Professional Documents

Culture Documents

ExactProtector10LP-Desiree Geronimo

Uploaded by

JC LimCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ExactProtector10LP-Desiree Geronimo

Uploaded by

JC LimCopyright:

Available Formats

Page 1 of 7

EQS70018708-99A9-CDA79A95BF9F-140402-OF

v13.0.13.12

Low Premium

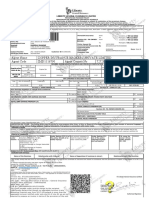

PruLink Exact Protector 10 is a ten-pay variable life insurance Proposed Insured : SAUL PIERRE DEANNO LLAGA GERONIMO

product that provides living, disability and death benefits. The Age :2

living benefits are the partially and fully withdrawable values

Sex : Male

which are taken from the policy's share in the separate fund(s).

The Total and Permanent Disability benefit accelerates a Regular Annual Premium : PHP 24,000.00

percentage of the sum assured. The death benefit is the total of

Sum Assured : PHP 650,000.00

the sum assured and the policy's full withdrawal value. Optional

Accelerated Total and

Benefits can be attached to this product.

Permanent Disability Benefit : PHP 400,000.00

This product is a variable contract. The benefits, namely the

partial and full withdrawal values and the actual death benefit at

time of death, all depend on the investment experience of

separate account(s) linked to the policy. If the fund value

becomes insufficient to pay for applicable charges, the policy

automatically terminates, and all benefits end. The applicable

charges are explained in the Illustration of Benefits for each fund.

PruLink Bond Fund

THE INVESTMENT RISKS ASSOCIATED WITH THIS PRODUCT

ARE BORNE SOLELY BY THE POLICYOWNER. The PruLink Bond Fund seeks to achieve an optimal level of

income in the medium term together with long term capital

If, after buying the policy, you decide it is not suitable to your growth through investments in fixed income securities and

needs, simply return the Policy Booklet with your Policy Data money market instruments.

Page to us within 15 days from the date you receive them. We

will refund the premium you paid in full.

PruLink Managed Fund

The PruLink Managed Fund seeks to optimize medium to

long term capital and income growth through investment in

I have read and understood the disclosures in this Sales Illustration . fixed income securities, money market instruments and

My agent has explained to my satisfaction the principal features of the shares listed on the Philippine Stock Exchange.

policy and the manner in which the variable benefits will reflect the

investment experience of the separate account (s). I fully understand

that when buying this policy, I am assuming all investment risks PruLink Growth Fund

associated with it.

The PruLink Growth Fund seeks to optimize medium to long

I have read and understood the Investor Classification in the attached term capital and income growth, with an emphasis on strong

page and have made an assessment of my risk appetite with the help capital growth, through a greater focus of investment in

of my agent. I have taken my Investor Classification into consideration shares of stocks listed in the Philippines. The fund also

invests in fixed income securities, and money market

in my choice of fund allocation.

instruments .

I also understand that in the event of claim, my policy, including any

optional benefits, will terminate if the aggregate amount of claim on

PruLink Equity Fund

Accelerated Total and Permanent Disability benefit and /or Accelerated

Crisis Cover benefit and/or Accelerated Life Care benefit is equal to The PruLink Equity Fund seeks to optimize medium to long

the sum assured on the basic policy exclusive of any Optional term capital growth through investments in shares of stocks

Benefits.

listed in the Philippines.

In addition, I understand that the Company has the right to vary the

insurance charge, policy fee, annual management charge, and any

rider charge and extra charge in the future. 100 % PruLink ProActive Fund

The PruLink ProActive Fund seeks to optimize medium to

long term capital and income growth with emphasis on

DESIREE ANN LLAGA GERONIMO dynamic asset allocation by fund managers through

Applicant investment in fixed income securities, money market

instruments and shares of stocks listed in the Philippines

This Sales Illustration shall form part of the insurance contract once

SAUL PIERRE DEANNO LLAGA GERONIMO the policy is issued. For more information on what constitutes the

Proposed Insured entire insurance contract, please ask your servicing agent or refer

to your policy booklet.

Presented by : JOSEPH CHRISTIAN R LIM Agent's Code : 70018708

Presented to : DESIREE ANN LLAGA GERONIMO Agent's Signature :

This Sales Illustration was prepared on 4/2/2014.

PruLink Exact Protector 10 Page 2 of 7

EQS70018708-99A9-CDA79A95BF9F-140402-OF

v13.0.13.12

INVESTOR CLASSIFICATION

This means that when you invest, you want your capital to be subject to minimal risk .

However, you realize that this may mean you may not achieve real capital growth on the

CAUTIOUS amount invested because of inflation.

Example: PruLink Bond Fund, PruLink Dollar Bond Fund, PruLink Asian Local Bond Fund

This means that when you invest, you want the potential of some real capital growth. You

understand that to have this potential, you need to take some risk with the capital you invest.

MODERATELY CAUTIOUS

Example: PruLink Managed Fund, PruLink ProActive Fund

This means that when you invest, you want the potential of greater real capital growth. You

understand that to have this potential, you need to take moderate risk with the capital you

MODERATELY ADVENTUROUS invest.

Example: PruLink Growth Fund, PruLink ProActive Fund

This means that when you invest, you want the potential of significant real capital growth .

You understand that to have this potential, you need to take higher risk with the capital you

ADVENTUROUS invest.

Example: PruLink Equity Fund, PruLink Asia Pacific Equity Fund

Presented by : JOSEPH CHRISTIAN R LIM Agent's Code : 70018708

Presented to : DESIREE ANN LLAGA GERONIMO Agent's Signature :

This Sales Illustration was prepared on 4/2/2014.

PruLink Exact Protector 10 Page 3 of 7

EQS70018708-99A9-CDA79A95BF9F-140402-OF

v13.0.13.12

PROTECTION BENEFITS PAGE

Enjoy the advantage of having a comprehensive plan complete with additional protection benefit(s) which enhance(s) the PruLink Exact

Protector 10 policy you are going to purchase.

You have chosen the benefits below:

Benefit Benefit Protection Benefit

Benefit Type Amount

Basic Cover (Sum Assured) Lump Sum 650,000.00 650,000.00

Accelerated Total and Permanent Disability Lump Sum 400,000.00 Included in Basic Cover

Payor Term Rider Lump Sum 245,000.00 245,000.00

Sum of Protection Coverage Indicated 895,000.00

Conditions apply to each benefit illustrated above. Please refer to the Policy Contract

for details.

Fund Value at "Current" Investment Return (Age 22) 504,051.07

Fund Value is not guaranteed. The indicated value is taken from the Illustration of

Withdrawal Benefits - ProActive Fund page of this Sales Illustration; all conditions

disclosed in the page apply.

Total Premiums Payable 240,000.00

Benefits-to-Total Premiums Payable Ratio 5.83

Benefit-to-Total Premiums Payable ratio is the Sum of Protection Coverage plus the

Fund Value at "Current" Investment Return (Age 22) Indicated divided by Total

Premiums Payable.

Presented by : JOSEPH CHRISTIAN R LIM Agent's Code : 70018708

Presented to : DESIREE ANN LLAGA GERONIMO Agent's Signature :

This Sales Illustration was prepared on 4/2/2014.

PruLink Exact Protector 10 Page 4 of 7

EQS70018708-99A9-CDA79A95BF9F-140402-OF

v13.0.13.12

ILLUSTRATION OF BENEFITS - PRULINK PROACTIVE FUND

The values below are based on the projected performance of the The HIGH and LOW investment returns, at 10.00% and 4.00%, are

fund where your policy is linked. Because fund performance is not those prescribed by the Insurance Commission. The illustrated

guaranteed, the values are also not guaranteed. In addition, the "CURRENT" investment return is based on the actual average

assumed investment returns used in projecting the LOW,

investment return experienced by the Fund in the last 36 months, as

CURRENT, and HIGH values represent a range of possible returns

indicated in the Historical Unit Fund Performance page, except that if

that may be achieved by the fund. The HIGH and LOW assumptions

the average exceeds 10.00%, the illustrated investment return is

are only for illustration purposes and do not represent the upper

capped at 10.00%.

and lower limit of the actual investment return that may occur.

PROJECTED BENEFITS

Policy Attained TopUp Withdrawal Fund

FULL WITHDRAWAL VALUE

Year Age Amount Amount Allocation**

LOW (4.00%)* CURRENT (7.26%)* HIGH (10.00%)*

1 3 - - 1,680.00 496.77 512.36 525.44

2 4 - - 7,200.00 6,751.30 6,979.98 7,172.47

3 5 - - 24,000.00 30,719.09 31,928.77 32,955.24

4 6 - - 24,000.00 55,555.16 58,596.77 61,221.09

5 7 - - 24,000.00 81,367.65 87,184.56 92,295.96

6 8 - - 24,000.00 108,192.88 117,828.76 126,457.87

7 9 - - 24,000.00 136,068.66 150,675.94 164,012.61

8 10 - - 24,000.00 165,042.33 185,891.58 205,305.09

9 11 - - 24,000.00 195,152.40 223,642.13 250,703.34

10 12 - - 24,000.00 226,403.35 264,069.42 300,574.54

11 13 - - - 234,054.08 281,803.00 329,148.74

12 14 - - - 241,893.01 300,702.98 360,455.47

13 15 - - - 249,887.52 320,812.68 394,725.51

14 16 - - - 258,035.79 342,211.64 432,246.60

15 17 - - - 266,345.73 364,995.29 473,345.66

16 18 - - - 274,839.76 389,280.64 518,397.31

17 19 - - - 283,538.55 415,190.45 567,810.79

18 20 - - - 292,466.25 442,859.16 622,039.12

19 21 - - - 301,643.57 472,426.40 681,575.89

20 22 - - - 311,100.89 504,051.07 746,973.44

58 60 - - - 832,659.06 6,183,772.28 26,016,972.80

63 65 - - - 932,283.94 8,691,161.12 41,801,810.31

*Investment returns used are net of final tax, Annual Management Charge and other investment expenses.

** Fund allocation illustrated are inclusive of loyalty bonus, if any.

Notes:

1. The projected benefits are already net of charges, as specified below . fee, insurance charge, rider charge or other applicable charges

These charges are not guaranteed. (including any policy debt), the policy automatically terminates on the

a. Annual insurance charge, inclusive of premium tax and day any such charges are due, subject to Note 5b below. In such an

Documentary Stamp Tax, which starts at PHP 0.66 per 1,000 of the event, the remaining balance of your units which are no longer

sum assured. All top-ups shall also be subject to insurance sufficient to pay off outstanding charges will just be refunded to you .

charge. While the insurance charge is quoted at an annual rate , 5.a If Full Withdrawal Value is positive from year 1 : The fund has no

deductions from the fund shall be made monthly. Rider charges, if policy debt. The rest of Note 5 does not apply.

any, are also deducted each month. Monthly deductions may 5.b If the Full Withdrawal Value is zero (0) in the early years : When the

change within one policy year as monthly insurance charges and Full Withdrawal Value is zero (0), the fund value may be insufficient to

rider charges are based on the attained age of the Proposed cover the charges. To provide you with insurance coverage (s), we

Insured. shall create a policy debt corresponding to the monthly charges while

b. Policy Fee, deducted monthly from the total fund, amounting to PHP there is no fund value, provided that premiums are paid on time and

33.33, if within premium paying period and PHP 16.67 after there are no fund withdrawals. This policy debt, accumulated in your

premium paying period. The policy fee is guaranteed not to exceed account without interest, is extinguished if, and as, the fund value

PHP 50.00 per month. grows. The policy will not be terminated on account of an outstanding

The annual insurance charge, rider charge (if any) and policy debt within the first three (3) years, provided that premiums are

policy fee are to be deducted proportionately based on the paid on time and there are no withdrawals from your account.

particular fund's share in the policy's total fund value. It 6. The above illustration assumes that all premiums are paid in full when

may happen that the LOW and CURRENT, or CURRENT and due and as planned with no premium holiday, and assuming that the

HIGH investment returns are the same for a particular current scale of charges remain unchanged.

fund, but their year-on-year Full Withdrawal Values differ, 7. In this illustration, top-ups are made at the beginning of the policy year ,

because these charges are allocated to each fund based and partial withdrawals are made at the end of the policy year.

on the weight of the fund to the policy's total fund value. 8. Partial withdrawals are funded by selling units from the fund (s) where

c. Annual Management Charge (AMC) of 2.25% of the fund value for your policy is linked. Because fund performance is not guaranteed, the

this particular fund. The rate is guaranteed not to exceed 2.50%. sufficiency of the fund value to support the indicated partial

2. All top-ups shall be subject to an initial charge of 6% of the top-up withdrawal(s) is also not guaranteed.

amount. 9. Values illustrated in this page are Full Withdrawals Values net of

3. The Loyalty Bonus is available only for the 15 pay variant. withdrawals plus top-ups indicated in this page. And if Full Withdrawal

4. The fund value may run out due to partial withdrawals and deduction of Value is withdrawn, your policy automatically terminates, and all future

charges. If the fund value is no longer sufficient to pay any of the policy withdrawals no longer apply.

Presented by : JOSEPH CHRISTIAN R LIM Agent's Code : 70018708

Presented to : DESIREE ANN LLAGA GERONIMO Agent's Signature :

This Sales Illustration was prepared on 4/2/2014.

PruLink Exact Protector 10 Page 5 of 7

EQS70018708-99A9-CDA79A95BF9F-140402-OF

v13.0.13.12

ILLUSTRATION OF DEATH BENEFITS

The values below are based on the projected performance of the The HIGH and LOW investment returns, meet the requirements

fund where your policy is linked. Because fund performance is not prescribed by the Insurance Commission. The illustrated

guaranteed, the values are also not guaranteed. In addition, the "CURRENT" investment return for Bond Fund, Managed Fund,

assumed investment returns used in projecting the LOW, Growth Fund, Equity Fund and ProActive Fund are based on the

CURRENT, and HIGH values represent a range of possible returns actual average investment return experienced by the Fund in the

that may be achieved by the fund. The HIGH and LOW last 36 months, as indicated in the Historical Fund Performance

assumptions are only for illustration purposes and do not page, except that if the average exceeds the HIGH rate, the

represent the upper and lower limit of the actual investment return illustrated investment return is capped at HIGH rate.

that may occur.

DEATH BENEFIT

Policy Attained

LOW CURRENT HIGH

Year Age

(4.00%)** (7.26%)** (10.00%)**

1 3 260,496.77 260,512.36 260,525.44

2 4 396,751.30 396,979.98 397,172.47

3 5 550,719.09 551,928.77 552,955.24

4 6 705,555.16 708,596.77 711,221.09

5 7 731,367.65 737,184.56 742,295.96

6 8 758,192.88 767,828.76 776,457.87

7 9 786,068.66 800,675.94 814,012.61

8 10 815,042.33 835,891.58 855,305.09

9 11 845,152.40 873,642.13 900,703.34

10 12 876,403.35 914,069.42 950,574.54

11 13 884,054.08 931,803.00 979,148.74

12 14 891,893.01 950,702.98 1,010,455.47

13 15 899,887.52 970,812.68 1,044,725.51

14 16 908,035.79 992,211.64 1,082,246.60

15 17 916,345.73 1,014,995.29 1,123,345.66

16 18 924,839.76 1,039,280.64 1,168,397.31

17 19 933,538.55 1,065,190.45 1,217,810.79

18 20 942,466.25 1,092,859.16 1,272,039.12

19 21 951,643.57 1,122,426.40 1,331,575.89

20 22 961,100.89 1,154,051.07 1,396,973.44

58 60 1,482,659.06 6,833,772.28 26,666,972.80

63 65 1,582,283.94 9,341,161.12 42,451,810.31

**Investment returns used are net of final tax, Annual Management Charge and other investment expenses.

The Death Benefit is comprised of the following:

1. Sum Assured.

2. Full Withdrawal Value.

3. 125% of all top-ups less 125% of all withdrawals on top-up units, but not to fall below zero (0).

Any outstanding policy debt shall be deducted from the death benefits/ supplemental benefits.

When the fund value is no longer sufficient to pay for any of the policy fee, insurance charge, rider charge or other applicable

charges (including any policy debt), the policy automatically terminates on the day any such charges are due and all benefits end. In

such an event, the remaining balance of your units which are no longer sufficient to pay off outstanding charges will just be refunded

to you.

Presented by : JOSEPH CHRISTIAN R LIM Agent's Code : 70018708

Presented to : DESIREE ANN LLAGA GERONIMO Agent's Signature :

This Sales Illustration was prepared on 4/2/2014.

Page 6 of 7

EQS70018708-99A9-CDA79A95BF9F-140402-OF

v13.0.13.12

VARIABLE LIFE INSURANCE PLAN

HISTORICAL UNIT FUND PERFORMANCE

The actual returns from PruLife UK's unit funds, net of final tax, Annual Management Charge and other investment expenses, are shown

below. Please note that past performance is not necessarily indicative of the future or likely performance of the fund.

Unit Fund Performance as of December 03, 2013

Bond Managed Growth Equity ProActive Money Market USD Bond Asian Local Asia Pacific

Fund* Fund* Fund* Fund*(**) Fund* Fund* Fund Bond Fund Equity Fund

Fund Launch Date Sept. 24, 2002 Sept. 24, 2002 July 22, 2005 Oct. 1, 2007 Feb. 1, 2009 Feb. 1, 2009 June 3, 2003 Jan 30, 2012 Feb 26, 2013

10.71 % 12.40 % 23.03 % 28.27 % 31.11 % 2.08 % 0.10 % 4.28 % Not Available

Year 1

4.02 % 9.71 % 61.44 % 80.90 % 19.32 % 1.76 % 12.12 % Not Available Not Available

Year 2

10.56 % 11.94 % -33.72 % -40.23 % 16.32 % 0.55 % 9.50 % Not Available Not Available

Year 3

18.49 % 21.36 % 12.49 % 11.25 % 12.62 % -0.58 % 13.46 % Not Available Not Available

Year 4

8.18 % 13.03 % 28.50 % 36.03 % Not Available Not Available 4.51 % Not Available Not Available

Year 5

1.59 % -4.36 % 27.47 % 32.36 % Not Available Not Available 2.39 % Not Available Not Available

Year 6

8.03 % 9.86 % 13.95 % 19.21 % Not Available Not Available 14.81 % Not Available Not Available

Year 7

8.54 % 16.78 % 21.71 % 26.11 % Not Available Not Available 9.84 % Not Available Not Available

Year 8

5.89 % 3.87 % Not Available Not Available Not Available Not Available 10.86 % Not Available Not Available

Year 9

10.86 % 12.65 % Not Available Not Available Not Available Not Available 5.69 % Not Available Not Available

Year 10

11.24 % 11.10 % Not Available Not Available Not Available Not Available Not Available Not Available Not Available

Year 11

Compound Annual Investment 8.84 % 10.57 % 16.38 % 19.56 % 19.65 % 0.95 % 8.23 % 4.28 % Not Available

Return based on completed

years

Average Annual Investment 8.54 % 8.07 % 12.20 % 15.09 % 7.26 % 0.09 % 4.64 % Not Available Not Available

Return for last 36 months

preceding December 03, 2013

*Bond Fund, Managed Fund, Growth Fund, Equity Fund, ProActive Fund and Money Market Fund are denominated in Philippine Peso. Money Market

fund performance is as of September 3, 2013.

**The Equity Fund has served as an underlying fund of the Managed and Growth Funds prior to the fund launch date.

The assets in our unit funds are valued using the marked-to-market valuation method on a daily basis.

The unit prices of Pru Life UK’s unit funds are published every Friday on major newspapers, or you may log on to our website

www.prulifeuk.com.ph for the latest unit prices.

Certified true and correct:

Lee C. Longa

EVP and Chief Financial Officer

Date of Certification: January 06, 2014

Presented by : JOSEPH CHRISTIAN R LIM Agent's Code : 70018708

Presented to : DESIREE ANN LLAGA GERONIMO Agent's Signature :

This Sales Illustration was prepared on 4/2/2014.

Page 7 of 7

EQS70018708-99A9-CDA79A95BF9F-140402-OF

v13.0.13.12

VARIABLE LIFE INSURANCE PLAN

ACKNOWLEDGEMENT OF VARIABILITY

Applicant's Name : DESIREE ANN LLAGA GERONIMO

Application Number :

Agent's Name : JOSEPH CHRISTIAN R LIM

Agent's Code : 70018708

Agent's Unit :

I acknowledge that:

I have applied with Pru Life UK for a Variable Life Insurance Policy and have reviewed the illustration(s) that

shows how a life insurance policy could perform using the Company's assumptions and based on Insurance

Commission's guidelines on investment returns.

I understand that since the fund performance may vary, the values of my units are not guaranteed and will depend

on the actual performance at that given period and that the value of my policy could be less than the capital

invested. The unit values of my variable life insurance policy are periodically published.

I understand that the investment risks under the policy are to be borne solely by me, as the policyowner.

Applicant's Signature over Printed Name Date

Presented by : JOSEPH CHRISTIAN R LIM Agent's Code : 70018708

Presented to : DESIREE ANN LLAGA GERONIMO Agent's Signature :

This Sales Illustration was prepared on 4/2/2014.

You might also like

- ExactProtector10LP-Desiree Geronimo (New)Document7 pagesExactProtector10LP-Desiree Geronimo (New)JC LimNo ratings yet

- ExactProtector10LP1500-Desiree GeronimoDocument7 pagesExactProtector10LP1500-Desiree GeronimoJC LimNo ratings yet

- ExactProtector10LP-Lady Shannel SorianoDocument7 pagesExactProtector10LP-Lady Shannel SorianoJC LimNo ratings yet

- PEPLow - Mykah Joanna 36k PDFDocument8 pagesPEPLow - Mykah Joanna 36k PDFRhea FranciscoNo ratings yet

- PAALowPremium (1388) - Brian EchipareDocument5 pagesPAALowPremium (1388) - Brian EchipareJC LimNo ratings yet

- PAAPlus (2k) - Josefina EchipareDocument7 pagesPAAPlus (2k) - Josefina EchipareJC LimNo ratings yet

- Jarwin Capuno 30kDocument8 pagesJarwin Capuno 30kThomasNo ratings yet

- PAALowPremium 20190417 MarsDocument5 pagesPAALowPremium 20190417 MarsPerryanne NuevaespanaNo ratings yet

- Link Bond FundDocument9 pagesLink Bond FundElly Jerzy Luna VillahermosaNo ratings yet

- New Saving Plan For Baby MateoDocument6 pagesNew Saving Plan For Baby MateoAlice M. GarinNo ratings yet

- PAAPlus3 6KJOHNDEMDocument8 pagesPAAPlus3 6KJOHNDEMMoktar Pandarat Maca-arabNo ratings yet

- PAAPlus 25200 SYGEEDocument8 pagesPAAPlus 25200 SYGEESygee BotantanNo ratings yet

- Catherine Kaye Roxas 27 Female PHP 63,426 PHP 3,000,000 PHP 1,000,000 PHP 60,000Document8 pagesCatherine Kaye Roxas 27 Female PHP 63,426 PHP 3,000,000 PHP 1,000,000 PHP 60,000danicaNo ratings yet

- Theresa O. Yagon 49 Female PHP 36,001 PHP 1,044,440 PHP 300,000 PHP 200,000Document8 pagesTheresa O. Yagon 49 Female PHP 36,001 PHP 1,044,440 PHP 300,000 PHP 200,000Moktar Pandarat Maca-arabNo ratings yet

- G CornejoDocument8 pagesG CornejoGessalyn CornejoNo ratings yet

- PAAPlus - Janina BelmesDocument7 pagesPAAPlus - Janina BelmesJC LimNo ratings yet

- Prumill at Age 50Document5 pagesPrumill at Age 50Robert RNo ratings yet

- PAAPlus - Eden Cea Polonan 3kDocument6 pagesPAAPlus - Eden Cea Polonan 3kYmmarie Autor RamosNo ratings yet

- PAAPlus 20210504pepmarie24kDocument8 pagesPAAPlus 20210504pepmarie24kMARIO SEMBRANONo ratings yet

- PAAPlus (2.5k) - Brian EchipareDocument7 pagesPAAPlus (2.5k) - Brian EchipareJC LimNo ratings yet

- PAAPlus (3kplusPTR) - Brian EchipareDocument7 pagesPAAPlus (3kplusPTR) - Brian EchipareJC LimNo ratings yet

- Joven CampuganDocument8 pagesJoven CampuganJovenNo ratings yet

- 29 Female - 3K PAADocument8 pages29 Female - 3K PAAHarrold FillomenaNo ratings yet

- JonsDocument8 pagesJonsMikaella Irish BugayongNo ratings yet

- Link Bond Fund: Page 1 of 6 EQS70113950-AF66-A0B74F1EBD46-231122-OF 17.1.23.01Document10 pagesLink Bond Fund: Page 1 of 6 EQS70113950-AF66-A0B74F1EBD46-231122-OF 17.1.23.01pearlmarierubinosNo ratings yet

- OutputDocument28 pagesOutputJenelyn AñascoNo ratings yet

- Crisanto - 3K Paa - 1M - 700K LCBDocument9 pagesCrisanto - 3K Paa - 1M - 700K LCBAntoniette Samantha NacionNo ratings yet

- PAA 2M SA TPD 1M ADD LCB 36k ApeDocument10 pagesPAA 2M SA TPD 1M ADD LCB 36k ApeRey Christopher CastilloNo ratings yet

- Crisanto - 2530 Paa - 1M - 500K LCBDocument9 pagesCrisanto - 2530 Paa - 1M - 500K LCBAntoniette Samantha NacionNo ratings yet

- Mrs Rosario Ocamia Paa Plus QuotationDocument10 pagesMrs Rosario Ocamia Paa Plus QuotationRosario OcamiaNo ratings yet

- Prulink Assurance Account Plus: Applicant-OwnerDocument8 pagesPrulink Assurance Account Plus: Applicant-OwnerAlexanderNo ratings yet

- ARCH - Ma. - Joanna - Revecca - Calling - Proposal 3 PDFDocument10 pagesARCH - Ma. - Joanna - Revecca - Calling - Proposal 3 PDFOliver Del CarmenNo ratings yet

- 2,5kMR ERROL SOLIDARIOS PAA Plus Quotation PDFDocument8 pages2,5kMR ERROL SOLIDARIOS PAA Plus Quotation PDFErrol Rabe SolidariosNo ratings yet

- Ms Shienna Lyn Karla Madayag Exact 15lp QuotationDocument8 pagesMs Shienna Lyn Karla Madayag Exact 15lp QuotationJerome BenipayoNo ratings yet

- MR FIFTY YEAR OLD Exact 10LP QuotationDocument12 pagesMR FIFTY YEAR OLD Exact 10LP QuotationAntoniette Samantha NacionNo ratings yet

- MR PAUL JOSEPH FERNANDEZ PAA Plus QuotationDocument10 pagesMR PAUL JOSEPH FERNANDEZ PAA Plus QuotationRaquel FernandezNo ratings yet

- Prulink Exact Protector 15: Ma. Joanna Revecca CallingDocument8 pagesPrulink Exact Protector 15: Ma. Joanna Revecca CallingOliver Del CarmenNo ratings yet

- UnookDocument8 pagesUnookPozza BoyNo ratings yet

- A Total Protection Plan Customised To Suit Your Needs: 3076-E - brochure-ENG-v6-r24.indd 1 3/18/15 12:11 PMDocument6 pagesA Total Protection Plan Customised To Suit Your Needs: 3076-E - brochure-ENG-v6-r24.indd 1 3/18/15 12:11 PMAisya TeeNo ratings yet

- 10 YEARS OLD - YEAR - OLD - Exact - 10LP - QuotationDocument12 pages10 YEARS OLD - YEAR - OLD - Exact - 10LP - QuotationAntoniette Samantha NacionNo ratings yet

- DR Malata EliteProtectorDocument9 pagesDR Malata EliteProtectorAlice M. GarinNo ratings yet

- Outshine: How Can You Make Your Child How CDocument5 pagesOutshine: How Can You Make Your Child How Cweb_chetanNo ratings yet

- MR RONALD MAYO Elite 15 QuotationDocument9 pagesMR RONALD MAYO Elite 15 QuotationRonald MayoNo ratings yet

- Ronald A. Mayo AGENCY Shield PHP 03222022184321Document10 pagesRonald A. Mayo AGENCY Shield PHP 03222022184321Ronald MayoNo ratings yet

- Outshine: How Can You Make Your Child How CDocument5 pagesOutshine: How Can You Make Your Child How CLiron MarkmannNo ratings yet

- ULIP's SATHYADocument9 pagesULIP's SATHYAsantoduNo ratings yet

- Marites Estrella-AGENCY-Shield-PHP-02242023073309Document11 pagesMarites Estrella-AGENCY-Shield-PHP-02242023073309jasleh ann villaflorNo ratings yet

- Fuel Ventures Scale Up EIS Fund KIDDocument3 pagesFuel Ventures Scale Up EIS Fund KIDctmcmenemyNo ratings yet

- Multi-Dimensions of Unit Linked Insurance Plan Among Various Investment AvenuesDocument8 pagesMulti-Dimensions of Unit Linked Insurance Plan Among Various Investment AvenuesRahul TangadiNo ratings yet

- Tata Aia Life Insurance Wealth-Pro BrochureDocument13 pagesTata Aia Life Insurance Wealth-Pro BrochureSankar DattaNo ratings yet

- MetLife Smart Platinum Plus Brochure - 20 Nov Copy - tcm47-76489Document13 pagesMetLife Smart Platinum Plus Brochure - 20 Nov Copy - tcm47-76489sandeepNo ratings yet

- Future Protect PlanDocument6 pagesFuture Protect PlanTulika ShreshthiNo ratings yet

- SmartSampoornaRaksha BrochureDocument14 pagesSmartSampoornaRaksha BrochureTechnical AkashNo ratings yet

- SmartSampoornaRaksha BrochureDocument14 pagesSmartSampoornaRaksha Brochuresanket bhosaleNo ratings yet

- Product Highlights: Sun Grepa Power Builder 10Document9 pagesProduct Highlights: Sun Grepa Power Builder 10Cyril Joy NagrampaNo ratings yet

- Mercado R Mlprime 28072023152829Document19 pagesMercado R Mlprime 28072023152829Jem AmansecNo ratings yet

- SmartSampoornaRaksha BrochureDocument16 pagesSmartSampoornaRaksha BrochureSuraj DubeyNo ratings yet

- Fuel Ventures SEIS Fund KIDDocument3 pagesFuel Ventures SEIS Fund KIDctmcmenemyNo ratings yet

- Prop Ad324235asafrc8cDocument11 pagesProp Ad324235asafrc8cfortunecNo ratings yet

- PAAPlus (2.5k) - Brian EchipareDocument7 pagesPAAPlus (2.5k) - Brian EchipareJC LimNo ratings yet

- PAAPlus (2k) - Josefina EchipareDocument7 pagesPAAPlus (2k) - Josefina EchipareJC LimNo ratings yet

- PAAPlus (2.5k) - Brian EchipareDocument7 pagesPAAPlus (2.5k) - Brian EchipareJC LimNo ratings yet

- PAAPlus (3kplusPTR) - Brian EchipareDocument7 pagesPAAPlus (3kplusPTR) - Brian EchipareJC LimNo ratings yet

- B&i C.P.Document3 pagesB&i C.P.Aditya D TanwarNo ratings yet

- NURS FPX 6218 Assessment 4 Advocating For Lasting ChangeDocument7 pagesNURS FPX 6218 Assessment 4 Advocating For Lasting ChangeEmma WatsonNo ratings yet

- Bank Authorisation: CIN: U66010MH2001PLC167089 Page 1 of 1Document1 pageBank Authorisation: CIN: U66010MH2001PLC167089 Page 1 of 1Dinesh BarhateNo ratings yet

- Insurance & Marine Transportation The Third International Conference OnDocument9 pagesInsurance & Marine Transportation The Third International Conference OnAnandhNo ratings yet

- Linked Comprehensive: Protection RiderDocument12 pagesLinked Comprehensive: Protection RiderM JagannathNo ratings yet

- Construction Defects: Casualty Loss Reserve SeminarDocument53 pagesConstruction Defects: Casualty Loss Reserve SeminarniluNo ratings yet

- Adv Accounts RTP M19Document35 pagesAdv Accounts RTP M19Harshwardhan PatilNo ratings yet

- E Shared PDFFILES 3151 PolicySchedule 202212310032451 PolicyScheduleDocument2 pagesE Shared PDFFILES 3151 PolicySchedule 202212310032451 PolicyScheduleLalit bhardwajNo ratings yet

- Bajaj Allianz General Insurance Company LTD.: Declaration by The InsuredDocument1 pageBajaj Allianz General Insurance Company LTD.: Declaration by The InsuredalertinsuranceNo ratings yet

- Loadmaster BE770-spare PartsDocument5 pagesLoadmaster BE770-spare Partsandrei20041No ratings yet

- Booking Payment Vranac SamojkoDocument5 pagesBooking Payment Vranac SamojkoTijana TosicNo ratings yet

- Insurance Industry Performance Report: % Increase/ (Decrease)Document1 pageInsurance Industry Performance Report: % Increase/ (Decrease)Hiyakishu SanNo ratings yet

- Non Insurance Methods of Risk ManagementDocument16 pagesNon Insurance Methods of Risk Managementshruthi sweetyNo ratings yet

- Site and Workshop ManagementDocument88 pagesSite and Workshop Managementedmondoviyo08No ratings yet

- Employer - Registration NISDocument2 pagesEmployer - Registration NISKerisha WilliamsNo ratings yet

- Community Based Health Insurance SchemeDocument25 pagesCommunity Based Health Insurance SchemeGbemigaNo ratings yet

- CP Word - Mitali-2Document91 pagesCP Word - Mitali-2Dixitaba DodiyaNo ratings yet

- RICS Official Definition: Isurv Recommended Reading and ServicesDocument5 pagesRICS Official Definition: Isurv Recommended Reading and ServicesFiloch MaweredNo ratings yet

- 2017 AnnualReport-webDocument212 pages2017 AnnualReport-webTanjil TafsirNo ratings yet

- Indemnity and GuaranteeDocument29 pagesIndemnity and GuaranteevimalNo ratings yet

- A Life Wealth Builder Brochure V3Document21 pagesA Life Wealth Builder Brochure V3Eminent Corporate AdvisoryNo ratings yet

- CitizensDocument3 pagesCitizensABC Action NewsNo ratings yet

- Comparison of Life Insurance ProductsDocument4 pagesComparison of Life Insurance ProductsPrithvi NathNo ratings yet

- Kante Sir NotesDocument345 pagesKante Sir Notesmank100% (7)

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument3 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationmohanNo ratings yet

- Banking Awareness January Set 1: Dr. Gaurav GargDocument20 pagesBanking Awareness January Set 1: Dr. Gaurav GargAtul MishraNo ratings yet

- Healthshare Cost Sharing PlansDocument3 pagesHealthshare Cost Sharing Plansapi-596118571No ratings yet

- IC 38 Short Notes (2) 131Document1 pageIC 38 Short Notes (2) 131Anil KumarNo ratings yet

- Report 20210621113942548 0Document9 pagesReport 20210621113942548 0sundaeNo ratings yet

- Emedlife Insurance Broking Services Limited: Group Mediclaim PolicyDocument2 pagesEmedlife Insurance Broking Services Limited: Group Mediclaim PolicyYanamandra Radha Phani ShankarNo ratings yet