Professional Documents

Culture Documents

Pay Slip - 1007868 - Aug-22

Uploaded by

Renu AmbaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pay Slip - 1007868 - Aug-22

Uploaded by

Renu AmbaniCopyright:

Available Formats

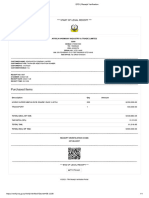

BHARAT SERUMS AND VACCINES LIMITED

17TH FLOOR, HOECHST HOUSE, NARIMAN POINT,

MUMBAI - 400 021

PAYSLIP FOR THE MONTH OF AUGUST 2022

EMP NO : 1007868 PF. NO : THVSH24962010000011908

NAME : Renu GLOBAL DATE OF JOINING :

DESIGNATION : Territory Business Manager DEPARTMENT : Trade

UAN : 100485014231 Regime Type : Old Regime

EARNINGS Rs. DEDUCTIONS Rs. COST CENTRE : IND-FMNR-DIL-FLD

Basic 15100.00 Provident Fund 1812.00 DATE OF JOINING : 07/01/2022

House Rent Allowance 7550.00 Professional Tax 200.00 DATE OF BIRTH : 04/01/1990

Education Allowance 200.00 STANDARD DAYS : 31

Leave Travel allowance 2265.00 DAYS WORKED : 31

City Compensatory Allowance 4341.00 LOCATION : JAIPUR

PSR Reimbursement 40159.00 PAN : BJKPR5095L

Incentive 39950.00 RESIDENTIAL STATUS : ROR

PAYMENT : BANK TRANSFER

BANK : -

A/C No. : 677001505135

Total Earnings Rs. 109565.00 Total Deductions Rs. 2012.00 Net Salary Rs. 107553.00

Income Tax Calculation Investment Details

Particulars Cumulative Total Add: Projected Less: Exempted Annual Provident Fund 21744.00

Basic 75500.00 105700.00 0.00 181200.00 Other Declarations

House Rent Allowance 37750.00 52850.00 0.00 90600.00 HRA Rent Paid Details 0.00

Education Allowance 1000.00 1400.00 0.00 2400.00 CLA Rent Paid Details 0.00

Leave Travel Allowance 11325.00 15855.00 0.00 27180.00 Number of Children for Edu. Rebate 0.00

City Compensatory Allowance 21705.00 30387.00 0.00 52092.00

Entitlements

Incentive 78950.00 0.00 0.00 78950.00

Entitlement Opening Claimed Closing

Total Income 432422.00 Balance This Balance

Add: Income received from Previous Employer 0.00 Month

Net Taxable Income 432422.00 Driver Salary 0.00 0.00 0.00 0.00

Less: Standard Deduction 50000.00 Hard Furnishing 0.00 0.00 0.00 0.00

Less: Prof. Tax recovered by Previous Employer 0.00 Helper Allowance 0.00 0.00 0.00 0.00

Less: Prof. Tax recovered by Current Employer 400.00 Vehicle Maintenance 0.00 0.00 0.00 0.00

Add: Other Taxable Income reported by the employee 0.00 Petrol Reimbursement 0.00 0.00 0.00 0.00

Gross Taxable Income 382022.00 Telephone 0.00 0.00 0.00 0.00

Reimbursement

Less : SEC80C - Deduction U/s 80C (Limit Rs.150000/-) 21744.00

Income Chargeable to Tax (Rounded Off) 360280.00

Income Tax Deduction

Income Tax Payable 5514.00

Less : Relief under Section 87 5514.00

Net Income Tax Payable 0.00

Add : Surcharge on Income Tax 0.00

Add : Cess 0.00

Total Income Tax & S/C & Cess Payable 0.00

Less : I. Tax & S/C paid by Prev. Employer 0.00

I.Tax & S/C & Cess to be recovered 0.00

I.Tax & S/C & Cess recovered till AUGUST 2022 0.00

Balance I. Tax & S/C & Cess to be recovered 0.00

Avg. Monthly I. Tax & S/C & Cess to be recovered 0.00

Note:

Wed Aug 31 18:30:04 IST 2022

This document contains confidential information. If you are not the intended recipient you are not authorized to use or disclose it in any form.

If you received this in error please destroy it along with any copies and notify the sender immediately.

31/08/2022

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Dec 2021Document1 pageDec 2021tashunaaztasneemNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Pay Slip - 604316 - May-22Document1 pagePay Slip - 604316 - May-22ArchanaNo ratings yet

- SRL Limited: Payslip For The Month of FEBRUARY 2019Document1 pageSRL Limited: Payslip For The Month of FEBRUARY 2019mkumarsejNo ratings yet

- Runi 1816Document1 pageRuni 1816Harsh JasaniNo ratings yet

- Pay Slip - 604316 - Oct-22Document1 pagePay Slip - 604316 - Oct-22ArchanaNo ratings yet

- Pay Slip - 604316 - Mar-23Document1 pagePay Slip - 604316 - Mar-23ArchanaNo ratings yet

- RSPL Limited: Payslip For The Month of JUNE 2021Document1 pageRSPL Limited: Payslip For The Month of JUNE 2021Manju ManjappaNo ratings yet

- Pay Slip - 604316 - Jul-23Document1 pagePay Slip - 604316 - Jul-23ArchanaNo ratings yet

- September PayslipDocument1 pageSeptember Payslipmishrajipiano13No ratings yet

- Pay Slip - 604316 - Feb-23Document1 pagePay Slip - 604316 - Feb-23ArchanaNo ratings yet

- SRL Limited: Payslip For The Month of JANUARY 2019Document1 pageSRL Limited: Payslip For The Month of JANUARY 2019Giri PriyaNo ratings yet

- Pay Slip - 604316 - Nov-22Document1 pagePay Slip - 604316 - Nov-22ArchanaNo ratings yet

- Payslip For The Month of May 2021: 16 Iris House Business Centre Nangal Raya New Delhi 110046Document1 pagePayslip For The Month of May 2021: 16 Iris House Business Centre Nangal Raya New Delhi 110046Manisha ThakurNo ratings yet

- 3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaDocument1 page3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaGamer JiNo ratings yet

- Gane 1824Document1 pageGane 1824govindansanNo ratings yet

- Payslip For The Month of June 2022: Kotak Mahindra Bank LTDDocument1 pagePayslip For The Month of June 2022: Kotak Mahindra Bank LTDshubham choure100% (1)

- 3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaDocument1 page3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaGamer JiNo ratings yet

- July SlipDocument1 pageJuly SlipNILAMANI SAHOONo ratings yet

- Pay Slip - 607043 - Jul-22Document1 pagePay Slip - 607043 - Jul-22Supriya KandukuriNo ratings yet

- A Unit of Haryana Power Generation Corporation LTD.: Panipat Thermal Power Station Urja Bhawan, C-7, Sector - 6 PanchkulaDocument2 pagesA Unit of Haryana Power Generation Corporation LTD.: Panipat Thermal Power Station Urja Bhawan, C-7, Sector - 6 PanchkulaRamchanderNo ratings yet

- Emp No: Emp Name::::::::::::: Division. Grade Complex Esi No. Eps No. PANDocument1 pageEmp No: Emp Name::::::::::::: Division. Grade Complex Esi No. Eps No. PANEnigmatic EthicsNo ratings yet

- AIRTELDocument2 pagesAIRTELKolkata Jyote MotorsNo ratings yet

- Kotak Mahindra Bank Limited Payslip For The Month of AUGUST - 2010Document1 pageKotak Mahindra Bank Limited Payslip For The Month of AUGUST - 2010Bharat Shahane33% (3)

- FormDocument1 pageFormKANHAIYA KUMARNo ratings yet

- Deloitte Financial Advisory Services India Private LimitedDocument1 pageDeloitte Financial Advisory Services India Private LimitedPRASHANT BANDAWARNo ratings yet

- Pay Slip For The Month of February 2021: This Is A Computer Generated Document, Hence No Signature Is RequiredDocument1 pagePay Slip For The Month of February 2021: This Is A Computer Generated Document, Hence No Signature Is Requiredsv netNo ratings yet

- DellDocument1 pageDellNaresh Kumar Yadav (nari)No ratings yet

- Wa0001.Document5 pagesWa0001.Pratyush Prateem BhattaNo ratings yet

- Payslip 2018 2019 1 100000000421201 IGSLDocument1 pagePayslip 2018 2019 1 100000000421201 IGSLArivu AkilNo ratings yet

- Pay Slip - 607043 - Jun-22Document1 pagePay Slip - 607043 - Jun-22Supriya KandukuriNo ratings yet

- Grofers India PVT LTD: Payslip For The Month of APRIL 2021Document1 pageGrofers India PVT LTD: Payslip For The Month of APRIL 2021Anirban GhoshNo ratings yet

- Roots Multiclean LTD Kovilpalayam, Pollachi: Pay Slip For The Month Of: LocationDocument1 pageRoots Multiclean LTD Kovilpalayam, Pollachi: Pay Slip For The Month Of: LocationMonishraj LakshmijanarthananNo ratings yet

- Income Tax Calculation For The Financial Year 2020-2021Document2 pagesIncome Tax Calculation For The Financial Year 2020-2021Kolkata Jyote MotorsNo ratings yet

- MarchDocument1 pageMarchx62bzy8pktNo ratings yet

- Aparna DecDocument1 pageAparna Decpraveen kumarNo ratings yet

- Cipla Limited Cipla House Lower Parel: Payslip For The Month of NOVEMBER 2021Document2 pagesCipla Limited Cipla House Lower Parel: Payslip For The Month of NOVEMBER 2021Dhruv RanaNo ratings yet

- Pay Slip - 473995 - Apr-21Document1 pagePay Slip - 473995 - Apr-21Siva RamakrishnaNo ratings yet

- Payslip For The Month of November 2020: Cms It Services Private LimitedDocument2 pagesPayslip For The Month of November 2020: Cms It Services Private LimitedKrishna AryanNo ratings yet

- Pay Slip - 473995 - Mar-22Document1 pagePay Slip - 473995 - Mar-22Siva RamakrishnaNo ratings yet

- CB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedDocument3 pagesCB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedsathyaNo ratings yet

- 100000000420152Document1 page100000000420152Sandeep SranNo ratings yet

- Payslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)SK TECH TRICKSNo ratings yet

- SettlementReportDocument1 pageSettlementReportPraneeth Sasanka TadepalliNo ratings yet

- Full and Final Payslip P1305Document1 pageFull and Final Payslip P1305ArmaanNo ratings yet

- Email Payslip Emails S-1626 2017 1Document1 pageEmail Payslip Emails S-1626 2017 1Manish PandeyNo ratings yet

- Teleperformance Global Services Private Limited: Payslip For The Month of November 2021Document1 pageTeleperformance Global Services Private Limited: Payslip For The Month of November 2021gajala jamirNo ratings yet

- Form (12) Payslip For JNR ExDocument1 pageForm (12) Payslip For JNR Exnikhil kumarNo ratings yet

- 2224 Payslip Feb2023 PDFDocument1 page2224 Payslip Feb2023 PDFTirumalesha DadigeNo ratings yet

- Cipla Limited Cipla House Lower Parel: Disclaimer: This Is A System Generated Payslip, Does Not Require Any SignatureDocument2 pagesCipla Limited Cipla House Lower Parel: Disclaimer: This Is A System Generated Payslip, Does Not Require Any SignatureImtiyaz Alam SahilNo ratings yet

- Salary Slip U Can Edit and UseDocument1 pageSalary Slip U Can Edit and Useshail100% (1)

- Payslip Sep2023Document2 pagesPayslip Sep2023ALINo ratings yet

- April 2022Document1 pageApril 2022Nagendra makamNo ratings yet

- 96745Document1 page96745KBS SinghNo ratings yet

- Nikhil KotakDocument2 pagesNikhil Kotaknikhilkadam607No ratings yet

- January'2023Document1 pageJanuary'2023s siddhikiNo ratings yet

- Renu NDocument1 pageRenu NRenu AmbaniNo ratings yet

- Form 2 Nomination and DeclarationDocument2 pagesForm 2 Nomination and DeclarationRenu AmbaniNo ratings yet

- DR SUSHILA SAINI DetailsDocument4 pagesDR SUSHILA SAINI DetailsRenu AmbaniNo ratings yet

- Covid Kit BillDocument1 pageCovid Kit BillRenu AmbaniNo ratings yet

- Renu MSLDocument67 pagesRenu MSLRenu AmbaniNo ratings yet

- EFD - Receipt Verification2Document1 pageEFD - Receipt Verification2Ramadhani YahayaNo ratings yet

- IINP222300238 JSC JV Homologation - 220714 - 110521Document1 pageIINP222300238 JSC JV Homologation - 220714 - 110521Gayrat KarimovNo ratings yet

- Budget Summary Template USDocument1 pageBudget Summary Template USSachin KulkarniNo ratings yet

- Form GST ASMT - 11 - NNNNNDocument2 pagesForm GST ASMT - 11 - NNNNNGovindNo ratings yet

- Mominul Joyanto Mosarraf Soumendro HanifDocument5 pagesMominul Joyanto Mosarraf Soumendro HanifbanglauserNo ratings yet

- General Principles & National Income Taxation Lecture Atty RizalinaDocument242 pagesGeneral Principles & National Income Taxation Lecture Atty RizalinaJoyce LapuzNo ratings yet

- Income Tax Audit List 1Document52 pagesIncome Tax Audit List 1Salman LatifNo ratings yet

- Fit - Tax Table 2Document4 pagesFit - Tax Table 2zipaganermy15No ratings yet

- LAPD-Gen-G01 - Taxation in South Africa - External GuideDocument116 pagesLAPD-Gen-G01 - Taxation in South Africa - External GuideTheoNo ratings yet

- Useful Invoice ProjectDocument1 pageUseful Invoice ProjectAruna100% (1)

- TATA 1mg Healthcare Solutions Private Limited: Barmer, Barmer, 344702, INDocument1 pageTATA 1mg Healthcare Solutions Private Limited: Barmer, Barmer, 344702, INNehru LalNo ratings yet

- Joint Venture-TaxabilityDocument10 pagesJoint Venture-TaxabilitySyzian ExonyryNo ratings yet

- Health Care As A Human Right The NationDocument3 pagesHealth Care As A Human Right The NationRobertoNo ratings yet

- Get LetterDocument1 pageGet LetterMACPRAISE HOLDINGSNo ratings yet

- Payroll ProjectDocument39 pagesPayroll ProjectAhmed Hose67% (45)

- Taxation Handbook 4th Edition 2022 - 10.02.2022Document170 pagesTaxation Handbook 4th Edition 2022 - 10.02.2022Mercy Akello100% (1)

- PF CalculatorDocument3 pagesPF CalculatorMdshajiNo ratings yet

- Tax Invoice: (Original For Recipient)Document3 pagesTax Invoice: (Original For Recipient)Apurv MathurNo ratings yet

- Quotation: Subject To Jamshedpur Jurisdiction This Is A Computer Generated Quotation and Does Not Require SignatureDocument2 pagesQuotation: Subject To Jamshedpur Jurisdiction This Is A Computer Generated Quotation and Does Not Require Signaturepratap chauhanNo ratings yet

- (D) Capital of The Surviving SpouseDocument3 pages(D) Capital of The Surviving SpouseAnthony Angel TejaresNo ratings yet

- Indirect Taxes Smart WorkDocument8 pagesIndirect Taxes Smart WorkmaacmampadNo ratings yet

- Top Delinquent TaxpayersDocument13 pagesTop Delinquent TaxpayersRosemary McCoyNo ratings yet

- Billing Summary Customer Details: Total Amount Due (PKR) : 5,992Document1 pageBilling Summary Customer Details: Total Amount Due (PKR) : 5,992Muhammad NoumanNo ratings yet

- Tax NotesDocument10 pagesTax Notescmv mendozaNo ratings yet

- Coi PrabhugreensaptDocument1 pageCoi PrabhugreensaptCorman LimitedNo ratings yet

- NYS - 45 Fill inDocument2 pagesNYS - 45 Fill inSalameh LaurieNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengalurunilnikNo ratings yet

- One Nation One TaxDocument23 pagesOne Nation One TaxSiddhi Hari Krishna GurramNo ratings yet

- Test Bank Public Finance DR - Ali UpdateDocument51 pagesTest Bank Public Finance DR - Ali UpdateMahmoud Ayoub Goda100% (2)

- BIR Form 2316Document1 pageBIR Form 2316edz_ramirez87% (15)