Professional Documents

Culture Documents

Jahr 800161722022

Jahr 800161722022

Uploaded by

Let ́s Fix ItOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jahr 800161722022

Jahr 800161722022

Uploaded by

Let ́s Fix ItCopyright:

Available Formats

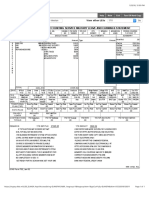

Payslip for the period

DD MM DD MM

Paying/pension paying office

From 01. 01 To 31. 12 2022 Tax number

91 063 4740

Employee: 10-digit social insurance number according to e-Card

FAMILY OR LAST NAME

6861 280566

Osborne

Social Date of birth

FIRST NAME TITLE status 3 (DDMMYYYY) 28.05.1966

Grant

Trans/

Non-binary/ Full- Part-

ADDRESS

Female Male XPrefer not to say time X time

Höfelgasse 10

AVAB was taken AEAB was taken Increased PAB was

POSTAL CODE CITY into account (Y/N) N into account (Y/N) N taken into account (Y/N)

5020 Salzburg If child bonuses were taken into account:

Number of children acc. to § 106 Para. 1

- Complete in UPPERCASE and only with black or AVAB/increased PAB:

blue ink - Amount fields in euros and cents Partner's ins. no.

- The fields with bold borders are also to be filled in

- Applicable points are to be checked

Citations of law without indication refer to

Partner's date of

EStG 1988

birth (DDMMYYYY)

Increased VAB was Family bonus plus was

Voluntary employment tax deduction acc. to §47 Para. 1b taken into account (Y/N) N taken into account (Y/N) N

Extraordinary non-recurring payment acc. to § 772a ASVG, § 400a Number of children for

GSVG, § 394a BSVG, § 95h PG 1965, or § 60 Para. 19 BB-PG N Home office days Family bonus plus

Gross pay acc. to § 25 (w/o § 26 and w/o § 3 Para.1(16b) .......................... 210 39.260,10

Tax-exempt pay acc. to § 68 ................................................... 215

Pay acc. to § 67 Para. 1 and 2 (within annual sixth insofar as not taxed acc. to § 67 Para. 10

and acc. to § 67 Para. 5 second graduation mark (within annual twelfth), before deduction of 5.569,55

social insurance contributions (SI contributions) ............................................. 220

Deducted in total for income liable to employment tax:

SI contributions, Chamber of Labor contribution, housing support................ 6.981,00

Minus retained SI contributions:

for pay acc. to key figure 220 .................. 225 799,28 230 6.181,72

for pay acc. to § 67 Para. 3 to 8 (except § 67 Para. 5 second

GM) and § 3 Para. 1(35), insofar as tax exempt or 226

taxed at fixed tax rate

Remaining Deductions:

Employment abroad acc. to § 3 Para. 1(10) ...................

Aid workers acc. to § 3 Para. 1(11)b ...........

Per diem reimbursement of trip expenses acc. to § 3 Para. 1(16)c...

Employee profit sharing acc. to §3 Para. 1(35) ...........

Commuter rate acc. to § 16 Para. 1(6) .................

Lump sum for income-related costs acc. to 17 Para. 6 forexpatriates....

Deducted voluntary contributions acc. to § 16 Para. 1(3)b ......... Total remaining

deductions

Tax-exempt pay or pay taxed at fixed rates acc. to § 67 Para.

3 to 8 (except § 67 Para. 5 second GM), before deduction of SI contributions .. 243

Cost-of-living bonus acc.to §124b(408)......................

Pay liable for tax

27.508,83

Other tax-exempt pay ............................ 245

4.296,51

Total employment tax deducted .......................

Chargeable employment

tax

Minus employment tax with fixed rates acc. to § 67 Para. 3 to 8

4.296,51

(except § 67 Para. 5 second graduation mark)................. 260

L16, Page 1, Version Dated August 2, 2022

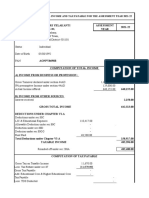

Costs incurred for mass transportation and

Commuter deduction (§ 33 Para. 5(4)) company transportation, Number of calendar months

........................................

Amount of family bonus plus that

actually effected a tax reduction Assumption of costs according to

§ 26(5)b .............................................

Other payments taxed acc. to pay

scale (§ 67 Para. 2, 5 second GM, 6, 10) 273,25 Exemption considered according to

§ 63 or § 103 Para. 1a ............................

Non-taxable pay (§ 26(4)) and

tax-exempt pay (§ 3 Para. 1(16)b) OeGB contributions taken into account during

recalculation .............................................

Employer contributions to pension

funds abroad (§ 26(7)) Paid in transfer

amount to BV .............................................

Lease of company car for journeys between

Home office per diem (§ 26(9)a) home and place of work, Number of calendar months

(§ 16 Para. 1(6)b) .........................................................................

Information on family bonus plus:

(If the family bonus plus was taken into account for more than 5 children, another L 16 form is to be filled out)

Child 1

FAMILY or LAST NAME

FIRST NAME

COUNTRY OF RESIDENCE1) on Dec 31, 2022

Change of country of residence during 2022

10-digit social insurance number according to e-card date of birth (DDMMYYYY)

Employee's relationship to child

Family allowance recipient Partner of family allowance recipient Alimony payer

The whole family bonus plus has been taken into account

From (MM) To (MM) 2022

Half the family bonus plus has been taken into account

From (MM) To (MM) 2022

Child 2

FAMILY or LAST NAME

FIRST NAME

COUNTRY OF RESIDENCE1) on Dec 31, 2022

Change of country of residence during 2022

10-digit social insurance number according to e-card date of birth (DDMMYYYY)

Employee's relationship to child

Family allowance recipient Partner of family allowance recipient Alimony payer

1)Enter international license plate ID for child's country ofresidence - for example, A for Austria, D for Germany

L16, Page 2, Version Dated August 2, 2022

The whole family bonus plus has been taken into account

From (MM) To (MM) 2022

Half the family bonus plus has been taken into account

From (MM) To (MM) 2022

Child 3

FAMILY or LAST NAME

FIRST NAME

COUNTRY OF RESIDENCE1) on Dec. 31, 2022

Change of country of residence 2022

10-digit social insurance number according to e-card Date of birth (DDMMYYYY)

Employee's relationship to child

Family allowance recipient Partner of family allowance recipient Alimony payer

The whole family bonus plus has been taken into account

From (MM) To (MM) 2022

Half the family bonus plus has been taken into account

From (MM) To (MM) 2022

Child 4

FAMILY or LAST NAME

FIRST NAME

COUNTRY OF RESIDENCE1) on Dec. 31, 2022

Change of country of residence during 2022

10-digit social insurance number according to e-card Date of birth (DDMMYYYY)

Employee's relationship to child

Family allowance recipient Partner of family allowance recipient Alimony payer

The whole family bonus plus has been taken into account

From (MM) To (MM) 2022

Half the family bonus plus has been taken into account

From (MM) To (MM) 2022

1)Enter international license plate ID for child's country ofresidence - for example, A for Austria, D for Germany

L16, Page 3, Version Dated August 2, 2022

Child 5

FAMILY or LAST NAME

FIRST NAME

COUNTRY OF RESIDENCE1) on Dec. 31, 2022

Change of country of residence during 2022

10-digit social insurance number according to e-card Date of birth (DDMMYYYY)

Employee's relationship to child

Family allowance recipient Partner of family allowance recipient Alimony payer

The whole family bonus plus has been taken into account

From (MM) To (MM) 2022

Half the family bonus plus has been taken into account

From (MM) To (MM) 2022

This part only needs to be completed by pension paying offices or public law bodies

Payments not to be entered acc. to Exempt. taken into account

§ 25 Par. 1(2)a and (3)a (75%)..... acc. § 35..................

M M M M

Care allowance Exemption taken into account

from to acc. to § 105 .................

Date of Issue

01.06.2023

Paying/pension paying office The accuracy and completeness is confirmed:

Company

Universität Salzburg

Kapitelgasse 4-6

5020 Salzburg

0662 8044-2101

Name and address, telephone number and ext. Signature

1)Enter international license plate ID for child's country ofresidence - for example, A for Austria, D for Germany

L16, Page 4, Version Dated August 2, 2022

You might also like

- 2022 Victor Tamayo YourDocument9 pages2022 Victor Tamayo YourCiber 13100% (3)

- 2019 Tax Return Documents (VERAS MELQUISEDED)Document7 pages2019 Tax Return Documents (VERAS MELQUISEDED)Edison Estrada100% (2)

- United States Estate (And Generation-Skipping Transfer) Tax ReturnDocument29 pagesUnited States Estate (And Generation-Skipping Transfer) Tax Returndouglas jones100% (1)

- MyPay PDFDocument1 pageMyPay PDFPaul BeznerNo ratings yet

- Planilla Federal Keyla 2021Document2 pagesPlanilla Federal Keyla 2021Keyla VelezNo ratings yet

- Ralston Medina W2Document2 pagesRalston Medina W2bussinesl las100% (1)

- Epayslip 2022-09-26 30909149Document1 pageEpayslip 2022-09-26 30909149Det LaurenteNo ratings yet

- Regular Income Tax - Gross IncomeDocument9 pagesRegular Income Tax - Gross IncomeJane0% (1)

- Type of ZakatDocument7 pagesType of ZakatMuhd Zulhusni MusaNo ratings yet

- Employer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterDocument2 pagesEmployer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterSharon JonesNo ratings yet

- Salary Slip - June 2022 - UnlockedDocument2 pagesSalary Slip - June 2022 - UnlockedRmillionsque FinserveNo ratings yet

- Axis Bank LTD Payslip For The Month of August - 2019Document3 pagesAxis Bank LTD Payslip For The Month of August - 2019Venkateswarlu KamaniNo ratings yet

- Axis Bank LTD Payslip For The Month of April - 2021: Leave DetailsDocument2 pagesAxis Bank LTD Payslip For The Month of April - 2021: Leave Detailssalma saifiNo ratings yet

- Journalizing Exercises 10Document11 pagesJournalizing Exercises 10John DelaPaz0% (1)

- Salma Saifi May SlipDocument2 pagesSalma Saifi May Slipsalma saifiNo ratings yet

- CVP Quiz - Bsa 2Document3 pagesCVP Quiz - Bsa 2Levi AckermanNo ratings yet

- FD 941 Apr-Jun 2017 PDFDocument3 pagesFD 941 Apr-Jun 2017 PDFScott WinklerNo ratings yet

- FinAcc 3 QuizzesDocument9 pagesFinAcc 3 QuizzesStella SabaoanNo ratings yet

- Accounting For Managers-Assignment MaterialsDocument4 pagesAccounting For Managers-Assignment MaterialsYehualashet TeklemariamNo ratings yet

- Income Computation DetailsDocument4 pagesIncome Computation DetailssachinNo ratings yet

- You Have Opted For Old Tax RegimeDocument2 pagesYou Have Opted For Old Tax RegimeRamsheed Ashraf100% (1)

- ACC111 Activity 22Document8 pagesACC111 Activity 22Triquesha Marriette Romero Rabi100% (1)

- CG FEB 2023 46280987 PayslipDocument1 pageCG FEB 2023 46280987 PayslipHR DucallNo ratings yet

- July PayslipReportDocument1 pageJuly PayslipReportBachu Saee RamNo ratings yet

- Sarmiento 1 9 2022Document2 pagesSarmiento 1 9 2022Franz Gabriel CubillanNo ratings yet

- B-4 Account Computation PFC SuerteDocument3 pagesB-4 Account Computation PFC SuerteElmer AlasNo ratings yet

- Final Computaion For Government OfficeDocument24 pagesFinal Computaion For Government OfficeGagan Deep PathakNo ratings yet

- Pay SlipDocument1 pagePay SlipEsteban PiskulichNo ratings yet

- Gra Form 2a and 7b2Document9 pagesGra Form 2a and 7b2Tarrick WeeksNo ratings yet

- 2016 - Tax ReturnDocument37 pages2016 - Tax Returncara harrisNo ratings yet

- I.T. Form-16 (2017-18)Document129 pagesI.T. Form-16 (2017-18)beohosakoteNo ratings yet

- KWASalary Maker V.4.03Document79 pagesKWASalary Maker V.4.03Prudhvi ChargeNo ratings yet

- BNK #0923-051 - Final Pay - Ishi Manzano - 6,246.33Document2 pagesBNK #0923-051 - Final Pay - Ishi Manzano - 6,246.33Rojay Ignacio IINo ratings yet

- Form16 16 2015-16Document4 pagesForm16 16 2015-16BDO KhandalaNo ratings yet

- 12 13 2021 DebitcardsDocument4 pages12 13 2021 DebitcardsRajesh BaswarajuNo ratings yet

- Apr22 Mar23 TaxsheetDocument3 pagesApr22 Mar23 TaxsheetKritika GuptaNo ratings yet

- Financials 2021 2022Document4 pagesFinancials 2021 2022Divya PadigelaNo ratings yet

- Monthly / Final Wages Account: Earnings DeductionsDocument1 pageMonthly / Final Wages Account: Earnings DeductionsyasvierNo ratings yet

- Ay 22-23 Dattatri Kadam With Sign & StampDocument13 pagesAy 22-23 Dattatri Kadam With Sign & StampRAJESH DNo ratings yet

- EA Pin2021 2Document1 pageEA Pin2021 2AisyaNo ratings yet

- Basu Deb SharmaDocument1 pageBasu Deb SharmaBasudev SharmaNo ratings yet

- Draft Computation SheetDocument3 pagesDraft Computation Sheettax advisorNo ratings yet

- SalSlipJan 2022Document1 pageSalSlipJan 2022T TiwariNo ratings yet

- Candy Simpson - (EE & ER) - PDOC-Date Paid-2020-12-12 (WEEK 2)Document1 pageCandy Simpson - (EE & ER) - PDOC-Date Paid-2020-12-12 (WEEK 2)mcocampo2No ratings yet

- HTML ReportsDocument8 pagesHTML Reportsdpkch4141No ratings yet

- Ind-Return English12Document8 pagesInd-Return English12mohibulhasan80No ratings yet

- 2nd Page Computation FY 20-21Document2 pages2nd Page Computation FY 20-21naveen kumarNo ratings yet

- ViewPDF AspxDocument3 pagesViewPDF AspxAllan DerickNo ratings yet

- Novice PDFDocument23 pagesNovice PDFabeatty34No ratings yet

- It 11 GaDocument8 pagesIt 11 GaSadav ImtiazNo ratings yet

- HR Practice AbstractDocument1 pageHR Practice Abstractsubu_saxNo ratings yet

- HTMLReports 1Document1 pageHTMLReports 1kuldeeptawar250No ratings yet

- TPD Fixe Aniv RomDocument1 pageTPD Fixe Aniv RomIulian TulucNo ratings yet

- APR MAY JUN JUL AUG SEP OCT NOV DEC JAN FEB MAR Projected Amount Total AmountDocument2 pagesAPR MAY JUN JUL AUG SEP OCT NOV DEC JAN FEB MAR Projected Amount Total AmountSrinivasan PNo ratings yet

- Epayslip 2022-10-26 25018077Document1 pageEpayslip 2022-10-26 25018077saintpalmers2012No ratings yet

- Web Payslip 266675 202308Document2 pagesWeb Payslip 266675 202308prabhat.finnproNo ratings yet

- 1040eeeeeeeeez PDFDocument2 pages1040eeeeeeeeez PDF6g72ftm0No ratings yet

- Get Payslip by OffsetDocument1 pageGet Payslip by OffsetMiranda VelascoNo ratings yet

- Tax Return of Asadul Haque 2015-16Document9 pagesTax Return of Asadul Haque 2015-16M R MukitNo ratings yet

- Income Tax - Computation - 2021Document26 pagesIncome Tax - Computation - 2021umasankarNo ratings yet

- Morin 1 12 2022Document2 pagesMorin 1 12 2022mark san andresNo ratings yet

- Epayslip 2024-01-26 11319801Document1 pageEpayslip 2024-01-26 11319801Anthony Balaba MabaoNo ratings yet

- For Irs For State: Origin Quick Calculator For 433f CalculationsDocument13 pagesFor Irs For State: Origin Quick Calculator For 433f CalculationsAnonymous NjNW0Gb6nNo ratings yet

- CG JUL 2023 46237545 PayslipDocument1 pageCG JUL 2023 46237545 Payslipsubalsahoo2018No ratings yet

- November 2023Document1 pageNovember 2023Rovie SazNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: 106 Ilang Ilang ST Zaballero Subd Brgy Gulang Gulang Lucena CityDocument2 pagesCertificate of Compensation Payment/Tax Withheld: 106 Ilang Ilang ST Zaballero Subd Brgy Gulang Gulang Lucena CityMaria Cristina TuazonNo ratings yet

- NON MEDICLAIM AY2024-25 SARBANI BORA-BDPPB0721G-ComputationDocument2 pagesNON MEDICLAIM AY2024-25 SARBANI BORA-BDPPB0721G-ComputationlaskarmohinNo ratings yet

- 13 Cut and Paste Body PtsDocument1 page13 Cut and Paste Body PtsLet ́s Fix ItNo ratings yet

- Mini Spot Welder Bk11 Bl18 MCUDocument1 pageMini Spot Welder Bk11 Bl18 MCULet ́s Fix ItNo ratings yet

- Mini Spot Welder Bk11 Bl18 Main BoardDocument1 pageMini Spot Welder Bk11 Bl18 Main BoardLet ́s Fix ItNo ratings yet

- Artikel 1 KleinDocument9 pagesArtikel 1 KleinLet ́s Fix ItNo ratings yet

- 2021 PDFDocument9 pages2021 PDFNekhavhambe MartinNo ratings yet

- FM Quiz ch1-3Document7 pagesFM Quiz ch1-3Noor SyuhaidaNo ratings yet

- Deferred Tax CalculatorDocument2 pagesDeferred Tax Calculatoramitanshu chaturvediNo ratings yet

- Top Glove Group AssignmentDocument24 pagesTop Glove Group AssignmentvithyaNo ratings yet

- Lesson 5 Tax Planning With Reference To Capital StructureDocument37 pagesLesson 5 Tax Planning With Reference To Capital StructurekelvinNo ratings yet

- Income Tax Amendment - 2021 by CA Rajat MoghaDocument46 pagesIncome Tax Amendment - 2021 by CA Rajat MoghaOm Sai Enterprises100% (1)

- Chapter 3 MCQs On Disallowance of PGBPDocument11 pagesChapter 3 MCQs On Disallowance of PGBPDevesh NagilaNo ratings yet

- QPDsDocument4 pagesQPDsDanisa NdhlovuNo ratings yet

- Acca Fa Trial - Exam - 1 - QuestionsDocument18 pagesAcca Fa Trial - Exam - 1 - QuestionsElshan ShahverdiyevNo ratings yet

- Tata Motors Financials-1Document4 pagesTata Motors Financials-1Naresh KumarNo ratings yet

- CAF02 Pas Papers From 2014 to 2023(JJ)Document227 pagesCAF02 Pas Papers From 2014 to 2023(JJ)hiddenseceret7No ratings yet

- Kaplan - SBR Simplest SummaryDocument13 pagesKaplan - SBR Simplest Summarymuazzam.danganaNo ratings yet

- Iaet RR 02-01 - 211123 - 122508Document6 pagesIaet RR 02-01 - 211123 - 122508HADTUGINo ratings yet

- Analyzing Balance Sheet of Nestle India LTDDocument2 pagesAnalyzing Balance Sheet of Nestle India LTDPrashant BarveNo ratings yet

- Taxation: DFA 2104YDocument16 pagesTaxation: DFA 2104YFhawez KodoruthNo ratings yet

- Worksheet TabaranzaDocument6 pagesWorksheet Tabaranzakianna doctoraNo ratings yet

- Lecture 3 Concept of Income Accounting Period and Methods of AccountingDocument21 pagesLecture 3 Concept of Income Accounting Period and Methods of AccountingCassie ParkNo ratings yet

- FM Practice Booklet For May 2023Document80 pagesFM Practice Booklet For May 2023Dainika ShettyNo ratings yet

- Uncollected Social Security and Medicare Tax On WagesDocument2 pagesUncollected Social Security and Medicare Tax On Wagesnujahm1639No ratings yet

- Cópia de OECD International Influencer Income and Tax Treaties IBFDDocument18 pagesCópia de OECD International Influencer Income and Tax Treaties IBFDEduarda ManossoNo ratings yet

- Acctg 1101-Financial Accounting and ReportingDocument4 pagesAcctg 1101-Financial Accounting and ReportingmeepxxxNo ratings yet

- Bba-1st Sem AccountancyDocument344 pagesBba-1st Sem AccountancyShravani SalunkheNo ratings yet