Professional Documents

Culture Documents

Lesson 3

Uploaded by

Alvaro MerayoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lesson 3

Uploaded by

Alvaro MerayoCopyright:

Available Formats

Introduction to Business 2019-2020

Lesson 3. Functional Areas of

Business

3.1. Operations

3.2. Marketing

3.3. Finance

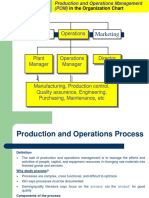

3.1 OPERATIONS

Role within the firm

•Value creating activities that transform

inputs into finished goods and services

Environment

Inputs

Basic Outputs

Creative Transformation

Goods

process

Managerial Services

By-products

Feedback

Eduardo González Fidalgo © 1

Introduction to Business 2019-2020

Some examples

Type of Inputs Processes Outputs

Business

Doctors, nurses,

Medical procedures,

operating rooms, Health

therapy, professional care

Hospital ambulances, services,

of patients, service

equipment, waste…

delivery…

patients…

Food preparation

Flour, sugar, Cakes, pies,

according to recipes,

Bakery equipment (ovens), bread,

machine setup, mix,

energy, bakers… waste…

mould, bake, pack…

Coal- Conversion of the chemical

burning Coal, boiler, turbine, energy stored in coal into

Electricity,

electric transmission lines, thermal energy,

CO2…

generating water, employees… mechanical energy and,

plant finally, electrical energy…

PARTS OF THE PRODUCTION PROCESS

1. Transformation process

• Process that converts inputs into outputs. In a broad sense this

is the production technology

Elements of the transformation process

• Tasks: actions performed on raw materials, intermediate or

finished products. They can be manual, mechanized or

automated (mechanization vs. automation)

• Flows: movement of materials and information from one

location to another

• Storage: keeping of materials and information in good

conditions for later use or transfer. There is no task and no

movement of materials or information

Eduardo González Fidalgo © 2

Introduction to Business 2019-2020

PARTS OF THE PRODUCTION PROCESS

2. Resources or inputs

• Everything that is used to obtain the final output

Types of inputs

• Basic: raw materials, components, information,

energy, labor, capital

• Creative: design of products and processes (related

to R&D)

• Managerial: planning, organizing & monitoring the

production process for a good functioning

PARTS OF THE PRODUCTION PROCESS

3. Outputs

• Products, services and by-products obtained at the end of the

production process. Some by-products are undesirable (e.g.

pollution)

4. Feedback

• Information gathered throughout the process that is compared

with the initial planning to adjust the system for better

functioning.

• Another source of feedback comes from the environment that

exerts a big influence on the adjustment of the production

process (customer complaints, environmental regulations,

prices of inputs, etc.)

Eduardo González Fidalgo © 3

Introduction to Business 2019-2020

GOALS OF THE PRODUCTION PROCESS

1. Efficiency (cost)

• Produce at the minimum cost that is possible

or at least at a similar cost as competitors

2. Quality

• Internal view: the products conform to the

technical specifications

• External view: customers are satisfied with the

product (compared with competitors)

GOALS OF THE PRODUCTION PROCESS

3. Lead time (delivery time)

• Time elapsed between receiving the order of

production and placing the product on the hands

of the customer (production cycle)

4. Flexibility

• Ability to adjust the production process to

produce new products, to change from one

product to another, or to modify production

volume

Eduardo González Fidalgo © 4

Introduction to Business 2019-2020

TRADITIONAL PRODUCTION SYSTEMS

Project

High

Product Diversity (Flexibility)

production

Jobbing

production

Medium

Batch

production

Mass

production

Continuous

Low

production

Very low Low Medium High Very high

Manufacturing Volume

TYPES OF PRODUCTION SYSTEMS

1. PROJECT PRODUCTION

• Examples: building (bridges, skyscrapers, ships) and

services (decoration)

• Product: unique for each client

• Unit cost: high (no economies of scale)

• Labor: highly skilled (adaptable to different tasks)

• Machinery and equipment: versatile, general use

• Plant layout: fixed position (the product does not

move during transformation. Workers move to

where the product is located to perform operations)

Eduardo González Fidalgo © 5

Introduction to Business 2019-2020

TYPES OF PRODUCTION SYSTEMS

2. JOB-SHOP AND BATCH PRODUCTION

• Examples: repair shops (j), bakery (b), pottery

(j/b), clothing (b), wedding dressmaker (j)

• Product: small volumes, high variety

• Unit cost: high

• Labor: highly skilled

• Machinery and equipment: versatile, general use,

hand tools (flexibility)

• Plant layout: process (the product visits the area

where the operation is to be performed)

Jobbing Batch

production production

Lathes Milling

T T T Drills

T T F F F F t t

Functional layout

Inspection E E Assembling

(process)

Painting

Materials

Products

warehouse P

warehouse P

Reception Shipping

Examples: repair shops (jobbing), bakery

(batch), pottery (jobbing/batching), wedding

Product A

dressmaker (jobbing) Product B

Product C 12

Eduardo González Fidalgo © 6

Introduction to Business 2019-2020

TYPES OF PRODUCTION SYSTEMS

3. MASS AND CONTINUOUS PRODUCTION

• Examples: industrial manufacturing ... Ford

automobiles (m), milk processing (c)

• Product: standardized, low variety, high volume

• Unit cost: low and very low

• Labor: low skilled

• Machinery and equipment: specialized, automation

• Plant layout: product (the product flows through

the physical locations where tasks are to be

performed in strict sequential order). Mechanized

materials handling

Mass Continuous

production production

Product layout (assembly line) is used when all products

undergo the same operations in the same sequence.

Reception

Shipping

Final assembly line

Examples: Cars (mass), milk bottling (cont.), petrochemicals (cont.)…

14

Eduardo González Fidalgo © 7

Introduction to Business 2019-2020

TYPES OF PRODUCTION SYSTEMS

Flexibility

Project

+ range / variety

- volume

Job shop

Flexible

Batch

Mass

Rigid Efficiency

Continuous

- range / variety

+ volume

Just in Time Flexibility and efficency

4. JUST IN TIME (JIT) / LEAN

• Examples: automobile manufacturing, Dell

computers…

• Product: high variety, large volume in small

batches

• Unit cost: low

• Labor: skilled multifunctional workers

• Machinery and equipment: general purpose,

flexible

• Plant layout: U-shaped or cellular layout (the

same worker or group of workers can perform

several different operations on the product)

• Suppliers: long term relationships (supplies

must come just in time whenever needed; no

stocks; reduce waste; pull system)

Eduardo González Fidalgo © 8

Introduction to Business 2019-2020

3.2 MARKETING

Role within the firm

• Manage the relationships with customers

• Get to know customer needs and satisfy them at a profit

Strategic marketing

• Analyze customer needs and develop marketing strategies

through:

• Market segmentation: identify different types of customers

and divide the market accordingly

• Positioning: managing how the firm is perceived by customers

Tactical marketing

• Manage the marketing-mix variables: Product, Price, Place and

Promotion (the 4 Ps)

Eduardo González Fidalgo © 9

Introduction to Business 2019-2020

MARKETING MIX

PRODUCT

• Something offered in the market to satisfy

consumer needs

• The product can be understood as a bundle of

attributes (tangible and intangible)

• Consumer goods (milk, bread, cars) vs. industrial

goods (vans, working tools)

• Goods: can be stored, long life, mostly tangible

• Services: cannot be stored, consumed and

produced at the same time, one use

Product

Consumer versus industrial or business products

Marketing implications

20

Eduardo González Fidalgo © 10

Introduction to Business 2019-2020

MARKETING MIX

MAIN ATTRIBUTES OF A PRODUCT

•Quality

•Design

•Packaging

•Size and quantity

•Added services (warranty, transportation)

•Image (brand name, reputation)

PRODUCT LIFE CYCLE

€ Introduction Growth Maturity Decline

Sales

0

time...

Profit

Eduardo González Fidalgo © 11

Introduction to Business 2019-2020

MARKETING MIX

PLACE (Distribution)

• This variable relates to the delivery of the product

• The product should be available in the quantity,

moment and place that is convenient for the

customer

• Different distribution channels can be used

• Direct channels: the firm sells directly to the final

customer (Catalogue, Internet)

• Indirect channels: representatives, wholesalers,

retailers

Place

Number of Channel Levels

Eduardo González Fidalgo © 12

Introduction to Business 2019-2020

Place

How Channel Members Add Value

Place

A manufacturer may use multiple channels

• To reach different market segments

– When the same product is sold to

consumers and businesses

• To increase sales or capture a larger

market share

Eduardo González Fidalgo © 13

Introduction to Business 2019-2020

MARKETING MIX

PRICE

• Amount of money that is paid for the product

• Summarizes the commercial policy of the firm

• Should reflect the value of the product for the

customer (as a bundle of attributes), with respect to

competing firms

• A higher price results in higher margins but lower

sales. These two effects should be optimally balanced

• Methods to establish prices: mark-up on cost,

demand-based pricing, comparison with competitors

MARKETING MIX

PROMOTION (Communication)

•Communicate with customers to get them informed about

our products and persuade them to buy

•Advertising: unilateral and impersonal communication using

mass media (unseen customers)

•Sales promotion: actions oriented to increase demand in a

limited period of time (discounts, gifts, food sampling, etc.)

•Public relations: actions oriented to build a favorable public

image of the firm (press releases, sponsorships, annual

reports)

•Direct marketing: personal communication with customers

(direct mail, telemarketing, door to door)

Eduardo González Fidalgo © 14

Introduction to Business 2019-2020

3.3 FINANCE

Role within the firm

• Raise funds to support the activities of the firm and

decide which investment projects are worthwhile

• Ultimate goal: help maximize firm value

Financing

• How to raise funds

• Debt, stock, bonds

Investment

• Allocate funds to projects that increase firm value

FINANCE

FINANCING

•Firms need to raise funds to finance

investment projects and activities (assets)

•The combination of different sources of

finance determines the firm’s financial

structure (owners’ equity & liabilities)

•Sources of funding: internal vs. external

•Cost of financial resources: minimize

Eduardo González Fidalgo © 15

Introduction to Business 2019-2020

BALANCE SHEET

ASSETS EQUITY AND LIABILITIES

Cash Accounts payable

Short term investments Notes payable (short term, incl. loans)

Accounts receivable CURRENT LIABILITIES

Inventory

TOTAL CURRENT ASSETS Notes payable (long term, incl. loans)

Bonds and debentures

Long term investments LONG TERM LIABILITIES

Plant and Equipment (tangible)

Patents and Licences (intangible) Capital stock

(Accumulated Depreciation) Retained earnings

TOTAL FIXED ASSETS TOTAL STOCKHOLDERS EQUITY

TOTAL ASSETS TOTAL OWNER’S EQUITY AND LIABILITIES

BALANCE SHEET

FIRM

time

A balance sheet is often described as a "snapshot” of a firm's

financial condition. It represents the assets, liabilities and

ownership equity of the firm at a given point in time.

32

Eduardo González Fidalgo © 16

Introduction to Business 2019-2020

SOURCES OF FUNDING

INTERNAL FUNDS

• Self financing: funds generated from

the operations of the firm and ready

to be reinvested

• Maintenance: cash available to

replace assets (depreciation)

• Growth: retained earnings

(dividend policy)

SOURCES OF FUNDING

EXTERNAL FUNDS

• Funds raised from investors and creditors

• Equity financing: the money raised from investors

in exchange of ownership rights is called

shareholders’ equity. Does not generate interest

expenses and does not have to be paid back.

• Initial capital (+ retained earnings)

• New stock issues (easier for floated companies)

• Debt financing (liabilities): the money raised from

borrowing is called debt or leverage. Has to be

repaid with an agreed-upon interest

Eduardo González Fidalgo © 17

Introduction to Business 2019-2020

SOURCES OF FUNDING

SOURCES OF DEBT FINANCING

•Trade credit (S/T)

•Bank loan (S/T) and (L/T)

•Bank overdraft (line of credit) (S/T)

•Bill of exchange/promissory note (S/T)

•Factoring and invoice discounting (S/T)

•Bonds and debentures (L/T)

•Leasing (L/T)

SOURCES OF FUNDING

COST OF CAPITAL

•Cost of equity

•Not to be paid back but has cost

•Opportunity cost for shareholders’ cash

•Ke= risk free return + risk premium

•Cost of debt

•Interests paid

•Ki= interest expenses/total liabilities

Eduardo González Fidalgo © 18

Introduction to Business 2019-2020

SOURCES OF FUNDING

WEIGHTED COST OF CAPITAL

E D

K Ke Ki

ED ED

E Equity

D Debt (total Liabilities )

FINANCE

INVESTMENT

•Allocate financial resources (funds raised)

to investment projects that create value

•A project creates value if its return is

higher than the weighted cost of capital

•If the return is not enough to cover the

cost of capital, the project destroys value

Eduardo González Fidalgo © 19

Introduction to Business 2019-2020

FINANCE

Variables of an investment project

•Initial investment (C0) (negative)

•Time horizon (n)

•Inflows (It)

•Outflows (Ot)

•Net cash flows (Ct=It-Ot)

DYNAMIC CRITERIA

Dynamic investments must consider the time value of money, i.e. a dollar received

today is worth more than a dollar received in the future because the sooner you

receive a sum of money, the sooner you can put that money to work

Net Present Value Internal Rate of

(NPV) Return (IRR)

40

Eduardo González Fidalgo © 20

Introduction to Business 2019-2020

DYNAMIC CRITERIA

Time value of money

(i=discount rate=cost of capital)

Future Value – how much a given

amount of cash received today will

be worth in a future period, given

the time value of money

Cn C0 (1 i ) n

capitalising

Co Cn t

Present Value – how much a

given amount of cash received

Cn

C0 in a future period is worth today,

(1 i) n given the time value of money

discounting

Co Cn

t

41

FINANCE

NET PRESENT VALUE

C1 C2 Cn

NPV C0

1 i (1 i ) 2

(1 i ) n

n

C0 C1 2C2 nCn t Ct

t 0

i discount rate ( cost of capital )

1 i capitaliza tion factor

1

discount factor

1 i

Eduardo González Fidalgo © 21

Introduction to Business 2019-2020

FINANCE

INTERNAL RATE OF RETURN (IRR)

C1 C2 Cn

C0 0

1 irr (1 irr ) 2

(1 irr ) n

FINANCE

EFFECTS ON FIRM VALUE

NPV IRR Effect

>0 >i Adds value

=0 =i Neutral

<0 <i Destroys value

Eduardo González Fidalgo © 22

Introduction to Business 2019-2020

NPV & IRR: Example

WHICH OF THESE PROJECTS WOULD YOU RECOMMEND?

Project C0 C1 C2 SUM

A -23000 4500 25000 6500

B -23000 18000 11000 6000

C -45000 3000 48000 6000

PROFITABILITY

PROFITABILITY RATIOS

• Relates profit to some relevant variable

• Return on Sales (ROS)

• Return on Assets (ROA)

• Return on Equity (ROE)

Eduardo González Fidalgo © 23

Introduction to Business 2019-2020

PROFITABILITY RATIOS

RETURN ON SALES

• Indicates how sales contribute to profit. It is a

measure of the gross profit margin per €1 in sales

EBIT

ROS

S

EBIT Earnings Before Interests and Taxes

S Sales

PROFITABILITY RATIOS

RETURN ON ASSETS

•Indicates how investment (assets) generates profit. What is

the profit each €1 invested in the company is generating?

EBIT

ROA ; A Assets

A

After tax version... .

EBIT Taxes

ROA

A

Eduardo González Fidalgo © 24

Introduction to Business 2019-2020

PROFITABILITY RATIOS

DECOMPOSING RETURN ON ASSETS

• Is return on sales multiplied by assets turnover

EBIT EBIT S

ROA · ROS ·AT

A S A

AT Assets Turnover

PROFITABILITY RATIOS

RETURN ON EQUITY

• Indicates how investment made by firm owners (equity)

converts into profit. What is the profit each €1 invested by the

owners is generating?

EBT

ROE

E

E Equity ; EBT Earnings Before Tax

NP

After tax version... . ROE

E

NP Net Profit

Eduardo González Fidalgo © 25

Introduction to Business 2019-2020

UNDERSTANDING THE RATIOS

Equity EBT

EBIT Assets

Debt I

PROFITABILITY RATIOS

DECOMPOSING RETURN ON EQUITY

EBT EBIT I ROA·A ki ·D

ROE

E E E

ROA·( D E ) ki ·D D D

ROA· ROA ki

E E E

D

ROA ( ROA ki ) ROA FL

E

D Debt ; Ki Average cost of debt ; FL Financial Leverage

ADE

Eduardo González Fidalgo © 26

Introduction to Business 2019-2020

Example

A firm makes €1 EBIT for each €10 in sales, generating €2 in sales

for each €1 in assets. The firm’s financial structure is evenly split,

50% debt and 50% equity. The average cost of debt is 16%.

Compute ROA and ROE and explain the difference between them

Exercise

Maxitrends Inc. made EBIT=€450 this year, with

ROA=0.18. Considering that the firm had to pay

€150 on interest expenses and that the gearing

ratio (D/E) is equal to 3, calculate ROE and

explain the difference with respect to ROA.

Eduardo González Fidalgo © 27

You might also like

- Manufacturing & Operations Management AA RevDocument96 pagesManufacturing & Operations Management AA RevDebashishDolonNo ratings yet

- Building An Effective Operation Management and Control ManagementDocument28 pagesBuilding An Effective Operation Management and Control ManagementMohan RajNo ratings yet

- TQMCH1Document44 pagesTQMCH1Neko MidoriNo ratings yet

- Lecture 1 Introduction and Process Analysis - 08-2021Document36 pagesLecture 1 Introduction and Process Analysis - 08-2021TeagueNo ratings yet

- Operation Management Chapter 1Document72 pagesOperation Management Chapter 1Prasansha TamangNo ratings yet

- Ch1 IntroductionDocument38 pagesCh1 Introductionmd1nemesis1No ratings yet

- 1-Production and Operations Management and Competitive AdvantageDocument29 pages1-Production and Operations Management and Competitive AdvantageJayant ChoudhariNo ratings yet

- Introduction To Operations ManagementDocument43 pagesIntroduction To Operations ManagementrajatNo ratings yet

- Operations ManagementDocument50 pagesOperations ManagementyknidNo ratings yet

- Chapter 1 OM Edited-1Document9 pagesChapter 1 OM Edited-1Seid KassawNo ratings yet

- MS1 - To StudDocument22 pagesMS1 - To StudFarshan SulaimanNo ratings yet

- Operations ManagementDocument50 pagesOperations ManagementNida RidzuanNo ratings yet

- Unit 1Document31 pagesUnit 1Muhammad ZayanNo ratings yet

- 1-BMCG2323 Introduction To ManufacturingDocument56 pages1-BMCG2323 Introduction To Manufacturinghemarubini96100% (1)

- M1&M2Document60 pagesM1&M2rashvindar_kaurNo ratings yet

- Operation Management ReviewerDocument68 pagesOperation Management ReviewerBryan Lord BatonNo ratings yet

- Production Operation Management Module1 (SC)Document23 pagesProduction Operation Management Module1 (SC)Manu DvNo ratings yet

- LESSON 1 - NotesDocument4 pagesLESSON 1 - NotesblahblahblahNo ratings yet

- IntroductionDocument30 pagesIntroductionkhaledshamsNo ratings yet

- UNIT 1 Part 3Document43 pagesUNIT 1 Part 3Tushar MadanNo ratings yet

- Bmgt25 - Lec1 - Operations Management Introduction and ConceptsDocument21 pagesBmgt25 - Lec1 - Operations Management Introduction and ConceptsRonald ArboledaNo ratings yet

- ProductionandOperationsManagement Module 1 (Autosaved)Document78 pagesProductionandOperationsManagement Module 1 (Autosaved)Sanjana DesmonNo ratings yet

- Chapter-1 Heizer S2-1Document16 pagesChapter-1 Heizer S2-1Erika GuillermoNo ratings yet

- CHAPTER 1 Itroduction To Operations ManagementDocument35 pagesCHAPTER 1 Itroduction To Operations Managementmohammed mohammedNo ratings yet

- L3 MMZG534 DMZG534 - L3 - Sustainable MFG - PDocument26 pagesL3 MMZG534 DMZG534 - L3 - Sustainable MFG - PsureshNo ratings yet

- Chapter 1 Production Planning and Control IntroductionDocument26 pagesChapter 1 Production Planning and Control IntroductionJULIANNE BAGYENDANo ratings yet

- Operation ManagementDocument26 pagesOperation ManagementNavinkumarNo ratings yet

- Value Streams: Fundamentals of Manufacturing Excellence ProgramDocument30 pagesValue Streams: Fundamentals of Manufacturing Excellence ProgramTuan AnhNo ratings yet

- Operations Management .An Overview, Definition of Production and Operations ManagementDocument18 pagesOperations Management .An Overview, Definition of Production and Operations ManagementKumar Shiv100% (1)

- Chapter One Introduction To Operations ManagementDocument10 pagesChapter One Introduction To Operations ManagementWiz SantaNo ratings yet

- Organization Finance Marketin G OperationsDocument4 pagesOrganization Finance Marketin G OperationsblahblahblahNo ratings yet

- Context of ManufacturingDocument23 pagesContext of ManufacturingmashalerahNo ratings yet

- 02 - Production Systems Configuration - Costs and PerformancesDocument85 pages02 - Production Systems Configuration - Costs and PerformancesMahmoud MabroukNo ratings yet

- Operations Management - ReviewerDocument7 pagesOperations Management - ReviewerJessa Mae ConversionNo ratings yet

- Introduction To Operation ManagementDocument17 pagesIntroduction To Operation ManagementUMMINo ratings yet

- Introduction To Operations Management: Dr. Rinki Rola PHD (Management) Mba (Finance) B. E. (Chemical)Document27 pagesIntroduction To Operations Management: Dr. Rinki Rola PHD (Management) Mba (Finance) B. E. (Chemical)rupasree deyNo ratings yet

- Operations Management: BY K. Sashi Rao Training and Management ConsultantDocument49 pagesOperations Management: BY K. Sashi Rao Training and Management ConsultantRajesh KumarNo ratings yet

- Chapter 1 ClassroomDocument19 pagesChapter 1 ClassroomRicart Von LauretaNo ratings yet

- Goods ServicesDocument27 pagesGoods ServicesAkash SinghNo ratings yet

- Operations ManagmentDocument25 pagesOperations ManagmentMuhammad USMANNo ratings yet

- MODULE I CBME 1 Intro Operational MGMT - PPTX AutosavedDocument16 pagesMODULE I CBME 1 Intro Operational MGMT - PPTX Autosavedgemuel marigosioNo ratings yet

- Lecture 2 UNIT 1 IntroductionDocument21 pagesLecture 2 UNIT 1 IntroductionPriya GuptaNo ratings yet

- Basic of ProductionDocument6 pagesBasic of ProductionAnand MauryaNo ratings yet

- Production Processes: Garrett J. Van RyzinDocument8 pagesProduction Processes: Garrett J. Van RyzinDeepak MishraNo ratings yet

- Operations Management Part-1Document23 pagesOperations Management Part-1Sai Rock SaiNo ratings yet

- Individual - Case Study of Strategic Planning and Performance EvaluationDocument16 pagesIndividual - Case Study of Strategic Planning and Performance Evaluation秦文聪No ratings yet

- Introduction Operation ManagementDocument3 pagesIntroduction Operation ManagementMelati Abdul AzizNo ratings yet

- UNIT 1 THE PRODUCTION SYSTEMpdfDocument30 pagesUNIT 1 THE PRODUCTION SYSTEMpdfanasNo ratings yet

- Chapter 1 - Overview of Production Planning and ControlDocument28 pagesChapter 1 - Overview of Production Planning and ControlAinatul Alia AlliasNo ratings yet

- Operating Management TUTORKU - Part 1Document20 pagesOperating Management TUTORKU - Part 1Felpos SenpaiNo ratings yet

- Materi I - MODocument11 pagesMateri I - MOSeger CakepNo ratings yet

- Introduction To Production and Operations Management: S. AjitDocument28 pagesIntroduction To Production and Operations Management: S. AjitAjit Sam50% (2)

- Omega PPT 1Document25 pagesOmega PPT 1Rishabh RajputNo ratings yet

- Introduction To ManufacturingDocument48 pagesIntroduction To ManufacturingSyakir ImanNo ratings yet

- Operations Management - IDocument16 pagesOperations Management - IAnurag SharmaNo ratings yet

- Human FactorsDocument21 pagesHuman FactorsYudhaPrawiraNo ratings yet

- Introduction To Operations ManagementDocument33 pagesIntroduction To Operations Managementdajit1No ratings yet

- Malabar Cements Project ReportDocument59 pagesMalabar Cements Project ReportRomiNo ratings yet

- Operations Management Slide 1st ChapDocument34 pagesOperations Management Slide 1st ChapMehedi HassanNo ratings yet

- Solution Manual For Financial Reporting Financial Statement Analysis and Valuation 8th EditionDocument7 pagesSolution Manual For Financial Reporting Financial Statement Analysis and Valuation 8th EditionReed NussNo ratings yet

- What-If Model - Users Guide: Project CostsDocument32 pagesWhat-If Model - Users Guide: Project CostsvxspidyNo ratings yet

- Tugas 14 SepDocument5 pagesTugas 14 Sepmelvina siregar100% (1)

- Books of Espanol Books of The Partnership ( (1) ) : Fish R Us Post Closing Trial Balance December 31, 2007Document3 pagesBooks of Espanol Books of The Partnership ( (1) ) : Fish R Us Post Closing Trial Balance December 31, 2007April Naida100% (1)

- Assignment 1Document9 pagesAssignment 1Seemab KanwalNo ratings yet

- CH 9 Solutions Solution Manual Principles of Corporate FinanceDocument7 pagesCH 9 Solutions Solution Manual Principles of Corporate FinanceMercy Dadzie100% (1)

- Capital StructureDocument34 pagesCapital StructureBerlian Leona SingarimbunNo ratings yet

- Maruti Suzuki: Submitted byDocument17 pagesMaruti Suzuki: Submitted byMukesh KumarNo ratings yet

- CPX Admin 11122Document198 pagesCPX Admin 11122sen2natNo ratings yet

- Chapter 3 - Chapter 3: Financial Forecasting and PlanningDocument35 pagesChapter 3 - Chapter 3: Financial Forecasting and PlanningAhmad Ridhuwan AbdullahNo ratings yet

- Quiz Question and Answers of Ratio Analysis Class 12 AccountancyDocument89 pagesQuiz Question and Answers of Ratio Analysis Class 12 AccountancybinodeNo ratings yet

- Narration Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Trailing Best Case Worst CaseDocument10 pagesNarration Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Trailing Best Case Worst CaseSaiteja NukalaNo ratings yet

- Acn 3102 Introductory AccountingDocument35 pagesAcn 3102 Introductory AccountingLinda Liong100% (1)

- Mgt101 Final Term Solved 14 PapersDocument161 pagesMgt101 Final Term Solved 14 Paperssalman khanNo ratings yet

- ch10 Financial Accounting AnswerDocument74 pagesch10 Financial Accounting AnswerGalih Astiansha Putra100% (10)

- Installment BuyingDocument33 pagesInstallment BuyingNors PataytayNo ratings yet

- Financial Statement Analysis - 10e by K. R. Am & John J. Wild Chapter01Document40 pagesFinancial Statement Analysis - 10e by K. R. Am & John J. Wild Chapter01Rifqi Ahmad Aula100% (2)

- Single Entry (F. Y. B.com) Sem.1Document13 pagesSingle Entry (F. Y. B.com) Sem.1Jignesh Togadiya0% (2)

- Basic Farm Accounting and Record Keeping Templates: If You Are or Plan To Be Certified OrganicDocument11 pagesBasic Farm Accounting and Record Keeping Templates: If You Are or Plan To Be Certified OrganicGeros dienosNo ratings yet

- Literature Review Financial Ratios AnalysisDocument8 pagesLiterature Review Financial Ratios Analysisfyh0kihiwef2100% (1)

- Module 4: Financial StatementsDocument7 pagesModule 4: Financial StatementsSophia De GuzmanNo ratings yet

- Sol. Man. - Chapter 4 - Accounts Receivable - Ia Part 1a - 2020 EditionDocument11 pagesSol. Man. - Chapter 4 - Accounts Receivable - Ia Part 1a - 2020 EditionKenaniah SanchezNo ratings yet

- TestBank 4 - Financial MarketsDocument6 pagesTestBank 4 - Financial MarketsRyan Christian BalanquitNo ratings yet

- Financial Statement Analysis & Valuation: Nusrat Jahan BenozirDocument10 pagesFinancial Statement Analysis & Valuation: Nusrat Jahan BenozirTamzid Ahmed LikhonNo ratings yet

- 02 The Accounting Equation PROBLEMSDocument7 pages02 The Accounting Equation PROBLEMSJohn Carlos Galit AdarayanNo ratings yet

- DMS Case (HPCL)Document11 pagesDMS Case (HPCL)Yashi SharmaNo ratings yet

- How Are Notes Payable Different From Accounts Payable?Document3 pagesHow Are Notes Payable Different From Accounts Payable?Ellaine Pearl AlmillaNo ratings yet

- Ch15 WRD25e InstructorDocument64 pagesCh15 WRD25e InstructorNilna AlifiaNo ratings yet

- Chapter 6 - Risk and Return Self Test ST1 Year Ra RB rAB A B ABDocument17 pagesChapter 6 - Risk and Return Self Test ST1 Year Ra RB rAB A B ABDiva Tertia AlmiraNo ratings yet

- ACC 30 Research PaperDocument29 pagesACC 30 Research PaperPat RiveraNo ratings yet