Professional Documents

Culture Documents

Cacao

Uploaded by

zakaria housniOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cacao

Uploaded by

zakaria housniCopyright:

Available Formats

Cocoa

Price Trends – Production – Forecasts

4th Quarter 2014

Report code: 4WCT10

Xerfi Global Commodity Trends

Contents

Key data 3 Production and usage (2) 7

● Forecast summary ● World Consumption (food)

● World cocoa production and consumption

● World production - consumption (food)

Price forecasts (1) 4

● $ per tonne

● Year on year change Production and usage (3) 8

● Real and nominal data ● Data table

Price forecasts (2) 5 Regional data 9

● Data table ● Cocoa production: major producing countries

● Consumption : major consuming countries

● Main importers of cocoa

● Main exporters of cocoa

● Cocoa production by geographical area in 2013

Production and usage (1) 6

● World cocoa production

● World cocoa production (% change)

● World cocoa production (long period)

Cocoa – Xerfi Global Commodity Trends – 4th Quarter 2014 2

Key data

Price (Spot, New-York) 40%

Unit: annual average change, %

30%

Worl d production fel l nea rl y 4% i n 2013, owi ng to drops i n production i n

Ivory Coa s t a nd Gha na , whi ch a re the top-two produci ng countri es a nd 20%

a ccount for more tha n a ha l f of worl d output. Al though production i s s et

10%

to bounce ba ck i n 2014 (+6% i n our es tima tes ), the worl d ma rket i s

hea ded for a new production defi ci t a nd a further drop i n s tocks , wi th 0%

s trong upwa rd pres s ure on worl d pri ces . Over the l a s t deca de, growi ng

i ncome per ca pi ta i n the emergi ng economi es ha s res ul ted i n hi gher -10%

dema nd for chocol a te products i n thes e countri es , whi l e i n the

-20%

i ndus tri a l i s ed countri es cons umption ha s moved towa rd chocol a te wi th

a hi gher cocoa content. As a cons equence, the gl oba l s uppl y of cocoa -30%

ha s not kept up wi th dema nd duri ng the pa s t deca de, except i n 2011-

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

2012, when production s ubs tantia l l y outwei ghed cons umption.

2008 2009 2010 2011 2012 2013 2014 2015

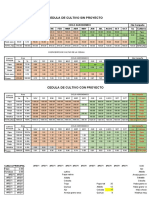

Production (thsd tonnes)

Worl d cocoa production 3,737 3,592 3,634 4,309 4,085 3,929 4,162 4,100

% change -3.9% 1.2% 18.6% -5.2% -3.8% 5.9% -1.5%

Consumption (thsd tonnes)

Worl d Cons umption (food) 3,775 3,537 3,737 3,938 3,957 4,083 4,195 4,300

% cha nge -6.3% 5.7% 5.4% 0.5% 3.2% 2.7% 2.5%

Cocoa production - cons umption (food) -38 55 -103 371 128 -154 -33 -200

Stocks (thsd tonnes, end of season)

Worl d s tocks 1,538 1,557 1,418 1,746 1,833 1,640 1,565 1,365

Prices ($/t)

Cocoa 2,557 2,794 2,947 2,924 2,347 2,403 3,033 3,104

% cha nge 9.3% 5.5% -0.8% -19.7% 2.4% 26.2% 2.3%

Sources : World Bank, United Nations Commodity Trade, Food and Agricultural Organization of United Nations, ICCO, Xerfi Global forecasts

Cocoa data (except for prices) are on October-September years through: 2014 stands for October 2013 / September 2014

Cocoa – Xerfi Global Commodity Trends – 4th Quarter 2014 3

Price forecasts (1)

Price 3,500

Unit: $/t

3,000

2,500

Cocoa pri ces os ci l l a ted between 900 a nd 1,600 USD/t from 1990 to 2001

a nd ha ve proved s trong ever s i nce, s oa ri ng a t a very fa s t pa ce i n 2007 2,000

a nd 2008. Si nce 2009, pri ces ha ve os ci l l a ted a t very hi gh l evel s . After 1,500

pea ki ng a t a new a l l time record i n Februa ry 2011 (a t 3,448 USD/t), pri ces 1,000

fi na l l y s ubs i ded a nd fel l s ha rpl y i n 2011. Si nce 2013, worl d pri ces ha ve 500

fol l owed a n upwa rd trend a ga i n, i n the context of a n i ncrea s i ng 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16

production defi ci t due to production s hortages i n Wes t Afri ca .

Price 80%

Unit : year on year 3 month moving average change (%) 60%

40%

Ri s i ng dema nd, s pecul a tion a nd tight s uppl y a ccount for much of the 20%

doubl e-di gi t growth ra tes of cocoa pri ces obs erved between 2007 a nd 0%

the s econd qua rter of 2008. Unl i ke other commodi ties , cocoa pri ces di d -20%

not col l a ps e i n 2009 a nd a new s trong upwa rd trend s tarted a t the end -40%

of 2009. After bei ng nega tive for a l a rge pa rt of 2011-2012, yea r-on-yea r -60%

i nfl a tion ha s turned pos i tive a ga i n s i nce mi d-2013 a nd thi s trend ha s Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16

continued throughout 2014, due to a further decrea s e i n worl d s tocks .

Nominal price 500

Nominal price Real price

Unit: 100 = 2000

400

The pri ce of cocoa ha s been mul tipl i ed by a l mos t four a t current pri ces 300

a nd by 2.8 i n rea l terms (i .e. taki ng i nto a ccount i nfl a tion) s i nce 2000.

However, one mus t note tha t i t a tta i ned a hi s tori ca l mi ni mum i n 2000. 200

After pea ki ng a t a hi s tori ca l record i n 2010, i t dropped i n 2011-2012, i n

100

the context of s l owi ng dema nd for chocol a te products i n i ndus tri a l i s ed

countri es a nd growi ng production ca pa ci ties i n the producer countri es . A 0

new upwa rd trend s tarted i n 2013 a nd ha s ga i ned momentum i n 2014. 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15

Cocoa – Xerfi Global Commodity Trends – 4th Quarter 2014 4

Price forecasts (2)

Spot pri ce Qua terl y cha nge, % YoY cha nge % Spot pri ce Qua terl y cha nge, % YoY cha nge %

03-04 1,528 03-10 3,086 -5.3% 20.6%

06-04 1,371 -10.3% 06-10 2,986 -3.2% 19.6%

09-04 1,552 13.2% 09-10 2,861 -4.2% -0.1%

12-04 1,565 0.9% 12-10 2,855 -0.2% -12.4%

03-05 1,604 2.5% 5.0% 03-11 3,303 15.7% 7.0%

06-05 1,479 -7.8% 7.9% 06-11 3,044 -7.8% 1.9%

09-05 1,405 -5.1% -9.5% 09-11 2,968 -2.5% 3.7%

12-05 1,406 0.1% -10.2% 12-11 2,382 -19.8% -16.6%

03-06 1,489 5.9% -7.2% 03-12 2,306 -3.2% -30.2%

06-06 1,500 0.8% 1.4% 06-12 2,217 -3.9% -27.2%

09-06 1,512 0.8% 7.7% 09-12 2,444 10.2% -17.7%

12-06 1,508 -0.3% 7.3% 12-12 2,422 -0.9% 1.7%

03-07 1,720 14.1% 15.5% 03-13 2,174 -10.3% -5.7%

06-07 1,904 10.7% 26.9% 06-13 2,278 4.8% 2.7%

09-07 1,937 1.7% 28.1% 09-13 2,425 6.5% -0.8%

12-07 1,972 1.8% 30.8% 12-13 2,735 12.8% 12.9%

03-08 2,416 22.5% 40.5% 03-14 2,882 5.4% 32.6%

06-08 2,770 14.7% 45.5% 06-14 3,004 4.3% 31.9%

09-08 2,789 0.7% 44.0% 09-14 3,181 5.9% 31.2%

12-08 2,252 -19.3% 14.2% 12-14 3,066 -3.6% 12.1%

03-09 2,559 13.7% 5.9% 03-15 3,081 0.5% 6.9%

06-09 2,497 -2.4% -9.9% 06-15 3,096 0.5% 3.1%

09-09 2,864 14.7% 2.7% 09-15 3,111 0.5% -2.2%

12-09 3,258 13.8% 44.7% 12-15 3,126 0.5% 2.0%

Sources: Xerfi Global forecasts, INSEE, Feri, latest figures Q3 2014

Cocoa – Xerfi Global Commodity Trends – 4th Quarter 2014 5

Production and usage (1)

World cocoa production 5,000

Unit: thousand tonnes

4,000

World cocoa production increased by 17% between 2004 and 2014 (year ended in 3,000

September 2014), in a context of rising demand for cocoa-based food, resulting in

2,000

increasing demand for cocoa powder. Mostly grown in tropical countries such as

Ivory Coast, Ghana, Nigeria and Indonesia, cocoa production has been rather 1,000

unstable since 2007, alternating years of strong and poor production. After a strong

hike in 2011, world output dropped in 2012-2013, due to a decrease in fertiliser 0

usage in Ivory Coast and Ghana, which reduced yields and production. 04 05 06 07 08 09 10 11 12 13 14 15

World cocoa production (% change) 20%

Unit: %, change

10%

Worl d cocoa production ha s been fa i rl y fl uctua ting over the cours e of

the l a s t ten yea rs mos tly due to cl i ma tic fa ctors . After a s tagna tion i n 0%

2010, worl d output bounced ba ck s trongl y i n 2011, tha nks to a record

ha rves t i n Gha na due to exceptiona l wea ther condi tions (a nd des pi te -10%

pol i tica l i ns tabi l i ty i n Ivory Coa s t). Worl d output fel l for two yea rs i n a

row i n 2012-2013, due to ba d wea ther condi tions a cros s the Wes t Afri ca n

-20%

cocoa bel t a nd l ower yi el ds due to a drop i n fertil i s er us a ge i n Afri ca . 04 05 06 07 08 09 10 11 12 13 14 15

World cocoa production (long period) 5,000

Unit: thousand tonnes

4,000

3,000

Si nce the ea rl y 2000s , cocoa production growth ha s been dri ven by ri s i ng

dema nd for chocol a te confectionery a nd products contai ni ng cocoa 2,000

powder (s uch a s i ce crea m) i n the emergi ng ma rkets . The i ncrea s ed us e 1,000

of fertil i s ers a nd the i ntroduction of hi gher yi el d trees ha ve res ul ted i n

hi gher outputs until 2011, but thi s pos i tive trend revers ed i n 2012, a s a 0

drop i n worl d pri ce forced ma ny fa rmers to reduce the us e of fertil i s ers . 1985 1990 1995 2000 2005 2010 2015

Cocoa – Xerfi Global Commodity Trends – 4th Quarter 2014 6

Production and usage (2)

World Consumption (food) 5,000

Unit: thousand tonnes

4,000

Worl d cocoa cons umption fel l by 6% i n 2009 i n the context of fa l l i ng 3,000

cons umer s pendi ng i n a dva nced economi es but the genera l upwa rd

2,000

trend obs erved between 2001 a nd 2008 res umed i n 2010-2011. In 2012

cons umption growth s l owed down s ha rpl y (+0.5%). Hi ghl y el a s tic to 1,000

i ncome, dema nd for chocol a te products wa s a ffected by s l owi ng GDP

growth a l l a cros s the worl d. However, cons umption ha s a ccel era ted

0

a ga i n s i nce 2013 a nd i s s et to rea ch 4.2 mi l l i on tons i n 2014. 04 05 06 07 08 09 10 11 12 13 14 15

World cocoa production and consumption 5,000

Unit: thousand tonnes Consumption (food) Production

4,000

3,000

Total output outpa ced cons umption i n 2011-2012, when the output

s urpl us wa s of nea rl y 500,000 tonnes over two yea rs . Thi s trend wa s 2,000

revers ed i n 2013 due to fa s ter growth i n cons umption tha n i n production 1,000

a nd a new production defi ci t wi l l be obs erved i n 2014, a ccordi ng to our

es tima tes . 0

04 05 06 07 08 09 10 11 12 13 14 15

World production - consumption (food) 600

Unit: thousand tonnes

400

Si nce 2000, worl d cons umption ha ve s i gni fi ca ntly outs tri pped production 200

onl y four times , i n 2001, 2007, 2010 a nd 2013, whi l e production s urpl us es

0

ha ve ra ther been the norm. The production s urpl us rea ched a record

l evel i n 2011, a t 374,000 tonnes , a ccounting for nea rl y 10% of worl d -200

production. It decrea s ed s ha rpl y i n 2012 (to 124,000 tonnes ) a nd turned

to a defi ci t i n 2013, a s production col l a ps ed whi l e cons umption kept

-400

i ncrea s i ng. A new defi ci t i s foreca s t i n 2014. 04 05 06 07 08 09 10 11 12 13 14 15

Cocoa – Xerfi Global Commodity Trends – 4th Quarter 2014 7

Production and usage (3)

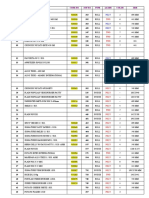

Cocoa

Worl d

Worl d cocoa production -

Cha nge Cha nge (%) Cons umption Cha nge Cha nge (%)

production cons umption

(food)

(food)

1986 2,079 1,954 125

1987 2,016 -64 -3.1% 2,020 66 3.4% -5

1988 2,519 504 25.0% 2,049 29 1.4% 470

1989 2,587 68 2.7% 2,273 224 10.9% 315

1990 2,487 -100 -3.9% 2,323 51 2.2% 164

1991 2,495 8 0.3% 2,453 130 5.6% 42

1992 2,636 141 5.6% 2,463 10 0.4% 172

1993 2,635 -1 0.0% 2,509 45 1.8% 126

1994 2,638 3 0.1% 2,596 87 3.5% 42

1995 2,958 320 12.1% 2,636 41 1.6% 321

1996 3,205 247 8.3% 2,853 216 8.2% 352

1997 2,971 -234 -7.3% 2,793 -60 -2.1% 178

1998 3,276 305 10.3% 2,917 125 4.5% 358

1999 2,934 -341 -10.4% 2,920 3 0.1% 14

2000 3,372 438 14.9% 3,141 221 7.6% 231

2001 2,865 -507 -15.0% 3,008 -133 -4.2% -143

2002 2,877 12 0.4% 2,886 -122 -4.0% -9

2003 3,179 302 10.5% 3,077 191 6.6% 102

2004 3,548 369 11.6% 3,237 160 5.2% 311

2005 3,378 -170 -4.8% 3,382 145 4.5% -4

2006 3,808 430 12.7% 3,522 140 4.1% 286

2007 3,430 -378 -9.9% 3,675 153 4.3% -245

2008 3,737 307 9.0% 3,775 100 2.7% -38

2009 3,592 -145 -3.9% 3,537 -238 -6.3% 55

2010 3,634 42 1.2% 3,737 200 5.7% -103

2011 4,309 675 18.6% 3,938 201 5.4% 371

2012 4,085 -224 -5.2% 3,957 19 0.5% 128

2013 3,929 -156 -3.8% 4,083 126 3.2% -154

2014 4,162 233 5.9% 4,195 112 2.7% -33

2015 4,100 -62 -1.5% 4,300 105 2.5% -200

Cocoa – Xerfi Global Commodity Trends – 4th Quarter 2014 8

Regional data

Cocoa production: major producing countries

Unit: % of world production

Cameroon 5.7%

2013

Nigeria 5.7% 2005

Indonesia 10.7%

Ghana 21.2%

Ivory Coast 36.8%

0% 10% 20% 30% 40%

Consumption : major consuming countries Main exporters of cocoa

Unit: % of world consumption Unit: % of world exports

Malaysia 7.2% Indonesia 5.3%

2013 2012

Germany 9.8% 2005 Cameroon 5.4% 2007

USA 10.1% Nigeria 6.9%

Ivory Coast 11.6% Ghana 19.1%

Netherlands 13.1% Côte d'Ivoire 36.7%

0% 5% 10% 15% 0% 10% 20% 30% 40%

Main importers of cocoa Cocoa production by geographical area in 2013

Unit: % of world imports Unit : % of world production

France 6.5%

2012 America 16.2%

Germany 11.1% 2007

Malaysia 11.2% Asia & Oceania 12.1%

United States of America 13.5%

21.1% Africa 71.7%

Netherlands

0% 5% 10% 15% 20% 25% 0% 20% 40% 60% 80%

Cocoa – Xerfi Global Commodity Trends – 4th Quarter 2014 9

You might also like

- Silicon Carbide Solid & Grains & Powders & Flour Abrasives World Summary: Market Sector Values & Financials by CountryFrom EverandSilicon Carbide Solid & Grains & Powders & Flour Abrasives World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Mining in Africa: Regulation and DevelopmentFrom EverandMining in Africa: Regulation and DevelopmentBonnie CampbellNo ratings yet

- 2 Pengeluaran Koko Di Malaysia PDFDocument72 pages2 Pengeluaran Koko Di Malaysia PDFHakimEngineerEmasNo ratings yet

- Baking PowderDocument29 pagesBaking PowderTed Habtu Mamo AsratNo ratings yet

- MargarineDocument25 pagesMargarineyenealem AbebeNo ratings yet

- Baking PowderDocument26 pagesBaking PowderTamene MatewosNo ratings yet

- 7.oat FlakesDocument18 pages7.oat FlakesMelakuaccessNo ratings yet

- Coff. RoastingDocument31 pagesCoff. Roastingyenealem Abebe100% (1)

- Peanut Products Profile-FDocument27 pagesPeanut Products Profile-Fyenealem AbebeNo ratings yet

- Chewing Gum, Chocolate and Hard CandyDocument30 pagesChewing Gum, Chocolate and Hard CandyNatnaelNo ratings yet

- 6 Sugar - FinalDocument28 pages6 Sugar - FinalMinerva RodríguezNo ratings yet

- Chewing Gum, Chocolate and Hard CandyDocument30 pagesChewing Gum, Chocolate and Hard Candyyenealem AbebeNo ratings yet

- Poultry Management LectureDocument117 pagesPoultry Management LectureMourad DerbalNo ratings yet

- I8683en PDFDocument6 pagesI8683en PDFLinko PamNo ratings yet

- Jam MarmaladeDocument28 pagesJam MarmaladeShishir Kumar Singh100% (1)

- World: Bananas - Market Report. Analysis and Forecast To 2020Document8 pagesWorld: Bananas - Market Report. Analysis and Forecast To 2020IndexBox MarketingNo ratings yet

- Composite FLourDocument27 pagesComposite FLouryenealem AbebeNo ratings yet

- Profile On The Production of BiscuitDocument27 pagesProfile On The Production of BiscuitTed Habtu Mamo AsratNo ratings yet

- Global Commodity Markets 2010 CocoaDocument1 pageGlobal Commodity Markets 2010 CocoaLe DembusNo ratings yet

- Detergent PowderDocument27 pagesDetergent PowderHabtu AsratNo ratings yet

- Jam & MarmaladeDocument29 pagesJam & Marmaladeyenealem AbebeNo ratings yet

- Dairy Prod.Document29 pagesDairy Prod.yenealem Abebe100% (1)

- Sector of Dry Pasta: Business ManagementDocument46 pagesSector of Dry Pasta: Business ManagementMuhammad Noman MehboobNo ratings yet

- Indian Edible Oils Demand & Supply and Outlook For 2016-17: Govindbhai G. PatelDocument21 pagesIndian Edible Oils Demand & Supply and Outlook For 2016-17: Govindbhai G. PatelMohanapriya JayakumarNo ratings yet

- Report Writing Saudia - Imdad AliDocument10 pagesReport Writing Saudia - Imdad AliHassan KhanNo ratings yet

- Strategic Issues in The Duterte Administration: Eliseo R. Ponce Arlene B. InocencioDocument58 pagesStrategic Issues in The Duterte Administration: Eliseo R. Ponce Arlene B. InocencioMaricel CalejaNo ratings yet

- Economy of MauritaniaDocument7 pagesEconomy of Mauritaniaabdul sorathiyaNo ratings yet

- World: Avocados - Market Report. Analysis and Forecast To 2020Document7 pagesWorld: Avocados - Market Report. Analysis and Forecast To 2020IndexBox Marketing100% (1)

- Project Profile On The Establishment of Commercial Starch Producing Plant Promoter: Dagnachew Kassahun Tel: 0918353443Document34 pagesProject Profile On The Establishment of Commercial Starch Producing Plant Promoter: Dagnachew Kassahun Tel: 0918353443Rass Getachew100% (1)

- Five-Year Baseline Projections of Supply and Demand For Wheat, Maize (Corn), Rice and Soyabeans To 2023/24Document32 pagesFive-Year Baseline Projections of Supply and Demand For Wheat, Maize (Corn), Rice and Soyabeans To 2023/24Leticia AssencioNo ratings yet

- Sugarcane Crisis of Uttar Pradesh: 2013: Economic Survey of IndiaDocument28 pagesSugarcane Crisis of Uttar Pradesh: 2013: Economic Survey of IndiaAishwarya RaoNo ratings yet

- Macaroni and SpagheriDocument29 pagesMacaroni and Spagheriyenealem AbebeNo ratings yet

- Corn Flakes Producing PlantDocument28 pagesCorn Flakes Producing PlantLakew100% (1)

- Ciptadana Company Update ROTI 5 Mar 2024 - Not RatedDocument7 pagesCiptadana Company Update ROTI 5 Mar 2024 - Not RatedCandra AdyastaNo ratings yet

- Los Precursores de Aromas Específicos de Cacao Se Generan Mediante Digestión Proteolítica de La Vicilina Como Globulina de Semillas de CacaoDocument35 pagesLos Precursores de Aromas Específicos de Cacao Se Generan Mediante Digestión Proteolítica de La Vicilina Como Globulina de Semillas de CacaoJulio Cesar Torres PereyraNo ratings yet

- Processing AND Packaging Food IndustryDocument40 pagesProcessing AND Packaging Food IndustryrahulnavetNo ratings yet

- FSR Calamansi Nov112009 NoTCDocument19 pagesFSR Calamansi Nov112009 NoTCUlysses J. Lustria Jr.100% (6)

- Market Intelligence Report Soya Beans Issue 4 of 2022Document28 pagesMarket Intelligence Report Soya Beans Issue 4 of 2022Oudano MomveNo ratings yet

- Peng GB4e PPT ch05Document38 pagesPeng GB4e PPT ch05GeddsueNo ratings yet

- World Dairy Forum 2008 Porto 17 10 2008Document22 pagesWorld Dairy Forum 2008 Porto 17 10 2008Stela SilvaNo ratings yet

- Policy Very IMPORTDocument6 pagesPolicy Very IMPORTAndré SinelaNo ratings yet

- Release of ICSG 2012 Statistical YearbookDocument1 pageRelease of ICSG 2012 Statistical YearbookashleyNo ratings yet

- India Sugar SectorDocument4 pagesIndia Sugar SectorsonysajanNo ratings yet

- Baby FoodDocument27 pagesBaby FoodFekadie TesfaNo ratings yet

- ClineDocument19 pagesClineerkanaydoganogluNo ratings yet

- Animal FeedDocument27 pagesAnimal FeedYem Ane100% (1)

- CommodityMonitor Monthly Jan2013Document10 pagesCommodityMonitor Monthly Jan2013krishnaNo ratings yet

- Food Processing Ingredients - Hanoi - Vietnam - 1-25-2015 PDFDocument52 pagesFood Processing Ingredients - Hanoi - Vietnam - 1-25-2015 PDFTalent AndrewNo ratings yet

- The Future of Global Sugar Markets Policies ReformDocument100 pagesThe Future of Global Sugar Markets Policies ReformAndrés Felipe OspinaNo ratings yet

- Trends in Production and Export of Lentils in EthiopiaDocument6 pagesTrends in Production and Export of Lentils in EthiopiaPremier PublishersNo ratings yet

- Sugar Industry of PakistanDocument30 pagesSugar Industry of Pakistanadnaneconomist100% (9)

- Spices ProcessingDocument28 pagesSpices Processingyenealem Abebe100% (1)

- Agro Chems Indian Agrochemical IndustryDocument42 pagesAgro Chems Indian Agrochemical Industryapi-383389367% (3)

- Profile On The Production of Sodium Silicate PDFDocument27 pagesProfile On The Production of Sodium Silicate PDFNebiyu Samuel100% (1)

- Ugc Net: General Paper On Teaching & Research AptitudeDocument6 pagesUgc Net: General Paper On Teaching & Research AptitudeAkarshika pandeyNo ratings yet

- DR G RaviprasadDocument14 pagesDR G RaviprasadRavi RajaniNo ratings yet

- Industry Study CacaoDocument27 pagesIndustry Study CacaoG Ant Mgd100% (1)

- Industry-Study Cacao PDFDocument27 pagesIndustry-Study Cacao PDFSila FelixNo ratings yet

- Pulp and Paper Sector SummitDocument82 pagesPulp and Paper Sector SummitKhiz1No ratings yet

- Food Outlook: Biannual Report on Global Food Markets: June 2022From EverandFood Outlook: Biannual Report on Global Food Markets: June 2022No ratings yet

- Couch Potatoes ScriptDocument4 pagesCouch Potatoes ScriptMadeleine GrossiNo ratings yet

- Raz lc43 MashpotatoesDocument12 pagesRaz lc43 MashpotatoesThái TrươngNo ratings yet

- Atlantic 2021 CCN ResultsDocument74 pagesAtlantic 2021 CCN ResultsGina SolorzanoNo ratings yet

- KelloggDocument2 pagesKelloggIZANNo ratings yet

- Variedades Oficiales de La Papa Del CIP: Generated From CIP/'s Online Catalog SystemDocument64 pagesVariedades Oficiales de La Papa Del CIP: Generated From CIP/'s Online Catalog SystemRaul Eloy Fierro YarangoNo ratings yet

- Cedula de CultivoDocument14 pagesCedula de CultivoZosimo ZarateNo ratings yet

- Gimme That Instructions 2022Document2 pagesGimme That Instructions 2022Kaye MatiasNo ratings yet

- Itc Vs Frito LayDocument309 pagesItc Vs Frito LayDeepak sahNo ratings yet

- Portable Mesin Pemotong Kentang OtomatisDocument10 pagesPortable Mesin Pemotong Kentang OtomatisSlamet WidodoNo ratings yet

- Pringles: Invented by Fredric Baur & Alexander LiepaDocument8 pagesPringles: Invented by Fredric Baur & Alexander LiepaRăzvan FlorescuNo ratings yet

- Mazetti Sustainability Report 1:4 2022Document24 pagesMazetti Sustainability Report 1:4 2022Rich BogrenNo ratings yet

- Pengaruh Suhu Penyimpanan Dan Pengkondisian Kembali TERHADAP KUALITAS UMBI KENTANG (Solanum Tuberosum Linn) Sebagai Bahan Baku Potato ChipsDocument37 pagesPengaruh Suhu Penyimpanan Dan Pengkondisian Kembali TERHADAP KUALITAS UMBI KENTANG (Solanum Tuberosum Linn) Sebagai Bahan Baku Potato ChipsNurfitria Resta OktavianiNo ratings yet

- Potato Varieties List 2020Document2 pagesPotato Varieties List 2020Nottingham GardenersNo ratings yet

- POly Code ListDocument3 pagesPOly Code ListddkatochNo ratings yet

- Planogram Feb 2020 Snacks - Additional 1ge (Peninsular Malaysia) - Snacks 1geDocument2 pagesPlanogram Feb 2020 Snacks - Additional 1ge (Peninsular Malaysia) - Snacks 1geNazmi Nur AfifahNo ratings yet

- Datasur: DIA MES ANO Aduana Numero de Aceptacion RUT Digito Verificador Rut ImportadorDocument32 pagesDatasur: DIA MES ANO Aduana Numero de Aceptacion RUT Digito Verificador Rut ImportadorJaime HidalgoNo ratings yet

- Macmillan Education Student - Influence L3 - Student's BookDocument1 pageMacmillan Education Student - Influence L3 - Student's BookVolandovoy volandovengoNo ratings yet

- 1898-Article Text-6336-1-10-20220331Document5 pages1898-Article Text-6336-1-10-20220331Widyawan Jaka PNo ratings yet

- Potato Vales EverestDocument1 pagePotato Vales EverestBoulos NassarNo ratings yet

- Quinoa International Directory Eng 2021Document89 pagesQuinoa International Directory Eng 2021Ricardo Rodriguez100% (3)

- Mahamegha - Return From The HellDocument4 pagesMahamegha - Return From The HellshrawakadaruwooNo ratings yet