Professional Documents

Culture Documents

Module 8 Homework

Uploaded by

Ruth KatakaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 8 Homework

Uploaded by

Ruth KatakaCopyright:

Available Formats

Econ 202

Module 8 Homework

1. Answer the following:

a. The demand for labor for a firm operating in a perfectly competitive output market equals

__ the value of the marginal product of labor. __.

b. The demand for labor for a firm with market power in the output market equals __ the

marginal revenue product ____.

2. Would you expect the presence of labor unions to lead to higher or lower pay for worker-

members? Would you expect a higher or lower quantity of workers hired by those

employers? Explain briefly.

The presence of labor unions will lead to higher pay for worker-members because labor

union uses its bargaining power to push for higher wages for its members. Labor union have

greater bargaining power than individual employees, and as such, they will be able to bargain

for higher pay. With higher labor cost, the company would be forced to embark on labor

saving strategy and this will further reduce the quantity of labor hired. With this in mind, we

would expect a lower quantity of workers hired by employers.

3. Researchers have found low-skilled immigration has a relatively small effect on the wages of

low-skilled workers. Explain this finding (Hint: there are multiple factors that can explain

this. You only need to explain one of them.)

Legal floor of federal and state minimum wage laws ensures that the compensation of low-

skilled does not fall below a certain level.

4. Answer the following:

a. What is the marginal cost of labor for a firm that operates in a competitive labor market?

The marginal cost of labor can be described as the extra cost incurred by firms from

employing additional units of labor. In competitive labor market, marginal cost of labor is

equal to the wage rate

b. How does this compare with the MCL for a monopsony? Monopsony is characterized by

a situation where there is only one sole employer demanding labor. Considering that the

firm does not face any competition in regard to hiring workers, the firm has full control

over the wage rate. Considering such firm faces positively sloped market labor supply

curve, it has to raise the market wage rate for its laborers to hire more workers and as

such the marginal cost of labor for monopsony is higher than that of competitive labor

market.

c. Who will pay higher wages: a monopsony or a competitive labor market? A competitive

labor market.

d. Who will employ more labor: a monopsony or a competitive labor market? A competitive

labor markets

5. If it is not profitable to discriminate, why does discrimination persist? Discrimination can

emerge at different levels in an organization: among managers, among workers, and among

customers. For instance, consider a situation where a manager who is not personally

prejudiced, but leads workers or serves customers who are prejudiced. By treating minority

groups or women fairly, the manager will negatively affect the morale of prejudiced workers

or drive away prejudiced customers. In such a context, it is evident that a non-discrimination

policy would reduce the firm’s profit. Businesses operate in the context of society and as

such, they have to follow societal norms or risk suffering.

6. If a country had perfect income equality what would the Lorenz curve look like? Lorenz

curve would be a line sloping up at a 45-degree angle

7. Offer one reason why income inequality might increase productivity and efficiency in an

economy.

Considering the higher propensity to save of the rich relative to the poor, distribution of income

to the rich promotes savings and this increases investments and the level of economic activity

hence positively related to increased productivity and efficiency in an economy.

Offer one reason why income inequality might reduce productivity and efficiency in an

economy. Explain your answers.

Income inequality may increase ill health and health spending, and reduce educational

performance of for the poor which will lead to a reduction in the productive potential of the

workforce in an economy.

8. In country A, the population is 300 million and 50 million people are living below the

poverty line. What is the poverty rate?

Poverty rate= (50/300) *100

=16.67%

9. Susan is a single mother with three children. She can earn $8 per hour and works up to 2,000

hours per year. However, if she does not earn any income at all, she will receive government

benefits totaling $16,000 per year. For every $1 of income she earns, her level of government

support will be reduced by $1. The table below is patterned after Table 15.8 from the text.

Number of Work Earnings from Work Government Benefits Total Income

Hours

2000 $16,000 $0 $16,000

1600 $12,800 3200 $16000

1200 $9600 6400 $16,000

800 $6400 9600 $16000

400 $3200 $12,800 $16,000

0 $0 $16,000 $16,000

a. Complete the table.

b. Is this program an example of a poverty trap? Explain your answer. Yes, the program is

an example of a poverty trap since Susan receives no net gain from working as each time,

she earns a specific amount she loses a similar amount in government support.

c. If this program is an example of a poverty trap, how can this program be altered to avoid

this problem? The program can be altered by designing an antipoverty program such that

instead of reducing government payments by $1 for every $1 earned, payments are

reduced by some smaller amount instead ($0.50). The bite of the poverty trap can also be

reduced by imposing requirements for work as a condition of receiving benefits and

setting a time limit on benefits.

10. A group of 10 people have the following annual incomes: $55,000, $30,000, $15,000,

$20,000, $35,000, $80,000, $40,000, $45,000, $30,000, $50,000. Complete the table.

Income Quintile Share of Income

$15,000 Bottom 8.75%

$20,000

$30,000 2nd 15%

$30,000

$35,000 3rd 18.75%

$40,000

$45,000 4th 23.75%

$50,000

$55,000 Top 33.75%

$80,000

a. If $4000 is taxed from the top earner and transferred to the lowest earner, would that

increase or decrease the share of income held by the top quintile? The share of income

held by top earner will decrease by 1%

b. Would this transfer increase or decrease the share of income held by the bottom quintile?

The share of income held by bottom quintile will increase by 1%

c. Would this have any effect on the 2nd quintile? The 3rd? The 4th? There would be no effect

on 2nd, 3rd, and 4th quintile

d. Would this transfer increase, decrease, or have no effect on income inequality in this

group? Decrease income inequality

e. Redistributing income from the highest earner to the lowest one would reduce the utility

of the top earner and increase the utility of the lowest earner. But what would happen to

overall utility in the economy? Would it increase, decrease, or remain the same? Explain

your answer. (Hint: does the marginal utility of income diminish as one earns more?)

According to marginal utility, each additional dollar is more valuable to those with

lower incomes because they have fewer dollars in total. For those with higher incomes,

the marginal utility of each additional dollar of income is lower. The idea is that income

redistribution from higher income earners to low-income earners will cause less loss of

utility for someone with a higher income. Overall utility in the economy will increase.

You might also like

- Should a batch-wise reactor be replaced with a continuous reactorDocument2 pagesShould a batch-wise reactor be replaced with a continuous reactorNovia Mia Yuhermita100% (1)

- Chap 013 SolutionsDocument7 pagesChap 013 SolutionsNg Hai Woon AlwinNo ratings yet

- ECN105 Week 2 Class ActivitiesDocument9 pagesECN105 Week 2 Class ActivitiesHarry SinghNo ratings yet

- Topic 4: Product Market: Topic Questions For Revision s2 2020Document3 pagesTopic 4: Product Market: Topic Questions For Revision s2 2020eugene antonyNo ratings yet

- Meyer/Corinth Response To CritiqueDocument7 pagesMeyer/Corinth Response To CritiqueGlennKesslerWPNo ratings yet

- Tyco fraud investigation timelineDocument12 pagesTyco fraud investigation timelineSumit Sharma100% (1)

- Name - Eco200: Practice Test 3A Covering Chapters 16, 18-21Document6 pagesName - Eco200: Practice Test 3A Covering Chapters 16, 18-21Thiện ThảoNo ratings yet

- 07 The Labor Market Wages and UnemploymentDocument48 pages07 The Labor Market Wages and UnemploymentLeng Yan PingNo ratings yet

- Module 13Document5 pagesModule 13Carla Mae F. DaduralNo ratings yet

- Economics 1st Edition Acemoglu Solutions ManualDocument16 pagesEconomics 1st Edition Acemoglu Solutions ManualKimCoffeyjndf100% (32)

- Economics Global 1st Edition Acemoglu Solutions ManualDocument16 pagesEconomics Global 1st Edition Acemoglu Solutions Manualemilyreynoldsopctfdbjie100% (25)

- MGEA06 Midterm Answer Key Winter 2017Document11 pagesMGEA06 Midterm Answer Key Winter 2017Krish AhluwaliaNo ratings yet

- Comparing Income Measures and Living StandardsDocument17 pagesComparing Income Measures and Living StandardsZulham IdahNo ratings yet

- ECO403 Short Question of Recommended Book RefrenceDocument21 pagesECO403 Short Question of Recommended Book RefrencemodmotNo ratings yet

- Ebook Economics Global 1St Edition Acemoglu Solutions Manual Full Chapter PDFDocument37 pagesEbook Economics Global 1St Edition Acemoglu Solutions Manual Full Chapter PDFenstatequatrain1jahl100% (6)

- 6SSMN966 Tutorial 8 SolutionsDocument3 pages6SSMN966 Tutorial 8 SolutionsyuvrajwilsonNo ratings yet

- Lab 2Document9 pagesLab 2Ahmad AlNo ratings yet

- Final Exam December 2020Document5 pagesFinal Exam December 2020Ikhwan RizkyNo ratings yet

- The Simple Keynesian ModelDocument9 pagesThe Simple Keynesian ModelRudraraj MalikNo ratings yet

- Mini Exam 3Document17 pagesMini Exam 3course101No ratings yet

- The Simple Multiplier ModelDocument9 pagesThe Simple Multiplier ModelInderpreet Singh SainiNo ratings yet

- Unemployment and Its Natural Rate: Solutions To Textbook ProblemsDocument12 pagesUnemployment and Its Natural Rate: Solutions To Textbook ProblemsMainland FounderNo ratings yet

- 6SSMN966 Tutorial 6 SolutionsDocument4 pages6SSMN966 Tutorial 6 SolutionsyuvrajwilsonNo ratings yet

- Macroeconomic Relationships and Investment DecisionsDocument3 pagesMacroeconomic Relationships and Investment DecisionsShuhada ShamsuddinNo ratings yet

- Economics Exam 3 Price Control ElasticityDocument6 pagesEconomics Exam 3 Price Control ElasticityMiguel MoraNo ratings yet

- Econ 305 Dr. Claudia Strow Sample Final Exam QuestionsDocument5 pagesEcon 305 Dr. Claudia Strow Sample Final Exam Questionscognac19840% (1)

- Epp - Exam2 - Spring2023 - MOD 2Document10 pagesEpp - Exam2 - Spring2023 - MOD 2MasaNo ratings yet

- ECONS3213 Problem Set 2 Draft and Group Submission DeadlinesDocument7 pagesECONS3213 Problem Set 2 Draft and Group Submission DeadlinesKirill AntonovNo ratings yet

- GDP Growth Rates and Real GDP Per Capita CalculationsDocument6 pagesGDP Growth Rates and Real GDP Per Capita CalculationsnadiaNo ratings yet

- p98 PDFDocument1 pagep98 PDFpenelopegerhardNo ratings yet

- Essential Foundations of Economics 7th Edition Bade Solutions ManualDocument16 pagesEssential Foundations of Economics 7th Edition Bade Solutions Manualnicolewoodsinmapoyejf100% (27)

- Bahria University macroeconomics midterm assignmentDocument8 pagesBahria University macroeconomics midterm assignmentAbrar Ahmed KhanNo ratings yet

- Multiplier Practice PDFDocument2 pagesMultiplier Practice PDFeco2dayNo ratings yet

- Unemployment, Inflation, and Long-Run Growth: Hapter ObjectivesDocument20 pagesUnemployment, Inflation, and Long-Run Growth: Hapter ObjectivesDACAPIO MARY JOYNo ratings yet

- Economic Conditions Analysis for BUS 530 Final AssignmentDocument12 pagesEconomic Conditions Analysis for BUS 530 Final AssignmentShoaib AhmedNo ratings yet

- 9.6 Keynesian MultiplierDocument23 pages9.6 Keynesian MultiplierkimmoNo ratings yet

- Microeconomics Chapter 07 SolutionsDocument13 pagesMicroeconomics Chapter 07 SolutionsRex CalibreNo ratings yet

- Lecture Notes 8: Income Distribution and Income InequalityDocument37 pagesLecture Notes 8: Income Distribution and Income InequalityMansab Raja KhanNo ratings yet

- Ec12 Ch9inflationunemploymentDocument19 pagesEc12 Ch9inflationunemploymentapi-378150162No ratings yet

- Probset 1Document10 pagesProbset 1Phat Minh HuynhNo ratings yet

- Answer Tutorial MacroeconomicsDocument6 pagesAnswer Tutorial MacroeconomicsAinaasyahirah RosidanNo ratings yet

- Essential Foundations of Economics 7th Edition Bade Solutions Manual Full Chapter PDFDocument37 pagesEssential Foundations of Economics 7th Edition Bade Solutions Manual Full Chapter PDFTerryGonzalezkqwy100% (14)

- HA1Document2 pagesHA1Ali ZafarNo ratings yet

- Tutorial 3 PresentDocument13 pagesTutorial 3 PresentLi NiniNo ratings yet

- A Lev Econ 01Document11 pagesA Lev Econ 01maailaaNo ratings yet

- The Effects of A Minimum-Wage Increase On Employment and Family IncomeDocument43 pagesThe Effects of A Minimum-Wage Increase On Employment and Family IncomeJeffrey DunetzNo ratings yet

- Microondas VeganoDocument8 pagesMicroondas VeganoJaime Rodríguez CanoNo ratings yet

- Class Questions EconomicsDocument7 pagesClass Questions Economicst2w662No ratings yet

- Tutorial - The Keynesian Model (Q)Document3 pagesTutorial - The Keynesian Model (Q)sapphirekuranNo ratings yet

- Exercise 4Document28 pagesExercise 4yu yuNo ratings yet

- EconomicsDocument9 pagesEconomicsTaibaAshrafNo ratings yet

- Federal Tax RevenuesDocument12 pagesFederal Tax RevenuesJOijiewjfNo ratings yet

- The Economics of Subsidies: J. Atsu AmegashieDocument9 pagesThe Economics of Subsidies: J. Atsu AmegashiesgneurosurgNo ratings yet

- Why We Need Transparent Pricing in Microfinance November 2008Document62 pagesWhy We Need Transparent Pricing in Microfinance November 2008Vivek ReddyNo ratings yet

- Macroeconomic Analysis AnswersDocument4 pagesMacroeconomic Analysis Answersibrahim b s kamaraNo ratings yet

- Chapters 28 Suggested Answers To Practice Questions On UnemploymentDocument2 pagesChapters 28 Suggested Answers To Practice Questions On UnemploymentQuỳnh Chi NguyễnNo ratings yet

- School of LawDocument4 pagesSchool of LawSri MuganNo ratings yet

- Final Review Answer KeyDocument6 pagesFinal Review Answer KeyKhanh Ngan PhanNo ratings yet

- Responses To SurveyDocument7 pagesResponses To Surveyapi-312461507No ratings yet

- Common Sense of Contemporary American Economics and Politics: How America Could Become a True DemocracyFrom EverandCommon Sense of Contemporary American Economics and Politics: How America Could Become a True DemocracyNo ratings yet

- Inequality and Evolution: The Biological Determinants of Capitalism, Socialism and Income InequalityFrom EverandInequality and Evolution: The Biological Determinants of Capitalism, Socialism and Income InequalityNo ratings yet

- Maharashtra Pharmacy Seat Allotment for CAP Round IIIDocument2 pagesMaharashtra Pharmacy Seat Allotment for CAP Round IIIPharmacy Admission ExpertNo ratings yet

- Social Media's Impact on Retail BusinessesDocument23 pagesSocial Media's Impact on Retail BusinessesMohammad IrfanNo ratings yet

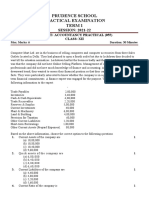

- Prudence School Accountancy Practical ExamDocument2 pagesPrudence School Accountancy Practical Examicarus fallsNo ratings yet

- Hypothesis-Driven DevelopmentDocument2 pagesHypothesis-Driven DevelopmentMuhammad El-FahamNo ratings yet

- Hammaad Akoojee: Education Personal DetailsDocument2 pagesHammaad Akoojee: Education Personal DetailsHammaad AkoojeeNo ratings yet

- Business Implications of Sustainability Practices in Supply ChainsDocument25 pagesBusiness Implications of Sustainability Practices in Supply ChainsBizNo ratings yet

- GOPRO Written Case DraftDocument3 pagesGOPRO Written Case DraftBritney BissambharNo ratings yet

- Semi Formal ExamplesDocument3 pagesSemi Formal ExamplesDjshh oiNo ratings yet

- Final Reaserch-3Document52 pagesFinal Reaserch-3Dereje BelayNo ratings yet

- Booking Invoice - M06AI23I17058515 - LTADocument1 pageBooking Invoice - M06AI23I17058515 - LTANishant DuggalNo ratings yet

- Extracting Value From Municipal Solid Waste For Greener Cities: The Case of The Republic of KoreaDocument5 pagesExtracting Value From Municipal Solid Waste For Greener Cities: The Case of The Republic of KoreajakariaNo ratings yet

- Duality Theory - Assignment A) Primal ProblemDocument5 pagesDuality Theory - Assignment A) Primal ProblemSohaib ArifNo ratings yet

- Work: Waterproofing Works For The Proposed 'Residential & Commercial Complex at Mohili, Sakinaka Mumbai 400 072' ContractorDocument11 pagesWork: Waterproofing Works For The Proposed 'Residential & Commercial Complex at Mohili, Sakinaka Mumbai 400 072' ContractorShubham DubeyNo ratings yet

- Landmark Guide Real Estate Valuation PrinciplesDocument8 pagesLandmark Guide Real Estate Valuation PrinciplesChristopher Gutierrez CalamiongNo ratings yet

- Group Assignment - A211 QUESTIONNAIREDocument9 pagesGroup Assignment - A211 QUESTIONNAIREMuhammad NafisNo ratings yet

- Mayoral Candidate Profile - Laurie Sears DeppaDocument1 pageMayoral Candidate Profile - Laurie Sears DeppaZainaAdamuNo ratings yet

- Employability Skills - Term IIDocument5 pagesEmployability Skills - Term IISSDLHO sevenseasNo ratings yet

- DTC 22-23 - Digital Transformation Strategy PDFDocument13 pagesDTC 22-23 - Digital Transformation Strategy PDFDebrian SaragihNo ratings yet

- Mini-Case SanyDocument2 pagesMini-Case SanyLeah C.100% (1)

- Capital BudgetingDocument87 pagesCapital BudgetingCBSE UGC NET EXAMNo ratings yet

- BS en 10250-3Document16 pagesBS en 10250-3butterflyhuahuaNo ratings yet

- GDPR data breach notification guidelinesDocument32 pagesGDPR data breach notification guidelinesraulxNo ratings yet

- Annual Report 2020-21Document121 pagesAnnual Report 2020-21Chhavi GajnaniNo ratings yet

- Some Thoughts On The Failure of Silicon Valley Bank 3-12-2023Document4 pagesSome Thoughts On The Failure of Silicon Valley Bank 3-12-2023Subash NehruNo ratings yet

- Audit and Review: Exam FocusDocument12 pagesAudit and Review: Exam FocusPhebieon MukwenhaNo ratings yet

- Intimex Xuan Loc - Porfolio - 2022 (Autosaved)Document11 pagesIntimex Xuan Loc - Porfolio - 2022 (Autosaved)VyDangNo ratings yet

- Principles of Engineering EconomyDocument14 pagesPrinciples of Engineering Economyabhilash gowdaNo ratings yet

- UBO - Lecture 03 - Mechanistic and Organic Forms of Organisational StructureDocument24 pagesUBO - Lecture 03 - Mechanistic and Organic Forms of Organisational StructureSerena AboNo ratings yet