Professional Documents

Culture Documents

Planning Your Retirement - 25 July 2023

Uploaded by

Times Media0 ratings0% found this document useful (0 votes)

6 views1 pagePlanning Your Retirement - 25 July 2023

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPlanning Your Retirement - 25 July 2023

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pagePlanning Your Retirement - 25 July 2023

Uploaded by

Times MediaPlanning Your Retirement - 25 July 2023

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

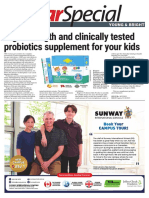

PLANNING YOUR RETIREMENT

THE STAR, TUESDAY 25 JULY 2023

Live comfortably in retirement

AFTER decades of hard work, so that you will have enough time rates globally, healthcare costs

Invest early to

your retirement should be a to save and invest, build your can eat into your retirement

retire in comfort.

time of leisure, where you can retirement fund and benefit fund, especially if you have not

kick back, relax and not worry from the power of compounding planned for it in advance.

about having to work any more interest. At the same time, you

to cover your costs of living. will have to remember to take Start planning today

To be able to live comfortably into consideration various

and enjoy your golden years, factors that could affect the While having to plan every

sufficient retirement funds are amount that you will need in step of the way to make sure you

needed to bankroll your desired your retirement nest egg. will be able to retire comfortably

retirement lifestyle. The total may seem daunting, Public

retirement fund needed to Retirement age Mutual Berhad has set up several

achieve this will depend on your applications and tutorials to

estimated monthly expenses once Depending on how long you make things easier for you.

you’ve stopped working. For want your retirement to be, you The Public Mutual Retirement

example, if you plan to have at will have to adjust and manage Planning Calculator can help you

least RM5,000 a month during your savings to follow suit. For If you plan to have a lavish of money you have saved for get a better estimation of the

your retirement, you’ll need to example, if you plan to retire lifestyle, then you will need to retirement may not be as much amount that you would need

save up to RM785,119 by the earlier and have more time to save and invest more as well as you think by the time you during your retirement. Public

time you decide to retire. relax in your older age, you will to be able to fully enjoy your retire. So, you will have to factor Mutual has also curated a special

This prediction is based on the need to save and invest more to retirement. in the economic phenomenon in Retirement Virtual Workshop

assumption that you plan to have cover the additional years of your retirement planning. educational video to help

a retirement period of 20 years retirement. Inflation Malaysians make the first steps

and your retirement expenses Healthcare costs in their retirement planning

are withdrawn annually at the Lifestyle Like it or not, we can’t escape journey.

beginning of the year, as well as inflation. Inflation is the increase Similar to inflation, the cost of

there being a rate of return of 8% Your desired retirement lifestyle in the prices of goods and healthcare will continue to rise n For more information, visit

and a yearly inflation rate of 3%. plays a major role in determining services and the fall in the over time, this is known as https://www.publicmutual.com.

Thus, it is important to start how much you will need to save purchasing value of money over medical inflation. Coupled with my/Menu/Financial-Planning-

your retirement planning early to build on your retirement funds. time. This means that the amount the increased life expectancy Services

You might also like

- Ultimate Guide To Financial PlanningDocument9 pagesUltimate Guide To Financial PlanningProlific SolutionsNo ratings yet

- Retirement PlanningDocument104 pagesRetirement PlanningPartik Bansal100% (9)

- Retirement Planning: From Start To FinishDocument9 pagesRetirement Planning: From Start To FinishbvbenhamNo ratings yet

- Retirement Planning For Women: ING Special ReportDocument4 pagesRetirement Planning For Women: ING Special Reportiyer_anusha81No ratings yet

- ADP 401K Enrollment KitDocument20 pagesADP 401K Enrollment KitjcilvikNo ratings yet

- CFA-Level 2 Mock-V1-Exam-2-AfternoonDocument98 pagesCFA-Level 2 Mock-V1-Exam-2-AfternoonHongMinhNguyenNo ratings yet

- Starbucks FY22 Annual ReportDocument100 pagesStarbucks FY22 Annual ReporttamtitNo ratings yet

- RETIREMENT BOX SET: The Ultimate Retirement Investing Guide! Smart Investing Solutions for Stress Free Retirement DaysFrom EverandRETIREMENT BOX SET: The Ultimate Retirement Investing Guide! Smart Investing Solutions for Stress Free Retirement DaysNo ratings yet

- Healthy Eyes - 5 March 2023Document2 pagesHealthy Eyes - 5 March 2023Times MediaNo ratings yet

- 15-Minute Retirement Plan FINALDocument23 pages15-Minute Retirement Plan FINALUmar FarooqNo ratings yet

- Family Offices in New YorkDocument13 pagesFamily Offices in New YorkMichael BuryNo ratings yet

- RETIREMENT: SMART INVESTING SOLUTIONS FOR THE BUDGETING MINDSET. Keeping Finance Simple while Achieving Financial Freedom and Being Debt FreeFrom EverandRETIREMENT: SMART INVESTING SOLUTIONS FOR THE BUDGETING MINDSET. Keeping Finance Simple while Achieving Financial Freedom and Being Debt FreeNo ratings yet

- Self-Help Guidebook for Retirement Planning For Couples and Seniors: Ultimate Retirement Planning Book for Life after Paid EmploymentFrom EverandSelf-Help Guidebook for Retirement Planning For Couples and Seniors: Ultimate Retirement Planning Book for Life after Paid EmploymentNo ratings yet

- Nutritional Health & You - 18 July 2023Document4 pagesNutritional Health & You - 18 July 2023Times MediaNo ratings yet

- World Sleep Day - 17 March 2023Document2 pagesWorld Sleep Day - 17 March 2023Times MediaNo ratings yet

- Dark Market PsychologyDocument28 pagesDark Market PsychologyEmmanuel100% (1)

- Your Health - 17 May 2023Document5 pagesYour Health - 17 May 2023Times MediaNo ratings yet

- Wealth ManagementDocument14 pagesWealth Managementnikki karma100% (1)

- Postgraduate - 16 May 2023Document2 pagesPostgraduate - 16 May 2023Times MediaNo ratings yet

- Cancer Awareness - 4 February 2023Document6 pagesCancer Awareness - 4 February 2023Times MediaNo ratings yet

- Healthy Liver - 16 April 2023Document2 pagesHealthy Liver - 16 April 2023Times MediaNo ratings yet

- Work & Study - 23 May 2023Document1 pageWork & Study - 23 May 2023Times MediaNo ratings yet

- Senior Citizen's Day - 21 August 2023Document5 pagesSenior Citizen's Day - 21 August 2023Times MediaNo ratings yet

- Senior LivingDocument16 pagesSenior LivingWatertown Daily TimesNo ratings yet

- Postgraduate - 17 January 2023Document2 pagesPostgraduate - 17 January 2023Times MediaNo ratings yet

- Healthy Bones - 11 July 2023Document2 pagesHealthy Bones - 11 July 2023Times MediaNo ratings yet

- What Does Retirement Mean To YouDocument5 pagesWhat Does Retirement Mean To Youmaria gomezNo ratings yet

- Retirement PlanningDocument4 pagesRetirement Planningakshaygupta55555411No ratings yet

- PFP Retirement Planning Unit 3 Bba IIIDocument13 pagesPFP Retirement Planning Unit 3 Bba IIIRaghuNo ratings yet

- A Guide To AnnuitiesDocument16 pagesA Guide To AnnuitiesRobert OtienoNo ratings yet

- What Is A Pension?Document5 pagesWhat Is A Pension?MajorlyNo ratings yet

- Financial Retirement PlanDocument2 pagesFinancial Retirement PlansscalNo ratings yet

- Personal Wealth ManagementDocument33 pagesPersonal Wealth ManagementVaibhav ArwadeNo ratings yet

- Chapter 1: IntroductionDocument20 pagesChapter 1: IntroductionAlyn CheongNo ratings yet

- Retirement PlanningDocument18 pagesRetirement PlanningsuryarathiNo ratings yet

- Build Financial Confidence: One of A Series of Papers On The Confident Retirement ApproachDocument9 pagesBuild Financial Confidence: One of A Series of Papers On The Confident Retirement ApproachBiki sahaNo ratings yet

- Planning RetirmentsDocument5 pagesPlanning Retirmentssavage.ashuNo ratings yet

- Money - April 2015 USA PDFDocument90 pagesMoney - April 2015 USA PDFr4scridNo ratings yet

- FIN102-Chapter 4 - Building WealthDocument20 pagesFIN102-Chapter 4 - Building WealthmartinmuebejayiNo ratings yet

- Secure 58: Why Shouldn't You Have The Freedom To Alter Your Retirement Plan at Any Time?Document16 pagesSecure 58: Why Shouldn't You Have The Freedom To Alter Your Retirement Plan at Any Time?Antony Manoj RNo ratings yet

- 04 Handout 2Document7 pages04 Handout 2jerome cortonNo ratings yet

- Investment HandbookDocument28 pagesInvestment HandbookAndy LiangNo ratings yet

- Retirement Planning for Beginners: Financial Planning Essentials, #1From EverandRetirement Planning for Beginners: Financial Planning Essentials, #1No ratings yet

- Retirement PlanningDocument26 pagesRetirement PlanningKashish JhambNo ratings yet

- Retirement Planning Guide Book: Steering you Through Crucial Choices to Shape Your Ideal Retirement SuccessFrom EverandRetirement Planning Guide Book: Steering you Through Crucial Choices to Shape Your Ideal Retirement SuccessNo ratings yet

- Retirement PlanningDocument11 pagesRetirement PlanningIan Miles TakawiraNo ratings yet

- Investment Plans For Retirement - Rs 1 Crore Enough To Retire - Here Are 3 Investment Plans To Make Savings Last During RetirementDocument18 pagesInvestment Plans For Retirement - Rs 1 Crore Enough To Retire - Here Are 3 Investment Plans To Make Savings Last During RetirementSrinivas KeshavamurthyNo ratings yet

- Financial Independence For Life After RetirementDocument2 pagesFinancial Independence For Life After RetirementSweeny DiasNo ratings yet

- FINAL - PFM - 5 - Steps - Retirement - Guide 2Document11 pagesFINAL - PFM - 5 - Steps - Retirement - Guide 2Jeffrey EmgeNo ratings yet

- Retirement Planning Basics: (Page 1 of 24)Document24 pagesRetirement Planning Basics: (Page 1 of 24)Goutam ReddyNo ratings yet

- Full ReportDocument37 pagesFull ReportXiao TianNo ratings yet

- Plan Your Retirement: 9 Steps So You Can Retire Happily: Financial Freedom & InvestmentFrom EverandPlan Your Retirement: 9 Steps So You Can Retire Happily: Financial Freedom & InvestmentRating: 3 out of 5 stars3/5 (1)

- Designing A New Retirement Plan Relevant To IndiaDocument29 pagesDesigning A New Retirement Plan Relevant To Indianaila iqbalNo ratings yet

- Retirement Planning BasicsDocument24 pagesRetirement Planning BasicsJakeWillNo ratings yet

- NOW I KNOW ! Cikaldana Newsletter No. 03-2015 (On Retirement Planning)Document5 pagesNOW I KNOW ! Cikaldana Newsletter No. 03-2015 (On Retirement Planning)CikaldanaNo ratings yet

- Pension Plans in India NEWWDocument22 pagesPension Plans in India NEWWKomal BhatiaNo ratings yet

- How to Retire Early: A Guide to Financial Planning and Early RetirementFrom EverandHow to Retire Early: A Guide to Financial Planning and Early RetirementNo ratings yet

- Asis 9 Chapter 13Document13 pagesAsis 9 Chapter 13Natasya BudionoNo ratings yet

- Suncorp Bank SuperannuationnDocument20 pagesSuncorp Bank SuperannuationnSuncorp-BankNo ratings yet

- New - Elite - Plus Brochure - V2Document11 pagesNew - Elite - Plus Brochure - V2Deepak GulwaniNo ratings yet

- Retirement Plans: Cover at SunsetDocument10 pagesRetirement Plans: Cover at Sunsetsachin_chawlaNo ratings yet

- Members' Education Annuity Presentation: BY Insurance Company of East Africa LTDDocument38 pagesMembers' Education Annuity Presentation: BY Insurance Company of East Africa LTDTusharNo ratings yet

- Pension Plans: Dr. (Prof) Sudhir Kumar GaurDocument3 pagesPension Plans: Dr. (Prof) Sudhir Kumar GaurNaveen RajputNo ratings yet

- Live A New Dream,: Every 3 YearsDocument10 pagesLive A New Dream,: Every 3 Yearsayushman rajNo ratings yet

- A Study On Investment Avenues Preferred by Working People For Retirement PlanningDocument4 pagesA Study On Investment Avenues Preferred by Working People For Retirement PlanningprabhakarbethiNo ratings yet

- Aditya Retirement PlanningDocument49 pagesAditya Retirement PlanningAditya TiwariNo ratings yet

- Lovely Professional University: Learning Outcomes: To Get Understanding of Types Retirement/pension Plans Offered byDocument7 pagesLovely Professional University: Learning Outcomes: To Get Understanding of Types Retirement/pension Plans Offered byTushar HalderNo ratings yet

- Retirement PlanningDocument3 pagesRetirement PlanningAarti GuptaNo ratings yet

- CSE K Reading-Morton Niederjohn Thomas-Building WealthDocument17 pagesCSE K Reading-Morton Niederjohn Thomas-Building Wealthgraphicman1060No ratings yet

- Chapter 12Document45 pagesChapter 12Angelo SaayoNo ratings yet

- Your Health - March 17 2024Document2 pagesYour Health - March 17 2024Times MediaNo ratings yet

- Your Health - 21 November 2023Document4 pagesYour Health - 21 November 2023Times MediaNo ratings yet

- Postgraduate - 21 November 2023Document4 pagesPostgraduate - 21 November 2023Times MediaNo ratings yet

- Healthcare in Malaysia - 25 February 2024Document2 pagesHealthcare in Malaysia - 25 February 2024Times MediaNo ratings yet

- Postgraduate - 19 March 2024Document2 pagesPostgraduate - 19 March 2024Times MediaNo ratings yet

- Course Focus: Pre-University - 30 May 2023Document2 pagesCourse Focus: Pre-University - 30 May 2023Times MediaNo ratings yet

- Brain Health - 4 July 2023Document2 pagesBrain Health - 4 July 2023Times MediaNo ratings yet

- Course Focus: Business Accounting & Finance 13 June 2023Document3 pagesCourse Focus: Business Accounting & Finance 13 June 2023Times MediaNo ratings yet

- Postgraduate - 18 April 2023Document3 pagesPostgraduate - 18 April 2023Times MediaNo ratings yet

- Postgraduate - 21 February 2023Document3 pagesPostgraduate - 21 February 2023Times MediaNo ratings yet

- Your Health - 21 March 2023Document4 pagesYour Health - 21 March 2023Times MediaNo ratings yet

- Postgraduate - 21 March 2023Document3 pagesPostgraduate - 21 March 2023Times MediaNo ratings yet

- PG Supplement December 2022Document4 pagesPG Supplement December 2022Sym World Advertising Sdn BhdNo ratings yet

- Postgraduate - 15 November 2022Document4 pagesPostgraduate - 15 November 2022Times MediaNo ratings yet

- Private & International School Guide - 1 November 2022Document4 pagesPrivate & International School Guide - 1 November 2022Times MediaNo ratings yet

- Your Health - 22 November 2022Document8 pagesYour Health - 22 November 2022Times MediaNo ratings yet

- Young & Bright - 6 December 2022Document2 pagesYoung & Bright - 6 December 2022Times MediaNo ratings yet

- World Diabetes Day - 14 November 2022Document4 pagesWorld Diabetes Day - 14 November 2022Times MediaNo ratings yet

- World Stroke Day - 29 October 2022Document3 pagesWorld Stroke Day - 29 October 2022Times MediaNo ratings yet

- Sahodayaterm2bstqpforprint-Set2 11258Document5 pagesSahodayaterm2bstqpforprint-Set2 11258Mridula MishraNo ratings yet

- HBR-investing in A Retirement Plan. Assignment Questions 1. What..Document4 pagesHBR-investing in A Retirement Plan. Assignment Questions 1. What..Sannithi YamsawatNo ratings yet

- PRACTICE Quiz 4 - CFASDocument4 pagesPRACTICE Quiz 4 - CFASLing lingNo ratings yet

- Ratio Analysis Extra QuestionDocument12 pagesRatio Analysis Extra Question4SquadsNo ratings yet

- Assignment 2 - SolutionsDocument3 pagesAssignment 2 - SolutionsEsther LiuNo ratings yet

- Working CapitalDocument6 pagesWorking CapitalSwati KunwarNo ratings yet

- SFM Super 30 TheoryDocument37 pagesSFM Super 30 TheorySahil SharmaNo ratings yet

- T&H Marketing (Final)Document59 pagesT&H Marketing (Final)Jeanna MejoradaNo ratings yet

- AP Handount 01 Cash and Bank Reconciliation PDFDocument8 pagesAP Handount 01 Cash and Bank Reconciliation PDFTherese AlmiraNo ratings yet

- Cash Budget Sums Mcom Sem 4Document14 pagesCash Budget Sums Mcom Sem 4Prachi BhosaleNo ratings yet

- Financial Management Theory and Practice 15th Edition Brigham Solutions ManualDocument36 pagesFinancial Management Theory and Practice 15th Edition Brigham Solutions Manualrappelpotherueo100% (30)

- Chap 5 Prob 1 3Document10 pagesChap 5 Prob 1 3Nyster Ann RebenitoNo ratings yet

- Slides Aymeric KALIFE - Vanilla StrategiesDocument38 pagesSlides Aymeric KALIFE - Vanilla StrategiesSlakeNo ratings yet

- ECO101 PS5 QuestionsDocument2 pagesECO101 PS5 Questionschuyue jinNo ratings yet

- FIN 420 Chapter 3 (Financial Ratio and Analysis)Document20 pagesFIN 420 Chapter 3 (Financial Ratio and Analysis)Damia AlyaNo ratings yet

- Entrep Quarter 3 Week 5 Day 2Document32 pagesEntrep Quarter 3 Week 5 Day 2CeeDyeyNo ratings yet

- SP Xi BSTDocument2 pagesSP Xi BSTAvni JainNo ratings yet

- KKCL - Investor Presentation Q2 & H1FY24Document45 pagesKKCL - Investor Presentation Q2 & H1FY24Variable SeperableNo ratings yet

- Chit FundsDocument1 pageChit FundsDeepanjali DasNo ratings yet

- OECD Economic Outlook - June 2023Document253 pagesOECD Economic Outlook - June 2023Sanjaya AriyawansaNo ratings yet

- Smart Investment 04 February 2024Document90 pagesSmart Investment 04 February 2024mittalashish001No ratings yet

- Access To Finance Presentation On Success Story of NCI FundDocument18 pagesAccess To Finance Presentation On Success Story of NCI FundGeoid AnalyticsNo ratings yet

- Quiz II - Important BankingDocument4 pagesQuiz II - Important BankingHaritika ChhatwalNo ratings yet

- Account StatementDocument14 pagesAccount StatementBude Singh BamniyaNo ratings yet

- Board MeetingDocument2 pagesBoard MeetingNyamat GuronNo ratings yet

- Admin, Hantono Dan Luther Girsang (UNPRI MEDAN)Document12 pagesAdmin, Hantono Dan Luther Girsang (UNPRI MEDAN)arjuna pangalengan2No ratings yet