Professional Documents

Culture Documents

Guideance IT 2022-23

Uploaded by

Pramod SakriOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Guideance IT 2022-23

Uploaded by

Pramod SakriCopyright:

Available Formats

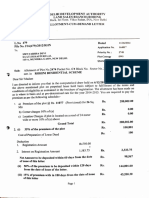

A Brief Guidance on Various Tax Savings Investments for FY 2022-23

The Old tax regime

Deductions unders section 10(13A)

In whose name

Sl No. Category Maximum Limit document can be Documents Required Qualifying Exemption

submitted

Rent Receipt should contain

a) Rent paid for the period

b) Name and signature of landlord

► Actual HRA Earned

c) Complete address of the property

► Rent paid in excess of

Recent 2 months Rent Recepts in ORIGINAL. d) PAN card copy of Landlord is Mandatory if rental

10% Basic Salary

Copy of the Rental Agreement is mandatory, in amount exeed Rs.8,333/- PM

1 House Rent Allowance ►40% or 50% of Basic Self

case the rent paid is Rs. 20,000/- above per Note: 1) Rent Receipts without the name and address of

(Incase of Metro Cities)

month. the owner will be rejected.

Least of the above is

2) If there is a change in the rent paid amount, then

Exempt

additional one rent receipts for each change is required.

3) Photocopy of rent receipts are not considered as

valid proof. Sample rent receipt format is enclosed.

Deductions under section 10 ( Leave Travel Allowance)

In whose name

Sl No. Category Maximum Limit document can be Documents Required Qualifying Exemption

submitted

a) Flight Tickets should be supported by the Boarding Pass.

Tickets without boarding pass will not be considered.

b) Employee should be part of the travel.

c) In case of travel by Taxi - Fare equivalent to the First

Leave Travel Allowance Exemption Self,Spouse,Children &

1 Actuals Original Travel Tickets along with LTA declaration class a/c train fare for the distance of the journey by the

(Domestic travel only) Dependents

shortest route only will be considered as exemption.

d) This exemption is limited to the actual expenses incurred

on the journey which inturn is strictly limited to expenses on

air fare, rail fare and bus fare only.

Deductions unders section 80C

(Maximum Deduction capped to Rs.1.50 Lakh inclusive of PF)

In whose name

Sl No. Category Maximum Limit document can be Documents Required Qualifying Exemption

submitted

Photocopy of Premium Paid receipt along with

(a) Late payment fees will not be considered. (b)

1 Life Insurance Premium (LIC) Self,Spouse,Children Insurance policy Annexure attached. (Format

Policy from any approved company by IRDA.

Attached)

Contribution towards 15 Years Public (a) PPF Account can be in the name of Individual / Spouse

2 Self,Spouse,Children Photocopy of Pass Book & Deposit Receipt

Provident Fund (PPF) / Children.

Subscription to National Saving

3 Self Photocopy of NSC (a) NSC Certficate can be in the name of Individual..

Certificates (NSC)

(a) Only amount mentioned as "Tuition fee" in the fee

Receipt will be considered for deduction. (b)

Donations, Capitation fees, Uniform fee, Sports fee & Bus

4 Children Education Tuition Fees Children Photocopy of receipt of fees paid

fee etc., are not allowed for deduction. (c)

Children Tuition fees paid receipts restricted to a max of 2

Rs.150,000/- children

Equity Linked Saving Scheme (Tax

5 Self Photocopy of receipt of amount paid

Saving Mutual Fund) ELSS

Tax Saving Fixed Deposit of 5 Years (a) Term Deposit for a minimum period of 5 years with a

6 Self Photocopy of Deposit Receipt

with Scheduled Bank (FD) scheduled bank are eligible for deduction

7 ULIP Self,Spouse,Children Photocopy of receipt of amount paid

8 Pension Policy (80CCC) Self Photocopy of Premium Paid receipt

a) Any of the parents of the girl child.

b) Any legal guardian, in case of parents not able to

9 Sukanya Samruddi Daughter's The Pass book from Bank or Post Ofiice contribute or parents not alive anymore.

c) Only one person contributing to Sukanya Samriddhi

Account can claim tax exemptions under the scheme.

10 NPS 80 CCD(1B) Rs.50,000/- Self Copy of NPS passbooks & Statement (a) NPS Account can be in the name of Individual.

Deductions unders section 80D to 80U

In whose name

Sl No. Category Maximum Limit document can be Documents Required Qualifying Exemption

submitted

a) Limited to Rs.25000/- In case of Individual, Spouse & Children.

b) Limited to Rs.50000/- In case of Individual, Spouse, Children

Self,Spouse,Children &

1 Mediclaim Insurance Premium - 80D Rs.75,000/- Copy of Premium Receipt and parents below 60 years.

Parents c) Limited to Rs.75000/- In case of Individual, Spouse, Children

and any one parent above 60 years

Photocopy of certificate (Form - 10-IA) issued by No benefit if disability is < 40%

Medical Treatment of a dependent Spouse,Children &

2 Rs.125,000 /- the competent medical authority in a Government Rs.75000/- if disability is >= 40% & <80%

with disability - 80DD Dependents Rs.125000/- if disability is >= 80%

Hospital specifying the % of disability

Deduction in respect of medical Photocopy of certificate (Form - 10-I) issued by (1) The deduction allowed is equal to the amount actually

Self,Spouse,Children &

3 treatment - 80DDB for speicified Rs.1,00,000/- the competent medical authority in a Government paid or Rs. 40,000 whichever is less. Incase of Senior

Dependents

ailments Hospital specifying the % of disability Citizens Rs. 1,00,000/-.

a) No benefit if disability is < 40%

Rs.75,000/- if disability is > 40% & <=80% Rs.125,000/- if

disability is >80%. b)

Photocopy of certificate (Form - 10-IA) issued by Certificate issued from a government doctor (who is a

Deductions in respect of a person with

4 Rs.125,000/- Self the competent medical authority in a Government physician, a surgeon, an oculist or a psychiatrist)

disability - Section 80U

Hospital specifying the % of disability which is issued in FY-2021-22 in the Form 10-IA format is

required to be submitted. If the certificate date is before

the beginning of this financial year then the exemption will

not be given.

Provisional certificate pertaining to current

a) Interest paid for the first 8 years on loans taken for

Interest on loan taken for higher financial year only (Apr ’22 – Mar ’23) from the

5 No Capping of maximum limit Self,Spouse &Children Higher Education such as

education - Section 80E Bank / Financial Institution specifying Break up of

Engineering/Medical/Mgt/Graduate

principle and interest paid

a) Should not own any other house property on the date of

the sanction of a loan. b) Stamp

Provisional certificate pertaining to current

duty value of the house property should be Rs 45 lakhs or

Interest paid on home loan for financial year only (Apr ’22 – Mar ’23) from the

6 Rs.1,50,000/- Self less. c)The

affordable housing - 80EEA Bank / Financial Institution specifying Break up of

taxpayer should be a first-time home buyer. The taxpayer

principle and interest paid

should not own any residential house property as on the

date of sanction of the loan.

a) The loan must be sanctioned anytime during the period

Provisional certificate pertaining to current starting from 1 April 2021. b)

Interest paid on loan taken for the

financial year only (Apr ’22 – Mar ’23) from the ‘Electric Vehicle’ here means a vehicle which is powered

7 purchase of electric vehicle (Auto Rs.1,50,000/- Self

Bank / Financial Institution specifying Break up of exclusively by an electric motor whose transaction energy

Loan) - 80EEB

principle and interest paid is supplied exclusively by transaction battery installed in the

vehicle and has an electric regenerative braking system.

Interest on Borrowed Capital for Computation of Income From House Property [Section 24(b)]

In whose name

Sl No. Category Maximum Limit document can be Documents Required Qualifying Exemption

submitted

a) Provisional certificate with breakup of interest a) Provisional certificate pertaining to current financial year

and principle from the Housing Finance Company (April 2022 to March 2023)

/ Bank. b) Pre-EMI interest (EMI paid before occupation of the

Loss on Self-Occupied house property (b) In case of Joint loan, declaration specifying house) is deductible in 5 equal installments starting from

1 Self

(Housing loan interest) Capped to a maximum of the % of benefit claimed by the individual.(Format the year when the construction is completed or property is

Rs.2,00,000/- only i.e. Total Attached) c) acquired. c)

amount allowed for a PAN of loan lender / bank is mandatory to furnish Interest and Pre EMI-Interest can be claimed only if the

property (Self & Let out to claim the housing loan benefit property has been occupied before 31st March, 2023;

both together) is (a) Provisional certificate pertaining to current

Rs.2,00,000/- financial year (Apr ’22 – Mar ’23) with breakup of

interest and principle from the Housing Finance a) If the premises is left vacant/occupied by family, as per

Loss / Income on Let out House

2 Self Company / Bank. Section 23(1)

Property (Housing loan interest)

(b) Form 12C - Format Attached (b) Notional rent to be taken as municipal valuation.

(c) Computation of Loss/Income as per rule is

mandatory. Calculation Template is attached.

Income Tax Slabs for FY 2022-2023 (old tax regime)

Income Slab Tax Rate

Upto Rs.2,50,000 NIL

Rs.2,50,001 to 5,00,000 5%

Rs.500,001 to 10,00,000 20%

Rs.10,00,001 and above 30%

1. Rebate under section 87A - Net taxable income does not exceed Rs. 5,00,000) can

avail rebate under section 87A. The amount of rebate is 100 percent of income-tax or Rs. 12,500,

whichever is less.

2. Secondary & Higher Education cess at 4% will be added on above mentioned TDS amount.

3) Surcharge: 10% If taxable income > Rs.50 Lakhs, 15% If taxable Income > 1 Crore, 25% If

taxable Income 2 Crore, 37% If taxable Income >5 Crore.

New tax regime

When you choose the New Tax Regime, you will have to forgo some exemptions [such as Leave Travel Allowance (LTA), House Rent Allowance (HRA), etc] and deductions available under chapter VI A of the Act

that grant deductions under Section 80 [such as 80C, 80CCC, 80CCD, 80D, 80DD, 80E, 80EE, 80G, 80GG, 80GGA, 80GGC, etc]. Even the Standard Deduction under Section 16 [which is currently Rs 50,000] available

to salaried individuals and the deduction on home loan interest, under Section 24(b) will be disallowed. Around 70 exemptions and deductions have been removed in the New Tax Regime.

Income Tax Slabs for FY 2022-2023 (New Tax Regime)

Income Slab Tax Rate

Upto Rs.2,50,000 NIL

Rs.2,50,001 to 5,00,000 5%

Rs.500,001 to 7,50,000 10%

Rs.7,50,001 to 10,00,000 15%

Rs.10,00,001 to 12,50,000 20%

Rs.12,50,001 to 15,00,000 25%

Rs.15,00,001 and above 30%

1. Rebate under section 87A - Net taxable income does not exceed Rs. 5,00,000 can

avail rebate under section 87A. The amount of rebate is 100 percent of income-tax or Rs. 12,500,

whichever is less.

2. Secondary & Higher Education cess at 4% will be added on above mentioned TDS amount.

3) Surcharge: 10% If taxable income > Rs.50 Lakhs, 15% If taxable Income > 1 Crore, 25% If

taxable Income 2 Crore, 37% If taxable Income >5 Crore.

You might also like

- Letter of Intent To Rent/AcceptanceDocument3 pagesLetter of Intent To Rent/Acceptancesambasivamme100% (3)

- 27S NotesDocument12 pages27S NotesPramod SakriNo ratings yet

- American Tax Resisters (Romain D. Huret)Document381 pagesAmerican Tax Resisters (Romain D. Huret)punktlichNo ratings yet

- ReSA B42 TAX Final PB Exam Questions Answers Solutions PDFDocument17 pagesReSA B42 TAX Final PB Exam Questions Answers Solutions PDFNamnam KimNo ratings yet

- Lease - Lessee's Perspective: Lecture NotesDocument9 pagesLease - Lessee's Perspective: Lecture NotesDonise Ronadel SantosNo ratings yet

- INTERNSHIP REPORT On FBR For JawadDocument40 pagesINTERNSHIP REPORT On FBR For JawadJawad Ahmad100% (1)

- Cir Vs Boac 149 SCRA 395Document3 pagesCir Vs Boac 149 SCRA 395Kaye de LeonNo ratings yet

- Residential Tenancy Agreement: Standard FormDocument11 pagesResidential Tenancy Agreement: Standard Formkrishnan112No ratings yet

- RA No. 11976 - Ease of Paying Taxes ActDocument22 pagesRA No. 11976 - Ease of Paying Taxes ActAnostasia NemusNo ratings yet

- Tax1 1 Basic Principles of Taxation 01.30.11-Long - For Printing - Without AnswersDocument10 pagesTax1 1 Basic Principles of Taxation 01.30.11-Long - For Printing - Without AnswersCracker Oats83% (6)

- Tax Benefit On Home Loan - Section 24, 80C, 80EE PDFDocument5 pagesTax Benefit On Home Loan - Section 24, 80C, 80EE PDFRajiv RanjanNo ratings yet

- Final Project Report On Tax Planning PDFDocument67 pagesFinal Project Report On Tax Planning PDFAniket ChavanNo ratings yet

- Case Digest Taxation 2Document50 pagesCase Digest Taxation 2Pcl Nueva VizcayaNo ratings yet

- Fabm 2: Quarter 4 - Module 4 Principles and Processes of Income and Business TaxationDocument22 pagesFabm 2: Quarter 4 - Module 4 Principles and Processes of Income and Business TaxationFlordilyn DichonNo ratings yet

- 2022 04 25 15 00 40 TDS Declaration Form For F Y 2022 23Document2 pages2022 04 25 15 00 40 TDS Declaration Form For F Y 2022 23Mayank RanaNo ratings yet

- 2023 04 25 17 32 23 TDS Declaration Form For FY 2023 24Document2 pages2023 04 25 17 32 23 TDS Declaration Form For FY 2023 24Mayank Rana0% (1)

- 2023 04 25 17 32 23 TDS Declaration Form For FY 2023 24Document2 pages2023 04 25 17 32 23 TDS Declaration Form For FY 2023 24Mayank RanaNo ratings yet

- IT Proof Submission Guidelines FY 22-23Document48 pagesIT Proof Submission Guidelines FY 22-23Chandan SinghNo ratings yet

- Income Tax Rebate ScemesDocument20 pagesIncome Tax Rebate ScemesVarun KumarNo ratings yet

- Input Tax Credit Rules: Rule# Rule Title Form # Time Limit Section Reference Text of The Provision AnalysisDocument23 pagesInput Tax Credit Rules: Rule# Rule Title Form # Time Limit Section Reference Text of The Provision AnalysisABHISHEKNo ratings yet

- Tax Unit 1-2 - 25Document1 pageTax Unit 1-2 - 25joy BoseNo ratings yet

- ANNEXURE 2 - Guidelines On Supporting For Actual Investment (FY 2021-22)Document7 pagesANNEXURE 2 - Guidelines On Supporting For Actual Investment (FY 2021-22)aasasasNo ratings yet

- Declaration: Previous Booking Details (Old Project) New Booking Details (Applicable For Both Fresh/Retention)Document1 pageDeclaration: Previous Booking Details (Old Project) New Booking Details (Applicable For Both Fresh/Retention)Sunny SharmaNo ratings yet

- Key Fact StatementDocument4 pagesKey Fact Statementsanjeev guptaNo ratings yet

- Actual Investment Declaration For FY 2017-18: Section Nature of Deduction Maximum Amt Documents RequiredDocument6 pagesActual Investment Declaration For FY 2017-18: Section Nature of Deduction Maximum Amt Documents Requiredsandeepreddys091537No ratings yet

- Process - Flow - Narrative - Window BDocument6 pagesProcess - Flow - Narrative - Window BrickmortyNo ratings yet

- BLDecoupleDLGFinal 10502391Document7 pagesBLDecoupleDLGFinal 10502391apatil54671No ratings yet

- Gardens Leasing Rental Structure - TGFA - 16-Nov-2020Document2 pagesGardens Leasing Rental Structure - TGFA - 16-Nov-2020draissamNo ratings yet

- Should You Buy A Home - Calculator - FinanceWithShaDocument15 pagesShould You Buy A Home - Calculator - FinanceWithShaAbhay MishraNo ratings yet

- Citizen'S Charter: Whom To Contact If Things Go WrongDocument5 pagesCitizen'S Charter: Whom To Contact If Things Go WrongKrishan GargNo ratings yet

- Key Fact StatementDocument4 pagesKey Fact StatementNanda Gopal Reddy AnamNo ratings yet

- Assignment 2: Chapter 13 Lease: 1. Define The 2 Classification of Leases Finance Lease Operating LeaseDocument2 pagesAssignment 2: Chapter 13 Lease: 1. Define The 2 Classification of Leases Finance Lease Operating LeaseKarylle Ynah MalanaNo ratings yet

- Notfctn 20 2019 Igst Rate EnglishDocument4 pagesNotfctn 20 2019 Igst Rate EnglishDr M R aggarwaalNo ratings yet

- FC Requirement New17Document1 pageFC Requirement New17Zahed IbrahimNo ratings yet

- Declaration: Previous Booking Details (Old Project) New Booking Details (Applicable For Both Fresh/Retention)Document1 pageDeclaration: Previous Booking Details (Old Project) New Booking Details (Applicable For Both Fresh/Retention)Sunny SharmaNo ratings yet

- Tenancy Agreement Slide 4Document31 pagesTenancy Agreement Slide 4Kamal GhafurNo ratings yet

- P 3 New Features On HDB Flat Portal & Enhanced Resale Flat Buying JourneyDocument4 pagesP 3 New Features On HDB Flat Portal & Enhanced Resale Flat Buying Journeycharmeyan1scribdNo ratings yet

- Calculation of ACP Rate For Secured AdvanceDocument3 pagesCalculation of ACP Rate For Secured AdvanceSIVA RAMA KRISHNAN chelladuraiNo ratings yet

- Repo Audit Note 1920-2869 Vishal EarthDocument20 pagesRepo Audit Note 1920-2869 Vishal EarthrushiNo ratings yet

- FEEDS Corp ChecklistDocument5 pagesFEEDS Corp ChecklistjeorgiaNo ratings yet

- House Building Advance PDFDocument52 pagesHouse Building Advance PDFRajesh GargNo ratings yet

- Ifrs 16-LeasesDocument4 pagesIfrs 16-LeasesfrondagericaNo ratings yet

- First Come First Serve Scheme 2022 CircularDocument2 pagesFirst Come First Serve Scheme 2022 CircularAshish SharmaNo ratings yet

- Plate 3 Contractor Pre QualificationDocument9 pagesPlate 3 Contractor Pre QualificationEmily RoseNo ratings yet

- DG Rental Structure - 01-Mar-2022Document2 pagesDG Rental Structure - 01-Mar-2022Hozayfa Abdel RahimNo ratings yet

- Clarification-1 Anwar IspatDocument42 pagesClarification-1 Anwar IspatPranoy BaruaNo ratings yet

- Bos 62599Document18 pagesBos 62599nerises364No ratings yet

- This Study Resource Was Shared Via: Review 105 - Day 20 TOADocument7 pagesThis Study Resource Was Shared Via: Review 105 - Day 20 TOAhello hahaNo ratings yet

- Computation Sheet: ImportantDocument1 pageComputation Sheet: ImportantJ SalesNo ratings yet

- Auditing Problems IAS 17: LEASES (0ld Standard) Dr. Glen de Leon, CPADocument29 pagesAuditing Problems IAS 17: LEASES (0ld Standard) Dr. Glen de Leon, CPAArcelli Dela CruzNo ratings yet

- Supporting Documents Checklist For Supply Application Up To 100kVADocument2 pagesSupporting Documents Checklist For Supply Application Up To 100kVAMuhammad Zulhelmi ZawawiNo ratings yet

- Schedule I Updated Stamp Act 1899Document6 pagesSchedule I Updated Stamp Act 1899Shahid HussainNo ratings yet

- Reply of Report-I Section Queries Communicated by Dated-1.09.2023 Sl. No. Queries ReplyDocument2 pagesReply of Report-I Section Queries Communicated by Dated-1.09.2023 Sl. No. Queries Replysanjanasoni89No ratings yet

- TG Rental Structure - 13-Jun-2021Document2 pagesTG Rental Structure - 13-Jun-2021tanveerwajidNo ratings yet

- Stamp Duty & FeesDocument12 pagesStamp Duty & FeesranjithxavierNo ratings yet

- Flyers Mre Blue (Arbitration Procedure)Document2 pagesFlyers Mre Blue (Arbitration Procedure)Jimmypalikat 1999No ratings yet

- Income From Property 1Document18 pagesIncome From Property 1aisha jabeenNo ratings yet

- Discussion Problems: FAR.2831-Leases MAY 2020Document13 pagesDiscussion Problems: FAR.2831-Leases MAY 2020Eira ShaneNo ratings yet

- Lecture Note BA212 L2 - Lease: (Katen / Lease Accounting/ DBS PNGUOTDocument3 pagesLecture Note BA212 L2 - Lease: (Katen / Lease Accounting/ DBS PNGUOTBee jayNo ratings yet

- Vol. I. 1 Ch. 3-DDocument12 pagesVol. I. 1 Ch. 3-DKanishka SihareNo ratings yet

- Freehold Leasehold ConveyancingDocument3 pagesFreehold Leasehold ConveyancingJoe JungNo ratings yet

- Addendum 1-2nd RoundDocument3 pagesAddendum 1-2nd Roundmohamed mcharoNo ratings yet

- Registration As A Trust Company: Companies RegistryDocument1 pageRegistration As A Trust Company: Companies RegistryFahed HelalNo ratings yet

- FAR 3 Lease AccountingDocument10 pagesFAR 3 Lease AccountingMhyke Vincent Panis100% (1)

- Form 1 Standard Ten AgreeDocument4 pagesForm 1 Standard Ten Agreechartreuse_pinkNo ratings yet

- Registration of Corporations Stock Corporation Basic RequirementsDocument27 pagesRegistration of Corporations Stock Corporation Basic RequirementsRhyz Taruc-ConsorteNo ratings yet

- Accounting Services Brgy - 2Document2 pagesAccounting Services Brgy - 2J JaNo ratings yet

- Ardenwood Cost SheetDocument1 pageArdenwood Cost SheetAditya UdaniNo ratings yet

- Adobe Scan Feb 23, 2022Document1 pageAdobe Scan Feb 23, 2022Hari KNo ratings yet

- University of Zimbabwe: (LB021) LL.B (Hons) Part Iii and Iv Conveyancing ExaminationDocument4 pagesUniversity of Zimbabwe: (LB021) LL.B (Hons) Part Iii and Iv Conveyancing Examinationsimdumise magwalibaNo ratings yet

- 27S - PendingDocument4 pages27S - PendingPramod SakriNo ratings yet

- Big Apple - Alternative 2Document6 pagesBig Apple - Alternative 2Pramod SakriNo ratings yet

- 27S - GF - LightsDocument4 pages27S - GF - LightsPramod SakriNo ratings yet

- 9926 Loadsch LTG 5002 - R1Document13 pages9926 Loadsch LTG 5002 - R1Pramod SakriNo ratings yet

- False Ceiling Qty BreakupDocument28 pagesFalse Ceiling Qty BreakupPramod SakriNo ratings yet

- Alliance ContractingDocument10 pagesAlliance ContractingPramod SakriNo ratings yet

- Discover The Power of Index MatchDocument7 pagesDiscover The Power of Index MatchPramod SakriNo ratings yet

- CIR Vs V. G. SincoDocument9 pagesCIR Vs V. G. SincoRhinnell RiveraNo ratings yet

- 05 G.R. No. 124043Document17 pages05 G.R. No. 124043Nathaniel CaliliwNo ratings yet

- CIR v. CA (301 SCRA 435) Not FinishedDocument10 pagesCIR v. CA (301 SCRA 435) Not FinishedKarl MinglanaNo ratings yet

- C4 PDFDocument373 pagesC4 PDFIssa Adiema100% (5)

- Chapter 12 Tds & TcsDocument28 pagesChapter 12 Tds & TcsRajNo ratings yet

- TDON1Document2 pagesTDON1Fevzi OzdemirNo ratings yet

- This Study Resource Was: Solutions To Assigned Problems & ExercisesDocument3 pagesThis Study Resource Was: Solutions To Assigned Problems & ExercisesMikaela Amigan EvangelistaNo ratings yet

- Taxation Material 2Document7 pagesTaxation Material 2Shaira BugayongNo ratings yet

- Income Taxation - Class Standing - Docx-2Document1 pageIncome Taxation - Class Standing - Docx-2Shannon ElizaldeNo ratings yet

- Answer Key Tax 501 by AmponganDocument37 pagesAnswer Key Tax 501 by AmponganRegina Dela RosaNo ratings yet

- Taxation of International TransactionsDocument2 pagesTaxation of International TransactionsariellejuanitoNo ratings yet

- EY Tax Alert: Malaysian DevelopmentsDocument12 pagesEY Tax Alert: Malaysian DevelopmentsdanNo ratings yet

- Taxation LawDocument5 pagesTaxation LawSayan GhoshNo ratings yet

- Taxation Law ReviewerDocument62 pagesTaxation Law ReviewerThemis ArtemisNo ratings yet

- MCQ On Individual Income TaxDocument14 pagesMCQ On Individual Income TaxRandy ManzanoNo ratings yet

- Government Regulation No 58 On PPH 21 (Wef 1 Jan 2024)Document5 pagesGovernment Regulation No 58 On PPH 21 (Wef 1 Jan 2024)pokcayNo ratings yet

- Effect of Tax Incentives On The Growth of SMEs in RwandaDocument10 pagesEffect of Tax Incentives On The Growth of SMEs in RwandaBhosx KimNo ratings yet

- Jose Orbillos vs. Cir and Cta 139 Scra 436 (1985)Document3 pagesJose Orbillos vs. Cir and Cta 139 Scra 436 (1985)FranzMordenoNo ratings yet

- NBSM Nepal Budget 2073 PDFDocument20 pagesNBSM Nepal Budget 2073 PDFnabin shresthaNo ratings yet

- 284 Supreme Court Reports Annotated: Nitafan vs. Commissioner of Lnternal RevenueDocument10 pages284 Supreme Court Reports Annotated: Nitafan vs. Commissioner of Lnternal RevenueRyan Jhay YangNo ratings yet