Professional Documents

Culture Documents

Payroll

Uploaded by

Mustafa K0 ratings0% found this document useful (0 votes)

0 views1 pageThis document contains payroll information for 4 employees for the period ending March 23, 2021. It lists each employee's gross pay, deductions for EI premiums, income taxes, medical insurance, United Way contributions, and other deductions. It also shows the total deductions and net pay for each employee. The bottom section summarizes the total gross pay and deductions. It then outlines the accounting entries to record salary expenses, payroll liabilities, and payment to the Receiver General for remitting payroll taxes and deductions.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains payroll information for 4 employees for the period ending March 23, 2021. It lists each employee's gross pay, deductions for EI premiums, income taxes, medical insurance, United Way contributions, and other deductions. It also shows the total deductions and net pay for each employee. The bottom section summarizes the total gross pay and deductions. It then outlines the accounting entries to record salary expenses, payroll liabilities, and payment to the Receiver General for remitting payroll taxes and deductions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

0 views1 pagePayroll

Uploaded by

Mustafa KThis document contains payroll information for 4 employees for the period ending March 23, 2021. It lists each employee's gross pay, deductions for EI premiums, income taxes, medical insurance, United Way contributions, and other deductions. It also shows the total deductions and net pay for each employee. The bottom section summarizes the total gross pay and deductions. It then outlines the accounting entries to record salary expenses, payroll liabilities, and payment to the Receiver General for remitting payroll taxes and deductions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

4/16/2023 Mustafa Khwaja

Entry: April 5th, 2023

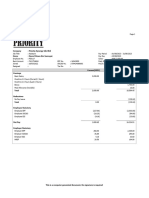

Deductions Pay Distribution

EI Income Medical United Total Office Guide

Employee Gross Pay CPP Net Pay

Premiums Taxes Ins. Way Deductions Salaries Salaries

Wynn, L. $1,200.00 $19.56 $246.21 $65.00 $67.40 $40.00 $438.17 $761.83 $1,200.00

Short, M. $950.00 $15.49 $166.12 $65.00 $52.52 $100.00 $399.13 $550.87 $950.00

Pearl, P. $1,150.00 $18.75 $228.52 $65.00 $64.42 $- $376.69 $773.31 $1,150.00

Quincy, B. $875.00 $14.26 $145.06 $65.00 $48.06 $50.00 $322.38 $552.62 $875.00

Totals $4,175.00 $68.06 $785.91 $260.00 $232.40 $190.00 $1,536.37 $2,638.63 $950.00 $3,225.00

Period Ending March 23, 2021

April 7 Record Employee Payroll Liabilities

March 23 Salary Expense 65,950.00

Employee’s EI Payable 1,055.60

Income Tax Payable 16,957.20

Employee’s CPP Payable 3,403.40

Medical Insurance Payable 1,150.00

United Way Payable 1,319.00

Salaries Payable 42064.80

April 8 Record Employer Payroll Liabilities

March 23 EI Expense 1477.84

CPP Expense 3403.40

EI Payable 1477.84

CPP Payable 3403.40

April 9 Record Payment to Receiver General

April 15 EI Payable 1477.84

CPP Payable 3403.40

Employee’s EI Payable 1055.60

Employee’s CPP Payable 3403.40

Income Tax Payable 16,957.20

Cash 26,297.44

To record the remittance of payroll liabilities

You might also like

- Concept Evolution Foundation - 1.2Document277 pagesConcept Evolution Foundation - 1.2abre1get522175% (4)

- WNS 30-Apr-2019Document1 pageWNS 30-Apr-2019Karthik RaoNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument2 pagesEmployee Details Payment & Leave Details: Arrears Current AmountVyas Keshini100% (1)

- DC Lawsuit I-295 CameraDocument40 pagesDC Lawsuit I-295 CameraABC7News100% (3)

- Tata Consultancy Services PayslipDocument2 pagesTata Consultancy Services PayslipNilesh SurvaseNo ratings yet

- Midterm Writing Prompt: Primary Source AnalysisDocument2 pagesMidterm Writing Prompt: Primary Source AnalysisLeanhtuan Nguyen50% (2)

- Payslip To Print 04 29 2017 PDFDocument1 pagePayslip To Print 04 29 2017 PDFDoraNo ratings yet

- Business Finance AssignmentDocument14 pagesBusiness Finance AssignmentTatiana Elena CraciunNo ratings yet

- Payroll Assignment Ers April 5Document1 pagePayroll Assignment Ers April 5Mustafa KNo ratings yet

- RPT Pay Slip YTDDocument1 pageRPT Pay Slip YTDTomola BlessingNo ratings yet

- Rajasthan Rajya Vidyut Prasaran Nigam LTD.: Total Earnings NetpayDocument1 pageRajasthan Rajya Vidyut Prasaran Nigam LTD.: Total Earnings Netpayvinodk33506No ratings yet

- HR Avenue - Employee Self ServiceDocument1 pageHR Avenue - Employee Self ServiceNurul Aziemah RoslanNo ratings yet

- Deduction: Hong Leong Assurance Berhad Remuneration Statement For The Month of March 2023Document1 pageDeduction: Hong Leong Assurance Berhad Remuneration Statement For The Month of March 2023sptan838No ratings yet

- Deduction: Hong Leong Assurance Berhad Remuneration Statement For The Month of March 2023Document1 pageDeduction: Hong Leong Assurance Berhad Remuneration Statement For The Month of March 2023sptan838No ratings yet

- Deductions (B) Earnings (A) : Print Date: 03.11.2019, Print Time: 20:51:14Document1 pageDeductions (B) Earnings (A) : Print Date: 03.11.2019, Print Time: 20:51:14Fire SuperstarNo ratings yet

- Final Payslip of Circle For 7-17Document11 pagesFinal Payslip of Circle For 7-17Manas Kumar SahooNo ratings yet

- 1 Apr 17Document1 page1 Apr 17pravin_3781No ratings yet

- ResignDocument1 pageResignBaBy GaMiNgNo ratings yet

- February 2023Document1 pageFebruary 2023Pradeep Kumar malikNo ratings yet

- Rates ExcelDocument13 pagesRates ExcelAugie LingaNo ratings yet

- 2023 8 (Run1)Document1 page2023 8 (Run1)iemaqeelnasNo ratings yet

- Pay SlioDocument1 pagePay SlioBenhar BenzzNo ratings yet

- Pay Slip Feb-2020Document1 pagePay Slip Feb-2020Ratnakar AryasomayajulaNo ratings yet

- Pay Statement: June 2019 Aspin Pharma Pvt. LTDDocument1 pagePay Statement: June 2019 Aspin Pharma Pvt. LTDAman AnsariNo ratings yet

- 1 2023 Calendar Month - 31-MAR-23 - 10112851-2 - 1.Document1 page1 2023 Calendar Month - 31-MAR-23 - 10112851-2 - 1.Caitlin HeaNo ratings yet

- Payslip - Mar 2018Document1 pagePayslip - Mar 2018malikasindhuNo ratings yet

- 4Document1 page4Victoria MrrNo ratings yet

- Pay Period 01.01.2014 To 31.01.2014: Income Tax ComputationDocument1 pagePay Period 01.01.2014 To 31.01.2014: Income Tax ComputationSumit ChakrabortyNo ratings yet

- 1109021 (1)Document1 page1109021 (1)Cms Stl CmsNo ratings yet

- Dec 2023Document1 pageDec 2023globalamshaNo ratings yet

- Https Payroll - Saneforce.info SalaryTemplate ListLoanTemp Vbirds EMP10180&month 10&year Need 2022&st 1&tid 12&org 92&subdiv 0&div 167Document1 pageHttps Payroll - Saneforce.info SalaryTemplate ListLoanTemp Vbirds EMP10180&month 10&year Need 2022&st 1&tid 12&org 92&subdiv 0&div 167Suryakant SinghNo ratings yet

- Ravi MukharjeeDocument2 pagesRavi MukharjeeDivesh RaiNo ratings yet

- SSPCNADVDocument1 pageSSPCNADVChristopher WongNo ratings yet

- Afaan OromooDocument1 pageAfaan Oromoookashkemal2No ratings yet

- Office Order-Transfer Benefits FTEDocument1 pageOffice Order-Transfer Benefits FTENandan SarkarNo ratings yet

- Jul 2023Document2 pagesJul 2023NilanjanNo ratings yet

- JAN Payslip India-UnlockedDocument2 pagesJAN Payslip India-Unlockedbskapoor68No ratings yet

- AY2021-22 ARUN KUMAR-DTTPK8285A-ComputationDocument2 pagesAY2021-22 ARUN KUMAR-DTTPK8285A-ComputationRaghav SharmaNo ratings yet

- Remuneration Statement For The Month of January 2024: Powered by MIHCMDocument1 pageRemuneration Statement For The Month of January 2024: Powered by MIHCMakma50924No ratings yet

- Toaz - Info Tata Consultancy Services Payslip PRDocument3 pagesToaz - Info Tata Consultancy Services Payslip PRIndrasis gunNo ratings yet

- Pay Slip of August 2023Document1 pagePay Slip of August 2023alim.siddiquiNo ratings yet

- Jul 2022Document2 pagesJul 2022Nikhil KumarNo ratings yet

- Paystub 202303Document1 pagePaystub 202303carinaNo ratings yet

- SodaPDF-converted-PAYSLIP - Umashankar VDocument1 pageSodaPDF-converted-PAYSLIP - Umashankar VCyriac JoseNo ratings yet

- Jun 2021 NikDocument2 pagesJun 2021 NikNikhil KumarNo ratings yet

- Wa0022.Document2 pagesWa0022.AzmirNo ratings yet

- 31 Jan 2024Document2 pages31 Jan 2024vikzNo ratings yet

- 2024-01-24 - Payslip - LK60 - 52010 (LK60-HRM-300 - 2463072 - 1 - A1) - 1Document1 page2024-01-24 - Payslip - LK60 - 52010 (LK60-HRM-300 - 2463072 - 1 - A1) - 1shashikagcs.official001No ratings yet

- Jadhao MHDocument1 pageJadhao MHsarojdubey0107No ratings yet

- JulyDocument1 pageJulyArif AnuarNo ratings yet

- Maretlwa PayslipDocument1 pageMaretlwa Payslipmoonyung602No ratings yet

- Amazon Development Center India Pvt. LTD: Akash SatputeDocument2 pagesAmazon Development Center India Pvt. LTD: Akash SatputepyNo ratings yet

- 31 Aug 2023Document1 page31 Aug 2023Ashish MishraNo ratings yet

- Uma Salary Slip JulyDocument1 pageUma Salary Slip Julyjyothi sNo ratings yet

- My Payslip - 20231116 - 164307Document1 pageMy Payslip - 20231116 - 164307azamafandi2004No ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountAkhila ChinniNo ratings yet

- Paystub 202109Document1 pagePaystub 202109Ankush BarheNo ratings yet

- Salary SlipDocument1 pageSalary SlipAMAN SHAHNo ratings yet

- Pay Slip 13867 July, 2021Document1 pagePay Slip 13867 July, 2021Jemal YayaNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountAnkur murarkaNo ratings yet

- Jan2024Document1 pageJan2024globalamshaNo ratings yet

- Ed 9Document2 pagesEd 9Sanjay DuaNo ratings yet

- Archmodels - Vol - 163 Copaci PDFDocument20 pagesArchmodels - Vol - 163 Copaci PDFDemyNo ratings yet

- Great Pacific Life Insurance Corp Vs CADocument7 pagesGreat Pacific Life Insurance Corp Vs CALeigh BarcelonaNo ratings yet

- Deed of SaleDocument4 pagesDeed of Salemaribeth ramirezNo ratings yet

- Problem Areas in Legal Ethics TamondongDocument5 pagesProblem Areas in Legal Ethics TamondongSirGen EscalladoNo ratings yet

- Local Media1764479852878615105Document140 pagesLocal Media1764479852878615105Ramareziel Parreñas RamaNo ratings yet

- SBD 99Document11 pagesSBD 99Mudasir Bashir KoulNo ratings yet

- 4 An31 Te WB 61 19 U08 PDFDocument16 pages4 An31 Te WB 61 19 U08 PDFMatis CHEDRUNo ratings yet

- S. 482 CRPCDocument12 pagesS. 482 CRPCAbhishek YadavNo ratings yet

- NRI Address Change FormDocument4 pagesNRI Address Change Formsrinivasan431No ratings yet

- Ghauker Khandsari Sugar Mills VDocument5 pagesGhauker Khandsari Sugar Mills VHarsh GargNo ratings yet

- Dress Code Proposal 8.3.21Document11 pagesDress Code Proposal 8.3.21Mindy WadleyNo ratings yet

- Dealers Attitude QuestionnaireDocument3 pagesDealers Attitude QuestionnaireSUKUMAR80% (10)

- CommunismDocument5 pagesCommunismallan_alanaNo ratings yet

- Ford Investment ThesisDocument7 pagesFord Investment Thesispatricialeatherbyelgin100% (1)

- BPLO - Activity Design Business Orientation SeminarDocument2 pagesBPLO - Activity Design Business Orientation SeminarEcole GaviolaNo ratings yet

- Jurisprudence Assignment (Shantanu Bhardwaj Bcom LLBDocument9 pagesJurisprudence Assignment (Shantanu Bhardwaj Bcom LLBShantanu BhardwajNo ratings yet

- Faculty of Law Jamia Millia Islamia: Release On Admonition and Probation On Basis of Good ConductDocument32 pagesFaculty of Law Jamia Millia Islamia: Release On Admonition and Probation On Basis of Good Conductkashif zafarNo ratings yet

- Republic Vs de Guzman - DEL ROSARIODocument1 pageRepublic Vs de Guzman - DEL ROSARIOJohn L.No ratings yet

- Bài kiểm tra tự luận Lợi nhuận mỗi cổ phiếu - Xem lại bài làmDocument8 pagesBài kiểm tra tự luận Lợi nhuận mỗi cổ phiếu - Xem lại bài làmAh TuanNo ratings yet

- Jack Keystone Cat 6 Belden AX104193 PDFDocument3 pagesJack Keystone Cat 6 Belden AX104193 PDFBethsy WinNo ratings yet

- Basf Masterflow 678 TdsDocument4 pagesBasf Masterflow 678 Tdsgazwang478No ratings yet

- B1 Note 4Document4 pagesB1 Note 4SBNo ratings yet

- Red Hat Enterprise Linux-7-7.3 Release Notes-En-USDocument218 pagesRed Hat Enterprise Linux-7-7.3 Release Notes-En-UShoadiNo ratings yet

- BGDRV1368F22DW800701Document2 pagesBGDRV1368F22DW800701alamgir80100% (1)

- FCDCC Constitution (Eng)Document63 pagesFCDCC Constitution (Eng)Let's Work Together100% (1)

- Bill C-985/C-986/C-987/C-988 End Cannabis Prohibition Acts (Open Public Draft)Document59 pagesBill C-985/C-986/C-987/C-988 End Cannabis Prohibition Acts (Open Public Draft)Sam VekemansNo ratings yet