Professional Documents

Culture Documents

BBK 2017 H1-Results-V6-Twin

Uploaded by

Manil UniqueOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BBK 2017 H1-Results-V6-Twin

Uploaded by

Manil UniqueCopyright:

Available Formats

BARCLAYS BANK OF KENYA LIMITED FINANCIAL STATEMENTS

The Board of Directors of Barclays Bank of Kenya Limited is pleased to announce the unaudited group results for the period ended 30 June 2017

Bank Group June December March June

2016 2016 2017 2017

June December March June June December March June

Shs '000 Shs '000 Shs '000 Shs '000

2016 2016 2017 2017 2016 2016 2017 2017 III OTHER DISCLOSURES

Shs ‘000 Shs ‘000 Shs ‘000 Shs ‘000 Shs ‘000 Shs ‘000 Shs ‘000 Shs ‘000 Unaudited Audited Unaudited Unaudited

I STATEMENT OF FINANCIAL POSITION Unaudited Audited Unaudited Unaudited Unaudited Audited Unaudited Unaudited

1) Non-performing loans and advances

A ASSETS

a) Gross non-performing loans and advances 8,764,640 11,472,301 11,713,284 11,999,105

1 Cash balances (both local and foreign) 3,605,575 5,033,498 4,057,366 4,769,926 3,605,575 5,033,498 4,057,366 4,769,926

b) Less: Interest in suspense 2,211,200 2,689,552 2,949,784 3,233,288

2 Balances due from Central Bank of Kenya 19,493,837 8,344,546 15,649,022 12,682,674 19,493,837 8,344,546 15,649,022 12,682,674

c) Total non performing loans and advances 6,553,440 8,782,749 8,763,500 8,765,817

3 Kenya Government and other securities held for dealing purposes 7,339,521 7,345,499 5,504,415 4,819,678 7,339,521 7,345,499 5,504,415 4,819,678

d) less: loan loss provisions 3,849,515 5,149,446 5,377,473 4,980,517

4 Financial Assets at fair value through profit and loss - - - - - - - -

e) Net non performing loans(c-d) 2,703,925 3,633,303 3,386,027 3,785,300

a) Investment Securities: - - - - - - - -

f) Discounted value of securities 957,527 1,786,209 1,684,882 865,724

Held to Maturity: - - - - - - - -

g) Net NPLs (Excess) / Exposure (e-f) 1,746,398 1,847,094 1,701,145 2,919,576

a. Kenya Government securities - - - - - - - -

2) Insider loans and advances -

b. Other securities - - - - - - - -

a) Directors, shareholders and associates 47,914 46,887 46,346 45,855

b) Available for sale: 47,569,434 48,698,795 44,019,539 52,649,364 47,569,434 48,698,795 44,019,539 52,649,364

b) Employees 13,482,054 13,013,190 12,839,489 12,526,856

a. Kenya Government securities 47,225,521 48,698,795 44,019,539 52,649,364 47,225,521 48,698,795 44,019,539 52,649,364

c) Total insider loans and advances 13,529,968 13,060,077 12,885,835 12,572,711

b. Other securities 343,913 - - - 343,913 - - -

6

3) Off Balance sheet items -

Deposits and balances due from local banking Institutions 1,600,000 - - 1,500,000 1,600,000 - - 1,500,000

7

a) Letters of credit ,guarantees, acceptances 34,758,627 29,277,167 28,765,378 27,411,100

Deposits and balances due from banking Institutions abroad 405,909 218,530 1,391,618 8,509,947 405,909 218,530 1,391,618 8,509,947

8

b) Forwards, swaps and options 9,925,218 12,553,578 38,958,537 37,014,721

Tax recoverable - - - 187,176 - 23,743 - 189,048

9

c) Other contingent liabilities - - - -

Loans and advances to customers(net) 153,304,211 168,509,529 168,701,793 163,782,554 153,304,212 168,509,529 168,701,793 163,782,554

10 Balances due from banking institutions in the group 6,130,352 5,568,202 5,224,124 3,884,354 6,130,352 5,971,491 5,224,124 3,884,354

Total Contingent liabilities 44,683,845 41,830,745 67,723,915 64,425,821

11 Investment in Associates - - - - - - - -

4) Capital Strength

12 Investment in Subsidiary Companies 275,678 262,512 262,512 362,512 - - - -

a) Core capital 37,068,129 37,617,089 38,447,311 38,230,413

13 Investment in joint Ventures - - - - - - - -

b) Minimum statutory capital 1,000,000 1,000,000 1,000,000 1,000,000

14 Investment properties - - - - - - - -

c) Excess / (Defeciency) 36,068,129 36,617,089 37,447,311 37,230,413

15 Property and equipment 3,351,384 3,080,831 3,164,236 3,063,790 3,351,384 3,080,831 3,164,236 3,063,790

d) Supplementary capital 5,048,135 5,128,461 5,154,788 5,187,256

16 Prepaid Operating Rental Leases 56,329 55,329 55,329 55,329 56,329 55,329 55,329 55,329 e) Total capital 42,116,264 42,745,550 43,602,099 43,417,669

17 Intangible assets 1,710,063 1,567,256 1,433,813 1,322,365 1,710,063 1,592,256 1,458,813 1,347,365 f) Total risk weighted assets 234,234,960 239,299,450 244,638,261 243,694,770

18 Deferred Tax 463,824 614,632 628,658 517,986 463,824 618,889 634,570 524,644 g) Core capital / total deposit liabilities 20.3% 21.1% 21.4% 20.3%

19 Retirement Benefit Asset 268,942 65,328 89,425 169,923 268,942 65,328 89,425 169,923 h) Minimum statutory ratio 8.0% 8.0% 8.0% 8.0%

20 Other assets

i) Excess / (Defeciency) 12.3% 13.1% 13.4% 12.3%

10,567,511 10,133,736 10,247,603 9,737,969 10,842,843 10,133,748 10,838,447 10,238,252

j) Core capital / total risk weighted assets 15.8% 15.7% 15.7% 15.7%

k) Minimum statutory ratio 10.5% 10.5% 10.5% 10.5%

21 TOTAL ASSET 256,142,570 259,498,223 260,429,453 268,015,547 256,142,225 259,692,012 260,788,697 268,186,848

l) Excess / (Defeciency) 5.3% 5.2% 5.2% 5.2%

m) Total capital / total risk weighted assets 18.0% 17.9% 17.8% 17.8%

B LIABILITIES

n) Minimum statutory ratio 14.5% 14.5% 14.5% 14.5%

22 Balances due to Central Bank of Kenya - - - - - - - -

o) Excess / (Defeciency) 3.5% 3.4% 3.3% 3.3%

23 Customers' deposits 182,875,680 178,447,777 181,803,911 189,020,234 182,875,680 178,179,795 181,535,911 188,652,234

5 Liquidity

24 Deposits and balances due to Banking institutions (Local) - 3,000,000 - 3,201,182 - 3,000,000 - 3,201,182

a) Liquidity ratio 36.6% 28.3% 29.6% 36.1%

25 Deposits and balances due to Banking institutions (Foreign) 163,145 263,679 1,667,191 792,802 163,145 263,679 1,667,191 792,802

b) Minimum statutory ratio 20.0% 20.0% 20.0% 20.0%

26 Other money market deposits - - - - - - - -

c) Excess / (Defeciency) 16.6% 8.3% 9.6% 16.1%

27 Borrowed Funds - - - - - - - -

28 Balances due to banking institutions in the group 23,201,804 24,895,103 22,182,392 21,575,265 23,201,805 24,895,103 22,182,392 21,575,265

29 Tax payable

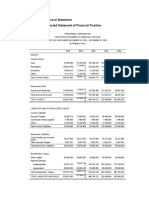

Message from the Directors:

536,137 375,119 967,216 - 536,137 504,047 1,117,515 -

30 Dividends payable 1,086,307 - - 1,086,307 1,086,307 - - 1,086,307

The Board of Directors of Barclays Bank of Kenya Limited have resolved to declare an interim dividend for the year

31 Deferred tax liability - - - - - - - - 2017 of Shs 0.20 per ordinary share of the Company to be paid on or about Friday, 13 October, 2017 to shareholders

32 Retirement Benefit Liability - - - - - - - - registered at close of business on Friday, 8 September, 2017.

33 Other liabilities 9,175,913 10,421,835 10,156,645 12,002,223 9,175,914 10,461,146 10,238,651 12,092,329

These financial statements are extracts from the books of the institution.The complete quarterly financial

34 Total liabilities 217,038,986 217,403,513 216,777,355 227,678,013 217,038,988 217,303,770 216,741,660 227,400,119

staments,statutory and qualitative disclosures can be accessed on the institutions website www.barclays.co.ke.

C SHAREHOLDERS' FUNDS

35 Paid up / Assigned capital 2,715,768 2,715,768 2,715,768 2,715,768 2,715,768 2,715,768 2,715,768 2,715,768 They may also be accessed at the instituions Head office at The West End Building, Waiyaki way.

36 Share premium / (discount) - - - - - - - -

37 Revaluation reserves (218,880) (152,158) (150,183) 228,308 (218,880) (152,158) (150,183) 228,308 They were approved by the board on Monday, 14 August 2017 and signed on its behalf by:

38 Retained earnings / (Accumulated losses) 36,373,461 34,901,321 36,555,623 37,208,133 36,373,114 35,194,853 36,950,562 37,657,328

39 Statutory loan loss reserve - - - - - - - -

40 Other reserves 233,235 284,550 185,661 185,325 233,235 284,550 185,661 185,325 Chairman Managing Director

41 Proposed dividend - 4,345,229 4,345,229 - - 4,345,229 4,345,229 - Charles Muchene Jeremy Awori

42 Capital Grants - - - - - - - -

43 Total shareholders' funds 39,103,584 42,094,710 43,652,098 40,337,534 39,103,237 42,388,242 44,047,037 40,786,729

44 Total liabilities and total shareholders funds 256,142,570 259,498,223 260,429,453 268,015,547 256,142,225 259,692,012 260,788,697 268,186,848

II STATEMENT OF COMPREHENSIVE INCOME

1 INTEREST INCOME

1.1 Loans and advances to customers 10,177,970 20,617,217 5,085,563 10,487,314 10,177,970 20,617,217 5,085,563 10,487,314

1.2 Government securities 2,573,410 5,587,158 1,289,394 2,586,698 2,573,410 5,587,158 1,289,394 2,586,698

1.3 Deposits and placements with banking institutions 86,484 151,130 19,949 49,127 86,484 151,130 19,949 49,127

1.4 Other interest income 1,065,593 1,765,684 7,309 13,674 1,065,593 1,765,684 7,309 13,674

1.5 Total interest income 13,903,457 28,121,189 6,402,215 13,136,813 13,903,457 28,121,189 6,402,215 13,136,813

2 INTEREST EXPENSES

2.1 Customer deposits 2,209,507 4,551,312 1,161,877 2,316,338 2,209,507 4,551,312 1,161,877 2,316,338

2.2 Deposits and placements with banking institutions 273,494 589,048 205,486 276,375 273,494 589,048 205,486 276,375

2.3 Other interest expenses 323,335 646,598 - - 323,335 646,598 - -

2.4 Total interest expenses 2,806,336 5,786,958 1,367,363 2,592,713 2,806,336 5,786,958 1,367,363 2,592,713

or speak to us today.

3 NET INTEREST INCOME 11,097,121 22,334,231 5,034,852 10,544,100 11,097,121 22,334,231 5,034,852 10,544,100

4 NON - INTEREST INCOME

4.1 Fees and commissions income on loans & Advances 828,135 958,951 163,704 322,464 828,135 958,951 163,704 322,464

4.2 Other fees and commissions 2,522,595 4,318,678 1,120,414 2,118,664 2,522,595 4,811,540 1,294,413 2,390,961

4.3 Foreign exchange trading income 1,348,595 2,620,337 805,170 1,480,233 1,348,595 2,620,337 805,170 1,480,233

4.4 Dividend income - - - - - - - -

4.5 Other income 438,572 959,053 106,982 191,860 438,572 959,053 106,982 200,818

4.6 Total non-interest income 5,137,897 8,857,019 2,196,270 4,113,221 5,137,897 9,349,881 2,370,269 4,394,476

5 Total operating income 16,235,018 31,191,250 7,231,122 14,657,321 16,235,018 31,684,112 7,405,121 14,938,576

6 OPERATING EXPENSES

6.1 Loan loss provision 2,009,443 3,927,137 774,707 1,353,470 2,009,443 3,927,137 774,707 1,353,470

6.2 Staff costs 4,875,849 9,661,728 2,435,599 5,073,526 4,875,849 9,729,330 2,460,528 5,123,834

6.3 Directors emoluments 65,324 107,859 32,196 68,950 65,324 107,859 32,196 68,950

6.4 Rental charge 643,241 1,307,165 300,427 627,406 643,241 1,309,268 303,285 632,688

6.5 Depreciation on property and equipment 308,805 664,921 191,825 398,001 308,805 664,921 191,825 398,001

6.6 Amortisation charges 280,066 526,244 122,413 245,733 280,066 526,244 122,413 245,733

6.7 Other operating expenses 2,229,166 4,556,510 998,960 1,960,444 2,229,166 4,566,946 1,000,304 1,963,733

7 Total operating expenses 10,411,894 20,751,564 4,856,127 9,727,530 10,411,894 20,831,705 4,885,258 9,786,409

Profit before tax and exceptional items 5,823,124 10,439,686 2,374,995 4,929,791 5,823,124 10,852,407 2,519,863 5,152,167

8 Exceptional items - - - - -

9 Profit after exceptional items 5,823,124 10,439,686 2,374,995 4,929,791 5,823,124 10,852,407 2,519,863 5,152,167

10 Current tax (1,953,910) (3,663,466) (765,600) (1,633,122) (1,953,910) (3,792,394) (810,715) (1,702,235)

11 Deferred tax 217,475 335,126 38,765 90,305 217,475 339,383 40,420 92,706

12 Profit after tax and exceptional items 4,086,689 7,111,346 1,648,160 3,386,974 4,086,689 7,399,396 1,749,568 3,542,638

13 OTHER COMPREHENSIVE INCOME

13.1 Gains/(Losses) from translating the financial statements of foreign - -

operations

13.2 Fair value changes in available for sale financial assets 1,062,039 1,157,356 2,820 543,523 1,062,039 1,157,356 2,820 543,523

13.3 Revaluation surplus on Property,plant and equipment - - -

13.4 Share of other comprehensive income of associates - - -

13.5 Income tax relating to components of other comprehensive income (318,612) (347,207) (846) (163,057) (318,612) (347,207) (846) (163,057)

14 Other Comprehensive Income for the year net of tax 743,427 810,149 1,974 380,466 743,427 810,149 1,974 380,466

15 Total comprehensive income for the year 4,830,116 7,921,495 1,650,134 3,767,440 4,830,116 8,209,545 1,751,542 3,923,104

Earnings per Share (Shs) 0.75 1.31 0.30 0.62 0.75 1.36 0.32 0.65

Dividends per share (Shs) 0.20 1.00 - 0.20 0.20 1.00 - 0.20

Barclays Bank Kenya Limited is regulated by the Central Bank of Kenya | Terms and conditions apply

Barclays Bank Kenya Limited is regulated by the Central Bank of Kenya

You might also like

- BBK 2016 q3 Financials v9Document1 pageBBK 2016 q3 Financials v9Manil UniqueNo ratings yet

- BBK 2020-Q1-ResultsDocument1 pageBBK 2020-Q1-ResultsManil UniqueNo ratings yet

- BBK 2015 q1 FinancialsDocument1 pageBBK 2015 q1 FinancialsManil UniqueNo ratings yet

- ABSA Bank Kenya PLC - Unaudited Group Results For The Period Ended 30-Sep-2023Document1 pageABSA Bank Kenya PLC - Unaudited Group Results For The Period Ended 30-Sep-2023karanjamike565No ratings yet

- Stanbic Bank Q3 2023 Financial ResultsDocument1 pageStanbic Bank Q3 2023 Financial Resultskaranjamike565No ratings yet

- Equity Group Holdings PLC Financial Statements For The Year Ended 31st December 2022Document1 pageEquity Group Holdings PLC Financial Statements For The Year Ended 31st December 2022shadehdavNo ratings yet

- KCB 2021 FY FinancialsDocument1 pageKCB 2021 FY Financialsmika piusNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Ratio - Calculator 22Document24 pagesRatio - Calculator 22ალექსანდრე ტაბუცაძეNo ratings yet

- Accounts 2017 NotesDocument40 pagesAccounts 2017 Notesaliakhtar02No ratings yet

- PROPOSED BUDGET ESTIMATES For The Year Ending December 31, 2023 (Blue Book)Document565 pagesPROPOSED BUDGET ESTIMATES For The Year Ending December 31, 2023 (Blue Book)Thembinkosi BhonkwaneNo ratings yet

- APR MAY JUN JUL AUG SEP OCT NOV DEC JAN FEB MAR Projected Amount Total AmountDocument2 pagesAPR MAY JUN JUL AUG SEP OCT NOV DEC JAN FEB MAR Projected Amount Total AmountSrinivasan PNo ratings yet

- Annual Results Mar17Document5 pagesAnnual Results Mar17bbaalluuNo ratings yet

- Mbsi Term 1 PP2 May 2022Document3 pagesMbsi Term 1 PP2 May 2022rnyaboke90No ratings yet

- Income Tax - VindfoDocument4 pagesIncome Tax - Vindfodafny glendaNo ratings yet

- Statement of Stockholders EquityDocument4 pagesStatement of Stockholders EquityWajiha NadeemNo ratings yet

- 0000184074-01 - Family Bank LTDDocument1 page0000184074-01 - Family Bank LTDSoko DirectoryNo ratings yet

- CF AssignmentDocument44 pagesCF AssignmentSwarnendu GhoshNo ratings yet

- 2019 Blue Book Combined PDFDocument311 pages2019 Blue Book Combined PDFhilton magagadaNo ratings yet

- Common Size Statementswith SOLUTIONSDocument58 pagesCommon Size Statementswith SOLUTIONSSrilekha RoyNo ratings yet

- UBL Annual Report 2018-116Document1 pageUBL Annual Report 2018-116IFRS LabNo ratings yet

- S.6 Ent 2Document5 pagesS.6 Ent 2danielzashleybobNo ratings yet

- Statement of Affairs of The State Bank of Pakistan Banking Department As On The 22 June, 2018Document1 pageStatement of Affairs of The State Bank of Pakistan Banking Department As On The 22 June, 2018FahadNo ratings yet

- Statement of Affairs of The State Bank of Pakistan Banking Department As On The 27 April, 2018Document1 pageStatement of Affairs of The State Bank of Pakistan Banking Department As On The 27 April, 2018muhammad nazirNo ratings yet

- Bank Reporting Example NABILDocument54 pagesBank Reporting Example NABILSujit KoiralaNo ratings yet

- UBL Annual Report 2018-101Document1 pageUBL Annual Report 2018-101IFRS LabNo ratings yet

- MS08092022Document3 pagesMS08092022Hoàng Minh ChuNo ratings yet

- BF405 May 2019 PDFDocument5 pagesBF405 May 2019 PDFhuku memeNo ratings yet

- Q.P. Code: 62202: Managerial AccountingDocument6 pagesQ.P. Code: 62202: Managerial Accountinganshul bhutangeNo ratings yet

- Statement of Affairs of The State Bank of Pakistan Banking Department As On 12Th June 2020Document1 pageStatement of Affairs of The State Bank of Pakistan Banking Department As On 12Th June 2020sm_1234567No ratings yet

- Monthly Statistics - 2077 - 03 July 2020 PDFDocument59 pagesMonthly Statistics - 2077 - 03 July 2020 PDFRupEshNo ratings yet

- Operational Statistics 2021-22Document45 pagesOperational Statistics 2021-22Vishwanath PatilNo ratings yet

- 6a MTP Oct 2020Document13 pages6a MTP Oct 2020Bijay AgrawalNo ratings yet

- Janet's ProjectDocument6 pagesJanet's ProjectAyam BakarNo ratings yet

- Cash Budget Problems and SolutionsDocument6 pagesCash Budget Problems and Solutionstamberahul1256No ratings yet

- 2022 Q4 Laporan Publikasi Triwulanan - enDocument15 pages2022 Q4 Laporan Publikasi Triwulanan - enAndri MirzalNo ratings yet

- Ammar 2023 RepoDocument2 pagesAmmar 2023 RepoDustyHouseNo ratings yet

- Afs Ekcl 2017Document67 pagesAfs Ekcl 2017Tonmoy ParthoNo ratings yet

- Ersonal Budget Stephano Chobwe Kanyinji-2022Document8 pagesErsonal Budget Stephano Chobwe Kanyinji-2022Chobwe Stephano KanyinjiNo ratings yet

- Account Payables - KarenDocument287 pagesAccount Payables - KarenAkie PalparanNo ratings yet

- Crisil ReportDocument15 pagesCrisil ReportMurli GhodeNo ratings yet

- Months: Sales Purchases Wages ExpensesDocument2 pagesMonths: Sales Purchases Wages Expensespranay639No ratings yet

- Advance Financia AnalysesDocument35 pagesAdvance Financia AnalysesXsellence AccountsNo ratings yet

- UBL Annual Report 2018-93Document1 pageUBL Annual Report 2018-93IFRS LabNo ratings yet

- Magh 2080 PublishDocument65 pagesMagh 2080 Publishabhishek.dudbcNo ratings yet

- Q1 From The Following Particulars of XYZ Ltd. Prepare The Cash Flow StatementDocument2 pagesQ1 From The Following Particulars of XYZ Ltd. Prepare The Cash Flow StatementSuvam PatelNo ratings yet

- Jay Cesar System Developer Worksheet DECEMBER 31 2019 Unadjusted Trial Balance REFDocument4 pagesJay Cesar System Developer Worksheet DECEMBER 31 2019 Unadjusted Trial Balance REFAdam CuencaNo ratings yet

- Outcome of 184th Board Meeting of Axis Bank Limited Held On 26th April 2018 and 27th April 2018 26.04.2018Document80 pagesOutcome of 184th Board Meeting of Axis Bank Limited Held On 26th April 2018 and 27th April 2018 26.04.2018anvesh anveshNo ratings yet

- UBL Annual Report 2018-109Document1 pageUBL Annual Report 2018-109IFRS LabNo ratings yet

- Projected Forcasted TrulyDocument8 pagesProjected Forcasted TrulyClaudine Anne AguiatanNo ratings yet

- Audited Consolidated Financial Statements For The Year Ended 31 October 2009Document32 pagesAudited Consolidated Financial Statements For The Year Ended 31 October 2009amitkanhere4397No ratings yet

- Adv Accounting 100 Imp Questions 1642420796 PDFDocument179 pagesAdv Accounting 100 Imp Questions 1642420796 PDFsigeshNo ratings yet

- Cash ManagementDocument14 pagesCash ManagementSushant MaskeyNo ratings yet

- Entrepreneurship P230pp2Document5 pagesEntrepreneurship P230pp2nasasiraluke861No ratings yet

- Rastriya Banijya Bank Limited Singhdurbar Plaza, Kathmandu Unaudited Financial Results (Quarterly) As at 1St Quarter of Fiscal Year 2008-09Document1 pageRastriya Banijya Bank Limited Singhdurbar Plaza, Kathmandu Unaudited Financial Results (Quarterly) As at 1St Quarter of Fiscal Year 2008-09gonenp1No ratings yet

- Annexure II 5Document76 pagesAnnexure II 5ahsen.raheemNo ratings yet

- Executive Summary: A. IntroductionDocument5 pagesExecutive Summary: A. IntroductionAlicia NhsNo ratings yet

- ACCT 440 FMGT Exams 2021 SandwichDocument4 pagesACCT 440 FMGT Exams 2021 SandwichNubor RichardNo ratings yet

- INDIA Trade 2018Document176 pagesINDIA Trade 2018Vipin LNo ratings yet

- Classfication of Audit: - by Shaina SachdevaDocument6 pagesClassfication of Audit: - by Shaina Sachdeva04 Shaina SachdevaNo ratings yet

- Expression of Interest (Consultancy) (BDC)Document4 pagesExpression of Interest (Consultancy) (BDC)Brave zizNo ratings yet

- DM No. 152, S. 2023Document4 pagesDM No. 152, S. 2023kevin aquinoNo ratings yet

- GMG Vendor FormDocument2 pagesGMG Vendor FormsandyNo ratings yet

- LT 2011 Final - Biro Pengaduan AwamDocument214 pagesLT 2011 Final - Biro Pengaduan Awamjaykhor9328No ratings yet

- Adrift Book SummaryDocument40 pagesAdrift Book SummaryAjesh ShahNo ratings yet

- @canotescommunity GST Nov22Document21 pages@canotescommunity GST Nov22Gomtesh BhatiNo ratings yet

- Kotak Mahindra Bank: Form No. 60Document1 pageKotak Mahindra Bank: Form No. 60Rahul JhaNo ratings yet

- Vinod Kumar: Ropeway CorpDocument5 pagesVinod Kumar: Ropeway CorpNitesh KumarNo ratings yet

- Application For Csag Permit Ecc 2019Document3 pagesApplication For Csag Permit Ecc 2019Armando MataNo ratings yet

- Introduction To Indian Financial System: The Union Budget 2021 Has Announced The Privatisation of Two Public Sector BanksDocument6 pagesIntroduction To Indian Financial System: The Union Budget 2021 Has Announced The Privatisation of Two Public Sector BanksVidushi TandonNo ratings yet

- Businessprofile (Business)Document2 pagesBusinessprofile (Business)PalesaNo ratings yet

- Service Agreement - Arnel TaburdanDocument3 pagesService Agreement - Arnel TaburdanJacquelyn RamosNo ratings yet

- 10th STD 2023 State BoardDocument1 page10th STD 2023 State Boardthrisha s suvarnaNo ratings yet

- GMC Registration Application FormDocument8 pagesGMC Registration Application FormRabiul IslamNo ratings yet

- JKSSB NotificationDocument4 pagesJKSSB NotificationImran Afzal BhatNo ratings yet

- Handout - Offer and AcceptanceDocument7 pagesHandout - Offer and AcceptanceAdam 'Fez' Ferris67% (3)

- B.SC Civil Engineering: Project & Contract Management CE 206Document24 pagesB.SC Civil Engineering: Project & Contract Management CE 206Engr Asad SufyanNo ratings yet

- Qazi Naseem Attendence OctDocument11 pagesQazi Naseem Attendence OctnajamNo ratings yet

- PT. Pertamina Retail: PO Service Purchase Order (PO)Document2 pagesPT. Pertamina Retail: PO Service Purchase Order (PO)Firman PrimahardhikaNo ratings yet

- IAF MD11 Issue 2 Version 2 03072019 PDFDocument14 pagesIAF MD11 Issue 2 Version 2 03072019 PDFnomanrahman5685No ratings yet

- 27AAACC1450B1ZE Cipla PVT - LTD.: Bill No.: 263Document1 page27AAACC1450B1ZE Cipla PVT - LTD.: Bill No.: 263Heera Hospitality Private LimitedNo ratings yet

- بيع القارDocument24 pagesبيع القارفكاهيات - FokahaNo ratings yet

- RR For PA SADocument15 pagesRR For PA SAnew besesdNo ratings yet

- 3 MFO Dealer & Retailer Annex 4 - Registration - Authority To Sell LPGDocument2 pages3 MFO Dealer & Retailer Annex 4 - Registration - Authority To Sell LPGCapo OnThird Fret100% (1)

- Hall Ticket For Common Recruitment Examination For Group C Posts in Higher Secondary LevelDocument2 pagesHall Ticket For Common Recruitment Examination For Group C Posts in Higher Secondary LevelParishruti DasNo ratings yet

- Acct Statement - XX5332 - 11052022Document2 pagesAcct Statement - XX5332 - 11052022Debendra SathyNo ratings yet

- Shortcomings of MGNREGA: 1) Poor Administration and Planning Policy: in The Rural Areas, There Have BeenDocument2 pagesShortcomings of MGNREGA: 1) Poor Administration and Planning Policy: in The Rural Areas, There Have BeenKanishk RohilanNo ratings yet

- MOA Manpower Provider Merchandisers - Docx Final2 2Document3 pagesMOA Manpower Provider Merchandisers - Docx Final2 2Ma Teresa Jaropojop LucianoNo ratings yet