Professional Documents

Culture Documents

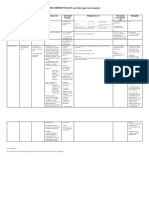

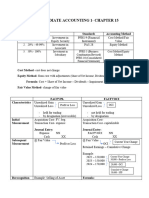

MEASUREMENT BASES and Other Important Reminders

Uploaded by

Shaina Monique Rangasan0 ratings0% found this document useful (0 votes)

1 views2 pagesThis document provides reminders about measurement bases and other accounting policies for various types of assets and liabilities:

1) It outlines the initial and subsequent measurement approaches for assets like borrowing costs, government grants, wasting assets, investment property, biological assets, and intangibles.

2) It also provides other reminders about topics like impairment testing criteria for different intangible assets, accounting for transfers between models, and rules for depreciating mining properties.

3) Measurement bases include cost, fair value, and lower of cost and fair value less costs to sell depending on the specific asset or liability.

Original Description:

Original Title

MEASUREMENT BASES and other important reminders

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides reminders about measurement bases and other accounting policies for various types of assets and liabilities:

1) It outlines the initial and subsequent measurement approaches for assets like borrowing costs, government grants, wasting assets, investment property, biological assets, and intangibles.

2) It also provides other reminders about topics like impairment testing criteria for different intangible assets, accounting for transfers between models, and rules for depreciating mining properties.

3) Measurement bases include cost, fair value, and lower of cost and fair value less costs to sell depending on the specific asset or liability.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views2 pagesMEASUREMENT BASES and Other Important Reminders

Uploaded by

Shaina Monique RangasanThis document provides reminders about measurement bases and other accounting policies for various types of assets and liabilities:

1) It outlines the initial and subsequent measurement approaches for assets like borrowing costs, government grants, wasting assets, investment property, biological assets, and intangibles.

2) It also provides other reminders about topics like impairment testing criteria for different intangible assets, accounting for transfers between models, and rules for depreciating mining properties.

3) Measurement bases include cost, fair value, and lower of cost and fair value less costs to sell depending on the specific asset or liability.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

MEASUREMENT BASES and other important reminders

Borrowing Government Wasting Assets Investment Biological Assets Noncurrent Intangibles

Costs Grant Property assets held for

sale

Initial Fair value Cost Cost plus any Confirm: lower of Cost

Measurement Income or transaction CA and FVCTS

Liability costs (DACs)

Cost model and

revaluation model

Subsequent Cost Model or Fair value FVCTS – if may Cost model or

Measurement Revaluation Model model or cost FVCTS or Cost less Acc Dep less IL increase in FVCTS revaluation model

model (with previously (if may active

recognized IL), the martket)

Any change in gain is limited only

FV is presented to the IL

in P/L

Disposal Net Proceeds

(SP – cost to

sell) – CA of the

asset =

gain/loss (P/L)

Other Reminders Applicable Receivable as Composition of cost: Cost (basket Cost to sell excludes transportation, finance cost, and Revluation surplus – Impairment of

only for compensation - acquisition cost method) income taxes (roque HO) walang piecemeal Patent:

qualifying for losses – (wasting assets include - Hindi given realization - compare CV with

assets. income na agad a land area – treated ang FV ng isa - Gain = includes harvest and birth its recoverable

as residual value to get use residual Reval: value (higher

GG do not the depletable approach Bearer plants with dual purpose – BA Change in FV – between value in

include amount) (allocate muna presented in OCI?? use and FVCTS)

government - exploration cost sa may FV) From valix:

assistance (before technical If mining equipment is movable and can be used for Trademark:

feasibility and Subsequent future extractvie project, use SL method. According to

commercial viability ; costs are also roque HO, if may

either successful effort capitalizable binigay na definite

or full cost method like sa PPE life pero sinabing

- development cost “trademark will be

(after technical Disposal: renewed in the

feasibility and If cost model – future indefinitely”,

commercial viability) dapat updated treat as asset with

- estimated restoration muna ang CA indefinite life.

cost

If fair value Customer list – if

Depletion model – use FV silent as to whether

- If may shut at the last acquired or

down, use SL reporting date internally

method kahit given ang generated, assume

- Inventoriable FV at the na acquired. So

(treated as disposal date subject to

direct amortization.

materials) Transfers:

Cost model – Internally generate

Rules in depreciating no gain or loss IA –

mining properties: - research phase –

- SHORTER FV model expense lahat

between UL - OOP to IP –

of the mining difference is

property reval surplus (if - development

and the UL walang phase – may

of the intention to criteria to be met

wasting reclassify from para macapitalize

assets. FV to cost, no

piecemeal Amortization of IA

Mining equipment realization. If with finite useful

- can be used in meron, may lives:

another mining site – SL piecemeal) - SHORTER

method between the

- walang use after all - Inventory to IP period of its

resources are removed – sa P/L lang legal/contractual

– use output method or rights and the

SL method. Depends - under period over which

kung ano ang shorter construction – the entity expects

between UL and FV – CA (of the to use the asset

mining period. CIP) shall go to - Amortization

P/L ceases at the

*if walang nagbago sa EARLIER between:

estimates, wala ring ▪ The asset in

change sa depletion classified as held

rate per unit. for sale

▪ Derecognition of

Shutdown: the asset

- compute

depreciation using UL Indefinite to finite

(based on remaining - amortize based

life and CV) on remaining life

- if nagresume – return

to output method

(using CA and

remaining estimate)

Government grant:

QS: if silent as to whether deferref income approach or deduction from the cost of the asset, ano gagamitin?

You might also like

- MEASUREMENT BASES and Other Important RemindersDocument2 pagesMEASUREMENT BASES and Other Important RemindersShaina Monique RangasanNo ratings yet

- INVESTMENTS W Matrix PFRS 9 PDFDocument7 pagesINVESTMENTS W Matrix PFRS 9 PDFAra DucusinNo ratings yet

- Assets PrintingDocument7 pagesAssets PrintingIrtiza AbbasNo ratings yet

- Accountancy Review Center (ARC) of The Philippines Inc.: Student HandoutsDocument5 pagesAccountancy Review Center (ARC) of The Philippines Inc.: Student HandoutsRNo ratings yet

- Aud Application 2 - Handout 6 Revaluation (UST)Document5 pagesAud Application 2 - Handout 6 Revaluation (UST)RNo ratings yet

- Asset Standard Initial Measurement Subsequent Measurement Included in Profit or Loss Financial POSITION PresentationDocument3 pagesAsset Standard Initial Measurement Subsequent Measurement Included in Profit or Loss Financial POSITION PresentationDidhane MartinezNo ratings yet

- Asset Standard Initial Measurement Subsequent Measurement Included in Profit or Loss Financial POSITION PresentationDocument3 pagesAsset Standard Initial Measurement Subsequent Measurement Included in Profit or Loss Financial POSITION PresentationDidhane MartinezNo ratings yet

- PAS Recognition Measurement Increase in Carrying Amount Due To Revaluation Derecognition Presentation and DisclosureDocument3 pagesPAS Recognition Measurement Increase in Carrying Amount Due To Revaluation Derecognition Presentation and DisclosureTimothy james PalermoNo ratings yet

- LCOE CHILE Ene - 11052401aDocument23 pagesLCOE CHILE Ene - 11052401aLenin AgrinzoneNo ratings yet

- 2nd Group - IASDocument63 pages2nd Group - IASmohihsanNo ratings yet

- Comprehensive Finance Cheat Sheet Collection 1698244606Document52 pagesComprehensive Finance Cheat Sheet Collection 1698244606muratgreywolf100% (1)

- Subsequent Measurement of Property, Plant and Equipment: Cost ModelDocument6 pagesSubsequent Measurement of Property, Plant and Equipment: Cost ModelLorraine Dela CruzNo ratings yet

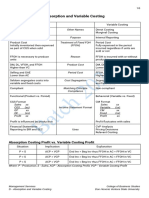

- D - Absorption and Variable CostingDocument5 pagesD - Absorption and Variable Costingian dizonNo ratings yet

- Idle Capacity and Management: BE PresentationDocument15 pagesIdle Capacity and Management: BE PresentationBhawna GosainNo ratings yet

- IntermedDocument1 pageIntermedEsther Oilynjoy MelendrezNo ratings yet

- Cost Accounting Nature of Costs/Cost Volume Profit Analysis IDocument25 pagesCost Accounting Nature of Costs/Cost Volume Profit Analysis IMackenzie Heart Obien0% (1)

- SBR NoteDocument20 pagesSBR NotechuwenNo ratings yet

- SS - 5-6 - Mindmaps - Financial ReportingDocument48 pagesSS - 5-6 - Mindmaps - Financial Reportinghaoyuting426No ratings yet

- Finance For Executives Managing For Value Creation 6Th Edition Gabriel Hawawini Full ChapterDocument67 pagesFinance For Executives Managing For Value Creation 6Th Edition Gabriel Hawawini Full Chapterjoyce.clewis414100% (16)

- Fra MindmapDocument10 pagesFra MindmapNghĩaTrầnNo ratings yet

- Ifrs Vs UsgaapDocument2 pagesIfrs Vs UsgaapPrachi JainNo ratings yet

- Lesson 12Document10 pagesLesson 12shadowlord468No ratings yet

- Chap09 - Student (Revised)Document36 pagesChap09 - Student (Revised)Fung Yat Kit KeithNo ratings yet

- Lesson 12Document6 pagesLesson 12Jamaica bunielNo ratings yet

- Ebook Finance For Executives Managing For Value Creation PDF Full Chapter PDFDocument67 pagesEbook Finance For Executives Managing For Value Creation PDF Full Chapter PDFjulie.morrill858100% (26)

- STRATCOST Quiz 2 Reviewer by Diamla, Foronda, GanDocument15 pagesSTRATCOST Quiz 2 Reviewer by Diamla, Foronda, GanAhga MoonNo ratings yet

- Joint Products / by Products: Accounting Decision MakingDocument16 pagesJoint Products / by Products: Accounting Decision MakingKaran KashyapNo ratings yet

- Reading 23 - Long-Lived AssetsDocument7 pagesReading 23 - Long-Lived AssetsLuis Henrique N. SpínolaNo ratings yet

- Process CostingDocument5 pagesProcess CostingRyo ShokoNo ratings yet

- Abusama Impairment of AssetsDocument1 pageAbusama Impairment of AssetsGarp BarrocaNo ratings yet

- Chapter 1Document11 pagesChapter 1kimberlyann ongNo ratings yet

- Ind As 23 - Mind MapDocument2 pagesInd As 23 - Mind MapSarun ChhetriNo ratings yet

- CVP TheoryDocument7 pagesCVP Theoryhassan malikNo ratings yet

- Reporting of Long-Lived Assets/PPE/Fixed AssetsDocument6 pagesReporting of Long-Lived Assets/PPE/Fixed AssetsAnishaSapraNo ratings yet

- Fra PDFDocument27 pagesFra PDFNeeraj KumarNo ratings yet

- Variable and Absorption CostingDocument3 pagesVariable and Absorption CostingAnna Pamela MarianoNo ratings yet

- Chapter 7. Leverage and Capital StructureDocument2 pagesChapter 7. Leverage and Capital StructureJhazz DoNo ratings yet

- P2Mindmap (JoeFang)Document41 pagesP2Mindmap (JoeFang)Mubashar HussainNo ratings yet

- Prepared By: Jessy ChongDocument7 pagesPrepared By: Jessy ChongDaleNo ratings yet

- UEU Penilaian Asset Bisnis Pertemuan 14Document67 pagesUEU Penilaian Asset Bisnis Pertemuan 14Saputra SanjayaNo ratings yet

- Ac 506 - Pas 16Document1 pageAc 506 - Pas 16Rome SibuyasNo ratings yet

- I. Cost Terminology: ElementDocument52 pagesI. Cost Terminology: ElementJomar PenaNo ratings yet

- AS 10 - Property Plant and Equipment: Recognition CriteriaDocument5 pagesAS 10 - Property Plant and Equipment: Recognition CriteriaAshutosh shriwasNo ratings yet

- Ias 16 Property, Plant and Equipment: Fact SheetDocument13 pagesIas 16 Property, Plant and Equipment: Fact SheetXYZA JABILINo ratings yet

- Adobe Scan 02-Feb-2022Document4 pagesAdobe Scan 02-Feb-2022Khyati PatelNo ratings yet

- Arginal OstingDocument69 pagesArginal Ostingmoses jcNo ratings yet

- Cost Allocation RequirementDocument3 pagesCost Allocation Requirementpatankar.vaibhav08No ratings yet

- Intermediate Accounting 1 - Chapter 15Document2 pagesIntermediate Accounting 1 - Chapter 15Joanah TayamenNo ratings yet

- Kislan PDFDocument2 pagesKislan PDFSankalan GhoshNo ratings yet

- Putting IFRS 9 Into Practice Presentation By: CPA Stephen Obock February 2018Document38 pagesPutting IFRS 9 Into Practice Presentation By: CPA Stephen Obock February 2018syed younasNo ratings yet

- Acct Final NoteDocument2 pagesAcct Final NotegraceNo ratings yet

- SS - 7-8 - Mindmaps - Corporate FinanceDocument38 pagesSS - 7-8 - Mindmaps - Corporate Financehaoyuting426No ratings yet

- Pas 16 Property Plant and EquipmentDocument4 pagesPas 16 Property Plant and EquipmentKristalen ArmandoNo ratings yet

- Capital Budgeting: This WeekDocument2 pagesCapital Budgeting: This WeekFath DiwirjaNo ratings yet

- Absorption and MarginalDocument7 pagesAbsorption and MarginalshafinasimanNo ratings yet

- Cost Recovery: Turning Your Accounts Payable Department into a Profit CenterFrom EverandCost Recovery: Turning Your Accounts Payable Department into a Profit CenterNo ratings yet

- Tax Calculator AY 09-10Document4 pagesTax Calculator AY 09-10madhuamsNo ratings yet

- Tutorial 2 AnswerDocument2 pagesTutorial 2 AnswerDiana TuckerNo ratings yet

- Testbank SolutionsDocument58 pagesTestbank SolutionsHaider KamranNo ratings yet

- YTD & FYFCST Budget Control M11Document11 pagesYTD & FYFCST Budget Control M11rominasavioNo ratings yet

- Federal Information Filing For Rachel DuncanDocument3 pagesFederal Information Filing For Rachel DuncanThe State NewspaperNo ratings yet

- InvoiceDocument1 pageInvoiceShreyas V SNo ratings yet

- 1268049518moneysaver Shopping GuideDocument24 pages1268049518moneysaver Shopping GuideCoolerAdsNo ratings yet

- Your BillDocument2 pagesYour Billsnandakishore21No ratings yet

- ITP Exam SuggetionDocument252 pagesITP Exam SuggetionNurul AminNo ratings yet

- Maha Pot BillDocument1 pageMaha Pot BillxidaNo ratings yet

- Public DebtDocument28 pagesPublic DebtAlia NdhirhNo ratings yet

- (CBTP)Document23 pages(CBTP)gudissagabissaNo ratings yet

- 2016 Bar Exam Suggested AnswersDocument17 pages2016 Bar Exam Suggested AnswersAnonymous WJT0oARK5No ratings yet

- InvoiceDocument1 pageInvoiceGovind SainiNo ratings yet

- 19 Smart Communications, Inc. vs. The City of DavaoDocument12 pages19 Smart Communications, Inc. vs. The City of Davaoshlm bNo ratings yet

- Lesotho Tax System (w1)Document3 pagesLesotho Tax System (w1)Limpho Teddy PhateNo ratings yet

- International Business EnvironmentDocument9 pagesInternational Business Environmentvinay rickyNo ratings yet

- 6.3 7Document26 pages6.3 7Revy CumahigNo ratings yet

- Payment Receipt 0005743148Document1 pagePayment Receipt 0005743148Chitradeep FalguniyaNo ratings yet

- Accounting Gov ReviewerDocument20 pagesAccounting Gov ReviewerShane TorrieNo ratings yet

- Com203 - Final Accounts of Insurance CompaniesDocument23 pagesCom203 - Final Accounts of Insurance CompaniesSanaullah M SultanpurNo ratings yet

- TATA 1MG Healthcare Solutions Private Limited: Jalandhar, 144410, INDocument1 pageTATA 1MG Healthcare Solutions Private Limited: Jalandhar, 144410, INGurpreet singhNo ratings yet

- Customs Modernization and Tariff ActDocument6 pagesCustoms Modernization and Tariff ActGabriel SantosNo ratings yet

- Income Tax Payment Procedures in TanzaniaDocument3 pagesIncome Tax Payment Procedures in Tanzaniashadakilambo100% (1)

- TRAIN LAW FindingsDocument10 pagesTRAIN LAW FindingsHoney Lizette Sunthorn80% (5)

- Egyptian Business Commercial Laws Edited Feb. 2016Document135 pagesEgyptian Business Commercial Laws Edited Feb. 2016Rima AkidNo ratings yet

- 19001914V1.0 Vol. 1Document532 pages19001914V1.0 Vol. 1JvlValenzuelaNo ratings yet

- Angeles S. Santos, vs. Paterio AquinoDocument2 pagesAngeles S. Santos, vs. Paterio AquinoDessa ReyesNo ratings yet

- IPru Elite Life II Leaflet 26 DecDocument8 pagesIPru Elite Life II Leaflet 26 DecAnkur GautamNo ratings yet

- E-Book On GST by CA. (DR.) G. S. Grewal - 2020Document58 pagesE-Book On GST by CA. (DR.) G. S. Grewal - 2020Aarav DhingraNo ratings yet