Professional Documents

Culture Documents

Ron's Reclamation Yard

Uploaded by

Châu Lê0 ratings0% found this document useful (0 votes)

5 views3 pagesOriginal Title

Ron’s Reclamation Yard

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views3 pagesRon's Reclamation Yard

Uploaded by

Châu LêCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

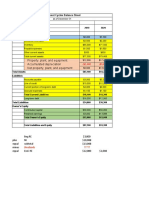

Sale revenue $ 153,000

Less: Cost of sale

Opnening Inventory $ 2,000

Purchases $ 50,000

Less: Closing inventory $ 5,000 $ 47,000

Gross Profit $ 106,000

Operating Expense

Administrative assistant wages $ 10,000

Delivery costs $ 8,000

Electricity $ 5,000

Rent and rates $ 20,000

Miscellaneous expenses $ 16,500

Annual depreciation $ 9,000

Other wages $ 25,000

Accured telephone bill $ 800 $ 94,300

Operating Profit (loss) before Interest and tax $ 11,700

Investment income $ 5,000

Less Interest Paid $ 120

Income before tax $ 16,580

Taxation $ 7,000

Net Income (loss) $ 9,580

Share capital

Begining Balance $ 200,000

Closing balance $ 200,000

Retained earning

Opening balance $ 5,000

Net income $ 9,580

Dividends $ (1,000) $ 13,580

Closing balance of equity $ 213,580

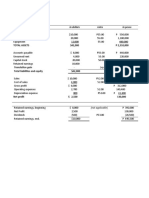

Assets

Current assets

Cash at bank $ 46,165

Trade Receivables $ 4,465

Inventory $ 5,000

Total current assets $ 55,630

Non-current asset

Long term Investment $ 50,000

Land and Buildings $ 110,000

Motor Vehicles $ 36,000

Accumulated depreciation $ (9,000)

Total Non-current assets $ 187,000

Total Assets $ 242,630

Liabilities and Equity

Current Liabilities

Trade Payable $ 1,750

Income Tax Payable $ 1,000

Accruals expenses $ 800

Accruals dividends $ 500

Total current liabilities $ 4,050

Long term Liabilities

Long term loan $ 25,000

Total Liabilities $ 29,050

Sharehoder's Equity

Share capital $ 200,000

Retain earning $ 13,580

Total Equity $ 213,580

Total Equity and Liabilities $ 242,630

You might also like

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- 3-14 Free Cash Flow: Bailey Corporation's Financial Statements (Dollars and Shares Are in Millions) Are ProvidedDocument8 pages3-14 Free Cash Flow: Bailey Corporation's Financial Statements (Dollars and Shares Are in Millions) Are ProvidedCASTOR, Vincent Paul0% (1)

- Alpha Beta Gamma Delta Epsilon Zeta Eta Theta Iota Kappa Lambda MuDocument3 pagesAlpha Beta Gamma Delta Epsilon Zeta Eta Theta Iota Kappa Lambda MulanNo ratings yet

- Balkan Languages - Victor FriedmanDocument12 pagesBalkan Languages - Victor FriedmanBasiol Chulev100% (1)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- HW 4Document4 pagesHW 4Mishalm96No ratings yet

- Glenn S Glue Stick IncDocument5 pagesGlenn S Glue Stick IncHenry KimNo ratings yet

- Concept Note TemplateDocument2 pagesConcept Note TemplateDHYANA_1376% (17)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Crystal Meadows of TahoeDocument5 pagesCrystal Meadows of TahoeNikitha Andrea Saldanha80% (5)

- Government Arsenal Safety and Security OfficeDocument5 pagesGovernment Arsenal Safety and Security OfficeMark Alfred MungcalNo ratings yet

- What Is OB Chapter1Document25 pagesWhat Is OB Chapter1sun_shenoy100% (1)

- SIP Annex 5 - Planning WorksheetDocument2 pagesSIP Annex 5 - Planning WorksheetGem Lam SenNo ratings yet

- Balance Sheet Formula Excel TemplateDocument5 pagesBalance Sheet Formula Excel TemplateD suhendarNo ratings yet

- Chapter 9. CH 09-10 Build A Model: Growth SalesDocument6 pagesChapter 9. CH 09-10 Build A Model: Growth SalesMatt SlowickNo ratings yet

- Accounting For Revenue and Other ReceiptsDocument4 pagesAccounting For Revenue and Other ReceiptsNelin BarandinoNo ratings yet

- Names of PartnerDocument7 pagesNames of PartnerDana-Zaza BajicNo ratings yet

- Matalam V Sandiganbayan - JasperDocument3 pagesMatalam V Sandiganbayan - JasperJames LouNo ratings yet

- Latihan Soal AFDocument10 pagesLatihan Soal AFReza MuhammadNo ratings yet

- Latihan Soal AF 2Document11 pagesLatihan Soal AF 2Reza MuhammadNo ratings yet

- Profit and Loss Account TemplatesDocument2 pagesProfit and Loss Account TemplatesSpam JunkNo ratings yet

- Answer TranslationDocument1 pageAnswer TranslationJULLIE CARMELLE H. CHATTONo ratings yet

- DifferenceDocument10 pagesDifferencethalibritNo ratings yet

- Issued & Paid Up Capital: 14 Schedual of Fixed AssetsDocument6 pagesIssued & Paid Up Capital: 14 Schedual of Fixed AssetsShoukat KhaliqNo ratings yet

- 3-Statement Model PracticeDocument6 pages3-Statement Model PracticeWill SkaloskyNo ratings yet

- Assets 2018 2019 Forecast: Balance SheetDocument12 pagesAssets 2018 2019 Forecast: Balance SheetJosephAmparoNo ratings yet

- Income Statement: Sales Gross ProfitDocument1 pageIncome Statement: Sales Gross ProfitNiki CuaNo ratings yet

- Statement of Cash Flows: Balances Accounts Jan 1, 2015 Dec 31, 2015Document2 pagesStatement of Cash Flows: Balances Accounts Jan 1, 2015 Dec 31, 2015Alyssa AlejandroNo ratings yet

- SPM Example 3Document8 pagesSPM Example 3inderNo ratings yet

- Ch04solution ProbDocument13 pagesCh04solution ProbdenisNo ratings yet

- RIZKA NURUL OKTAVIANI - 120110180007 - TugasFinancialPlanningDocument4 pagesRIZKA NURUL OKTAVIANI - 120110180007 - TugasFinancialPlanningRizka OktavianiNo ratings yet

- Practice 3 Balance SheetDocument4 pagesPractice 3 Balance SheetsherinaNo ratings yet

- Far (Semestral Project)Document5 pagesFar (Semestral Project)Diana Rose RioNo ratings yet

- Comparative Financial Statements: Heritage Antiquing Services Comparative Balance Sheet (Dollars in Thousands)Document2 pagesComparative Financial Statements: Heritage Antiquing Services Comparative Balance Sheet (Dollars in Thousands)Rose BaynaNo ratings yet

- PDF 3 PDFDocument2 pagesPDF 3 PDFPatricia RodriguesNo ratings yet

- Alekaya StatementDocument4 pagesAlekaya Statementapi-527776626No ratings yet

- 2 .Accounting Statements, Taxes, and Cash FlowDocument27 pages2 .Accounting Statements, Taxes, and Cash FlowBussines LearnNo ratings yet

- Jawaban Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Document22 pagesJawaban Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Vincenttio le CloudNo ratings yet

- Dr. ($) Cr. ($) Dr. ($) Cr. ($) Dr. ($) Cr. ($)Document3 pagesDr. ($) Cr. ($) Dr. ($) Cr. ($) Dr. ($) Cr. ($)Ishrat Jahan PapiyaNo ratings yet

- Chapter 7. Student CH 07-15 Build A Model: AssetsDocument3 pagesChapter 7. Student CH 07-15 Build A Model: Assetsseth litchfieldNo ratings yet

- Confra Financial StatementsDocument3 pagesConfra Financial StatementsPia ChanNo ratings yet

- Practice Problems, CH 5Document7 pagesPractice Problems, CH 5scridNo ratings yet

- Fixed Costs $15,000 Variable Costs $8,627: Sales Revenue $29,502Document3 pagesFixed Costs $15,000 Variable Costs $8,627: Sales Revenue $29,502Umair KamranNo ratings yet

- Financial Planning and Forecasting: AsssumptionsDocument4 pagesFinancial Planning and Forecasting: AsssumptionssubhenduNo ratings yet

- Carley NDocument11 pagesCarley NaliNo ratings yet

- Fin 621Document3 pagesFin 621animations482047No ratings yet

- Hira Karim Malik Section B - Financial Ratios Practice AssignmentDocument7 pagesHira Karim Malik Section B - Financial Ratios Practice AssignmenthirakmalikNo ratings yet

- Accrual Basis AccountingDocument149 pagesAccrual Basis AccountingManzoor AlamNo ratings yet

- Chapter 7. Student CH 7-14 Build A Model: AssetsDocument5 pagesChapter 7. Student CH 7-14 Build A Model: Assetsseth litchfieldNo ratings yet

- Accounting Statements, Taxes, and Cash FlowDocument29 pagesAccounting Statements, Taxes, and Cash FlowBussines LearnNo ratings yet

- Tugas MK11Document2 pagesTugas MK11Nan BaeeeNo ratings yet

- FCF 12th Edition Chapter 04Document49 pagesFCF 12th Edition Chapter 04David ChungNo ratings yet

- Answer 4 - Excel For Diff. Acctg.Document42 pagesAnswer 4 - Excel For Diff. Acctg.Rheu ReyesNo ratings yet

- Long-Term Financial Planning and GrowthDocument34 pagesLong-Term Financial Planning and GrowthBussines LearnNo ratings yet

- ACCT 3061 Asignación Cap 4 y 5Document4 pagesACCT 3061 Asignación Cap 4 y 5gpm-81No ratings yet

- Crash Landing On You Company Financial StatementsDocument6 pagesCrash Landing On You Company Financial StatementsEmar KimNo ratings yet

- Financial StatementDocument18 pagesFinancial StatementhamdanNo ratings yet

- Chapter 8Document6 pagesChapter 8ديـنـا عادلNo ratings yet

- Problem 2-14 & 2-15Document12 pagesProblem 2-14 & 2-15Qudsiya KalhoroNo ratings yet

- Answers To Concepts Review and Critical Thinking QuestionsDocument6 pagesAnswers To Concepts Review and Critical Thinking QuestionsHimanshu KatheriaNo ratings yet

- Ch02 P14 Build A Model SolutionDocument6 pagesCh02 P14 Build A Model SolutionSeee OoonNo ratings yet

- ABM 14 - Casañas - BALANCE SHEETDocument1 pageABM 14 - Casañas - BALANCE SHEETCasañas, Gillian DrakeNo ratings yet

- Chapter 3. CH 03-10 Build A Model: AssetsDocument4 pagesChapter 3. CH 03-10 Build A Model: AssetsAngel L Rolon TorresNo ratings yet

- HARD ROCK COMPANY Statement of Financial PositionDocument3 pagesHARD ROCK COMPANY Statement of Financial PositionJade Lykarose Ochavillo GalendoNo ratings yet

- Illustration 1 & 2Document5 pagesIllustration 1 & 2faith olaNo ratings yet

- Chemalite AnswersDocument2 pagesChemalite AnswersMine SayracNo ratings yet

- Gym BudgetDocument3 pagesGym BudgetJOHN MANTHINo ratings yet

- Financial Management - Brigham Chapter 3Document4 pagesFinancial Management - Brigham Chapter 3Fazli AleemNo ratings yet

- Jawaban 11 - Statement of Cash FlowDocument2 pagesJawaban 11 - Statement of Cash FlowBie SapuluhNo ratings yet

- Super Typhoon HaiyanDocument25 pagesSuper Typhoon Haiyanapi-239410749No ratings yet

- Buyer - Source To Contracts - English - 25 Apr - v4Document361 pagesBuyer - Source To Contracts - English - 25 Apr - v4ardiannikko0No ratings yet

- Financial Management: Usaid Bin Arshad BBA 182023Document10 pagesFinancial Management: Usaid Bin Arshad BBA 182023Usaid SiddiqueNo ratings yet

- EREMES KOOKOORITCHKIN v. SOLICITOR GENERALDocument8 pagesEREMES KOOKOORITCHKIN v. SOLICITOR GENERALjake31No ratings yet

- Strategic Management A Competitive Advantage Approach Concepts and Cases 17Th 17Th Edition Fred R David All ChapterDocument67 pagesStrategic Management A Competitive Advantage Approach Concepts and Cases 17Th 17Th Edition Fred R David All Chaptertabitha.turner568100% (3)

- Frias Vs Atty. LozadaDocument47 pagesFrias Vs Atty. Lozadamedalin1575No ratings yet

- Profile Story On Survivor Contestant Trish DunnDocument6 pagesProfile Story On Survivor Contestant Trish DunnMeganGraceLandauNo ratings yet

- People vs. DonesaDocument11 pagesPeople vs. DonesaEarlene DaleNo ratings yet

- Sales ProcessDocument4 pagesSales ProcessIsaac MorokoNo ratings yet

- 45-TQM in Indian Service Sector PDFDocument16 pages45-TQM in Indian Service Sector PDFsharan chakravarthyNo ratings yet

- My Portfolio: Marie Antonette S. NicdaoDocument10 pagesMy Portfolio: Marie Antonette S. NicdaoLexelyn Pagara RivaNo ratings yet

- Ais CH5Document30 pagesAis CH5MosabAbuKhater100% (1)

- DPS Quarterly Exam Grade 9Document3 pagesDPS Quarterly Exam Grade 9Michael EstrellaNo ratings yet

- SUDAN A Country StudyDocument483 pagesSUDAN A Country StudyAlicia Torija López Carmona Verea100% (1)

- Tok SB Ibdip Ch1Document16 pagesTok SB Ibdip Ch1Luis Andrés Arce SalazarNo ratings yet

- Civics: Our Local GovernmentDocument24 pagesCivics: Our Local GovernmentMahesh GavasaneNo ratings yet

- SWOT Analysis and Competion of Mangola Soft DrinkDocument2 pagesSWOT Analysis and Competion of Mangola Soft DrinkMd. Saiful HoqueNo ratings yet

- Michel Cuypers in The Tablet 19.6Document2 pagesMichel Cuypers in The Tablet 19.6el_teologo100% (1)

- Easter in South KoreaDocument8 pagesEaster in South KoreaДіана ГавришNo ratings yet

- Bangladesh Labor Law HandoutDocument18 pagesBangladesh Labor Law HandoutMd. Mainul Ahsan SwaadNo ratings yet

- Wendy in Kubricks The ShiningDocument5 pagesWendy in Kubricks The Shiningapi-270111486No ratings yet