Professional Documents

Culture Documents

Isaiah To Stella

Uploaded by

Balamaze Isaiah0 ratings0% found this document useful (0 votes)

25 views2 pagesOriginal Title

Isaiah to Stella

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views2 pagesIsaiah To Stella

Uploaded by

Balamaze IsaiahCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

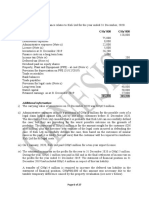

Below is an extract of the financial statements for Hanifah Ltd for the year ended 31st December

2022.

HANIFAH LTD

STATEMENT OF COMPREHENSIVE INCOME

2022 2021

Ugx ‘000’ Ugx ‘000’

Revenue 52,074 48,222

Cost of sales (31,160) (32,732)

Gross profit 20,914 15,490

Compensation on land 6,226

Rent and other incomes 282 206

Total income 21,196 21,922

Operating expenses (12,894) (15,518)

Operating profit 8,302 6,404

Financial costs 242 6,074

Profit (loss) before tax 8,060 330

Tax expense 3,312 142

Profit for the year 4,748 188

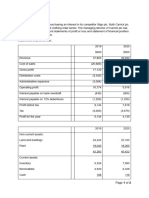

HANIFAH LTD

STATEMENT OF FINANCIAL POSITION

2022 2021

Ugx ‘000’ Ugx ‘000’

Issued capital 40,000 40,000

Retained earnings 15,898 11,150

Total equity 55,898 51,150

Non-current liabilities 65,294 54,792

Total equity and non-current liabilities 121,192 105,942

Represented by: - -

Non-current assets 95,466 101,150

Current assets (1) 35,060 23,962

Current liabilities 9,334 19,170

121,192 105,942

Notes

(1) Cash and inventory as components of current assts are given in the table

below.

2022 2021

Ugx ‘000’ Ugx ‘000’

Cash 7,050 4,600

Inventory 10,520 6,602

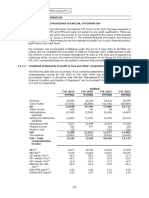

a) Calculate the following ratios for both 2022 and 2019

i. Net profit margin

ii. Debt to equity ratio

iii. Asset turnover ratio

iv. Gross profit margin

v. Current ratio

vi. Debt to capital ratio

vii. Cash ratio

viii. Inventory turnover ratio

b) From the calculated ratios above, use at least one ratio to explain the

performance of HANIFAH Ltd between 2021 and 2022 in terms of liquidity,

profitability, efficiency and solvency

You might also like

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Part F - Additional QuestionsDocument9 pagesPart F - Additional QuestionsDesmond Grasie ZumankyereNo ratings yet

- Vicom 1Document10 pagesVicom 1johnsolarpanelsNo ratings yet

- Bolix SAfinalDocument54 pagesBolix SAfinalRavi SinghNo ratings yet

- ABC Corporation Annual ReportDocument9 pagesABC Corporation Annual ReportCuong LyNo ratings yet

- Group 5 Case of Financial StatementDocument6 pagesGroup 5 Case of Financial StatementDhomas AgastyaNo ratings yet

- Announcement June 2020 - tcm387-605455Document2 pagesAnnouncement June 2020 - tcm387-605455Valamunis DomingoNo ratings yet

- Kin Pang Holdings Limited 建 鵬 控 股 有 限 公 司: Audited Annual Results Announcement For The Year Ended 31 December 2021Document37 pagesKin Pang Holdings Limited 建 鵬 控 股 有 限 公 司: Audited Annual Results Announcement For The Year Ended 31 December 2021ALNo ratings yet

- Accounting Information System HomeWork 1 Jazan UniversityDocument7 pagesAccounting Information System HomeWork 1 Jazan Universityabdullah.masmaliNo ratings yet

- FinalDocument20 pagesFinalMuhammad Aminul HoqueNo ratings yet

- Financial Statement AnalysisDocument6 pagesFinancial Statement AnalysisKimberly AsanteNo ratings yet

- Choo Bee Metal Industries Berhad (10587-A)Document18 pagesChoo Bee Metal Industries Berhad (10587-A)Iqbal YusufNo ratings yet

- Activity in Finance Nov 20Document1 pageActivity in Finance Nov 20LANSANGAN, MYRA MAE - ABMNo ratings yet

- Dic FS Ann e 20 03 2023Document77 pagesDic FS Ann e 20 03 2023MarizeteNo ratings yet

- Wipro Ltd. (India) : SourceDocument6 pagesWipro Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Financial Reporting Mcom 3 Semester: AssetsDocument2 pagesFinancial Reporting Mcom 3 Semester: AssetsYasir AminNo ratings yet

- T Systems (Report)Document219 pagesT Systems (Report)Prachi SaklaniNo ratings yet

- Consolidated Balance Sheet For Hindustan Unilever LTDDocument11 pagesConsolidated Balance Sheet For Hindustan Unilever LTDMohit ChughNo ratings yet

- AYER HOLDINGS BERHAD - Financial Report 2021-16-17Document2 pagesAYER HOLDINGS BERHAD - Financial Report 2021-16-172023149467No ratings yet

- QUESTION 6 Financial Reporting May 2021 KOLIDocument6 pagesQUESTION 6 Financial Reporting May 2021 KOLILaud ListowellNo ratings yet

- JHM 1Qtr21 Financial Report (Amendment)Document13 pagesJHM 1Qtr21 Financial Report (Amendment)Ooi Gim SengNo ratings yet

- Consolidated Interim Financial Information (Unaudited) As of March 31, 2021 and 2020Document45 pagesConsolidated Interim Financial Information (Unaudited) As of March 31, 2021 and 2020Fernando SeminarioNo ratings yet

- Taliworks Q4FY19Document28 pagesTaliworks Q4FY19Gan ZhiHanNo ratings yet

- Tutorial 8Document6 pagesTutorial 8WEI QUAN LEENo ratings yet

- Quarterly Report 20221231Document21 pagesQuarterly Report 20221231Ang SHNo ratings yet

- Question 2 FR April 2022 Question 2 CaputDocument6 pagesQuestion 2 FR April 2022 Question 2 CaputLaud ListowellNo ratings yet

- IAS 7 - Statement of CashflowsDocument7 pagesIAS 7 - Statement of CashflowsidarausungNo ratings yet

- Assignment 5 - Statement of Cash FlowsDocument2 pagesAssignment 5 - Statement of Cash FlowsJezza Mae Gomba RegidorNo ratings yet

- Careplus Group Berhad: Unaudited Condensed Consolidated Statements of Comprehensive IncomeDocument16 pagesCareplus Group Berhad: Unaudited Condensed Consolidated Statements of Comprehensive IncomethamNo ratings yet

- Standard Chartered Bank Ghana PLC: Unaudited Financial Statements For The Period Ended 30 September 2021Document1 pageStandard Chartered Bank Ghana PLC: Unaudited Financial Statements For The Period Ended 30 September 2021Fuaad DodooNo ratings yet

- Financial Statement 7EDocument9 pagesFinancial Statement 7ENurin SyazarinNo ratings yet

- Bursa Q1 2015v6Document19 pagesBursa Q1 2015v6Fakhrul Azman NawiNo ratings yet

- Un-Audited Financial Statements For The Six Months Ended June 30, 2021Document1 pageUn-Audited Financial Statements For The Six Months Ended June 30, 2021Fuaad DodooNo ratings yet

- Alasseel Financial ResultsDocument17 pagesAlasseel Financial ResultsmohamedNo ratings yet

- Financial Report For The Year 2020-21Document280 pagesFinancial Report For The Year 2020-21Amanuel TewoldeNo ratings yet

- A Wholly-Owned Subsidiary of Philippine National Oil CompanyDocument4 pagesA Wholly-Owned Subsidiary of Philippine National Oil CompanyLolita CalaycayNo ratings yet

- PPBInt RPT 2003Document15 pagesPPBInt RPT 2003Gan ZhiHanNo ratings yet

- Karora FS Q1 2021Document16 pagesKarora FS Q1 2021Predrag MarkovicNo ratings yet

- GP 2 Far 620Document8 pagesGP 2 Far 620Syafahani SafieNo ratings yet

- Merrill Lynch Saudi Arabia Co Annual Fs - 2021Document35 pagesMerrill Lynch Saudi Arabia Co Annual Fs - 2021RANo ratings yet

- Enfs Q322Document29 pagesEnfs Q322xen101No ratings yet

- Access Full Year Financials 2020 WebDocument2 pagesAccess Full Year Financials 2020 WebFuaad DodooNo ratings yet

- Quiz 1Document2 pagesQuiz 1jevieconsultaaquino2003No ratings yet

- QUESTION 4 - Financial-Reporting - QUESTION 4 - NEETADocument7 pagesQUESTION 4 - Financial-Reporting - QUESTION 4 - NEETALaud ListowellNo ratings yet

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- Vitrox q22020Document16 pagesVitrox q22020Dennis AngNo ratings yet

- Financial Report For The Year 2020-21-DDocument74 pagesFinancial Report For The Year 2020-21-DAmanuel TewoldeNo ratings yet

- Assign #03 FNNDocument11 pagesAssign #03 FNNUsman GhaniNo ratings yet

- Vitrox q42021Document17 pagesVitrox q42021Dennis AngNo ratings yet

- Fusen Pharmaceutical Company Limited 福 森 藥 業 有 限 公 司Document22 pagesFusen Pharmaceutical Company Limited 福 森 藥 業 有 限 公 司in resNo ratings yet

- MBA Session 2 Carrick QuestionDocument2 pagesMBA Session 2 Carrick QuestionTafsir-i- AliNo ratings yet

- Session 6Document4 pagesSession 6samuel tabotNo ratings yet

- RBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddDocument3 pagesRBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddFuaad DodooNo ratings yet

- Laaaaaafarge 1st Quarter Report 2021Document24 pagesLaaaaaafarge 1st Quarter Report 2021Ahm FerdousNo ratings yet

- Finance, Accounting and Risk Management: Code: AMIL38Document9 pagesFinance, Accounting and Risk Management: Code: AMIL38ilayanambiNo ratings yet

- Cloudpoint Technology Berhad IPO Prospectus 9 May 2023 Part 2Document154 pagesCloudpoint Technology Berhad IPO Prospectus 9 May 2023 Part 2Oliver Oscar100% (1)

- Financial Accounting and Reporting: IFRS - 2021 December AKDocument15 pagesFinancial Accounting and Reporting: IFRS - 2021 December AKMarchella LukitoNo ratings yet

- Question 6 Chic Homes LTD GroupDocument5 pagesQuestion 6 Chic Homes LTD GroupsavagewolfieNo ratings yet

- Oppstar - Prospectus (Part 2)Document204 pagesOppstar - Prospectus (Part 2)kokueiNo ratings yet

- Four Fold AmenDocument1 pageFour Fold AmenBalamaze IsaiahNo ratings yet

- Kyrie Eleison 2-Osinde PDFDocument2 pagesKyrie Eleison 2-Osinde PDFBalamaze IsaiahNo ratings yet

- Olunaku Lw'omukama 3 Olwa Paska Omwaka A: Mu. La Bu Ry'o e Mu. La Bu e Ry'o Kku Bo e Ga Li Nda ODocument1 pageOlunaku Lw'omukama 3 Olwa Paska Omwaka A: Mu. La Bu Ry'o e Mu. La Bu e Ry'o Kku Bo e Ga Li Nda OBalamaze IsaiahNo ratings yet

- Christ The King Church Choirs' Association Easter Songs ProgrameDocument2 pagesChrist The King Church Choirs' Association Easter Songs ProgrameBalamaze IsaiahNo ratings yet

- Have Mercy (Kandaya Mass-Osinde)Document1 pageHave Mercy (Kandaya Mass-Osinde)Balamaze IsaiahNo ratings yet

- Mwesimye - Imwe - Abalungi 3 PDFDocument3 pagesMwesimye - Imwe - Abalungi 3 PDFBalamaze IsaiahNo ratings yet

- Atone For Your Sins (D)Document2 pagesAtone For Your Sins (D)Balamaze IsaiahNo ratings yet

- Kyrie Eleison-Osinde PDFDocument1 pageKyrie Eleison-Osinde PDFBalamaze IsaiahNo ratings yet

- 18.but Thanks Be To GodDocument6 pages18.but Thanks Be To GodBalamaze IsaiahNo ratings yet

- Summit and Source - FR Deogratias SsonkoDocument2 pagesSummit and Source - FR Deogratias SsonkoBalamaze IsaiahNo ratings yet

- Philip Bliss - It Is Well - Arranged by Clyde Davids (Piano)Document3 pagesPhilip Bliss - It Is Well - Arranged by Clyde Davids (Piano)Balamaze IsaiahNo ratings yet

- Sing The Wondrous Love of JesusDocument1 pageSing The Wondrous Love of JesusBalamaze IsaiahNo ratings yet

- Missa RicardoDocument37 pagesMissa RicardoBalamaze IsaiahNo ratings yet

- Mass in Honour of St. Rose. Have Mercy-1Document2 pagesMass in Honour of St. Rose. Have Mercy-1Balamaze IsaiahNo ratings yet

- Olunaku LwO'Mukama 32 Mu Budde Obw'Omwaka CDocument1 pageOlunaku LwO'Mukama 32 Mu Budde Obw'Omwaka CBalamaze IsaiahNo ratings yet

- Olunaku Lw'omukama Olwa 30 Mu Budde Obw'omwaka CDocument1 pageOlunaku Lw'omukama Olwa 30 Mu Budde Obw'omwaka CBalamaze IsaiahNo ratings yet

- Mass in Honour of St. Rose. LAMB-1Document1 pageMass in Honour of St. Rose. LAMB-1Balamaze IsaiahNo ratings yet

- 413 Follow Follow I Will Follow JesusDocument2 pages413 Follow Follow I Will Follow JesusBalamaze IsaiahNo ratings yet

- Preview: Ing of ARYDocument1 pagePreview: Ing of ARYBalamaze IsaiahNo ratings yet

- New Providers List 2022-AugDocument22 pagesNew Providers List 2022-AugBalamaze IsaiahNo ratings yet

- Mass of ST - Josephine (Lamb) ..Document1 pageMass of ST - Josephine (Lamb) ..Balamaze IsaiahNo ratings yet

- 30th Sunday in Ordinary Time Year CDocument1 page30th Sunday in Ordinary Time Year CBalamaze IsaiahNo ratings yet

- Agnus Magnificat-1Document1 pageAgnus Magnificat-1Balamaze IsaiahNo ratings yet

- 24th Sunday in Ordinary Time Year CDocument1 page24th Sunday in Ordinary Time Year CBalamaze IsaiahNo ratings yet

- Responsorial Psalm (Twenty Second Sunday in C)Document2 pagesResponsorial Psalm (Twenty Second Sunday in C)Balamaze IsaiahNo ratings yet

- Olunaku Lw'OMukama 24 Mu Budde Obw'Omwaka CDocument1 pageOlunaku Lw'OMukama 24 Mu Budde Obw'Omwaka CBalamaze IsaiahNo ratings yet

- Kandaya Mass: Have MercyDocument3 pagesKandaya Mass: Have MercyBalamaze IsaiahNo ratings yet

- LORD HAVE MERCY St. AnthonyDocument1 pageLORD HAVE MERCY St. AnthonyBalamaze IsaiahNo ratings yet

- OYINGIRE OMU MWOYO GWANGE by Augustine ZirabaDocument2 pagesOYINGIRE OMU MWOYO GWANGE by Augustine ZirabaBalamaze IsaiahNo ratings yet

- Resume Sistem Pengendalian ManajemenDocument49 pagesResume Sistem Pengendalian ManajemenAldilla Yasmin InasNo ratings yet

- Lower Taxes: Supporting Households, Driving Investment and Creating JobsDocument19 pagesLower Taxes: Supporting Households, Driving Investment and Creating JobsLeeNo ratings yet

- Finals Exam - IaDocument8 pagesFinals Exam - IaJennifer Rasonabe100% (1)

- Sample of New Format of Audit Report IN BANKDocument17 pagesSample of New Format of Audit Report IN BANKAmit Malshe0% (1)

- Profit Pools: Author: Dana Peck Reviewer: Michael CollinsDocument31 pagesProfit Pools: Author: Dana Peck Reviewer: Michael Collinssara0009100% (1)

- Investment Appraisal TechniquesDocument4 pagesInvestment Appraisal TechniquesSarfraz KhalilNo ratings yet

- Topic No. 1 - Statement of Financial Position PDFDocument4 pagesTopic No. 1 - Statement of Financial Position PDFSARAH ANDREA TORRESNo ratings yet

- Financial Accounting Notes 3Document45 pagesFinancial Accounting Notes 3bevinjNo ratings yet

- 03 Financial AnalysisDocument55 pages03 Financial Analysisselcen sarıkayaNo ratings yet

- BurkinaFaso L'OccitaneDocument20 pagesBurkinaFaso L'OccitaneSonam RaghuwanshiNo ratings yet

- Bennington CompanyDocument4 pagesBennington CompanyKhoa VoNo ratings yet

- Business Finance: Financial Statement Preparation, Analysis, and InterpretationDocument7 pagesBusiness Finance: Financial Statement Preparation, Analysis, and InterpretationRosalyn Mauricio VelascoNo ratings yet

- Accounting FOR ManagementDocument38 pagesAccounting FOR ManagementAnonymous 1ClGHbiT0JNo ratings yet

- DBBL Annual Report 2013 PDFDocument408 pagesDBBL Annual Report 2013 PDFRiver SunNo ratings yet

- Report - Solar Power Plant - Financial Modeling PrimerDocument48 pagesReport - Solar Power Plant - Financial Modeling Primeranimeshsaxena83100% (3)

- 1-1-2017 Petty Cash FundDocument4 pages1-1-2017 Petty Cash FundMr. CopernicusNo ratings yet

- Comparative Statement of Profit and LossDocument6 pagesComparative Statement of Profit and LossHimanshi ChopraNo ratings yet

- Isb540 - MusharakahDocument19 pagesIsb540 - MusharakahMahyuddin KhalidNo ratings yet

- 2019 Annual Focus Media CHNDocument118 pages2019 Annual Focus Media CHNHarold PaidNo ratings yet

- MAS Midterm Quiz 2Document4 pagesMAS Midterm Quiz 2Joseph John SarmientoNo ratings yet

- Oil and Gas Valuation ConsiderationDocument34 pagesOil and Gas Valuation ConsiderationBagus Deddy AndriNo ratings yet

- MAS Reviewer - Cost Behavior & CVP AnalysisDocument10 pagesMAS Reviewer - Cost Behavior & CVP AnalysisJohn Carlo Peru100% (1)

- Question No. 1 - C: Rey Ocampo Online Ap Diagnostic ExamDocument6 pagesQuestion No. 1 - C: Rey Ocampo Online Ap Diagnostic ExamBernadette PanicanNo ratings yet

- AFA 4e PPT Chap04Document70 pagesAFA 4e PPT Chap04فهد التويجريNo ratings yet

- Partnership Digest Obillos Vs CIRDocument2 pagesPartnership Digest Obillos Vs CIRJeff Cadiogan Obar100% (9)

- ICDS - 3 Construction ContractsDocument13 pagesICDS - 3 Construction Contractskavita.m.yadavNo ratings yet

- A Sample Digital Advertising Agency Business Plan TemplateDocument29 pagesA Sample Digital Advertising Agency Business Plan TemplateHexaNotesNo ratings yet

- MINI-CASE 3 Intangible Assets AnswerDocument5 pagesMINI-CASE 3 Intangible Assets Answeryu choongNo ratings yet

- Lovelock C - 1983 - Classifying Services To Gain Strategic Marketing Insights - Journal of Marketing - 47 - Pp. 9-20Document13 pagesLovelock C - 1983 - Classifying Services To Gain Strategic Marketing Insights - Journal of Marketing - 47 - Pp. 9-20Băltoiu Son AlisaNo ratings yet

- Environment and MarketDocument39 pagesEnvironment and MarketJoni MurphyNo ratings yet