Professional Documents

Culture Documents

Scs 3

Scs 3

Uploaded by

LokiOriginal Title

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document• Instructions

• Objectives

• Study Tips

• Overview

• Accounting Applications

• Class Interaction and Discussion

• Optional Small Group Extension Activity

• Optional Internet Exploration and Research Activity

• Summary Questions

Instructions:

1. Print and read the following case study.

2. On your own, complete the Accounting Application questions.

3. As a class, complete the Class Interaction and Discussion questions.

4. Optional: Complete the Small Group Extension Activity and Internet

Exploration and Research Activity.

5. Complete the Summary Questions.

Objectives:

After completing the following case study, you will be able to:

Complete a work sheet and financial statements for a service business owned by a

sole proprietor

Explain why businesses prepare financial statements

Discuss why someone trying to choose a career would go to a career consultant

Research a professional organization on the Internet

Study Tips:

Complete this case study after Chapter 9, Glencoe Accounting, First-Year Course.

Approximate time to complete: 11/2 hours.

Copyright © Glencoe/McGraw-Hill. All rights reserved. 1

Overview:

Unhappy with her job as a telecommunications consultant, Cathy Luce started a new

business called Magical Meals. For $300 Ms. Luce plans customized menus based on her

clients’ needs. She creates vegetarian meals, special diets for those with health problems,

or menus for families with little time for cooking. She sets aside a day for each client in

which she packs up her red Alpha Romeo with pots and utensils, shops for food, and

cooks 20 entrees in her client’s home. Then she labels and either refrigerates or freezes

the entrees and takes the dirty pans home with her. Cathy requires that payment be made

on the day services are rendered.

Before changing careers, Ms. Luce hired a career consultant. Together they decided that a

career in cooking looked viable. First she considered being a restaurant chef. Then,

through the Internet, she found the U.S. Personal Chef Association. “I called them that

day. I knew without a doubt that that was what I am supposed to do,” Ms. Luce says.

Ms. Luce took a course from the U.S. Small Business Administration on how to start a

business, paid $2,000 in up-front costs, and determined the name for her business. By

cooking in her clients’ homes, she avoided purchasing expensive equipment, such as

extra sinks, to meet state requirements for commercial kitchens.

Accounting Applications:

Instructions: Now that you have reviewed the case study above, answer the following

questions on your own.

Prepare the appropriate end-of-month reports for Magical Meals for the month ending

November 30 this year using the following account names and balances. (Please note:

The following account names and balances were created for this case study. Only the

name of the business is real.)

Cash in Bank $3,750.00

Computer Equipment 4,897.00

Cooking Equipment 1,281.00

Accts. Pay. —The Computer Store 1,050.00

Accts. Pay. —The Green Grocers 124.00

Cathy Luce, Capital 6,748.00

Cathy Luce, Withdrawals 3,000.00

Fees 6,500.00

Advertising Expense 75.00

Food Expense 1,244.00

Utilities Expense 175.00

Copyright © Glencoe/McGraw-Hill. All rights reserved. 2

Using blank accounting stationery, complete the following for Magical Meals. (Select

and print the accounting forms from the Accounting Forms menu, or your teacher will

provide the forms to you.)

1. A work sheet

Copyright © Glencoe/McGraw-Hill. All rights reserved. 3

2. An income statement

Copyright © Glencoe/McGraw-Hill. All rights reserved. 4

3. A statement of changes in owner’s equity. Beginning capital for November 1 was

$6,748.00. There were no additional investments made in November.

Copyright © Glencoe/McGraw-Hill. All rights reserved. 5

4. A balance sheet

Class Interaction and Discussion:

Instructions: Read the following questions. As a class, discuss your responses.

1. Discuss why Magical Meals has no accounts receivable.

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

2. Discuss how Ms. Luce might use a computer in her business.

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

Copyright © Glencoe/McGraw-Hill. All rights reserved. 6

Optional Small Group Extension Activity:

Instructions: Break into pairs and complete the following activity.

Role-play a consultation with a career consultant. Write down the

questions a consultant might ask someone who is trying to choose a

career. Discuss the possible benefits of using a career consultant.

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

Optional Internet Exploration and Research Activity:

Instructions: Use your favorite search engine to research the following activity.

Locate the home page for the U.S. Personal Chef Association. What is a

Personal Chef Certificate? What is required to obtain one?

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

Copyright © Glencoe/McGraw-Hill. All rights reserved. 7

Summary Questions:

1. What are financial statements? Where does the preparation of financial statements

fall in the accounting cycle?

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

2. When does a net loss occur?

__________________________________________________________________

__________________________________________________________________

3. What information does a balance sheet report about a business?

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

Copyright © Glencoe/McGraw-Hill. All rights reserved. 8

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Unmatched Transactions and Balances: Restated Fiscal Year Fiscal Year 2019 2018Document1 pageUnmatched Transactions and Balances: Restated Fiscal Year Fiscal Year 2019 2018LokiNo ratings yet

- Language Learning With Free PodcastsDocument3 pagesLanguage Learning With Free PodcastsLokiNo ratings yet

- Food - The GuardianDocument7 pagesFood - The GuardianLoki100% (1)

- Largest Income Tax Expenditures As of September 30, 2019Document2 pagesLargest Income Tax Expenditures As of September 30, 2019LokiNo ratings yet

- 2019 Country Reports On Human Rights Practices - United States Department of StateDocument10 pages2019 Country Reports On Human Rights Practices - United States Department of StateLokiNo ratings yet

- Tax Assessments: Required Supplementary Information (Unaudited) 208Document1 pageTax Assessments: Required Supplementary Information (Unaudited) 208LokiNo ratings yet

- Notes To The Financial Statements27Document1 pageNotes To The Financial Statements27LokiNo ratings yet

- Culture - The GuardianDocument8 pagesCulture - The GuardianLokiNo ratings yet

- Notes To The Financial Statements26 PDFDocument1 pageNotes To The Financial Statements26 PDFLokiNo ratings yet

- Note 22. Social Insurance: 137 Notes To The Financial StatementsDocument18 pagesNote 22. Social Insurance: 137 Notes To The Financial StatementsLokiNo ratings yet

- Tax Gap: Corporate Income Tax Liability For Tax Year 2016Document1 pageTax Gap: Corporate Income Tax Liability For Tax Year 2016LokiNo ratings yet

- United States Government Other Information (Unaudited) For The Years Ended September 30, 2019, and 2018Document2 pagesUnited States Government Other Information (Unaudited) For The Years Ended September 30, 2019, and 2018LokiNo ratings yet

- Sustainability of Fiscal PolicyDocument11 pagesSustainability of Fiscal PolicyLokiNo ratings yet

- Deferred Maintenance and RepairsDocument1 pageDeferred Maintenance and RepairsLokiNo ratings yet

- Social Insurance: Social Security and MedicareDocument26 pagesSocial Insurance: Social Security and MedicareLokiNo ratings yet

- Note 24. Stewardship Land and Heritage Assets: 161 Notes To The Financial StatementsDocument1 pageNote 24. Stewardship Land and Heritage Assets: 161 Notes To The Financial StatementsLokiNo ratings yet

- Note 23. Long-Term Fiscal ProjectionsDocument6 pagesNote 23. Long-Term Fiscal ProjectionsLokiNo ratings yet

- Notes To The Financial Statements20Document6 pagesNotes To The Financial Statements20LokiNo ratings yet

- Note 21. Fiduciary Activities: Thrift Savings PlanDocument2 pagesNote 21. Fiduciary Activities: Thrift Savings PlanLokiNo ratings yet

- Note 25. Disclosure Entities and Related PartiesDocument5 pagesNote 25. Disclosure Entities and Related PartiesLokiNo ratings yet

- Note 17. Collections and Refunds of Federal RevenueDocument3 pagesNote 17. Collections and Refunds of Federal RevenueLokiNo ratings yet

- Note 19. Commitments: Long-Term Operating Leases As of September 30, 2019, and 2018Document3 pagesNote 19. Commitments: Long-Term Operating Leases As of September 30, 2019, and 2018LokiNo ratings yet

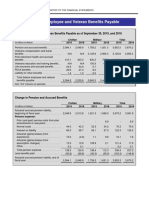

- Note 12. Federal Employee and Veteran Benefits PayableDocument10 pagesNote 12. Federal Employee and Veteran Benefits PayableLokiNo ratings yet

- Note 15. Insurance and Guarantee Program LiabilitiesDocument2 pagesNote 15. Insurance and Guarantee Program LiabilitiesLokiNo ratings yet

- Notes To The Financial Statements18Document7 pagesNotes To The Financial Statements18LokiNo ratings yet

- Notes To The Financial Statements14Document1 pageNotes To The Financial Statements14LokiNo ratings yet

- Notes To The Financial Statements16Document2 pagesNotes To The Financial Statements16LokiNo ratings yet

- Note 13. Environmental and Disposal LiabilitiesDocument2 pagesNote 13. Environmental and Disposal LiabilitiesLokiNo ratings yet

- Note 11. Federal Debt Securities Held by The Public and Accrued InterestDocument4 pagesNote 11. Federal Debt Securities Held by The Public and Accrued InterestLokiNo ratings yet

- Notes To The Financial Statements9Document1 pageNotes To The Financial Statements9LokiNo ratings yet