 2013 Game Theory Exercise 9Document10 pagesEcon1268 Price Theory Third Semester 2013 Game Theory Exercise 9HanTranNo ratings yet

- NCFE Level 1/2 Technical Award in Business and Enterprise (603/2955/5)Document22 pagesNCFE Level 1/2 Technical Award in Business and Enterprise (603/2955/5)Syed Mohammad Hammad ZaidiNo ratings yet

- Vocabulary Terms Meaning (Keyword/s)Document5 pagesVocabulary Terms Meaning (Keyword/s)Steiffen ivan IlaganNo ratings yet

- Chapter 9Document21 pagesChapter 9kumikooomakiNo ratings yet

- Ceylon Hospitals PLC and Nawaloka Hospitals PLC (1194)Document22 pagesCeylon Hospitals PLC and Nawaloka Hospitals PLC (1194)Bajalock Virus0% (1)

- Project Report On Strategic Analysis of PDFDocument17 pagesProject Report On Strategic Analysis of PDFNarina KananyanNo ratings yet

- Impact of Advertising On Sales and ProfitDocument7 pagesImpact of Advertising On Sales and ProfitSharmili DharNo ratings yet