Professional Documents

Culture Documents

RPT 03 DXL - Margin Kpis

Uploaded by

api-513411115Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RPT 03 DXL - Margin Kpis

Uploaded by

api-513411115Copyright:

Available Formats

Margin KPIs

While you’ll likely look at Sales first, your margin KPIs are just as critical to

understanding the health and sustainability of your business and driving next

actions. After all, margins are what your business actually delivers to the

organization.

You may have only one margin metric that you track and manage to, or you may

have visibility to multiple margin KPIs, including:

• Initial Mark-Up (IMU)

• Gross Margin – usually Sales less COGS*

• Other Margins – e.g., incorporating transportation costs, inventory holding costs or other “costs

to service” etc.

*What’s included in COGs can vary by company definition. This is why it’s important to understand what

is and is not included in each calculation/KPI definition!

In the end, there is also a net or final margin for the company, which comprises what is left after SG&A

(Selling, General and Administrative Expenses), Marketing and other costs, and is not typically yours to

manage to. As a Merchant or Planner, you are responsible for a version of the Merchandise Margin from

which these other costs are deducted.

Type and Frequency of Margin KPIs

The following are the most commonly looked at Markdown and Margin KPIs and the time periods they

are most valid for. You’ll note that Markdown KPIs are included in this category, as these are the primary

lever impacting the realized margin. Further, decisions about markdowns are the primary way that you

can influence the margin as you manage the business in-season.

Daily Weekly Monthly Quarterly/ “Product Lifetime”

Seasonally/

Annually

• N/A (can • Gross Margin • Same as Weekly • Same as Monthly • Same as Monthly

fluctuate too Value

plus

widely to drive • Gross Margin %

daily reaction) • Promo/POS • Receipt IMU %

Markdown Value (initial mark-up

• Promo/POS rate)

Markdown %

• Permanent

Markdown Value

• Permanent

Markdown %

These figures should always be compared to Plan (where applicable), Forecast (where available) and

Last Year.

© Merchant Academy, B.V. 2022. All rights reserved. Confidential. Page 1

In addition to the most common or typical margin KPIs above, you also may have visibility to your

average unit retail (AUR). When you also have your average initial retail AIR, comparing the two is often

a quick way to see how much of your product is being sold at – or near – full price. Both of these KPIs

can be applied at the item level, but also rolled up to larger groupings of products, so it represents the

blended AIR and AUR.

You can also check the AUR against both Plan and LY to see if discounting is running higher or lower than

expected, so looking at AUR in this manner is another way to determine if unexpected discounting is

impacting your margin.

However, AUR will also capture whether or not there has been a major shift in the value of the product

going out the door versus either your Plan or LY. This may be due to a change in regular price retail or

the mix of product in the category you are looking at, so while it’s a handy measure, its shifts vs. Plan

and LY may not reflect only discounting and a margin impact.

It should also be noted that if your business is managed at cost value, then you will not have a

Markdown Plan… Markdowns only exist in a plan if you are managing your inventory at retail value.

What Are You Looking For?

In reviewing your margin and profitability figures there are three main

insights you are trying to gain on your business:

• Are you achieving (or exceeding) your margin plan? Pay particular

attention to the margin value vs. the margin percentage. After all,

you don’t take a percentage to the bank.

• What areas of the business are driving your margin results (what is

strong, what is weak)? This can be determined by looking at both

the value and % of margin for different sections of the business -

by Brand, by product category, by product type, etc.

• What role are both the IMU (Initial Mark-Up) and

promo/markdown activity having on the profit result? Are these

results in line with your expectations given your strategy and the

time in the season?

Turning Insights Into Actions

You never look at your markdowns and resulting margin in isolation. You

consider them in context of your sales performance and your inventory

position. But all other things being equal, you want to turn your margin

insights into action by changing tactics to increase profit without increasing

your (future) inventory risk.

In practical terms, you are trying to find ways to increase the profit-per-

item-sold, and selling more of the items that get you higher margin.

© Merchant Academy, B.V. 2022. All rights reserved. Confidential. Page 2

Your main levers are to:

• Increase your initial mark-up (usually

mainly a pre-season activity, but can

be employed in-season during the re-

negotiation of costs for re-orders)

• Reduce your markdown cost

• Offset your markdown cost

Vendor markdown support (money they give

you to “pay” for their markdowns) is the most

common avenue to offset your cost. But this

will only improve your margin if your financial

systems allow you to recognize and take the

credit before the calculation of your margin.

Your business rules, your position in the market and your company strategies will influence which of

these levers you actually have available to you. But each week you should be reviewing all of your

options in order to determine which actions will help you achieve your margin goals.

Some things to ask yourself as you review IMU, Markdowns and Margin:

• Can I negotiate a better cost on product still to come in?

• Can I increase my orders on items with higher IMU?

• Should I dial-up or dial-down upcoming promotional activity?

• Do I need to accelerate or hold off on taking permanent

markdowns?

• Can I get vendor support/funding to offset the costs of the actions I

need to take?

Remember, Margin is a critical KPI… but you can’t control it directly. You can only take actions that will

drive sales, IMU or markdowns, which will result in a margin for your business.

© Merchant Academy, B.V. 2022. All rights reserved. Confidential. Page 3

You might also like

- RPT 02 - Sales KpisDocument3 pagesRPT 02 - Sales Kpisapi-513411115No ratings yet

- Break Even AnalysisDocument3 pagesBreak Even AnalysisNikhil AgrawalNo ratings yet

- Summary: Financial Intelligence: Review and Analysis of Berman and Knight's BookFrom EverandSummary: Financial Intelligence: Review and Analysis of Berman and Knight's BookNo ratings yet

- SaaS - Primer (VF) PDFDocument20 pagesSaaS - Primer (VF) PDFfiend114100% (2)

- How to Structure a Commission Plan That Works: Sales Optimisation, #1From EverandHow to Structure a Commission Plan That Works: Sales Optimisation, #1No ratings yet

- Growth Strategies: Quick Guide for Growing Your Business and Brand OnlineFrom EverandGrowth Strategies: Quick Guide for Growing Your Business and Brand OnlineNo ratings yet

- Practical Guide Analysing Your Business Sales 80 20 RuleDocument10 pagesPractical Guide Analysing Your Business Sales 80 20 RuleIssam Yaseen BasbarNo ratings yet

- Sales ManagementDocument9 pagesSales ManagementSANJAY RATHINo ratings yet

- Break Even Analysis Roi (Return On Investment) Economic Analysis New Product DevelopmentDocument40 pagesBreak Even Analysis Roi (Return On Investment) Economic Analysis New Product DevelopmentGurpreet GillNo ratings yet

- Revenue Model: - Assess The Potential Sources of RevenueDocument32 pagesRevenue Model: - Assess The Potential Sources of RevenueChaitali KeluskarNo ratings yet

- The Profit Zone (Review and Analysis of Slywotzky and Morrison's Book)From EverandThe Profit Zone (Review and Analysis of Slywotzky and Morrison's Book)No ratings yet

- Sales QuotasDocument19 pagesSales QuotastanyaNo ratings yet

- Sales Performance Metrics CalculatorDocument26 pagesSales Performance Metrics CalculatorTyas NinggarNo ratings yet

- Key Performance Indicators: Strategy Directors' BriefingDocument4 pagesKey Performance Indicators: Strategy Directors' BriefingMarcel e Andrea BonfimNo ratings yet

- Sales QuotaDocument8 pagesSales QuotaKiran S RaoNo ratings yet

- Reporting On Financial Performance-UpdateDocument17 pagesReporting On Financial Performance-UpdateMD. AZMAL HOSSAINNo ratings yet

- RPT 01 - Kpi and Reporting Rules of ThumbDocument4 pagesRPT 01 - Kpi and Reporting Rules of Thumbapi-513411115No ratings yet

- The Breakthrough Imperative (Review and Analysis of Gottfredson and Schaubert's Book)From EverandThe Breakthrough Imperative (Review and Analysis of Gottfredson and Schaubert's Book)No ratings yet

- Mathematics of Retail BuyingDocument34 pagesMathematics of Retail BuyingBhavyata ChavdaNo ratings yet

- Mastering Operational Performance : The Ultimate KPI HandbookFrom EverandMastering Operational Performance : The Ultimate KPI HandbookNo ratings yet

- BoS - Helping You Assess Your Business PerformanceDocument33 pagesBoS - Helping You Assess Your Business PerformancegerardkokNo ratings yet

- Break-Even Point PDFDocument2 pagesBreak-Even Point PDFFaisal Rao67% (3)

- Key Performance IndicatorsDocument6 pagesKey Performance IndicatorsfloraNo ratings yet

- 50+ Metrics For StartupsDocument20 pages50+ Metrics For Startupsbao toan nguyenNo ratings yet

- Key Metrics Start Up NotesDocument18 pagesKey Metrics Start Up NotesYUVRAJ SINGHNo ratings yet

- 4 Essential Metrics For SaaS Startups Evaluation - MetabetaDocument11 pages4 Essential Metrics For SaaS Startups Evaluation - MetabetaDragosnicNo ratings yet

- The Business Case For Product RationalizationDocument19 pagesThe Business Case For Product RationalizationitspossblNo ratings yet

- Distinguishing Revenue - Profitability - and Risk MetricsDocument5 pagesDistinguishing Revenue - Profitability - and Risk Metricsdmalyshev0No ratings yet

- Super-Charge Your Sales Team: A Sales Manager’s Guide to Effective CoachingFrom EverandSuper-Charge Your Sales Team: A Sales Manager’s Guide to Effective CoachingNo ratings yet

- KPI Help in Predicting The Growth of BusinessDocument1 pageKPI Help in Predicting The Growth of Businessvishal kashyapNo ratings yet

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- 100 Tips for Consulting Firms to Accelerate Profit and Value GrowthFrom Everand100 Tips for Consulting Firms to Accelerate Profit and Value GrowthRating: 4 out of 5 stars4/5 (1)

- MA MidtermDocument3 pagesMA MidtermTRUNG NGUYỄN KIÊNNo ratings yet

- Top 10 Metrics For A Product TeamDocument16 pagesTop 10 Metrics For A Product TeamLaure DSYNo ratings yet

- Key 3 The Hidden Power of Your Financial ForecastDocument10 pagesKey 3 The Hidden Power of Your Financial ForecastIcecream-y JaclynNo ratings yet

- Sales Forecasting ProjectDocument8 pagesSales Forecasting ProjectVipul KothariNo ratings yet

- The Founder's Guide To Finance - 20+ Metrics To Track in 2024Document2 pagesThe Founder's Guide To Finance - 20+ Metrics To Track in 2024Abhishek8101No ratings yet

- The SaaS Sales Method for Customer Success & Account Managers: How to Grow Customers: Sales Blueprints, #6From EverandThe SaaS Sales Method for Customer Success & Account Managers: How to Grow Customers: Sales Blueprints, #6Rating: 4 out of 5 stars4/5 (2)

- Sales Plan Template 21Document3 pagesSales Plan Template 21Anonymous xv5fUs4AvNo ratings yet

- What Is A Sales Forecast?Document7 pagesWhat Is A Sales Forecast?Mr.SDNo ratings yet

- Gross MarginDocument13 pagesGross MarginIshita Ghosh100% (1)

- Credible Framework WorkbookDocument4 pagesCredible Framework WorkbookKunalNo ratings yet

- Mini Project ReportDocument18 pagesMini Project ReportClash With KAINo ratings yet

- LEAN ENTERPRISE: Transforming Organizations Through Agile Principles and Continuous Improvement (2023 Guide for Beginners)From EverandLEAN ENTERPRISE: Transforming Organizations Through Agile Principles and Continuous Improvement (2023 Guide for Beginners)No ratings yet

- Marketing Matters: A Market Analysis Methodology Leading to a Marketing Simulation CapabilityFrom EverandMarketing Matters: A Market Analysis Methodology Leading to a Marketing Simulation CapabilityNo ratings yet

- Financial Evaluation Report With SampleDocument12 pagesFinancial Evaluation Report With SamplemaidangphapNo ratings yet

- Financial PlanDocument9 pagesFinancial PlanIndra Kusuma AdiNo ratings yet

- Ap 04 - Assortment Performance Analysis DXLDocument4 pagesAp 04 - Assortment Performance Analysis DXLapi-513411115No ratings yet

- Spreadsheet DDocument9 pagesSpreadsheet Dapi-513411115No ratings yet

- 5below NotesDocument1 page5below Notesapi-513411115No ratings yet

- Ap 03 - Product TypesDocument4 pagesAp 03 - Product Typesapi-513411115No ratings yet

- Ap 01 - Introduction To Assortment Planning DXLDocument4 pagesAp 01 - Introduction To Assortment Planning DXLapi-513411115No ratings yet

- Ap 02 - Product RolesDocument4 pagesAp 02 - Product Rolesapi-513411115No ratings yet

- Chapter 3 NotesDocument1 pageChapter 3 Notesapi-513411115No ratings yet

- Press Release - A Fire Cannot Stop Camp JCCDocument1 pagePress Release - A Fire Cannot Stop Camp JCCapi-513411115No ratings yet

- Digital PortfolioDocument27 pagesDigital Portfolioapi-513411115No ratings yet

- Aa 05 - Attribute AnalysisDocument3 pagesAa 05 - Attribute Analysisapi-513411115No ratings yet

- dsmr232 - Team CharterDocument2 pagesdsmr232 - Team Charterapi-513411115No ratings yet

- Assignment B - Calculating Individual and Cumulative Markups 7Document4 pagesAssignment B - Calculating Individual and Cumulative Markups 7api-513411115No ratings yet

- Aa 04 - Defining and Using AttributesDocument3 pagesAa 04 - Defining and Using Attributesapi-513411115No ratings yet

- BiographiesDocument3 pagesBiographiesapi-513411115No ratings yet

- Assignment A Using Computerized Spreadsheets 7Document9 pagesAssignment A Using Computerized Spreadsheets 7api-513411115No ratings yet

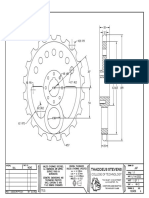

- Week 13 SprocketDocument1 pageWeek 13 Sprocketapi-513411115No ratings yet

- Fact SheetDocument1 pageFact Sheetapi-513411115No ratings yet

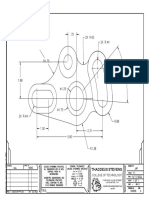

- Week 9 Idler PlateDocument1 pageWeek 9 Idler Plateapi-513411115No ratings yet

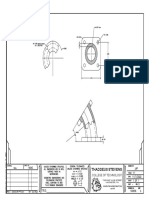

- Week 12 ElbowDocument1 pageWeek 12 Elbowapi-513411115No ratings yet

- Fabscrap ReflectionDocument2 pagesFabscrap Reflectionapi-513411115No ratings yet

- TextilesDocument1 pageTextilesapi-513411115No ratings yet

- DSMR 211 Final Presentation Madison PfaffDocument11 pagesDSMR 211 Final Presentation Madison Pfaffapi-513411115No ratings yet

- Woven LabDocument2 pagesWoven Labapi-513411115No ratings yet

- Wool Yarn Project Madison PfaffDocument3 pagesWool Yarn Project Madison Pfaffapi-513411115No ratings yet

- Swatches Man Made Fibers Madison PfaffDocument8 pagesSwatches Man Made Fibers Madison Pfaffapi-513411115No ratings yet

- Swatches Print Assignment MadisonpfaffDocument16 pagesSwatches Print Assignment Madisonpfaffapi-513411115No ratings yet

- Whats New in Woven FabricsDocument8 pagesWhats New in Woven Fabricsapi-513411115No ratings yet

- Airworthiness Directive: FAA Aviation SafetyDocument2 pagesAirworthiness Directive: FAA Aviation SafetyCarlos VarrentiNo ratings yet

- STD Specification For Design and Integration of Fuel Energy Storage F3063Document7 pagesSTD Specification For Design and Integration of Fuel Energy Storage F3063Kobus PretoriusNo ratings yet

- BBO2020Document41 pagesBBO2020qiuNo ratings yet

- IBS and SIBO Differential Diagnosis, SiebeckerDocument1 pageIBS and SIBO Differential Diagnosis, SiebeckerKrishna DasNo ratings yet

- Chanakya: For The Indian Television Series Based On His Life, SeeDocument11 pagesChanakya: For The Indian Television Series Based On His Life, SeeTrinadh CrazyguyNo ratings yet

- Firing OrderDocument5 pagesFiring OrderCurtler PaquibotNo ratings yet

- RIBA PoWUpdate 131009 ProbynMiersDocument28 pagesRIBA PoWUpdate 131009 ProbynMiersYellowLightNo ratings yet

- O Repensar Da Fonoaudiologia Na Epistemologia CienDocument5 pagesO Repensar Da Fonoaudiologia Na Epistemologia CienClaudilla L.No ratings yet

- RELATION AND FUNCTION - ModuleDocument5 pagesRELATION AND FUNCTION - ModuleAna Marie ValenzuelaNo ratings yet

- Heisenberg, "Über Den Anschaulichen Inhalt Der Quantentheoretischen Kinematik Und Mechanik"Document16 pagesHeisenberg, "Über Den Anschaulichen Inhalt Der Quantentheoretischen Kinematik Und Mechanik"Benjamin Crowell0% (1)

- Intergard 475HS - Part B - EVA046 - GBR - ENG PDFDocument10 pagesIntergard 475HS - Part B - EVA046 - GBR - ENG PDFMohamed NouzerNo ratings yet

- Teacher'S Individual Plan For Professional Development SCHOOL YEAR 2020-2021Document2 pagesTeacher'S Individual Plan For Professional Development SCHOOL YEAR 2020-2021Diether Mercado Padua100% (8)

- Mang-May-Tinh - 03a.-Dns1 - (Cuuduongthancong - Com)Document52 pagesMang-May-Tinh - 03a.-Dns1 - (Cuuduongthancong - Com)Anh Quân TrầnNo ratings yet

- PDFDocument3 pagesPDFvaliNo ratings yet

- Acronyms and AbbreviationsDocument875 pagesAcronyms and AbbreviationsLacky KrishnanNo ratings yet

- Daily Plankton Agrabinta CianjurDocument141 pagesDaily Plankton Agrabinta CianjurPutra Cahya GemilangNo ratings yet

- CSCU Module 08 Securing Online Transactions PDFDocument29 pagesCSCU Module 08 Securing Online Transactions PDFdkdkaNo ratings yet

- Caddy Arc 251i Service ManualDocument52 pagesCaddy Arc 251i Service Manualrikycien100% (8)

- 1Z0-061 Sample Questions AnswersDocument6 pages1Z0-061 Sample Questions AnswersLaura JohnstonNo ratings yet

- Computerized Flat Knitting Machine Computerized Flat Knitting Machine Computerized Flat Knitting Machine Computerized Flat Knitting MachineDocument61 pagesComputerized Flat Knitting Machine Computerized Flat Knitting Machine Computerized Flat Knitting Machine Computerized Flat Knitting MachineAmira's ClothesNo ratings yet

- Polyembryony &its ImportanceDocument17 pagesPolyembryony &its ImportanceSURIYA PRAKASH GNo ratings yet

- Case StudyDocument2 pagesCase StudyFadhlin Sakina SaadNo ratings yet

- PrimerCube Manufacturing GuideDocument57 pagesPrimerCube Manufacturing GuideTinaMaleenaNo ratings yet

- COMMISSIONING COUPLE Aafidavit SANKET DOCTORDocument2 pagesCOMMISSIONING COUPLE Aafidavit SANKET DOCTORYogesh ChaudhariNo ratings yet

- BRENTON TarrantDocument4 pagesBRENTON TarrantSayyidNo ratings yet

- PBPO008E FrontmatterDocument13 pagesPBPO008E FrontmatterParameswararao Billa67% (3)

- Geopolitica y Medio Ambiente - Tarea 4 - Evaluacion FinalDocument7 pagesGeopolitica y Medio Ambiente - Tarea 4 - Evaluacion FinalKATERINENo ratings yet

- Pell (2017) - Trends in Real-Time Traffic SimulationDocument8 pagesPell (2017) - Trends in Real-Time Traffic SimulationJorge OchoaNo ratings yet

- Microbial Diseases of The Different Organ System and Epidem.Document36 pagesMicrobial Diseases of The Different Organ System and Epidem.Ysabelle GutierrezNo ratings yet

- Thesis Topics in Medicine in Delhi UniversityDocument8 pagesThesis Topics in Medicine in Delhi UniversityBecky Goins100% (2)