Professional Documents

Culture Documents

Amalgamation - 1 Page Notes 1

Amalgamation - 1 Page Notes 1

Uploaded by

Aakash VishwakarmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Amalgamation - 1 Page Notes 1

Amalgamation - 1 Page Notes 1

Uploaded by

Aakash VishwakarmaCopyright:

Available Formats

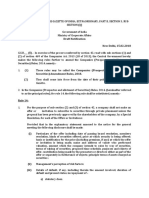

Clarification under Section 232(6) of the Companies Act, 2013

A clarification has been issued by the MCA on 21st August, 2019 regarding Section 232(6).

According to the Clarification: -

Topic Detailed Explanation

Appointed Date The provision of Section 232(6) of the Act enables the Companies in question to choose

and state in the scheme an 'Appointed Date'.

This date -

(1) may be a Specific Calendar Date OR

(2) may be tied to the Occurrence of an Event

such as -

(a) grant of license by a competent authority OR

(b) fulfilment of any preconditions agreed upon by the parties, OR

(c) meeting any other requirement as agreed upon between the parties, etc.,

which are relevant to the scheme.

.

Ind-AS 103 The 'Appointed Date' identified under the scheme shall also be deemed to be the -

(1) 'Acquisition Date' and

(2) ‘Date of Transfer of Control’

for the purpose of conforming to AS (including Ind-AS 103 Business Combinations).

Specific Where the 'Appointed Date' is chosen as a Specific Calendar Date, it MAY precede the

Calendar Date date of filing of the application for scheme of Merger/Amalgamation in NCLT.

may precede

Note:

Application

If the 'Appointed Date' is significantly ante-dated beyond a year from the date of

Date before

filing, the justification for the same would have to be specifically brought out in the

NCLT

scheme and it should not be against public interest.

.

Indicate the (1) The scheme may identify the 'Appointed Date' based on -

Appointed Date (a) the occurrence of a trigger event which is key to the proposed scheme and

on the Scheme (b) agreed upon by the parties to the scheme.

(2) This event would have to be indicated in the scheme itself upon occurrence of

which the scheme would become effective.

Note:

In case of such event-based date being a date subsequent to the date of filing the

order with the ROC under Section 232(5), the Company shall file an intimation of the

same with the ROC within 30 days of such scheme coming into force.

.

You might also like

- List of Potential Law Firm (Updated)Document19 pagesList of Potential Law Firm (Updated)ramadana vikramNo ratings yet

- GIZ Template VN Solar Lease and Maintenance Contract en FinalDocument65 pagesGIZ Template VN Solar Lease and Maintenance Contract en FinalPhạm Duy ĐạtNo ratings yet

- BSBPMG635 Implement Project Governance: Task 2 - Portfolio of EvidenceDocument57 pagesBSBPMG635 Implement Project Governance: Task 2 - Portfolio of EvidenceAroosa Mirza0% (1)

- GCC General Terms and Conditions of Work OrderDocument25 pagesGCC General Terms and Conditions of Work OrderSoniyaSinghNo ratings yet

- GeneralCircular 21082019Document3 pagesGeneralCircular 21082019Life Hacks Stunt PerfectNo ratings yet

- Article - Tax Guru - Section 232 (6) - The Saga of Appointed Date'Document3 pagesArticle - Tax Guru - Section 232 (6) - The Saga of Appointed Date'keshavsadaniNo ratings yet

- 240216RRF00 - Draft Potential ArticleDocument5 pages240216RRF00 - Draft Potential ArticleNylzarreNo ratings yet

- AssignmentDocument10 pagesAssignmentYougoige LowNo ratings yet

- 2 COTMA Overview Amanda Koh 2Document22 pages2 COTMA Overview Amanda Koh 2Angie Siok Ting LimNo ratings yet

- Draft Combinations RegulationsDocument43 pagesDraft Combinations RegulationsSoujanya BoxyNo ratings yet

- BCA Circular 28 Mar 22Document16 pagesBCA Circular 28 Mar 22ssiknguongNo ratings yet

- Low Value Contract - General Conditions 227E7H v1 1Document14 pagesLow Value Contract - General Conditions 227E7H v1 1ale tof4eNo ratings yet

- 2 დანართიDocument31 pages2 დანართიr_mukuyuNo ratings yet

- Module Title & CodeDocument13 pagesModule Title & CodeEmaanNo ratings yet

- Entity Name: Zodiac Power Chittagong Limited Financial Statement Date: 30 June 2021Document12 pagesEntity Name: Zodiac Power Chittagong Limited Financial Statement Date: 30 June 2021Shohag RaihanNo ratings yet

- ITT-05.02 - Special ConditionsDocument9 pagesITT-05.02 - Special ConditionszahirNo ratings yet

- Business Facilitation Act 2022Document27 pagesBusiness Facilitation Act 2022LIFE WITH TORINo ratings yet

- Ias 37 Onerous ContractDocument8 pagesIas 37 Onerous ContractSchwi DolaNo ratings yet

- EPC Contract DeliverablesDocument3 pagesEPC Contract DeliverablesAshish VermaNo ratings yet

- Vestrel Contractor Agreement M TrexeiraDocument4 pagesVestrel Contractor Agreement M TrexeiraMatheus Fabrício TeixeiraNo ratings yet

- Annexure - 1 Part D Subcontract Agreement (Sample Copy)Document6 pagesAnnexure - 1 Part D Subcontract Agreement (Sample Copy)Ahmed BoraeyNo ratings yet

- Draft JV Guidelines (For 23 Aug 2019 Public Consultation)Document48 pagesDraft JV Guidelines (For 23 Aug 2019 Public Consultation)paomillan0423No ratings yet

- 8 Section 8 SCCDocument29 pages8 Section 8 SCCTRANSIT STRNo ratings yet

- Mergers & Acquisitions ProcedureDocument29 pagesMergers & Acquisitions ProcedurePreety Borah MarakNo ratings yet

- Voith Mudita AgreementDocument7 pagesVoith Mudita AgreementOpen AINo ratings yet

- Corrigendum 3Document32 pagesCorrigendum 3Nadeem QureshiNo ratings yet

- Co Law SupplementDocument20 pagesCo Law SupplementRajiv DsoujaNo ratings yet

- Signing of Final Agreement - Trust Green ProjectDocument4 pagesSigning of Final Agreement - Trust Green Projectsonhcqtgmail.comNo ratings yet

- Documents - Pub - Points Noted Between Fidic 87 and Fidic 99 PerformanceDocument71 pagesDocuments - Pub - Points Noted Between Fidic 87 and Fidic 99 PerformanceDay.No ratings yet

- 2024MC - SEC MC No. 6 S. of 2024 Updated Fines and Penalties On The Late and Non Submission of Audited Financial Statements AFS General Information Sheet GIS Non Compliance With SEC MC 28Document14 pages2024MC - SEC MC No. 6 S. of 2024 Updated Fines and Penalties On The Late and Non Submission of Audited Financial Statements AFS General Information Sheet GIS Non Compliance With SEC MC 28Bea AlonzoNo ratings yet

- Research On Preparing Eot Application, Analyzing and Certification by Ar Ridha RazakDocument40 pagesResearch On Preparing Eot Application, Analyzing and Certification by Ar Ridha RazakRidha Razak100% (3)

- Of Covid 19 Pandemic On The Contractual Obligations in India PDFDocument3 pagesOf Covid 19 Pandemic On The Contractual Obligations in India PDFLaiba FatimaNo ratings yet

- DBC (Equipo Medico 2)Document67 pagesDBC (Equipo Medico 2)Jean HidalgoNo ratings yet

- Amendment Notes For Elective Law - Nov 20Document20 pagesAmendment Notes For Elective Law - Nov 20Kapil MeenaNo ratings yet

- StandardSECI-WPDPPA Tranche-XI1200MWWind FinaluploadDocument77 pagesStandardSECI-WPDPPA Tranche-XI1200MWWind FinaluploadbhargavNo ratings yet

- Legal Procedure in The Case of A MergerDocument5 pagesLegal Procedure in The Case of A MergerShashwat JainNo ratings yet

- Sub Contract AgreementDocument8 pagesSub Contract AgreementLalita AvhadNo ratings yet

- Rules Relating To Compromises, Arrangements, Amalgamations and Capital Reduction NotifiedDocument8 pagesRules Relating To Compromises, Arrangements, Amalgamations and Capital Reduction Notifiedadarsh kumarNo ratings yet

- Section Iv - General Conditions of The ContractDocument3 pagesSection Iv - General Conditions of The ContractGreater MchinesNo ratings yet

- Onerous Contracts-Cost of Fulfilling A Contract Amendments To Ias 37Document6 pagesOnerous Contracts-Cost of Fulfilling A Contract Amendments To Ias 37Suzy BaeNo ratings yet

- Pre-Need CodeDocument20 pagesPre-Need CodeJoanNo ratings yet

- United States Securities and Exchange Commission Washington, D.C. 20549 Form 1-U Current Report Pursuant To Regulation ADocument8 pagesUnited States Securities and Exchange Commission Washington, D.C. 20549 Form 1-U Current Report Pursuant To Regulation AAnthony ANTONIO TONY LABRON ADAMSNo ratings yet

- 340275-2022-Clarifying Issues Relative To Revenue20221114-12-R8lqtsDocument4 pages340275-2022-Clarifying Issues Relative To Revenue20221114-12-R8lqtsRen Mar CruzNo ratings yet

- FanDuel/State of Georgia AgreementDocument8 pagesFanDuel/State of Georgia AgreementJonathan RaymondNo ratings yet

- Section 53 of IBCDocument2 pagesSection 53 of IBCUmang ShirodariyaNo ratings yet

- Department of The Air Force XXX AfbDocument6 pagesDepartment of The Air Force XXX AfbJao Austin BondocNo ratings yet

- Lalit Kumar Jain vs. Union of India & Ors. (Transferred Case (Civil) No. 245 of 2020 and Other Writ Petitions)Document4 pagesLalit Kumar Jain vs. Union of India & Ors. (Transferred Case (Civil) No. 245 of 2020 and Other Writ Petitions)Arihant RoyNo ratings yet

- MTP 3 15 Answers 1680935509Document8 pagesMTP 3 15 Answers 1680935509Umar MalikNo ratings yet

- Claims Management Final - IDocument8 pagesClaims Management Final - INuwantha UduwageNo ratings yet

- Contractor's Guide To Managing Impact of COVID-19 PDFDocument11 pagesContractor's Guide To Managing Impact of COVID-19 PDFSaNo ratings yet

- DraftCompaniesProspectusSecuritiesRules2018 15022018 PDFDocument10 pagesDraftCompaniesProspectusSecuritiesRules2018 15022018 PDFKaran kashyapNo ratings yet

- Case For Opinion - Concessional Import Duty - 26.07.2022Document4 pagesCase For Opinion - Concessional Import Duty - 26.07.2022Vaibhav SachdevaNo ratings yet

- HRSA-UHG Letter Contract For Provider Relief FundDocument59 pagesHRSA-UHG Letter Contract For Provider Relief FundRachel CohrsNo ratings yet

- NPH,+ERC+Case+No +2014-076+RCDocument23 pagesNPH,+ERC+Case+No +2014-076+RCsinnyen.hengNo ratings yet

- Amalgamation & MergerDocument7 pagesAmalgamation & MergerMukesh MadanNo ratings yet

- Tender ConditionDocument14 pagesTender Conditionsiraj sNo ratings yet

- COVID-19 Singapore & Hong Kong-Projects & Construction UpdateDocument10 pagesCOVID-19 Singapore & Hong Kong-Projects & Construction Updatecuong voNo ratings yet

- Leaflet - SOP ProvisionsDocument2 pagesLeaflet - SOP ProvisionsWan Ho MakNo ratings yet

- Forms Under Companies Act, 1956Document8 pagesForms Under Companies Act, 1956Chandrashekar ShekarNo ratings yet

- D Tender FormDocument19 pagesD Tender Formrahul pardeshiNo ratings yet

- Nzs Condition of Contract 3910 2013Document59 pagesNzs Condition of Contract 3910 2013susithniro0% (1)

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- Form DGT-New (Per25 THN 2018)Document12 pagesForm DGT-New (Per25 THN 2018)SellyNo ratings yet

- At.3205-Preliminary Engagement ActivitiesDocument5 pagesAt.3205-Preliminary Engagement ActivitiesDenny June CraususNo ratings yet

- E ManufacturingDocument13 pagesE ManufacturingIkramNo ratings yet

- FA Program BrochureDocument25 pagesFA Program BrochureThandolwenkosi NyoniNo ratings yet

- SAP OverviewDocument60 pagesSAP OverviewPallaviNo ratings yet

- Ax2012 Enus Fa 04Document60 pagesAx2012 Enus Fa 04asifNo ratings yet

- PAYROLLDocument1 pagePAYROLLMarianne GarcinesNo ratings yet

- Brosur Guerbet - OptiOneDocument2 pagesBrosur Guerbet - OptiOnecicik wijayantiNo ratings yet

- UCSP Module 7Document7 pagesUCSP Module 7jonalyn obinaNo ratings yet

- Types of Companies PDFDocument8 pagesTypes of Companies PDFHadiBies100% (3)

- InvoiceDocument1 pageInvoiceciocbromheadNo ratings yet

- Trading JourneyDocument19 pagesTrading Journeysap.dosapatiNo ratings yet

- Overview of Vietnam Tax SystemDocument13 pagesOverview of Vietnam Tax SystemNhung HồngNo ratings yet

- Valion CampusHireDocument15 pagesValion CampusHireRicha SNo ratings yet

- Course Structure: BBA Logistics and Supply Chain ManagementDocument2 pagesCourse Structure: BBA Logistics and Supply Chain ManagementsanzitNo ratings yet

- Right Against ExploitationDocument11 pagesRight Against ExploitationBhawnaNo ratings yet

- AlbaniaDocument13 pagesAlbaniakavyaNo ratings yet

- Differences Between GATT and WTODocument1 pageDifferences Between GATT and WTOYashraj AroraNo ratings yet

- Staffing Organizations 8th Edition Heneman Solutions ManualDocument8 pagesStaffing Organizations 8th Edition Heneman Solutions Manualngocalmai0236h100% (24)

- KPMG Report Exec SummaryDocument19 pagesKPMG Report Exec SummaryNawin KumarNo ratings yet

- IRRBA ManualDocument156 pagesIRRBA Manualfigaleeso123No ratings yet

- PARTNERSHIPDocument153 pagesPARTNERSHIPJoen SinamagNo ratings yet

- Review Strategies and Tactical Approaches Applied by Organizations To Demonstrate How Business Objectives Can Be Achieved SuccessfullyDocument3 pagesReview Strategies and Tactical Approaches Applied by Organizations To Demonstrate How Business Objectives Can Be Achieved Successfullymajd qatawnehNo ratings yet

- Editorial Business Research in The VUCA World (Volatility, Uncertainty, Complexity and Ambiguity)Document12 pagesEditorial Business Research in The VUCA World (Volatility, Uncertainty, Complexity and Ambiguity)Padmini PoojaNo ratings yet

- Entries GuidelineDocument27 pagesEntries GuidelineAFOLABI100% (2)

- Offer Letter VistaraDocument2 pagesOffer Letter Vistara11913474sakshiNo ratings yet

- United CMC Textile Workers Union v. BLRDocument6 pagesUnited CMC Textile Workers Union v. BLRSamuel ValladoresNo ratings yet

- Smart Parking SystemDocument8 pagesSmart Parking SystemTanay BurnwalNo ratings yet