Professional Documents

Culture Documents

Morin 1 12 2022

Uploaded by

mark san andresOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Morin 1 12 2022

Uploaded by

mark san andresCopyright:

Available Formats

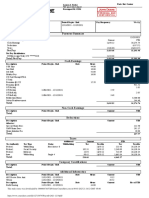

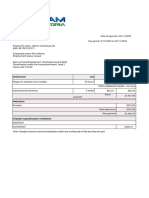

CONCENTRIX DAKSH SERVICES PHILIPPINES CORPORATION

Final Pay Computation

Employee Number: 102056391

Employee Name: MORIN MA. MERCEDEZ ENVERGA

Family Name Given Name Middle Name

Date Hired: July 13, 2022 Date of Birth: December 27, 1999

Date Separated: November 10, 2022 Tax Exemption: S

Last Salary Received (Cut-off): November 06 - November 19, 2022 Basic Pay 10,001.52

Department/Account: CRM Operations Daily Rate: 459.84

Tin

FINAL PAY CALCULATION - FOR 2022

Hours Amount

13th Month Pay 2,807.34

Gross Pay 2,807.34

Less Deductions

Tax Due Refund Current Year -

Total Deductions -

Final Pay 2,807.34

Hold Last Pay -

Total Final Pay 2,807.34

Deduct Final Pay Released -

Total Final Pay - Additional 2,807.34

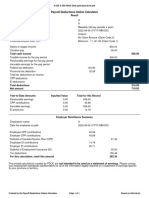

ANNUALIZATION - 2022

YTD Paid FFP Total

Regular Overtime 246.68 - 246.68

Basic Pay 31,920.53 - 31,920.53

Regular Overtime Night Differential 267.34 - 267.34

Regular Night Differential 2,065.06 - 2,065.06

Rice Allowance Prorated 6,804.60 - 6,804.60

Regular Night Differential Adjustment 120.71 - 120.71

Basic Pay Adjustment 1,307.67 - 1,307.67

Special Holiday 157.21 - 157.21

Legal Holiday 57.48 - 57.48

Legal Holiday Night Differential 137.95 - 137.95

Service Incentive Leave 459.84 - 459.84

Special Holiday Overtime Night Differential 08.90 - 08.90

Special Holiday Night Differential 170.96 - 170.96

Special Holiday Adjustment (01.38) - (01.38)

13th Month Pay - 2,807.34 2,807.34

Gross Compensation 43,723.55 2,807.34 46,530.88

Less Non Taxable:

De Minimis / Other Non Taxable Income

Rice Allowance Prorated 6,804.60 - 6,804.60

13th Month Pay - 2,807.34 2,807.34

SSS / PHIC / HDMF 3,158.15 3,158.15

Total Non Taxable Income 12,770.08

Taxable Income 33,760.80

Taxable Income from Previous Employer -

Total Taxable Income 33,760.80

Tax Due -

Taxes Withheld -

Taxes Withheld from Previous Employer -

Total Taxes -

Tax Due (Refund) -

You might also like

- Sarmiento 1 9 2022Document2 pagesSarmiento 1 9 2022Franz Gabriel CubillanNo ratings yet

- Vinod Singh Computation Revised-3Document4 pagesVinod Singh Computation Revised-3vinodNo ratings yet

- Itr 1 FormatDocument3 pagesItr 1 FormatPawanNo ratings yet

- PayslipDocument1 pagePayslipJM GereroNo ratings yet

- Income Computation DetailsDocument4 pagesIncome Computation DetailssachinNo ratings yet

- XR 80Document1 pageXR 80ncanellosNo ratings yet

- Draft Computation SheetDocument3 pagesDraft Computation Sheettax advisorNo ratings yet

- Catalbas, Joshua Galura 13588176 80031716 11,000.00 07/15/2023 09/08/2023Document4 pagesCatalbas, Joshua Galura 13588176 80031716 11,000.00 07/15/2023 09/08/2023catalbasNo ratings yet

- 2023 05 07.santiago AgudeloDocument1 page2023 05 07.santiago Agudelothiago040103No ratings yet

- Candy Simpson - (EE & ER) - PDOC-Date Paid-2020-12-12 (WEEK 2)Document1 pageCandy Simpson - (EE & ER) - PDOC-Date Paid-2020-12-12 (WEEK 2)mcocampo2No ratings yet

- PayslipDocument1 pagePayslipchloeNo ratings yet

- Ageeta AY 2018-2019: Computation of Income (ITR4)Document50 pagesAgeeta AY 2018-2019: Computation of Income (ITR4)pmcmbharat264No ratings yet

- Pay StubDocument1 pagePay Stubnurulamin00023No ratings yet

- NCH Customer Support Services, Inc. PayslipDocument1 pageNCH Customer Support Services, Inc. PayslipTrainer EntainNo ratings yet

- Employee Name - (EE & ER) - PDOC-Date Paid-2024-03-28Document2 pagesEmployee Name - (EE & ER) - PDOC-Date Paid-2024-03-28RileyNo ratings yet

- NCH Customer Support Services, Inc. PayslipDocument1 pageNCH Customer Support Services, Inc. PayslipTrainer EntainNo ratings yet

- Screenshot 2021-09-16 at 11.56.11 AMDocument1 pageScreenshot 2021-09-16 at 11.56.11 AMMartinez BryanNo ratings yet

- ASRPDocument1 pageASRPEugene GuillermoNo ratings yet

- Computation FY 18-19 PDFDocument6 pagesComputation FY 18-19 PDFRuch JainNo ratings yet

- Com 23Document3 pagesCom 23TAX INDIANo ratings yet

- Taxable Earnings Hours/Day S Amount PHP Deductions Amount PHP Amount PHPDocument1 pageTaxable Earnings Hours/Day S Amount PHP Deductions Amount PHP Amount PHPKent CantoNo ratings yet

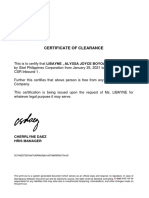

- Certificate of Clearance: Cherrlyne Daez Hris ManagerDocument2 pagesCertificate of Clearance: Cherrlyne Daez Hris ManagerFernan MacusiNo ratings yet

- Salary Break Down and Invoicing ProjectionDocument6 pagesSalary Break Down and Invoicing ProjectionShu'l Gz MrtinzNo ratings yet

- Salary Slip - Quess)Document1 pageSalary Slip - Quess)gamersingh098123No ratings yet

- Computation of Income: Income Under Head Other SourcesDocument1 pageComputation of Income: Income Under Head Other SourcesCA Devanshu N. SinhaNo ratings yet

- Ay2022 23 Ujjawal Dhawan Apypd6567j ComputationDocument2 pagesAy2022 23 Ujjawal Dhawan Apypd6567j ComputationAkshat MittalNo ratings yet

- Sindoor 2Document2 pagesSindoor 2sanju.wageeshaNo ratings yet

- Paystub 2021 12 19 PDFDocument2 pagesPaystub 2021 12 19 PDFLuis MartinezNo ratings yet

- Pay Slip Rima Febrian92411Document1 pagePay Slip Rima Febrian92411sasol bezzetNo ratings yet

- NCH Customer Support Services, Inc. PayslipDocument1 pageNCH Customer Support Services, Inc. PayslipTrainer EntainNo ratings yet

- NCH Customer Support Services, Inc. PayslipDocument1 pageNCH Customer Support Services, Inc. PayslipTrainer EntainNo ratings yet

- A - (EE & ER) - PDOC-Date Paid-2022-08-05Document1 pageA - (EE & ER) - PDOC-Date Paid-2022-08-05armanf2020zNo ratings yet

- Profits and Gains of Business or Profession: Rs. Rs. Rs. SCH - NoDocument2 pagesProfits and Gains of Business or Profession: Rs. Rs. Rs. SCH - NoSatyasheel ChandaneNo ratings yet

- Natalie Ruth Grace Payslip 1Document2 pagesNatalie Ruth Grace Payslip 1bonnie zhuNo ratings yet

- Salary Slip Format For HCLDocument1 pageSalary Slip Format For HCLrajkannamdu100% (1)

- Hotel Tourist Palace Balance Sheet: Itahari, SunsariDocument8 pagesHotel Tourist Palace Balance Sheet: Itahari, SunsarisarojdawadiNo ratings yet

- Payslip 1010437564Document1 pagePayslip 1010437564Leojrsalvador MabaquiaoNo ratings yet

- NON MEDICLAIM AY2024-25 SARBANI BORA-BDPPB0721G-ComputationDocument2 pagesNON MEDICLAIM AY2024-25 SARBANI BORA-BDPPB0721G-ComputationlaskarmohinNo ratings yet

- MR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDDocument1 pageMR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDSharanu HosamaniNo ratings yet

- Prabhat Shankar Ranjan - 510033 - F&FDocument1 pagePrabhat Shankar Ranjan - 510033 - F&FTechnoCommercial2 OfficeNo ratings yet

- PL and Balance Sheet Detailed FormatDocument5 pagesPL and Balance Sheet Detailed FormatPradeep G MenonNo ratings yet

- Full & Final Pay Calculation: 368507 Nabata, Esathena BalderamaDocument4 pagesFull & Final Pay Calculation: 368507 Nabata, Esathena BalderamaËsatheńā ŃabaťāNo ratings yet

- SalSlipJan 2022Document1 pageSalSlipJan 2022T TiwariNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument2 pagesIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriNo ratings yet

- Barcela, John Christian 13634019 80031904 10,000.00 02/15/2023 02/15/2023Document1 pageBarcela, John Christian 13634019 80031904 10,000.00 02/15/2023 02/15/2023JCNo ratings yet

- Computationofincome2023 1Document2 pagesComputationofincome2023 1rtaxhelp helpNo ratings yet

- Sspofadv 4Document1 pageSspofadv 4Antoni Zelaya0% (1)

- April 1st Bi-Weekly PayoutDocument1 pageApril 1st Bi-Weekly PayoutJohn HenryNo ratings yet

- Jasmine Petrovski 5/71 Pine Street Reservoir VIC 3073: Paid byDocument1 pageJasmine Petrovski 5/71 Pine Street Reservoir VIC 3073: Paid bygeorgiaNo ratings yet

- Qpfufegh6rgk3cm1jviagq Sspcnadv-2Document1 pageQpfufegh6rgk3cm1jviagq Sspcnadv-2tobiawmNo ratings yet

- Your Paycheck Statement At-a-Glance: SampleDocument1 pageYour Paycheck Statement At-a-Glance: SampleGeorge J AlexNo ratings yet

- It ComputationDocument1 pageIt Computationamarnath ojhaNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument3 pagesIncome From Salaries: Rs. Rs. Rs. SCH - NoBilalNo ratings yet

- Book 1Document3 pagesBook 1Sridhar GandikotaNo ratings yet

- Francisca Da Silva Costa 72 Teme Road Worcester: Grupo Antolin (Droitwich) Head OfficeDocument1 pageFrancisca Da Silva Costa 72 Teme Road Worcester: Grupo Antolin (Droitwich) Head Officefranciscasilvacosta2No ratings yet

- Statement of Earnings and DeductionsDocument2 pagesStatement of Earnings and Deductionstaylorizabella1No ratings yet

- Payslip 5430 11212023 12042023 12182023 222023Document1 pagePayslip 5430 11212023 12042023 12182023 222023Pat AgustinNo ratings yet

- $RN8C7G2Document3 pages$RN8C7G2akxerox47No ratings yet

- Name - Mark John-WPS OfficeDocument1 pageName - Mark John-WPS Officemark san andresNo ratings yet

- Name - Janry B. L-WPS OfficeDocument2 pagesName - Janry B. L-WPS Officemark san andresNo ratings yet

- THE PROBLEM-WPS OfficeDocument17 pagesTHE PROBLEM-WPS Officemark san andresNo ratings yet

- 4 Registration Permit IrregularDocument1 page4 Registration Permit Irregularmark san andresNo ratings yet

- Ambang Tinambac Camarines SurDocument5 pagesAmbang Tinambac Camarines Surmark san andresNo ratings yet

- Loi Landbank TeachersDocument1 pageLoi Landbank Teachersmark san andres100% (1)

- Activities - PrintDocument5 pagesActivities - Printmark san andresNo ratings yet

- LRP Lesson Map Central Bikol Alphabet KnowledgeDocument30 pagesLRP Lesson Map Central Bikol Alphabet Knowledgemark san andresNo ratings yet

- Child Profile Form Final - 030722Document3 pagesChild Profile Form Final - 030722mark san andresNo ratings yet

- Episode 1 1Document14 pagesEpisode 1 1mark san andres100% (1)

- LRP - Lesson Map - Central Bikol - Phrases and Sentence ReadingDocument96 pagesLRP - Lesson Map - Central Bikol - Phrases and Sentence Readingmark san andresNo ratings yet

- Episode 11 16Document33 pagesEpisode 11 16mark san andresNo ratings yet

- Episode 6 10Document31 pagesEpisode 6 10mark san andresNo ratings yet

- Episode 2 3Document21 pagesEpisode 2 3mark san andresNo ratings yet

- LESSON MAP IN MATHEMATICS - SubtractionDocument11 pagesLESSON MAP IN MATHEMATICS - Subtractionmark san andresNo ratings yet

- LESSON-MAP-IN-MATHEMATICS - Understanding NumbersDocument16 pagesLESSON-MAP-IN-MATHEMATICS - Understanding Numbersmark san andres100% (1)

- Mapping of Melcs (Tos0key Stage 1Document9 pagesMapping of Melcs (Tos0key Stage 1mark san andresNo ratings yet

- LRP Lesson Map Central Bikol Listening ComprehensionDocument2 pagesLRP Lesson Map Central Bikol Listening Comprehensionmark san andresNo ratings yet

- LESSON MAP IN MATHEMATICS - Multiplication and DivisionDocument3 pagesLESSON MAP IN MATHEMATICS - Multiplication and Divisionmark san andresNo ratings yet

- ENGLISH - LESSON MAPS ConsolidatedDocument115 pagesENGLISH - LESSON MAPS Consolidatedmark san andresNo ratings yet

- LRP Lesson Map Central Bikol VocabularyDocument3 pagesLRP Lesson Map Central Bikol Vocabularymark san andresNo ratings yet

- ENGLISH - LESSON MAPS ConsolidatedDocument115 pagesENGLISH - LESSON MAPS Consolidatedmark san andresNo ratings yet

- LRP - Lesson Map - Central Bikol - Selection Reading ComprehensionDocument75 pagesLRP - Lesson Map - Central Bikol - Selection Reading Comprehensionmark san andresNo ratings yet

- LRP Lesson Map Central Bikol Word ReadingDocument71 pagesLRP Lesson Map Central Bikol Word Readingmark san andresNo ratings yet

- LRP Lesson Map Central Bikol Reading FluencyDocument1 pageLRP Lesson Map Central Bikol Reading Fluencymark san andresNo ratings yet

- LRP - Lesson Map - Central Bikol - Phrases and Sentence ReadingDocument95 pagesLRP - Lesson Map - Central Bikol - Phrases and Sentence Readingmark san andresNo ratings yet

- LRP Lesson Maps Central Bikol July 2022finalDocument552 pagesLRP Lesson Maps Central Bikol July 2022finalmark san andresNo ratings yet

- LRP Lesson Map Phonological AwarenessDocument2 pagesLRP Lesson Map Phonological Awarenessmark san andresNo ratings yet

- LRP Lesson Map Learning-Center-ActivitiesDocument2 pagesLRP Lesson Map Learning-Center-Activitiesmark san andresNo ratings yet

- LRP Lesson Map Central Bikol Alphabet KnowledgeDocument30 pagesLRP Lesson Map Central Bikol Alphabet Knowledgemark san andresNo ratings yet

- Project Report On "Buying Behaviour: of Gold With Regards ToDocument77 pagesProject Report On "Buying Behaviour: of Gold With Regards ToAbhishek MittalNo ratings yet

- Full Download Fundamentals of Thermodynamics 6th Edition Sonntag Solutions ManualDocument20 pagesFull Download Fundamentals of Thermodynamics 6th Edition Sonntag Solutions Manualadenose.helveo0mvl100% (39)

- 1 PDFDocument176 pages1 PDFDigna Bettin CuelloNo ratings yet

- Chapter (2) Industry and Competitive AnalysisDocument16 pagesChapter (2) Industry and Competitive Analysisfsherif423No ratings yet

- Test 6Document7 pagesTest 6RuslanaNo ratings yet

- Persephone and The PomegranateDocument3 pagesPersephone and The PomegranateLíviaNo ratings yet

- Insurance OperationsDocument5 pagesInsurance OperationssimplyrochNo ratings yet

- Morals and Dogma of The Ineffable DegreesDocument134 pagesMorals and Dogma of The Ineffable DegreesCelephaïs Press / Unspeakable Press (Leng)86% (7)

- Nestle Corporate Social Responsibility in Latin AmericaDocument68 pagesNestle Corporate Social Responsibility in Latin AmericaLilly SivapirakhasamNo ratings yet

- 3rd Periodic Test - Mapeh 9Document3 pages3rd Periodic Test - Mapeh 9Rap Arante90% (30)

- I See Your GarbageDocument20 pagesI See Your GarbageelisaNo ratings yet

- COURSE CONTENT in HE 503 Foods Nut. Ed 2nd Sem. 2021 2022 FINALDocument6 pagesCOURSE CONTENT in HE 503 Foods Nut. Ed 2nd Sem. 2021 2022 FINALLISA MNo ratings yet

- 13th Format SEX Format-1-1: Share This DocumentDocument1 page13th Format SEX Format-1-1: Share This DocumentDove LogahNo ratings yet

- Surviving Hetzers G13Document42 pagesSurviving Hetzers G13Mercedes Gomez Martinez100% (2)

- Horizon Trial: Witness Statement in Support of Recusal ApplicationDocument12 pagesHorizon Trial: Witness Statement in Support of Recusal ApplicationNick Wallis100% (1)

- Paytm Wallet TXN HistoryDec2021 7266965656Document2 pagesPaytm Wallet TXN HistoryDec2021 7266965656Yt AbhayNo ratings yet

- PotwierdzenieDocument4 pagesPotwierdzenieAmina BerghoutNo ratings yet

- DIS Investment ReportDocument1 pageDIS Investment ReportHyperNo ratings yet

- Effectiveness of The Automated Election System in The Philippines A Comparative Study in Barangay 1 Poblacion Malaybalay City BukidnonDocument109 pagesEffectiveness of The Automated Election System in The Philippines A Comparative Study in Barangay 1 Poblacion Malaybalay City BukidnonKent Wilson Orbase Andales100% (1)

- Principles of Natural JusticeDocument20 pagesPrinciples of Natural JusticeHeracles PegasusNo ratings yet

- California Department of Housing and Community Development vs. City of Huntington BeachDocument11 pagesCalifornia Department of Housing and Community Development vs. City of Huntington BeachThe Press-Enterprise / pressenterprise.comNo ratings yet

- Yahoo Tabs AbbDocument85 pagesYahoo Tabs AbbKelli R. GrantNo ratings yet

- Automated Behaviour Monitoring (ABM)Document2 pagesAutomated Behaviour Monitoring (ABM)prabumnNo ratings yet

- Full Download Health Psychology Theory Research and Practice 4th Edition Marks Test BankDocument35 pagesFull Download Health Psychology Theory Research and Practice 4th Edition Marks Test Bankquininemagdalen.np8y3100% (39)

- Iraq-A New Dawn: Mena Oil Research - July 2021Document29 pagesIraq-A New Dawn: Mena Oil Research - July 2021Beatriz RosenburgNo ratings yet

- NSBM Student Well-Being Association: Our LogoDocument4 pagesNSBM Student Well-Being Association: Our LogoMaithri Vidana KariyakaranageNo ratings yet

- People Vs MaganaDocument3 pagesPeople Vs MaganacheNo ratings yet

- Journey Toward OnenessDocument2 pagesJourney Toward Onenesswiziqsairam100% (2)

- Consti 2: Case Digests - Regado: Home Building & Loan Assn. V BlaisdellDocument6 pagesConsti 2: Case Digests - Regado: Home Building & Loan Assn. V BlaisdellAleezah Gertrude RegadoNo ratings yet

- Questionnaire of Personal and Organizational Values Congruence For Employee (Q-POVC-115)Document6 pagesQuestionnaire of Personal and Organizational Values Congruence For Employee (Q-POVC-115)Kowshik SNo ratings yet