Professional Documents

Culture Documents

NN City Council Members To Pay Back Money After Misuse of City Credit Cards

NN City Council Members To Pay Back Money After Misuse of City Credit Cards

Uploaded by

WTKR News 30 ratings0% found this document useful (0 votes)

4K views8 pagesNN City Council members to pay back money after misuse of city credit cards

Original Title

NN City Council members to pay back money after misuse of city credit cards

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNN City Council members to pay back money after misuse of city credit cards

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

4K views8 pagesNN City Council Members To Pay Back Money After Misuse of City Credit Cards

NN City Council Members To Pay Back Money After Misuse of City Credit Cards

Uploaded by

WTKR News 3NN City Council members to pay back money after misuse of city credit cards

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 8

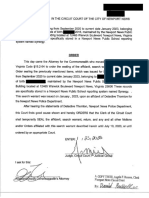

CITY OF NEWPORT NEWS

CITY ATTORNEY’S OFFICE

May 1, 2023

TO: Cindy Rohlf, City Manager

Susan R. Goodwin, Director of Finance

FROM: Collins L. Owens, Jr., City Attorney

SUBJECT: Questioned City Council Credit Card Charges

You advised that all members of City Council, with the exception of one (1), utilize City

credit cards, With regard to recent City credit card use by members of City Council, you asked

that T ascertain whether such use was in compliance with Federal and State law, as well as with

the City’s Travel Policy. In this regard, the following credit card charges have come to your

attention: approximately eleven hundred dollars ($1,100) in restaurant charges during a single

month incurred during constituent meetings by a City Council member, with some restaurant

receipts containing multiple meal charges; two (2) or more five hundred dollar ($500) cash

advances received by a Council member and then paid to non-City employees for

constituent/administrative services; payment for meals at a restaurant where three (3) City Council

members dined together in celebration of their election victories; a Foodbank donation made in a

City Council member's personal name; payment for an upgrade to a City Council member's

personal LinkedIn subscription; payment for air travel to Indiana, including hotel and Iugeage

expenses, for a City Council member's attendance at a Christopher Newport University basketball

game in contravention of the Travel Policy, and unassociated with City business; payment for a

Woodside High School basketball game ticket, unrelated to any City Council purpose at the game;

and a travel request for payment of expenses associated with attendance ata conference associated

with a political party. Lastly, you advised that in the past, members of City Council have, on

occasion, made charges on their respective City issued credit eards without providing receipts or

explanations for the charges.

The issues are whether the aforementioned expenses are official and reasonable City

Council business expenses for which the City may assume financial responsibility in accordance

with applicable law and its Personnel and Administrative Manual Travel and Meeting Expense

Policy (Travel Policy), and, if not, what consequences result from use of City eredit cards in the

manner described. In addressing these issues, it is first important to note that the Internal Revenue

Service (IRS) has promulgated regulations to help employers determine the correct tax treatment

of employee remuneration other than stated pay (such as meals, travel expenses and other working

condition benefits), and when such remuneration should be treated as income for withholding and

reporting purposes. Addressing this issue is significant, because if certain expenses charged do

not qualify as excludable fringe benefits under Internal Revenue Code (IRC) regulations then, in

cordance with such regulations, the City must report the amount of those charges as taxable

income to the City Couneil members in question. 26 U.S.C. § 61(a)(1)(2); 26 CFR 1.132-1(a).

However, if the City is required by IRS regulations to count any of the charges mentioned as

income, the City Council members and/or Mayor would exceed the mandatory annual income

limitations set for them under Va. Code § 15.2-1414.6, at $25,000 and $27,000 respectively. In

such case, and because these salary caps are mandatory, City Council members and/or the Mayor

would be required to refund the City any expenses that must be attributed as income to them.

In this regard IRC provisions identify what is called an “Accountable Plan”, which is an

allowance or reimbursement policy (not having to be memorialized in a written plan) wherein an

employer may pay business expenditures incurred by employees as long as the following factors

exist: 1) there is a clear business connection to the expenditure, 2) there is adequate accounting by

the recipient within a reasonable period of time, and 3) excess reimbursements or advances are

returned within a reasonable period of time. 26 CFR § 1.62-2(c)(2). The “business connection”

means that the employee must have paid or incurred allowable business expenses while performing,

services as an employee.” 26 CFR § 1.62-2(d). Regarding the “adequate accounting” requirement,

the employee must verify the date, time, place, amount and business purpose of the expenses, and

receipts are required unless the reimbursement is made using per diem rates (per diem rates are

used for meals and lodging while traveling away from home overnight and regarding which

receipts are not required as long as other requirements are met). 26 CFR § 1.62-2(e). In order for

non-travel meeting meals to qualify as an Accountable Plan fringe benefit, the above referenced

Accountable Plan qualifiers must be met. Further, in accordance with 26 U.S.C. § 274k), a

business meal may only be excluded from income if such expense is not lavish or extravagant

under the circumstances and if the employee is present at the furnishing of such meal

In addition to the aforementioned, an employer may exclude working condition fringe

benefits from an employee’s income. However, to be excludable, the working fringe benefit must:

1) relate to the employer’s business, 2) the expense would have been an allowable business expense

deduction to the employee if the expense had been paid personally, and 3) the business use must

be substantiated with records. 26 U.S.C. § 132(d). Nevertheless, “cash payments or cash

equivalents are not working condition fringe benefits; however they may be excluded if they

represent reimbursements paid under an Accountable Plan.” IRS Publication 5137 (Tax Exempt

& Government Entities Fringe Benefit Guide 10-2022, p. 8).

Anexception to the general rules detailed above regarding whether to include the value of

{fringe benefits provided to employees in their gross income, are de minimis fringe benefits. These

are any property (including meals) or service provided by an employer for an employee, the value

of which is so small in relation to the frequency with which it is provided, that accounting for it is

unreasonable or administratively impracticable. To reiterate, if the property or service is provided

infrequently and of minimal value, then the same can be excluded from income as a de minimis

fringe benefit. 26 U.S.C. 132(e); CFR § 1.132-6(a)(b)& (d)(2).

Lastly, pursuant to 26 U.S.C, § 274(a)(1)(A) entertainment, amusement, and recreation

expenses paid by an employer for the benefit of an employee must be included in the employee's

income.

With the above-mentioned Internal Revenue Code and Code of Federal Regulations’

provisions as a backdrop, in the following paragraphs I will examine the City oredit card charges

and expense reimbursement requests in question, and analyze them in light of relevant Virginia

Code and City Travel Policy provisions. As to State standards for reimbursement, Va. Code §

15.2-1414.6 states that, “Any member of council shall be eligible to be reimbursed for any

personal expenses incurred by him for official business. However, all claims for reimbursement

shall be for reasonable expenses to the extent permitted by law incurred in the conduct of official

city business and shall be itemized and documented by stamped paid receipts to the extent

feasible.” This standard, limiting reimbursement to the payment of reasonable expenditures

incurred by city council members in connection with official City business regarding which

documented and itemized receipts are required, is consistent with the dictates of our Travel

Policy, which became applicable to City Council through its adoption of Resolution No. 12673-

14.

Lastly, when examining the charges in question, it is also important to note that Va. Code

§ 15.2-953 proscribes the parameters under which a locality may provide gifts. Generally

speaking, a locality may only provide monetary or in-kind gifts to charitable and other specified

organizations (including other governmental entities) for non-sectarian use. This issue is relevant

with respect to City Council’s use of credit cards to pay for the meals or donated services of others.

In this regard, the payment of meals for private individuals is not permitted; however, the payment

of a meal for another governmental official, during a City business meeting with that official, is

permissible.

As stated previously, in order to be counted as fringe benefits payable by the employer and

excluded from the employee’s income, 26 CER § 1.62-2(c)(2) requires that such expenses be

“allowable businesses expenses” by the employer, the business purpose of the expense must be

documented, non-travel/off-business premises meals must meet Accountable Plan requirements,

and the meals cannot be extravagant. In this instance, and because the City business purpose of

the constituent meetings meals was not provided, the aforementioned requirements have not been

met. Additionally, the $1,100 meal charges, do not appear to have been allowable business

expenses paid by the City under 26 U.S.C. § 274(k) and Va. Code § 15.2-1414.6, as their

reasonableness is questionable due to the high cost. Section XIV(A) of the Travel Policy prohibits

reimbursement above 50% of the applicable U.S. General Services Administration (GSA) rate,

and it is not clear whether the meals charged exceeded that amount (the GSA meal and incidental,

expense rates for FY 2023 are $59-79, with the standard rate at $59). Additionally, the Council

member did not provide names of the persons involved as is required under Section XIV(A) of the

Travel Policy, and Section II(A) thereof only permits reimbursement for the City Council

member, not for the constituents whose meals were charged. It is also my understanding that

receipts for some constituent meeting meals were not provided as is required by § 15.2-1414.6,

the Travel Policy, and Accountable Plan procedures. For these reasons, the expenses charged do

not qualify for exclusion from income under IRC Accountable Plan and business meal

requirements and must, therefore, be attributed as income to the City Council member in question

pursuant to 26 CFR § 1.62-2(c)(2). To the extent such expenditures included purchases of meals

as gifts to private persons, the same would also violate Va. Code § 15.2-953 which, as stated,

permits gifts of City money or property only to charities, and other identified organizations, for

non-sectarian purposes.

3 Person Councilmember Celebratory Dinner

Gathering for a meal to celebrate election victories does not constitute official business of

the City and was, therefore, not an allowable City business expense under Va. Code § 15.2-1414.6

and/or Accountable Plan requirements. Nevertheless, if the members of City Council involved

did discuss bona fide City business during the celebratory meal, then the gathering constituted an

improper meeting under Va. Code § 2.2-3701 of FOIA, in that three (3) members of the governing,

body gathered to discuss business of the City without notice to the public and without taking

minutes of the meeting, in violation of Va. Code § 2.2-3707. As a result, and even under this,

scenario, the expenses do not qualify as Accountable Plan business expenses because the business

‘meeting associated with the meal was improper. In such case, the expenses must be attributed as

income to each respective City Council member (unless you determine that each meal expense

was de minimus in accordance with the above stated qualifications for such a finding)

Foodbank Donation

A donation made by a single member of City Council in their personal name does not

constitute official City business as required by Va. Code § 15.2-1414.6. Additionally, Section

IX(A)(10) (Non-Reimbursable Expenses) of the Travel Policy provides that personal expenses

such as donations will not be reimbursed. As result, the Council member's Foodbank donation

charge, made in his personal name, was not an allowable City business expense and should be

treated as income to the City Council member pursuant to 26 CFR § 1.62-2(c)(2).

Indiana Travel) Woodside High School Basketball Game

Because the City Council member’s hotel, luggage, and airline costs to Indiana to attend

a CNU basketball game were not associated with official City business, as is required under Va.

Code § 15.2-1414.6, the charges were improper and, in that regard, also violated Section TV(A)

of the Travel Policy. The charges appear to have been entertainment, amusement and/or recreation

charges and, as such, do not meet IRC allowable business expense Accountable Plan criteria and

must be included in the Council member’s income pursuant to 26 U.S.C. § 274(a)(1)(A) and 26

CER § 1.62-2(c)(2). The same is true of the Council member's Woodside High School basketball

game ticket charge.

LinkedIn Upgrade

Va, Code Sec. 2.2-3103(1) & (3) of the State and Local Government Conflict of Interests

Act (COIA) states that no officer of local governmental shall, “1. Solicit or accept money or other

thing of value for services performed within the scope of his official duties, except the

compensation, expenses or other remuneration paid by the agency of which he is an officer or

employee. This prohibition shall not apply to the acceptance of special benefits that may be

authorized by law.” City payment for a private social media subscription for a local government

officer is not a special benefit authorized by law, and is not a part of any compensation package or

salary offered to members of City Council. It was, therefore, improper for the Council member in

question to charge the City for an upgrade to his LinkedIn subscription and, thus, receive a thing

of value, outside of his normal compensation for the City Council duties he performs. For these

reasons, the LinkedIn charges do not meet the IRC allowable business expense Accountable Plan

criteria and must, therefore, be attributed as income to the City Council member pursuant to 26

CER § 1.62-2(¢)(2).

Cash Advances for Constituent s

In accordance with the Virginia Public Procurement Act (VPPA) any contract, whether

oral or written, for goods or services between a public body and a non-governmental source must

comply with the competitive procurement requirements of the VPPA. Va. Code § 2.2-4300 et seq.

Even with regard to “small” contracts, such as the ones in question, the same must be accomplished

through utilization of the procedures established by the City’s Purchasing Agent, pursuant to Va.

Code § 2.2-4303.G(1) and City Code § 2-554.1(b). Because the constituent services charged to

the City were not obtained in accordance with the City’s purchasing procedures and requirements,

it is not proper for the City to pay the same.

In addition, pursuant to § 8.09 of the City Charter, no officer of the City may, “expend or

contract to expend any money or incur any liability, or enter into any contract which by its terms

involves the expenditure of money, for any purpose, in excess of the amounts appropriated for that

general classification of expenditure.” This section goes on to state that any written or verbal

contract made in contravention of the aforesaid prohibition shall be null and void. The only

amounts appropriated for the type of expenditures incurred in this instance were for services

provided by the City Clerk and her staff, and because no other monies were appropriated for the

expenses that were incurred in this regard, the expenditures were improper. Further, the City

cannot simply donate the said amounts to the individual to whom the payments were made as Va.

Code § 15.2-953 only permits localities to donate money to charitable and other identified

organizations, among other requirements. There is no indication that the payments made to the

individual in question for constituent services qualify as donations under § 15.2-953, Payments

by the City in this regard are, therefore, not permissible,

Lastly, and although the IRC permits employers to exclude from an employee's income

certain working condition benefits for property or services supplied to their employees, cash

payments do not qualify as working condition fringe benefits. Nevertheless, two (2) of the

constituent services’ payments were cash advance payments to a Council member who then

claimed to use the cash to pay individuals, with no substantiating records. IRS Publication 5137

(Tax Exempt & Government Entities Fringe Benefit Guide 10-2022, p. 8). Additionally, the

payments do not qualify as excludable fringe benefits under an Accountable Plan because they are

not allowable City business expenses in that they were procured in violation of applicable City

and State Code provisions. 26 CFR § 1.62-2(¢)(2). The expenses in question must, therefore, be

attributed as income to the City Council member who charged the expenses. Additionally, the City

Clerk has advised that her office informed City Council members during their retreat in January

of this year, that the Clerk’s office is willing and able to provide administrative services to City

Council members, such as communicating with constituents, organizing emails, and calendaring

events. It appears, therefore, that the expenses were not reasonable as required under Va. Code §

15.2-1414.6,

Payment of Travel Expenses for a Political Conference

5 USC Sec. 1502(a)(2) of the Hatch Act prohibits a local officer and/or employee from

directly or indirectly commanding or advising another local officer or employee to pay anything

of value to a party, committee, or organization for political purposes. This prohibition precludes a

public officer from requesting and receiving City funding for the payment of travel and conference

expenses for the conference in question because the event is political and/or sponsored by a

political organization, Additionally, Va. Code Sec. 15.2-1512.2.F states that employees of a

locality are prohibited from suggesting or implying that a locality has officially endorsed a political

party, candidate, or campaign. Payment by the City for participation in a partisan conference

suggests that the City is in support of a political party, which is prohibited by the aforementioned

State statute. Further, the Travel Policy only permits the payment of travel expenses that are

necessary and associated with official City business, and official City business does not include

that which is prohibited by Federal and State law. Payment of travel expenses for a conference

associated with a political party is, therefore, not a permissible City expenditure. Because this

travel expense is not an allowable employee business expense it is not excludable from income

under an IRC Accountable Plan. 26 CFR § 1.62-2(c)(2).

Occasional City Credit Card Charges Without Receipts

In accordance with Va. Code § 15.2-1414.6, City payment for expenses incurred by City

Council members in connection with official business shall “be itemized and documented by

stamped paid receipts to the extent feasible”. Unless an acceptable reason is provided as to why it

was not feasible to obtain an itemized stamped receipt authenticating an expense charged, then a

receipt is required under the Virginia Code, and Section IV(B) of the Travel Policy. Further, an

explanation as to the necessity of the charge, as it pertains to official City business, should also be

provided so as to meet the requirement contained in Section [V(A) of the Travel Policy.

Nevertheless, if the expense is for a meal or service, the value of which is so small in relation to

the frequency with which it is provided, that accounting for it is unreasonable or administratively

impracticable, then it can be excluded from income as a de minimis fringe benefit, regardless of

whether a receipt is provided or whether the expense qualifies as a business expense under an

Accountable Plan, 26 U.8.C. 132(e); CFR § 1.132-6(a)(b)& (42).

Consequences/Penalties

City Council member violations of the Travel Policy and/or their misuse of City issued

credit cards, raises the issue of possible penalties and or consequences. Section XV

(Reimbursement of Erroneous Payments) of the Travel Policy states that, “All unauthorized” and

“improper” travel advances “shall be immediately reimbursed by the traveler to the City and failure

to do so may result in disciplinary action, as well as deduction from one’s paycheck if it remains

unpaid past fourteen (14) business days of being notified of the need to reimburse. Alll travelers

hereby consent to such deduction by participation under this Travel Policy.” As previously stated,

reimbursement will be required for all of the above mentioned expenses that are not excludable

from income for the City Couneil members in question and the Mayor so that their income does

not exceed the limitations specified in Va. Code § 15.2-1414.6. It would appear that such

reimbursement can be achieved through payroll deductions unless the City Couneil members in

question wish to reimburse the amounts necessary through direct payments.

In addition, it is necessary that City officials request reimbursement in order to avoid

violations of Va. Code Sec, 18.2-112.1.B. (Misuse of public assets; penalty), which states that,

“Any full-time officer, agent, or employee of the Commonwealth, or of any city, town, county, or

any other political subdivision who, without lawful authorization, uses or permits the use of public

assets for private or personal purposes unrelated to the duties and office of the accused or any other

legitimate government interest when the value of such use exceeds $1,000 in any 12-month period,

is guilty of Class 4 felony.” My opinion is that if City employees, such as the Director of Finance,

the City Manager (and, perhaps, others) permit members of City Council to either retain funds

that were improperly charged to the City and/or permit them to continue to make improper charges

that exceed the annual amount specified in the aforementioned statute, then such persons may be

subject to the criminal penalty prescribed in the statute, In this regard, and in accordance with the

City Charter, Section 8.08.C., the Director of Finance has the responsibility to audit “all bills,

invoices, payrolls and other evidences of claims, demands or charges against the city government,

and, with advice of the city attorney, determine the regularity, legality and correctness of such

claims, demands or charges.” It would appear that after auditing the charges in question and

determining they are improper, the Director of Finance, and the City Manager as her supervisor,

have a legal obligation to request that the members of City Council involved return funds that

were improperly charged to the City and that cannot, without exceeding the maximum allowable

salary, be attributed as income to them,

Further, if after being advised of the applicable Federal and State Code, and Travel Policy

provisions, the City Council members involved do not agree to return the funds requested (and

assuming, for whatever reason, such funds are not withheld from their pay), Va. Code Sec. 18.2

112, details the possible criminal punishment to which the City Council members would be

subject. This Code section states, “If any officer, agent or employee of the Commonwealth or of

any city, town, county, or any other political subdivision, or the deputy of any such officer having

custody of public funds, or other funds coming into his custody under his official capacity,

knowingly misuse or misappropriate the same or knowingly dispose thereof otherwise than in

accordance with law, he shall be guilty of a Class 4 felony; and any default of such officer, agent,

employee or deputy in paying over any such funds to the proper authorities when required by law

to do so shall be deemed prima facie evidence of his guilt.”

In addition, and as to a review of the charges involved by an outside agency, Va. Code

Sec. 30-138.A. requires that, “Upon the discovery of circumstances suggesting a reasonable

possibility that a fraudulent transaction has occurred involving funds or property under the control

of any state department, court, officer, board, commission, institution or other agency of the

Commonwealth, including local constitutional officers and appointed officials exercising the

powers of elected constitutional officers, as to which one or more officers or employees of state or

local government may be party thereto, the state agency head, court clerk or local official in charge

of such entity shall promptly report such information to the Auditor of Public Accounts (Auditor),

the State Inspector General, and the Superintendent of State Police (Superintendent).” This Code

section applies to our situation, if after the City Couneil members in question are advised, they

refuse to refund the City. Under such circumstance, fraud would exist pertaining to the funds

involved which are under the control of a local constitutional officer (ie., the City Treasurer)

regarding which one or more officers of local government may be a party. If applicable, this

section requires the “local official in charge” (i.e., the City Manager and/or the Director of Finance)

to report any fraudulent activity to the Auditor of Public Accounts.

Conclusion/Recommendation

Based on the foregoing, it is my opinion that the City credit card charges in question are

in violation of the reimbursement restrictions contained in Va, Code See. 15.2-1414.6 and the

City’s Travel Policy, for which criminal penalties could result under Va, Code §§ 18.2-112 &

18.2-112.1, against the members of City Council involved and against the Director of the

Department of Finance and the City Manager, respectively, (and, perhaps, others), if

reimbursement is not sought when statutorily required and/or the amounts in question are not

retuned after an explanation of the applicable regulatory laws and Policy is provided.

Reimbursement is mandatory due to IRC income provisions regarding fringe benefits when

viewed in combination with the income caps applicable to the City Council and Mayor contained

in the Virginia Code. If the City Council members do not agree to refund the total amounts owed

to the City, then the City Manager and/or the Director of Finance are obligated to advise the

Auditor of Public Accounts as to the transactions. Further, the entire City Council, as a body,

would need to be advised as well.

Ihope that I have adequately responded to the issues you raised. Please advise me should

you require additional information or analysis.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Norfolk Commonwealth's Attorney Finds 2022 Off-Duty Deputy Shooting JustifiedDocument2 pagesNorfolk Commonwealth's Attorney Finds 2022 Off-Duty Deputy Shooting JustifiedWTKR News 3No ratings yet

- Climate Action 2030Document32 pagesClimate Action 2030WTKR News 3No ratings yet

- 2022 Year-End Holiday Travel Forecast ReportDocument8 pages2022 Year-End Holiday Travel Forecast ReportWTKR News 3No ratings yet

- VBMSC Final ReportDocument16 pagesVBMSC Final ReportWTKR News 3No ratings yet

- Portsmouth Crime PresentationDocument16 pagesPortsmouth Crime PresentationWTKR News 3No ratings yet

- '2021 RD642-Virginia's Homeless Programs - 2020-2021 Program Year20Document32 pages'2021 RD642-Virginia's Homeless Programs - 2020-2021 Program Year20WTKR News 3No ratings yet

- Komen Tidewater Landscape Analysis ReportDocument104 pagesKomen Tidewater Landscape Analysis ReportWTKR News 3No ratings yet

- PopulationEstimates July2022 VA CooperCenterDocument6 pagesPopulationEstimates July2022 VA CooperCenterWTKR News 3No ratings yet

- Armed Forces Brewing Attorney LetterDocument2 pagesArmed Forces Brewing Attorney LetterWTKR News 3No ratings yet

- FINAL Approved Redacted Richneck Shooting Search WarrantsDocument22 pagesFINAL Approved Redacted Richneck Shooting Search WarrantsWTKR News 3100% (1)

- Virginia Department of Social Services ReportDocument29 pagesVirginia Department of Social Services ReportWTKR News 3100% (1)

- Emerald Ash Borer TrackingDocument1 pageEmerald Ash Borer TrackingWTKR News 3No ratings yet

- 2023 Clear Backpack CommunicationDocument3 pages2023 Clear Backpack CommunicationWTKR News 3No ratings yet

- State and Local Actions and Federal Resources To Address Accessibility of Early VotingDocument71 pagesState and Local Actions and Federal Resources To Address Accessibility of Early VotingWTKR News 3No ratings yet

- Brent James Stokes IndictmentDocument3 pagesBrent James Stokes IndictmentWTKR News 3No ratings yet

- Model Policies VADocument18 pagesModel Policies VAABC7 WJLANo ratings yet

- Pride Month Proclamation 1Document1 pagePride Month Proclamation 1WTKR News 3No ratings yet

- HeadWaters Resort and CasinoDocument34 pagesHeadWaters Resort and CasinoWTKR News 3No ratings yet

- Movement-Display of USS Iowa 16-Inch - JEB Fort Story - 11-10-22 Version 3.0Document40 pagesMovement-Display of USS Iowa 16-Inch - JEB Fort Story - 11-10-22 Version 3.0WTKR News 3No ratings yet

- VBCPS AgendaDocument126 pagesVBCPS AgendaWTKR News 3No ratings yet

- SITW School Bus UseDocument7 pagesSITW School Bus UseWTKR News 3No ratings yet

- RESOLUTION Nondiscrimination Against LGBTQ Youth in EducationDocument3 pagesRESOLUTION Nondiscrimination Against LGBTQ Youth in EducationWTKR News 3No ratings yet

- Harvey Lindsay JR Press Release FinalDocument3 pagesHarvey Lindsay JR Press Release FinalWTKR News 3No ratings yet

- Better Business NetworkDocument1 pageBetter Business NetworkWTKR News 3No ratings yet

- Norfolk Branch NAACP #7098 Calls For Redo of Hiring Practice and Search For Police ChiefDocument2 pagesNorfolk Branch NAACP #7098 Calls For Redo of Hiring Practice and Search For Police ChiefWTKR News 3No ratings yet

- Military Circle Mall Demo Press Release FinalDocument1 pageMilitary Circle Mall Demo Press Release FinalWTKR News 3No ratings yet

- Polar Plunge 2023 ScheduleDocument1 pagePolar Plunge 2023 ScheduleWTKR News 3No ratings yet

- Selby Suspicious Death, UPDATEDocument2 pagesSelby Suspicious Death, UPDATEWTKR News 3No ratings yet

- Letter To Parents and GuardiansDocument1 pageLetter To Parents and GuardiansWTKR News 3No ratings yet