Professional Documents

Culture Documents

Ac 506 - Pas 16

Uploaded by

Rome SibuyasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ac 506 - Pas 16

Uploaded by

Rome SibuyasCopyright:

Available Formats

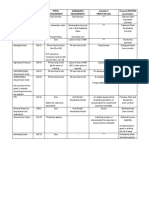

Hernani, Christopher 506 9-12 MW Tangible assets … probable future As 1 line item: Property, Plant, and

DEFINITION Used for production of RECOGNITION economic benefits CLASSIFICATION PRESENTATION Equipment

PAS 16 goods or services, for will flow to the entity Non-current Assets

With disclosures on composition,

rentals or for administrative

… the cost can be carrying amounts, and other

purposes

measured reliably necessary information on the Notes

` Expected to be used during

more than one period

PROPERTY, PLANT AND COST MODEL Cost – accumulated depreciation – accumulated impairment loss

EQUIPMENT MEASUREMENT Initial: @ Cost

Subsequent: Cost Model; or

REVALUATION MODEL Revalued Amount – accumulated depreciation – accumulated impairment loss

Revaluation Where Revalued Amount is either…

DEPRECIATION

MATCHING PRINCIPPLE

ACQUISITION Fair Value or;

Depreciated Replacement Cost [Sound Value]

UNIFROM CHARGE

STRAIGHT LINE CASH ON ACCOUNT INSTALLMENT ISSUANCE ISSUANCE EXCHANGE EXCHANGE

(Cost – Scrap Value)/ Useful Cash Paid or; Invoice Price Cash Price; SHARE CAPITAL BONDS PAYABLE NO COMMERCIAL SUBSTANCE W/ COMMERCIAL SUBSTANCE

Life in years less: Discount CA of asset given + cash

a. FV or asset received a. FV of bonds NO CASH

Equivalent If not available Cash Price,

OR Whether taken or b. FV or share capital payment [PAYOR]

Cash Price b. FV of asset received

Depreciable Amount x c. Par or stated value a. FV of Asset given

not PV of all payments using c. Face Value of bonds

annual depreciation rate CA of asset given – cash b. FV of Asset received

an implied interest rate of share capital

payment [PAYYEE] c. CA of asset given

EXCHANGE DONATION CONSTRUCTION CAPITALIZABLE COSTS

COMPOSITE WITH CASH

TRADE IN Direct Materials Purchase Price Survey Cost Borrowing Costs

Direct Labor PAYOR FV of asset given +

Composite life = total a. FV of asset given + Legal Fees Building Permit Excavation

Overhead cash payment

depreciable amount/total cash payment Commission Fees Insurance (during construction) Architect Fee

annual depreciation b. Trade In Value of Escrow Fees Freight Storage Fee PAYEE FV of asset given –

asset given + cash Mortgages Assumed Installment Cost Insurance (while in cash payment

Composite Rate = total payment Interest Assumed Testing Costs transit)

annual depreciation/total Unpaid Taxes up to date of Net Demolition Cost Estimated

cost acquisition Cost of Option dismantling cost

GROUP Irrecoverable taxes Rearrangement Costs (present obligation)

And other costs necessary to bring the PPE to the location and condition for their intended use

Total Cost x Annual

Depreciation Rate

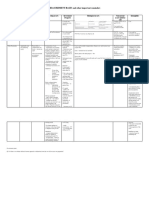

OTHER METHODS

VARIABLE CHARGE

DECREASING CHARGE NO ACCUMULATED DEPRECIATION MAINTAINED

WORKING HOURS PRODUCTION SUM OF YEAR’S DIGITS DECLINING BALANCE DOUBLE DECLINING BALANCE INVENTORY METHOD RETIREMENT METHOD REPLACEMENT METHOD

Rate = Depreciable Rate = Depreciable SYD = Life[(Life+1)/2] Rate = 1 – nth root of Rate = Straight Depreciation = Depreciation = Cost – Depreciation =

Amount/Estimated Amount/Estimated (Residual Value/Cost) Line Rate x 2 Balance – Value at salvage proceeds

Charge = (Life – n) x Replacement Cost – salvage

Working Hours useful life in terms of year end

Depreciable Amount Charge = Rate x proceeds

units of output n is the useful life in

Depreciation = Rate x years Carrying Amount

Actual Working Hours Depreciation = Rate x n is the expired portion of

Actual Units of Output the useful life in years Rate x Carrying Amount

You might also like

- Abusama Impairment of AssetsDocument1 pageAbusama Impairment of AssetsGarp BarrocaNo ratings yet

- Pas 16Document5 pagesPas 16iyahvrezNo ratings yet

- ACCA - Professional Strategic Business Reporting IFRS 16 SummaryDocument40 pagesACCA - Professional Strategic Business Reporting IFRS 16 SummaryPhạm Thu HuyềnNo ratings yet

- Asset Standard Initial Measurement Subsequent Measurement Included in Profit or Loss Financial POSITION PresentationDocument3 pagesAsset Standard Initial Measurement Subsequent Measurement Included in Profit or Loss Financial POSITION PresentationDidhane MartinezNo ratings yet

- Asset Standard Initial Measurement Subsequent Measurement Included in Profit or Loss Financial POSITION PresentationDocument3 pagesAsset Standard Initial Measurement Subsequent Measurement Included in Profit or Loss Financial POSITION PresentationDidhane MartinezNo ratings yet

- MEASUREMENT BASES and Other Important RemindersDocument2 pagesMEASUREMENT BASES and Other Important RemindersShaina Monique RangasanNo ratings yet

- E-Portfolio: PAS 40 - Investment Property D E F I N I T I O NDocument4 pagesE-Portfolio: PAS 40 - Investment Property D E F I N I T I O NKaye NaranjoNo ratings yet

- Ias 16 Property, Plant and Equipment: Fact SheetDocument13 pagesIas 16 Property, Plant and Equipment: Fact SheetXYZA JABILINo ratings yet

- Inocencio PFRS SMEs Matrix ACElec 1Document6 pagesInocencio PFRS SMEs Matrix ACElec 1alianna johnNo ratings yet

- PAS Recognition Measurement Increase in Carrying Amount Due To Revaluation Derecognition Presentation and DisclosureDocument3 pagesPAS Recognition Measurement Increase in Carrying Amount Due To Revaluation Derecognition Presentation and DisclosureTimothy james PalermoNo ratings yet

- Summary - Ppe - ImpairmentDocument15 pagesSummary - Ppe - ImpairmentLorelie OrtegaNo ratings yet

- Reading 23 - Long-Lived AssetsDocument7 pagesReading 23 - Long-Lived AssetsLuis Henrique N. SpínolaNo ratings yet

- SBR NoteDocument20 pagesSBR NotechuwenNo ratings yet

- Inocencio PFRS SmallEntites Matrix ACElec 1Document6 pagesInocencio PFRS SmallEntites Matrix ACElec 1alianna johnNo ratings yet

- MEASUREMENT BASES and Other Important RemindersDocument2 pagesMEASUREMENT BASES and Other Important RemindersShaina Monique RangasanNo ratings yet

- Singson DM A. Concept Map RevisionDocument2 pagesSingson DM A. Concept Map RevisionDonna Mae SingsonNo ratings yet

- Property, Plant and Equipment (Pas 16)Document1 pageProperty, Plant and Equipment (Pas 16)Jhets CalumbayNo ratings yet

- Ias 16 - Property, Plant and Equipment: Compiled By: Murtaza QuaidDocument8 pagesIas 16 - Property, Plant and Equipment: Compiled By: Murtaza QuaidFalak FaizNo ratings yet

- MindMap PPEDocument1 pageMindMap PPEHazel Rose CabezasNo ratings yet

- Fsa c2 - Balance Sheet - Long-Lived Asset AnalysisDocument2 pagesFsa c2 - Balance Sheet - Long-Lived Asset AnalysisK59 LE NGUYEN HA ANHNo ratings yet

- Intangible AssetsDocument3 pagesIntangible Assetsgreat angelNo ratings yet

- Far 21 Notes and Loans Payable Debt RestructuringDocument7 pagesFar 21 Notes and Loans Payable Debt RestructuringJulie Mae Caling MalitNo ratings yet

- FAR 006 Summary Notes - Property, Plant & EquipmentDocument9 pagesFAR 006 Summary Notes - Property, Plant & EquipmentMarynelle Labrador SevillaNo ratings yet

- Pas 16Document32 pagesPas 16kiema katsutoNo ratings yet

- Chapter 6 Cfas ReviewerDocument2 pagesChapter 6 Cfas ReviewerBabeEbab AndreiNo ratings yet

- Afar.2905 Business Combination Mergers PDFDocument5 pagesAfar.2905 Business Combination Mergers PDFCyrille Keith FranciscoNo ratings yet

- FAR 04 Investment in Debt Instruments LectureDocument4 pagesFAR 04 Investment in Debt Instruments Lecturebyunb3617No ratings yet

- N/R Bio Asset GP Method Concepts Bank Recon Receivables FinancingDocument1 pageN/R Bio Asset GP Method Concepts Bank Recon Receivables Financingmac mercadoNo ratings yet

- Intermediate Accounting 1_044932Document6 pagesIntermediate Accounting 1_044932AMIEL TACULAONo ratings yet

- Financial&managerial Accounting - 15e Williamshakabettner Chap 9Document17 pagesFinancial&managerial Accounting - 15e Williamshakabettner Chap 9mzqaceNo ratings yet

- Audit 2 - Concept Map For InvestmentsDocument4 pagesAudit 2 - Concept Map For InvestmentsPrecious Recede100% (1)

- SME vs FULL IFRS Treatment of Intangible AssetsDocument4 pagesSME vs FULL IFRS Treatment of Intangible AssetsMary Ann B. GabucanNo ratings yet

- Grap 17 (IAS 16) - Layout 1Document1 pageGrap 17 (IAS 16) - Layout 1gvmgNo ratings yet

- Adjusting EntriesDocument1 pageAdjusting EntriesNadifa AisyahNo ratings yet

- PPE PART 1 SummaryDocument3 pagesPPE PART 1 SummaryunknownNo ratings yet

- Chap09 - Student (Revised)Document36 pagesChap09 - Student (Revised)Fung Yat Kit KeithNo ratings yet

- RECEIVABLESDocument7 pagesRECEIVABLESbona jirahNo ratings yet

- PFRS for SMEs vs Full PFRS: Key DifferencesDocument14 pagesPFRS for SMEs vs Full PFRS: Key DifferencesAnthon GarciaNo ratings yet

- Chap 04Document36 pagesChap 04Ahmad AlayanNo ratings yet

- Ind As 23 - Mind MapDocument2 pagesInd As 23 - Mind MapSarun ChhetriNo ratings yet

- Crib Sheet For MidtermDocument2 pagesCrib Sheet For MidtermSayyedah NanjiNo ratings yet

- CH 4 PPTDocument36 pagesCH 4 PPTJoseph IbrahimNo ratings yet

- AC 2102 Intermediate Accounting 2Document5 pagesAC 2102 Intermediate Accounting 2conniNo ratings yet

- Full PFRS Pfrs For Smes: Directly Attributable To TheDocument12 pagesFull PFRS Pfrs For Smes: Directly Attributable To TheKristine Astorga-NgNo ratings yet

- Acctg132 Investment-PropertyDocument1 pageAcctg132 Investment-PropertyRalph Ernest HulguinNo ratings yet

- Cfas EquityDocument3 pagesCfas EquityKeith SalesNo ratings yet

- Summary of IFRSDocument32 pagesSummary of IFRSFarwa Samreen67% (3)

- 36 Nature of Accounts As Per Traditional Modern ApproachDocument2 pages36 Nature of Accounts As Per Traditional Modern ApproachChandresh100% (1)

- INTERMEDIATE ACCOUNTING - IMPAIRMENT OF ASSETS (PAS 36)Document4 pagesINTERMEDIATE ACCOUNTING - IMPAIRMENT OF ASSETS (PAS 36)22100629No ratings yet

- The Accounting Cycle:: Accruals and DeferralsDocument41 pagesThe Accounting Cycle:: Accruals and DeferralsNursultanNo ratings yet

- PAS 16 Property Plant and Equipment GuideDocument4 pagesPAS 16 Property Plant and Equipment GuideKristalen ArmandoNo ratings yet

- INVESTMENTS W Matrix PFRS 9 PDFDocument7 pagesINVESTMENTS W Matrix PFRS 9 PDFAra DucusinNo ratings yet

- Accountancy Review Center (ARC) of The Philippines Inc.: Student HandoutsDocument5 pagesAccountancy Review Center (ARC) of The Philippines Inc.: Student HandoutsRNo ratings yet

- Aud Application 2 - Handout 6 Revaluation (UST)Document5 pagesAud Application 2 - Handout 6 Revaluation (UST)RNo ratings yet

- Chapter 10 - NON-CURRENT ASSETS AND DEPRECIATIONDocument15 pagesChapter 10 - NON-CURRENT ASSETS AND DEPRECIATIONĐặng Thái SơnNo ratings yet

- Fra MindmapDocument10 pagesFra MindmapNghĩaTrầnNo ratings yet

- Assets PrintingDocument7 pagesAssets PrintingIrtiza AbbasNo ratings yet

- IFRS vs USGAAP DifferencesDocument7 pagesIFRS vs USGAAP DifferencesRahul AgarwalNo ratings yet

- (Chap2) CFFR SummaryDocument2 pages(Chap2) CFFR Summaryliza marie basiaNo ratings yet

- EPI Program Member ManualDocument56 pagesEPI Program Member Manualcharina.nemenzo23No ratings yet

- 3036 7838 1 PBDocument17 pages3036 7838 1 PBAmandaNo ratings yet

- Eight Important Question Words: Italian Grammar Made EasyDocument2 pagesEight Important Question Words: Italian Grammar Made EasybeeNo ratings yet

- Land II NotesDocument28 pagesLand II NotesYun YiNo ratings yet

- Property Reviewer - Labitag OutlineDocument38 pagesProperty Reviewer - Labitag OutlineClarissa de VeraNo ratings yet

- Malaysia Sewerage Industry Guideline Volume 1Document281 pagesMalaysia Sewerage Industry Guideline Volume 1Asiff Razif100% (1)

- En Cybersecurity Holiday WorkbookDocument6 pagesEn Cybersecurity Holiday WorkbookAbdul Rehman ZafarNo ratings yet

- ABDULLAH BOZKURT - Iran Plays Subversive Role in Turkey PDFDocument4 pagesABDULLAH BOZKURT - Iran Plays Subversive Role in Turkey PDFAnonymous Bbxx7Z9No ratings yet

- Canadian Securities Institute Learning Catalogue: Csi Learning Solutions GuideDocument11 pagesCanadian Securities Institute Learning Catalogue: Csi Learning Solutions Guidemuhammadanasmustafa0% (1)

- Town of Hounsfield Zoning Map Feb 2016Document1 pageTown of Hounsfield Zoning Map Feb 2016pandorasboxofrocksNo ratings yet

- An Interview with Novelist Anita BrooknerDocument12 pagesAn Interview with Novelist Anita BrooknerlupearriegueNo ratings yet

- Admissions"Document7 pagesAdmissions"Lucky GuptaNo ratings yet

- QuizDocument18 pagesQuizParul AbrolNo ratings yet

- Text Wawancara BerpasanganDocument4 pagesText Wawancara BerpasanganSanjiNo ratings yet

- 5 Characteristics-Defined ProjectDocument1 page5 Characteristics-Defined ProjectHarpreet SinghNo ratings yet

- Property rights in news, body parts, and wild animalsDocument22 pagesProperty rights in news, body parts, and wild animalskoreanmanNo ratings yet

- Sany Introduction PDFDocument31 pagesSany Introduction PDFAnandkumar Pokala78% (9)

- Public Health Group AssignmentDocument7 pagesPublic Health Group AssignmentNANNYONGA OLGANo ratings yet

- Ssoar-2011-Afzini Et Al-Occupational Health and Safety inDocument39 pagesSsoar-2011-Afzini Et Al-Occupational Health and Safety inShan YasirNo ratings yet

- Res Ipsa Loquitur Section 328 D 2d Restatement of Torts (Excerpt)Document2 pagesRes Ipsa Loquitur Section 328 D 2d Restatement of Torts (Excerpt)George Conk100% (1)

- Introduction: Mobile Phone and Mobile Banking: 1.1 Problems To Be Evaluated and AssessedDocument56 pagesIntroduction: Mobile Phone and Mobile Banking: 1.1 Problems To Be Evaluated and AssessedAbhay MalikNo ratings yet

- EEDI and SEEMP Guide for Yachts and OSVsDocument3 pagesEEDI and SEEMP Guide for Yachts and OSVskuruvillaj2217No ratings yet

- NATO Bombing of Yugoslavia (TEXT)Document4 pagesNATO Bombing of Yugoslavia (TEXT)ana milutinovicNo ratings yet

- DECEPTION of GOD'S NAME - Part Five - FALSE TEACHERS PERRY STONE and JONATHAN ... (PDFDrive)Document28 pagesDECEPTION of GOD'S NAME - Part Five - FALSE TEACHERS PERRY STONE and JONATHAN ... (PDFDrive)Gisella Marisol De La Cruz CapchaNo ratings yet

- Pre-Employment Issues: by Group-6Document8 pagesPre-Employment Issues: by Group-6Debabratta PandaNo ratings yet

- Tickets State of OriginDocument4 pagesTickets State of OriginSimon MckeanNo ratings yet

- NACH FormDocument1 pageNACH FormPrem Singh Mehta75% (4)

- Write To MD Complain Report3Document85 pagesWrite To MD Complain Report3Abhishek TiwariNo ratings yet

- Rate Analysis m25Document2 pagesRate Analysis m25Biswajit Sinha100% (4)