Professional Documents

Culture Documents

'SWOT' Analysis On Goods and Services Tax (GST) in India

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

'SWOT' Analysis On Goods and Services Tax (GST) in India

Copyright:

Available Formats

Volume 8, Issue 8, August – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

'SWOT' Analysis on Goods and Services

Tax (GST) in India

Dr. P. Kalaiselvi*

*Assistant Professor, Department of Commerce,

Government Arts College, Chidambaram - 608102,

Abstract:- "One India, One Tax" is expected to became Taxes are enforced contributions that are exacted in

true through the Rajya Sabha endorsing the Constitution accordance with legal authority; they are not voluntary

(101st Amendment) bill, 2016 on August 3rd 2016. Then and payments or donations. It is a tax that the government imposes

there several meetings were conducted to execute the Good under several names, including toll, tribute, duty, custom,

and Service Tax (GST) in India but it was postponed due excise, subsidy, aid, and supply. Government alone has the

to some political reasons competing stakeholder interests. authority to impose taxes. It is crucially important that the

Many states have opposed for the execution of Goods and taxation system is designed in a way that prevents market

Services Tax (GST). Then they were convinced and distortions and economic failures of any kind. The tax rules

assured by the central government to pay compensation are fiercely competitive, allowing for incredibly efficient and

and additional percentage of revenue to meet the expenses successful revenue collection. Tax is the main source of

for the respective state government. GST was presumed to revenue for the government to meet various expenses for the

get into effect on Ist April - 2017, but it was also deferred development of the country. "One India, one Tax" was the

due to some clarification needs in the online portal for dream of India's Honorable Ex. Prime Minister Mr. Atal

registration and filing of GST. The Goods and Services Bihari Vajpayee. Several meetings were conducted to execute

Tax (GST) have finally been came into force on 1st July, the GST in India but it was interrupted due to some political

2017 after a long process and struggle. It is a reasons competing stakeholder interests. Many states have

comprehensive tax scheme which integrate all indirect opposed to execute the Goods and Services Tax (GST). Then

taxes imposed by the state government and central certain amendments were made to the GST Bill like,

government and united financial system, into a single Compensation to states for revenue loss on account of GST

nationwide market. The fundamental objective of GST execution for five years, Scrapping of 1% additional Tax on

progress is to incorporate all indirect taxes in India, like interstate supply of goods, Redesigning of frame work for

Service tax, VAT, Sales Tax, Octroi duty, Excise duty, distribution of CGST and IGST that will be collected by the

Customs duty and so on, by implementing "One India, Centre amongst Central and States, etc. After the legitimate

One Tax" system to avoid the cascading effect on various modification, Central Government introduced the GST Bill in

taxes. GST based taxation structure enhanced clarity in 2017 in Parliament. On April 4, 2017 the bill received assent

the taxation scheme, raised the Gross Domestic Product of Prime Minister of India but it was delayed due to some

(GDP) rate from 1% to 6.1%, and reduced tax evasion and clarification needs in the online portal for registration and

fraudulence. Hence, this article emphasized the existing filing of GST. After a long process and struggle, the Goods

taxation system, importance of GST, impact of GST on the and Services Tax (GST) came into power on 1st July, 2017.

Indian economy, Strength, Weakness Opportunities, and

Threats of GST execution in India. II. EXISTING TAXATION SYSTEM IN INDIA

Keywords:- Stakeholder, Corporate Bodies, GST, Cascading In terms of efficiency and equality, tax policies directly

Effect, GST Execution. affect the economies of all nations and are essential to their

success. An effective taxation strategy takes into account the

I. INTRODUCTION whole income distribution while also generating tax income

for the central and state governments in a way that can boost

The word “tax” have originated from Latin word the economy overall and the nation's citizen safety, public

“taxare” which means "assess". Taxation is the most services, infrastructure, defense, and exports. The entirety of

significant factor of the financial structure of each and every the indirect taxation system is governed by Indian

nation. Taxes are imposed upon individuals and corporate constitutional laws. The Central and the respective State

bodies that are compulsorily paid to the state and or central Governments have the power to collect indirect taxes in

government. Taxes are regarded as contributions made by the accordance with Seventh Schedule of Article 246, which is

individuals and corporate bodies for the growth and based on the trade of products and services. Each producer has

development of country. a different tax structure depending on the place of sale or the

IJISRT23AUG948 www.ijisrt.com 1556

Volume 8, Issue 8, August – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

size of exports and imports. Based on origin, indirect taxation- to both goods and services under the GST, which is a crystal

based collection schemes are designed to apply and collect the clear tax policy which improved the revenue collections.

tax in the event that any taxable movement takes place. Additionally, it creates a transparent tax structure and gets rid

of corruption and tax evasion. GST makes the system highly

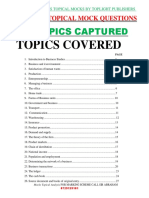

Objectives of the Study apparent and offers leniency in tax laws because it is a form of

The primary objectives the present study are as follows: tax which favorable to businesses but it suppose to cover all

To highlight the importance of Goods and Services Tax the products (including petroleum products) and services

(GST) in India. under GST regime for the welfare of public.

To understand the Strength, Weakness, Opportunities and

Threats of GST execution in India. Rate of GST in India

The current GST rates executed in India are 5%, 12%,

Scope of the Study 18%, and 28%. These rates apply to a variety of goods and

The Good and Services Tax (GST) is very advantageous services. The GST Council decides the various GST rate slabs.

for the key sectors of the Indian economy because it brings Since the introduction of the Goods and Services Tax (GST),

uniformity to tax rates and eliminates many inadequacies in the GST rates for a variety of products have been altered

the Indian Taxation System relating to Indirect Tax numerous times. It provide bigger tax pay raise to the

Assessment. This article presents a thorough understanding of government and manufacturing segment face enormous

how the GST was implemented across the nation. development with decline in tax rate. Numerous Unorganized

sectors acquire benefited cost advantage equivalent to the tax

III. IMPORTANCE OF GST TAXATION SYSTEM rate executed by GST. As a result, lots of industries like,

hardware, paint, electronic items, etc., are now subject to

With bigger interfaces between the existing taxes and taxes. With GST everything must be carefully planned out to

GST schemes, beside with the hazards of cascading effects ensure an ordered taxation rate. Petroleum products,

and accidental non-taxation schemes, GST surmounted a consumable alcohol and electricity are not taxed under GST

number of progress-related challenges. The GST laid a solid rates.

framework for revenue collection at the beginning of value

addition. Each taxable person contributes to the GST Registration

administration, collection, and payment of the tax pertaining A person who supply goods or providing services or both

to its border. As a result, GST travels through the supply chain and his aggregate turnover exceeds the threshold limits have to

to the final consumer's taxable supply. The GST reforms play register under GST. Nevertheless, However certain category

very important function in the flow of goods and services from of persons like, Intra and Interstate suppliers, casual taxable

one to another. persons, Non Resident Taxable Persons, Persons taxable under

the reverse charge basis, under reverse charge, Input service

GST rules fairly detailed to determine time and place of Providers, persons required to deduct TDS and collect TCS

supply. It is parting with MRP based taxation and widening of under GST are required to compulsorily be registered. Over

input tax credits to taxpayers. Refund of input tax credit 13.8 million GST taxpayers have registered at this time. In

balances in case of inverted tax structure is a step in right India, there were around 12.38 million people who paid GST

direction. The process of GST registration and filing at ease taxes that year.

through online portal. It increase the possibilities for FDI in

India. Strict execution of GST provides Direct Tax Revenue. It Threshold Limits

helps to improve the national GDP growth. The existing threshold limits for sale of products or

services was Rs. 20,00,000 (aggregate turnover) for normal

Types of GST category states and Rs. 10,00,000 (aggregate turnover) for

SGST, CGST, IGST and UTGST are the various types of special category states in India. On considering the demands

GST implemented in India. raised by MSMEs, the GST Council increased the GST

CGST is Goods and Services Tax imposed by the Centre. registration threshold limits from Rs. 20,00,000 to Rs.

SGST is Goods and Services Tax imposed by the States. 40,00,000 for normal category states and from Rs.10 lakh to

Dual GST is Goods and Services Tax imposed by both Rs.20 lakh for special category states and there is no alteration

Centre and States concomitantly. for service providers in this regard. If an individual's total

IGST is Goods and Services Tax imposed when the goods aggregate turnover reaches Rs. 10 lakh by providing services

and services has interstate movement, between the state in a state under the special category or Rs. 20 lakh in a state

and Union Territory across the nation under the standard category, they must register. At the 32nd

UTGST is GST to be imposed by the Union Territory. GST Council meeting, which took place on January 10, 2019,

these amendments were suggested.

All the existing taxes are ceased since the GST take

place. There is now only one tax, and it is a national tax that is

entirely controlled by the central government. One tax applies

IJISRT23AUG948 www.ijisrt.com 1557

Volume 8, Issue 8, August – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Thrshold Limits to Composition Scheme Strength and Opportunities of GST Implementation in

As of April 1st, 2019, the yearly turnover requirement for India

the composition scheme was lifted up to Rs. 1.5 crore. At the The registration and filing of GST in online portal

beginning on April 1, 2019, the individuals who have reduces the time and paper work for the tax payers.

registered for the system are required to pay their taxes on a Government gets major source of revenue from GST to meet

quarterly basis and file annual returns. For North Eastern the expenses for the development of infrastructure, welfare,

states and Uttarakhand, the cap stands at Rs. 75 lakh. education, health industries, investments, etc. Using paperless

Additionally, eateries that don't provide alcoholic beverages e-resources by the private concerns and government for filing

are subject to the limit. Service providers now have access to of GST. Opportunities are there for the GDP growth and

the composition plan, which introduces a set tax rate of 6% development in Indian economy. GST promises a lot for

with 3% CGST and 3% SGST. This system is open to self- transparency in great improvements towards collections of

governing service providers as well as mixed suppliers of revenues. GST facilitate the Input Tax Credit to the Tax

goods and services with a prior fiscal year's annual revenue up payers. It replaced the existing tax system and procedure. It

to Rs. 50,00,000. facilitates the e-waybill when goods are moved from one place

to another. It make easy for the taxation authorities to verify

Impact of GST on the Indian Economy the filed documents. It eradicate the cascading effect on tax.

With a huge struggle, the GST was implemented in India There is an effectiveness in cost reduction for domestic

on the first day of July, 2017, has greatly impacted on the total industries. Import of needless goods would be reduced which

taxation system of the Indian economy. It has updated the tax in turn India's payments to other countries be reduced. Due to

system, leading to increased fulfilment and formalisation of the encouragement on exports, India will get more FOREX

the economy. It has improved the industrial growth in which will helps to make the payment of imports. The cost

manufacturing and logistics which in turn, the national GDP reduction on consumer goods may lead to increase in savings,

ratio and also control inflation have improved to some extent. household income, investment, and purchasing power.

Nevertheless, the reform mainly be beneficial to the

manufacturing industry, but some challenges for the service Weakness and Threats of GST Implementation in India

sector industry. The Indian economy grew by 6.1% year over Since the GST is still developing, tax modification

year in 2023, above the market expectations of 5% and concerning the finalization of tax rates, the application of new

outpacing the upwardly revised 4.5% in 2022. The main forces tax, or even the elimination earlier rates, might rarely take

behind the expansion during a loosening of input cost place during GST Council meetings. As GST meetings

restraints were manufacturing, exports of services, and private continue and a great deal job still has to be done, the majority

consumption. Moreover, services have grown to be a of the data provided in the study was speculatively

substantial engine, accounting for more than half of GDP. investigative in nature. As a result, the research's final

conclusions may perhaps fluctuate depend on how other

Table - 1. India's GDP Growth Rate after GST Execution people see it. The GST Act is frequently changed, which

Year GDP Growth (%) Annual Change causes uncertainty among the taxpayers. The exclusion of

2022 7.00% -2.05% fossil fuels and energy is having a domino effect and

2021 9.05% 14.88% negatively affecting indigenous industries' competitiveness in

2020 -5.83% -9.70% the global market. Due to the rate arbitrage, the exclusion of

2019 3.87% -2.58% alcohol from the GST could encourage smuggling. The GST

2018 6.45% -0.34% may be regressive in nature if there isn't a carefully examined

2017 6.80% -1.46% and compiled negative list of essential products. The price of

Source: Compiled from the finished products slightly high due to GST implementation

https://www.macrotrends.net/countries/IND/india/gdp-growth- which affects the poor people. There won't be an opportunity

rate to reduce the rate of GST in future due to the revenue

requirements for government. The free flow of commodities

The above table - 1 shows that India's GDP growth rate throughout the nation has been successfully facilitated by

after GST execution from 2017 to 2022 such as India GDP GST. As taxes differed from state to state, city to city, and

growth rate for 2022 was 7.00% with an annual change even municipal bodies, check points in the past operated as

of 2.05% decline from 2021, for 2021 it was 9.05%, with a bottlenecks that not only required lengthy wait times, but also

change of 14.88% increase from 2020, for 2020 it was 5.83% served as hotbeds for corruption. GST might have increased

with a change of 9.7% decline from 2019, for 2019 was 3.87% compliance costs for small firms and contributed to short-term

with a change of 2.58% decline from 2018. inflation. It might have caused the supply chain to break down

and possibly decreased exports.

IJISRT23AUG948 www.ijisrt.com 1558

Volume 8, Issue 8, August – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

IV. CONCLUSION [6]. Central Board of Excise and Customs, Ministry of

Finance. (2017). Revised GST rate for certain goods.

In 1960, France became the first nation to enact GST. India Retrieved from http://www.cbec.gov.in

developed and recommended the GST idea a few years ago, [7]. Adhana, D.K. (2015). Goods and services tax (GST): A

but on July 1, 2017, the government of India successfully panacea for Indian economy. International Journal of

brought it into effect under the proficient control of Honorable Engineering & Management Research, 5 (4), 332 - 338.

Prime Minister Shri Narendra Modi. As a result, Honorable [8]. Garg, G. (2014). Basic concepts and features of goods

Ex. Prime Minister Shri Atal Bihari Vajpayee's dream was and services tax in India. International Journal of

realized with an introduction of the GST in India is powerfully Scientific Research and Management (IJSRM), 2 (2),

supported by new administration due to many advantages like, 542 - 549.

progress tax collections, speed up economic growth of India, [9]. Jain, A. (2013)l An empirical analysis on goods and

and abolish all tax barriers between the Central and State service tax in India: Possible impacts, implications and

Governments transparently. The Indian economy grew by policies. International Journal of Reviews, Surveys and

6.1% year over year in 2023, above the market expectations of Research (IJRSR), 2 (1). Retrieved

5% and outpacing the upwardly revised 4.5% in 2022. fromhttps://www.ijrsr.com/January2013/5.pdf Jain, J. K.

(n.d.). Goods and service tax. Retrieved from

SCOPE FOR FUTURE RESEARCH https://www.caclubindia.com/articles/goods-and-st-

basics- 25424.asp

Following the adoption of the GST, a new need for a [10]. Chakraborty, P., & Rao, P.K. (2010). Goods and services

technical based infrastructure like GSTNET has emerged for tax in India: An assessment of the base. Economic and

the successful monitoring of the taxing system. Additionally, Political Weekly, 45 (1), 49 - 54.

the GST Council should have monthly meetings to discuss [11]. Panda, A., & Patel, A. (2010). The impact of GST (goods

changes in tax reflections. Researchers may examine these and services tax) on the Indian tax scene. DOI :

topics in upcoming study. https://dx.doi.org/10.2139/ssrn.18686219.Poddar, S., &

Impact of Goods and Services Tax (GST) in Corporate Ahmad, E. (2009). GST reforms and intergovernmental

Sector. consideration in India (Working Paper No.1/2009-DEA).

Perception of GST Payers at different perspectives. Retrieved fromhttp://dea.gov.in/sites/

Critical Analysis on GST with reference to industrial [12]. Kelkar, V.(2009), A tax for economic growth, Retrieved

Sector. from http://www.livemint.com

[13]. https://www.macrotrends.net/countries/IND/india/gdp-

REFERENCES growth-rate

[1]. Maruthi, M V (2020), Assistant Professor, K.L.E.

Society’s S. Nijalinganppa College, Rajajinagar,

Bangalore - 560010,Volume 4, Special Issue No.1, July

2020, ISSN: 2474-5146 (Online) 2474-5138 (Print),

International Review of Business and Economics, One

Day Online International Conference Organised by IRBE

Publications, Denver, USA.

[2]. Kalaiselvi, P. (2020), Tax Payers' Perception on Goods

and Services Tax (GST) in Chidambaram Town, Studies

in Indian Place Names, 40 (13), ISSN: (Online) 1603-

1608, (Print) 2394-3114.

[3]. Kumar P. & Sarkar S. (2016), Goods and service tax in

India: problems and prospects, Asian journal of

management research, Volume - 6 Issue - 3, 504-513.

[4]. Goods and Services Tax Council (2017). Retrieved from

http://www.gstcouncil.gov. in/GST India.com (2016,

March 21). Basic concepts of GST (Part - 13) –

Constitutional amendment for GST. Retrieved from

http://www.gstindia.com/basic-concepts-of-gstpart-13-

constitutional-amendment-forgst

[5]. Kumar A.& Nayak R. (2017), GST A New Tax Reforms

in India- Implementing Towards Sustainable

Development of the Economy, International journal of

creative thoughts, Volume 5, issue 4, 2350-2355.

IJISRT23AUG948 www.ijisrt.com 1559

You might also like

- How to Handle Goods and Service Tax (GST)From EverandHow to Handle Goods and Service Tax (GST)Rating: 4.5 out of 5 stars4.5/5 (4)

- Ayushi PatraDocument12 pagesAyushi PatraAdithya anilNo ratings yet

- Positive and Negative Impact of GST On Indian Economy: A DashDocument3 pagesPositive and Negative Impact of GST On Indian Economy: A Dashकमाक्क्षी जोशीNo ratings yet

- The GST and Economic GrowthDocument4 pagesThe GST and Economic GrowthEditor IJTSRDNo ratings yet

- GST: Impact On Indian Economy: PallavikapilaDocument3 pagesGST: Impact On Indian Economy: PallavikapilaVishal kumarNo ratings yet

- A COMPREHENSIVE ANALYSIS OF GST IN INDIADocument8 pagesA COMPREHENSIVE ANALYSIS OF GST IN INDIABasavarajNo ratings yet

- Swot 2 Eco 2Document6 pagesSwot 2 Eco 2Amrutha GayathriNo ratings yet

- Positive and Negative Impact of GST On Indian Economy A DashDocument4 pagesPositive and Negative Impact of GST On Indian Economy A DashRaveena JangidNo ratings yet

- GST: An Economic Overview: Challenges and Impact AheadDocument4 pagesGST: An Economic Overview: Challenges and Impact AheadKaran Veer SinghNo ratings yet

- GST's Impact on Indian EconomyDocument10 pagesGST's Impact on Indian EconomyKetan YadavNo ratings yet

- IMPACT OF GST ON INDIAN ECONOMYDocument10 pagesIMPACT OF GST ON INDIAN ECONOMYbijay2022No ratings yet

- A Study On Impact of GST On Indian Economy: Chirag RanaDocument4 pagesA Study On Impact of GST On Indian Economy: Chirag RanaPratyasha SarkarNo ratings yet

- Implementation of Goods and Services Tax (GST)Document11 pagesImplementation of Goods and Services Tax (GST)NATIONAL ATTENDENCENo ratings yet

- Continuous Evaluation Project Taxation Law II 18B176Document15 pagesContinuous Evaluation Project Taxation Law II 18B176un academyNo ratings yet

- The Impact of GST On Manufacturing Sector in India: Vol 11, Issue 7, July/ 2020 ISSN NO: 0377-9254Document6 pagesThe Impact of GST On Manufacturing Sector in India: Vol 11, Issue 7, July/ 2020 ISSN NO: 0377-9254Rohit MuleyNo ratings yet

- 2 Internal Assignment: NAME-Rachit Arya - 17010125059 SEM - 8 Div-A B.A L.L. B (Hons.)Document6 pages2 Internal Assignment: NAME-Rachit Arya - 17010125059 SEM - 8 Div-A B.A L.L. B (Hons.)Ayush singhNo ratings yet

- GST Implementation and Its Impact On Indian EconomyDocument4 pagesGST Implementation and Its Impact On Indian EconomyarcherselevatorsNo ratings yet

- Internal - I: Name - Ayush Kumar Singh PRN - 18010126240 Div - CDocument6 pagesInternal - I: Name - Ayush Kumar Singh PRN - 18010126240 Div - CAyush singhNo ratings yet

- An Exploratory Study of Problems and Prospects of Goods and Service Tax Post Implementation in IndiaDocument7 pagesAn Exploratory Study of Problems and Prospects of Goods and Service Tax Post Implementation in Indiashyaan ramNo ratings yet

- Project ReportDocument24 pagesProject ReportanilNo ratings yet

- Goods and Services Tax (GST) in India - An Overview and ImpactDocument3 pagesGoods and Services Tax (GST) in India - An Overview and Impactsamar sagarNo ratings yet

- GST in India: An Analysis of its Concept, Implementation and ImpactDocument26 pagesGST in India: An Analysis of its Concept, Implementation and ImpactSukrit GandhiNo ratings yet

- Original Document (Autosaved)Document55 pagesOriginal Document (Autosaved)BADDAM PARICHAYA REDDYNo ratings yet

- GST in IndiaDocument26 pagesGST in IndiaAKHIL H KRISHNANNo ratings yet

- An Exploratory Study On Evolution & Implementation of GST in IndiaDocument5 pagesAn Exploratory Study On Evolution & Implementation of GST in IndiaRajeswari DeviNo ratings yet

- impactofgstonindianeconomypaperDocument10 pagesimpactofgstonindianeconomypaperharshitverma1762No ratings yet

- Impact of Goods and Services Tax (GST) On Indian EconomyDocument5 pagesImpact of Goods and Services Tax (GST) On Indian EconomyMCOM 2050 MAMGAIN RAHUL PRASADNo ratings yet

- GST - International TaxationDocument6 pagesGST - International TaxationAnkita ThakurNo ratings yet

- Impact of GST On The Indian EconomyDocument16 pagesImpact of GST On The Indian EconomySandeep TomarNo ratings yet

- GST Data CollectedDocument11 pagesGST Data CollectedtpplantNo ratings yet

- Impact of GST in Foreign Trade ProjectDocument7 pagesImpact of GST in Foreign Trade ProjectkiranNo ratings yet

- Critical Analysis of GSTDocument7 pagesCritical Analysis of GSTPooja BhagatNo ratings yet

- Economics RP Kartik Goel BBA - LLBDocument21 pagesEconomics RP Kartik Goel BBA - LLBKartikNo ratings yet

- Impact of GST On Indian Economy PaperDocument10 pagesImpact of GST On Indian Economy PaperDevil DemonNo ratings yet

- Shodhsancharbulletinjanuarytomarch2020g P DangDocument12 pagesShodhsancharbulletinjanuarytomarch2020g P Dangakhileshyadav3794186No ratings yet

- GST and Its Impact 3 PDFDocument3 pagesGST and Its Impact 3 PDFanushka kashyapNo ratings yet

- UTKARSH YADAV (Sec - B) (Research Paper)Document8 pagesUTKARSH YADAV (Sec - B) (Research Paper)UTKARSH YADAVNo ratings yet

- Insights Into Yojana: August 2017: Goods and Services Tax (GST)Document14 pagesInsights Into Yojana: August 2017: Goods and Services Tax (GST)Abhishek SinghNo ratings yet

- An Analysis of GST Collection of India SDocument6 pagesAn Analysis of GST Collection of India SAditi ChandraNo ratings yet

- Tax-2project VinayDocument28 pagesTax-2project Vinayvinay sharmaNo ratings yet

- GST Impact on Indian Economy and Key SectorsDocument20 pagesGST Impact on Indian Economy and Key SectorsAKHIL H KRISHNANNo ratings yet

- The Impact of GST On IndiaDocument8 pagesThe Impact of GST On Indiasahil khanNo ratings yet

- GST Unit 1Document23 pagesGST Unit 1hpotter46103No ratings yet

- A Review On GST Execution and Its Effect PDFDocument9 pagesA Review On GST Execution and Its Effect PDFAsma KhanNo ratings yet

- GST - A Game Changer: 2. Review of LiteratureDocument3 pagesGST - A Game Changer: 2. Review of LiteratureMoumita Mishra100% (1)

- GST - A Game Changer: 2. Review of LiteratureDocument3 pagesGST - A Game Changer: 2. Review of LiteratureInternational Journal in Management Research and Social ScienceNo ratings yet

- GST Invoice and Bill Maker APP: M.Krishnakanth, M. Jagadeeshwaran, S.Kirubakaran, D.KarthikaDocument8 pagesGST Invoice and Bill Maker APP: M.Krishnakanth, M. Jagadeeshwaran, S.Kirubakaran, D.Karthika4051-krishna kanth.MNo ratings yet

- An Overview of Gst in India ( Content to Be Take From the 20 Articles).DocxDocument67 pagesAn Overview of Gst in India ( Content to Be Take From the 20 Articles).DocxBADDAM PARICHAYA REDDYNo ratings yet

- Ijm - 08!04!002 GST ArticleDocument8 pagesIjm - 08!04!002 GST ArticleAnand JaiswalNo ratings yet

- Impact of GST on India's EconomyDocument11 pagesImpact of GST on India's EconomyabcNo ratings yet

- Complete GST NotesDocument102 pagesComplete GST Noteslawsaba6No ratings yet

- Basic Concepts and Features of Goods and Service Tax in IndiaDocument3 pagesBasic Concepts and Features of Goods and Service Tax in Indiamansi nandeNo ratings yet

- GST & Its Impact On Business 1Document6 pagesGST & Its Impact On Business 1Aditya Narayan DashNo ratings yet

- Goods and Services Tax - 2Document35 pagesGoods and Services Tax - 2Mayank SainiNo ratings yet

- GST VS VatDocument62 pagesGST VS VatMohit AgarwalNo ratings yet

- How GST Will Benefit the Indian Economy and BusinessesDocument5 pagesHow GST Will Benefit the Indian Economy and BusinessesvasanthisbNo ratings yet

- Indirect Taxes: Assignment-2Document27 pagesIndirect Taxes: Assignment-2Arpita ArtaniNo ratings yet

- Sip 3 CH AsmaDocument20 pagesSip 3 CH AsmaAsma KhanNo ratings yet

- SIP 123 AsmaDocument20 pagesSIP 123 AsmaAsma KhanNo ratings yet

- GST Final PaperDocument5 pagesGST Final PaperIjcams PublicationNo ratings yet

- An Analysis on Mental Health Issues among IndividualsDocument6 pagesAn Analysis on Mental Health Issues among IndividualsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Insights into Nipah Virus: A Review of Epidemiology, Pathogenesis, and Therapeutic AdvancesDocument8 pagesInsights into Nipah Virus: A Review of Epidemiology, Pathogenesis, and Therapeutic AdvancesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Compact and Wearable Ventilator System for Enhanced Patient CareDocument4 pagesCompact and Wearable Ventilator System for Enhanced Patient CareInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Smart Cities: Boosting Economic Growth through Innovation and EfficiencyDocument19 pagesSmart Cities: Boosting Economic Growth through Innovation and EfficiencyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Implications of Adnexal Invasions in Primary Extramammary Paget’s Disease: A Systematic ReviewDocument6 pagesImplications of Adnexal Invasions in Primary Extramammary Paget’s Disease: A Systematic ReviewInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Parkinson’s Detection Using Voice Features and Spiral DrawingsDocument5 pagesParkinson’s Detection Using Voice Features and Spiral DrawingsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Relationship between Teacher Reflective Practice and Students Engagement in the Public Elementary SchoolDocument31 pagesThe Relationship between Teacher Reflective Practice and Students Engagement in the Public Elementary SchoolInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Harnessing Open Innovation for Translating Global Languages into Indian LanuagesDocument7 pagesHarnessing Open Innovation for Translating Global Languages into Indian LanuagesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Air Quality Index Prediction using Bi-LSTMDocument8 pagesAir Quality Index Prediction using Bi-LSTMInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Investigating Factors Influencing Employee Absenteeism: A Case Study of Secondary Schools in MuscatDocument16 pagesInvestigating Factors Influencing Employee Absenteeism: A Case Study of Secondary Schools in MuscatInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Advancing Healthcare Predictions: Harnessing Machine Learning for Accurate Health Index PrognosisDocument8 pagesAdvancing Healthcare Predictions: Harnessing Machine Learning for Accurate Health Index PrognosisInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Exploring the Molecular Docking Interactions between the Polyherbal Formulation Ibadhychooranam and Human Aldose Reductase Enzyme as a Novel Approach for Investigating its Potential Efficacy in Management of CataractDocument7 pagesExploring the Molecular Docking Interactions between the Polyherbal Formulation Ibadhychooranam and Human Aldose Reductase Enzyme as a Novel Approach for Investigating its Potential Efficacy in Management of CataractInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Dense Wavelength Division Multiplexing (DWDM) in IT Networks: A Leap Beyond Synchronous Digital Hierarchy (SDH)Document2 pagesDense Wavelength Division Multiplexing (DWDM) in IT Networks: A Leap Beyond Synchronous Digital Hierarchy (SDH)International Journal of Innovative Science and Research TechnologyNo ratings yet

- The Making of Object Recognition Eyeglasses for the Visually Impaired using Image AIDocument6 pagesThe Making of Object Recognition Eyeglasses for the Visually Impaired using Image AIInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Utilization of Date Palm (Phoenix dactylifera) Leaf Fiber as a Main Component in Making an Improvised Water FilterDocument11 pagesThe Utilization of Date Palm (Phoenix dactylifera) Leaf Fiber as a Main Component in Making an Improvised Water FilterInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Impact of Digital Marketing Dimensions on Customer SatisfactionDocument6 pagesThe Impact of Digital Marketing Dimensions on Customer SatisfactionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Survey of the Plastic Waste used in Paving BlocksDocument4 pagesA Survey of the Plastic Waste used in Paving BlocksInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Diabetic Retinopathy Stage Detection Using CNN and Inception V3Document9 pagesDiabetic Retinopathy Stage Detection Using CNN and Inception V3International Journal of Innovative Science and Research TechnologyNo ratings yet

- Formulation and Evaluation of Poly Herbal Body ScrubDocument6 pagesFormulation and Evaluation of Poly Herbal Body ScrubInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Comparatively Design and Analyze Elevated Rectangular Water Reservoir with and without Bracing for Different Stagging HeightDocument4 pagesComparatively Design and Analyze Elevated Rectangular Water Reservoir with and without Bracing for Different Stagging HeightInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Terracing as an Old-Style Scheme of Soil Water Preservation in Djingliya-Mandara Mountains- CameroonDocument14 pagesTerracing as an Old-Style Scheme of Soil Water Preservation in Djingliya-Mandara Mountains- CameroonInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Explorning the Role of Machine Learning in Enhancing Cloud SecurityDocument5 pagesExplorning the Role of Machine Learning in Enhancing Cloud SecurityInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Auto Encoder Driven Hybrid Pipelines for Image Deblurring using NAFNETDocument6 pagesAuto Encoder Driven Hybrid Pipelines for Image Deblurring using NAFNETInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Cyberbullying: Legal and Ethical Implications, Challenges and Opportunities for Policy DevelopmentDocument7 pagesCyberbullying: Legal and Ethical Implications, Challenges and Opportunities for Policy DevelopmentInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Review: Pink Eye Outbreak in IndiaDocument3 pagesA Review: Pink Eye Outbreak in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Design, Development and Evaluation of Methi-Shikakai Herbal ShampooDocument8 pagesDesign, Development and Evaluation of Methi-Shikakai Herbal ShampooInternational Journal of Innovative Science and Research Technology100% (3)

- Electro-Optics Properties of Intact Cocoa Beans based on Near Infrared TechnologyDocument7 pagesElectro-Optics Properties of Intact Cocoa Beans based on Near Infrared TechnologyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Hepatic Portovenous Gas in a Young MaleDocument2 pagesHepatic Portovenous Gas in a Young MaleInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Navigating Digitalization: AHP Insights for SMEs' Strategic TransformationDocument11 pagesNavigating Digitalization: AHP Insights for SMEs' Strategic TransformationInternational Journal of Innovative Science and Research Technology100% (1)

- Automatic Power Factor ControllerDocument4 pagesAutomatic Power Factor ControllerInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Ca Covid Tenant Relief Act Info 10-1-21Document2 pagesCa Covid Tenant Relief Act Info 10-1-21Darlene GoldmanNo ratings yet

- KIA SELTOS BookingDocketDocument7 pagesKIA SELTOS BookingDocketNeelNo ratings yet

- Test Bank For Western Civilization Ideas Politics and Society Volume II From 1600 11th Edition DownloadDocument17 pagesTest Bank For Western Civilization Ideas Politics and Society Volume II From 1600 11th Edition Downloadadrienneturnerkpqowgcymz100% (16)

- Quiz Employee Benifits Income TaxDocument2 pagesQuiz Employee Benifits Income TaxMonica MonicaNo ratings yet

- Shelton Gallery Had The Following Petty Cash Transactions in FebDocument1 pageShelton Gallery Had The Following Petty Cash Transactions in FebAmit PandeyNo ratings yet

- Tax Invoice/Bill of Supply/Cash MemoDocument1 pageTax Invoice/Bill of Supply/Cash MemoPrem ChanderNo ratings yet

- Account HeadsDocument6 pagesAccount HeadsNabin DhakalNo ratings yet

- The Greatest Options Strategy Ever MadeDocument14 pagesThe Greatest Options Strategy Ever MadeAnkur DasNo ratings yet

- GST Notes-CA Inter-May 23 1 Lyst8910 PDFDocument172 pagesGST Notes-CA Inter-May 23 1 Lyst8910 PDFMaheshkumar PerlaNo ratings yet

- Basic Financial Statements Chapter Number 2Document2 pagesBasic Financial Statements Chapter Number 2Muhammad UsamaNo ratings yet

- Cost AccntgDocument36 pagesCost AccntgRoselynne GatbontonNo ratings yet

- Lesson 7 - Laboratory BudgetDocument27 pagesLesson 7 - Laboratory BudgetFranzil Shannen PastorNo ratings yet

- ACCA SBR Notes - AsraDocument69 pagesACCA SBR Notes - AsraReem JavedNo ratings yet

- 3000 High CPC KeywordsDocument114 pages3000 High CPC KeywordsSuara PesanNo ratings yet

- E00a6 Non Performance Assets - HDFC BankDocument62 pagesE00a6 Non Performance Assets - HDFC BankwebstdsnrNo ratings yet

- SampleDocument32 pagesSampleA. NurfauziahNo ratings yet

- Bescom GSTN No: 29Aaccb1412G1Z5Document2 pagesBescom GSTN No: 29Aaccb1412G1Z5RajkiranaNo ratings yet

- Indianwear Retail Industry Report 100422 VFDocument154 pagesIndianwear Retail Industry Report 100422 VFEr.Vivek RaghuwanshiNo ratings yet

- PDF The Impact of Train Law in Micro Business On Sari-Sari Stores IncomeDocument68 pagesPDF The Impact of Train Law in Micro Business On Sari-Sari Stores IncomeRussel100% (2)

- Pre-Mediation ApplicationDocument2 pagesPre-Mediation ApplicationHarshitha MNo ratings yet

- Schwab Company Case Analysis PDFDocument6 pagesSchwab Company Case Analysis PDFgoutam1235No ratings yet

- Benefits of Credit ManagementDocument9 pagesBenefits of Credit ManagementJason wongNo ratings yet

- Business Studies Topical QuestionsDocument64 pagesBusiness Studies Topical Questionsnyabinge silvesterNo ratings yet

- Nationalization of Ethiopia's Bank of IssueDocument16 pagesNationalization of Ethiopia's Bank of IssueChinmoy MishraNo ratings yet

- Difference Between Profit Maximization and Wealth Maximization Financial ManagementDocument6 pagesDifference Between Profit Maximization and Wealth Maximization Financial ManagementAnkush KujurNo ratings yet

- Economics WordsearchDocument1 pageEconomics WordsearchSandy SaddlerNo ratings yet

- Project Report UrjaDocument16 pagesProject Report Urjashubham jagtapNo ratings yet

- 2022 CNOOC Annual ReportDocument175 pages2022 CNOOC Annual ReportBlack RiverNo ratings yet

- Transaction Information: Remitbee IncDocument1 pageTransaction Information: Remitbee IncPIRATEJOURNEYNo ratings yet

- Energy, Climate and The EnvironmentDocument271 pagesEnergy, Climate and The EnvironmentMikel MendezNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Stiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreFrom EverandStiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreRating: 4.5 out of 5 stars4.5/5 (13)

- What Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemFrom EverandWhat Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemNo ratings yet

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- Tax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsFrom EverandTax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsRating: 4 out of 5 stars4/5 (1)

- Freight Broker Business Startup: Step-by-Step Guide to Start, Grow and Run Your Own Freight Brokerage Company In in Less Than 4 Weeks. Includes Business Plan TemplatesFrom EverandFreight Broker Business Startup: Step-by-Step Guide to Start, Grow and Run Your Own Freight Brokerage Company In in Less Than 4 Weeks. Includes Business Plan TemplatesRating: 5 out of 5 stars5/5 (1)

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipFrom EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNo ratings yet