Professional Documents

Culture Documents

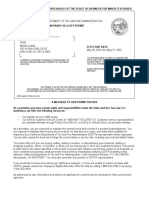

Remote Seller's Intent To Terminate Use Tax Responsibilities/Remote Seller Status

Remote Seller's Intent To Terminate Use Tax Responsibilities/Remote Seller Status

Uploaded by

Lax OranoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Remote Seller's Intent To Terminate Use Tax Responsibilities/Remote Seller Status

Remote Seller's Intent To Terminate Use Tax Responsibilities/Remote Seller Status

Uploaded by

Lax OranoCopyright:

Available Formats

01-798 PRINT FORM RESET FORM

(Rev.12-21/3)

Remote Seller's Intent to Terminate Use Tax Responsibilities/Remote Seller Status

This form is to terminate Remote Seller Texas Use Tax responsibilities and/or Remote Seller status. A "remote seller" can

not have a physical presence or representative in the state.

A remote seller that terminates its use tax responsibilities must resume collection on the first day of the second month

following any 12 calendar months in which total Texas revenue exceeds $500,000. See Rule 3.286, Seller's and

Purchaser's Responsibilities, for more information.

Taxpayer Name 11-digit Texas Taxpayer number

NUA STORE LLC 84-3916491

Street address

8680 EDGEFIELD AVENUE

City State ZIP code

SAN ANGELO TEXAS 76904

Name of contact person Termination Date

NAJIB ULLAH AFRIDI

Phone number (Area code and number) Email address

najib.ullah0918@gmail.com

As a remote seller, I am terminating my use tax collection responsibilities because:

✔ I meet the definition of a remote seller, with no physical presence in Texas. I have twelve consecutive

months in which total revenue from sales of all tangible personal property and services in Texas for the

preceding twelve calendar months was less than $500,000.

I am no longer selling items or services in Texas.

I am terminating my remote seller status because:

✔ I have a physical presence or representative in Texas.

If you have a physical presence or representative in the state, you are required to collect sales and use

tax. Terminating remote seller status does not terminate this responsibility to collect sales and use tax. If

you are eligible to terminate your use tax collection responsibility, check one of the other boxes.

I hereby certify that the information contained in this document is true and correct to best of my knowledge and belief.

Printed Taxpayer name or duly authorized agent Title

Najib Ullah Afridi Director

Daytime phone (Area code and number)

Mail to Comptroller of Public Accounts

If you have any questions, call 800-252-5555. P.O. Box 149354

Details are also available online at www.comptroller.texas.gov. Austin, TX 78714-9354

You have certain rights under Chapters 552 and 559, Government Code, to review, request and correct information we have on file about you.

Contact us at the address or phone number listed on this form.

You might also like

- S09-3 Compressor CTN10-16 (1.00)Document34 pagesS09-3 Compressor CTN10-16 (1.00)Anonymous AW4pRV7r75% (4)

- Catalog PDFDocument47 pagesCatalog PDFitounos100% (4)

- Affidavit of Notary PresentmentDocument7 pagesAffidavit of Notary Presentmentpreston_402003100% (7)

- Jack Up Drilling Rig PDFDocument2 pagesJack Up Drilling Rig PDFm3t4ph0RNo ratings yet

- Republic of The Philippines Department of Trade and Industry Business Name Registration Sole Proprietorship Application FormDocument7 pagesRepublic of The Philippines Department of Trade and Industry Business Name Registration Sole Proprietorship Application FormThrecia RotaNo ratings yet

- Texas Sales and Use Tax Exemption CertificationDocument2 pagesTexas Sales and Use Tax Exemption CertificationluherservicesNo ratings yet

- Texas-Resale-Certificate Wasi LLCDocument2 pagesTexas-Resale-Certificate Wasi LLCSyed TouseefNo ratings yet

- Republic of The Philippines Department of Trade and Industry Business Name Registration Sole Proprietorship Application FormDocument4 pagesRepublic of The Philippines Department of Trade and Industry Business Name Registration Sole Proprietorship Application FormTIA BARTE FERRERNo ratings yet

- Republic of The Philippines Department of Trade and Industry Business Name Registration Sole Proprietorship Application FormDocument4 pagesRepublic of The Philippines Department of Trade and Industry Business Name Registration Sole Proprietorship Application FormJaime GonzalesNo ratings yet

- J.2.5 Tax AffidavitDocument1 pageJ.2.5 Tax Affidavitameerm_abdullahNo ratings yet

- Dtiform 6 15 2022Document6 pagesDtiform 6 15 2022Hiraeth WeltschmerzNo ratings yet

- Inactive Realtor ApplicationDocument1 pageInactive Realtor ApplicationWayne ChaiNo ratings yet

- Trustee Address Change IRSDocument2 pagesTrustee Address Change IRS25sparrow100% (5)

- Sales Tax Exempt Fill in TemplateDocument1 pageSales Tax Exempt Fill in TemplatePublic Knowledge100% (1)

- Tax Deferral For Home OwnersDocument1 pageTax Deferral For Home OwnerscutmytaxesNo ratings yet

- DND-Sec Cert BiddingDocument1 pageDND-Sec Cert BiddingjeanneNo ratings yet

- UndertakingApplicationForm HBNJ199310200700Document4 pagesUndertakingApplicationForm HBNJ199310200700Jatricc Qhyzer RodriguezNo ratings yet

- 14DAYDocument2 pages14DAYmiranda criggerNo ratings yet

- Application For Rental BlankDocument4 pagesApplication For Rental BlankJeremy Seth TrumbleNo ratings yet

- Vendor - Questionnaire - Form - 2021Document1 pageVendor - Questionnaire - Form - 2021ferdixx7No ratings yet

- Classification Form 01700000090231Document1 pageClassification Form 01700000090231sayeedkhan007No ratings yet

- Texas Sales and Use Tax Exemption Certificate 3 - BlueSnap - 27july2020 - v01Document1 pageTexas Sales and Use Tax Exemption Certificate 3 - BlueSnap - 27july2020 - v01mberchtoldNo ratings yet

- Undertaking Gfiw707816323490Document4 pagesUndertaking Gfiw707816323490CeazarFabillarMoralesJr.No ratings yet

- Application FormDocument2 pagesApplication FormJulius Espiga ElmedorialNo ratings yet

- Additional Instructions For Judgment Debtor Exams: (Report Form On Next Page)Document2 pagesAdditional Instructions For Judgment Debtor Exams: (Report Form On Next Page)WarriorpoetNo ratings yet

- Application For Release From Prohibition or Removal OrderDocument13 pagesApplication For Release From Prohibition or Removal OrderMark ReinhardtNo ratings yet

- Reinstatment FiguresDocument2 pagesReinstatment Figureskapri_jacksonNo ratings yet

- Wasi LLC EinDocument2 pagesWasi LLC EinLax OranoNo ratings yet

- Tax Exempt FormDocument1 pageTax Exempt Formjuan camaneyNo ratings yet

- 05 391 PDFDocument1 page05 391 PDFBen OmarNo ratings yet

- Forms 20 SalnDocument2 pagesForms 20 SalnWelfred Ronquillo100% (1)

- 14DAYDocument2 pages14DAYmiranda criggerNo ratings yet

- 2018 Statement of Financial DisclosureDocument4 pages2018 Statement of Financial DisclosureAnnie AndersenNo ratings yet

- Viscotech Docs For ApplicationDocument3 pagesViscotech Docs For ApplicationJoanne RoqueNo ratings yet

- Sworn Statement - LOOSELEAF BOOK OF ACCTSDocument2 pagesSworn Statement - LOOSELEAF BOOK OF ACCTSMagdalena Tupalar100% (1)

- Washington STATE14 Day For Evicit Notice Legal TemplateDocument2 pagesWashington STATE14 Day For Evicit Notice Legal Templatemiranda criggerNo ratings yet

- 14DAYDocument2 pages14DAYmiranda criggerNo ratings yet

- Republic of The Philippines Department of Trade and Industry Business Name Registration Sole Proprietorship Application FormDocument4 pagesRepublic of The Philippines Department of Trade and Industry Business Name Registration Sole Proprietorship Application FormPaulo JavierNo ratings yet

- Application Business-PermitDocument2 pagesApplication Business-Permitklein uyNo ratings yet

- 14DAYDocument2 pages14DAYmiranda criggerNo ratings yet

- I, MOHSIN Q. GALMAC, of Legal Age, Filipino, Married and A ResidentDocument2 pagesI, MOHSIN Q. GALMAC, of Legal Age, Filipino, Married and A ResidentalfieNo ratings yet

- Business Update of Information Update Fee: P 2,000.00 Reference Code: JBHU565010382872Document2 pagesBusiness Update of Information Update Fee: P 2,000.00 Reference Code: JBHU565010382872ARNOLD SANTOSNo ratings yet

- Cra (2) DddaDocument14 pagesCra (2) DddadulmasterNo ratings yet

- Account Holder: AEOI Self-Certification For An Individual/Controlling PersonDocument3 pagesAccount Holder: AEOI Self-Certification For An Individual/Controlling PersonNigil josephNo ratings yet

- Saln 2012 Blank FormDocument3 pagesSaln 2012 Blank FormGel KorlanNo ratings yet

- Tax Change AddressDocument3 pagesTax Change AddressamoszhouNo ratings yet

- Affidavit of Closure of Business (BIR) - Dael GerongDocument1 pageAffidavit of Closure of Business (BIR) - Dael GerongDael GerongNo ratings yet

- Fanime Sellers PermitDocument1 pageFanime Sellers PermitBrian LiangNo ratings yet

- 1993 - Rick Berg Real Estate License - Midwest ManagementDocument1 page1993 - Rick Berg Real Estate License - Midwest ManagementNorthDakotaWayNo ratings yet

- 4 - Irs 8822Document1 page4 - Irs 8822Hï FrequencyNo ratings yet

- DTI PermitDocument3 pagesDTI PermitErielle Sta. AnaNo ratings yet

- 2018 Florida Annual Resale Certiicate For Sales TaxDocument1 page2018 Florida Annual Resale Certiicate For Sales TaxStas BorkinNo ratings yet

- Form For Appointment of OfficersDocument2 pagesForm For Appointment of OfficersAndrew BenitezNo ratings yet

- 336 Greystone Hiram ApplicationDocument3 pages336 Greystone Hiram ApplicationthesouthernbutterflyNo ratings yet

- FYI 406 Your Rights Under The Tax LawDocument2 pagesFYI 406 Your Rights Under The Tax LawFuji guruNo ratings yet

- Terminate FormDocument1 pageTerminate FormTiffany DacinoNo ratings yet

- How To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreFrom EverandHow To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreNo ratings yet

- Invoice: Osh Notch LLC Osama Chaghtai 18117 Biscayne BLVD, Suite 2599 Miami, FL 33160 +1 (321) 599-6130Document2 pagesInvoice: Osh Notch LLC Osama Chaghtai 18117 Biscayne BLVD, Suite 2599 Miami, FL 33160 +1 (321) 599-6130Lax OranoNo ratings yet

- Najib Ullah PassportDocument1 pageNajib Ullah PassportLax OranoNo ratings yet

- FullStmt 1687243028368 3650143354115 SyedTouseef93Document2 pagesFullStmt 1687243028368 3650143354115 SyedTouseef93Lax OranoNo ratings yet

- Patient Report PDFDocument1 pagePatient Report PDFLax OranoNo ratings yet

- Patient Report PDFDocument1 pagePatient Report PDFLax OranoNo ratings yet

- The Night FloorsDocument57 pagesThe Night FloorsNat LinkenNo ratings yet

- Chapter 5-Leadership and MotivationDocument62 pagesChapter 5-Leadership and MotivationAklilu GirmaNo ratings yet

- Physics MCQs For Class 12 With Answers Chapter 10Document12 pagesPhysics MCQs For Class 12 With Answers Chapter 10Akshith ReddyNo ratings yet

- 7SG117 Argus 7 Catalogue SheetDocument8 pages7SG117 Argus 7 Catalogue SheetHimdad TahirNo ratings yet

- Behavioral Health - JournalDocument1 pageBehavioral Health - JournalCindy Melford Dusong MarbellaNo ratings yet

- Heart Disease and Stroke BrochureDocument3 pagesHeart Disease and Stroke Brochureapi-461951012No ratings yet

- 4.Hum-The Trauma of Dalit Existence - Reviewed - 1 - 2Document8 pages4.Hum-The Trauma of Dalit Existence - Reviewed - 1 - 2Impact JournalsNo ratings yet

- Keph205 PDFDocument18 pagesKeph205 PDFRohit Kumar YadavNo ratings yet

- Unit - IDocument86 pagesUnit - IZeeshanMirzaNo ratings yet

- Church-State Relations, National Identity, and Security in Post-Cold War GreeceDocument31 pagesChurch-State Relations, National Identity, and Security in Post-Cold War GreeceTeo ThemaNo ratings yet

- Tourism Essay FinalDocument6 pagesTourism Essay FinalNiyatee ManjureNo ratings yet

- External Commands of Dos With Syntax PDFDocument2 pagesExternal Commands of Dos With Syntax PDFCekap100% (2)

- CKM 200 Car Key Master ManualDocument33 pagesCKM 200 Car Key Master Manualselereak100% (1)

- ArmorDocument7 pagesArmorRecep VatanseverNo ratings yet

- Progress of Refractories Used in BFDocument8 pagesProgress of Refractories Used in BFAloísio Simões RibeiroNo ratings yet

- Smardt Solar Chiller - FinalDocument4 pagesSmardt Solar Chiller - FinalLuthfi LegooNo ratings yet

- Gas Filter SizingDocument148 pagesGas Filter SizingRAJIV_332693187No ratings yet

- Webinar KNX Visualisation - Updates and Solutions July 2017 - BU EPBP GPG Building AutomationDocument37 pagesWebinar KNX Visualisation - Updates and Solutions July 2017 - BU EPBP GPG Building AutomationIorgoni LiviuNo ratings yet

- Ch.2 English & Its StagesDocument35 pagesCh.2 English & Its StagesMatilda100% (1)

- Catalog Sydor 2022Document21 pagesCatalog Sydor 2022Chonk LeeNo ratings yet

- Consultant ListDocument9 pagesConsultant ListFitsum DojuNo ratings yet

- MELODY 5.3 Treatment Methods Theoretical - V2.0 - 211122Document19 pagesMELODY 5.3 Treatment Methods Theoretical - V2.0 - 211122MelodyNo ratings yet

- Best Hashtag Guide For Your Instagram PDFDocument10 pagesBest Hashtag Guide For Your Instagram PDFhow toNo ratings yet

- Unit 7-Working AbroadDocument31 pagesUnit 7-Working AbroadNgọc VõNo ratings yet

- Rhetorical Questions With "Nandao" - Chinese Grammar WikiDocument3 pagesRhetorical Questions With "Nandao" - Chinese Grammar WikiluffyNo ratings yet

- Kant Eti 2017Document5 pagesKant Eti 2017orionUPCNo ratings yet

- "Healthy Lifestyle": Vocabulary Above The Level of Your TextDocument2 pages"Healthy Lifestyle": Vocabulary Above The Level of Your TextZUBAIDAH BINTI JAMALUDDIN MoeNo ratings yet