Professional Documents

Culture Documents

# 36 I Terra V Maker

Uploaded by

Krutarth PatelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

# 36 I Terra V Maker

Uploaded by

Krutarth PatelCopyright:

Available Formats

# 36 | Terra v Maker: War of the

Worlds

Conquering Living Space Ain't the Big Deal, That Comes With Keeping It

Luca Prosperi

8 2

Apr 7

“ We know now that in the early years of the 20th century, this world was being

watched closely by intelligences greater than man's and yet as mortal as his

own. ” - The War of the Worlds , fictional broadcasting by Orson Welles

On Sunday, October 30, 1938, America received news of gas explosions happening on

Mars, followed by those of a strange meteorite landing in New Jersey. Reporters

rushed to the site to find a metal cylinder that unscrewed letting horrific monsters

emerge from its insides. The brave policemen who approached the strange beings

waving a flag of truce were brutally obliterated by an extraterrestrial heat ray. What

happened later is unclear, at least until five great machines waded the Hudson to

reach New York City, pushing thousands to dive like rats into the East River in a

desperate attempt to flee an invaded Manhattan.

When Orson Welles left the Mercury Theatre and the rehearsal of Danton’s Death that

night, what he found in Time Square was an outraged nation on the verge of a world

war, emotionally unprepared to fight a galactic one. Whether the Martian invasion of

Earth was fictional rather than real didn't really matter at the time - it was fear and not

truth to have paralysing effects. Whether the story of the ironic misunderstanding of a

radio broadcasting for a chronicle of the end of the human race is itself fictional rather

than real doesn’t matter today either - it is myth and not truth to retain historical

consequences.

The self-referencing effects happening between story-telling and story-making are

difficult to explore for historians, especially when they accept that the same characters

acting in the play are fully aware of them. We live a chaotic system that keeps

influencing itself, a chaotic system of the second degree at least. It is the East against

the West, the World against the Meta-World, the Church against a Cult, a Tribe against

another. Beliefs run strong in everybody's veins, but keeping the faith flowing isn’t

cheap. Starting the War of the Worlds doesn’t take much, surviving it is a completely

different story.

Hey, 3pool-Ers, Gimme the Loot

On the 1st of April @ezaan posted on Terra’s forum about the Community’s intentions

to partner with Frax and [REDACTED] Cartel in order to boost $UST’s multi-chain

usage. He made clear it wasn't April Fools’. And my other writing plans flew off the

window.

How did they want to do it? Through a newly-deployed Curve pool named 4pool ,

composed of $UST, $FRAX, $USDC, and $USDT. Exactly, no $DAI. The deployment

would be tested on Fantom and Arbitrum chains first, and then finally activated on

mainnet. 4pool would become, per Terra’s intentions, the new benchmark liquidity

pool on Curve, ousting the 3pool ($DAI + $USDC + $USDT) that currently has a TVL on

Ethereum of USD 3.3b. Starting to appreciate the intricacies of the move requires some

level of understanding of the Curve model and of what it entails. We have already

written about the so-called Curve Wars on DR - here so rather than repeating ,

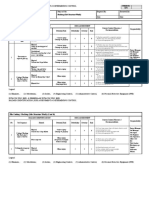

ourselves it is more fun to look at a current Curve snapshot and try to decipher it.

The list above includes all mainnet’s Curve pools above USD 1b TVL. What can we

learn from it?

3pool is THE liquidity building block → with USD3.3b of TVL the 3pool is the

largest stable-based pool on Curve, and it is used as a base block for other

pools like Frax’s, Terra’s, and MIM’s

Pools resemble more parking lots than trading venues → big stable pools

show relatively limited trading activity - e.g. 0.42% for 3pool, 0.37% for Frax’s,

1.90% for $UST

3pool-based pools are heavily $CRV subsidised → 3pool-based pools are

heavily subsidised through $CRV new issuances - yield can be boosted up to c.

10% via $CRV issuance through long-term locks; it isn’t surprising that Frax and

Terra are the largest protocol owners of $CVX, with the power to allocate large

portion of newly issued $CVX to their own gauges

Market yields are telling us something → there seems to be a persistent arb

for stablecoin issuers that play the Curve game - in other words it doesn’t seem

rational for depositors to place their stables in the Curve pools vs. lending them

natively or through crypto money markets

Point (4) is particularly important for the rest of our discussion. Let’s look at the $UST

example. A $UST (Terra’s stable) holder has the option to deposit his holdings on

Anchor and clip c. 19.5% - which seems the most obvious play and in effect has c.

12.4b now sitting in the protocol. $UST represents 50% of the Curve pool, with the rest

being composed by $USDC+$USDT+$DAI that have a blended deposit rate of c. 2.5%

on (e.g.) Aave. It would be therefore rational for a $UST depositor to place holdings in

the pool only if the blended yield is higher than 11.0% - all things equal. The total yield

for the pool isn’t so high and sits at < 10%; in addition i) it is composed mainly of

$CRV-denominated APY, and ii) it is achievable only through a 4-year lock. It doesn’t

make sense. But things look differently if we go one level higher. Through Convex,

(indirect) depositors in the Curve pool could achieve c. 14.6% - the delta is roughly

coming in $CVX form. With no additional sources of revenues existing at Convex level,

the difference between the 14.6% achievable thru Convex and the Curve-native c. 10%

is, by applying Occam’s Razor, just some form of leverage. The discussion is different

for what concerns the difference between c. 10% (Curve all-in yield) and 0.35% - Curve

base yield. To me, it’s a lot of risk substitution plus some market inefficiency. Numbers

bounce around, but hope the diagram below can explain better what mean.

I I

There are a lot of numbers but here’s the summary.

For the investor → Depositing into Convex meta-pool investors diversify out part of

their $LUNA volatility risk in favour of more stable (but less remunerative)

$USDC+$USDT+$DAI, and instead amplify yield by levering Curve’s base yield up

through Curve’s and Covex’s dilutive issuance. Leverage is marked-to-market through

$CRV and $CVX pricing. There is no right or wrong, it is a matter of taste for the

investors.

For $UST issuer → Terra (Anchor) makes money through lending out $UST; Anchor is

the natural parking lot for $UST but it’s very expensive for Terra to maintain; by

diverging part of those flows away from Anchor into Curve’s pool Terra is reducing the

cost of its liabilities. It is a very good move for Terra.

Cold Wars and Warm Questions

Terra isn't the only one aiming at Curve to reduce its cost of capital. Do Kwon

sustained publicly they control 50% of voting power, which would seem consistent

with this $CVX leaderboard that shows Frax as the largest $CVX holder among

,

protocol - with 16.9%, followed by Terra itself - 13.1%, [REDACTED] - 11.3%, and

Olympus - 6.7%. Combined that would give us roughly 48%. If we assume < 100%

voting participation the number would be high enough to drive emissions, but things

are a bit more complex. @CryptoCondom does a different calculation that points to a

maximum 13.8% of voting power for the Terra newly formed cartel. The existence of

tactical bribing suggests indeed that Terra doesn’t own structural voting majority of

the Curve ecosystem: based on Llama Force Frax and Terra paid c. USD 7.8m and c.

USD 5.1m respectively through Votium on bribing fees to allocate themselves the lion

share of gauge weights on the 4th of April voting cycle and starve the 3pool.

Simultaneously, a proposal to create a 2pool USDC-USDT implementation was voted

on Curve, basically aiming at marginalising $DAI from Curve’s liquidity building block.

Reminder: this is not a post about tactical prowess and the complexity of governance

mechanisms in DeFi, nor about tribal politics and founder-flexing. What concerns us

are structural characteristics of complex systems, and the accumulation and release of

forces of diverse nature. Ultimately, it is DR ’s conviction it pays off to keep eyes on the

ball, silence the world around us, and try to answer simple questions. So here are my

questions.

Question 1. Why is Terra’s proposing the 4pool?

Question 2. Why are Frax and [REDACTED] joining in?

Question 3. What could depositors do?

Question 4. What will be the effect on the stablecoins landscape?

Q1 → $UST is the native currency and pillar product of Terra. It is a volatility absorber

for $LUNA holders (more on this here and a core pillar of the whole ecosystem. $UST

)

currently sits comfortably at #4 among stables, behind fully centralised web2.5 $USDT,

$USDC, and $BUSD, and at #1 well ahead of $DAI and $FRAX among the decentralised

coins. We can put aside arguments on how decentralised $UST actually is. Literature on

USD teaches us that there is a disproportionate competitive advantage in being the

global reference currency. Most recently this status has been achieved through military

superiority but Terra doesn’t have it, so it has to pay to obtain it. But bootstrapping a

currency into such role through financial incentivisation is expensive. Of the almost

USD 17b worth of $UST currently in circulation, $UST 12.4b are sitting in Anchor’s

deposit vaults costing the protocol/ ecosystem a hefty 19.5% - and only $UST 0.7b are

in Curve’s dedicated pool. By successfully replacing $DAI’s 1.5b 3pool volume Terra

would save c. 300m / year of passive interest, more than enough to justify bribing

costs, but not enough to solely compensate the depletion in reserves.

Long way to go, but it is a rational direction for Terra. Especially if we as Do believe

that the substitution effect can absorb with time not only $DAI but way more volumes

from the centralised counterparties too. But it is no coincidence that it was $DAI the

target of his marginalisation efforts: the MakerDAO-minted stable is $UST’s #1

competitor among decentralised currency candidates.

Terra cares about sustainability and expansion, and the Curve hack is only point one in

Terra’s Reasonable Strats Part Five They argue it’s about liquidity, but reply it’s about

. I

the cost of liabilities, mainly. Caveat for the chart above: calculations are cash-based

and ignore on the one hand $ANC incentivisation and on the other the opportunity

costs of holding significant amount of money immobilised in the Curve<>Convex

ecosystem. Still, don’t think it would significantly change the picture, assuming

I

investors would continue willingly to play the Curve game and wouldn’t mind shifting

their holdings in favour of $UST. The stickiness of $USDT’s success story tells us

currency holders aren’t picky about governance concerns.

Q2 → Let’s clear the easy one first. It isn’t difficult to explain why the [REDACTED]

Cartel found attractive to create a larger cartel with the most powerful players in the

field. [R] is a meta-governance protocol that intends to attract value to extract even

more value through governance mechanisms that promote concentration - hence,

partnering with large players enhances their impact. If you are a mercenary paid only

following victory it makes sense to partner with the strong side. Frax deserves a more

comprehensive answer that can only be partially covered here - DR will soon dedicate

a deep-dive to Frax. Of the $FRAX c. 2.8b outstanding, 14.5% is not collateralised (i.e.

backed by protocol equity in the form of $FXS) with the rest being collateralised by

whitelisted assets. The Curve AMO represents 75% of the collatearlised portion. In

simple terms, the AMO (Algoritmic Market Operations) is a venue through which Frax

will run open market operations to manage its peg and collateralisation level.

Expanding the Curve-based AMO to the 4pool would mean few things for Frax: (i)

increase the Curve War loot that can be used as collateral with constructive effects on

$FXS (the equity token) price, (ii) insert $UST in the asset pool backing the currency,

(iii) more liquidity / less slippage for pegging, (iv) great marketing. like (iii) and (iv), I I

am not sure how sustainable (i) is, and am very nervous about (ii). To me, $FRAX is a

I

beautifully elegant way to add (a little bit of) algorithmic leverage on top of

overcollateralised or centralised stables, if $UST becomes a large portion of that

backing it would be difficult to control all-in leverage for $FRAX in my opinion.

Q3 → We have argued above that for $UST holders moving funds from Anchor

deposits into subsidised Curve pools is equivalent to a risk shift. In more detail, to me

this means reducing the long exposure on $LUNA in favour of (humongous) leverage

built on top Curve’s base (0.4%) APY, with the benefit of extra TradFi-like

collateralisation embedded in the $USDT and $USDC 4pool component. A good proxy

of the value the market is putting on such levered yield is given by $CVX market cap

movements. Whether this is rational or shortsighted is not for me to say, but looking

at Uniswap v3 expansion in USD stable trading am not sure how sustainable the

I

castle will be, although profitable bribing can go on for a long time looking at Terra’s

incentive to keep the liquidity there on Curve - Uniswap doesn’t have similar bribing

mechanisms. Adding to the mix that a successful $UST shift from Anchor to Curve

assumes absolute indifference of $USDT and especially $USDC between $DAI and

$UST, am not sure how good of a trade this is for investor. Personally have never

I I

been a good market timer, and being leverage extremely time-sensitive this is not a

trade for me.

Q4 → MakerDAO has been Do’s public target for a while, and for the reasons we have

described above. But the minter of $DAI hasn’t reacted to Terra’s moves. It is arguable,

as stated by @jofo_real in his recent brilliant post that $DAI has developed over time

,

valuable (and cheap) alternatives to sustain its trading fungibility through Uniswap v3

and the PSM - Maker’s 1-to-1 zero-slippage between $DAI and $USDC and, in a much

smaller amount, $USDP. While the tight relationship between Maker and centralised

minters such as $USDC (currently c. 4.7b out of c. 15.2b total collateral sitting behind

$DAI is $USDC) has been under scrutiny recently, it is undeniable that the availability of

such liquidity venue will provide significant protection for Maker during the War of the

Worlds. Ultimately, however, the struggle to become the decentralised reserve

currency of DeFi is a first-past-the-post one. Maker and Terra face each other

equipped with divergent competitive advantages: Maker would benefit from a slow-

moving conflict of attrition while Terra might intend to suck the air out of $DAI’s sails

and relegate it into insignificance as soon as possible. Looked through those lens

rhetorics make sense. Interestingly it might ultimately be the old-school corporate

called Circle thorough $USDC, a key ally of both Maker (as part of the PSM) and Terra

(as part of the prospective 4pool) to be the one deciding the struggle. God bless

decentralisation.

You might also like

- Role-Playing Game: A Well-Meaning Hack of Evil Hat's FATE System by Aidan WalshDocument49 pagesRole-Playing Game: A Well-Meaning Hack of Evil Hat's FATE System by Aidan WalshKeon Kobra100% (1)

- World-S Most Instructive Amateur Game BookDocument404 pagesWorld-S Most Instructive Amateur Game BookKrutarth Patel80% (5)

- Alternity - Stardrive - Star Compendium - Systems of The VergeDocument130 pagesAlternity - Stardrive - Star Compendium - Systems of The VergeTed Lucas100% (1)

- SWD6 OptionalRulesResourceDocument179 pagesSWD6 OptionalRulesResourcedalahmahr100% (4)

- CYBORG COMMANDO RPG-Campaign Book-Referees' ManualDocument67 pagesCYBORG COMMANDO RPG-Campaign Book-Referees' ManualTodd Archer100% (1)

- BattleTech - Magazine - Commander Quarterly, Issue 3067 - (WizKids Product)Document54 pagesBattleTech - Magazine - Commander Quarterly, Issue 3067 - (WizKids Product)toddtimlake2336100% (1)

- Imperial PrimerDocument22 pagesImperial Primerteampreston100% (4)

- ITD01Document33 pagesITD01ChristyMayfeld100% (3)

- Babylon 5 RPG (1st Ed.) - EarthForce Campaign BookDocument163 pagesBabylon 5 RPG (1st Ed.) - EarthForce Campaign Bookkurage57100% (9)

- Pile Cutting / Hacking (Sub-Structure Work)Document2 pagesPile Cutting / Hacking (Sub-Structure Work)Rahmat HariNo ratings yet

- Headwind RPGDocument22 pagesHeadwind RPGnelevar100% (2)

- Tar Oldier: TO Ol S TR AD eDocument33 pagesTar Oldier: TO Ol S TR AD eHanseaticLeague1993100% (1)

- The Tech Factory - Issue #13Document38 pagesThe Tech Factory - Issue #13R86% (7)

- Problems in Geometry - ModenovDocument407 pagesProblems in Geometry - ModenovKrutarth PatelNo ratings yet

- Meta Arts-How Deep The Hole?, SOC Drawer, Eat The Rich, Not From ConcentrateDocument15 pagesMeta Arts-How Deep The Hole?, SOC Drawer, Eat The Rich, Not From ConcentrateDeckard666No ratings yet

- 5 Strategies For Managing Generational DifferencesDocument7 pages5 Strategies For Managing Generational DifferencesPragya GuptaNo ratings yet

- Wilderness Exploration OGLDocument4 pagesWilderness Exploration OGLKathy HazlewoodNo ratings yet

- Skyward Steel PDFDocument57 pagesSkyward Steel PDFMeni GeorgopoulouNo ratings yet

- Bot War 2 - Turbo Edition RulebookDocument96 pagesBot War 2 - Turbo Edition RulebookVEX - HAN - 092100% (1)

- Touring The Stars - Bone NormanDocument16 pagesTouring The Stars - Bone NormanSly Mantis0% (1)

- Star Wars - The Essential Atlas Extra - The Knight Errant Gazetteer PDFDocument8 pagesStar Wars - The Essential Atlas Extra - The Knight Errant Gazetteer PDFTimNo ratings yet

- NISM-Series-VIII Equity Derivatives Solved Exam QuestionsDocument21 pagesNISM-Series-VIII Equity Derivatives Solved Exam QuestionsHitisha agrawalNo ratings yet

- Touring The Stars - HerotitusDocument16 pagesTouring The Stars - HerotitusSly Mantis75% (4)

- Touring The Stars - Promised LandDocument16 pagesTouring The Stars - Promised LandSly Mantis50% (2)

- Skyward SteelDocument57 pagesSkyward SteelCimbri100% (1)

- Olympiad Combinatorics PDFDocument255 pagesOlympiad Combinatorics PDFKrutarth Patel100% (5)

- Stellar Reaches #22Document135 pagesStellar Reaches #22Alvin Plummer100% (4)

- Cole Harris IndictmentDocument14 pagesCole Harris IndictmentJennifer Van LaarNo ratings yet

- Business PlanDocument21 pagesBusiness PlanTHARANITARAN100% (1)

- SPA TitlingDocument2 pagesSPA TitlingJoan ChristineNo ratings yet

- Warhammer 40k - Planet Generator V2Document14 pagesWarhammer 40k - Planet Generator V2Raúl Iglesias100% (3)

- Comparative Analysis of Major Fast Food Joints in India Mcdonalds KFC Subway and Burger King-1Document51 pagesComparative Analysis of Major Fast Food Joints in India Mcdonalds KFC Subway and Burger King-1Saksham Kumar89% (19)

- POLARIS RPG - QuickstartDocument24 pagesPOLARIS RPG - Quickstartvitorrossi100% (8)

- E BusinessDocument100 pagesE BusinessMd YounusNo ratings yet

- Analysis of A Global Marketing and Online Business Practices of Maliban Biscuit Manufactories (PVT) LimitedDocument32 pagesAnalysis of A Global Marketing and Online Business Practices of Maliban Biscuit Manufactories (PVT) LimitedYiMi Dilshani100% (1)

- Money, Magic, and How to Dismantle a Financial Bomb: Quantum Economics for the Real WorldFrom EverandMoney, Magic, and How to Dismantle a Financial Bomb: Quantum Economics for the Real WorldNo ratings yet

- POLARIS RPG - Quickstart Guide Adventure PDFDocument24 pagesPOLARIS RPG - Quickstart Guide Adventure PDFJeffrey McKinley100% (1)

- The Curve Wars Rage On - Knower's SubstackDocument15 pagesThe Curve Wars Rage On - Knower's SubstackDiego FernandezNo ratings yet

- Third Expansion Rules - EpicDocument17 pagesThird Expansion Rules - EpicMichaelNo ratings yet

- SN Rules v250Document86 pagesSN Rules v250DougNewNo ratings yet

- Coagulometer DiagramDocument2 pagesCoagulometer Diagramcres zamorNo ratings yet

- Infraestructura Cripto CracksDocument3 pagesInfraestructura Cripto CracksClaudio GraterolNo ratings yet

- Terra IfniDocument2 pagesTerra IfniBen RussellNo ratings yet

- Split Files Firefly Myptecoach 07.29 08.04 RosDocument17 pagesSplit Files Firefly Myptecoach 07.29 08.04 RosranbirNo ratings yet

- Gaze V6Document18 pagesGaze V6burningbrightNo ratings yet

- GTR July 02Document8 pagesGTR July 02jeanyoperNo ratings yet

- Split Files Firefly Myptecoach 07.15 07.21Document16 pagesSplit Files Firefly Myptecoach 07.15 07.21ranbirNo ratings yet

- Fundamentals of Multinational Finance 5th Edition Moffett Test BankDocument26 pagesFundamentals of Multinational Finance 5th Edition Moffett Test BankWilliamHuntbxmr100% (54)

- PAT Sample Paper - 2Document11 pagesPAT Sample Paper - 2Vrijendra Pal0% (1)

- Essay Fundamental RightsDocument7 pagesEssay Fundamental Rightsezhj1fd2100% (2)

- Codex Rebellion Third DraftDocument13 pagesCodex Rebellion Third DraftEnigma179No ratings yet

- Laborate BanalityDocument5 pagesLaborate BanalityJuan Miguel Ala TolentinoNo ratings yet

- Sanders Why The Numbers Should Sometimes CountDocument12 pagesSanders Why The Numbers Should Sometimes CountFederico AbalNo ratings yet

- When God Pinched My Toe Part-191Document5 pagesWhen God Pinched My Toe Part-191Eddie WinklerNo ratings yet

- Full Download Multinational Business Finance 14th Edition Eiteman Test Bank PDF Full ChapterDocument36 pagesFull Download Multinational Business Finance 14th Edition Eiteman Test Bank PDF Full Chaptertightlybeak.xwf5100% (20)

- Horrors of The DeepDocument10 pagesHorrors of The DeepPiotr Paweł SzutoczkinNo ratings yet

- Using This Adventure: The-Cheap-Part-3-Fate-Zones-With-Index-CardsDocument4 pagesUsing This Adventure: The-Cheap-Part-3-Fate-Zones-With-Index-CardsSam DrostNo ratings yet

- DA 3136 LinkNetDocument131 pagesDA 3136 LinkNetJoe BlogsNo ratings yet

- Scenario 41Document7 pagesScenario 41Dave DileggeNo ratings yet

- Will The Rest of The World Live Like America?: Jesse H. AusubelDocument30 pagesWill The Rest of The World Live Like America?: Jesse H. AusubelColleen MuelkerNo ratings yet

- Now That Terra Luna Is DeadDocument9 pagesNow That Terra Luna Is DeadCorina VirlanNo ratings yet

- Year Make Model VINDocument8 pagesYear Make Model VINKrutarth PatelNo ratings yet

- Covid-19: Researcher Blows The Whistle On Data Integrity Issues in Pfizer's Vaccine TrialDocument3 pagesCovid-19: Researcher Blows The Whistle On Data Integrity Issues in Pfizer's Vaccine TrialKrutarth PatelNo ratings yet

- 10 PrinciplesDocument1 page10 PrinciplesKrutarth PatelNo ratings yet

- Post-Quantum' CryptographyDocument1 pagePost-Quantum' CryptographyKrutarth PatelNo ratings yet

- Association of Social Distancing and Face Mask Use With Risk of COVID-19Document10 pagesAssociation of Social Distancing and Face Mask Use With Risk of COVID-19Krutarth PatelNo ratings yet

- Association of Social Distancing and Face Mask Use With Risk of COVID-19Document10 pagesAssociation of Social Distancing and Face Mask Use With Risk of COVID-19Krutarth PatelNo ratings yet

- Sociology ProblemsDocument11 pagesSociology ProblemsKrutarth PatelNo ratings yet

- (Tutorial) A Way To Competitive Programming - From 1900 To 2200Document6 pages(Tutorial) A Way To Competitive Programming - From 1900 To 2200Krutarth PatelNo ratings yet

- A New Method For Sampling and Detection of Exhaled Respiratory Virus AerosolsDocument3 pagesA New Method For Sampling and Detection of Exhaled Respiratory Virus AerosolsKrutarth PatelNo ratings yet

- Announcement of Winners 2017Document17 pagesAnnouncement of Winners 2017Krutarth PatelNo ratings yet

- (Tutorial) Math Note - Möbius Inversion - CodeforcesDocument6 pages(Tutorial) Math Note - Möbius Inversion - CodeforcesKrutarth PatelNo ratings yet

- A Competitive Programming Approach To A University Introductory Algorithms CourseDocument6 pagesA Competitive Programming Approach To A University Introductory Algorithms CourseKrutarth PatelNo ratings yet

- Algebra Problem On Telescoping Series - Sum - Find The Floor - Sanjeet Raria - BrilliantDocument5 pagesAlgebra Problem On Telescoping Series - Sum - Find The Floor - Sanjeet Raria - BrilliantKrutarth PatelNo ratings yet

- GR Pharma Limited - Ghana - MEDOPHARM-DISTRIBUTION AGT-V3 - 22-04-2020Document17 pagesGR Pharma Limited - Ghana - MEDOPHARM-DISTRIBUTION AGT-V3 - 22-04-2020shoban008No ratings yet

- Qompete 2024 - Participant's HandbooqDocument16 pagesQompete 2024 - Participant's HandbooqJAMES CRISTOFER TARROZANo ratings yet

- FINAL MODULE Mia PDFDocument31 pagesFINAL MODULE Mia PDFmEOW SNo ratings yet

- Paper Analysis of NTA UGC - NET COMMERCE December 2019 PDFDocument7 pagesPaper Analysis of NTA UGC - NET COMMERCE December 2019 PDFVikram DograNo ratings yet

- Chapter 8 Bank ReconciliationDocument18 pagesChapter 8 Bank ReconciliationAimerose ObedencioNo ratings yet

- Brand ArchitectureDocument5 pagesBrand ArchitectureannetteNo ratings yet

- Priority MLQ RR Fairshare Cpu SchedulingDocument10 pagesPriority MLQ RR Fairshare Cpu SchedulingClay JensenNo ratings yet

- Financial Accounting 1: Accounting (Information For Decision Making)Document4 pagesFinancial Accounting 1: Accounting (Information For Decision Making)system020No ratings yet

- State v. Joint Development Authority, Et Al. Final Order On Bond ValidationDocument34 pagesState v. Joint Development Authority, Et Al. Final Order On Bond ValidationZachary HansenNo ratings yet

- Camlin Fine SciencesDocument21 pagesCamlin Fine SciencesSreenadhVNo ratings yet

- Footwear Design in Fusion 360Document17 pagesFootwear Design in Fusion 360TonyNo ratings yet

- Management and Marketing Principles Final ExamDocument4 pagesManagement and Marketing Principles Final ExamMhild GandawaliNo ratings yet

- Absorptive Capacity and Green Innovation Adoption in SMEs: The Mediating Effects of Sustainable Organisational CapabilitiesDocument11 pagesAbsorptive Capacity and Green Innovation Adoption in SMEs: The Mediating Effects of Sustainable Organisational CapabilitiesAfzaal AliNo ratings yet

- Group 3 - Cash and Marketable SecuritiesDocument71 pagesGroup 3 - Cash and Marketable SecuritiesNaia SNo ratings yet

- Chapter Five: Activity-Based Costing and Customer Profitability AnalysisDocument48 pagesChapter Five: Activity-Based Costing and Customer Profitability AnalysisSupergiant EternalsNo ratings yet

- Overview of Apparel Manufacturing Industry in IndiaDocument28 pagesOverview of Apparel Manufacturing Industry in Indiashreay12345No ratings yet

- D&D Packaging Machinery.: Tax InvoiceDocument1 pageD&D Packaging Machinery.: Tax InvoiceBhavesh MiraniNo ratings yet

- OBCDCH046Document75 pagesOBCDCH046jossieNo ratings yet

- Finfsan Group Report (FINALIZED)Document7 pagesFinfsan Group Report (FINALIZED)Sittie Ainna Acmed UnteNo ratings yet

- Pillai College of Arts, Commerce and Science, New Panvel: (Autonomous)Document9 pagesPillai College of Arts, Commerce and Science, New Panvel: (Autonomous)DivyanshiNo ratings yet

- Diagnostic Exam Accounting 1.1 AKDocument14 pagesDiagnostic Exam Accounting 1.1 AKRobert CastilloNo ratings yet