Professional Documents

Culture Documents

V 12 - Schedule of Important Labor Laws - 22.02.2023

Uploaded by

haris hafeez0 ratings0% found this document useful (0 votes)

11 views6 pageslabor laws Pak

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentlabor laws Pak

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views6 pagesV 12 - Schedule of Important Labor Laws - 22.02.2023

Uploaded by

haris hafeezlabor laws Pak

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 6

WORKER’S FACILITIES AND BENEFITS

WITH REFERENCE OF LAW

As on 22nd February 2023 – V.12

Sr. Description Min. No. Level Limit Rate Coverage &

# of Salary / Facilities

Employee

Wages

1 Bonus 20 or All No Salary = One One bonus per

Ref. u/s 10 – C More Workers Limit month salary year, if company

Punjab Industrial & / wage declares profit

Commercial 1. No profit no

Employment bonus

(Standing Orders) 2. If profit is

Amendment Act

more than one-

2012

month wages

then one bonus

may be

disbursed.

3. If profit is

equal to one-

month wages

then 30% bonus

may be

disbursed.

4. If profit is less

than one-month

wages then 15%

bonus may be

disbursed.

2 Compulsory 50 or All No Salary Rs. Natural /

Group More workers Limit 500,000/- Accidental death

Insurance Per head / disability

Ref. u/s 10-B (3) coverage

Punjab Industrial &

Commercial

Employment

(Standing Orders)

Amendment Act

2012

3 Gratuity 10 or All No Salary Last drawn Retirement /

Ref. u/s 12 (6) More Workers Limit gross salary Separation

Punjab Industrial & / 26 X30 Benefit

Commercial

Becomes

Employment

(Standing Orders) Eligible after six

Amendment Act months service,

2012 on prorate

Author: Amjad Bhatti, HR & IR Consultant and Trainer,

Contact No. 0300 946 8738

basis) Ref. 1976

PLC 578

4 Provident Fund 10 or All No Salary Self-8.33% Principal

Ref. u/s 12(6) More Workers Limit Co. 8.33% amount (Self +

Punjab Industrial & (Industrial Company’s

Commercial

Practice. Contribution) +

Employment

(Standing Orders) Law’s focus profit paid at the

Amendment Act on one time of

2012 gross salary separation

after

completion

of one year

service)

5 Medical Checkup 10 or All No Salary Rs. 10/- Inoculation

Ref. u/s 23-A More Workers Limit Twice a year against TB,

Factories Act 1934 Cholera

6 Canteen 250 or All No Salary Subsidized food

Ref. u/s 24 More workers Limit and catering

Factories Act 1934 services

7 Overtime 10 or All No Salary Basic Pay + 2 hrs per day @

Ref. u/s 47 (1) More Workers Limit Statutory double, if

Factories Act 1934 Allowances weekend lost

then double OT

+1

Compensatory

Leave, if

Gazetted

holiday lost then

double OT + 2

Leaves

8 Leaves 10 or All No Salary Casual-10 With pay leaves

Ref. u/s 49 (B) (H) More Workers Limit Medical-8 per year

Factories Act 1934 Annual -14

Section 36 Maternity No limit of

PESSI 1965 leaves – 90 deliveries

days (45 day

before and

45 days

after the

delivery)

U/s 37 (2) Iddat Leaves 100% wages for

PESSI 1965 4 months 130 days

and 10 days

Author: Amjad Bhatti, HR & IR Consultant and Trainer,

Contact No. 0300 946 8738

Compensato Worked against

ry Leaves Weekly off days

or Gazetted

holidays

May be made

availed with in

next 3 days.

9 Annual Leave 10 or All No Salary Annual Un-availed

Encashment More Workers Limit Leaves annual leaves in

excess of two

Ref. u/s 14 (2) (b) years balance

Shop and i.e 28 days @

Establishment gross salary

Ordinance

10 Cost of Living 10 or All No Salary Rs.100/1993 Part of Wages,

Allowance More workers Limit Rs. 50/1994

COLA 93,94 & 97 Rs.300/1997

11 Employees Old 5 or All Rs. Co. 5 % Monthly old age

Age More Employee 25,000/- Emp.1 %, pension,

Benefit Institute s pm Minimum Survivor

EOBI 1976 (From Pension Rs. pension, Grant

Peon to 8,500/- per Etc. Retirement

GM) month, benefit (for

Excluding applicable pension

Directors w.e.f. 1st payment of 15

January year

2020. contributions is

Pension must and for

becomes death benefits 5

due at the years payment

age Male 60 of contribution is

and female must)

55 years.

12 Fair Price Shop 100 or All No Salary No profit, Provision of

Ref. More Workers Limit whole sale essential food

The Punjab Fair rate items, as per

Price Shops detail provided

(Factories) in the law.

Ordinance 1971

Author: Amjad Bhatti, HR & IR Consultant and Trainer,

Contact No. 0300 946 8738

13 Worker 50 or All No Salary Harmonious

Management More Workers Limit working

Counsel condition,

Ref. u/s 29 redress of

PIRA 2010 grievances etc.

14 Minimum Wage All Punjab Minimum wage

Ref. Minimum Unskilled Rs.25,000 for unskilled

Wage Notification Workers w.e.f 1st July workers

2022 2022

W.e.f 01.07.2022

15 Working Hours All No Salary No Salary 48 hours per

Ref. u/s 34 Workers Limit Limit week, 8 hours

Factories Act 1934 per day

16 Punjab 10 or All Salary Co. 6 % Sickness,

Employees More Workers Range (Total Medical,

Social Security Workers from Rs. Employer’s Family and

Institution 1965 25,000/- Responsibilit parents covered

PESSI pm to Rs. y)

31,000/- Hajj – 10

per month workers every

year selected

through balloting

17 Education Cess 10 or All PESSI Rs.25/- per For welfare of

Ref. More Covered worker per workers like

The Workers' Workers Workers quarter. Max children

Children (Education) Rs.100/- per education up to

Ordinance, 1972 worker per PhD level,

year sewing

machines,

residential

colonies etc.

18 PESSI – Funeral 10 or All Rs.18,000/-

Expenses More Covered Parents covered

Ref. u/s 37 Workers Workers

PESSI 1965

Injury Benefits 100% wages for

180 days

19 Trade Union / 50 or All No Salary Executive Redress of

CBA More Workers Limit =<100, 8 individual

Ref. u/s 25 (1)(a) =<200,10 grievances,

=<300,12 collective

=<400,14

Author: Amjad Bhatti, HR & IR Consultant and Trainer,

Contact No. 0300 946 8738

bargaining,

strike, etc.

20 Workers 10 or All No Salary As per Compensation

Compensation More Workers Limit schedule against Injuries

Act 1923 Max. Rs. and death

Ref. u/s 4 500,000/-

21 Company’s 50 or All Cat 1- 5 % of profit, Worker’s share

Profit (Worker’s More Workers 17,500/- Max =4 min in profit

Participation)(Am Cat 2 – wages Cat 1 – 4 Units

endment) 17,501 – Cat 2 – 2 Units

Ordinance 2018 22,000 Cat 3 - 1 Unit

Cat 3 –

22001

and above

22 Death Grant All No Salary Rs. In case of death,

Ref. Punjab Workers Limit 600,000/- may be paid to

Workers Welfare nominated

Board person / legal

31.10.2013 heirs

23 Marriage Grant All All Rs.200,000/- Marriage grant

Ref. Punjab Workers daughters per case

Worker’s Welfare 3 year

Board service

24 Disabled Quota Organization 3%

Ref. u/s 10 is bound to

THE PUNJAB provide

DISABLED employment

PERSONS to disables

(EMPLOYMENT Or

AND

Deposit

REHABILITATION)

(AMENDMENT)

amount =

BILL 2015 25,000 x 3

to the Govt.

Treasury

25 Apprenticeship 20% of Rs.28,253 First year Books, Shoes,

Ordinance 1962 the skilled /- stipend Toolkit, Uniform,

manpower (Min wage 50%, Calculator,

. of skilled Rs.14,126/- drawing

worker) pm instruments and

(Applicabl Second year other study

e w.e.f stipend 60% material is

Author: Amjad Bhatti, HR & IR Consultant and Trainer,

Contact No. 0300 946 8738

22nd June Rs.16,951/- responsibility of

2022) pm the employer.

Third year

stipend

70%,

Rs.19,777/-

pm

26 Talent All All Workers Upto Rs. 3,500/- pm

Scholarship Employe Workers registered Intermediate

Punjab Workers es with with

Welfare Board 3 year PESSI or Graduation Rs. 4,500/- pm

service EOBI

Post- Rs. 5,500/- pm

Graduation

MS, M. Phill, 100 % Expense

P.hd

27 Appointment of 500 Take care the

Welfare Officer Workers workers welfare

U/s 24 – A

(Factory Act

1934)

28 Final settlement Death Grant Rs.600,000/- (Govt. of Punjab)

(Death case) Group Life Insurance Rs.500,000/- by Company

Payable to the EOBI Pension Rs.8,500/- pm

legal heirs Grant in case of contribution paid less than 15 years

through wage Funeral expenses by PESSI Rs. 18,000/-

commissioner

In addition to the above:

1. Provident Fund / Gratuity,

2. Death grant by company, if applicable

3. Leave encashment,

4. Unpaid wages, bonus and overtime, etc.

PESSI notification for enhancement of upper limit of contribution from Rs. 25,000/- Rs.

31,000/- is in process.

Author: Amjad Bhatti, HR & IR Consultant and Trainer,

Contact No. 0300 946 8738

You might also like

- Sapient Offer Letter Gurgoan PDFDocument15 pagesSapient Offer Letter Gurgoan PDFdimpy50% (2)

- Salary-Chp 3Document38 pagesSalary-Chp 3Rozina TabassumNo ratings yet

- Understanding Salary Breakup, Salary Structure, and Salary ComponentsDocument11 pagesUnderstanding Salary Breakup, Salary Structure, and Salary ComponentsDoss MartinNo ratings yet

- Multi Format Assessment Paper 4 MarkingDocument13 pagesMulti Format Assessment Paper 4 MarkingSafety OfficerNo ratings yet

- National Institute of Occupational Safety and Health: Institut Keselamatan Dan Kesihatan Pekerjaan NegaraDocument3 pagesNational Institute of Occupational Safety and Health: Institut Keselamatan Dan Kesihatan Pekerjaan NegaraTeh ArfahNo ratings yet

- Tax Implications For Employers Amidst Covid-19Document4 pagesTax Implications For Employers Amidst Covid-19Bryan JosephNo ratings yet

- Ifrs at A Glance IAS 19 Employee BenefitsDocument5 pagesIfrs at A Glance IAS 19 Employee BenefitsnanaNo ratings yet

- IAS 19 Employee BenefitsDocument14 pagesIAS 19 Employee BenefitsShiza ArifNo ratings yet

- India Offer Letter 2024-02-07Document9 pagesIndia Offer Letter 2024-02-07jagdishkumawat22576No ratings yet

- Amruthyunjaya Hruser 4 1670936962502Document7 pagesAmruthyunjaya Hruser 4 1670936962502Anusha RampalliNo ratings yet

- Offer LetterDocument1 pageOffer Lettertoughguy_850No ratings yet

- 02 Ias19Document8 pages02 Ias19AANo ratings yet

- Bonous ActDocument2 pagesBonous Actfinx786No ratings yet

- Appointment Letter - DraftDocument5 pagesAppointment Letter - DraftKarishma ParekhNo ratings yet

- Dr. Shannu Narayan PGP - Fintax Batch Session 3Document18 pagesDr. Shannu Narayan PGP - Fintax Batch Session 3ayman abdul salamNo ratings yet

- Salaries: After Studying This Chapter, You Would Be Able ToDocument82 pagesSalaries: After Studying This Chapter, You Would Be Able ToLilyNo ratings yet

- Offer Letter TaskusDocument9 pagesOffer Letter TaskusAkshay SharmaNo ratings yet

- Assignment 2 ECBMDocument11 pagesAssignment 2 ECBMchakradhar pmNo ratings yet

- Salary and Its TaxationDocument12 pagesSalary and Its TaxationBasit BandayNo ratings yet

- Tax On Compensation Income: Activi TY SheetDocument14 pagesTax On Compensation Income: Activi TY SheetJudylyn SakitoNo ratings yet

- Naac Data c5-2-1 1661850316893Document4 pagesNaac Data c5-2-1 1661850316893vibhapanchal7470No ratings yet

- Unit - Ii - : Income Under The Head Salaries Definition of The Head 'SalariesDocument36 pagesUnit - Ii - : Income Under The Head Salaries Definition of The Head 'SalariesVENKATESWARLUMCOMNo ratings yet

- Salaries: After Studying This Chapter, You Would Be Able ToDocument80 pagesSalaries: After Studying This Chapter, You Would Be Able ToSatyam Kumar AryaNo ratings yet

- Notes - Income From SalaryDocument13 pagesNotes - Income From SalarySajan N ThomasNo ratings yet

- Unit 5Document9 pagesUnit 5Harsh ChaudharyNo ratings yet

- Employee Benefits P201Document18 pagesEmployee Benefits P201krisha milloNo ratings yet

- Compensation Income and Fringe Benefit Tax. ReviewerDocument4 pagesCompensation Income and Fringe Benefit Tax. RevieweryzaNo ratings yet

- Sunday, April 5, 2009: Income Under The Head Salary (Section 15 - 17)Document14 pagesSunday, April 5, 2009: Income Under The Head Salary (Section 15 - 17)Prashant singhNo ratings yet

- Module - 2 Incomes From Salary and Income From House PropertyDocument7 pagesModule - 2 Incomes From Salary and Income From House PropertyNikitha AlpetNo ratings yet

- Employee Benefits P201Document17 pagesEmployee Benefits P201krisha milloNo ratings yet

- Congratulations and Welcome To HP.: Novaark Digital Consulting Pvt. Ltd. (Hpgroup)Document6 pagesCongratulations and Welcome To HP.: Novaark Digital Consulting Pvt. Ltd. (Hpgroup)Tharun RickyNo ratings yet

- Salary Income-Pg DTDocument11 pagesSalary Income-Pg DTOnkar BandichhodeNo ratings yet

- Income Tax 05Document17 pagesIncome Tax 05AMJAD ULLA RNo ratings yet

- Payroll For Beginners 1630740553Document110 pagesPayroll For Beginners 1630740553Ahmed ElwaseefNo ratings yet

- House-Senate Comparison of Key ProvisionsDocument11 pagesHouse-Senate Comparison of Key Provisionsapi-25909546No ratings yet

- Satyam Offer Letter@DeeptiDocument10 pagesSatyam Offer Letter@Deeptiapi-3837147100% (5)

- The Payment of Bonus Act-ChecklistDocument1 pageThe Payment of Bonus Act-ChecklistRohini G ShettyNo ratings yet

- Offer Letter GurgoanDocument15 pagesOffer Letter GurgoandimpyNo ratings yet

- Offering Documents - Software Engineering - Mukhammad Sabda AbdullohDocument6 pagesOffering Documents - Software Engineering - Mukhammad Sabda AbdullohAisah HjNo ratings yet

- Whichever Is Lower: A) DeductionsDocument3 pagesWhichever Is Lower: A) Deductions8151 KATALE PRIYANKANo ratings yet

- Candidate 1Document2 pagesCandidate 1Fascino WhiteNo ratings yet

- Employee Profit Sharing and Its Position in NepalDocument7 pagesEmployee Profit Sharing and Its Position in Nepalpratiksha bhattaraiNo ratings yet

- Offer LetterDocument3 pagesOffer LetterKaran RanjanNo ratings yet

- The Payment of Gratuity Act, 1972Document6 pagesThe Payment of Gratuity Act, 1972abd VascoNo ratings yet

- TX TSNDocument55 pagesTX TSN유니스No ratings yet

- Salary StructureDocument1 pageSalary Structureomer farooqNo ratings yet

- Alphonse Irudayaraj Offer LetterDocument4 pagesAlphonse Irudayaraj Offer Letteralphonse INo ratings yet

- Tharun J - Ford 15.3Document6 pagesTharun J - Ford 15.3Tharun Ricky0% (1)

- Offer LetterDocument3 pagesOffer LetterrudraNo ratings yet

- Mohit MishrikotiDocument4 pagesMohit MishrikotiKunalNo ratings yet

- Business Math 12Document9 pagesBusiness Math 12Scottie James Martin FaderangaNo ratings yet

- 57496bos46599cp4 PDFDocument80 pages57496bos46599cp4 PDFManoj GNo ratings yet

- Ref No: 19000WB3 Pooja Arbind ShahDocument3 pagesRef No: 19000WB3 Pooja Arbind ShahPooja Shah0% (1)

- Salary 2018 19Document36 pagesSalary 2018 19Mahaveer DhelariyaNo ratings yet

- SlaaDocument36 pagesSlaaGovind BharathwajNo ratings yet

- Salary Annexure - Associate SADocument1 pageSalary Annexure - Associate SAheartz31No ratings yet

- Unit 7Document19 pagesUnit 7vfcvhjNo ratings yet

- IAS-19 at Glance (BDO)Document4 pagesIAS-19 at Glance (BDO)FaraisNo ratings yet

- Employment LawDocument16 pagesEmployment LawIrene Yoon100% (1)

- Provident FundDocument9 pagesProvident Fundmohammed umairNo ratings yet

- Separation and Finale SettlementDocument16 pagesSeparation and Finale SettlementShaila Chowdhury DipaNo ratings yet

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionFrom EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionNo ratings yet

- Bulletin January 2023Document6 pagesBulletin January 2023Fikri HidayatNo ratings yet

- Brotherhood vs. ZamoraDocument3 pagesBrotherhood vs. ZamoraRex RegioNo ratings yet

- Bioterge As-40k SDSDocument9 pagesBioterge As-40k SDSManojNo ratings yet

- MSMWHS200 AT1 S Safety 210125Document2 pagesMSMWHS200 AT1 S Safety 210125MNo ratings yet

- Hse Performance Record LKT PDFDocument1 pageHse Performance Record LKT PDFrendra syamNo ratings yet

- Case Study Past Sem 4 Iffah Imanina 2019328965Document4 pagesCase Study Past Sem 4 Iffah Imanina 2019328965Farah SyahirahNo ratings yet

- The Role of Personal Protective Equipment and Safety Regulations On The Occupational Hazards Among NursesDocument15 pagesThe Role of Personal Protective Equipment and Safety Regulations On The Occupational Hazards Among NurseskylaNo ratings yet

- Herzberg Two Factor Theory PDFDocument1 pageHerzberg Two Factor Theory PDFMaitreyee DeshmukhNo ratings yet

- Confined Space Policy: Potential Fatal Risks PolicyDocument3 pagesConfined Space Policy: Potential Fatal Risks PolicyOfer GardenNo ratings yet

- 04 - Worksheet - 1-Activity in BusmathDocument2 pages04 - Worksheet - 1-Activity in BusmathJemimah VillanocheNo ratings yet

- DONE Manila Hotel Corporation vs. de Leon. G.R. No. 219774, July 23, 2018Document1 pageDONE Manila Hotel Corporation vs. de Leon. G.R. No. 219774, July 23, 2018Kathlene JaoNo ratings yet

- Staffing Agency and Recruiting Agency in CaliforniaqktguDocument11 pagesStaffing Agency and Recruiting Agency in Californiaqktgurhythmbrow84No ratings yet

- Labor Law I Meeting 1 I. Fundamental Principles and Policies Underlying Labor Laws Legal Provisions: A. Labor Code: ADocument2 pagesLabor Law I Meeting 1 I. Fundamental Principles and Policies Underlying Labor Laws Legal Provisions: A. Labor Code: Arein_nantesNo ratings yet

- Leave Policy in IndiaDocument2 pagesLeave Policy in Indiaup mathuraNo ratings yet

- Contract and Offer LetterDocument5 pagesContract and Offer LetterfahadshamohammedNo ratings yet

- OSHJ-GL-16 Permit To Work Version 1 EnglishDocument15 pagesOSHJ-GL-16 Permit To Work Version 1 EnglishsajinNo ratings yet

- Malaysia Employment Labour Law 2019Document12 pagesMalaysia Employment Labour Law 2019Alageswaran Tamil SelvanNo ratings yet

- Confined SpaceDocument1 pageConfined SpaceSafety ManagerNo ratings yet

- 7207 - Other Employee BenefitDocument2 pages7207 - Other Employee Benefitjsmozol3434qcNo ratings yet

- G.R. No. 100158 June 2, 1992 ST. SCHOLASTICA'S COLLEGE, PetitionerDocument8 pagesG.R. No. 100158 June 2, 1992 ST. SCHOLASTICA'S COLLEGE, PetitionerNadzlah BandilaNo ratings yet

- TOYOTA MOTOR PHILS vs. NLRCDocument2 pagesTOYOTA MOTOR PHILS vs. NLRCAreeNo ratings yet

- 10.4.3. Liberty Flour Mills Employees Association v. Liberty Flour Mills December 29 1989Document2 pages10.4.3. Liberty Flour Mills Employees Association v. Liberty Flour Mills December 29 1989Sam ManioNo ratings yet

- Case Study On Compensation AdministrationDocument2 pagesCase Study On Compensation AdministrationCathy Joyce SumandeNo ratings yet

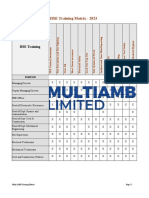

- Multi AMB HSE Training Matrix 2016Document1 pageMulti AMB HSE Training Matrix 2016Wilson AbingiNo ratings yet

- IRLL (6th) May2022 PDFDocument2 pagesIRLL (6th) May2022 PDFMynthan MoorthyNo ratings yet

- Jobdesc - Hse Manager Kso Jaya AdhiDocument16 pagesJobdesc - Hse Manager Kso Jaya AdhiNia MagdalenaNo ratings yet

- Human Resource ManagementDocument35 pagesHuman Resource ManagementKELLY KIPKOECHNo ratings yet

- A Few Words About The Mieu 3. How To Become A Member? 6. What You Should Do Now?Document3 pagesA Few Words About The Mieu 3. How To Become A Member? 6. What You Should Do Now?MIEU PJNo ratings yet