Professional Documents

Culture Documents

Advanced Market Report Week 44

Uploaded by

Mai PhamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advanced Market Report Week 44

Uploaded by

Mai PhamCopyright:

Available Formats

WEEKLY SHIPPING MARKET REPORT

WEEK 44

Week 44 (28th Oct to 4th Nov 2022)

Bulkers Baltic Indices

The Capesize “Orient Angel” 176/2007 Namura & Sasebo, Japan (SS Bulkers

06/2025, DD 06/2023) was committed to Turkish buyers for region USD 19 5.000

mill. Remind you that a month ago, the two-years-older sister vessel “Shinyo 4.000

Guardian” 177/2005 Namura & Sasebo, Japan (SS 11/2024, DD 08/2023,

3.000

BWTS fitted) was sold at USD 17,25 mill.

2.000

Navios Maritime have sold their Panamax “Navios Taurus” 76/2005 Imabari, 1.000

Japan (SS 01/2025, DD 04/2023) for USD 14 mill. Note that a week ago, the 0

two-years-younger sister vessel “Blue Chip” 76/2007 Imabari, Japan (SS/DD

11/2022) was sold at low USD 15 mill. Moreover, the “Prabhu Puni” 76/2002

Tsuneishi, Japan (SS 05/2027, DD 03/2025, BWTS fitted) from Tolani B.D.I B.C.I B.P.I. B.S.I. B.H.S.I.

Shipping was committed for USD 11,5 mill, while the “Dooyang Jeju”

76/2002 Imabari, Japan (SS/DD 11/2022) was sold a week ago at USD 10,2

INDEX 4-Nov 28-Oct ± (%)

mill.

BDI 1.323 1.534 -13,75%

On the Ultramax sector, Nisshin Shipping sold their “Nord Yucatan” 63/2019 BCI 1.343 1.670 -19,58%

Nantong, China (SS/DD 10/2024, BWTS & Scrubber fitted) for USD 28,5 mill. BPI 1.700 1.817 -6,44%

For reference, the three-years-older “Nautical Anne” 63/2016 Jiangsu, China BSI 1.268 1.483 -14,50%

(SS/DD 12/2021, BWTS & Scrubber fitted) was sold in August at USD 31 mill.

BHSI 836 897 -6,80%

Tankers Daily T/C Avg 4-Nov 28-Oct ± ($)

Following the sale of the Suezmax “Lila Guangzhou” 159/2004 Bohai, China Capesize $ 11.139 $ 13.852 -2.713

(SS 05/2024, DD 12/2022, BWTS fitted) back in September at USD 23,5 mill, Kamsarmax $ 15.299 $ 16.350 -1.051

Lila Global have now sold the sister vessel “Lila Shenzhen” 159/2004 Bohai, Supramax 58 $ 13.945 $ 16.318 -2.373

China (SS 12/2024, DD 01/2023, BWTS fitted) to Chinese buyers for USD 25 Handysize 38 $ 15.043 $ 16.142 -1.099

mill. In addition, Polembros Shipping committed their “Kimolos Warrior”

157/2013 Samsung, Korea (SS/DD 03/2023) to Turkish buyers for region USD

46 mill. Note that back in September, the one-year-older sister vessel

“Vinga” 159/2012 Samsung, Korea (SS/DD 11/2022) was sold at USD 42 mill. Tankers

2.000

Union Maritime have committed their LR1 “Houston Star”75/2004 Hyundai, 1.600

Korea (SS 02/2024, DD 10/2022) to Turkish buyers for USD 13 mill. For

1.200

comparison, the “Karadeniz Powership Anatolia” 72/2004 Samsung, Korea

(SS 07/2024, DD 12/2022) was sold a month ago at the same price. 800

400

The MR2 “Atlantica Bell” 50/2006 Stx, Korea (SS 03/2026, DD 05/2024, 0

BWTS fitted, Ice Class 1A) from Atlantica Shipping was sold to undisclosed

buyers for USD 20,7 mill. Remind you that the one-year-older sister vessel

“Northern Ocean” 50/2005 Stx, Korea (SS 05/2025, DD 09/2023, BWTS BDTI BCTI

fitted, Ice Class 1A) was sold a month ago at high USD 19 mill.

INDEX 4-Nov 28-Oct ± (%)

BDTI 1.836 1.823 0,71%

BCTI 1.199 1.227 -2,28%

WEEKLY SHIPPING MARKET REPORT - pg. 1

DRY BULK COMMENTARY

Week 44 (28th Oct to 4th Nov 2022)

Capesize Capesize

40.000

Week 44 saw iron ore rates on the West Australia / China route continued

30.000

at the level of mid/high usd 7,00’s fio range. A Capesize was fixed on a period

at the usd 16,000 pd basis delivery Far East for 1 year employment.

$/day

20.000

10.000

Kamsarmax / Panamax 0

CIS Pacific rounds ranged at the usd 20,000/22,000 pd. North Pacific rounds

continued rating primarily in the usd 15,000/17,000 pd range. A number of

Indonesian trips into China were reported fixed in the usd 12,000/14,000 pd

range. Australian trips into China were reported at the level of usd Kamsarmax

16,000/18,000 pd. Indian trips via South Africa into China were fixed around 40.000

usd 18,000/19,000 pd. India chrome ore trips into China were reported at

30.000

the level of usd 11,000/12,000 pd. Inter-continental trips via North Coast $/day

South America were fixed around usd 13,000/15,000 pd. US Gulf trips via 20.000

Red Sea into China were reported at the level of usd 16,500 pd plus ballast

10.000

bonus at the usd 650K. South American trips into Continent were fixed

around usd 30,000 pd. South American trips into China were reported at the 0

level of usd 17,000/18,000 pd plus ballast bonus at the usd 700K/800K. On

the period front, Kamsarmax was reported fixed at the level of usd 24,750

pd for 4/6 months employment basis delivery India. Also, a Kamsarmax was

fixed on a period at the usd 16,000 pd basis delivery Far East for 1 year

employment.

Supramax

40.000

30.000

Ultramax / Supramax

$/day

20.000

A generally quiet week for this segment. A reposition fixture for a Supramax

10.000

at the usd 12,000 pd on a backhaul. A number of Indonesian trips into China

were reported fixed in the usd 7,000/9,000 pd range. Indonesian trips into 0

India were reported at the level of usd 13,000/14,000 pd. Australian trips

into Continent with alumina were fixed around usd 14,000/15,000 pd. No

period activity to report here.

Handysize 38k

Handymax / Handysize 40.000

30.000

No fixture reported for this segment. No period activity to report here.

$/day

20.000

10.000

WEEKLY SHIPPING MARKET REPORT - pg. 2

REPORTED SALES

Week 44 (28th Oct to 4th Nov 2022)

Bulk Carriers

Type Name Dwt YoB Yard SS M/E Gear Price Buyer Comments

Orient Namura & MAN- Region

Capesize 176.859 2007 06/2025 - Turkish

Angel Sasebo, Japan B&W $ 19m

Navios Imabari,

Panamax 76.596 2005 01/2025 B&W - $ 14m Undisclosed

Taurus Japan

Tsuneishi,

Panamax Prabhu Puni 76.015 2002 05/2027 B&W - $ 11,5m Undisclosed BWTS fitted

Japan

Nord Nantong, MAN- BWTS fitted,

Ultramax 63.500 2019 10/2024 4x35T $ 28,5m Undisclosed

Yucatan China B&W Scrubber fitted

Stx Dalian, MAN-

Supramax Pan Crocus 57.269 2009 05/2024 4x30T $ 14,7m Undisclosed BWTS fitted

China B&W

Delivered,

Supramax Fanoula 56.560 2008 IHI, Japan 04/2023 Wartsila 4x35T $ 16m Chinese

BWTS fitted

Cyprus

Sea Oshima, MAN- Old sale,

Supramax 51.658 2011 11/2026 4x30T $ 19m based (SMT

Etiquette Japan B&W BWTS fitted

Shipping)

Waal Shin Kochi, OHBS,

Handysize 33.387 2009 06/2024 Mitsubishi 4x30T $ 15,2m Undisclosed

Confidence Japan BWTS fitted

Tankers

Type Name Dwt YoB Yard SS M/E Price Buyer Comments

VLCC Brilliant Jewel 305.178 2002 Daewoo, Korea 01/2025 B&W $ 40m Undisclosed DD 01/2023

MAN- Greek (Delta

Suezmax RS Aurora 159.812 2018 SWS, China 10/2025 $ 66m BWTS fitted

B&W Tankers)

MAN- BWTS fitted,

Suezmax Lila Shenzhen 159.549 2004 Bohai, China 12/2024 $ 25m Chinese

B&W DD 01/2023

Kimolos MAN- Region

Suezmax 157.258 2013 Samsung, Korea 03/2023 Turkish

Warrior B&W $ 46m

Raffles MAN-

LR2 105.405 2013 Hyundai, Korea 01/2023 $ 41,8m Undisclosed Scrubber fitted

Harmony B&W

MAN-

LR1 Houston Star 74.999 2004 Hyundai, Korea 02/2024 $ 13m Turkish DD 10/2022

B&W

Shin Kurushima, Excess

MR Celsius Rimini 53.603 2009 03/2027 Mitsubishi Undisclosed BWTS fitted

Japan $ 24m

MAN- BWTS fitted,

MR Atlantica Bell 50.844 2006 Stx, Korea 03/2026 $ 20,7m Undisclosed

B&W Ice Class 1A

WEEKLY SHIPPING MARKET REPORT - pg. 3

REPORTED SALES

Week 44 (28th Oct to 4th Nov 2022)

Tankers (continued)

Type Name Dwt YoB Yard SS M/E Price Buyer Comments

Chemical/Oil

Avalon 24.035 2005 3 Maj, Croatia 12/2025 MaK $ 9,4m Greek

Products

Chemical/Oil

Bro Anna 16.979 2008 Gemak, Turkey 02/2023 MAN Ice Class 1A

Products $ 27m

Undisclosed

Chemical/Oil enbloc

Bro Agnes 16.791 2008 Turkter, Turkey 03/2023 MAN Ice Class 1A

Products

Chemical/Oil 21st Century, MAN-

Bernora 13.148 2008 03/2023 $ 7,8m Norwegian BWTS fitted

Products Korea B&W

Gas

Type Name Dwt YoB Yard SS M/E Cbm Price Buyer Comments

Higaki,

LPG Epic Balta 5.076 2000 06/2025 MAN-B&W 6.185 $ 6m Undisclosed

Japan

WEEKLY SHIPPING MARKET REPORT - pg. 4

DEMOLITION

Week 44 (28th Oct to 4th Nov 2022)

Indicative Demolition Prices

Price Bulkers Tankers

Country 720 720

$/ldt

660 660

India 555

600 600

$/ldt

$/ldt

Bangladesh 595 540 540

Bulkers

480 480

Pakistan 580

India Bangladesh Pakistan India Bangladesh Pakistan

Turkey 250

Bulkers Tankers

480 480

India 565 420

420

360 360

Bangladesh 610

Tankers

$/ldt

$/ldt

300 300

240 240

Pakistan 590

180 180

Turkey 260

Turkey Turkey

Demolition Sales

Type Vessel Dwt YoB Ldt Price $/ldt Country Comments

WEEKLY SHIPPING MARKET REPORT - pg. 5

NEWBUILDING

Week 44 (28th Oct to 4th Nov 2022)

Containers

Units Teu Yard Delivery Price Owner Comments

7 24.000 NACKS, China 2026/2028 $ 240m Chinese (OOCL) Methanol dual-fuelled

5 24.000 DACKS, China 2027-2028 $ 240m Chinese (Cosco Shipping) Methanol dual-fuelled

Gas

Units Cbm Yard Delivery Price Owner Comments

HK based

2 175.000 Jiangnan, China 2027 $ 230m

(Shandong Shipping)

Japanese (MOL) &

3+2 175.000 DSIC, China 2026 $ 230m T/C to Sinopec

Chinese (CSLNG)

German

2 175.000 Yangzijiang, China 2025/2026 $ 230m

(Hammonia Reederei)

Hudong-Zhonghua, Chinese (Tianjin Southwest

3 174.000 2028 $ 250m T/C to ENN Natural Gas

China Maritime)

WEEKLY SHIPPING MARKET REPORT - pg. 6

INDICATIVE PRICES

Week 44 (28th Oct to 4th Nov 2022)

Bulkers Tankers

Week Week Week Week

Size Age ±% Size Age ±%

44 43 44 43

Capesize 180k Resale 56,5 56,5 0,00% VLCC 310k Resale 118 117 0,85%

Capesize 180k 5 years 47 47 0,00% VLCC 310k 5 years 89 88 1,14%

Capesize 180k 10 years 30 30 0,00% VLCC 300k 10 years 66 65 1,54%

Capesize 170k 15 years 19 19 0,00% VLCC 300k 15 years 52 51 1,96%

Kamsarmax 82k Resale 37,5 37,5 0,00% Suezmax 160k Resale 79 78 1,28%

Kamsarmax 82k 5 years 31 31 0,00% Suezmax 160k 5 years 62 60 3,33%

Panamax 76k 10 years 22,3 22,3 0,00% Suezmax 150k 10 years 45 44 2,27%

Panamax 74k 15 years 15,5 15,5 0,00% Suezmax 150k 15 years 29,5 28,5 3,51%

Ultramax 63k Resale 37 37 0,00% Aframax 110k Resale 72 72 0,00%

Ultramax 61k 5 years 29,5 29,5 0,00% Aframax 110k 5 years 57 57 0,00%

Supramax 56k 10 years 21,3 21 1,43% Aframax 105k 10 years 42 42 0,00%

Supramax 52k 15 years 15,5 15,3 1,31% Aframax 105k 15 years 27,5 27,5 0,00%

Handysize 38k Resale 28,5 29 -1,72% MR 52k Resale 46,5 46,5 0,00%

Handysize 37k 5 years 24,5 25 -2,00% MR 51k 5 years 39 39 0,00%

Handysize 32k 10 years 16,8 17 -1,18% MR 47k 10 years 28 28 0,00%

Handysize 28k 15 years 10,8 11 -1,82% MR 45k 15 years 19 19 0,00%

Bulkers

60 Capesize

50 Kamsarmax

Million US$

40 Panamax

30 56,5 Ultramax

20

47

37,5 37 31 29,5 24,5 Supramax

28,5 30

10 22,3 21,3 16,8 19 15,5 15,5

10,8 Handysize

0

Prompt Resale 5 years 10 years 15 years

Tankers

120

100 VLCC

Million US$

80 Suezmax

60 118 Aframax

40 79 89 MR

72 62 66

46,5 57 45 52

20 39 42 28 29,5 27,5 19

0

Prompt Resale 5 years 10 years 15 years

WEEKLY SHIPPING MARKET REPORT - pg. 7

KEY INDICATORS

Week 44 (28th Oct to 4th Nov 2022)

Currencies

Currency 3-Nov 27-Oct ± (%)

EUR / USD 0,9814 0,9968 -1,54%

USD / JPY 147,89 146,27 1,11%

USD / KRW 1.423,10 1.420,65 0,17%

NOK / USD 0,0956 0,0974 -1,85%

EUR / USD

1,20

1,15

1,10

1,05

1,00

0,95

0,90

Commodities

Commodity 3-Nov 27-Oct ± (%)

Brent Crude (BZ) 94,67 96,96 -2,36%

WTI Crude Oil (WTI) 89,35 88,26 1,23%

Natural Gas (NG) 5,98 5,19 15,22%

Gold (GC) 1.637,70 1.668,80 -1,86%

Copper (HG) 3,43 3,52 -2,56%

Wheat (W) 840,50 838,50 0,24%

Oil Prices

130

Brent Crude

120

WTI Crude

110

$/bbl

100

90

80

70

60

WEEKLY SHIPPING MARKET REPORT - pg. 8

SHIPPING INDICATIVE SHARE VALUE

Week 44 (28th Oct to 4th Nov 2022)

Stock Prices – Shipping Companies

Company Stock Exchange 3-Nov 27-Oct ± (%)

Diana Shipping Inc (DSX) NYSE 4,23 4,17 1,44%

Euroseas Ltd (ESEA) NASDAQ 18,98 19,18 -1,04%

Eagle Bulk Shipping Inc (EGLE) NASDAQ 49,09 47,83 2,63%

Navios Maritime Holdings Inc (NM) NYSE 1,93 1,91 1,05%

Navios Maritime Partners LP (NMM) NYSE 24,97 25,11 -0,56%

Star Bulk Carriers Corp (SBLK) NASDAQ 17,75 17,84 -0,50%

Seanergy Maritime Holdings Corp (SHIP) NASDAQ 0,46 0,48 -4,17%

Safe Bulkers Inc (SB) NYSE 2,53 2,57 -1,56%

Golden Ocean Group Ltd (GOGL) NASDAQ 8,61 8,48 1,53%

Shreyas Shipping and Logistics Limited

NSE 3,85 4,04 -4,70%

(SHREYAS.NS)

Stock Prices - Wet

Company Stock Exchange 3-Nov 27-Oct ± (%)

Capital Product Partners LP (CPLP) NASDAQ 15,17 14,32 5,94%

TOP Ships Inc (TOPS) NASDAQ 4,07 4,74 -14,14%

Tsakos Energy Navigation Ltd (TNP) NYSE 18,86 17,23 9,46%

Stock Prices - Other

Company Stock Exchange 3-Nov 27-Oct ± (%)

Danaos Corp (DAC) NYSE 57,17 56,16 1,80%

StealthGas Inc (GASS) NASDAQ 3,14 3,32 -5,42%

Rio Tinto PLC (RIO) NYSE 53,02 54,75 -3,16%

Vale SA (VALE) NYSE 13,11 13,37 -1,94%

Archer-Daniels-Midland Co (ADM) NYSE 96,28 94,13 2,28%

BHP Group Ltd (BHP) NYSE 48,33 49,90 -3,15%

WEEKLY SHIPPING MARKET REPORT - pg. 9

CONTACT DETAILS

Week 44 (28th Oct to 4th Nov 2022)

ADVANCED SHIPPING & TRADING S.A.

Vouliagmenis Avenue 168, 1st Floor,

E-mail: snp@advanced-ship.gr

Glyfada 16674, Greece

E-mail: chartering@advanced-ship.gr

Tel: +30 210 30 03 000

E-mail: finance@advanced-ship.gr

Fax: +30 210 30 01 305

E-mail: research@advanced-ship.gr

Sale & Purchase Department: Dry Cargo Chartering Department:

Cpt. Fountoglou Michalis Mob: +30 6947 70 07 18 Pittas Jordan Mob: +30 6944 05 27 46

Thermos Stavros Mob: +30 6944 24 20 20 Filippis Dimitris Mob: +30 6949 19 58 96

Papoutsis George Mob: +30 6951 00 51 65 Veronikis Spyros Mob: +30 6946 28 07 21

Chrousalas Thanasis Mob: +30 6955 47 77 73 Paraskevopoulou Mina Mob: +30 6949 37 47 06

Landrakis Stelios Mob: +30 6955 47 77 74 Saratzi Evi Mob: +30 6952 35 06 46

Bilias Tasos Mob: +30 6955 47 77 71 Dienis Angelos Mob: +30 6951 82 94 48

Kontaratos Alkis Mob: +30 6949 19 11 79 Karvounis Stelios Mob: +30 6949 11 49 73

Markoutsa Nela Mob: +30 6959 99 85 10

Chief Executive Consultant: Research Department:

Cpt. Galonis Dimitrios Mob: +30 6945 55 36 81 Avdikos Alexandros Mob: +30 6979 49 91 78

Operations Department: Liadi Ioanna Mob: +30 6946 75 59 10

Katsouli Fotini Mob: +30 6942 54 23 57 Liadi Artemis Mob: +30 6956 58 41 49

“ THINK BIG”

Legal Disclaimer

The information contained herein has been obtained by various sources. Although every effort has been made to ensure that this information is accurate, complete

and up-to-date, Advanced Shipping & Trading S.A. does not accept any responsibility whatsoever for any loss or damage occasioned or claimed, upon reliance on the

information, opinions and analysis contained in this report.

Research compiled by: Advanced Shipping & Trading S.A. Market Research on behalf of the Sale & Purchase, Dry Cargo Chartering and Tanker Chartering Departments.

For any questions, please contact: research@advanced-ship.gr

WEEKLY SHIPPING MARKET REPORT - pg. 10

You might also like

- 外贸英语口语大全Document29 pages外贸英语口语大全ruipeng tangNo ratings yet

- Shipping Market Fearnleys Week 52Document1 pageShipping Market Fearnleys Week 52VizziniNo ratings yet

- CharteringDocument338 pagesCharteringSAIGAL TANKER100% (1)

- WSM - Chemical Tanker Operation ManualDocument232 pagesWSM - Chemical Tanker Operation ManualMai Pham100% (1)

- SMS Ship ManualDocument245 pagesSMS Ship ManualMai PhamNo ratings yet

- Cargo Operations Manual - Tankers TemplateDocument61 pagesCargo Operations Manual - Tankers TemplateMai Pham100% (1)

- Cargo Operation Equipment For TankersDocument172 pagesCargo Operation Equipment For TankersDon Sheens100% (1)

- Advanced Market Report Week 42Document11 pagesAdvanced Market Report Week 42Mai PhamNo ratings yet

- Advanced Market Report Week 43Document10 pagesAdvanced Market Report Week 43Mai PhamNo ratings yet

- Advanced Market Report Week 4Document10 pagesAdvanced Market Report Week 4Mai PhamNo ratings yet

- Advanced Market Report Week 25Document10 pagesAdvanced Market Report Week 25Mai PhamNo ratings yet

- Advanced Market Report Week 31Document10 pagesAdvanced Market Report Week 31Mai PhamNo ratings yet

- Advanced Market Report Week 2Document10 pagesAdvanced Market Report Week 2Mai PhamNo ratings yet

- Advanced Market Report Week 33Document9 pagesAdvanced Market Report Week 33Sandesh Tukaram GhandatNo ratings yet

- Advanced Market Report Week 18Document10 pagesAdvanced Market Report Week 18Mai PhamNo ratings yet

- Advanced Market Report Week 32Document9 pagesAdvanced Market Report Week 32Sandesh Tukaram GhandatNo ratings yet

- Advanced Market Report Week 19Document11 pagesAdvanced Market Report Week 19Mai PhamNo ratings yet

- Shipping Market Advanced Week 52Document10 pagesShipping Market Advanced Week 52VizziniNo ratings yet

- Weekly Shipping Market Report Week 31: Bulkers Baltic IndicesDocument10 pagesWeekly Shipping Market Report Week 31: Bulkers Baltic IndicesSANDESH GHANDATNo ratings yet

- Advanced Market Report Week 52 PDFDocument9 pagesAdvanced Market Report Week 52 PDFvikeshNo ratings yet

- Weekly Shipping Market Report Highlights Bulker Sales and Index DeclinesDocument10 pagesWeekly Shipping Market Report Highlights Bulker Sales and Index DeclinesBudi PrayitnoNo ratings yet

- Report 05 01 2024Document3 pagesReport 05 01 2024bill duanNo ratings yet

- WEEK 10, 14 March 2021: CapesizeDocument13 pagesWEEK 10, 14 March 2021: CapesizeVGNo ratings yet

- Intermodal Report Week 26 2021Document8 pagesIntermodal Report Week 26 2021Nguyen Le Thu HaNo ratings yet

- Intermodal Report Week 07 2021Document8 pagesIntermodal Report Week 07 2021Akın AKNo ratings yet

- Weekly Tanker Report - Week 13 - DraftDocument3 pagesWeekly Tanker Report - Week 13 - DraftMai PhamNo ratings yet

- GMS Weekly January 24th, 2020Document8 pagesGMS Weekly January 24th, 2020Tom LNo ratings yet

- Weekly Market Report and Baltic Index UpdateDocument5 pagesWeekly Market Report and Baltic Index UpdateSandesh Tukaram GhandatNo ratings yet

- Advanced - Week 23 - 16.06.03 PDFDocument11 pagesAdvanced - Week 23 - 16.06.03 PDFgeorgevarsasNo ratings yet

- ReportDocument18 pagesReportfclmlchNo ratings yet

- Weekly Market Report Wk4Document5 pagesWeekly Market Report Wk4Sandesh Tukaram GhandatNo ratings yet

- Shipping Market Review E13Document19 pagesShipping Market Review E13fromantoan100% (1)

- FearnleysDocument7 pagesFearnleysSANDESH GHANDATNo ratings yet

- ReportDocument9 pagesReportfclmlchNo ratings yet

- WEEKLY SHIPPING REPORTDocument11 pagesWEEKLY SHIPPING REPORTgeorgevarsasNo ratings yet

- Market Report Week 31Document18 pagesMarket Report Week 31Mai PhamNo ratings yet

- Container Weekly 4th February - 10th February PDFDocument3 pagesContainer Weekly 4th February - 10th February PDFvj_epistemeNo ratings yet

- Shipping Market Review E12Document17 pagesShipping Market Review E12fromantoanNo ratings yet

- Media 1946 Dry Ffas Mar 21Document32 pagesMedia 1946 Dry Ffas Mar 21KASHANNo ratings yet

- MARKET REPORTDocument5 pagesMARKET REPORTSandesh Tukaram GhandatNo ratings yet

- WEEKLY REPORT Fearnleys Weekly Report - Week 39 2020Document7 pagesWEEKLY REPORT Fearnleys Weekly Report - Week 39 2020SANDESH GHANDATNo ratings yet

- GMS Ship Recycling - Weekly FactsDocument9 pagesGMS Ship Recycling - Weekly FactsTom LNo ratings yet

- Diamond Offshore Rig Status Report UpdatesDocument2 pagesDiamond Offshore Rig Status Report UpdatesSipa1109No ratings yet

- Weekly Market Report WK11Document5 pagesWeekly Market Report WK11Sandesh Tukaram GhandatNo ratings yet

- Weekly Market Report Wk6Document5 pagesWeekly Market Report Wk6Sandesh Tukaram GhandatNo ratings yet

- Weekly Container Briefing: Market Comment Time Charter RatesDocument1 pageWeekly Container Briefing: Market Comment Time Charter RatesQuyên LýNo ratings yet

- Week 41 S&P Market ReportDocument2 pagesWeek 41 S&P Market ReportFotini HalouvaNo ratings yet

- Weekly Market Report Wk8Document5 pagesWeekly Market Report Wk8Sandesh Tukaram GhandatNo ratings yet

- Packing List STN003-KY171009Document14 pagesPacking List STN003-KY171009Andry GallardoNo ratings yet

- Cahaya Bintang LautDocument1 pageCahaya Bintang LautJoe SteveNo ratings yet

- Weekly Ship Recycling Report WEEK35Document7 pagesWeekly Ship Recycling Report WEEK35Sandesh Tukaram GhandatNo ratings yet

- ACFTA Certificate of OriginDocument2 pagesACFTA Certificate of OriginKANIA SABILANo ratings yet

- Weekly Market Report: April 5, 2021Document4 pagesWeekly Market Report: April 5, 2021Sandesh Tukaram GhandatNo ratings yet

- Compass Maritime Weekly Market ReportDocument6 pagesCompass Maritime Weekly Market ReportJoel SegoviaNo ratings yet

- Weekly Ship Recycling Report HighlightsDocument6 pagesWeekly Ship Recycling Report HighlightsSandesh Tukaram GhandatNo ratings yet

- Purachase RequisitionDocument38 pagesPurachase RequisitionSA WOWNo ratings yet

- Semi-Annual: 2016/2017 BUDGET YEAR Export Performance ReportDocument8 pagesSemi-Annual: 2016/2017 BUDGET YEAR Export Performance ReportSisay TesfayeNo ratings yet

- Weekly Market Report Wk9Document5 pagesWeekly Market Report Wk9Sandesh Tukaram GhandatNo ratings yet

- WK 42 - 20 CARRIERS - S&P MARKET REPORTdraftDocument2 pagesWK 42 - 20 CARRIERS - S&P MARKET REPORTdraftFotini HalouvaNo ratings yet

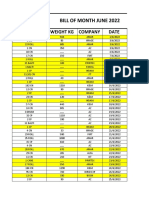

- Bill June 2022Document8 pagesBill June 2022SanaNo ratings yet

- Coalfax 6 Sep 2019Document4 pagesCoalfax 6 Sep 2019Muhammet Ali VELİOĞLUNo ratings yet

- THE DETERMINANTS OF PRICES OF NEWBUILDING IN THE VERY LARGE CRUDE CARRIERS (VLCC) SECTORFrom EverandTHE DETERMINANTS OF PRICES OF NEWBUILDING IN THE VERY LARGE CRUDE CARRIERS (VLCC) SECTORNo ratings yet

- HttpsDocument1 pageHttpsMai PhamNo ratings yet

- PDS - Amc F.O.T.Document2 pagesPDS - Amc F.O.T.Mai PhamNo ratings yet

- Itinerary BUI VAN GIANGDocument2 pagesItinerary BUI VAN GIANGMai PhamNo ratings yet

- Report WeeklyDocument3 pagesReport WeeklyMai PhamNo ratings yet

- CV - Nguyen Minh ThongDocument3 pagesCV - Nguyen Minh ThongMai PhamNo ratings yet

- Bareboat Charters Second EditionDocument540 pagesBareboat Charters Second EditionMai PhamNo ratings yet

- Ukraine Conflict Ports Operational StatusDocument1 pageUkraine Conflict Ports Operational StatusMai PhamNo ratings yet

- Golden Lotus NewsDocument2 pagesGolden Lotus NewsMai PhamNo ratings yet

- WWT Criteria and First Foot Limits Confirmed 2019 Aug 27Document1 pageWWT Criteria and First Foot Limits Confirmed 2019 Aug 27Mai PhamNo ratings yet

- Simpson's Rule Capt. Martins Including Past MMD QDocument25 pagesSimpson's Rule Capt. Martins Including Past MMD QMai PhamNo ratings yet

- Russia Sanctions Against Novorossiysk Commercial SDocument1 pageRussia Sanctions Against Novorossiysk Commercial SMai PhamNo ratings yet

- Form m007b - Surveys - Secondary Certificates StatusDocument5 pagesForm m007b - Surveys - Secondary Certificates StatusMai PhamNo ratings yet

- Form M007a - Surveys - Statutory Certificates StatusDocument3 pagesForm M007a - Surveys - Statutory Certificates StatusMai PhamNo ratings yet

- TCH - 08B-1 Bunkering ChecklistDocument11 pagesTCH - 08B-1 Bunkering ChecklistMai PhamNo ratings yet

- RECORDED WEBINAR - Longer Hauls To Support Continued StrengthDocument11 pagesRECORDED WEBINAR - Longer Hauls To Support Continued StrengthMai PhamNo ratings yet

- Advanced Market Report Week 2Document10 pagesAdvanced Market Report Week 2Mai PhamNo ratings yet

- Trading Cert ListDocument1 pageTrading Cert ListMai PhamNo ratings yet

- Tasco Q&aDocument386 pagesTasco Q&aMai PhamNo ratings yet

- Oil Major Vetting and ApprovalsDocument3 pagesOil Major Vetting and ApprovalsMai PhamNo ratings yet

- Toll Fee Result: Vessel Type Tankers of Petroleum Products Draft 12 SCNT 26457 GRT 29370 Ship Status LadenDocument1 pageToll Fee Result: Vessel Type Tankers of Petroleum Products Draft 12 SCNT 26457 GRT 29370 Ship Status LadenMai PhamNo ratings yet

- 2023 07 15 Vaca Muerta ViveDocument8 pages2023 07 15 Vaca Muerta ViveMai PhamNo ratings yet

- December Falcon Carrier V2Document2 pagesDecember Falcon Carrier V2Mai PhamNo ratings yet

- Business - Invoice - Template - Singapore (Recovered) (Version 1) (Recovered)Document1 pageBusiness - Invoice - Template - Singapore (Recovered) (Version 1) (Recovered)Mai PhamNo ratings yet

- ECA New - Pdf-MinDocument9 pagesECA New - Pdf-MinPSC WorlwideNo ratings yet

- Valpiters RobertsDocument58 pagesValpiters RobertsMai PhamNo ratings yet

- HPCL profit and loss analysis for FY20 and FY19Document10 pagesHPCL profit and loss analysis for FY20 and FY19riyaNo ratings yet

- The Economy Under Democratic vs. Republican Presidents: ClaimsDocument2 pagesThe Economy Under Democratic vs. Republican Presidents: ClaimsGrahamNo ratings yet

- The Industry, The Company and Its Products 1.1 The IndustryDocument7 pagesThe Industry, The Company and Its Products 1.1 The IndustryRuthchell CiriacoNo ratings yet

- Bahan PPT e ProcDocument15 pagesBahan PPT e ProcFEBY ANGEL BUKOHIRUL PUTRINo ratings yet

- IFRS - 2019 - Solved QPDocument14 pagesIFRS - 2019 - Solved QPSharan ReddyNo ratings yet

- Topic 1 - Introduction To InvestingDocument26 pagesTopic 1 - Introduction To InvestingLim Wei HanNo ratings yet

- IAL - Economics - Scheme - of - Work - FINALDocument53 pagesIAL - Economics - Scheme - of - Work - FINALNkanyezi TshabalalaNo ratings yet

- IIT HSEE Essay Topics from Previous YearsDocument2 pagesIIT HSEE Essay Topics from Previous YearsGagan TottempudiNo ratings yet

- Shipping & Billing Address: Neha Singh: Date: 23/02/2024Document2 pagesShipping & Billing Address: Neha Singh: Date: 23/02/2024tyrainternationalNo ratings yet

- MODULE 1 Midterm FAR 3 LeasesDocument31 pagesMODULE 1 Midterm FAR 3 LeasesKezNo ratings yet

- Tutor 3 - Chapter 3 DiscussionDocument4 pagesTutor 3 - Chapter 3 DiscussionBaoyiNo ratings yet

- The History of Las Piñas CityDocument5 pagesThe History of Las Piñas Cityaj averiaNo ratings yet

- ch09Document44 pagesch09Balach MalikNo ratings yet

- HARSHAD - MEHTA Claw PresentationDocument9 pagesHARSHAD - MEHTA Claw PresentationPalzer SherpaNo ratings yet

- Formal Informal EnglishDocument20 pagesFormal Informal EnglishThinn Thinn OoNo ratings yet

- Banking Sector Concentration, Competition and Financial Stability: The Case of The Baltic CountriesDocument40 pagesBanking Sector Concentration, Competition and Financial Stability: The Case of The Baltic CountriesMordecaï OMGANo ratings yet

- ST Series Wall Mounting EnclosureDocument7 pagesST Series Wall Mounting EnclosureSalmanNo ratings yet

- Coase Theorem: - Aaksha Sajnani - Muskaan DargarDocument16 pagesCoase Theorem: - Aaksha Sajnani - Muskaan DargarKuldeep jajraNo ratings yet

- Reading Comprehension Grade 10semester 2 20231206 193833Document27 pagesReading Comprehension Grade 10semester 2 20231206 193833aolefirNo ratings yet

- Uspto 97197301Document2 pagesUspto 97197301Sebastian SinclairNo ratings yet

- Private Equity and Private Debt Investments in IndiaDocument71 pagesPrivate Equity and Private Debt Investments in IndiaShashwat JainNo ratings yet

- Pre T EntrepDocument13 pagesPre T EntrepJullie Ann SolanoNo ratings yet

- TLE 10 - MODULE Cover PageDocument12 pagesTLE 10 - MODULE Cover PagePedro GenosasNo ratings yet

- De Cuong Cuoi Hki Anh 9 TC 23-24 - Ban HSDocument16 pagesDe Cuong Cuoi Hki Anh 9 TC 23-24 - Ban HSmyphuonghuynh1287No ratings yet

- Ir DBQ 2021Document5 pagesIr DBQ 2021Lizbeth HerreraNo ratings yet

- Basic Concepts in Forest Valuation and Investment Analysis - EditiDocument336 pagesBasic Concepts in Forest Valuation and Investment Analysis - EditiAsfaw GelanNo ratings yet

- Memo TaxDocument2 pagesMemo TaxKristine MagbojosNo ratings yet

- Narrative Report - Chapter 10Document4 pagesNarrative Report - Chapter 10Hazel BorboNo ratings yet

- Emergency Luminaire U21 - Standard Non Maintained - 1 H - 70 LM - LedDocument1 pageEmergency Luminaire U21 - Standard Non Maintained - 1 H - 70 LM - Ledmouhcine meskiNo ratings yet