Professional Documents

Culture Documents

Processing and Lawyer's Fee Proposal - Mendoza - Lim

Uploaded by

Abraham S. OlegarioOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Processing and Lawyer's Fee Proposal - Mendoza - Lim

Uploaded by

Abraham S. OlegarioCopyright:

Available Formats

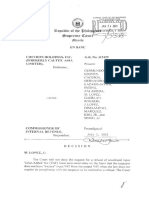

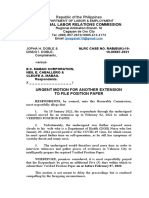

HEIRS OF ANDRES ALFREDO MENDOZA

(AL MICHAEL T. MENDOZA AND

Ravanera, Manuel R. (+) MAGI CAROLINE ANN T. MENDOZA)

Olegario, Abraham Jr. S.

Bago, Jayfrancis D. *

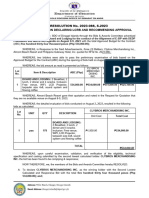

Area: 546 square meters.

Naduma, Mat Kieven T. * Location: Cagayan De Oro City

BIR Zonal Valuation: Php37,150.00/sqm

BIR Estimated Zonal Valuation: 37,150/sqm x 546sqm =20, 283,900.00

Ravanera, Ilya Kristine R. Deed of Sale: Php25,000,000.00

Niog, Rejee Mae

Closas, Robert Jones H. Note: The basis of the BIR in the computation of the taxes shall be the Deed

of Sale or the BIR Zonal valuation, whichever is higher. The basis now is

the Deed of Sale as it is much higher than the BIR Zonal Valuation.

Ampong , Jason A.

Cabrera, Ana Karla L.

Laroga, Christine Lou A. BIR/ASSESSOR/ROD TAXES:

Oguis, Reese B.

1. Capital Gains Tax (6%) P 1,500,000.00

2. Documentary Stamp Tax (1.5%) 375,000.00

3. Transfer Tax (1/2%) 125,000.00

4. Registration Fee (1/4%) 62,500.00

5. BIR Certification Fee- 100.00

6. Docstamp @30.00/stamp 150.00

TOTAL: Php 2,062,750.00

Special Counsel

Balane, Ruben F. (+)

Seno, Maricel R.

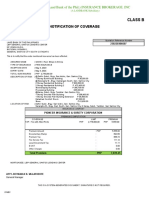

LAWYER’S FEE (DEED OF SALE) 2.5% Php625,000.000

Note: This can be negotiated by Atty. Abraham Olegario

PROCESSING FEE (From BIR,Assessor,ROD) Php30,000.00

Door A, Ground Floor

Lim Building Note: Exclusive of costs (Photocopy, printing, transportation, and others.

Vamenta Boulevard, Carmen These costs are subject to liquidation for the presentation of receipts.

Cagayan de Oro City, 9000

Thank you very much.

Telephone No.:

+63(088) 850 1668 Very truly yours,

Email Address:

info@robnlaw.com

ABRAHAM S. OLEGARIO, JR.

For the firm

Correspondent firm of MOST LAW

(formerly Marcos Ochoa Serapio Tan)

www.mostlawfirm.net

You might also like

- Transfer of Tax DeclarationDocument1 pageTransfer of Tax DeclarationAldrienNo ratings yet

- Bureau of Internal Revenues (Bir) Penalties Cases Penalties Compromise Penalty Amount DuesDocument4 pagesBureau of Internal Revenues (Bir) Penalties Cases Penalties Compromise Penalty Amount DuesRoxanne Mae GonzagaNo ratings yet

- List of Properties and Status: Total Transfer Tax Payment: 2,420.00Document18 pagesList of Properties and Status: Total Transfer Tax Payment: 2,420.00JessiePatronNo ratings yet

- Price of The Agricultural LandDocument2 pagesPrice of The Agricultural Landcoolest51No ratings yet

- 874 Shotwell ST, San Francisco, CA 94110 MLS #4Document1 page874 Shotwell ST, San Francisco, CA 94110 MLS #4govindNo ratings yet

- Litonjua Vs Marcelino AM No. P-18-3865Document10 pagesLitonjua Vs Marcelino AM No. P-18-3865Di JoyaNo ratings yet

- Schools Division Office of Pampanga Obligation Request and StatusDocument8 pagesSchools Division Office of Pampanga Obligation Request and StatusIrene ReyesNo ratings yet

- Concert Aj Event ProposalDocument21 pagesConcert Aj Event Proposalajantess alderiteNo ratings yet

- Working Papers Presentation-Ap-NpDocument6 pagesWorking Papers Presentation-Ap-NpAngelica Mae MarquezNo ratings yet

- BAC ResolutionDocument2 pagesBAC ResolutionBarangay AlipaoNo ratings yet

- Penanshin Shipping (Phils.) Inc.: Debit NoteDocument1 pagePenanshin Shipping (Phils.) Inc.: Debit NoteEnriquez Martinez May AnnNo ratings yet

- Namecheap Order 38276620Document1 pageNamecheap Order 38276620Claudia BernardNo ratings yet

- Sen Robert Duncan Flight Records Oct ADocument3 pagesSen Robert Duncan Flight Records Oct ALee Ann O'NealNo ratings yet

- Final Compre Problem Bir Forms2017Document8 pagesFinal Compre Problem Bir Forms2017Louina YnciertoNo ratings yet

- CPA REVIEWDocument4 pagesCPA REVIEWjtNo ratings yet

- 5115 Cascade Palmetto Hwy Fairburn Buyer's Info PacketDocument18 pages5115 Cascade Palmetto Hwy Fairburn Buyer's Info PacketSonal KaliaNo ratings yet

- Rizal Cares Association (Caring Attending Responding To Environmental Issues) 18 September 2019 Hon. Dave Q. Odiem Provincial Vice Governor/Presiding OfficerDocument9 pagesRizal Cares Association (Caring Attending Responding To Environmental Issues) 18 September 2019 Hon. Dave Q. Odiem Provincial Vice Governor/Presiding OfficerclaireNo ratings yet

- Chevron Holdings, Inc. (Formerly Caltex Asia Limited) vs. Commissioner of Internal Revenue, G.R. No. 215159, July 5, 2022Document30 pagesChevron Holdings, Inc. (Formerly Caltex Asia Limited) vs. Commissioner of Internal Revenue, G.R. No. 215159, July 5, 2022Anonymous oGfAqF1No ratings yet

- CMG Home Ownership Accelerator Example Doc Set CA050207Document94 pagesCMG Home Ownership Accelerator Example Doc Set CA050207Robert Emmett McAuliffeNo ratings yet

- Ms. Ruth Ricalde and Mr. Joshua Dalangin (Executive + Garden)Document2 pagesMs. Ruth Ricalde and Mr. Joshua Dalangin (Executive + Garden)sara ricaldeNo ratings yet

- Republika NG Pilipinas Kawaran NG Pananalapi Kawanihan NG Rentas InternasDocument12 pagesRepublika NG Pilipinas Kawaran NG Pananalapi Kawanihan NG Rentas InternasdanieladiezNo ratings yet

- Namecheap Order 51625389Document1 pageNamecheap Order 51625389azibNo ratings yet

- Exhibitor Reg FormDocument1 pageExhibitor Reg FormJames BurrussNo ratings yet

- Rossmont Green - Broker-PackageDocument2 pagesRossmont Green - Broker-Packagegul khaNo ratings yet

- Payroll: Increase JAN. 2019 Increase FEB. 2019 Increase MAR. 2019 Increase APR. 2019Document1 pagePayroll: Increase JAN. 2019 Increase FEB. 2019 Increase MAR. 2019 Increase APR. 2019san nicolas 2nd betis guagua pampangaNo ratings yet

- RE: Commission DemandDocument2 pagesRE: Commission DemandMegan PerezNo ratings yet

- 4373 Alabama: 4373 Alabama - San Diego, CA 92104Document8 pages4373 Alabama: 4373 Alabama - San Diego, CA 92104assistant_sccNo ratings yet

- LA County Land W Permits & PlansDocument112 pagesLA County Land W Permits & PlanserespinozaNo ratings yet

- Golden Leaf Quick Ref Guide 2015-0218Document2 pagesGolden Leaf Quick Ref Guide 2015-0218Kevin NewmanNo ratings yet

- Alternative Investments Angus Cartwright, JR Case AnalysisDocument9 pagesAlternative Investments Angus Cartwright, JR Case Analysissharanya86No ratings yet

- Building - Donation - Form of A Church in CAGAYANDocument1 pageBuilding - Donation - Form of A Church in CAGAYANJose Roberto RamosNo ratings yet

- Fee Schedule Notice of Intent-Generic NotaryDocument8 pagesFee Schedule Notice of Intent-Generic NotaryC100% (1)

- ROD LetterDocument1 pageROD LettermikzhiNo ratings yet

- Reso 91Document2 pagesReso 91DHEMIE PIODONo ratings yet

- Rab Coal Imip Gar 5100 Bg.10.00mt - Eba (Kalteng) - EbaDocument1 pageRab Coal Imip Gar 5100 Bg.10.00mt - Eba (Kalteng) - EbaErwinNo ratings yet

- Check RequestDocument36 pagesCheck RequestApril MagpantayNo ratings yet

- 174 Ex. C (Pp. 13-24) - K & B Redated Billing 6.2.16)Document15 pages174 Ex. C (Pp. 13-24) - K & B Redated Billing 6.2.16)larry-612445No ratings yet

- Nep Za TariffDocument3 pagesNep Za TariffAnonymous 9ZakghkbiYNo ratings yet

- Caswell County - Carolina Sunrock Invoice Through 8-31-20-C1 PDFDocument3 pagesCaswell County - Carolina Sunrock Invoice Through 8-31-20-C1 PDFLisa SorgNo ratings yet

- Namecheap Order 75812944Document1 pageNamecheap Order 75812944oui nonNo ratings yet

- Accounts Payable Check RequestDocument6 pagesAccounts Payable Check Requestjimenezsam380No ratings yet

- SUG116Document5 pagesSUG116coffeepathNo ratings yet

- Prepared For:: Larry Pittman National Agent Network Phone:832.413.2BUY FaxDocument10 pagesPrepared For:: Larry Pittman National Agent Network Phone:832.413.2BUY Faxapi-26107759No ratings yet

- Namecheap Order 65823079Document1 pageNamecheap Order 65823079CharlotteNo ratings yet

- Namecheap Order 90150173Document1 pageNamecheap Order 90150173KaiNo ratings yet

- Cost-Proposal NDT GreenlandDocument1 pageCost-Proposal NDT GreenlandDang-dang Siggaoat-CopiacoNo ratings yet

- Abm Final Group 4Document7 pagesAbm Final Group 4Unfernie Christian Jhe PulveraNo ratings yet

- Namecheap Order 72415312Document1 pageNamecheap Order 724153121xBet 1xBetNo ratings yet

- Stability Chamber Pro Forma InvoiceDocument2 pagesStability Chamber Pro Forma InvoiceJoshua CuevasNo ratings yet

- LERIS - Professional Regulation Commission PDFDocument3 pagesLERIS - Professional Regulation Commission PDFSHIELA OMEGANo ratings yet

- Namecheap Order 116926670Document1 pageNamecheap Order 116926670Ayoub BengebaraNo ratings yet

- Denish Finance Report Sept 2010Document125 pagesDenish Finance Report Sept 2010Steve TerrellNo ratings yet

- Aei Enterprise, Inc.: Cash Allowance Report of Empployees For The Period April 2019Document29 pagesAei Enterprise, Inc.: Cash Allowance Report of Empployees For The Period April 2019Ritchelle Quijote DelgadoNo ratings yet

- Namecheap Receipt for SSL Certificate and Domain RegistrationDocument1 pageNamecheap Receipt for SSL Certificate and Domain Registrationoui nonNo ratings yet

- GARAY, Rock Eliseo & Emma FIRE COC MAY 2023-2024Document1 pageGARAY, Rock Eliseo & Emma FIRE COC MAY 2023-2024Penguin 37No ratings yet

- Safari - 5 Jul 2019 at 10:22 PM PDFDocument1 pageSafari - 5 Jul 2019 at 10:22 PM PDFNorfaidah LondoNo ratings yet

- Joaquin T Borromeo at LawphilDocument35 pagesJoaquin T Borromeo at LawphilnehrupipzNo ratings yet

- ChandelierDocument2 pagesChandelierAnaNo ratings yet

- Supreme Court: Republic of The Philippines ManilaDocument52 pagesSupreme Court: Republic of The Philippines ManilaAbraham S. OlegarioNo ratings yet

- January 13 - Pros. Landicho (Cybercrime Act of 2012)Document102 pagesJanuary 13 - Pros. Landicho (Cybercrime Act of 2012)Abraham S. OlegarioNo ratings yet

- Musa Moson 1991Document4 pagesMusa Moson 1991Abraham S. OlegarioNo ratings yet

- Inhibition of JudgesDocument21 pagesInhibition of JudgesAbraham S. OlegarioNo ratings yet

- January 13 - USec. Pangulayan (Updates in Agrarian Reform)Document129 pagesJanuary 13 - USec. Pangulayan (Updates in Agrarian Reform)Abraham S. OlegarioNo ratings yet

- CUENCO 73venuevjurisdictionDocument13 pagesCUENCO 73venuevjurisdictionAbraham S. OlegarioNo ratings yet

- Court Reviews Forced Eviction Case Due to Co-Ownership IssueDocument6 pagesCourt Reviews Forced Eviction Case Due to Co-Ownership IssueDarkSlumberNo ratings yet

- Maloles Maloles 2000Document13 pagesMaloles Maloles 2000Abraham S. OlegarioNo ratings yet

- JUNTA-Perez V CADocument5 pagesJUNTA-Perez V CAAbraham S. OlegarioNo ratings yet

- Law firm directory for ROBN LawDocument1 pageLaw firm directory for ROBN LawAbraham S. OlegarioNo ratings yet

- Progressive Development Corporation, Inc., Petitioner, Vs - Court of AppealsDocument8 pagesProgressive Development Corporation, Inc., Petitioner, Vs - Court of AppealsJumen Gamaru TamayoNo ratings yet

- January 13 - Judge Dela Rosa (Litigating Land Registration Cases)Document71 pagesJanuary 13 - Judge Dela Rosa (Litigating Land Registration Cases)Abraham S. OlegarioNo ratings yet

- January 13 - DCP Medrano - Updates in Criminal ProcedureDocument64 pagesJanuary 13 - DCP Medrano - Updates in Criminal ProcedureAbraham S. OlegarioNo ratings yet

- David V ArroyoDocument88 pagesDavid V ArroyoarjoguzmanNo ratings yet

- Extra Judicial Settlement of Estate in The PhilippinesDocument3 pagesExtra Judicial Settlement of Estate in The PhilippinesJus EneroNo ratings yet

- Memorandum of Agreement: Copy of The Memorandum of Agreement Is Hereto Attached and Made As An Integral Part Hereof)Document3 pagesMemorandum of Agreement: Copy of The Memorandum of Agreement Is Hereto Attached and Made As An Integral Part Hereof)Abraham S. OlegarioNo ratings yet

- Musa Moson 1991Document4 pagesMusa Moson 1991Abraham S. OlegarioNo ratings yet

- Maloles Maloles 2000Document13 pagesMaloles Maloles 2000Abraham S. OlegarioNo ratings yet

- Client Demands Payment for Outstanding Business DebtDocument1 pageClient Demands Payment for Outstanding Business DebtAbraham S. OlegarioNo ratings yet

- Loss NPDLDocument1 pageLoss NPDLAbraham S. OlegarioNo ratings yet

- NLRC Ecmabao Extension 2ndDocument2 pagesNLRC Ecmabao Extension 2ndAbraham S. OlegarioNo ratings yet

- San Luis vs. San LuisDocument14 pagesSan Luis vs. San LuisMichelangelo TiuNo ratings yet

- Affidavit of Surviving Heirs for Cemetery Lot WaiverDocument1 pageAffidavit of Surviving Heirs for Cemetery Lot WaiverAbraham S. OlegarioNo ratings yet

- ABRATIQUINDocument1 pageABRATIQUINAbraham S. OlegarioNo ratings yet

- BAGUIODocument1 pageBAGUIOAbraham S. OlegarioNo ratings yet

- EJEMDocument1 pageEJEMAbraham S. OlegarioNo ratings yet

- General Power of Attorney .Alaya AyDocument2 pagesGeneral Power of Attorney .Alaya AyAbraham S. Olegario100% (1)

- Alternative Learning System teaches financial mathDocument4 pagesAlternative Learning System teaches financial mathAngeline Panaligan AnselaNo ratings yet

- 6937 - Statement of Cash FlowsDocument2 pages6937 - Statement of Cash FlowsAljur SalamedaNo ratings yet

- Coins of India, Pakistan, Nepal & Bhutan: From Ancient Times To The PresentDocument10 pagesCoins of India, Pakistan, Nepal & Bhutan: From Ancient Times To The Presentraja000ramNo ratings yet

- The Management of Capital: True/False QuestionsDocument6 pagesThe Management of Capital: True/False QuestionsAmira GawadNo ratings yet

- BU9201 Course Outline 20132014s1Document2 pagesBU9201 Course Outline 20132014s1Feeling_so_flyNo ratings yet

- Accounting Equation Chapter ExplainedDocument3 pagesAccounting Equation Chapter ExplainedTariq Rahim60% (5)

- F L J M I: Aculty OF AW Amia Illia SlamiaDocument37 pagesF L J M I: Aculty OF AW Amia Illia SlamiaMohd YasinNo ratings yet

- Daftar Riwayat Hidup Calon Anggota Dewan Komisaris PT Bank Jago TBKDocument5 pagesDaftar Riwayat Hidup Calon Anggota Dewan Komisaris PT Bank Jago TBKbimobimoprabowoNo ratings yet

- Orford Creditor's ReportDocument29 pagesOrford Creditor's Reportdyacono5452No ratings yet

- Renewal NoticeDocument1 pageRenewal NoticevishalmprojectNo ratings yet

- Loan Agreement TemplateDocument3 pagesLoan Agreement TemplateWilma PereñaNo ratings yet

- Acc-106 Sas 4Document11 pagesAcc-106 Sas 4hello millieNo ratings yet

- Macro Economy Today 14th Edition Schiller Test Bank Full Chapter PDFDocument67 pagesMacro Economy Today 14th Edition Schiller Test Bank Full Chapter PDFcarlarodriquezajbns100% (12)

- General Terms & Conditions (Provisional) : Phase 9Document30 pagesGeneral Terms & Conditions (Provisional) : Phase 9Durgesh NandiniNo ratings yet

- Crypto A Succesfull Application of BlockchainDocument19 pagesCrypto A Succesfull Application of BlockchainYousef abachirNo ratings yet

- Karnataka Bank 5326520315Document101 pagesKarnataka Bank 5326520315eepNo ratings yet

- Changes To Key Performance Indicators Under IFRS 17: Interesting Thought Is About Which Regime Will Become LeadingDocument1 pageChanges To Key Performance Indicators Under IFRS 17: Interesting Thought Is About Which Regime Will Become LeadingMuhammad KholiqNo ratings yet

- Pulak Chandan PrasadDocument6 pagesPulak Chandan PrasadferozamedNo ratings yet

- Ijbamv7n1spl 05Document16 pagesIjbamv7n1spl 05MIR FAISAL YOUSUFNo ratings yet

- Kami Export - U1 Vocabulary Personal FinanceDocument2 pagesKami Export - U1 Vocabulary Personal FinanceAbel CopaNo ratings yet

- Economic and Legal Analysis of Inflation and DeflationDocument23 pagesEconomic and Legal Analysis of Inflation and Deflationbindu priyaNo ratings yet

- Wiley Finance Art of Value Investing How The World S Best Investors Beat The Market 1 To 60Document60 pagesWiley Finance Art of Value Investing How The World S Best Investors Beat The Market 1 To 60ravz510100% (2)

- Characteristics of EuroDocument10 pagesCharacteristics of EuroSujith PSNo ratings yet

- Ifrs 3 - Business Combination: According To The Nature of BusinessDocument5 pagesIfrs 3 - Business Combination: According To The Nature of BusinessBrian GoNo ratings yet

- Crypto Valuation Report v20181016 FVDocument63 pagesCrypto Valuation Report v20181016 FVşakir Sakarya100% (1)

- Bank statement title generatorDocument45 pagesBank statement title generatorrohit kathaleNo ratings yet

- Fundamentals of Accounting I The Accounting EquationDocument10 pagesFundamentals of Accounting I The Accounting EquationericacadagoNo ratings yet

- Financial Management Coursework Cash Flow AnalysisDocument3 pagesFinancial Management Coursework Cash Flow AnalysisA.A LastNo ratings yet

- MORB 2010 Vol. 2Document856 pagesMORB 2010 Vol. 2Kristina LayugNo ratings yet

- First PhaseDocument7 pagesFirst PhasesameertawdeNo ratings yet