Professional Documents

Culture Documents

(Daily Caller Obtained) - JLL388

Uploaded by

Henry RodgersOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(Daily Caller Obtained) - JLL388

Uploaded by

Henry RodgersCopyright:

Available Formats

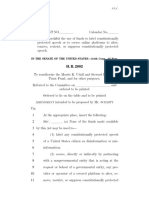

Stricken language would be deleted from and underlined language would be added to present law.

1 State of Arkansas

2 94th General Assembly A Bill DRAFT JLL/JLL

3 First Extraordinary Session, 2023 SENATE BILL

4

5 By: Senator J. Dismang

6 By: Representative Eaves

7

8 For An Act To Be Entitled

9 AN ACT TO AMEND THE INCOME TAX LAWS; TO REDUCE THE

10 INCOME TAX RATES APPLICABLE TO INDIVIDUALS, TRUSTS,

11 ESTATES, AND CORPORATIONS; TO CREATE AN INFLATIONARY

12 RELIEF INCOME TAX CREDIT FOR CERTAIN TAXPAYERS; TO

13 DECLARE AN EMERGENCY; AND FOR OTHER PURPOSES.

14

15

16 Subtitle

17 TO REDUCE THE INCOME TAX RATES APPLICABLE

18 TO INDIVIDUALS, TRUSTS, ESTATES, AND

19 CORPORATIONS; TO CREATE AN INFLATIONARY

20 RELIEF INCOME TAX CREDIT FOR CERTAIN

21 TAXPAYERS; AND TO DECLARE AN EMERGENCY.

22

23

24 BE IT ENACTED BY THE GENERAL ASSEMBLY OF THE STATE OF ARKANSAS:

25

26 SECTION 1. Arkansas Code § 26-51-201(a)(3), concerning the income tax

27 imposed on individuals, trusts, and estates, is amended to read as follows:

28 (3) For tax years beginning on or after January 1, 2024:

29 (A) Every resident, individual, trust, or estate having

30 net income less than or equal to eighty-seven thousand dollars ($87,000)

31 shall determine the amount of income tax due under this subsection in

32 accordance with the table set forth below:

33 From Less Than or Equal To Rate

34 $0 $5,099 0%

35 $5,100 $10,299 2%

36 $10,300 $14,699 3%

DRAFT 09/07/2023 12:42:35 PM JLL388

SB

1 $14,700 $24,299 3.4%

2 $24,300 $87,000 4.4%

3 (B) Every resident, individual, trust, or estate having

4 net income greater than eighty-seven thousand dollars ($87,000) shall

5 determine the amount of income tax due under this subsection in accordance

6 with the table set forth below:

7 From Less Than or Equal To Rate

8 $0 $4,400 2%

9 $4,401 and above 4.4%

10 (C) Every resident, individual, trust, or estate having

11 net income greater than or equal to eighty-seven thousand one dollars

12 ($87,001) but not greater than ninety thousand eight hundred dollars

13 ($90,800) shall reduce the amount of income tax due as determined under

14 subdivision (a)(3)(B) of this section by deducting a bracket adjustment

15 amount in accordance with the table set forth below:

16 From Less Than or Equal To Bracket Adjustment Amount

17 $87,001 $87,100 $380

18 $87,101 $87,200 $370

19 $87,201 $87,300 $360

20 $87,301 $87,400 $350

21 $87,401 $87,500 $340

22 $87,501 $87,600 $330

23 $87,601 $87,700 $320

24 $87,701 $87,800 $310

25 $87,801 $87,900 $300

26 $87,901 $88,000 $290

27 $88,001 $88,100 $280

28 $88,101 $88,200 $270

29 $88,201 $88,300 $260

30 $88,301 $88,400 $250

31 $88,401 $88,500 $240

32 $88,501 $88,600 $230

33 $88,601 $88,700 $220

34 $88,701 $88,800 $210

35 $88,801 $88,900 $200

36 $88,901 $89,000 $190

2 09/07/2023 12:42:35 PM JLL388

SB

1 $89,001 $89,100 $180

2 $89,101 $89,200 $170

3 $89,201 $89,300 $160

4 $89,301 $89,400 $150

5 $89,401 $89,500 $140

6 $89,501 $89,600 $130

7 $89,601 $89,700 $120

8 $89,701 $89,800 $110

9 $89,801 $89,900 $100

10 $89,901 $90,000 $90

11 $90,001 $90,100 $80

12 $90,101 $90,200 $70

13 $90,201 $90,300 $60

14 $90,301 $90,400 $50

15 $90,401 $90,500 $40

16 $90,501 $90,600 $30

17 $90,601 $90,700 $20

18 $90,701 $90,800 $10

19 $90,801 and up $0

20 (4) The tables set forth in subdivisions (a)(1) and (2) (a)(1)-

21 (3) of this section shall be adjusted annually in accordance with the method

22 set forth in subsection (d) of this section.

23

24 SECTION 2. Arkansas Code § 26-51-205(a), concerning the income tax

25 imposed on domestic corporations, is amended to add an additional subdivision

26 to read as follows:

27 (5) For tax years beginning on or after January 1, 2024, every

28 corporation organized under the laws of this state shall pay annually an

29 income tax with respect to carrying on or doing business on the entire net

30 income of the corporation, as now defined by the laws of this state, received

31 by the corporation during the income year, on the following basis:

32 (A) On the first three thousand dollars ($3,000) of net

33 income or any part thereof, one percent (1%);

34 (B) On the next three thousand dollars ($3,000) of net

35 income or any part thereof, two percent (2%);

36 (C) On the next five thousand dollars ($5,000) of net

3 09/07/2023 12:42:35 PM JLL388

SB

1 income or any part thereof, three percent (3%); and

2 (D) On net income exceeding eleven thousand dollars

3 ($11,000), four and eight-tenths percent (4.8%).

4

5 SECTION 3. Arkansas Code § 26-51-205(b), concerning the income tax

6 imposed on foreign corporations, is amended to add an additional subdivision

7 to read as follows:

8 (5) For tax years beginning on or after January 1, 2024, every

9 foreign corporation doing business within the jurisdiction of this state

10 shall pay annually an income tax on the proportion of its entire net income

11 as now defined by the income tax laws of this state, on the following basis:

12 (A) On the first three thousand dollars ($3,000) of net

13 income or any part thereof, one percent (1%);

14 (B) On the next three thousand dollars ($3,000) of net

15 income or any part thereof, two percent (2%);

16 (C) On the next five thousand dollars ($5,000) of net

17 income or any part thereof, three percent (3%); and

18 (D) On net income exceeding eleven thousand dollars

19 ($11,000), four and eight-tenths percent (4.8%).

20

21 SECTION 4. DO NOT CODIFY. TEMPORARY LANGUAGE. Inflationary relief

22 income tax credit.

23 (a) As used in this section, “resident” means natural persons and

24 includes, for the purpose of determining liability for the tax imposed by the

25 Income Tax Act of 1929, § 26-51-101 et seq., upon or with reference to the

26 income of any taxable year, any person domiciled in the State of Arkansas and

27 any other person who maintains a permanent place of abode within this state

28 and spends in the aggregate more than six (6) months of the taxable year

29 within this state.

30 (b)(1)(A) For the tax year beginning January 1, 2023, a resident

31 individual taxpayer who files an Arkansas full-year resident income tax

32 return, other than a joint return, having net income up to one hundred three

33 thousand six hundred dollars ($103,600) is allowed an income tax credit

34 against the individual income tax imposed by the Income Tax Act of 1929, §

35 26-51-101 et seq., in accordance with the following table:

36 From Less Than or Equal to Credit Amount

4 09/07/2023 12:42:35 PM JLL388

SB

1 $1 $89,600 $150

2 $89,601 $90,600 $140

3 $90,601 $91,600 $130

4 $91,601 $92,600 $120

5 $92,601 $93,600 $110

6 $93,601 $94,600 $100

7 $94,601 $95,600 $90

8 $95,601 $96,600 $80

9 $96,601 $97,600 $70

10 $97,601 $98,600 $60

11 $98,601 $99,600 $50

12 $99,601 $100,600 $40

13 $100,601 $101,600 $30

14 $101,601 $102,600 $20

15 $102,601 $103,600 $10

16 $103,601 and up $0

17 (B) Spouses filing separately on the same income tax

18 return may each claim one (1) credit under subdivision (b)(1)(A) of this

19 section against the tax on the return of each spouse.

20 (2)(A) For the tax year beginning January 1, 2023, resident

21 individual taxpayers who file a joint Arkansas full year resident income tax

22 return having net income up to two hundred seven thousand two hundred dollars

23 ($207,200) are allowed an income tax credit against the individual income tax

24 imposed by the Income Tax Act of 1929, § 26-51-101 et seq., in accordance

25 with the following table:

26 From Less Than or Equal to Credit Amount

27 $1 $179,200 $300

28 $179,201 $181,200 $280

29 $181,201 $183,200 $260

30 $183,201 $185,200 $240

31 $185,201 $187,200 $220

32 $187,201 $189,200 $200

33 $189,201 $191,200 $180

34 $191,201 $193,200 $160

35 $193,201 $195,200 $140

36 $195,201 $197,200 $120

5 09/07/2023 12:42:35 PM JLL388

SB

1 $197,201 $199,200 $100

2 $199,201 $201,200 $80

3 $201,201 $203,200 $60

4 $203,201 $205,200 $40

5 $205,201 $207,200 $20

6 $207,201 and up $0

7 (B) Spouses filing jointly on the same income tax return

8 shall receive only one (1) credit under subdivision (b)(2)(A) of this section

9 against their aggregate tax.

10 (c) The income tax credits allowed under subdivisions (b)(1) and (2)

11 of this section shall not be claimed by a taxpayer:

12 (1) For any tax year other than the tax year beginning on

13 January 1, 2023; or

14 (2) Who files a nonresident return or a part-year resident

15 return.

16 (d) The amount of the income tax credit under this section that may be

17 claimed by a taxpayer in a tax year shall not exceed the amount of income tax

18 due by the taxpayer.

19

20 SECTION 5. EMERGENCY CLAUSE. It is found and determined by the

21 General Assembly of the State of Arkansas that this act would create

22 significant changes to the state's income tax laws; that taxpayers and

23 employers plan to meet their obligations on a calendar-year basis; and that

24 this act is immediately necessary to ensure the financial stability of the

25 state, to allow taxpayers and employers time both to plan for and to

26 implement the changes in law created by this act, and to ensure that the

27 Department of Finance and Administration has sufficient time to update its

28 forms and software and train its personnel in accordance with this act.

29 Therefore, an emergency is declared to exist, and this act being immediately

30 necessary for the preservation of the public peace, health, and safety shall

31 become effective on:

32 (1) The date of its approval by the Governor;

33 (2) If the bill is neither approved nor vetoed by the Governor,

34 the expiration of the period of time during which the Governor may veto the

35 bill; or

36 (3) If the bill is vetoed by the Governor and the veto is

6 09/07/2023 12:42:35 PM JLL388

SB

1 overridden, the date the last house overrides the veto.

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

7 09/07/2023 12:42:35 PM JLL388

You might also like

- AUTOFINANCIAMIENTODocument7 pagesAUTOFINANCIAMIENTOrocio.guadalupe.reynoso.solis5No ratings yet

- Balance General de 8 ColumnasDocument4 pagesBalance General de 8 ColumnasJavier Ignacio ValdiviaNo ratings yet

- Axel Torres Mora: Grupo 4961Document3 pagesAxel Torres Mora: Grupo 4961Axel Antonio TorresNo ratings yet

- Nro. Unidades 350,000 280,000 350,000 420,000 Precio Unitario $ 580 $ 609 $ 639 $ 671 Costo Unitario $ 319 $ 335 $ 352 $ 369Document3 pagesNro. Unidades 350,000 280,000 350,000 420,000 Precio Unitario $ 580 $ 609 $ 639 $ 671 Costo Unitario $ 319 $ 335 $ 352 $ 369cruzNo ratings yet

- Calculating BenefitsDocument2 pagesCalculating Benefitsஅபூ மூபஸ்ஸராNo ratings yet

- Planilla de Contratos: Val - MaxDocument2 pagesPlanilla de Contratos: Val - MaxDayber MendozaNo ratings yet

- Deal With The Devil MathDocument9 pagesDeal With The Devil Mathzack morrisNo ratings yet

- Taller 3Document22 pagesTaller 3CRISTIAN CAMILO MORALES SOLISNo ratings yet

- HB1114Document14 pagesHB1114OKCFOXNo ratings yet

- Interes 1Document9 pagesInteres 1Milo GuevaraNo ratings yet

- Ejercicios Comp 4Document2 pagesEjercicios Comp 4Carlos CanalesNo ratings yet

- Laascanood WARD MAN ROOM Foundation Works: Bill of Quantities (BOQ) OUTPATIENTDocument8 pagesLaascanood WARD MAN ROOM Foundation Works: Bill of Quantities (BOQ) OUTPATIENTAbdirazak MohamedNo ratings yet

- State Law Changes Maximum Aid Payment (Map) Levels For Cash Aid RecipientsDocument2 pagesState Law Changes Maximum Aid Payment (Map) Levels For Cash Aid Recipientscynthia.maez222No ratings yet

- State Law Changes Maximum Aid Payment (Map) Levels For Cash Aid RecipientsDocument2 pagesState Law Changes Maximum Aid Payment (Map) Levels For Cash Aid RecipientsGoldy MaezNo ratings yet

- Sheet1: InflowsDocument8 pagesSheet1: InflowsReactivador FantasmaNo ratings yet

- Tablas de Amortizacion 1 PuntoDocument9 pagesTablas de Amortizacion 1 PuntoAsistente Admin. CistepNo ratings yet

- Fixed Ratio ExampleDocument10 pagesFixed Ratio ExampletoughnedglassNo ratings yet

- 08 ENMA302 InflationExamplesDocument8 pages08 ENMA302 InflationExamplesMotazNo ratings yet

- Tabla de Inversion Axitla Primera EtapaDocument10 pagesTabla de Inversion Axitla Primera EtapaAntonio Jair López SánchezNo ratings yet

- Tugas Kelompok 5 - Studi Kasus Franklin LumberDocument30 pagesTugas Kelompok 5 - Studi Kasus Franklin LumberAgung IswaraNo ratings yet

- Flat Tax RateDocument2 pagesFlat Tax RateirfanNo ratings yet

- Exel Calculation (Version 1)Document10 pagesExel Calculation (Version 1)Timotius AnggaraNo ratings yet

- FINC 721 Project 3Document6 pagesFINC 721 Project 3Sameer BhattaraiNo ratings yet

- Synergy Arena International LTD: 3 Years Perpective Business Plan APRIL 2023Document10 pagesSynergy Arena International LTD: 3 Years Perpective Business Plan APRIL 2023brook emenikeNo ratings yet

- County Steel Inc.Document20 pagesCounty Steel Inc.ingrid619No ratings yet

- Forecast 663210613-9Document1 pageForecast 663210613-99twyp8bpd2No ratings yet

- Pagos ProvisionalesDocument2 pagesPagos ProvisionalesVianey ValdiviaNo ratings yet

- E Street Development Waterfall - Fall 2020 Part 2 - MasterDocument38 pagesE Street Development Waterfall - Fall 2020 Part 2 - Masterapi-544095773No ratings yet

- Ministry of Finance Assignments to MunicipalitiesDocument4 pagesMinistry of Finance Assignments to MunicipalitiesRoberto VacaNo ratings yet

- Ing. Economica Pregunta 2Document2 pagesIng. Economica Pregunta 2Sheiler Alvarado SanchezNo ratings yet

- 9 - Advanced Monte CarloDocument9 pages9 - Advanced Monte CarloKevin MartinNo ratings yet

- Amortizaciones Practica 3Document7 pagesAmortizaciones Practica 3Joseline GuzmanNo ratings yet

- Tax LiabilityDocument133 pagesTax LiabilitySebastian Cruz RivasNo ratings yet

- Home Buy Vs Rent Complex 2019 UpdateDocument6 pagesHome Buy Vs Rent Complex 2019 UpdateOthman Alaoui Mdaghri BenNo ratings yet

- Cuota Fina Cuota Fija y Recalculo de Cuota Fija Fija para Todos Los PeriodosDocument16 pagesCuota Fina Cuota Fija y Recalculo de Cuota Fija Fija para Todos Los PeriodosPaula GómezNo ratings yet

- Credit Card Extract 19-52-03Document1 pageCredit Card Extract 19-52-03Lucila CardosoNo ratings yet

- Figure out buy vs rent with IRRDocument6 pagesFigure out buy vs rent with IRRLogan WilsonNo ratings yet

- TN 34 The WM Wrigley JR Company Capital Structure Valuation and Cost of CapitalDocument108 pagesTN 34 The WM Wrigley JR Company Capital Structure Valuation and Cost of CapitalStanisla Lee0% (2)

- New Automobile Depreciation: Years ValueDocument22 pagesNew Automobile Depreciation: Years Valueroyalb100% (4)

- Hubbard County Payable 2024 Preliminary Levy ChartDocument2 pagesHubbard County Payable 2024 Preliminary Levy ChartShannon GeisenNo ratings yet

- Informe Impo 484Document27 pagesInforme Impo 484Julieta TaveraNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Wildlife Restoration ApportionmentsDocument4 pagesWildlife Restoration ApportionmentsinforumdocsNo ratings yet

- GEOID Mapping & City County Income IntersectionsDocument20 pagesGEOID Mapping & City County Income IntersectionsJena benNo ratings yet

- Matematicas Financiera - Solver función para determinar tasa máxima de interés y flujo de cajaDocument10 pagesMatematicas Financiera - Solver función para determinar tasa máxima de interés y flujo de cajaLeidy Carolina MEDINA GOMEZNo ratings yet

- Actividad 7 Mat FinancieraDocument10 pagesActividad 7 Mat Financierajuguetes ymasNo ratings yet

- 5.3 Estado de Flujo CorregidoDocument3 pages5.3 Estado de Flujo CorregidoBrenda GonzálezNo ratings yet

- Multinivel - Libertad Financiera: Ganancias Fijas Semanales Ganancias Fijas Mensuales 2,568,000Document6 pagesMultinivel - Libertad Financiera: Ganancias Fijas Semanales Ganancias Fijas Mensuales 2,568,000Maria PaulaNo ratings yet

- Datos Generales: Unidades ProducidasDocument10 pagesDatos Generales: Unidades ProducidasJavier Lopez RodriguezNo ratings yet

- Loan Amortization ScheduleDocument30 pagesLoan Amortization ScheduleMarc QuinamotNo ratings yet

- Ocean Carriers MemoDocument2 pagesOcean Carriers MemoAnkush SaraffNo ratings yet

- 320 Units - Oakleaf, FL - 4-Story - Conceptual Estimate - 2022.11.30Document10 pages320 Units - Oakleaf, FL - 4-Story - Conceptual Estimate - 2022.11.30Nancie BrennanNo ratings yet

- Annual profits and salaries from vehicle fleet operations over 40 yearsDocument9 pagesAnnual profits and salaries from vehicle fleet operations over 40 yearsLaika AerospaceNo ratings yet

- Cali 5872 1174.4 4981 996.2 - 2196 - 439.2 9823.65 1964.73 3,93,451.86 #Value! CARERRA 83A 42-86 #Value! 0Document23 pagesCali 5872 1174.4 4981 996.2 - 2196 - 439.2 9823.65 1964.73 3,93,451.86 #Value! CARERRA 83A 42-86 #Value! 0julio amayaNo ratings yet

- Multinivel - Libertad FinancieraDocument8 pagesMultinivel - Libertad FinancieraJohn Walter Yepes CortesNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- (DAILY CALLER OBTAINED) -- FILE_1302Document2 pages(DAILY CALLER OBTAINED) -- FILE_1302Henry RodgersNo ratings yet

- GAETZ_224_xmlDocument1 pageGAETZ_224_xmlHenry RodgersNo ratings yet

- (DAILY CALLER OBTAINED) -- Amicus Brief - Webster v. Commission for Lawyer DisciplineDocument27 pages(DAILY CALLER OBTAINED) -- Amicus Brief - Webster v. Commission for Lawyer DisciplineHenry RodgersNo ratings yet

- (DAILY CALLER OBTAINED) -- Banks 175 XMLDocument2 pages(DAILY CALLER OBTAINED) -- Banks 175 XMLHenry RodgersNo ratings yet

- (DAILY CALLER OBTAINED) -- CJC Letter to DOE Granholm 041924Document2 pages(DAILY CALLER OBTAINED) -- CJC Letter to DOE Granholm 041924Henry RodgersNo ratings yet

- (DAILY CALLER OBTAINED) -- 2024-04-15 JDJ JC to Garland Re SubpoenaDocument4 pages(DAILY CALLER OBTAINED) -- 2024-04-15 JDJ JC to Garland Re SubpoenaHenry RodgersNo ratings yet

- (DAILY CALLER OBTAINED) -- CARTGA_078_xmlDocument2 pages(DAILY CALLER OBTAINED) -- CARTGA_078_xmlHenry RodgersNo ratings yet

- (DAILY CALLER OBTAINED) -- 2024-04-09 JDJ to DOJ re Ongoing MeetingsDocument3 pages(DAILY CALLER OBTAINED) -- 2024-04-09 JDJ to DOJ re Ongoing MeetingsHenry RodgersNo ratings yet

- (DAILY CALLER OBTAINED) - Witness Invite - Secretary Granholm 05152024Document3 pages(DAILY CALLER OBTAINED) - Witness Invite - Secretary Granholm 05152024Henry RodgersNo ratings yet

- (DAILY CALLER OBTAINED) -- Goldman Complaint 2Document12 pages(DAILY CALLER OBTAINED) -- Goldman Complaint 2Henry Rodgers100% (2)

- (DAILY CALLER OBTAINED) - Oll 24231Document2 pages(DAILY CALLER OBTAINED) - Oll 24231Henry RodgersNo ratings yet

- (DAILY CALLER OBTAINED) - Johnson IRS LetterDocument1 page(DAILY CALLER OBTAINED) - Johnson IRS LetterHenry RodgersNo ratings yet

- (DAILY CALLER OBTAINED) -- Heritage Ukraine Spending Topline 1Document2 pages(DAILY CALLER OBTAINED) -- Heritage Ukraine Spending Topline 1Henry RodgersNo ratings yet

- (DAILY CALLER OBTAINED) -- 4.8.24 Letter to ED OIG (1)Document2 pages(DAILY CALLER OBTAINED) -- 4.8.24 Letter to ED OIG (1)Henry RodgersNo ratings yet

- (Daily Caller Obtained) - Ehf24110Document3 pages(Daily Caller Obtained) - Ehf24110Henry RodgersNo ratings yet

- (DAILY CALLER OBTAINED) - Sen. Schmitt Free Speech AmendmentDocument2 pages(DAILY CALLER OBTAINED) - Sen. Schmitt Free Speech AmendmentHenry RodgersNo ratings yet

- (DAILY CALLER OBTAINED)-- NAL Letter to FCC RE- AudacyDocument1 page(DAILY CALLER OBTAINED)-- NAL Letter to FCC RE- AudacyHenry RodgersNo ratings yet

- (DAILY CALLER OBTAINED) - 2024.03.20 Sen. Cruz, Budd, Vance, Sullivan and Blackburn Letter To Airports Council Re Aliens (Final)Document5 pages(DAILY CALLER OBTAINED) - 2024.03.20 Sen. Cruz, Budd, Vance, Sullivan and Blackburn Letter To Airports Council Re Aliens (Final)Henry RodgersNo ratings yet

- (DAILY CALLER OBTAINED) - Dhs Ice LetterDocument1 page(DAILY CALLER OBTAINED) - Dhs Ice LetterHenry RodgersNo ratings yet

- (DAILY CALLER OBTAINED) - 2024.03.20 Sen. Cruz and CST Members Letter To FAA Administrator Whitaker Re Aliens (Final)Document4 pages(DAILY CALLER OBTAINED) - 2024.03.20 Sen. Cruz and CST Members Letter To FAA Administrator Whitaker Re Aliens (Final)Henry RodgersNo ratings yet

- (DAILY CALLER OBTAINED) - 24-00791 - ICE's Signed Response To Representative Matt GaetzDocument1 page(DAILY CALLER OBTAINED) - 24-00791 - ICE's Signed Response To Representative Matt GaetzHenry RodgersNo ratings yet

- (DAILY CALLER OBTAINED) - Buchan 068 XMLDocument3 pages(DAILY CALLER OBTAINED) - Buchan 068 XMLHenry RodgersNo ratings yet

- (DAILY CALLER OBTAINED) - 03.13.2024 - Letter To DOL and OSHA Re RFA Follow UpDocument3 pages(DAILY CALLER OBTAINED) - 03.13.2024 - Letter To DOL and OSHA Re RFA Follow UpHenry RodgersNo ratings yet

- (DAILY CALLER OBTAINED) - LC 473002Document7 pages(DAILY CALLER OBTAINED) - LC 473002Henry RodgersNo ratings yet

- (DAILY CALLER OBTAINED) - 2024.02.28 BRW Letter To FDADocument3 pages(DAILY CALLER OBTAINED) - 2024.02.28 BRW Letter To FDAHenry RodgersNo ratings yet

- (DAILY CALLER OBTAINED) - 03.13.2024 - Letter To DOE Re RFA Follow UpDocument2 pages(DAILY CALLER OBTAINED) - 03.13.2024 - Letter To DOE Re RFA Follow UpHenry RodgersNo ratings yet

- (DAILY CALLER OBTAINED) - ICE Response - GCDocument1 page(DAILY CALLER OBTAINED) - ICE Response - GCHenry RodgersNo ratings yet

- (DAILY CALLER OBTAINED) - Dodea Letter FinalDocument4 pages(DAILY CALLER OBTAINED) - Dodea Letter FinalHenry RodgersNo ratings yet

- (DAILY CALLER OBTAINED) - 022624 Van Der Weide Federal Reserve LetterDocument5 pages(DAILY CALLER OBTAINED) - 022624 Van Der Weide Federal Reserve LetterHenry RodgersNo ratings yet

- (DAILY CALLER OBTAINED) - Oll 24119Document2 pages(DAILY CALLER OBTAINED) - Oll 24119Henry RodgersNo ratings yet

- EOCh 1 Self TestDocument9 pagesEOCh 1 Self TestHannah valdeNo ratings yet

- Chapter 2Document9 pagesChapter 2Sheilamae Sernadilla GregorioNo ratings yet

- IT12EI - Return of Income Exempt Organisations - External FormDocument2 pagesIT12EI - Return of Income Exempt Organisations - External FormrodystjamesNo ratings yet

- 2020 Bonitas 18062020143403 Tax CertificateDocument2 pages2020 Bonitas 18062020143403 Tax CertificateCharles MutetwaNo ratings yet

- New York State Film Tax CreditDocument2 pagesNew York State Film Tax CreditIvan AraqueNo ratings yet

- Acco 4133 - Taxation: College of Accountancy and FinanceDocument10 pagesAcco 4133 - Taxation: College of Accountancy and FinanceNadi Hood100% (1)

- Module 6 CGT - 1Document3 pagesModule 6 CGT - 1Marklein DumangengNo ratings yet

- Income Tax of IndividualsDocument23 pagesIncome Tax of Individualspeter banjaoNo ratings yet

- My Phil Tax FinalDocument11 pagesMy Phil Tax FinalRochelle Ann DianeNo ratings yet

- Lumbera NotesDocument41 pagesLumbera Notesthinkbeforeyoutalk67% (3)

- Quiz - No. - 2 Daily, Ma. Jhoan A.Document2 pagesQuiz - No. - 2 Daily, Ma. Jhoan A.Ma. Jhoan DailyNo ratings yet

- Goods & Services Tax (GST) & Customs Law: Department of Commerce University of DelhiDocument2 pagesGoods & Services Tax (GST) & Customs Law: Department of Commerce University of DelhiStanzin LundupNo ratings yet

- A Comparative Study On Individual Tax Payers Preference Between Old Vs New Tax RegimeDocument14 pagesA Comparative Study On Individual Tax Payers Preference Between Old Vs New Tax RegimeJ.P. Venu GopalNo ratings yet

- Ümmüşnur Özcan-Proforma Questions Part2Document9 pagesÜmmüşnur Özcan-Proforma Questions Part2UMMUSNUR OZCANNo ratings yet

- Direct Taxation Mujtaba Zaidi Deduction and Collection of Tax at SourceDocument20 pagesDirect Taxation Mujtaba Zaidi Deduction and Collection of Tax at SourceManohar LalNo ratings yet

- A Review of The Accounting CycleDocument44 pagesA Review of The Accounting CycleBelle PenneNo ratings yet

- AUDITING AND TAXATION KEY TERMSDocument7 pagesAUDITING AND TAXATION KEY TERMSKadam KartikeshNo ratings yet

- Power The Tata Power Company Limited: Payment DetailsDocument2 pagesPower The Tata Power Company Limited: Payment DetailschiragNo ratings yet

- Assurance IP 1 Week 1Document1 pageAssurance IP 1 Week 1rui zhangNo ratings yet

- Form 12CDocument2 pagesForm 12CAllahBaksh100% (2)

- Mukesh Saini-ResumeDocument3 pagesMukesh Saini-Resumeca.anup.kNo ratings yet

- Aspects of TaxationDocument1 pageAspects of TaxationJuvie AnNo ratings yet

- 194 Q and 206C (1H)Document4 pages194 Q and 206C (1H)harshNo ratings yet

- Withholding CertificateDocument1 pageWithholding CertificatephoebeNo ratings yet

- Letters. Strictly No Erasures/Alterations. Show Your SolutionDocument4 pagesLetters. Strictly No Erasures/Alterations. Show Your SolutionRenalyn ParasNo ratings yet

- Indian Income Tax Updated Return Acknowledgement TitleDocument1 pageIndian Income Tax Updated Return Acknowledgement TitleDKINGNo ratings yet

- Employer Employee Not Later Than 1 MonthDocument1 pageEmployer Employee Not Later Than 1 MonthNazreen MohammedNo ratings yet

- UNIT 2 Registration Under GSTDocument35 pagesUNIT 2 Registration Under GSTaKsHaT sHaRmANo ratings yet

- Assignment Questions PDFDocument3 pagesAssignment Questions PDFFahim TanvirNo ratings yet

- Computerized Accounting ProjectDocument21 pagesComputerized Accounting ProjectEliza jNo ratings yet